share

A yield farming token is a key term for yield farmers. Instead of cryptocurrency, all yield farming platforms use their own native tokens, which allow unifying financial exchange.

The Definition

This is an internal recording on a blockchain in the form of a smart contract or, otherwise, digital assets with value. Its purpose is determined by the goals and functions of the platform.

Not the Same as Cryptocurrency

In decentralized crypto markets, the crypt plays the role of fiat money. Yield farming is part of DeFi, but its own coins are more often used here. Each currency has its own value and purchasing power. They can be used to pay for both physical and digital objects. They represent an independent payment instrument.

Tokens, on the other hand, are more similar to securities. They are issued by a person or entity on a centralized basis in order to simplify financial and business transactions on a particular platform. Unlike crypto, tokens cannot be mined.

Another important difference is that they operate on blockchains of coins. Most yield farming tokens run on Ethereum. They do not have their own blockchain, and crypto does.

Various Types of Yield Farming Work

Governance Token

This is the asset distributed among early adopters during the ICO on the crypto market. Apart from the potential value that it might bring if it becomes successful, it also provides users with rights to contribute to managing the start-up. In the case of yield farming, it might mean adding new currencies, changing the technologies, etc.

Tokens trade on exchanges, but they are just as volatile as cryptocurrencies. To monitor their prices, investors can use CoinMarketCap charts. For example, yield farming exchange Uniswap has its own tokens, and their price has varied in the range between $2 and $42.

With the help of a governance token, the exchange founders attract their first followers, hoping to make some profit. Sometimes, there can be a ten-fold or a hundred-fold increase in its price.

Liquidity Token as Part of Smart Contracts

It is a confirmation of the share of the contribution to the liquidity pool. At the same time, the actions of investors fall into smart contracts, which allows you to ensure yield farming is safe.

Yield farming exchanges create LP tokens as an internal currency, universal and common to all. With their help, you can get additional profit and try yield farming. So more users are attracted to yield farming, the internal turnover of finances in the system is growing. An example is PancakeSwap’s Cake, with a market cap of more than $1,8 bln.

Each yield farming service issues its own governance and liquidity tokens, and some of them, for example, Aave, combine the two functions.

To better understand the role played by the yield farming token, we need to understand the principles of liquidity exchanges.

The Operation Principle of Yield Farming

Yield farming has already become an integral component of the market of decentralized finance. The idea that tokens and coins should work instead of just being stored in wallets was first brought up by the founders of the Compound protocol.

In 2017, two businessmen developed and implemented a blockchain-based system for lending cryptocurrency. They created a platform where crypto holders could lock their finances in liquidity pools, and traders were able to receive loans there.

This system was based on the concept of liquidity – the opportunity of quickly converting digital assets into cash. All internal transactions are conducted using cTokens that are issued depending on the provided currency. Thus, ETH holders receive cETH.

The service is managed by COMP token owners who are able to vote on basic technological decisions. As a result, the project’s development path is determined by the community instead of the founders.

The Total Value Locked (TVL) is $7,258,342,479, while the market cap of Comp tokens is $2,271,587,203.15.

Currently, there are already many liquidity exchanges on the market. The most popular among them are PancakeSwap, Uniswap, Aave, Curve, and Binance Liquid Swap.

Yield farming offers three main ways of making money.

Lending

This method ensures that a yield farming platform is provided with sufficient funds value by liquidity providers – investors who deposit their digital assets.

Traders and DEX use the liquidity pool as borrowers. When they need to get a specific cryptocurrency, it is easier to get it on yield farming by providing collateral in the amount corresponding to the current market value. The main risk of borrowing is that the price of the deposited assets drops sharply, the loan is automatically liquidated, and the collateral is locked up. Therefore, crypto investors are protected against the risk of losing their funds, with the risk borne entirely by the users.

Liquidity mining

Yield farming itself has been quite a sensation on the DeFi market. Its principle of making a profit is very simple. Multiple yield farmers deposit their funds, and in return, they receive LP tokens that can be used to pay for the transaction fees, which is significantly more cost-efficient than using cryptocurrencies. Many tokens trade on exchanges and can be easily converted into fiat money.

Investors are rewarded with transaction fees for actions with all the funds. Most often, such services are used by exchange platforms that do not store their coins but instead borrow them from a liquidity pool. By depositing tokens, their holder allows borrowers to use them based on smart contracts.

The main risk is that of impermanent loss. It arises when there are drastic changes in the price of deposited assets. The system balances the savings account by adding more of the cheaper tokens and less of the expensive tokens. When the funds are withdrawn, the losses become permanent because they are not compensated anymore.

Staking

This is the traditional blockchain-based method of making a profit. Investors lock up their money in wallets for earning interest. The exchange receives funds for regulating the demand and supply. In fact, staking is an indicator of the project’s viability because by locking up their assets, users ensure the operation of the blockchain.

Additional Liquidity Incentives

The competition in the yield farming market is constantly increasing, and new players need to offer their users innovative ways of making a profit. For example, PancakeSwap organizes lotteries with a ticket cost of about $5 in Cake. Users can also test their analytical skills by trying to predict the price of BNB-USDT. Even though the rewards are usually small, it is still nice to get them.

The simplest way to earn passive income is to stake in syrup pools. One click, and the interest starts to accrue.

The interest rate is higher than that of a typical bank account, where the inflation rate often reduces the profits while you keep your money in the bank.

Strategies of Yield Farmers

Investors have access to various ways to make income, from yield farming a single cryptocurrency to more complex strategies.

Simply Yield Farming

The classic way to generate income is by investing two assets in a 50/50 ratio.

Lending and Depositing

In this case, coins are not locked up in the system but rather deposited at an interest rate. It should be noted that DeFi platforms offer significantly higher interest rates which sometimes reach over 20%.

Double Lending

Some exchanges offer rewards to lenders and borrowers in their own tokens. Users can increase their profits by taking out a loan and using it for lending.

Lending and Yield Farming

Borrowing costs are often more than compensated for by staking rewards. In order to lock up a pair of coins, it is necessary to purchase them. If a user considers it to be unprofitable (for example, if there is a rise in the price of one coin and a decrease in the price of the other), it may be easier to resort to borrowing on the same platform. In this case, you will not need to spend more on buying the coins, which are more expensive at the moment.

Profitability Indicators

There are two ways to find out the potential profitability in DeFi.

Annual Percentage Rate (APR)

This indicator corresponds to earning interest over a year. The value of funds is multiplied by the interest rate to calculate the returns.

Annual Percentage Yield (APY)

The profits take into account the reinvestment of returns or the effect of compound interest. If you earn interest every month, the total amount will be bigger because every time, the annual rate is accrued on the increased token balance.

For example, if the APR is 20%, then APY, or the actual rate of return, is 21.94% for monthly compounding or 22.13% for daily compounding.

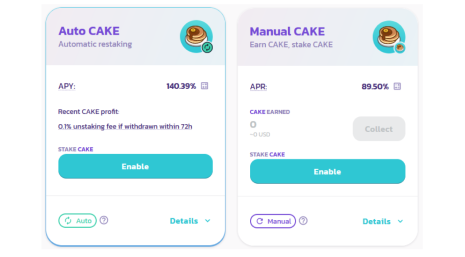

The indicator used on exchanges depends on the specific service. For example, PancakeSwap offers Syrup Pools in two modes: manual mode and auto mode. In the case of the former, investors manage their earnings automatically, and the exchange does not automatically compound. And in the second case, the system performs all operations independently, and liquidity providers can see future income.

Yield Farming Work

Choosing a farming site, you can take into account different indicators.

Total Value Locked (TVL)

This indicator shows the total value of tokens and coins currently staked on the yield farming platform. The higher it is, the more yield farmers have entrusted the platform with their money.

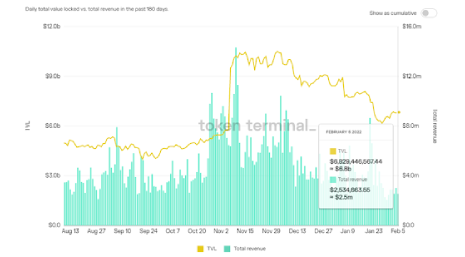

Currently, the TVL of Uniswap is $6,8 bn.

Total Revenue

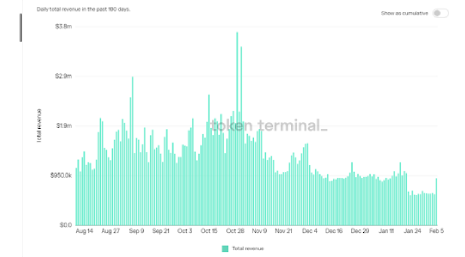

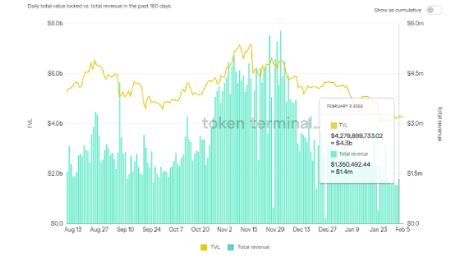

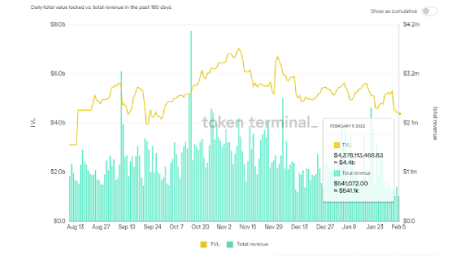

This indicator allows users to assess whether yield farming on this protocol is safe and reliable. It shows how many people are ready to pay for the platform’s services.

For example, Aave currently has a TR of less than $1 mln, while last October, it exceeded $3.5 mln.

Protocol Revenue

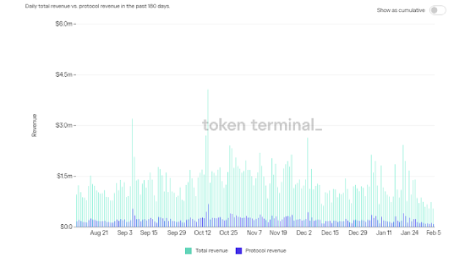

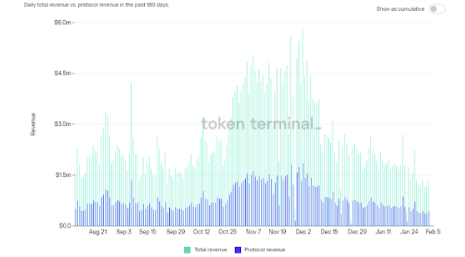

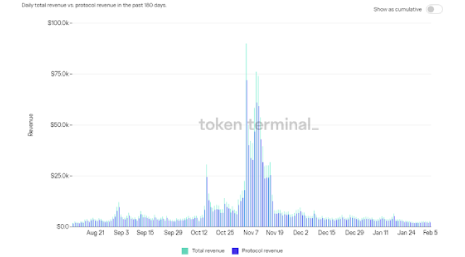

It represents the share of revenue that goes to token holders. For example, let us take a look at the charts of Sushiswap (the first screenshot) and PancakeSwap (the second screenshot).

Apparently, PancakeSwap pays a larger share of its revenue to the lenders.

Polkadot is still in the earlier stages of development and spends most of its revenue on dividends.

Uniswap does not report this indicator because it does not pay any dividends, with investors making money on exchange commission.

TVL and Total Revenue

The ratio of these two indicators demonstrates the efficiency of a yield farming service. The TR/TVL ratio shows the revenue for each dollar locked in the system.

For example, for Uniswap, this value is equal to $0.37. It is clear that investors make a profit on this exchange even without payments on governance tokens.

For PancakeSwap, it is $0.32.

And for Sushiswap, this value is only $0.000123.

By taking into account all of these indicators, you can find a reliable and profitable yield farming platform.

Token Protocols

A protocol is a standard. Its purpose is to ensure compatibility. When it comes to tokens, a protocol is used for defining the rules to facilitate interaction in the decentralized app system.

ERC-20

Currently, the standard protocol is ERC-20. All other standards follow its guidelines and offer some modifications. Many tokens are ERC-20-compliant, which ensures compatibility and safety.

ERC-20 tokens are based on smart contracts: they are not autonomous but instead exist as part of a contract on a blockchain. They are easy to set up and can be used in a wide range of DeFi platforms and DeFi applications.

Later versions of the ERC-20 protocol, such as ERC-1155, ERC-223, and ERC-721, offer additional features. 721 can be used for creating an NFT, while 223 and 621 are more convenient. 223 offers protection against accidental data transmission, and 621 adds the capacity of controlling supply.

BEP-2

This is the first common protocol for all Binance tokens that operates only on the blockchain on this exchange. The next protocol, known as BEP-20, allows transferring tokens between various networks. This technology allowed the creation of tokenized versions of coins such as Bitcoin, Ether, Litecoin, etc.

The main purpose of a token linked to coins is to ensure smooth exchange between DeFi platforms.

NEP-5

This is an emerging protocol of the NEO network that ensures a high speed of financial transactions (a new block is generated in 15 seconds instead of 6 minutes in the case of Ethereum) and zero transaction fees while also supporting several programming languages. So far, there have been few ICOs on this blockchain because it is less known by investors, unlike Ethereum. However, the NEO token trades on exchanges, with its price varying in the range between $20 and $25 in early 2022. In May 2021, its price spiked to $122.

Conclusion

In yield farming, tokens play a very important role. They allow users to deposit coins based on various blockchains easily. They unify all operations, fees for financial transactions, and returns.

Governance tokens carry out an administrative function by allowing the community to take decisions on the project development. With each ICO, the provider issues its own tokens, but this does not prevent interactions between various cryptosystems.