share

The DeFi space is developing rapidly, thanks to profitable farming. Farming attracts many users and investors with its high profitability. Curve is one of the most popular protocols in the world of profitable farming. In this article, we will take a look at it.

What Is Yield Farming?

Yield farming is a new trend in the crypto world, whose participants strive to get the maximum profit from their investments using DeFi protocols. The name can be explained by the direction of work of crypto farmers – they “grow” their income from investments “sown” earlier.

To achieve the goal, investors use various strategies. Among them are:

- The first strategy helps to earn money on interest through loans. To earn money using such a strategy, it is needed to register with the DeFi project, which issues loans. For example, in the Compound. The funds are transferred to the user who has applied for a loan on special conditions – with the subsequent payment of interest.

The commission received is the income of the crypto farmer from participating in the project. In addition, tokens are distributed among Compound users. By selling them or HODLing them (expecting coins to soar), you can also get additional profit.

- Liquidity. Users are rewarded for working with a specific protocol. They perform the role of liquidity providers, popularizing the project. As a rule, a startup distributes a certain amount of cryptocurrency between participants on a daily basis.

The influx of customers increases the demand for the startup and its products, and, as a result, the project token becomes more expensive. Subsequently, it can be sold on a decentralized exchange or another trading platform. - Conduct swaps—exchange tokens of one protocol for coins of another. An important component of profitable farming is constant market research in order to find alternative strategies.

What Is Curve Finance?

Curve is a protocol that focuses on providing users with a platform for the simple trading of certain Ethereum-based digital assets.

Unlike traditional centralized exchanges that require sales orders to match purchase orders, Curve uses a market creation algorithm to maintain the liquidity of its markets. This makes Curve an Automated Market Maker (AMM) protocol.

For those who do not know, a market model (market maker) is a software or asset that buys and sells financial instruments. It provides liquidity in the market and, at the same time, profits from the difference between the purchase and sale prices.

Yield Farming on Curve

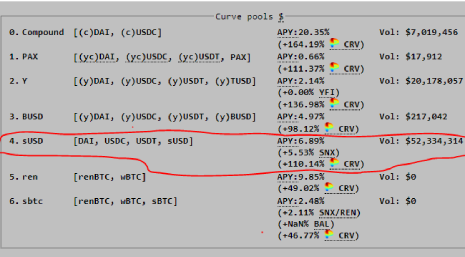

Curve is a decentralized exchange or yield farm focused on DAI, USDC, USDT, TUSD, BUSD and sUSD. Although their UX is pretty primitive today, the Curve team recently launched the Curve DAO and the CRV management token to reward liquidity providers for providing liquidity in Curve pools. Thanks to this, Curve pools today bring the best profit in the DeFi space.

How to Start Yield Farming on Curve?

Before you start, make sure that you have stablecoins in your MetaMask wallet along with some ETH (to pay for gas). Also, do not forget that you will have to pay trading fees, so calculate all costs in advance.

- Go to Curve.

If you scroll down, you will see different Curve pools with different yields to provide liquidity. As you can see, the sUSD pool brings 6.69% for deposits in stablecoins and a large number (113%) of CRV tokens.

- Connect your wallet.

Go to the Deposit section.

Connect your Metamask wallet.

Select the number of coins you want to add.

Click on Deposit.

- Approve Transactions.

It is required to confirm the transaction. You need to click confirm.

- Add Curve liquidity.

Now you will see a wallet window asking you to allow Curve to launch a smart contract to add Curve liquidity.

Click on the Confirm button.

- Check your wallet.

Go to Metamask.

Add a token (at the bottom).

Insert the smart contract address into the Token Address field.

Click “Next”, you should see the tokens in your wallet.

- Head towards the Curve sensor.

Here we will get a yield of 6.89% per annum since, in the example, we chose a pool with such a yield. To see a big profit, we need to put our liquidity pool tokens.

Connect your wallet, scroll down to the susdv2 liquidity indicator and click “Deposit and Bet”.

- Approve the transaction.

Once again, you will need to approve transactions (don’t forget about trading fees).

Click confirm.

You have now staked your tokens!

- Check the Curve sensor.

Scroll down. You should see the distribution of sensors. You can also reconfigure them and go through the confirmation process again.

It is important to say that these rewards won’t last forever since the returns depend on the price of the CRV token. Keep checking this site to see your rewards (in CRV and SNX tokens) to claim them.

Summing It Up

Profitable farming may seem hard due to the abundance of specific terms and the use of complex strategies. However, in fact, the goal of the movement can be described in just one phrase – achieving maximum income with the help of DeFi protocols. So we can highlight 3 more important points, such as:

- Profitable farming is quite a risky business. With the growth of this industry, fraud is also growing. The protocol in which you have invested money may turn out to be fraudulent, or it may already be closed tomorrow. Be careful and study the protocols for their transparency and stability.

- It is very difficult to farm without the support of the community. Strategies for earning money on farming are constantly changing, new trends are emerging, etc.

- In order to make good money on farming, you need to be well versed in decentralized finance, be able to build strategies and correctly evaluate your digital assets.