share

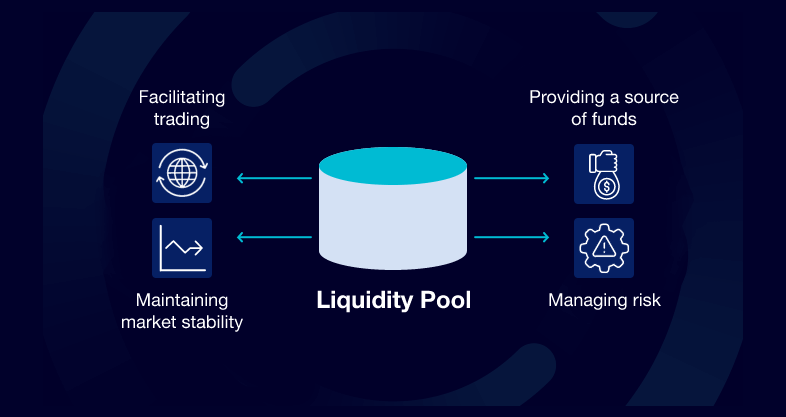

The digital finance and digital asset business spheres have been seeing exponentially more and more traction throughout recent years. Thousands of deals are taking place daily, and for them to work, liquidity pools are a necessity.

Liquidity pools provide for faster transaction verification processes and speed up the whole ordeal surrounding digital asset commerce.

The Importance of a Liquidity Pool

Liquidity refers to the speed and ease of conversion of a specific asset into conventional currency. This characteristic is especially relevant with cryptocurrencies as, a lot of the time if a cryptocurrency has a low liquidity factor, it means that it’s not specifically viable for a trader to invest in a specific currency.

Additionally, when a market experiences low fluidity levels, it means that the whole space is less desirable for dealers, and the price of crypto skyrockets, while high fluidity levels provide more stable grounds for trading to take place. The higher the liquidity levels, the faster and easier it is to trade from moment to moment.

In the space of conventional commerce, currency fluidity is often decided by stockbrokers themselves, while digital financial markets are forced to rely on liquidity pools or credit buffers to operate smoothly. The nature of how liquidity pools work and what they provide makes for a stable flow of fluidity to the eCommerce space making deals fair and ideal.

What Is Required for Crypto Liquidity Pools to Work?

The machinations of a liquidity pool are a complex matter that requires many different aspects and agents to work properly. Therefore, understanding why and how these services operate is vital to finding success in their use.

There are 2 main cogwheels in this system. You need to take note of Automated Market Makers (AMMs) and Liquidity Providers.

Automated Market Makers

These are the backbone of modern crypto commerce. They function by connecting 2 brokers and presenting them with their desired self-executing agreement for deals to take place. In addition, AMMs also present traders with accurate commerce data and currency prices to help them make a decision about their next move.

Liquidity Providers

This piece of the puzzle is by far the most important one as a credit buffer with little to no fluidity. Lenders are doomed to fail sooner than later. Additionally, this aspect of liquidity pools is how most crypto traders have found success in their fields in recent years.

How to Provide Liquidity and Make a Profit off of It?

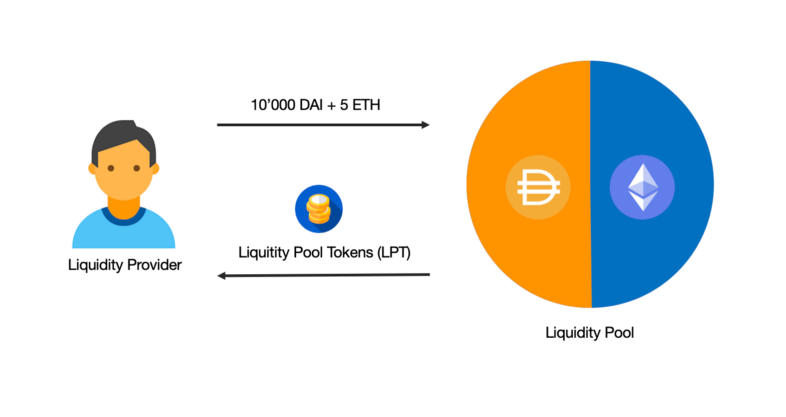

People that lend a credit buffer their resources to fulfill deals are called liquidity providers. Becoming a liquidity provider is quite simple, but a lot of thought needs to be put into how you do it.

First, you will need to choose a convenient credit buffer for you. This step is pivotal to your success. You need to find a liquidity pool that deals in the assets you not only hold but also believe in the success of.

Next, you will need to deposit crypto resources into a dealer match of your choice in an even 50-50 split. After you deposit funds, they will be locked in a self-executing agreement for the duration of time that you choose. During this time, you cannot lift the funds placed in the liquidity pool, so choose this period wisely. Additionally, while your funds are locked up, you will be rewarded with a portion of commerce expenses from the deals made with the part of the pool you’ve lent.

Once the lock on your part of the pool is lifted, you are free to withdraw your currency, and you will be paid in liquidity pool tokens.

The Pros and Cons of Liquidity Pools

Like any business opportunity, credit buffers have inherent advantages and disadvantages of use that may affect your success chances heavily. The main advantages of liquidity pools are as follows:

Streamlining and Ease of Use

Any crypto trader will have experienced the painstaking process that is finding an appropriate trade partner. A lot of the time, you won’t be able to find a suitable trading partner and will have to bargain to have your way. Liquidity pools completely circumvent this process by automating it using a complex of bots and processes to make your experience fast and efficient. Using self-executing agreements, credit buffers automatically pair you up with a different crypto trader.

Low Price Volatility

Since all the assets dealt with using liquidity pools are already stored within smart contracts, there won’t be situations where you are forced to pay double or even triple the regular cost of a cryptocurrency. With credit buffers, times, when sellers would charge obscene prices, are long gone in return for fair and advantageous deals. The way liquidity buffers organize this is through the use of commerce rates. A liquidity pool will take the data across the internet of how a cryptocurrency performs and what the average sell price of the currency is and present traders with accurate and advantageous prices.

Most disadvantages of liquidity pools are carried through their use of self-executing agreements. While it is the best way to trade crypto currently, smart contracts have a few flaws that may dissuade some users. The disadvantages are as follows:

System-Wide Errors

While not commonplace, these technological hiccups can impact your performance heavily. Since a smart contract holds your funds for the trade to come through, there is a chance that if a system-wide mishap occurs, you will lose all the funds that have been deposited in the contract. Tread through smart contracts with care and caution. It might just save you from a large loss of resources.

Fraudulent Trading Practices

Even though liquidity pools circumvent disadvantageous deals, there is still a similar way people can make you spend much more than you should. Sometimes the access given to consumers in a self-executing agreement varies. There might be cases where the effective rules of the self-executing agreement can be changed on the fly, possibly spelling a complete loss of all the pool’s funds.

How Safe Are Liquidity Pools?

This is a hard topic to discuss as liquidity pools are safer than most services like it but are still risky enough when looked at in a vacuum. Liquidity pools are safer than something like an order book because they don’t hold your crypto for as long as order books do, which decreases the inherent smart contract risk.

On the other hand, these services can be quite risky for the liquidity provider as the assets stored within the pool are completely out of their reach. A lot of the risk factor depends on how much research is done by the liquidity provider on the specific pool they’re determined to deposit funds into. Beginner or gullible traders can easily lose vast amounts of their resources.

Most Popular Liquidity Pools

Uniswap

Uniswap has been around since late 2018 and has proven itself to be a mainstay among other popular liquidity pool services. Uniswap is an Ethereum-based system where you can freely deal in ERC-20 with other stockbrokers.

Balancer

Balancer is another very popular fluidity service. Like the former entry in this list, Balancer is an Ethereum-based system. The thing that distinguishes it from most other services in its space is that Balancer has more established and robust credit buffer customization options.

Curve

And last but not least, an Ethereum-based platform, Curve Finance, presents a unique opportunity in the fluidity space for dealers to take part in stablecoin commerce.

Long Story Short

Liquidity pools have proven their usefulness in the decentralized marketplace and will most likely be a mainstay for quite a while. The edge-cutting technology that allows for lightning-speed exchanges to take place is hard to match in the modern trading space. Therefore, a trader that pays diligent time and effort into investing in this sphere is sure to see good results at the end of the day.