share

Ever since the financial crisis of 2008, peer-to-peer lending has skyrocketed in popularity, and it’s not by sheer luck. That was around the time when banks determined that they would not lend to anyone. The judgment opened the door for the free market to create a new way for people to borrow money. That’s when the peer-to-peer (P2P) lending phenomenon really took off.

The rapid expansion of P2P lending can be attributed to a number of factors. Is it, on the other hand, a viable lending option for you? Even if it is, do you know enough about P2P lending to make the most of it? If you want to know about the industry and are looking to get your feet wet, then this is the article for you. We’ll tell you everything you need to know, starting from the very basics.

What Is P2P Lending?

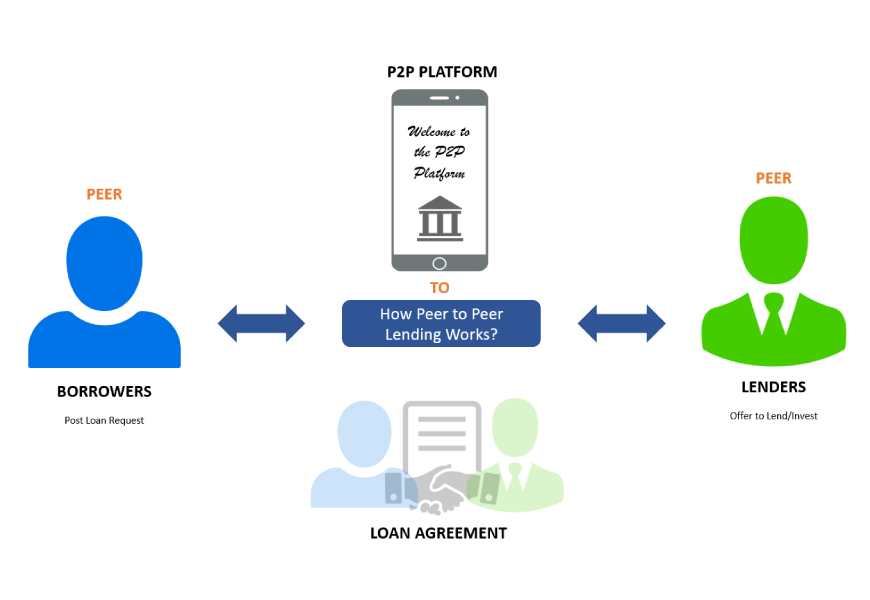

Peer-to-peer lending is referred to as non-bank financing. It is, in other words, a lending and borrowing mechanism that does not rely on traditional banks. As a result, it looks to be quite distinct from conventional banking.

Peer-to-peer lending is mostly done over the internet. Borrowers come to P2P lending websites in search of loans – and better terms than they can get from their local bank – while investors come to give money at far higher rates than they can get from a bank.

On the surface, greater rates for peer-to-peer lending investors appear to transfer into higher loan rates for borrowers, but this isn’t always the case. A P2P lending company brings borrowers and investors together on the same websites. It’s an arrangement that cuts out the banker.

Here’s the thing: owning and operating a bank is costly. There must be a physical branch, which needs maintenance. It is also necessary to hire people, which necessitates multiple salaries and employee benefits. Then there’s the cost of obtaining and maintaining advanced security measures, as well as in-house computer systems and software.

When the costs of a single bank branch are multiplied by the number of branches, it’s easy to see how you may spend 15% for a loan at a bank where you’ll earn less than 1% on deposited funds. It is far from being a democratic or equitable financial system.

Banks have real estate, hundreds or thousands of employees, and high-tech equipment; P2P lending does not. As a result, you’ll see a transaction with a ten percent lending rate and an eight percent return on your investment capital.

How Does P2P Lending Work?

People can begin investing with a rather small amount. The provider divides the investment into several smaller chunks, which are then put in a queue to be lent to people in need of a personal loan.

Borrowers make a monthly payment, which includes the principal (the amount borrowed) and interest, and is automatically credited to the Lending Works account of the investor. Depending on their investment goals, they can choose to reinvest repayments so that their interest earns interest or to create additional income by automatically withdrawing to their bank account.

The best way to visualize this is to view P2P sites as moderators rather than actual lenders.

Advantages Of P2P Lending

As part of our deep dive into P2P lending, let’s first take a look at the things that make it advantageous.

Quicker Transactions

P2P platforms are totally online, which means the application process is much faster and more convenient when it comes to obtaining money. The majority of the time, P2P platforms have a waiting list of investors willing to make loans to the proper borrowers, which means that the time it takes for borrowers to receive their funds can be quite short — sometimes as little as a few hours.

Lower Rates

Because of the increased competition among lenders and lower origination fees, P2P loans typically have lower interest rates. Moreover, the investors send money directly to the borrowers through these platforms. There is no need for an intermediary. As a result, both parties profit from more favorable interest rates.

Higher Returns

When compared to other sorts of investments, P2P offers investors larger returns. The lack of an intermediary contributes to higher returns. The average annual return is 7%-11%.

Disadvantages Of P2P Lending

Nothing under the sun is wholly positive. Here are some of the pitfalls associated with P2P lending.

Application Fees

A loan arrangement fee must be paid whenever a borrower applies for a loan with a bank or other traditional lender. Instead of charging for loan arrangements, P2P loans make money by connecting lenders and borrowers. This service fee is entirely dependent on the amount of money borrowed, the length of the loan, and the borrower’s creditworthiness.

Limited Legality

In some places, peer-to-peer lending is prohibited. Australia, Argentina, Canada (Ontario), New Zealand, and the United Kingdom, for example, require P2P platforms to adhere to investing legislation. As a result, this service may not be offered to all borrowers or lenders.

Credit Risk

P2P lending platforms are often associated with significant credit risks because the borrowers who apply through these platforms have a poor credit rating, which prevents them from obtaining regular bank loans.

Types Of P2P Loans

There are a lot of different types of loans you can access through P2P financing. Some of these are:

Personal Loans

Personal loans are the most frequent type of loan offered by peer-to-peer lending websites. One of the main reasons for this is flexibility. Traditional banks impose more limitations on loan funds than P2P lenders. Another consideration is credit quality. While banks tend to lend only to persons with very high credit scores, peer-to-peer networks are more likely to lend to people with a lower credit score.

If you have a good credit history, you can usually borrow loan amounts of up to $35,000 on an unsecured loan with a duration of two to five years. Interest rates start in the mid-single digits, which is far lower than credit card rates.

Car Loans

On peer-to-peer lending networks, auto loans are an unauthorized loan category. Although you can borrow money to buy or refinance a car, the loan may not be a car loan. You may borrow up to $35,000 for personal finance, for example, which you can use to buy or refinance a car.

Although the rates given on automobile loans (or, more specifically, personal loans) may be greater than those offered by banks, peer-to-peer sites have one advantage that bank auto loans do not: the loans are not secured by the vehicle.

Business Loans

Peer-to-peer lenders are rapidly filling the gap in the market for business loans. That’s also a positive thing. Hundreds of banks advertise that they offer company loans, but they usually have strict lending criteria, require inconceivable amounts of documentation, and don’t issue nearly as many loans as they claim.

Business loans provided by peer-to-peer lenders may have the benefits that other forms of loans have. Low interest rates, a straightforward application process, rapid response times, and more credit flexibility are all part of this package. Peer-to-peer lending services are frequently able to provide business loans that are not available from traditional banks even if you have a minimum FICO score.

Mortgages

Lending money for a home has always been a difficult business. Mortgage lending is fiercely competitive, and peer-to-peer companies aren’t quite there yet in terms of cost and loan terms. However, because P2P is a relatively young business, everything is in flux, and if mortgage lending progresses in the same way as other types of online lending and loans, good things are on the way!

Student Loans

Peer-to-peer lenders are possibly more essential than any other loan type when it comes to student debt refinances. While there are hundreds of sources for student loans, including banks and the federal government, finding lenders who will refinance student loans is difficult. The number of lenders who do so can probably be counted on two hands. With the exponential growth of student loans in recent years, peer-to-peer lending should only grow in the years ahead.

Bad Debt Loans

To argue that peer-to-peer lending has expanded into subprime loans is definitely an exaggeration. However, the competitive market is gradually making headway in making loans available to consumers with fair or poor credit, as determined based by banks. Even with the high interest, people in that situation may be unable to obtain credit from any other source.

Medical Loans

Medical financing, like student debt refinancing, is becoming increasingly significant. The demand for medical funding circles is expanding as deductibles and copayments rise, and standard health insurance policies prohibit certain treatments and operations. Medical funding is accessible on peer-to-peer websites in general to cover the growing list of expenses that health insurance does not cover.

What Are the Best P2P Lending Platforms To Use?

Now we get to the meat and potatoes of the article. In this section, we will take a look at the best peer lending sites you can access. We will give you all the relevant information that will help you decide which is the best peer lending option for you! So, without further ado, here we go!

Prosper

Prosper offered the market’s first peer-to-peer lender. It was established in 2005 as the United States’ first peer-to-peer lending platform. According to their website, they have facilitated over $18 billion in loan transactions.

You can acquire personal loans of up to $40,000 with a fixed rate and a fixed period of three or five years if you’re a borrower. For the life of the loan, your monthly payment is fixed. There are no prepayment penalties, so you won’t be penalized if you pay it off early. You can see what your rate will be right away, and once authorized, the funds will be paid immediately into your bank account.

Payoff

Payoff is unique among the companies on this list in that it is neither a peer-to-peer lending platform nor a bank. Payoff is a “financial wellness” company that works with other lenders to provide clients with a loan to help them pay off their credit card debt.

Payoff uses a simple smartphone interface to let a customer choose which credit cards they wish to pay off and combine them into a single loan, rather than having to keep track of many credit card payments each month. You’ll only have to make one payment instead of 36 monthly payments this way (at a low rate).

LendingClub

LendingClub is comparable to Prosper, except that it launched two years later, in 2007. They’ve aided over three million consumers in obtaining over $60 billion in finance. LendingClub offers four distinct sorts of solutions to borrowers:

- Personal loans. These loans are made to individuals. You can acquire a personal loan of up to $40,000 to pay off credit cards, consolidate debt, improve your property, or cover large expenses like a wedding or a car.

- Loans for small businesses. A business loan of up to $300,000 can be obtained with a set term of 1 to 5 years and no prepayment penalty. To be eligible, you must have been in business for at least 12 months, have yearly sales of at least $50,000, have acceptable business credit, and own at least 20% of the company.

- Auto refinancing is a service that allows you to refinance your vehicle. You may be eligible for an auto refinancing loan if your car is less than ten years old, has less than 120,000 miles, and is used for personal purposes. You must owe between $5,000 and $55,000 on a loan that originated at least a month ago and has at least two years left on it.

- Patient-centered solutions like LendingClub partner with doctors across the country to help you pay for medical and dental bills that you can’t afford to pay in full.

Peerform

Peerform was created in 2010 by a group of Wall Street executives with experience in both finance and technology, making it the ideal combination for launching a peer lending website. According to their website, they had two main goals, which they still have today:

The first was to give consumers a favorable experience when applying for personal loans through a simple, quick, and fair process. The second goal was to provide a well-vetted selection of investment opportunities with the potential for positive risk-adjusted returns.

Upstart

Upstart is a cutting-edge peer-to-peer lending platform developed by three former Google workers. They’ve produced intuitive software for banks and financial institutions in addition to being a P2P lending platform.

What sets Upstart apart is the way they assess risk. While most creditors will look at a lender’s FICO score, Upstart has developed a system that assesses a wide range of the borrower’s risks using AI/ML (artificial intelligence/machine learning). As a result, the company’s loss rates are much lower than those of its competitors.

StreetShares

StreetShares is a peer-to-peer lending platform that differs from the others mentioned. To begin with, the borrower loans are geared toward small business owners and business owners in general. There are three sorts of loans available to you as a borrower to help your small business grow:

- Term Loan is a type of loan that you can acquire anywhere from $2,000 and $100,000, with periods ranging from three months to three years. There are no prepayment penalties, and the money is deposited promptly after approval.

- Patriot Express Credit Line gives you more options. With maturities ranging from three months to three years, you can borrow anywhere from $5,000 to $100,000. You can draw on the funds as needed because it’s a line of credit, and you’ll only pay interest on the money you use.

- Contract financing is based on your future earning potential, not your current net worth, and requires a little more documentation to get accepted. There is no maximum loan amount, there is a Mobilization Loan/Line option, and there are no prepayment penalties.

You must be a U.S. resident, have been in the company for at least one year, have a minimum revenue (StreetShares does not specify what this is), and have a business guarantor with “acceptable” credit to qualify for any of these loans.

Kiva

If you wish to make a difference in the world, Kiva offers a unique experience in peer loans. Kiva is a non-profit corporation located in San Francisco that helps people all around the world fund their businesses with minimum investment and no interest. They were founded in 2005 with the goal of “connecting people via loans to reduce poverty.”

If you need money to expand your business, you can borrow a minimum loan amount or up to $10,000 without paying interest. That’s right; there isn’t any. You’ll find the best solution to be able to ask friends and relatives to lend to you after completing an application and being pre-qualified.

Final Thoughts

That was our list of the seven best P2P lending sites that you can find! With the way the world is going, it pays to be well-informed. The world of finance is always in flux, meaning there are always a lot of options to get the money for what you want. As long as you keep an open mind and are willing to do the research, new options will emerge.

However, you are dealing with money, so always exercise caution. Know what you are getting into before you take the plunge. And now that you know about the best P2P platforms, you can go ahead and decide which one works for your needs the most and go from there. Good luck!

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)