share

More and more traditional financial instruments are intertwined with blockchain technology. What we used to consider exclusively in terms of the use of fiat currency is now being successfully tested in the blockchain network. This also applies to crypto VC funds – one of the main ways to get financing for startups.

Cryptoverse in Research

This status is explained by the huge growth in the number of blockchain users. At the same time, decentralized finance provided all the leverage necessary to generate additional income – now, the token does not lie in wallets just like that but brings profit to its owners, sometimes much more significant than fiat. For example, interest on bank deposits remains at the level of 2-3%, and in farming, you can get more than 100% per annum.

Crypto.com did research involving the number of crypto users for the first half of 2021.

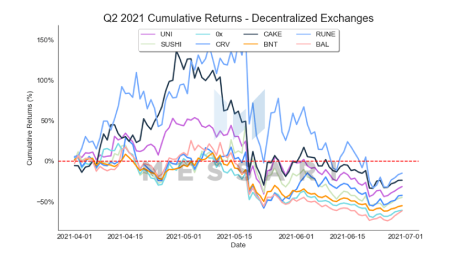

The cumulative returns of decentralized exchanges have grown by 150%, according to Messari.

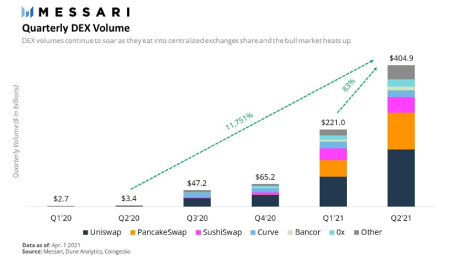

DeFi exchange volumes surpassed $400 billion by May.

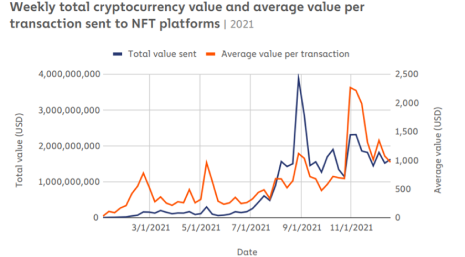

Chainanalysis showed that the NFT market would reach the same $4 billion by the end of 2021.

All this clearly proves the popularity and relevance of cryptocurrency projects on the market – according to research, every 25th inhabitant of the planet has a cryptocurrency wallet and at least one token in it.

What Determines the Mainstream Adoption of Cryptocurrency?

Owning a cryptocurrency in itself will not give you anything. The main value of money lies not in its value but in its capabilities. DeFi is the key to the success of crypto in the world. So far, this area has just begun its development, and its further success largely depends on the position of crypto VC funds.

In order for people to start using their capital, the best minds create crypto projects. Blockchain companies are emerging at an incredible rate, and many of them offer innovative ideas, the implementation of which is underpinned by financing, as well as comprehensive expert support.

As was the case with the Internet of the late 90s and early 2000s, those who are willing to take risks win in the crypto space. Recall Mark Andreessen, the creator of the Netscape browser, who launched such projects as Facebook, Airbnb, Github, and Twitter. He created the leading venture capital firm in the Silicon Valley – Andreessen Horowitz, which grew 10 times in three years.

Now there are hundreds of early-stage companies in the crypto space, many of which are founded by the world-class team. Their skill sets amaze the imagination of ordinary people, and the technologies used by the developers are easy to use and difficult to understand. Some ideas are not viable, but many can underpin new DeX principles. Right now, the moment has come when you can get rich just by believing in the blockchain sector.

What Is a VC Fund in Traditional Finance?

A venture fund is a set of investor funds united by a common name and direction of investments. The venture capital firm is engaged in administration. The manager is responsible for attracting other institutional investors. In the accepted terminology, the founders are called “general partners”, and the members are called “limited partners”.

The Main Goal of a Venture Fund – Find a Promising Startup That Will Make a Profit.

Usually, a large portion of investments is lost, but due to the excess profits of one or two projects, investors get a huge income.

Venture capital is usually invested in risky, non-liquid early-stage companies. You can enter it only at the initial stage, and you cannot withdraw your investment until the termination of its work. This is where venture funds differ from hedge funds. Hedge fund managers also attract third-party investors, but they direct the invested money into liquid projects, so the risk is lower here.

How VC Fund Works

The investment process is implemented in several stages.

VC Fund Foundation

This is managed by a venture capital firm, which may have several different funds. They differ in the geography of investment, the focus of funding (on specific areas of businesses or broadly specialized), the ownership of funds raised (retail investors or state-owned companies), etc.

The Attraction of Private and Institutional Investors

These are people who are ready to risk venture capital, fund new ideas, and expect super-profits. Usually, every fifth project pays off all unsuccessful investments. Investors are becoming major players in the financial market, as they need to invest at least $100,000.

The Hedge Fund Managers Review Applications

The list of investment projects is submitted by startups or existing firms that require funding to scale. They indicate the main ideas and parameters of the company.

Project Analysis

This is a comprehensive study of the business plan, an assessment of the perspectives of the idea, the team and the skill sets of each member are considered. At this stage, nonviable ideas, potential scammers and swindlers are eliminated.

Completion of Paperwork

When a positive decision is made on funding (only 1% of applications reach this stage) and investor funds are received, the investment gets a legal and documentary basis. As a rule, investors receive the rights to own a part of the future project in the form of preferred shares.

Financing

The project funding is done not all at once but gradually at every stage of business development – starting from the early stage. The process of cooperation lasts 3-10 years.

Project Exit

In the event of its successful development, the assets become liquid, and the VC fund may terminate its activities. The stocks and business shares are sold on the market to corporate or retail investors.

Venture Funding in the Crypto Space

Venture funds came into the blockchain not so long ago. For the past three decades, they have been actively investing in technology projects related to IT, but due to the high volatility of the cryptocurrency and the early stage of the development of the DeFi market, investors have not actively invested in crypto.

However, the situation is changing. Those who were willing to take risks made really high profits, and the growth in the number of crypto users showed that this is not a bubble: blockchain network is a technology of the future.

The owners of digital assets have access to powerful trading and passive income tools. Business development in the blockchain network is moving forward with great strides, and more and more entrepreneurs are choosing this market for the creation of companies. The crypto industry has gained such momentum that it is no longer possible to ignore it.

Initial financing in this area still carries risk, but it is already significantly less than it was 3-5 years ago. Crypto startups associated with the blockchain network go to the state level because it is safer to store data in a distributed database. Blockchain infrastructure automatically protects data, and smart contracts are impartial and cheap. DeFi captures not only trading but also other types of businesses, and funding in the crypto space can give a huge return.

Among other things, venture capital firms are also changing, adjusting to new conditions. So, the newly created VC fund, supported by Electric Capital, will specialize in blockchain technology and will be based on a fair distribution of tokens and will focus on the community.

Rules for Receiving Investments

Three years ago, the most popular way to get investing in crypto startups was ICO – the initial tokens offering. Thus, retail investors and crypto community enthusiasts were attracted, and the project could raise an insufficient amount for development. In addition, this method was significantly undermined due to scam offers when administrators collected funds and departed in an unknown direction.

Venture investing is much more reliable in this regard. The manager and his team carefully check all aspects of the offer before accepting it.

In order to get venture capital at the idea stage, future developers must provide a carefully crafted business plan and a complete portfolio. Most often, a primary functioning product is required. The institutional investors are hard to convince, but the main goal – supporting the project for several years – is worth it. Therefore, teams with extensive experience and thoughtful ideas win in the venture investing market.

To receive financing, you need to prove your perspectives, reliability and anti-fraud approach.

What Benefits Does a Startup Get From VC?

Venture investing is not only about money. The limited partners will not agree to invest in a VC fund that does not support a project or a startup. There is a class of funds that work at the seedling stage – they look for promising ideas and actually create businesses from scratch.

This approach is important for startup entrepreneurs. They have at their disposal the experience of experts who help develop the idea and promote it. A venture capital firm is a community of developers, marketers, and economists who delve into all the details of the project.

The second important aspect is reputation in the market. Fundraising with the help of ICO was carried out “for good luck” and for both parties. Developers could not attract investors, and those, in turn, did not receive any guarantees against fraud. If a VC fund backs the project, this means that a detailed check of all components, including the founders, has been carried out. Accordingly, a startup enters the market with a supported reputation, and it has more chances to turn into something worthwhile.

In case of failure, the image of the development team is preserved – in the community. They are not branded as scammers and swindlers. Often the fund managers take some of the blame on themselves, reporting that they did not provide adequate support to the project.

An important aspect is the gradual infusion of investment – not all businesses are able to immediately “digest” huge financial investments. Gradual investing, starting from the early stage, makes it possible to develop the idea systematically and step by step. This approach creates flexibility – at any time, there is an opportunity to change business models since the funds received have not yet been fully utilized.

Stages of Financing Crypto Companies

The rounds that blockchain companies go through come from traditional finance.

Seed Funding

This is an obligatory stage through which they pass in order to prove their worth as developers for a venture capital firm. Pre-seed funds are personal and received from relatives and friends. Further, with a certain amount of luck, you can get money from angel investors. These are holders of large capital, ready to risk part of it. As a rule, such a person believes in you and your ideas.

Developers find angels on their own and allocate them a share in businesses. They need to provide a portfolio – the more complete it is, the more likely it is to get approved.

Series A

When there is already something to show to the investment firm and the documents are signed, early-stage startups receive the first portion of funds. A large portion of it goes to team creation (or expansion), product refinement, marketing, and branding.

Series B

The project has started an expansion stage, and the flow of financing does not stop. If the product has successfully entered the market, it gets developed and begins to capture its sector. Technological risk is minimized, and the first income flows in. The business models of the company are being improved and possibly redesigned for the new market.

Series C

It implies an exit to the open cryptocurrency space and a presentation for the community. This is a growth stage. The startup is already trying to secure its own capital, placing its shares on stock exchanges. If the stock market accepts a newcomer, the profit will begin to grow, and the project will move into the category of full-fledged participants in the market.

Alternatives to Venture Investing

In addition to venture financing, a company can receive funds through Private Equity and hedge funds.

Private Equity

Private Equity is when financing is attracted for an already finished and developed project. The check amounts in Private Equity are larger because there is less risk. The investments are aimed at private companies and are characterized by a higher level of project maturity.

Hedge Funds

Hedge funds – investments are intended for public companies, that is, those with shares on the stock market. Due to this, you can exit the hedge fund at any stage. For example, when crypto investors invest in liquid digital assets.

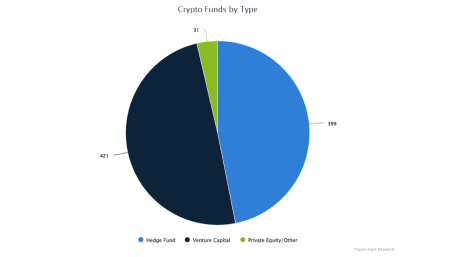

Currently, the distribution of market investing in the crypto field is as follows:

Venture capital slightly outperforms hedge funds and takes a leading position. The share of Private Equity is minimal.

How Digital Assets Can Participate in Venture Capital

So far, digital assets are only the purpose of investment – sometimes VC funds are invested not in companies but in tokens. Crypto VC funds do not make direct investments in cryptocurrency. This is done by retail investors. Some crypto companies offer LP tokens.

This is explained by two factors:

- Insufficient regulation of crypto and blockchain at the state and legal levels;

- High volatility of any token except for stablecoins – when investing in the blockchain for several years, the calculations become difficult because the price of digital assets is constantly changing by quite significant amounts.

The Best Venture Capital Firm

In 2022, the largest venture capital firm specializing in blockchain technology and cryptocurrency will be capitalized in billions of dollars. Let’s highlight the five largest companies in the capital in descending order, with the top one in the first place. The data is current at the time of writing and taken from Cryptorank.io. There you can also study the detailed portfolio of each company.

Pantera Capital

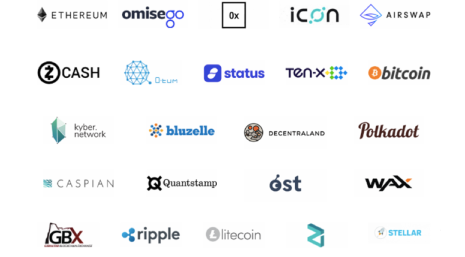

It has existed since 2013 and is the oldest investment company in the crypto field. Capitalization is over 138 million dollars. Leading investment XRP, and also Terra LUNA, Polkadot.

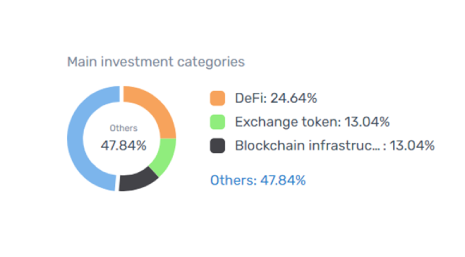

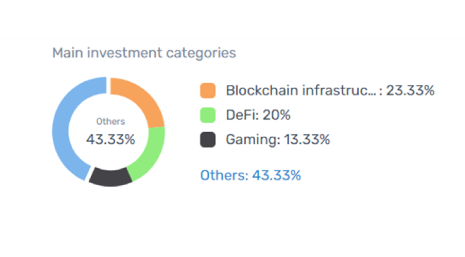

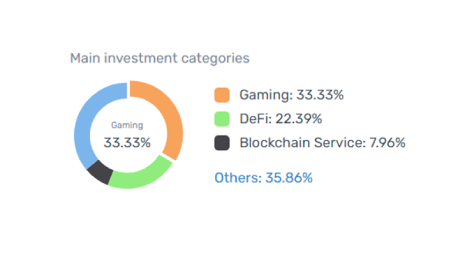

Almost half of the funding is directed to the blockchain, and a quarter of the investment is directed to decentralized finance.

Multicoin Capital

Founded in 2017, it invests in startups and tokens. Among its investors is Marc Andreessen. Since its inception, the Capital VC fund has grown from $2.5 million to $135 billion. The founders took a risk and invested in the unreliable Binance exchange at that time and did not lose. The leading token in the portfolio is BNB.

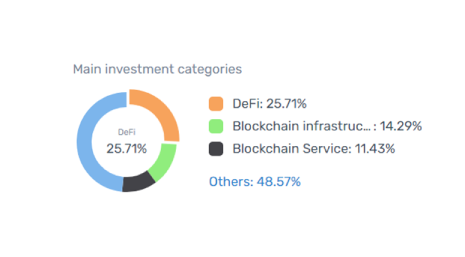

The distribution of investment is approximately the same as that of the market leader.

Kenetic Capital

The company was founded in 2017 in Hong Kong. Engaged in investing, trading, collateral and liquidity and investment portfolio management.

Investing money in 100 crypto projects turned out to be more than successful.

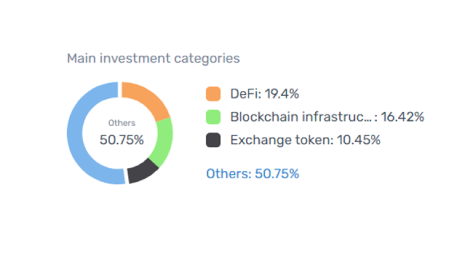

The capitalization of the venture fund is about $130 billion. The main areas of investment in the crypto industry are DeFi and blockchain infrastructure.

Andreessen Horowitz (a16z)

The founders are well-known people in the IT field with no experience in investment – Mark Andreessen and Ben Horowitz. Sufficiently tough management and aggressive promotion methods have made the venture capital firm a leader in Silicon Valley. Recently, the owners paid attention to the blockchain sector and are actively investing in projects.

The market capitalization is approaching $130 billion. The main investment is in the blockchain network and also DeFi.

AU21 Capital

The firm was widely known for creating a joint venture with the Polygon blockchain, which has since been actively developed. This happened in June 2021. The cost was 21 million dollars. They mainly invest in promising startups on the blockchain.

Capitalization is $128 billion. Gaming projects are one of the main directions of investments.

Conclusion

To receive investment fund support, an entrepreneur must go through the pre-seed stage on his own and then carefully prepare. There are three main parameters.

Idea

The perspective of the idea, its careful development and scalability. This is documented in the business plan.

Portfolio

Having a portfolio. With absolutely no experience, only truly innovative and viable ideas get supported.

Minimum Viable Product

Presentation of a functioning product. The seed stage shows the perseverance and desire to develop, as well as the communication skills of the startup founder.

These conditions are not mandatory, and the decision always remains with the VC fund manager. However, their implementation significantly increases the chances of attracting venture capital investments.

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)