share

In this article, we’ll try to understand the specifics of creating a successful marketing strategy in the blockchain space. As you likely know, marketing is key in delivering your product to the right audience, at the right time, in the right way.

There’s a lot going into a strategic marketing planning process. This includes analyzing your brand’s core values, studying the marketplace as a whole as well as your specific nice, breaking down the psyche and behavioral patterns of your factual and potential customers, and so on.

But what is the end goal of a marketing strategy? What are the criteria for the success of a strategic marketing plan? And, more importantly, how does all that apply to blockchain and crypto projects? Let us find out.

Marketing Strategy vs. Sales

What is the goal of a marketing strategy? If you answered “to sell a product,” you need to think again. Selling is the goal of a sales strategy. Think about it as scoring a goal in football or basketball.

In turn, a marketing strategy can be compared to setting up the pitch for a match. A marketing plan lays the groundwork for all the interactions between the customer and the brand.

The goal of a marketing strategy is to create an opportunity for a sale to take place. The marketer arranges a way that customers will likely close a deal on the product. This includes advertising, influencer marketing, airdrops, whitelist privileges, and other goodies.

The main bit: a marketing plan should never seek to force or rush the customer into doing a particular action.

Vision: The Groundwork of a Strategic Marketing Plan

The blockchain field is still in its relative infancy, and many big projects in it are driven largely by the vision behind them. Understanding your vision and mission will prove invaluable in achieving your marketing goals. When planning a blockchain marketing strategy, the first step is to answer the following questions:

- What does our project stand for?

- The vision is the highest element in your marketing hierarchy, and it’s what steers the strategic marketing plan. It’s what you seek to deliver to your target audience, i.e., the unique utility of your token or blockchain service.

- What unique value do we offer our customers?

- What is it that you can give them that will make their lives better and their spending more worthwhile? People invest in blockchain initiatives because they can feel their quality of life can be improved in return. Therefore, a solid marketing plan in this field should be centered around that.

- How is our offering similar to those of others? How is it different?

- The strategic marketing planning process is largely defining your project’s key attributes. You need to know exactly what makes your token or DApp stand out and/or lag behind. This way, you can set yourself up for long-term success.

- What crypto projects are our soul brothers and nearest rivals? Who represents similar values to ours?

- If you have a defined and unique offer, chances are there are projects out there whose marketing goals can mutually benefit yours. Blockchain is packed with collaborations and mutual integrations. As new networks arise, DApps and services blend together. A collaborative marketing plan can help you both reach new audiences and build investor loyalty in the long run.

- What cluster or existing blockchain products do we belong to?

- Knowing your exact niche is of the essence in strategic marketing planning. You’ve got to understand where your product sits in the current marketplace so as to know which way to steer it.

The Problems of a Marketing Strategy

The cryptocurrency world is replete with short-lived projects that may start off promising but ultimately turn out a flop. That’s no surprise, given the level of freedom and flexibility offered by blockchain. Anyone can start a token or a DApp of any kind in no time. But who would want to be that anyone?

Why exactly does a crypto project flop? Many failed projects have been fueled by strong technology, sufficient financial backing, and a committed follower base. So how a blockchain project avoid falling at any hurdle, safeguard its marketing efforts and stay on track for the long term?

To answer that, you need to understand the two key problems that marketing seeks to solve.

The Attention Problem

For a customer to engage with a brand, the brand needs to have grabbed their attention first. Your strategic marketing planning should focus on how your crypto token or service is supposed to pique someone’s interest and keep them interested.

This doesn’t have to mean loud, in-your-face slogans and astronomical return on investment promises. Every crypto product that’s made to last has a set of core values it needs to fall upon on every level: logo, design, tone of voice, advertising campaigns, etc. To know what grabs the attention of your audience, you must understand the core features of your project as a whole.

The Conversion (Persuasion) Problem

Conversion is the marketing process of turning a bypasser into a buyer or investor. This problem is all the more acute in the crypto space. There are myriads of initiatives in Web3, and the customer often gets misled or lost in a sea of options.

To help the customer along the right path, consider incorporating the AIDA formula into your marketing strategy. AIDA stands for Attention, Interest, Desire, and Action. It represents the cycle of customer engagement and their journey to become a buyer. Let’s have a look at how that happens.

Attention

First, the product grabs attention. This can be achieved with conventional advertising methods: context ads, social media posts, YouTube videos, Discord/Twitter mentions, creative placement techniques, etc. The goal of a marketing plan is to make the user aware of the product.

Interest

Generate and keep interest in the project. After creating awareness, the product needs to generate interest in it. For example, a blockchain solution could entice people with the promise of instant and near-free transactions. A DApp could offer a unique service or just a nice little convenience to make people’s lives easier. The marketing goals at this stage are to educate the user on why your project is the real deal. For that, you can use whitepapers, webinars, YouTube videos, educational courses, etc.

Desire

The point of a marketing plan is to guide the customer from the first A to the last while keeping them convinced they’ve made the right choice. This is where you can gently ‘exploit’ people’s FOMO and a general desire to relate to something progressive and cool. For that, offer time-bound discounts, promotions, or other incentives to get people itching to pitch in.

Action

While the previous 3 stages relate to your marketing process, the last A – the action stage – is really just a sales activity. At this stage, the user finally decides to buy, or invest in, your product. The buyers need to be gently guided toward the purchase. The best way to do this is to provide clear and concise call-to-actions. This can be done both on your website and via an individual mailing campaign. If the customer crossed the last A – consider your strategic marketing plan realized.

Assume That No One Cares

They just don’t know they need you yet.

A great strategic marketing plan should rest on the assumption that people don’t always know what they want. True mastery of making a marketing strategy is to anticipate needs. Before Bitcoin, nobody knew they needed a peer-to-peer digital currency. Before Ethereum, crypto users had no idea smart contracts could change their lives.

When Ignorance Is the Bliss

The “curse of knowledge” bias is a major obstacle to a strategic marketing plan. Being too close to their own products, project owners, developers, and marketers tend to forget what it’s like to not care. Meanwhile, it’s the most important vantage point, and it’s especially relevant in blockchain and crypto. Being a highly technological field, blockchain remains impenetrable to the masses. A proper marketing strategy should seek to view the product from both sides of the digital counter.

Paradoxically enough, overcoming the knowledge bias requires more knowledge about the customer and the project, i.e., market research. The goal is to get into the shoes of your target audience and see the world from their perspective. Having gained that knowledge, you can tailor your marketing budget to a more up-to-date picture.

What Makes a Token’s Price

As you go along with your strategic marketing planning, you’ll need to understand what makes your crypto token valuable (or not).

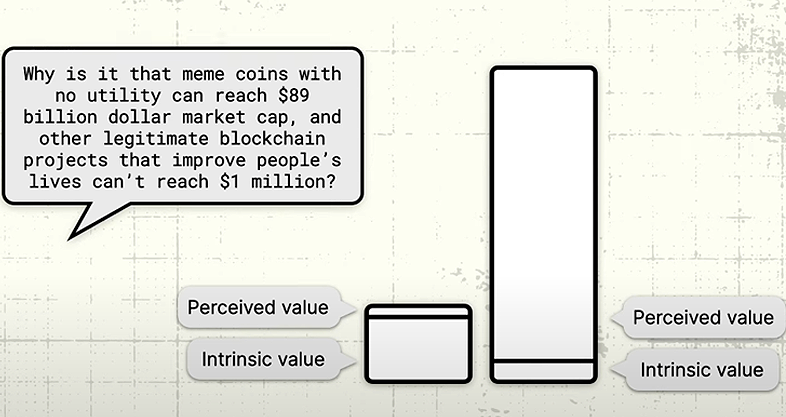

Broadly speaking, there are two elements to a token’s price – its intrinsic value and its perceived value. Let’s have a look at their differences.

Intrinsic Value

The intrinsic value of a token lies in the project’s technological capabilities, potential for widespread adoption, and the real-world problems it can solve. Picture a cryptocurrency with groundbreaking technology that can transform an entire industry, like blockchain, and you’ll see the potential for significant value in the long run. But that’s not all – if a token has a clear use case that addresses real-world issues, its intrinsic value skyrockets.

And let’s not forget about scarcity and utility. A token with a limited supply can be considered valuable due to its rarity. Similarly, if a token is part of a platform or ecosystem, it can gain utility value. Take the Ethereum network’s Ether (ETH) token, for example. It’s not just another cryptocurrency – it’s the fuel that powers the network’s transaction fees and computational services, making it an intrinsic value beyond market speculation.

On the flip side, a cryptocurrency with a weak technological foundation and no clear use case doesn’t have any intrinsic value. Its perceived worth is based solely on market speculation and hype, leading to price volatility and market instability. Informed investors will always consider these factors when evaluating the long-term value of a cryptocurrency.

Let’s take Bitcoin as an example. It was the first cryptocurrency to use blockchain technology, which ensures a secure and transparent peer-to-peer transaction system that operates without intermediaries. Bitcoin’s decentralized nature makes it resistant to censorship and manipulation, and its finite supply of 21 million coins ensures scarcity, making it increasingly valuable.

However, it’s important to note that these factors are not set in stone and are subject to market dynamics and technological advancements.

In contrast, some cryptocurrencies lack a clear use case and are merely copies of existing projects. These “shitcoins” often have no intrinsic value, making them prone to pump-and-dump schemes and market manipulation.

Perceived Value

The perceived value of a crypto token is a complex blend of various elements, each carrying its weight in influencing the overall perception. It’s how the target audience gauges the worth of the token, often influenced by market sentiment, speculation, and other external factors. This value is subjective and can fluctuate widely based on how the market perceives the token’s potential for future growth and adoption.

The difference between the two often arises when the market sentiment or hype inflates the perceived value of the token, causing it to diverge from its intrinsic value. For example, in a bullish market, the perceived value can skyrocket due to speculation, even if the token’s intrinsic value remains unchanged. Conversely, in a bearish market, the perceived value can plummet, even if the token’s intrinsic value hasn’t changed.

With that in mind, let’s have a look at some projects whose marketing efforts took an unexpected turn because of the imbalance of intrinsic and extrinsic value.

Case Study: Great Fundamentals, Underwhelming Perception

BAT (Basic Attention Token)

The Basic Attention Token project seeks to tokenize user attention and offer rewards for viewing ads, as well as a privacy-focused browsing experience. In turn, content creators should get more incentives to create content that better suits their audience. The project has a solid team and backing but suffers from an overall lack of awareness among its target audience and investors, which in turn translates to a lack of adoption.

Ripple

The Ripple blockchain seeks to harness the power of blockchain to facilitate cross-border payments worldwide. It also has a solid backing and powerful fundamentals. However, the project has faced criticisms and even litigations in the regulated field, which undermined its perceived value among investors.

IOTA

The IOTA project seeks to marry blockchain and Internet of Things solutions, offering seamless user experiences. Sporting a great idea, strong underlying tech, and a team of pros behind it, the project still suffers from a lack of interest from the end user, which is, in turn, caused to a lack of awareness and interest.

Case Study: No Fundamentals, Overwhelmingly Good Perception

Take Dogecoin, Shiba Inu, Pepe, and other meme coins as the exact opposite of the above. If you’ve been in crypto for at least 10 minutes, you will have heard of at least one of them. Here’s what unites them:

- They boast astronomical market caps;

- They offer huge returns to early (and sometimes later) investors while also being ridiculously volatile;

- They draw a lot of interest in any weather;

- As regards the crypto market, they bring absolutely nothing to the table. None of the meme coins offers any intrinsic value except the sheer hype and potential for speculation.

The meme coin phenomenon is yet to be studied in depth. However, for now, it’s clear that there’s one key driver of their overwhelming success: their through-the-roof perceived value.

How Can That Knowledge Benefit Your Strategic Marketing Planning Process?

It’s simple: focus your efforts and your marketing budget on fostering the perceived value of your project. Don’t put all eggs in one basket, though. There are countless projects out there that haven’t survived past their own launch precisely because they offered little to no fundamentals.

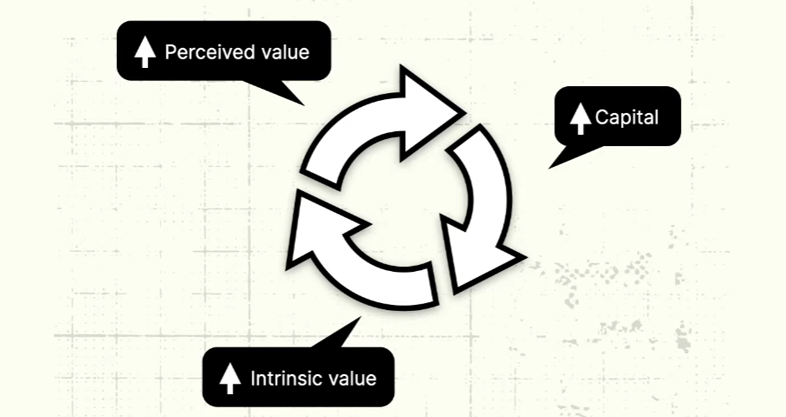

The perfect marketing loop should aim to reinforce both intrinsic and perceived value, starting with the latter. By boosting the perceived value of your token, you enhance your AIDA component (described above) and make the project more appealing. This attracts capital and further attention to the project. This, in turn, can help you polish its fundamentals and help it offer more value to the marketplace, which in its turn can help create more perceived value, etc.

Some extreme examples of huge perceived value are scam projects like Bitconnect. While being intrinsically a fraud, Bitconnect garnered an insane amount of publicity and capital precisely because it managed to promise investors a better future.

Sell Them What They Want, Give Them What They Need

The crypto space is still in its deep infancy. Don’t be fooled by the astronomical growth of Bitcoin and other major coins. Adoption still has a long way to go, and that’s precisely what most crypto marketers don’t realize.

Blockchain isn’t about technology. It’s about the future that will be. It didn’t take off because it offered state-of-the-art hashing solutions. It took off because it offered freedom, ease, and convenience. Early Bitcoin fans bought into the idea of being able to transact, trade and transfer capital without regulatory control or hindrance. There was no such tech at the time, and for many, it was a no-brainer to invest in. Early Bitcoin investors didn’t invest in the Bitcoin of 2009. They invested in the Bitcoin of 2019, 2023, etc.

It doesn’t have to be all about transactions, though. Blockchain offers so much more potential than storing and transferring value. For example, you may launch a decentralized, community-regulated video hosting that could compete with YouTube and offer more incentives for content creators and viewers.

The reason why blockchain projects take off is because they manage to sell a future, a promise, and hope. Once that’s done, they can then offer the investors technology, that is. If that technology manages to improve the investors’ lives at present, then they will be more confident in the project’s future and all the more willing to invest further.

Who Bakes the Cake? Cooking up the Right Marketing Mix

“People sometimes believe what you tell them, but they always trust their own conclusions.”

What would you enjoy more: buying a cake or baking one yourself? Of course, the answer will vary. In our case, the cake is the chain of conclusions that leads to a decision to invest. A customer’s mind works in a way that favors its own conclusions over those of others. Even the dimmest of users will always follow their own judgment, however poor.

A crypto marketing strategy should be based on this fact: people want to bake their own cake.

Here’s how it works.

Suppose you come across a flashy ad banner or social media post that says: “Promising project! Huge potential! Definitely worth investing in”.

Now imagine that there’s a product you have been following or have just discovered. You’ve had a look at its fundamentals and team, and both seem solid enough. You’ve checked its market cap and price: it’s somewhere in the mid-range, among the top 30 CoinMarketCap. What’s more noteworthy is that over the past 12 months, the project has actually climbed there from the bottom of the top 100.

So far, the token has not shown impressive growth, but you see in the roadmap that they’ll be partnering will a large exchange (which is confirmed by the exchange). The team has just hired a project manager from another project that proved a massive success. You put all the ingredients together, and you come up with your own decision cake: it’s a promising project, it has huge potential, and it definitely seems worth investing in.

The crypto market is overflown with shills, and it takes no effort to shill up a worthless project. If you’re in this for the long term, you’ve got to understand that the best investors will always ask you for ingredients first, then will then bake their own cake. The goal of your marketing plan is to provide the right ingredients.

Set Achievable Goals and Measurable KPIs Only

The icing on the cake should be the classic SMART formula.

According to it, your marketing goals should be:

Specific: you need to know what exact performance you’re trying to achieve and by what means. For example, launch a decentralized ride-sharing platform that allows users to pay for rides using cryptocurrency.

Measurable: you need to have a metric for every step that you take along the way. Example: Achieve 10,000 registered users and 5,000 completed rides within the first 6 months of launch.

Attainable: the goals should be realistically achievable with the tools and resources that you have. This may look like “Develop a user-friendly mobile app with secure payment integration and reliable ride matching algorithms.”

Relevant: the objectives should be up-to-date with both the brand’s current state and the market as a whole. An example of that would be: “Provide an alternative payment method for ride-sharing services that are secure and transparent while also promoting the use of cryptocurrency.”

Time-bound: you need to have at least a general time frame for achieving your goal. Launch the platform by the end of Q2 2022 and achieve the set targets within the first 6 months of operation. If that doesn’t come off – you’ve got to have a plan B prepared.

So, if your goals aren’t SMART, your marketing campaigns can fall apart.

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)