share

Today we will be taking a closer look at the best DeFi projects of late. We’ll consider some of the key names fueling the entire ecosystem, as well as some major drawbacks that aren’t immediately obvious.

DeFi: What Is Its Place in Crypto?

DeFi is the common acronym for Decentralized Finance. It is the place where finance meets blockchain.

The goal of the DeFi space is to offer financial services independent of centralized entities and give the end user full control over their crypto assets – something that’s hard to imagine in a traditional financial system. Users should be able to enjoy every service offered by traditional financial institutions, but also benefit from flexibility and full control.

Where Decentralized Finance Started

Ethereum is where the DeFi space was born. It pioneered a lot of the concepts that we now take for granted. While the very idea of cryptographically programmed money is a merit of Bitcoin, the crypto market as we know it today has been shaped by Ethereum in many more ways than Bitcoin. Ethereum brought about a lot of technical innovations, namely smart contracts and DApps (Decentralized Apps). These in turn enabled a plethora of other concepts that we know today, including DAO (Decentralized Autonomous Organization), NFT (Non-fungible token), Liquidity Pool, ICO (Initial Coin Offering), and Blockchain games (aka GameFi).

Today, most DeFi projects, and their respective DeFi tokens, find their home on Ethereum. However, viable and competitive alternatives are constantly emerging in this part of the crypto world. These include Binance Smart Chain, Avalanche, Polygon, Arbitrum, Optimism, Phantom, Harmony, and other blockchain networks. The main disadvantage of Ethereum is its high (sometimes, absurdly high) gas fees. One could even argue that Ethereum gas fees may have been the reason why other solutions even came about.

What Can You Do With Decentralized Finance?

The range of potential use cases of DeFi projects is infinite. These could be anything from simple analytical widgets to full-on unique financial instruments, including those that go way beyond what smart contracts can deliver. Among the popular use cases are exchanging, lending, and borrowing crypto. With community-driven liquidity pools, users can trade assets and earn a yield on their holding in just a few clicks. All it takes is to connect your crypto wallet, and you’re good to go.

With that in mind, let’s have a look at some of the best DeFi projects 2023 has to offer.

Aave

Aave is a top-ranking DeFi project providing lending services. Established in 2017, it has since seen two major updates – Aave V2 and V3 – and has been considered one of the best crypto projects around. It sits among the Top-5 DeFi projects by Total Value Locked (TVL) as per DeFiLama. Aave supports over a dozen blockchains, including Avalanche network, Polygon, Artbitrum, Optimism, Phantom, and Harmony. It offers a wide product offering, ranging from depositing, loans, staking, and even an affiliated game called Aavegotchi, in addition to instant swaps and flash loans.

It allows users to borrow and lend cryptocurrency without KYC or even a credit score. Likewise, it also poses no time limits on loans or deposits. This is made possible by a combination of economics, user incentives, and over-collateralization. To borrow crypto on Aave, you need to deposit a dollar amount higher than the desired loan amount.

How Aave Calculates Interest Rates

The interest rate for loans is governed by the supply and demand for the DeFi project token being borrowed. The more supply and the less demand – the higher the rates go, and vice versa. This way, users are discouraged from borrowing a non-liquid asset, while lenders are incentivized to deposit more of it into the system to meet the demand. Borrowers can also choose to pay higher, but fixed interest to mitigate volatility. The catch is that the borrower has to ensure that the dollar value of their collateral is always higher than that of the loaned funds. Otherwise, the excess part of their loan will automatically get liquidated through the network’s smart contracts to ensure the stability of the entire system.

Its own DAO governs the ecosystem through the AAVE token. Users can stake their AAVE and earn a share of the system’s fees. This ensures that the protocol is solvent at all times, regardless of market volatility.

The recent launch of AAVE V3 will allow users to take larger loans, increasing liquidity and capital efficiency. Its isolation mode also means even more new assets, including riskier, long-tail assets, can be supported on AAVE too. Furthermore, Singapore banks just conducted their first real-world application test using AAVE to complete foreign exchange and government bond transactions. There’s also reason to expect a stablecoin from Aave soon, which will cement its reputation as one of the top projects in the space.

Uniswap

Uniswap is probably the oldest top-ranking DeFi project and is a decentralized protocol for exchanging (swapping) assets on the Ethereum blockchain. In other words, it’s a decentralized exchange (DEX). Today, there are several noteworthy DEXes in the field, but Uniswap is what started the whole genre. Launched by Hayden Adams back in 2017, it pioneered the automated market maker (AMM) model. In it, traditional order books are replaced with community-driven liquidity pools. Users can instantly exchange assets via smart contracts.

Apart from exchanging assets, users can also earn interest on their liquidity. Anyone can become a market maker and create their own liquidity pool on Uniswap. This is done by depositing an equivalent amount of ETH and tokens into the system. The market maker sets the exchange rate, adjusted in the course of trading. When there are fewer assets on one side and more assets on the other, the price changes to keep the balance. Apart from swapping crypto assets, Uniswap also offers an NFT marketplace.

The UNI token powers the whole ecosystem and has remained in the top ranks according to CoinMarketCap and CoinGecko.

Compound

Compound is among the best DeFi lending protocols that can be found on Ethereum. It allows you to take secured loans or make money on interest by depositing funds, all in a completely permissionless manner. Interest starts accruing instantly after funds are deposited, and rates change every 15 seconds based on what the market is doing. All liquidity deliveries come in the form of cTokens and users can borrow up to 75% of the total cTokens value.

You can deposit or withdraw crypto at any time. The caveat is to always keep a sufficient size of collateral to avoid liquidation. Compound is community-governed via COMP, the project’s governance token. 10% of the interest paid goes straight to reserves, and the rest is paid to liquidity providers in the form of COMP (issued in May 2020).

MakerDAO

MakerDAO is the home of the decentralized USD-pegged stablecoin DAI. The platform enables users to borrow and lend crypto, and deposit collateral in order to mint new DAI.

You can borrow up to 66% of the value of the deposit in DAI (i.e. a ratio of 150%). If the value falls below this level, then there’s a risk of a fine and even liquidation of the position.

The DAI Stablecoin

Any user of this DeFi project can open a vault, lock up their cryptocurrency as collateral, and mint an equivalent amount of DAI. Afterward, they’re free to do with their new DAI as they please.

The stability fee is expressed in the form of continuously accruing interest on the invested cryptocurrency. Once the debt is repaid, interest is paid back.

Unlike the largest stablecoins such as USDT and USDC, the DeFi project that is DAI has the benefit of being more decentralized than its competition. No central party controls its issuance, and it enjoys wide use in a plethora of DeFi projects, centralized platforms, and even DApps.

The MKR Token

The staple of the MakerDAO ecosystem is MKR. Its primary purpose is to stabilize DAI with collateralized debt positions (CDPs for short). Maker users deposit their MKR into the system’s smart contracts. Its holders contribute to maintaining the entire Maker ecosystem, such as community governance and voting.

The current drawback is that DAI is collateralized to a large extent by centralized stablecoins such as USDC. For instance, MakerDAO recently voted to custody $1.6 billion of its USDC collateral on Coinbase via its institutional-grade service, which would earn an interest rate of up to 1.5%. Developments are underway to make this DeFi project even more flexible, which would allow for near-total decentralization of the stablecoin.

Curve Finance

Like Uniswap, Curve is a decentralized exchange (swap). Unlike Uniswap, which caters to all types of DeFi tokens, Curve deals specifically in stablecoins. This is often referred to as a stable swap – that is, assets that trade 1:1 with each other.

When trading stablecoins on Curve, users have lower slippage and exchange fees than elsewhere. Moreover, CRV holders and liquidity providers can earn extra yield within the thriving ecosystem of protocols built on top of it, including Convex and Redacted Protocol.

How to Earn Rewards on Curve

You can also opt to supply liquidity to earn Curve’s native token, CRV, as well as a cut of the trading fees. However, Curve’s UI can be tricky to navigate for new users, and the ‘Curve Wars’ and ecosystem are quite hard to understand. Like Aave, Curve also has a stablecoin in the works and, like other best DeFi projects out there, it will look to launch on more chains soon.

Convex Finance

Convex allows Curve liquidity providers to earn additional income from their assets.

It was built on top of the Curve protocol. Essentially, it’s a platform for ‘boosted’ token staking on Curve. Initially built solely around Curve, it later added support for the Frax protocol.

Convex staking is meant primarily for LPs on the Curve protocol, which allows you to increase income from providing liquidity. For that, there’s boosting. You can further lock up the CRV received for providing liquidity, raising the pool profits by 1.5-2.5 times.

Convex allows you to bypass this mechanism. The profits come from the fees paid to the Curve exchange and enable CRV boosting without locking assets up in the pool. Instead, the rewards are made possible by staking Curve LP’s LP tokens (cCRV or tCRV). It only takes minutes to deposit assets in the pool and start earning a cut of the exchange’s fees, in addition to boosting income.

Convex supports all the networks available on Curve: Ethereum, Polygon, Fantom, and xDai Network.

The service protocol is governed through the use of the CVX token. It’s distributed as a reward through the Curve platform, and it can even be staked for additional income.

What Convex Finance has going for it is zero withdrawal fees. Also, the platform doesn’t have a staking threshold, which can reduce gas costs when the network is not under load. The main disadvantage of Convex and Curve is their rather convoluted rewards system. Because of it, both platforms can be quite confusing for beginners.

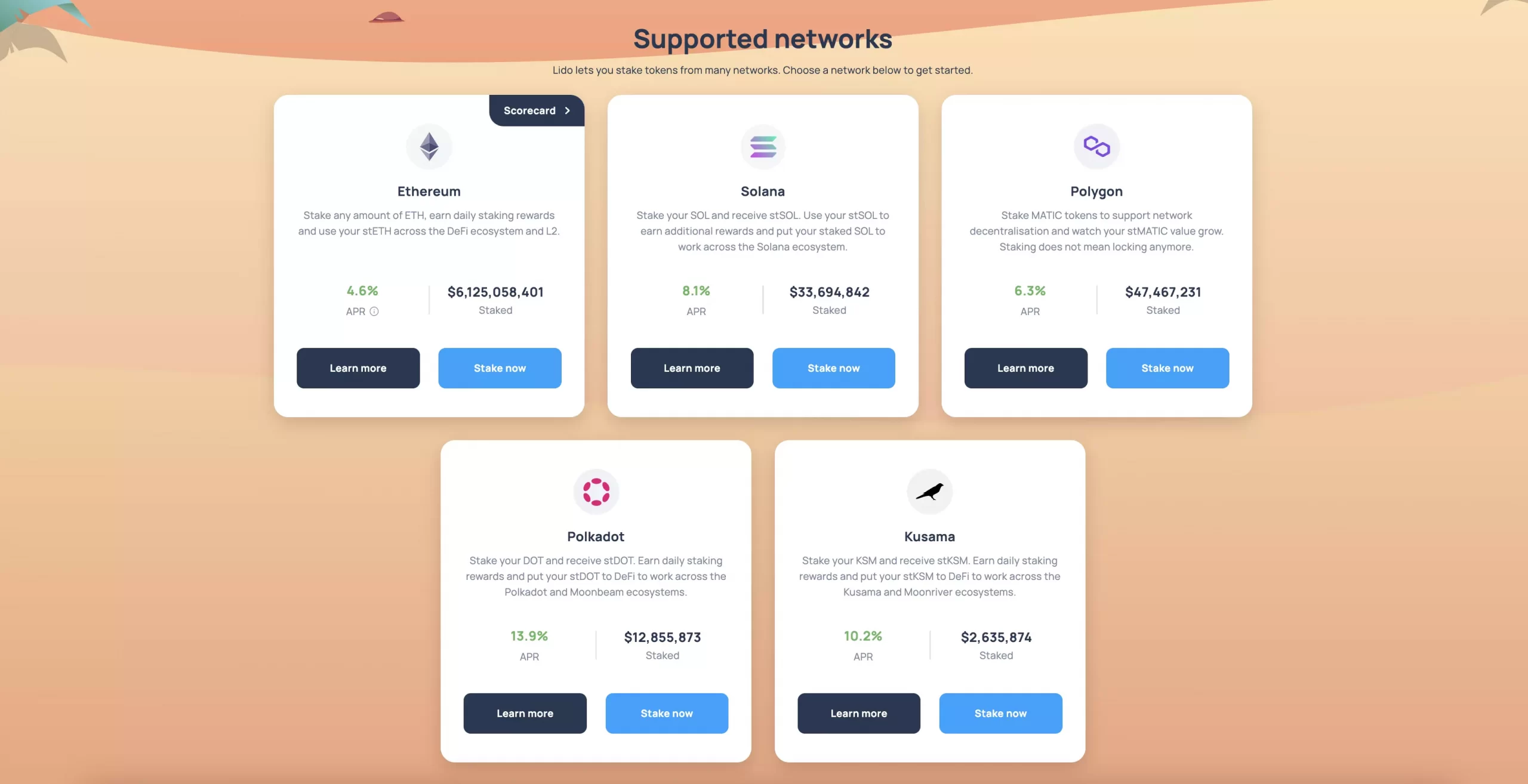

Lido

Lido is a recent but already top-ranking liquid staking protocol. Since its inception, it grew so big that, as of mid-2022, 1/3 of all the ETH staked on the Beacon Chain came from Lido alone. As of this writing, Lido ranks 1st by total value locked (TVL) on DefiLlama, with a 17% margin. Given its ingenious tokenomics, it could have huge implications not just for Ethereum, but for every proof-of-stake cryptocurrency on the market.

Instead of locking up their assets as is done in staking, users can lock up their assets on Lido and withdraw anytime.

How Staking on Lido Works

Lido allows you to stake PoS cryptocurrencies without having to lock them up. You get to trade your coins freely while having them staked in the protocol. When you lock up your crypto, the protocol provides you with a tradable crypto asset that works as proof of deposit. For example, when you stake ETH, you get a token called “staked ETH” or stETH in return, which is pegged to the price of Ethereum and can be traded as such. stETH maintains its peg to Ether through a combination of arbitrage, liquidity mining incentives, and organic need for it.

However, the fact that stETH earns staking rewards in real-time means its value also changes. Sadly, this renders Lido incompatible with a number of DeFi protocols, namely decentralized exchanges such as Uniswap. To that end, there’s yet another derivative asset called WstETH or Wrapped stETH. It enables your stETH to keep appreciating while maintaining a peg for convenient DEX trading.

The main reason Lido is in high demand among DeFi projects is that it allows bypassing the ‘official’ requirements for staking Ether – 32 ETH – which is unaffordable for most people. Besides, staking ETH via a node requires deep technical knowledge and 24/7 monitoring and maintenance by the user, which is not a good deal for most. Lido Finance allows you to bypass all these restraints and submit as many assets as you like. You only have to claim your rewards once they’re accrued.

Aside from Ethereum, Lido supports liquid staking for Polygon, Solana, Polkadot, and Kusama. The deposited assets for these networks are stMATIC, stDOT, stKSM, and stSOL.

So, aside from the freedom to withdraw stakes anytime, your position is tokenized, which can also be deployed for other activities, along with access to an easy and user-friendly staking process. The one drawback so far is Lido’s fee on staking rewards – 10% – which might be considered too high for some.

Frax Finance

Frax, as the name would suggest, offers the crypto world a fractional stablecoin, something few DeFi projects have managed to get right. Essentially, it’s an algorithmic stablecoin with partial collateralization and stabilization mechanisms.

What Frax Aims to Achieve

At present, there are three types of stablecoins: collateralized stablecoins backed by an asset of value, uncollateralized ones maintained by an algorithmic supply/demand system, and hybrid stable coins that make use of both mechanisms. Frax is the latter: it employs the two-pronged approach of using both mathematical cryptographic algorithms and asset collateralization. It is permissionless, open-source, and it works with Ethereum in addition to a host of other blockchains.

Its value proposition lies in providing a scalable system with algorithmic, decentralized money instead of a simple store of value digital money such as Bitcoin. The Frax protocol is built around the FRAX stablecoin and the so-called Frax shares (FXS), which is a governance token. Frax is programmed to maintain a peg to the US dollar, with collateral ratio adjustments responding to whatever the market situation is. This helps keep FRAX at one dollar instead of running a fixed ratio. When FRAX goes beyond its intended 1-to-1 peg, the system reduces the deposit ratio by 0.25%. When it dips below the peg, the ratio is increased by 0.25%.

A Look at FRAX and FXS

With fiat-backed stablecoins and their related DeFi projects currently reigning supreme on the crypto market, FRAX stands as a promising and potentially revolutionary alternative to the status quo. At a market cap of just about $1B, the FRAX token occupies the 51st place on the list of the biggest coins as per CoinGecko (at press time).

dYdX

Launched in 2019, dYdX is considered the leader in decentralized margin trading due to its combination of cutting-edge technology and accessibility. It can be called the first viable alternative to centralized perpetual exchanges like Bitmex, ByBit, and Bitfinex.

Centralized exchanges require KYC for accessing derivatives. As a decentralized exchange, dYdX doesn’t require anything except to connect your crypto wallet. For that, it leverages the full scope of blockchain innovations, such as decentralization, liquidity pools, collateralization, and lending.

The platform is backed by the largest business angels and investment funds, such as Andreessen Horowitz, a16zcrypto, Paradigm, Polychain, and others.

What Makes dYdx Stand Out

dYdX is based on the StarkEx layer 2 protocol, which allows trading without gas fees. Traders pay for gas only when transferring crypto to a dYdX futures account, withdrawing, and allowing the exchange to work with a coin.

Being a DEX, dYdX is completely decentralized and has no dedicated trade management node. All trades happen in a peer-to-peer fashion with the aid of smart contracts. The liquidity is drawn from community-driven pools. When making a trade on dYdX, you work with funds supplied entirely by other users.

The platform is governed through its own DAO with its utility token dYdX. Trading on dYdX is completely anonymous and secure thanks to the zero-knowledge proofs system.

dYdX also offers cross-margin, i.e. trading several perpetual contracts markets at once through one account. This simplifies working with multiple pairs.

The fees are charged according to a maker-taker model, much like traditional crypto exchanges. Other fees depend on the load of the Ethereum network.