DeFi Development

Get a powerful DeFi platform that will make your profit soar.

Apply Now

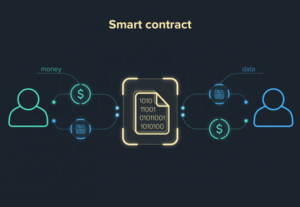

Decentralized finance – DeFi is an abbreviation, which usually refers to digital assets and financial smart contracts, protocols and decentralized applications built on Ethereum. Simply put, it is a financial software built on the blockchain that can be connected together.

To find out about the services that exist in the Ethereum DeFi ecosystem, you can check the DeFi rating, which tracks the current value concluded in popular DeFi smart contracts.

Computers have destroyed almost every industry over the years. Each innovation builds on the previous one, and digital products and services are becoming more sophisticated. Thanks to technology, we have provided the world to meet our needs. Programs – from digital assistants to home automation – now affect many aspects of your daily life. So why will the money be different?

The traditional financial system relies on institutions such as banks, which act as intermediaries, and courts to ensure the resolution of disputes.

In the segment of finance, a DeFi development company does not need intermediaries and courts. The code determines the resolution of each possible dispute, and users, in turn, keep all their funds under control. This reduces the cost of providing and using products and allows you to create a more trouble-free financial system.

Since the deployment of software for a new type of financial services is carried out on top of blockchain networks, the presence of a single point of failure in the system is excluded. The data is recorded in the blockchain and distributed among thousands of nodes, which virtually eliminates the presence of censorship or a shutdown.

Due to the fact that the framework allows you to create a DeFi development company in advance, their development and deployment becomes less complicated and more secure.

Another significant advantage of such an open ecosystem is the ease of access to decentralized finance development services for people who, for some reason, do not have such an opportunity. Since the traditional financial system is based on mediation for profit, they usually do not provide their services in low-income places. However, thanks to DeFi development, operating costs are significantly reduced, and similar communities will also be able to use the necessary financial services.

Decentralized finance (DeFi development) aims to create a financial system that is open to everyone and minimizes the need to trust and rely on central authorities. The Internet, cryptography and blockchain are relatively new technologies that give us the tools to build and control a decentralized and completely new financial system without the need for central authorities. There is a saying in the blockchain: “Don’t believe, check.” Because with the blockchain network, you, as an individual, can verify any transaction that occurs in the blockchain.

Most DeFi development projects are based on Ethereum. Ethereum is a blockchain that supports a common register of digital values. Instead of a central authority, the participants who make up the network decentralize the release of ETH, the network’s own cryptocurrency.

Developers have the opportunity to program their protocols based on Ethereum. Such protocols can create, store and manage digital assets, also called a DeFi token, on the blockchain. These are so-called smart contracts or decentralized applications (Dapps). You can enter into complex irreversible agreements without the need for an intermediary, thanks to the smart contract. Any protocol based on the Ethereum blockchain works on the basis of smart contracts, and this facilitates the process of developing and using the site.

Decentralized finance (DeFi development) has the opportunity to create a more stable and transparent financial system. Anyone with an Internet connection can access and interact with smart contracts built on the Ethereum blockchain. Many DeFi smart contract development is created with open source code and is compatible with existing smart contracts. Thus, users can check the code of smart contracts and choose which services best suit them.

Perhaps the most popular and fastest-growing sector of decentralized finance (DeFi development) is the platform for borrowing and lending. Just like in a bank, users invest money and receive interest from other users who borrow their assets. However, in this case, the assets are digital, and DeFi smart contract development connects lenders with borrowers, ensures compliance with the terms of loans and distributes interest. And all this happens without the need to trust each other or an intermediary bank. And, excluding intermediaries, lenders can earn higher profits and understand risks more clearly thanks to a transparent blockchain.

The DeFi token, called stable coins, are also important for the DeFi development company ecosystem. You may get the impression that the entire cryptocurrency is unstable. However, stable coins are DeFi tokens (DeFi token development) designed to hold a certain value, and they are usually tied to a paper currency such as the US dollar. For example, DAI is a stable coin pegged to the US dollar and backed by ether (ETH). For each DAI, there is $1.50 ETH enclosed in a MakerDAO smart contract as collateral.

Another type of popular DeFi development company is what is called a decentralized exchange, or DEX for short. DEX is a cryptocurrency DeFi exchange that uses smart contract development to ensure compliance with the rules of trading, making transactions and safely processing funds if necessary. When you trade on DEX, you don’t have an exchange operator, registration, identity verification, or withdrawal fees.

There are various degrees of decentralization related to all financing products and services (DeFi development services). It is worth noting that decentralization is certainly good, but not everything in this world can be decentralized.

As mentioned earlier, stable coins are popular in decentralized finance, DeFi. But not all stable coins are decentralized like DAI. Many of them are actually tokens representing deposits in fiat currency. For example: for each USDC token, 1 dollar is stored in the bank. You can theoretically “tokenize” or create a DeFi token (DeFi token development) to represent any real-world asset. While you can trade, send, and receive these tokens on the blockchain, you cannot completely eliminate the need for physical management or real-world asset repurchase.

Take, for example, the purchase of a house on the blockchain. Let’s say someone places a house on a decentralized exchange, and you buy it. Without a proper legal setup and the law on your side, you cannot simply force this person out of your home, regardless of whether you are the owner of the digital version. Currently, you will have to resort to the judicial system of your country to settle the dispute.

In short, this technology has limitations, and sometimes the DeFi development lines start to fade. Over time, laws will adapt to changing financial conditions, and DeFi’s place in the world will become clearer. At the same time, one thing is clear: DeFi development services are here to stay.

Open credit protocols are one of the most popular types of applications in the DeFi development company ecosystem. Open, decentralized loans have many advantages over the traditional credit system. These include instant settlement of transactions, the ability to secure digital assets, the absence of credit checks and potential standardization in the future.

Due to the fact that, in this case, credit services are built on public blockchains, they minimize the necessary trust in them and provide a guarantee of the operation of cryptographic verification methods. Blockchain-based credit marketplaces reduce counterparty risk, make loans cheaper, faster and more accessible to more people.

Since DeFi development services are financial by definition, the availability of monetary banking services is obvious to them. Decentralized finance development may include the issuance of stablecoins, mortgages and insurance.

As the blockchain industry develops, more and more attention is paid to the creation of stablecoins. They are a type of cryptocurrency that is tied to a real asset and can be transferred digitally relatively easily. Since cryptocurrencies are highly volatile, decentralized stablecoins can be accepted for everyday use as digital funds that are not issued and are not controlled by central authorities (DeFi yield farming).

Due to the number of intermediaries who have to take part, the process of obtaining a mortgage is quite expensive and long in registration. With the use of smart contracts, underwriting and legal fees can become significantly cheaper.

This category of applications can be difficult to evaluate since the DeFi segment itself provides a large number of opportunities for various financial innovations.

Perhaps some of the most important DeFi development services – applications are decentralized exchanges (DEX). Such platforms allow users to trade digital assets without the participation of a trusted intermediary (DeFi exchange) to store their funds. Transactions are made directly between user wallets using smart contract development.

Since such trading platforms (DeFi staking platform) require much less maintenance, a decentralized DeFi exchange charges a lower commission for trading operations, unlike their centralized counterparts. Blockchain technology can also be used to issue and authorize ownership of a wide range of traditional financial instruments. Such decentralized finance applications work in a decentralized manner, which eliminates the presence of a single point of failure.

This idea looks quite tempting, but not in all cases decentralization can be useful. Finding the use cases that best match the characteristics of blockchains is crucial to creating a useful stack of open financial products. But our team of experts will help you to sort out all the questions and problems.

If successful, development decentralized finance (DeFi development services) will take power away from large centralized organizations and put it in the hands of the free software community. However, at the moment, it is not known exactly how effective the financial system will be, and even more so when decentralized finance will become the main direction and will be accepted by the public. At the moment, the new technology has already found response in many hearts of users. But it is worth noting that a decentralized financial system should be recognized by states for its full functioning.

In the DeFi space, a DeFi development company, as well as DeFi development services, are the future of our life. A completely new financial system will open up many opportunities for everyone. Already today, it is worth thinking about working with DeFi, ensuring your future. Summing up the reasoning, you can deduce the main advantages that will help you increase your finances and opportunities. You can read them below.

Testimonials

We are the team of experts that will support your business at all stages

Website Privacy Policy

Generic privacy policy template

This privacy policy ("policy") will help you understand how Global Digital Consulting LLC uses and protects the data you provide to us when you visit and use https://icoda.io ("website", "service").

We reserve the right to change this policy at any given time, of which you will be promptly updated. If you want to make sure that you are up to date with the latest changes, we advise you to frequently visit this page.

What User Data We Collect

When you visit the website, we may collect the following data:

Why We Collect Your Data

We are collecting your data for several reasons:

Safeguarding and Securing the Data

Global Digital Consulting LLC is committed to securing your data and keeping it confidential. Global Digital Consulting LLC has done all in its power to prevent data theft, unauthorized access, and disclosure by implementing the latest technologies and software, which help us safeguard all the information we collect online.

Our Cookie Policy

Once you agree to allow our website to use cookies, you also agree to use the data it collects regarding your online behavior (analyze web traffic, web pages you spend the most time on, and websites you visit).

The data we collect by using cookies is used to customize our website to your needs. After we use the data for statistical analysis, the data is completely removed from our systems.

Please note that cookies don't allow us to gain control of your computer in any way. They are strictly used to monitor which pages you find useful and which you do not so that we can provide a better experience for you.

Restricting the Collection of your Personal Data

At some point, you might wish to restrict the use and collection of your personal data. You can achieve this by doing the following:

Global Digital Consulting LLC will not lease, sell or distribute your personal information to any third parties, unless we have your permission. We might do so if the law forces us. Your personal information will be used when we need to send you promotional materials if you agree to this privacy policy.

Terms and Conditions

Please read these Terms and Conditions ("Terms", "Terms and Conditions") carefully before using the https://icoda.io website (the "Service") operated by Global Digital Consulting LLC.

Your access to and use of the Service is conditioned on your acceptance of and compliance with these Terms. These Terms apply to all visitors, users and others who access or use the Service.

Links To Other Web Sites

Our Service may contain links to third-party web sites or services that are not owned or controlled by Global Digital Consulting LLC.

Global Digital Consulting LLC has no control over, and assumes no responsibility for, the content, privacy policies, or practices of any third party web sites or services. You further acknowledge and agree that Global Digital Consulting LLC shall not be responsible or liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any such content, goods or services available on or through any such web sites or services.

Changes

We reserve the right, at our sole discretion, to modify or replace these Terms at any time. If a revision is material we will try to provide at least 30 days' notice prior to any new terms taking effect. What constitutes a material change will be determined at our sole discretion.

Contact Us

If you have any questions about these Terms, please contact us.