share

Over the past decade, peer-to-peer financing has become a viable alternative to banking and credit union funding. Peer-to-peer financing lets people lend money. Peer-to-peer borrowing has increased. Peer-to-peer financing involves one person helping another. Networks simplify the process of getting money for peer-to-peer (P2P) lenders. Crowdsourcing also describes this fundraising method. This allows lenders to earn interest on their assets and borrowers to get loans at better rates than conventional financial institutions.

P2P (peer-to-peer) financing allows consumers and debtors to complete financial deals online and in real-time. Networks that simplify and speed up the process boost this potential. This online lender provides funds. Peer-to-peer allows for smaller transfers, greater flexibility, and faster operations. These benefits outclass traditional banking and Fair credit unions.

Beginning Peer-to-Peer Money Help Systems

Zopa was the first UK peer-to-peer lender in 2005. Peer-to-peer loans are made between people. “Peer-to-peer” loans involve people lending money to each other. Peer-to-peer funding is when people directly exchange money. Peer-to-peer funding occurs online. “Peer-to-peer borrowing” refers to this.

The first US peer-to-peer lending platform, Prosper, launched in 2006. This network enabled money transfers. This event is considered the start of peer-to-peer funding. Peer-to-peer financing involves web loans. Over the past decade, peer-to-peer (P2P) funding has skyrocketed, making websites like LendingClub and Funding Circle extremely famous among financiers and clients. Peer-to-peer (P2P) funding has skyrocketed over the past decade due to this appeal. Over the past decade, peer-to-peer (P2P) financing has skyrocketed in appeal due to this success.

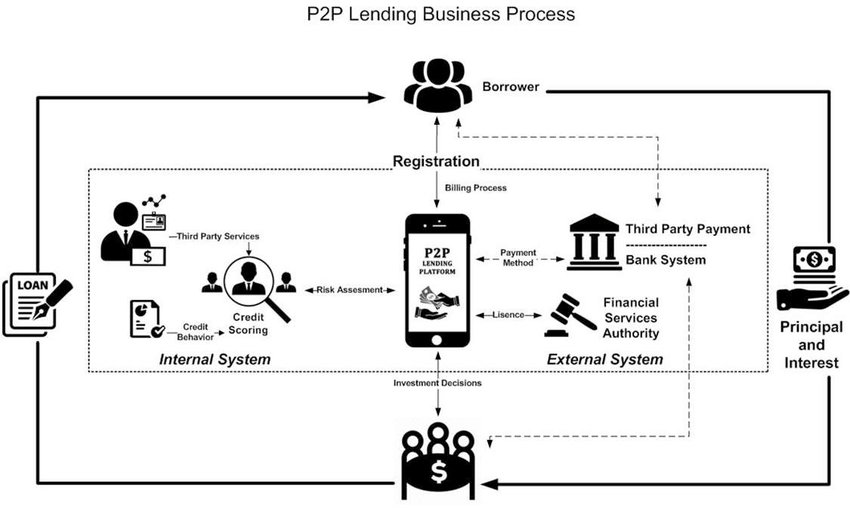

Principles of Peer-to-Peer Funding and Trading

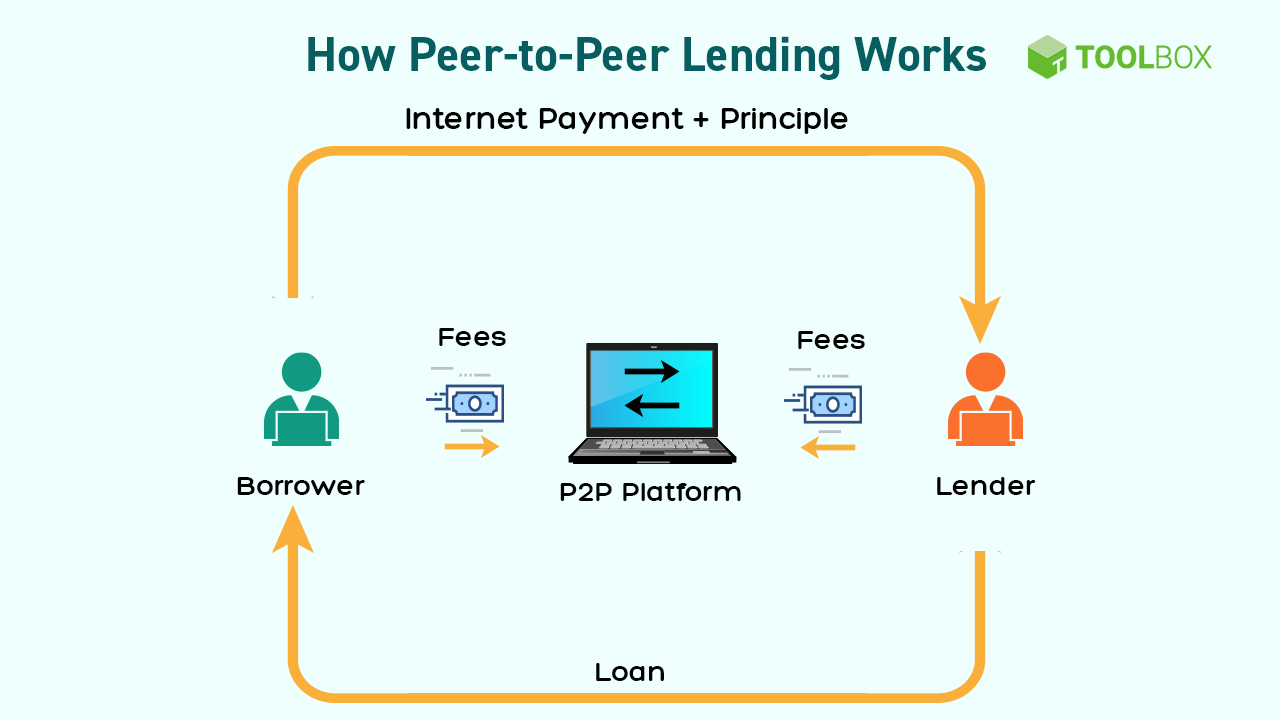

Peer-to-peer lenders match debtors with lenders based on risk level and loan purpose. A direct loan is peer-to-peer. Peer-to-peer financing firms evaluate the reason an individual needs personal credit. Some communities call this form of funding “direct lending.” After investors choose their investments and obligations, the website acts as an intermediary to help investors and debtors transfer funds. After participants choose their duties and assets. After everyone chooses their expenses and duties, this step is finished. This step occurs after members choose their roles and budgets.

After paying off the loan, the borrower will start paying the company. After these payments are made, the aggregation of debt consolidation process will begin, and the platform will disperse the same amount of money to each loan participant. Peer-to-peer financing sites charge lower prices than typical loan companies, which charge higher prices. Peer-to-peer networks charge much lower rates than typical lenders.

Mentor Financing Perks for Private Clients

Simple, Fast Borrowing

A peer-to-peer loan through a website may be accepted even if a bank/credit union loan is denied. Individuals pay peer-to-peer debts. Peer-to-peer loans are debts between individuals. Peer-to-peer loans are direct loans between individuals. Peer-to-peer loans are paid by the borrowers themselves instead of a financial entity, unlike traditional lenders. Whether they meet a minimum credit score or not, candidates are evaluated for benefits. This only applies if the applicant has no security and no acquisition costs.

Credit Management Should Be Simple and Effective

Sites that allow people to borrow from each other are more time-efficient and simpler than traditional banking. The collaborative consumption plan is a common financial option. Consumers have a unique personal loan choice. Algorithms are used by platforms to assess client trustworthiness, and automation is used in credit origination fees.

Investor-Friendly Conditions

Exceptional ROI Growth

Peer-to-peer finance networks offer better returns than other commodities. Peer-to-peer banking networks are autonomous. Peer-to-peer banking networks are autonomous. Peer-to-peer financial networks are decentralized and demand faith from their members. Peer-to-peer (P2P) funding offers higher interest rates than private and bond assets. These rates compare to stock and bond investment rates.

Easy Activity Variety

P2P funding streamlines financial risk dispersal, making risk management easier. Peer-to-peer funding also broadens risk-taking participation. This gives the stockholder more management power over the share, which increases profits. Peer-to-peer (P2P) funding allows users to tailor risk and yield to their financial goals. This gives them an edge over banks. These systems allow lenders to lend to each other and give consumers many loan choices. These methods let lenders draw from each other.

Try to Minimize Interest on Unpaid Payments.

Peer-to-peer lending websites may help borrowers lower their loan interest rates and save money over the length of their debt repayment. The user may spend less on debt repayment. Peer-to-peer funding services can help achieve this goal. Peer-to-peer loan websites can charge lower credit rates than typical lenders because they have fewer administrative costs. This helps peer-to-peer lending services to offer more affordable credit rates. This allows peer-to-peer financing websites to charge fair loan rates.

Finances

Peer-to-peer financing systems let investors choose which loans to fund. Owners have more control over their assets. Consumers have many money options. Personalizing options can include an investor’s risk tolerance and financial goals.

Peer-to-Peer Funding Risks

Peer-To-Peer Loan Risks Include Buyer Nonpayment

Peer-to-peer financing networks’ biggest risk is that users won’t be able to repay their loans. Peer-to-peer financing sites let users give money to each other instead of a bank. Peer-to-peer financing systems allow users to send money to each other instead of a financial institution. Investors risk having their money stolen if the vendor fails to make payments.

Platform Dangers

Individual donations may encounter network issues. This is unavoidable. If a peer-to-peer funding website closes, investors risk losing all their money.

Poor Monitoring and Tracking

Peer-to-peer lending sites must follow a lower supervision standard than traditional financial institutions. Network users may be more likely to engage in immoral or dishonest conduct. Non-networkers may do this. Because the government and FDIC do not back these websites, networks are less likely to be examined. The government does not promote these services. This directly reduces network investigation chance.

Collateral-Free Funding

Most personal debts are unsecured. Most unregulated peer-to-peer lenders do not demand collateral. Unsecured personal loans dominate the market for many factors, including investors without security risk losing their money if the creditor fails. This leaves the trader vulnerable to losing money.

How to Choose a Peer-to-Peer Loan Network for Your Needs

Before obtaining money from strangers, use a website you know and trust. This will reassure you that you won’t default on the debt. LendingClub, Prosper, and FundingCircle are three successful peer-to-peer lending firms. Three companies have brand-specific websites.

Internet enrollment forms require participants to provide personal information. These may include names, professions, and Social Security numbers. Participation requires this. After choosing a base, players will advance (SSN).

After that, the user can review the loans on the website before committing. Before the buyer commits financially, this happens before the client invests any money. This occurs before the customer commits financially. Before the client invests money, this happens. Diversify your financial assets and monitor risks. Failure to do so can cause substantial losses. If you don’t, you risk serious harm.

Buyers in peer-to-peer lending networks should set a schedule for asset assessment and follow it. This will allow them to verify that their financial resources are being used according to their forecasts. This makes network activity effective and efficient. If a loan fails to perform, the lender may demand that the buyers give up their assets. Real land, cars, and other items may be included.

P2P Funding Can Be Understood in Several Ways

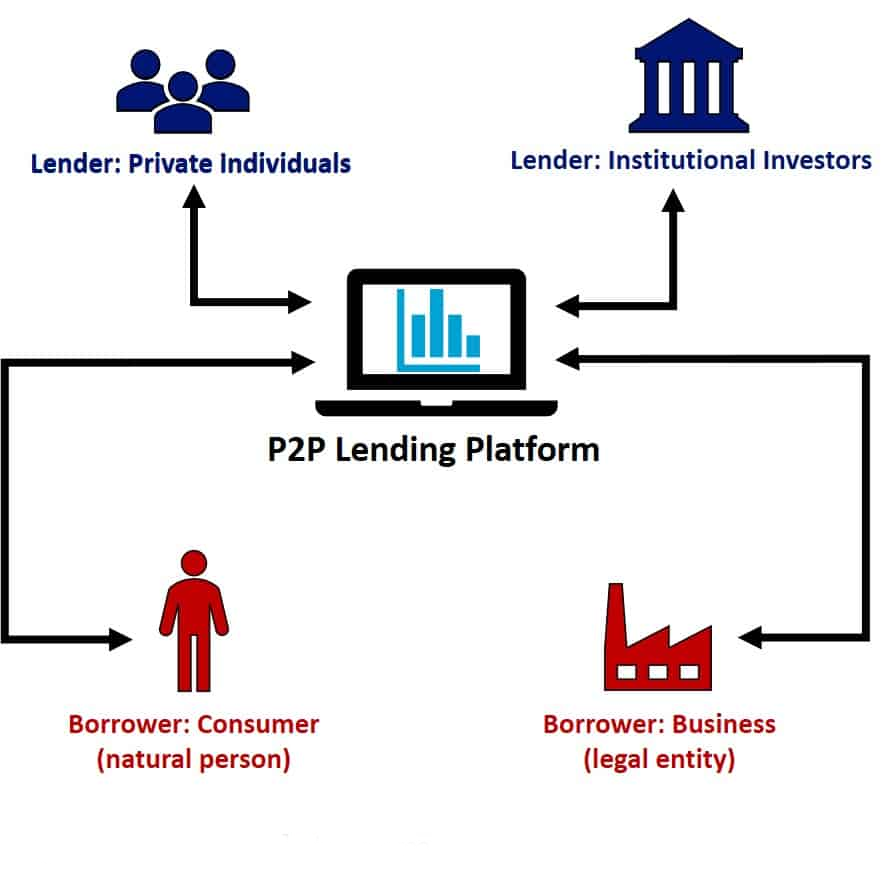

Each peer-to-peer funding plan targets a distinct customer or investor. Peer-to-peer lending has grown in popularity. Peer-to-peer financing has increased recently. The following groups describe the many types of peer-to-peer financing:

Customer Funding

By Using Peer-to-Peer Networking Infrastructure, Online P2P markets are the most common way consumers use peer-to-peer funding. It is the simplest peer-to-peer funding tool. This is the most common use of peer-to-peer finance. It’s how people get money for personal expenses like loan repayment, home renovations, and weddings. Personal money uses: Money uses include: “Peer-to-peer funding,” which refers to direct lending between people. This funding method typically yields lower credit amounts, quicker payback periods, and no security. These loans also charge larger interest. Creditworthiness and investor risk tolerance determine the interest rate. The applicant’s solvency affects the interest rate.

Peer-to-Peer Loans for Your Company (P2P)

Corporations can borrow money directly from private people through corporate peer-to-peer loans (also known as “business P2P lending”). Enterprise peer-to-peer funding is another term. This alternative or non-conventional funding is ideal for small and medium-sized companies (SMEs) that have trouble getting business loans. This alternative or non-conventional funding is great for small and medium-sized companies.

The loans can be used to buy machinery, grow the company, or finance activities, among other things. Businesses may demand larger interest rates for peer-to-peer lending than people and accept monthly payments. Companies demand larger interest rates than people. This is because companies charge higher interest than people. Financing a firm involves more risk.

Property Peer-to-Peer Loans

Peer-to-peer real estate funding participants lend money to each other for various real estate development projects. This assistance can finance extra real estate growth ventures, among other things. This help has many uses, including the following: Because the lender expects the recipient to use the property as security, this type of peer-to-peer lending usually yields better returns.

Peer-to-peer networks enable real estate deals. Obligation-based and property-based deals exist. Peer-to-peer networks enable these transfers. Peer-to-peer funding gives debt-based real estate deals credit instead of cash. The beneficiary receives cash in standard funding. The buyer of equity-based peer-to-peer real estate financing becomes a firm shareholder. Equity underpins peer-to-peer real estate loans.

Student-to-Student

“Student peer-to-peer lending”—also known as “student P2P lending”—is when students give money to each other to fund their schooling. Student P2P loans and peer-to-peer lending are synonymous. This alternative funding can replace traditional student loans, which have higher interest rates and tighter application requirements. Traditional college debts are old. Peer-to-peer loans are usually uninsured, with fixed interest rates and multiple payback options. This funding is for schooling. Commercial peer-to-peer funding usually involves ownership of assets.

Monday P2P Borrowing

Peer-to-peer loans can be used to pay off overnight debts and have high-interest rates. These loans are meant to be repaid with the borrower’s next salary, so repayment terms are usually simple and fast. Peer-to-peer finance for a single night’s stay has grown in appeal. Because this banking allows people to give and take money directly. Short-term loans at high-interest rates are called payday peer-to-peer funding. These tiny debts last less than a week. Most bills are under $100.

Receipt-Based Debt

P2P finance, or peer-to-peer lending, includes invoice financing. P2P lending allows firms to sell their receivables to private buyers for cash. This financing is called invoice leveraging. P2P banking can take many forms. Invoice funding is one. Reorganizing data for a different authentication method is another term for it. This may be a good option to bank loans or lines of credit for a company that needs cash quickly but lacks the credit history or securities for conventional funding.

This choice may benefit these businesses. This group includes companies that need funding but lack credit history or instruments. Due to invoice funding, reimbursement terms and interest rates are usually very fast and costly. Because invoice financing is factoring, the firm receives the money instantly. The company can use the funds instantly.

Peer-to-Peer Environmental or Sustainability Help

“Green peer-to-peer lending” (P2P lending) allows individuals to give money to ecologically friendly projects like renewable energy, energy-efficient buildings, and agribusiness. These are “green P2P loans.” This funding choice is ideal for environmentally conscious companies that want to avoid conventional financing. If these businesses get this financing, they will likely pay more in the near run. However, their ability to limit environmental damage will ultimately help the ecosystem.

This group includes recycling, ecological building, and energy efficiency efforts. This group includes many types of tasks. Green peer-to-peer funding offers monthly or yearly payments and lower interest rates than other P2P lending. Due to the widespread view that environmentally friendly actions are safer, the current scenario has arisen. This follows this view.

Closing Remark

Peer-to-peer lending (P2P financing) offers debtors an option to bank and credit union loans. Peer-to-peer funding refers to P2P loans. This financing is called “peer-to-peer finance.” “Peer-to-peer finance” is another term for this form of financing. Networks that facilitate the peer-to-peer (P2P) banking process brings together lenders and consumers, whether they are friends, family, or strangers.

This allows lenders to earn income on their assets and clients to get loans at better rates than traditional financial companies. Conventional banks charge larger interest rates. This agreement benefits both sides. This causes these benefits. P2P networks must pay debtors’ interest because borrowers are under their authority. P2P networks will now pay these interest fees.

“Borrowing from peers” can offer a financial chance for a person. “Peer-to-peer financing” is this (P2P for short). Buyers should assess their short- and long-term financial goals and risk tolerance before investing in peer-to-peer funding. This evaluation should be done before any cash commitment. After that, they must consider whether to make a purchase. Investing in a range of loans through peer-to-peer networks reduces risk. This lets you engage in more results. Thus, you can spread your assets across more results.

This gives you more freedom to spread your money across a wider range of possible outcomes. This allows you to spread your financial money across more personal loans. This approach will reduce the life-altering effects of possible losses. This applies whether or not you lose.

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)