The DeFi landscape has evolved dramatically. In 2024, we witnessed an explosive 211% growth in Total Value Locked (TVL), reaching $214 billion. But here’s the catch: not all projects benefited equally.

The winners shared common traits: laser focus on Real Yield, exceptional user experience, vibrant communities, and forward-thinking AI optimization. If you’re building in DeFi and want to join their ranks, this comprehensive guide will show you exactly how.

The New Rules of DeFi Success

Gone are the days when flashy APRs and token incentives alone could drive sustainable growth. Today’s successful DeFi projects understand that sustainable TVL growth requires a fundamentally different approach:

- Real Yield over Token Emissions: Users increasingly prefer protocols that generate actual revenue

- Community-First Development: Strong communities drive organic growth better than any marketing campaign

- AI-Ready Infrastructure: With AI assistants becoming primary research tools, discoverability depends on AI optimization

- Security as a Feature: Trust has become the ultimate competitive advantage

Let’s dive into the four-stage framework that successful protocols use to scale their TVL systematically.

Stage 1: Foundation (Months 1-3)

Building Bulletproof UX and Security

Your product is your foundation. No amount of marketing can compensate for a broken user experience or security vulnerabilities.

Case Study: Trader Joe’s Success Trader Joe didn’t just build another DEX. They created the “Liquidity Book” with discrete liquidity bins, enabling zero-slippage trading while giving liquidity providers unprecedented capital efficiency. Their friendly branding and intuitive interface helped them capture significant market share on Avalanche.

The UX Optimization Checklist:

✅ Simplify Onboarding: Reduce registration and first deposit to 2-3 clicks maximum

✅ Mobile-First Design: Over 50% of users access DeFi via mobile devices

✅ Intuitive Navigation: Self-explanatory menus and clear terminology

✅ A/B Testing: Continuously optimize key conversion funnels

Security Must-Haves:

✅ Smart Contract Audits: Multiple audits from reputable firms (Consensys, Trail of Bits, OpenZeppelin)

✅ Multi-Signature Wallets: For treasury and critical protocol changes

✅ Emergency Pause Mechanisms: Ability to halt operations during attacks

✅ Insurance Integration: Partner with Nexus Mutual or InsurAce

Expected Results: 40-80% improvement in conversion rates, 25-50% increase in average deposit size, enhanced trust from institutional investors.

Community: Your Growth Engine

A strong community isn’t just nice to have—it’s your most valuable asset for organic growth.

Case Study: SparkDEX’s Community-Driven Growth SparkDEX achieved 410% TVL growth in one year through daily Discord engagement, weekly AMAs, and user-generated content campaigns. Their secret? Consistent, authentic community interaction.

The Three Essential Platforms:

| Plarform | Discord | X (Twitter) | Telegram |

| Value | Community Hub | Public Face | Quick Communication |

| Purpose | 🔹 Technical support 🔹 Deep discussions 🔹 AMAs 🔹 Governance | 🔹 Project news 🔹 Educational content 🔹 Industry networking | 🔹 Instant notifications 🔹 Brief discussions 🔹 Mobile access |

| Structure | #general #support #announcements #governance channels | 🔹 Daily protocol updates 🔹 Educational threads 🔹 Industry commentary | 🔹 Important announcements 🔹 Quick Q&A responses |

| Key feature | Daily Q&A, weekly team AMAs, proposal discussions | Reply to mentions, join discussions, cross-promote with partners | Bots for protocol event notifications |

Community Programs That Work:

- Ambassador programs for active members

- Achievement systems and leaderboards

- User-generated content contests

- Exclusive beta testing opportunities

Target Metrics: 500-2,000 active community members in first 3 months, with organic growth through word-of-mouth.

Stage 2: Incentivization (Months 4-9)

Real Yield Programs That Actually Work

Modern liquidity programs focus on sustainable Real Yield rather than unsustainable token emissions.

Case Study: Compound’s Evolution Compound modernized their distribution program with a Real Yield focus: 70% from actual protocol fees + 30% token emissions. Result: 340% TVL growth in 6 months with much better user retention.

Case Study: Curve’s veCRV Model Curve’s ve-tokenomics with up to 4-year lockups, gauge voting, and Real Yield from fees has maintained $2.5B TVL through multiple market cycles.

The Real Yield Framework:

Revenue Distribution:

- 60-70% rewards from actual protocol revenue (trading fees, interest)

- 30-40% from controlled token emissions

- Automatic reinvestment and compounding

- Gradual emission reduction over time

Distribution Mechanics:

- Quadratic formulas to prevent large player dominance

- Time-based bonuses for long-term participation

- Anti-gaming protections (minimum holding periods)

- Gradual unlock schedules (25% immediate, 75% over 12 months)

ve-Tokenomics Implementation:

- Lock tokens for 1-4 years to gain voting power

- Vote on reward distribution between pools

- Share real protocol revenue with ve-token holders

- Marketplace for vote delegation

Expected Results: 200-400% TVL growth, 300-500% increase in user retention time.

Strategic Airdrops and Point Campaigns

Quality campaigns attract real users instead of farmers.

Case Study: LayerZero’s Anti-Sybil Success LayerZero focused on authentic cross-chain activity with anti-sybil mechanisms and community voting on criteria. They attracted a high-quality, long-term user base despite (or because of) their strict qualification requirements.

The Point System Framework:

| Category | Allocation | Criteria |

| TVL Contribution | 40-50% | 🔹 Deposit amount and duration 🔹 Consistency of deposits over time |

| Protocol Participation | 25-30% | 🔹 Diversity of functions used 🔹 Transaction frequency and complexity |

| Community Contribution | 15-20% | 🔹 Quality content creation 🔹 Helping other users 🔹 Governance participation |

| Referral Program | 10-15% | 🔹 Bringing in active users 🔹 Quality over quantity metrics |

Anti-Sybil Protection:

- Minimum time-based activity thresholds

- Identity verification for large allocations

- Machine learning for suspicious pattern detection

- Community validation of large recipients

Expected Results: 5,000-50,000 quality users, viral growth, 50-200% TVL boost.

Stage 3: Scaling (Months 10-15)

Omnichannel Marketing That Converts

Comprehensive content marketing and influencer partnerships for maximum reach.

Case Study: Successful Omnichannel Campaign One project achieved 670K+ user reach and 36% TVL growth through 14 top-tier influencer posts + coverage in 33 crypto publications over 14 days. The key was coordinated messaging across all channels.

Content Strategy That Works:

Educational Content (3-4 posts/week):

- Protocol tutorials and DeFi guides

- Market analysis and trend insights

- Technical explanations and updates

Twitter Strategy:

- Daily update threads

- Educational DeFi threads

- Engagement with industry leaders

- Participation in trending discussions

Influencer Marketing Tiers:

| Top Tier (>100K followers) | Mid Tier (10K-100K followers) | Micro Tier (<10K followers) |

| 🔹 Major announcements and product reviews 🔹 High impact, low frequency | 🔹 Regular collaborations and educational content 🔹 Consistent engagement | 🔹 Community advocacy and detailed reviews 🔹 High authenticity, niche audiences |

Expected Results: 500K-2M user reach, 200-400% brand awareness increase, 25-80% TVL growth.

Strategic Partnerships for Growth

Essential integrations for expanding functionality and audience reach.

Case Study: Spark Protocol x Aave Integration with Aave’s ecosystem drove growth from $1.2B to $7.2B TVL in 5 months through liquidity access and shared yield strategies.

Priority Partnership Types:

Technical Integrations:

- Wallet Partners: MetaMask, Trust Wallet, WalletConnect

- DEX Aggregators: 1inch, Paraswap for liquidity routing

- Portfolio Trackers: Zerion, Zapper for visibility

- Analytics: DeFiLlama, Dune Analytics for data

Ecosystem Partnerships:

- Cross-chain Bridges: For multi-chain access

- Yield Aggregators: Yearn, Convex for complex strategies

- Insurance Protocols: Nexus Mutual for additional protection

- Governance Platforms: Snapshot, Tally for voting

Expected Results: Access to 50K-500K partner users, 30-100% TVL growth through enhanced functionality.

Stage 4: Optimization (Months 16+)

Advanced Yield Innovation

Cutting-edge revenue strategies and AI-future preparation for long-term competitive advantage.

Case Study: Pendle’s RWA Integration Pendle integrated Real World Assets (sDAI, fUSDC) with yield tokenization, creating markets for trading future yields. Result: 580% TVL growth through yield innovation.

Yield Innovation Strategies:

Real World Asset Integration:

- Treasury bill rates through RWA protocols

- Tokenized future yields (separate principal and yield tokens)

- Automated strategies with rebalancing

- Leveraged stable yield with protection mechanisms

Advanced Products:

- Yield Futures: Forward contracts on expected yields

- Auto-compounding Vaults: Automated reinvestment with gas optimization

- Insurance-wrapped Yield: Protected yield products

AI Optimization (AIO): The New SEO

In 2025, protocols are read not just by humans but by AI assistants. AI optimization is critical for organic growth.

Technical Foundation:

- Comprehensive Dune Analytics dashboards with verifiable data

- Schema.org markup and real-time API endpoints

- LLMS.txt file for directing AI crawlers

- <3 second load times, semantic HTML markup

AI-Friendly Content:

- Structured FAQs with direct answers

- Objective protocol comparisons with data

- Glossary of terms and technical documentation

- Regular performance reports

AI Mention Monitoring:

- Regular queries to major AI assistants (ChatGPT, Claude, Perplexity)

- Track frequency and context of protocol mentions

- Optimize content based on AI feedback

Expected Results: 300-600% TVL growth through yield innovations, 25-60% organic traffic growth through AI over 6-12 months.

The Integrated Approach: Making It All Work Together

Phased Development Model

Maximum impact comes from synergistic application of all stages with proper coordination.

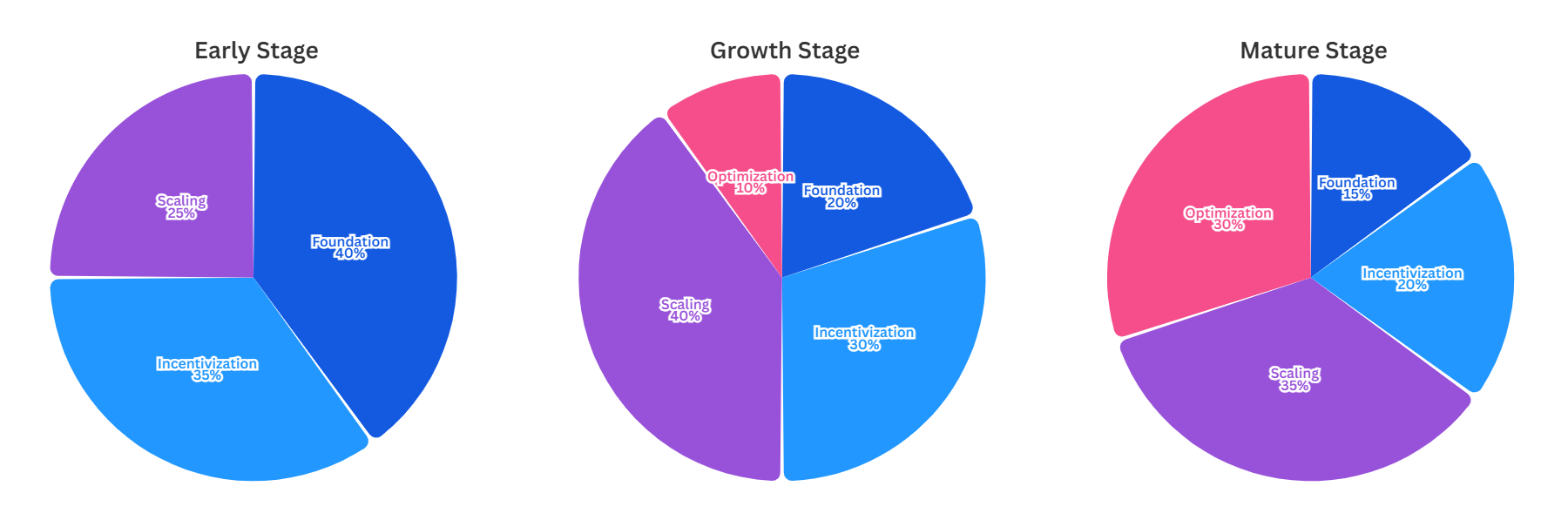

Resource Allocation by Stage:

- Early Stage (<$10M TVL) — 40% Foundation, 35% Incentivization, 25% Scaling

- Growth Stage ($10M-$100M TVL) — 20% Foundation, 30% Incentivization, 40% Scaling, 10% Optimization

- Mature Stage (>$100M TVL) — 15% Foundation, 20% Incentivization, 35% Scaling, 30% Optimization

Critical Success Factors

| 🧱 Foundation First | Security, UX, and community are non-negotiable prerequisites |

| 📈 Real Yield Focus | Sustainable economics over short-term token incentives |

| 🤖 AI Readiness | Optimization for AI discovery is essential for organic growth |

| 👥 Community-Centric | Authentic engagement drives sustainable expansion |

Key Takeaways for DeFi Builders

The DeFi landscape rewards projects that combine technical excellence with thoughtful economic design and strategic positioning. Success requires:

- Patience and Persistence: Sustainable growth takes 12-18 months minimum

- User-First Thinking: Every decision should improve the user experience

- Community Investment: Your community is your most valuable asset

- Data-Driven Optimization: Measure everything, optimize continuously

- Future-Focused Planning: Prepare for AI-driven discovery and interaction

The projects that will dominate the next cycle are building today with these principles in mind. The question isn’t whether DeFi will continue growing—it’s whether your project will be part of that growth.

This guide is based on analysis of real case studies from 2024-2025. Regular strategy updates are recommended to adapt to the evolving DeFi ecosystem.

Rate the article