share

Contrary to popular belief, cryptocurrency wallets are not designed to actually store cryptocurrencies, instead they provide the tools necessary for interacting with the blockchain network. In other words, these wallets can generate the necessary data to send and receive cryptocurrency using transactions. Among other things, this data consists of one or more pairs of public and private keys.

The wallet also includes a public address, which is an identifier in the form of a set of letters and numbers, which is generated based on the public and private keys. The public address is a kind of location on the blockchain where you can send coins. This means that you can share your public address with another user to receive funds, but you should never show your private key to anyone.

A private key provides access to your cryptocurrencies, regardless of which wallet you use. Thus, even if your computer or smartphone has been compromised, you can still access your funds from any other device, provided that you have the corresponding private key (or seed phrase).

Wallets for storing cryptocurrencies may vary depending on how they work on “hot” and “cold” ones.

A hot wallet is any type of wallet that is connected to the Internet. For example, when you create an account on the exchange and send funds to your account, you make a deposit to the hot wallet of this exchange.

In turn, cold wallets do not have an Internet connection. Instead, they use physical media to store keys offline, which makes them more resistant to cracking. Thus, this type of wallet is a safer alternative for storing your coins.

Software Wallets

Software wallets could be web, desktop or mobile. Most of them are somehow connected to the Internet and are hot in nature. The following is a description of the most common wallets.

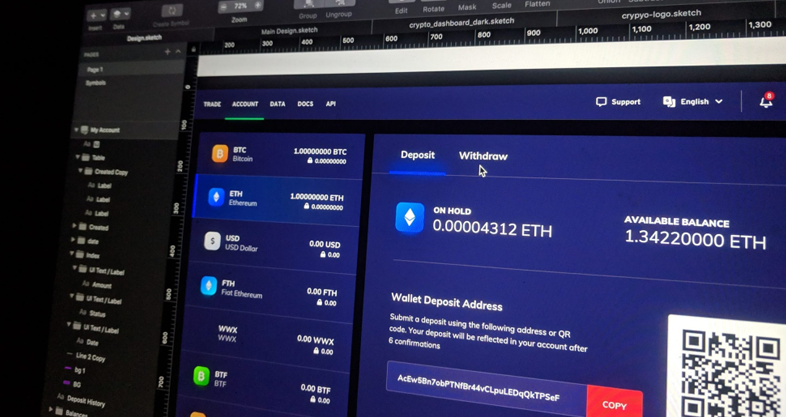

You can use web wallets to access the blockchain through the browser interface without the need to download or install third-party software. This applies to wallets on exchanges, as well as any others that are based on the browser.

Examples of such wallets are Cryptopay, Blockchain, CoinKite, BitGo, SpectroCoin, Coinbase wallet and others.

In most cases, you can create a new wallet and set a personal password to access it. However, some companies manage private keys on your behalf. This may seem more convenient for inexperienced users, but it is less secure. If you do not own your private key, you trust your funds to the other side. To solve this problem, many web-based wallets allow you to manage keys in full or through general control (via multi-signature). In fact, if they hack the exchange, then there is a good chance that all wallets will also be hacked.

Hardware Wallets

A hardware wallet is a physical electronic device that uses random number generation (RNG) to create public and private keys. Keys are stored on the Internet. Thus, the device is one of the safest.

Although these wallets provide a higher level of protection against various attacks, the weak point of such devices is various types of firmware failures. In addition, hardware wallets are less convenient due to more difficult access to funds compared to hot ones.

Examples of such wallets are Ledger, Trezor, Keep Key and CoolWallet.

You should consider using a hardware wallet if you plan to keep cryptocurrency for a long time, as well as for large capital. Currently, most of these wallets allow you to set your PIN, as well as a recovery phrase, which you can use if your device is lost.

Paper Wallets

A paper wallet is a piece of paper on which a public address and a private key are printed in the form of QR codes. These codes can then be scanned for cryptocurrency transactions.

Some websites allow you to download a code from a paper wallet to generate a new address and key offline. Thus, the wallet is highly resistant to hacker attacks and can be considered as an alternative to its cold counterparts. The main disadvantage of paper wallets is that they are not suitable for partial sending of funds, but only for sending the entire balance.

Paper wallet can created at BitAddress paper wallet generator. The need for such a wallet arises when a rather impressive amount accumulates, which you do not intend to contact for some time. That is, it is not intended to participate in trading operations, and it is not planned to transfer it to someone.

In our opinion, hardware wallets are the safest at the moment, their cost usually ranges from $ 60 to $ 120, which is a very small security fee.

If you keep funds for a long time, then physical hardware wallets are the best choice. If you use cryptocurrency for quick and small transfers, for example, to an exchange platform, then you can get by with regular online wallets.