share

In 2021, the market of NFTs experienced a real test of strength – the number of transactions exceeded expectations in every conceivable way. The researchers noticed the NFT revolution. There still will be heated debates about the perspectives of non-fungible tokens for a long time. The NFT market is too young for any kind of sustainability.

Three large-scale studies have been found. These studies, based on over 4 years of NFTs usage, show the future trends and changes in the users’ behavior. The first study, a scientific one based on solid mathematical calculations, was carried out by Mathieu Nadini, Andrea Baronchelli (The Alan Turing Institute, UK) together with some researchers from the Technical University of Denmark, the Catholic University of the Sacred Heart (Italy), IBM Research (USA), IT University of Copenhagen (Denmark), UCL Center for Blockchain Technologies, University College London (UK). You will find a link to the original article at the bottom of this page.

Two more reports have been made by NonFungible. The link can be found on the company’s website. This company was founded in 2018 in order to support the Decentraland platform. In the course of its gradual expansion, the company started to consider the whole NFT market. We analyzed the reports for the years 2020 (containing the data since 2018) and 2021 to track the development. Our investigation reveals NFT community provides the market of tokens with much more chances than any skeptics could predict.

Why Does the NFT Market Makes One’s Hearts Beat

Andrea Baronchelli, PhD in mathematics at the Alan Turing Institute and City University London, paid her attention to the NFTs phenomenon after the record-breaking sale of Beeple’s “Everydays”: The First 5000 Days was sold for 69,34 million dollars. Such prices were common for the people working with Bitcoin and, sometimes, Ethereum. However, this sale of a digital painting turned into a real hype.

Previously, the researchers from the group dealt with the mathematical mechanisms implemented in the Blockchain, but the new phenomenon stimulated more detailed learning of the technology and the NFT market trends.

Our investigation reveals NFT community gained access to the data such as an average sale price, profit, and loss, market trends, and patterns.

Total Numbers

A new research of NonFungible reveals that the capitalization of the NFT market has grown by 300% over three years in 2020 (from $123,999,573 to $372,203,300) and by 4,540% in 2021 (to $16,898,362,987). The growth rate reached 13,628%. And that is in just three years. One can say that this is an absolute record for the DeFi market. The growth continues – according to the website coingecko.com the NFT market capitalization as of April 29, 2022, is $35,1 billion.

The profit from resales in 2021 made up $5,407,158,315, and the loss was $667,191,955, which means that people got income 8 times more often than they lost their money.

The number of active wallets has grown by 23 times since 2018. Thus NFT communities have been replenished by almost 2.5 million people. This number has grown from 110,551 in 2018 to the current 2,574,302. The number of buyers and sellers of the art NFTs has grown over 4 years by 44 and 43 times, respectively.

The average sale price of an NFT is $6,732, while three-quarters of all the transactions have prices around $15, and only 1% show higher prices – over $1,500. Based on the overall average numbers, we can say that the prices largely depend on such sales. Just remember the Beeple’s “Everydays”.

NFT Market Segmentation

The researchers from the City University London analyzed the same segments in parallel with NonFungible:

- Art

- Collectibles

- Metaverses

- Services

- Gaming

- Others (NonFungible included sports in this particular case)

According to NonFungible, in 2021 the largest sales in the specific segments were shown by:

- CryptoPunks and Bored Ape Yacht Club in Collectibles ($1,862,605,426 and $1,744,863,506 respectively).

- Axie Infinity in gaming ($3,485,878,200).

- The Sandbox and Decentraland in the Metaverses ($317,607,356 and $110,760,195 respectively).

- VeeFriends in Services ($158,186,652).

- ArtBlocks in Arts ($1 329 717 503).

The difference in the results can be explained by the fact that the City University’s scientists used the data from large marketplaces, while NonFungible analyzed only the protocols they support. However, we believe that two different analyses provide you with a complete picture – the cross-links in these two sets are precisely the NFTs sales objects of the highest demand.

Changing Focus Based on Segmentation

At the end of 2017, the real trend of the newly created NFT market was presented by the CryptoKitties collection. Cute cats instantly won the hearts of users, and the first NFT community formed itself around them. The ability to select genetics, cross cats, and breed new breeds has made the idea useful. It is not interesting just to have a cat. The selection is really engaging.

The sales remained stable within $60,000 until the middle of 2020. The NFT revolution began in July, and the daily trading rose to 10 million dollars by May 2021. The NFT market has grown 150 times within 8 months.

Throughout 2018, the market trends were dominated by the art NFTs. Further, the distribution by segments changed:

- 18% for the art,

- 33% for the Gaming,

- 39% for the Metaverses.

At the same time, 71% of transactions are still made with the art NFTs. In July 2020, we saw a shift – 44% of transactions are with Gaming, and 38% with Collectibles. The art keeps only 10%. You can see an interesting pattern – Art’s share is constantly growing while the transactions are declining.

A summary we could make – the members of the NFT community are actively generating new objects, but sales are getting less and less.

The Segmentation of the Average Sale Price of NFTs

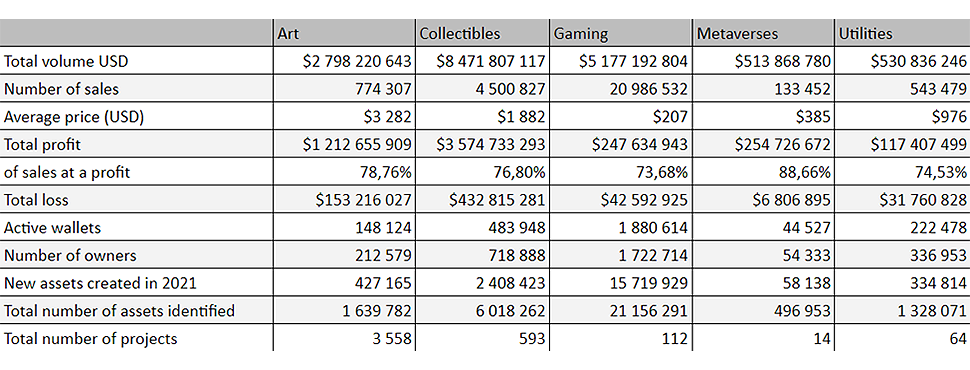

Let us consider a pivot table by segments.

If we consider the field of art, the prices are still higher – $3,282 on average, but you will get more profit in Collectibles. The same applies to the total volume. But the percentage of those who benefited from the resale is higher among those who buy and resell in the Metaverses. This correlates with the number of projects. There are only 14 in the Metaverses, and it indicates the relative rarity (so the prices are higher). On the other hand, we have 3,558 artists, and these are only the significant ones in the field of art.

Losses and Profits

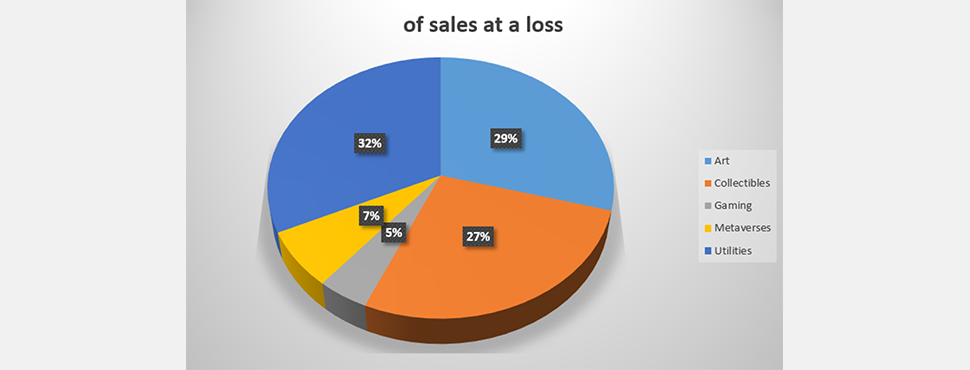

The percentage of losses from the total trading volume is the highest in the category of Utilities – 5.98%. The art NFTs and Collectibles are close to this number. However, the Gaming and Metaverse categories promise you the highest profits.

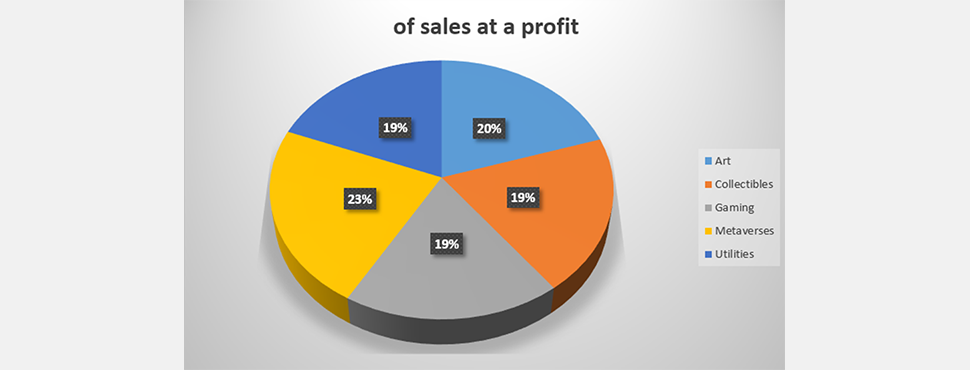

The distribution by shares of all profits is approximately equal, not depending on segmentation.

The Size of the NFT Community

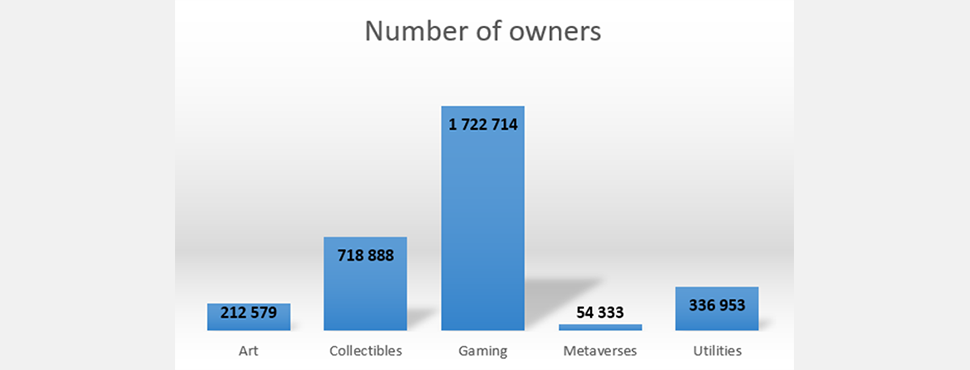

If we take a look at the number of NFT communities, we will see the dominance of the Gaming segment.

The interested ones prevail here. And this number is growing. The possibility of getting your profit from the off-site resale has stimulated this process. So far, not all the manufacturers in the gaming industry are ready for it. They get some of their income through controlling the exchange of artifacts in games. But the interest of NFT community members speaks for itself. By building a new control model or completely abandoning it, developers profit from the players’ number growth. We can witness this process right now – the above-mentioned category is certainly the leading one. Just look at the number of the new assets – 15,719,929.

The Market Share Based on Blockchain

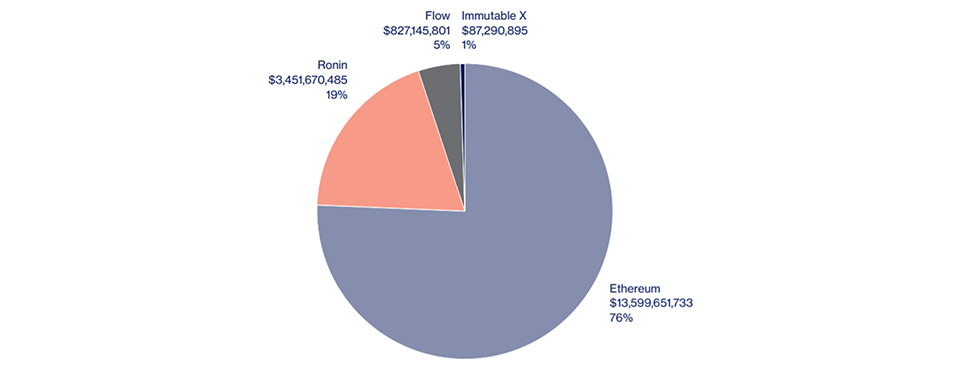

As expected, the Ethereum blockchain is in the lead – 76% of all created tokens have the ERC protocol.

A little less than a fifth of the market is taken by the Ronin blockchain, founded by the developers of Axie Infinity to create games with a users-based economy. The market capitalization of the RON token is $215,827,969, and the price at the time of writing is about one and a half dollars.

The blockchain Flow (the creators of CryptoKitties) takes 5%. The popularity of the game has become a reason for big problems on the Ethereum blockchain related to access and transaction processing speed. Therefore, the developers created their own network.

The capitalization of the native Flow token is $1,955,320,744, and the price is $5.43.

The Blockchain Immutable X was created specifically for minting NFTs based on the Ethereum blockchain. It supports over 200 million transactions per day. It is planned that it will become the default blockchain for NFTs.

The Structure of NFT Traders

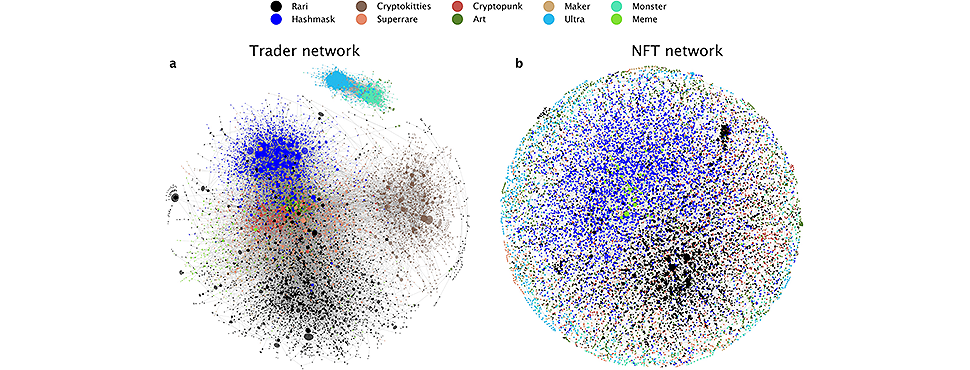

The scientists of the Alan Turing Institute came to an interesting conclusion, investigating the nature of the sale on the NFT market based on the trade networks, the nodes of which are the traders themselves.

It turned out that 10% of traders make 85% of all the transactions, and 97% of all digital assets are processed by them. Moreover, those NFT traders who have been participating in selling for a long time are in the lead.

Between themselves, the NFT traders mainly discuss the collections. Most often, the transactions are made between sellers and buyers who own NFTs from the same collection.

The researchers also found a regular clustering of the trade networks of NFTs. They came to the conclusion that the following is true for the sequential transactions: small collections are bought “at random”, while the large ones are bought purposefully.

At the same time, the NFT clusters are more blurred than the NFT traders’ clusters.

Visual Features of the Art NFTs Collections

After processing 1.25 million graphic images from different collections through a trained AlexNet convolution neural network, the scientists evaluated the visual similarity of different objects. The most homogeneous (that is, similar) among themselves turned out to be the NFTs of the Sorare and Cryptopunks sets.

You can see similar visual features in the Chubbie, Cryptopunks, and Wrapped Punks collections. They are also presented in the Cryptokitties and Axie collections.

Segment Outlook in Numbers

NonFungible considered the capabilities of most segments in their report.

Mordor Intelligence has published a report on the global market. The market’s value in 2021 was estimated at almost $174 million. By 2026, it is expected to grow to 300 billion, i.e. about 10% annually.

The share of NFTs was $4 billion, which is about 2%. Considering the growth rate of NFT Game, we can conclude that by 2026 NFT will take 10% of the gaming market.

We can also expect some kind of growth in the Metaverse segment. The main reason for this is the fact that through the creation, development, provision of data, and maintenance of parallel worlds, a lot of people get real job positions. Let us imagine any further expansion of this segment. If we consider any other digital areas (for example, Internet marketing or Gaming), we can expect that it will capture its part of the economy offline. Take a look at the main token of the Sandbox universe. It’s capitalization has already reached $3,000,567,229 and costs $2.59. The Metaverses are not just about the self-realization for members of the crypto community but also about a full-fledged means to make money.

Check out the financial markets. The experts say that the NFT market is too young and not safe enough. We do not expect any breakthrough in 2022, judging the use of non-fungible tokens in the field of finance. The first step is to work on the regulatory tools and the market’s infrastructure.

NFTs Can Cause Problems. Which Ones?

The year 2021 was a hype source for the NFT. It was new, trendy, and unusual. However, some skeptics say that 2022 has put everything in its place and the “bubble” is close to bursting. Most of these comments are based on the failure in respect of the sale of the first post on Jack Dorsey’s Twitter. In March 2021, it was sold for $2.9 billion. In April 2022, the maximum auction price for this lot was $6,849.30.

Is this a crushing failure of the end of the NFTs era? To answer this question, we need to list all the problems associated with non-fungible tokens found in the new research.

Services Usability

The very interaction with marketplaces and minting sites is quite difficult for inexperienced users. In addition, many users mentioned the difficulty when transferring tokens to buyers or as a gift. Also, in terms of ease of use, the marketplaces are far from online stores and platforms for the sale of real products. Imperfect filters and search complexity significantly complicate your work with NFTs.

Legal Bases and Taxes

At this point, the decentralized finance market itself is far from perfect, and you don’t understand the importance of NFTs in this case. The regulatory bodies offer different options, but the crypto legislation is completely separate from the NFT legislation – this is a completely different asset. The token segments themselves are so heterogeneous that it is not yet possible to bring them to a common denominator.

Talking about taxes, you should keep in mind that you are likely to have big problems when sending your tax form for the sale of tokens. The reason is the CLASSIFICATION. This is especially true for legal entities.

Anti-fraud Activities

While the NFT market is technologically weak, some marketplaces like OpenSea are eliminating plagiarism and fraud on their own. You do not know how to deal with the situation when many tokens can be issued for one object. Also, a new type of fraud has appeared – sleepminting. It turned out that it was possible to issue a token for an artist and then, without his consent, transfer the rights to ownership to yourself. At the same time, the transaction in the Blockchain is considered completely legitimate.

There is also a very real threat of a surge in money laundering activity. The decentralization involves bypassing KYC rules (“know your customer”) compliance. Dealing with it is another headache for the regulators.

Ecology

This problem affects all projects based on the Proof-of-Work algorithm. The energy consumption and the associated increase in carbon dioxide emissions into the atmosphere are of concern to all crypto and NFT communities. However, this problem is solved by switching to the Proof-of-Staking algorithm.

Inflation and Speculation

While the crypto markets are just getting their stability, this problem remains. In 2021 we saw the record highs for speculative selling. The inflation also appeared with an increase in the number of projects, imitators, and celebrities on the marketplaces.

Lack of Knowledge

While the tokens are more related to the hype, any middle person buys them only because of the trend. This is especially true for the Art category, where most of the traded objects do not have any value. You can find some real benefits among the club options (for example, Bored Ape Yacht Club), service, and financial tokens. If we take a look at the entertainment, NFTs are also a big part of an idea.

However, the mass consumers consider the NFTs either as a bubble or as a Harry Potter’s stick to get some wealth. It takes many years to demystify this phenomenon in the market.

Missing Some Digital Assets Display

This problem mostly applies to all the digital copies of real things. For example, if you bought a crown with some diamonds from Dolce and Gabbana or a pair of super-quality sneakers from Gucci, your suit will shock even the star of glamour, Paris Hilton. A great idea. But where do you show all these treasures? In reality, you can visit some fashionable hangouts, shows, and events, but they are not online yet.

The industry is developing, and it lacks virtual reality platforms where each user can show what he/she is worth.

By the way, do not forget about the art NFTs. The museum of NFTs, “MOCA. Museum to CryptoArt”, is here, but it is still an exception to the rule.

Some collectors and connoisseurs of something great get difficulties when searching for platforms where they can arrange an exhibition or a showcase of their latest acquisitions. Spending a large sum of money generates interest, but this is valuable only for the readers of the New York Times or some art newspapers. However, there are still no virtual worlds with the presentation of NFTs exhibitions. You need a website that will show some visual features of the work of any art online and allow you to get into its virtual space.

Summary

It’s too early to talk about any crisis in the NFT market. This phenomenon will stay with us. However, it will become a full-fledged part of the digital economy. Based on smart contracts, token minting is an excellent solution for impartial proof of your ownership in the virtual world. It took just four years for the NFT market to make its name. Yes, so far, there is more hype than any kind of regulation. And please do not forget the scams. But is there any example in the history of mankind when a new economic phenomenon became ideal from the moment it appeared?

The legislation and tools to combat scammers develop gradually – law enforcement and security specialists are always behind those making the problems. This statement is true in any area of human activity. The NFTs are no exception.

The opportunities that non-fungible tokens offer us relate to consumer rights protection. The NFTs can become the main tool in the fight for copyright and confirmation of the legitimacy and purity of the transactions. When this technology evolves, we will get the most powerful tools for regulating legal relations online. This applies to any area.

Real Estate

A middle person of any deal, leaving his/her function to the smart contracts. The models of the Metaverses are now working out the nuances of real estate transactions, and the first example of their transfer to the real world already exists. When the mechanism is worked out, the real estate agents will be replaced by smart contracts, and the process of buying some real estate will not incur huge additional costs for the person who checks the documents. Filling blockchain data of transactions in a few decades will make it possible to easily check the cleanliness when closing real-estate deals.

The Film Industry and Events

In addition to copyright and ownership, tokens can act as tickets – with or without unique characteristics (row, place, bonuses). Some film companies already include the opportunity to act in films or take part in the drawing in tokens.

Many people consider this to be interest speculation, but NFTs are just a form here. When the market settles, instead of an electronic or a printed document, the users will freely handle tokens.

Status Confirmation

Are you a part of a closed community, or do you have a unique avatar on a social network? It’s about your rights, and we’re back to the power of NFTs. Only instead of a card that wears out over time, which can be lost, or a typical image, you can confirm your involvement and uniqueness with the help of your original image. And a token in the Blockchain will indicate your ownership.

Protecting Data and Defining Access Rights

While this problem in IT is solved in different ways, and huge resources are spent on ensuring reliability and confidentiality. However, the release and circulation of NFTs are simple and cheap. And the protection from any malicious intent provided by the very environment of their circulation is Blockchain technology.

There are lots of methods of using NFTs. We are still lacking technological implementation. However, the speed of the DeFi market development gives us confidence that we will constantly receive news and get acquainted with the new idea in the NFT space.