As the crypto market matures and speculative cycles give way to infrastructure-driven value, long-term investors are shifting their focus from hype to sustainability. Whether you’re a retail investor building a strategic position or a crypto project seeking to align with trusted networks, understanding which assets are best positioned for 2025–2030 is critical.

At ICODA, we work with some of the most forward-thinking blockchain companies, and we’re often asked: what’s the best long-term crypto investment today? To answer that, we’ve analyzed a wide range of assets across technical maturity, ecosystem strength, institutional relevance, and risk profile.

Here’s our curated list of the top 10 best long-term crypto assets — with real fundamentals, developer momentum, and the infrastructure to power Web3 for the next decade.

Why These Picks? Inside Our Crypto Selection Strategy

We didn’t just follow TVL charts or social media buzz. These cryptocurrencies were chosen based on concrete metrics and forward-looking fundamentals:

- Ecosystem Strength: Size, usage, developer activity, and integrations

- Token Utility: Whether the token captures network value (fees, staking, governance)

- Scalability & Innovation: Future-readiness (e.g. L2s, ZK, AI alignment)

- Institutional & Regulatory Fit: Adoption by enterprises, ETF readiness, or legal clarity

- Use Case Relevance: Real infrastructure: DeFi, AI/data, storage, scalability, payments

At-a-Glance Comparison: Best Long-Term Crypto Assets

Ethereum ($ETH)

Smart contract leaderUse Case

- DeFi

- Web3 Infrastructure

Ecosystem Strength

Risk Level

Bitcoin ($BTC)

Digital gold assetUse Case

- Store of Value

Ecosystem Strength

Risk Level

Solana ($SOL)

High-speed L1 chainUse Case

- Payments

- NFTs

Ecosystem Strength

Risk Level

Chainlink ($LINK)

Oracle infrastructureUse Case

- Data

- Interop

Ecosystem Strength

Risk Level

Polygon ($MATIC)

Ethereum scaling hubUse Case

- L2

- Enterprise

Ecosystem Strength

Risk Level

Filecoin ($FIL)

Decentralized storageUse Case

- Storage

- AI

Ecosystem Strength

Risk Level

Avalanche ($AVAX)

App-specific chainsUse Case

- Subnets

- Finance

Ecosystem Strength

Risk Level

Arbitrum ($ARB)

Leading Ethereum L2Use Case

- DeFi Scaling

Ecosystem Strength

Risk Level

Polkadot ($DOT)

Interoperability L1Use Case

- Cross-chain Layer

Ecosystem Strength

Risk Level

Near ($NEAR)

Scalable smart contract L1Use Case

- Web3

- AI

Ecosystem Strength

Risk Level

Disclaimer: This is not financial advice. Crypto investments are risky. Always consult a professional before investing

In-Depth Insights: What Makes These Crypto Projects Winners?

Ethereum ($ETH)

Ethereum remains the undisputed infrastructure backbone of decentralized finance. With the largest developer community, ongoing upgrades (like sharding and danksharding), and integration into traditional finance through ETFs and tokenized assets, Ethereum is a foundational layer for Web3. It’s also transitioning into a scalable settlement layer for a universe of Layer-2 chains, and its deflationary tokenomics enhance long-term holding appeal. For many, it’s simply the best long-term crypto to hold.

| Coin | Bullish Theses | Bearish Theses |

| ETH | 🟢 Institutional adoption 🟢 L2 scaling 🟢 DeFi dominance | 🔴 L1 fees still high 🔴 Regulatory ambiguity |

Bitcoin ($BTC)

As the original cryptocurrency, Bitcoin has evolved from a speculative asset into a globally recognized macro hedge. Institutional inflows via ETFs, sovereign adoption, and the Lightning Network’s expansion as a payment rail all support Bitcoin’s utility beyond mere speculation. Its capped supply and unmatched decentralization make it a safe cornerstone for any long-term crypto portfolio.

| Coin | Bullish Theses | Bearish Theses |

| BTC | 🟢 Scarcity 🟢 ETF flows 🟢 Global acceptance | 🔴 Low programmability 🔴 ESG and PoW scrutiny |

Solana ($SOL)

Solana’s comeback has been nothing short of remarkable. With high throughput, sub-second finality, and cheap transactions, it has become a favorite for NFT platforms, consumer apps, and high-frequency trading. Firedancer, a new validator client, is expected to boost decentralization and stability, helping Solana transition from a fast experiment to a real-world-ready platform.

| Coin | Bullish Theses | Bearish Theses |

| SOL | 🟢 Speed + UX 🟢 Firedancer 🟢 Mobile/Web3 gaming traction | 🔴 History of outages 🔴 Centralization concerns |

Chainlink ($LINK)

Chainlink is the indispensable oracle network that feeds off-chain data into smart contracts. With its Cross-Chain Interoperability Protocol (CCIP), staking, and partnerships with global institutions like SWIFT, Chainlink is solidifying its role as blockchain’s middleware. If smart contracts scale globally, Chainlink will likely be one of the best long-term crypto infrastructure bets.

| Coin | Bullish Theses | Bearish Theses |

| LINK | 🟢 CCIP adoption 🟢 Real revenue 🟢 Institutional integration | 🔴 Token value capture debated 🔴 New oracle competitors |

Polygon ($MATIC )

Polygon has positioned itself as Ethereum’s scalability gateway. With zkEVM in production, a robust enterprise pipeline (Starbucks, Reddit, Nike), and its transition to Polygon 2.0 with the POL token, it’s more than just an L2 — it’s a network of interoperable Ethereum-native chains. If you believe Ethereum wins, Polygon is one of the best ways to scale with it.

| Coin | Bullish Theses | Bearish Theses |

| MATIC | 🟢 zk rollups 🟢 Big brands 🟢 Ethereum synergy | 🔴 SEC scrutiny 🔴 Competition from other L2s |

Filecoin ($FIL)

The decentralized storage king. Filecoin isn’t just about passive file hosting; it’s evolving into a full data economy layer for Web3. With smart contract support (FVM), real clients like UC Berkeley and OpenAI, and retrieval/CDN advancements like Saturn, Filecoin is aligning itself with the AI + Web3 narrative — quietly becoming one of the best long-term crypto assets for digital infrastructure.

| Coin | Bullish Theses | Bearish Theses |

| FIL | 🟢 AI + data storage 🟢 FVM smart contracts 🟢 Retrieval/CDN | 🔴 Still niche, long onboarding for traditional users |

Avalanche ($AVAX)

Avalanche’s subnet model allows for scalable, custom blockchain deployments — ideal for institutions, games, or regulated assets. Backed by AWS and already enabling real-world use cases (like Intain’s bond platform), Avalanche is carving a unique space in modular blockchain architecture. Its value accrual via AVAX staking and subnet activity makes it a strong contender.

| Coin | Bullish Theses | Bearish Theses |

| AVAX | 🟢 Subnets scaling, DeFi + enterprise mix 🟢 Low finality time | 🔴 Subnet fragmentation, ecosystem dilution |

Arbitrum ($ARB)

As the largest Ethereum Layer-2 by total value locked and active DeFi applications, Arbitrum is defining the optimistic rollup space. With upcoming updates expected to enable fee-sharing with ARB holders, and infrastructure to launch Layer-3s via Orbit chains, Arbitrum is fast becoming a super-layer for Ethereum.

| Coin | Bullish Theses | Bearish Theses |

| ARB | 🟢 TVL dominance 🟢 Stylus expansion 🟢 DAO governance model | 🔴 Centralized sequencer 🔴 Delayed token utility |

Polkadot ($DOT)

Designed for a multichain world, Polkadot connects dozens of parachains under one shared security umbrella. The network’s OpenGov, active treasury, and expanding enterprise interest make it a smart infrastructure bet — though it still needs broader adoption to fulfill its vision. For cross-chain maximalists, DOT remains one of the most strategic best long-term crypto options.

| Coin | Bullish Theses | Bearish Theses |

| DOT | 🟢 Shared security 🟢 Governance innovation 🟢 Parachain traction | 🔴 Value leak to parachain tokens 🔴 Slow TVL growth |

Near Protocol ($NEAR)

NEAR is a developer-friendly Layer-1 pushing boundaries in Web3 UX, AI integration, and multichain usability. Its Blockchain Operating System (BOS) vision, paired with a fast finality chain and growing ecosystem, makes it a stealth pick. If AI and composability drive the next cycle, NEAR has a front-row seat.

| Coin | Bullish Theses | Bearish Theses |

| NEAR | 🟢 AI synergy 🟢 BOS UX layer 🟢 Dev-friendly | 🔴 Low user traction vs. Ethereum/Solana |

Investor Checklist: Is This Long-Term Crypto Worth Your Money?

What problem does the crypto solve? Does it have real demand?

Projects with vibrant GitHub repos and frequent updates are more credible.

Is there actual value capture (fees, staking)? Or just inflation?

Are VCs, enterprises, or DAOs actively backing or building?

Has the network weathered bear markets, hacks, or competition and still grown?

Build Your Portfolio: Match the Right Crypto to Your Goals

It’s not just about picking winners — it’s about aligning with your goals and risk tolerance.

Step 1: Define Your Risk Appetite

Low-risk = BTC/ETH; Mid-risk = LINK, ARB, MATIC; High-risk = SOL, NEAR

Step 2: Diversify by Use Case

Mix DeFi, storage, L2s, and data assets to build a balanced allocation.

Step 3: Consider Holding Period & Liquidity

Are you HODLing 5+ years? Need staking yield? Look for highly liquid, yield-generating coins.

Step 4: Track On-Chain and Off-Chain Activity

Use tools like Token Terminal, DeFiLlama, and Electric Capital to assess developer and user metrics.

What Other Forms of Analysis Can I Use?

Beyond charts and market cap rankings, there are several fundamental analysis methods to assess crypto:

- Token velocity and inflation modeling

- Governance proposal history

- Validator/staking distribution

- Ecosystem growth (dApps, integrations, SDKs)

- Enterprise adoption or grant activity

These insights help verify whether a crypto asset is more than just hype — a must when selecting the best long-term crypto for real returns.

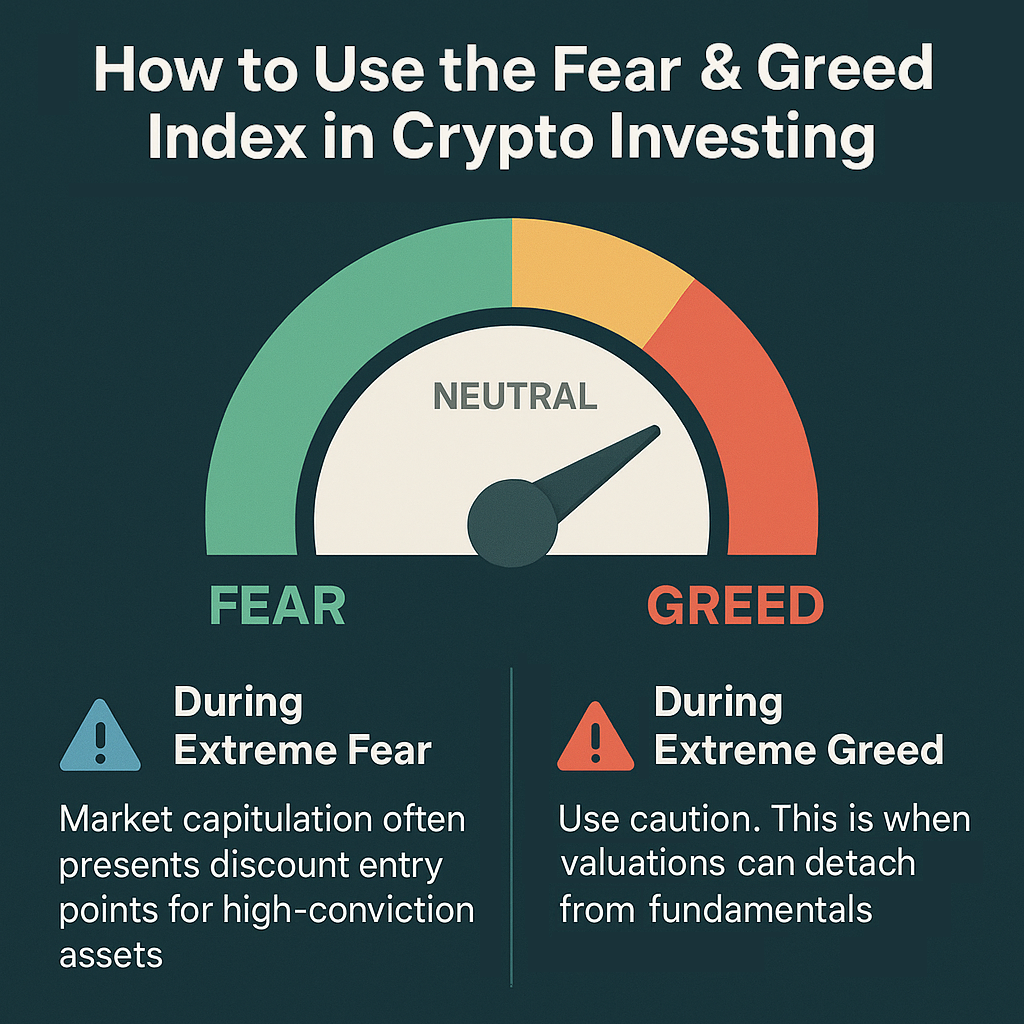

Use the Fear & Greed Index to Your Advantage

The Fear & Greed Index captures market sentiment from extreme fear (buying opportunities) to extreme greed (potential tops). For long-term crypto investors, it’s a helpful contrarian signal:

- During Extreme Fear: Market capitulation often presents discount entry points for high-conviction assets.

- During Extreme Greed: Use caution. This is when valuations can detach from fundamentals.

Smart long-term investors often use this index to scale into or out of positions gradually.

Conclusion

The next five years will define the infrastructure winners of Web3. The best long-term crypto projects won’t just survive — they’ll become core layers of the decentralized internet.

Whether it’s Ethereum scaling, Bitcoin adoption, or decentralized data layers like Filecoin, these ten assets are positioned to thrive beyond short-term volatility. They represent real use cases, developer traction, and increasing institutional trust.

If you’re ready to align your project or portfolio with the future of crypto, ICODA can help — from go-to-market strategies to global PR, we help blockchain companies grow where it counts.

Frequently Asked Questions (FAQ)

The best long-term cryptocurrency is one that combines strong utility, consistent development, and broad adoption across real-world use cases. Long-term resilience also depends on network security, active community support, and institutional integration.

Assets with 1000x potential are typically early-stage, low market cap projects solving major infrastructure or scalability challenges. However, they carry significant risk and require deep research into tokenomics, team credibility, and adoption potential.

Bitcoin still leads in mining, but profitability depends on energy costs and halving cycles.

Elon Musk has publicly expressed interest in a few cryptocurrencies (Bitcoin, Ethereum, and Dogecoin, but his companies may hold more), primarily for their cultural or technological relevance. However, his holdings are not fully disclosed, and his influence tends to reflect personal opinions rather than financial advice.

A five-year investment horizon favors cryptocurrencies with proven technology, clear roadmaps, and strong community ecosystems. The goal is to choose assets that can weather volatility while delivering meaningful innovation and adoption.

Rate the article