share

The financial system is changing right before our eyes. Traditional finance still prevails, but the market share of blockchain technology and smart contracts is constantly growing. As users learn the benefits of decentralization, the market keeps shifting towards digital currencies.

What Is the Meaning of Decentralized Finance, and How Is It Different From Traditional Financial Services?

These are decentralized technologies built on smart contracts. Decentralization means that there is no central authority. The first truly decentralized system is the Internet. It consists of numerous subnetworks combined in a single system.

Decentralized finance (DeFi) is also characterized by the lack of a full-scale control center. These services operate on public blockchains and are regulated by their rules on a technological level. The digital economy is more structured, reliable, and flexible.

Moreover, the capabilities of the human-machine concept are only limited by the speed of generating and implementing ideas. The DeFi ecosystem is developing at a truly impressive rate. Currently, more and more new users are entering the decentralized finance market.

Modern Financial Institutions

A decentralized financial system is a combination of a smart contract and a decentralized finance application deployed on a blockchain network. Everything operates on some very basic principles:

- Smart contracts contain rules and monitor their implementation.

- A decentralized finance application is the user’s entry point which functions as a human-machine interface.

In the new digital world, banks and other organizations have moved from centralized finance to a distributed ledger network and have been replaced by software.

What Is Defi, and How Does It Work?

DeFi is an abbreviation that stands for “decentralized finance .”Similar to the Internet, where the name of a network has come to describe the entire global system, this word encompasses all financial instruments of the digital market.

You do not need to be a programmer or a technology geek to understand the concept of DeFi. Any ordinary user can join the world of decentralized finance. However, you need to know the basics of traditional finance because DeFi has borrowed a lot from it. You also need to understand the most important concepts of blockchain technology.

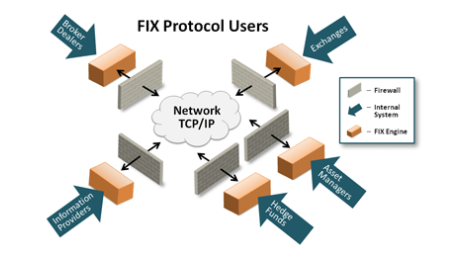

What Is a Finance Protocol?

A finance protocol contains the rules of transferring economic information in traditional finance. Usually, this is a standard that is not controlled by any organization and is open to the public. It ensures information safety, data transfer rate, and data integrity. Various DeFi development services try to comply with these rules when creating software in order to ensure the possibility of a decentralized exchange between them.

What Is a DeFi Protocol?

DeFi token development services create protocols, and the most efficient of them are adopted by others and become widespread in the ecosystem. It is also a set of rules or standards, but it is used in a different environment. Because of that, users can perform the same actions on various platforms, and the progress of DeFi wallet development has made it possible to keep crypto from various blockchains in one place.

Protocols are needed to ensure the compatibility of various services in decentralized finance. Many DeFi protocols have already become a kind of an industry standard and are used to describe trading and economic technologies. Moreover, they are used to explain the workflow of financial platforms.

The Benefits of DeFi Protocols

It is still too early to say that the decentralized finance market has achieved extraordinary success. However, its advantages are already obvious. These services are:

Transparent

All DeFi protocols are open to the public, and their methodologies can be analyzed. Therefore, decentralized applications also usually have an open-source code. This allows IT experts to evaluate their reliability and express their opinion for ordinary users to consider. This approach ensures equal opportunities for all providers of DeFi development services. The investment amount gives way to creativity, talent, and consistent actions.

Easy-To-Access

To join the market and use DeFi services, you only need an Internet connection and any digital device such as a PC, a tablet, or a smartphone. Unlike in traditional financial services, there is no need to go through the bureaucracy and provide papers to prove your existence. Some exchanges, such as Binance, follow the Know Your Customer rule and require passport data for registration, which automatically means that they do not belong to the decentralized finance industry. True representatives of DeFi do not control the crypto assets of users, cannot seize their assets, and do not require identity authentication. Of course, this approach is associated with certain risks, but decentralized finance can be seen as a new and more mature stage of humanity, where each market participant bears responsibility for their actions.

Fast

In the traditional economy, financial transactions can take up to several days, whether they are implemented via a banking app or an operator. A blockchain network is free of this disadvantage. The speed is only limited by the technical specifications, and most transactions do not take more than 15 minutes. Moreover, it does not matter whether money is sent to a user half the world away or someone is sitting right next to you. In DeFi, there are absolutely no geographic boundaries and distances. One can say that it is a completely different paradigm.

Inexpensive

People are used to the fact that they always need to pay middleman fees when conducting fiat currency transactions. You might face the need to pay a small fee in almost any situation, whether you are paying for rent or sending money to your family member. If banks offer low or no fees, they often use it as a marketing advantage. We also pay to other intermediaries such as payment aggregators, services, etc. In decentralized finance, there are also fees that can be used to interest miners or attract lenders, but they are significantly lower than centralized exchange fees.

Autonomous

For many users, this is the main advantage. Participants of the DeFi market can dispose of their crypto assets as they wish. There are more powerful capabilities, and you can always find sources of additional income. Each decentralized service is a democratic platform with collective governance.

Compatible

Due to common protocols, new decentralized applications can easily be integrated with existing services, and there are very few restrictions in the area of DeFi development.

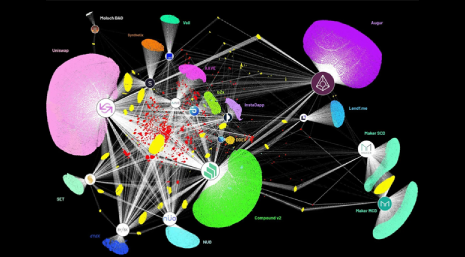

How Many DeFi Protocols Are There?

No one could tell exactly how many protocols there are. Brand new DeFi solutions appear all the time, and they often require specific protocols. Many development services support numerous DeFi protocols, both their own and those developed by other platforms.

Below, you will find the most popular DeFi protocols that currently exist in the area of decentralized finance. It should be noted that a protocol is often named after the platform it is based on.

- MakerDAO is a DeFi lending platform that allows users to borrow DAI tokens by depositing other currencies as collateral.

- Aave is another popular DeFi lending platform for flash DeFi lending.

- Compound is a DeFi protocol for lending and borrowing crypto. Many investment exchanges run on this protocol.

- Uniswap is the protocol of the eponymous platform that provides numerous opportunities for generating passive income.

A separate category is represented by the protocols of DeFi tokens, for example, the ERC series that became the foundation of almost all alternative tokens.

To achieve a better understanding of the DeFi system and the role of protocols within it, it is necessary to study the opportunities of this system because the standards are classified according to the available features.

The Categories of DeFi Services

Stablecoins

This is an important decentralized finance component that helps to stabilize volatile cryptocurrencies. The value of a stablecoin is pegged to a specific asset. For example, USDT is pegged to the U.S. dollar, and its cost is always equal to 1 USD. It is backed by a fiat currency. DAI is also pegged to the U.S. dollar, but it is collateralized by Ether. Therefore, DAI is a representative of DeFi, being a multi-collateral token of Maker, a decentralized platform for lending.

DeFi Lending

In the traditional financial system, lending decisions are made by bank officers. They rely on numerous financial indicators, including the income level, the financial history of family members, job stability, etc. Getting microcredit is easier, but the high-interest rates make it seem rather like daylight robbery than like financial services.

In decentralized finance, lending platforms are based on open lending protocols. Any owner of crypto assets can procure flash loans. These are used as collateral at the platform for decentralized crypto banking. Depositing money to lend money might seem strange at first, but in DeFi, this is a standard procedure that allows you to quickly get the necessary sum in a certain cryptocurrency and start using it, for example, for trading. This is what traders and DeFi exchanges do to obtain the necessary assets.

Moreover, any user who owns crypto can become a lender by depositing their crypto assets in liquidity pools. In this case, the interest rates are significantly higher than in traditional finance. Therefore, the income is also higher. At the same time, market participants do not need any special skills or expertise, and it is very easy to grasp the system’s basic concepts.

Decentralized Exchanges (DeX)

Decentralized exchange platforms for trading crypto eliminate the risks associated with an unreliable central authority. Owners have total control over their assets, which cannot be seized. Centralized exchanges have complete control over the assets of their users and depend heavily on national policy. Sometimes they are forced to freeze the assets of their users upon the request of authorities.

Derivatives

Derivatives are financial instruments that allow participants to secure the transaction details from the beginning until the end. Derivatives are a typical concept for decentralized finance since they are based on contracts. The smart contracts technology is perfect for this instrument, and the derivatives market making is only just starting.

Insurance

This type of financial services takes its origin in the traditional economy. Some DeFi platforms offer to provide insurance protection, for example, against volatility risks. The insurance is provided for a small fee. This is part of risk management.

Yield Farming

Currently, this is one of the most popular ways to earn passive income. It is basically a crypto deposit with an interest rate accrued over time. The assets are locked in the DeFi system to provide liquidity that other users can borrow. Farming is characterized by offering additional sources of income that are provided by DeFi platforms. For example, you can deposit native tokens and support the yield farming platform at the same time.

Lotteries

Lotteries are often organized at platforms for staking and yield farming. The assets provided by users are allocated to one or several participants. As a raffle is based on the code of smart contracts, the participants can trust in its reliability and transparency.

Investment Portfolio Management

This service is widespread in centralized finance and is currently developing in the sphere of DeFi. Asset owners entrust their investment strategies to algorithms and can easily track the activities due to the transparency of such services.

Are DeFi Services Truly Decentralized?

So far, there are no completely decentralized financial services. All known services are partially centralized due to the existence of a DeFi development company that controls the DeFi platform with regard to its technical implementation and development. All other parameters such as price formation, management, and free access comply with decentralization principles.

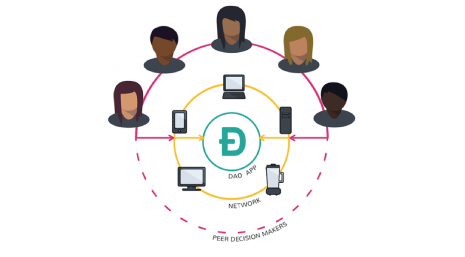

Such entities are known as DAO, which stands for a decentralized autonomous organization. From the ideological point of view, a DAO is a community of interested users who play an active role in developing and functioning their platform.

These platforms are classified into various types, including grant, operating, protocol, investment, service, social, media, and collector systems.

Example of a DeFi Project

There is some competition among DeFi platforms, but it is still not as high as the competition in traditional finance. There are not thousands of DAO platforms, and there are even less popular services. Let us look at the most prominent DeFi platforms that offer profit opportunities.

Maker DAO

This is a DeFi platform for generating the DAI stablecoin. This stablecoin is pegged to USD and backed by Ethereum. It was created to mitigate the risks related to crypto volatility. Anyone can issue DAI tokens by using other digital assets as collateral.

The protocol is known as Maker, and the governance token is MKR. Token owners have the right to vote within the system.

The platform was established in 2015 and had a good track record. DAI is traded on exchanges. Due to their stability, such tokens can be used as a means of value storage, payment, and measure of value. Basically, Maker is a financial gateway between various cryptocurrencies.

Compound

This is a DeFi platform for lending and borrowing that is based on the eponymous protocol. It features liquidity pools where users deposit their digital assets. In return, they receive cTokens implemented as Ethereum smart contracts, and interest is accrued on these tokens. As a result, some users can receive passive income while others can obtain flash loans.

To start using the service, it is enough to have a crypto wallet. You do not even need to register; you can connect using the wallet. The platform also has its own API that is used for DeFi staking platform development.

UNISWAP

This is a decentralized exchange based on liquidity pools. Currently, the trading volume exceeds 866 billion U.S. dollars. The DeFi ecosystem includes numerous wallets, aggregators, strategic tools, credit mechanisms, and other features. UNISWAP has been used to create numerous decentralized applications.

The UNISWAP protocol is designed for trading in ERC-20 tokens. A liquidity pool is created by users, and the reserve and pricing information changes during trading. Automated smart contracts keep rebalancing the reserves to avoid interaction between counterparties.

This decentralized exchange is noted for the capability of exchanging tokens directly from the wallet by using the exchange address. The automated market maker algorithm makes it possible to set the prices of DeFi tokens on the go.

Synthetix.Exchange

This is an exchange with the largest available DeFi protocol that is used to generate derivatives, also known as synthetic assets or Synths. These assets allow users to profit from the volatility of crypto without actually owning it. A trader purchases a Synth that is pegged to the price of an underlying asset and profits from the changes in its price. There are Synths for 14 various assets, including gold, Bitcoin, Ether, and others.

Financial assets can be easily exchanged without wasting time and going through any unnecessary bureaucracy. In general, decentralized derivatives allow any user to access financial markets.

TokenSets

It is a platform for automated investment portfolio management. The Strategy Enabled Token (SET) optimizes revenue generation. Robo sets buy and sell crypto according to certain rules described in smart contracts and support four types of automatic strategies. Social trader sets are based on the best trading strategies of this platform.

Tokenization of trading strategies is a completely new concept that originated from DeFi.

PoolTogether

This is a no-loss lottery where the participants can withdraw their deposit even if they don’t win. The prize pool is made up of the interest accumulated on the users’ deposits via Compound. The tickets are bought for DAI or USDT, and one lucky participant gets the prize. The process is quite simple and engaging. Moreover, participants do not lose anything. To improve your chances, you can buy several tickets, with each of them representing one stake.

Which Blockchain Is Best for DeFi?

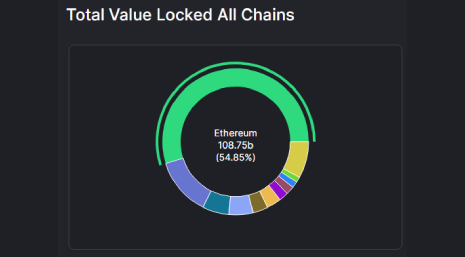

According to defillama.com, almost 55% of all assets in decentralized finance are based on the Ethereum blockchain.

The second most prominent blockchain is Terra. Almost 6% belongs to the Binance Smart Chain.

The main concept of decentralized finance is smart contracts. These are transaction rules implemented as a programming algorithm. The first blockchain to implement smart contracts was Ethereum. This is why it still remains the leader in DeFi deployment.

The protocols of ERC series tokens are the standard for all DeFi token development companies that need their DeFi applications to implement a decentralized exchange and free trading in various currencies.

Is Bitcoin Decentralized Finance?

Bitcoin is the product of the first blockchain that was created long before smart contracts were invented. This is why, to be used in DeFi, Bitcoin is converted into a derivative — the wBTC token that is based on the ERC-20 protocol. In fact, this is the method of converting the world’s first cryptocurrency to be used on the Ethereum ecosystem.

In the blockchain technology of Bitcoin, decentralized finance is rarely used due to the restrictions of transaction rates. The network supports smart contracts with limited functions such as testament, multi-sig, escrow, and vault. Unlike Ethereum, the Bitcoin blockchain is not Turing-complete, meaning that there are some functions that cannot be calculated. Therefore, this blockchain technology is characterized by certain flexibility issues in the sphere of DeFi.

What Is DeFi Development, and Who Does It?

DeFi development is the process of creating a decentralized finance service. Our DeFi development company provides the entire range of services — from elaborating the basic concept to marketing and advertising the final product. Based on our experience of DeFi development at ICODA, we have identified the main steps on the way to a successful platform launch.

Analyzing the Market and Describing the Idea

Obviously, an idea is the main driver of the entire DApp platform development process. Without a solid idea, the result can never be satisfactory. However, at the early stages, an idea is often formulated in a couple of sentences, which is not enough.

To elaborate on the main objective of your project and identify the tasks, you need to thoroughly analyze the market and your competitors. Will this service be in demand? Are there any similar companies? Will the DeFi development pay off?

Our DeFi development company has professional experts to answer all these questions. If the author believes that the idea is good enough, we continue working together.

Creating the Business Logic

When it is clear what features will be implemented and how it is time to describe the functional models of the DeFi system, this is an analytical process that involves describing all future roles and interactions.

Choosing the Technology

This is a very important step that determines the implemented and potential product capabilities. Either an existing blockchain is chosen, or a new one is developed. The developers choose DeFi protocols or create their own protocols if necessary. They also choose the DeFi development services and programming languages.

Preparing the Technical Specifications for DeFi Development

This document describes the entire system functionality, modules, interfaces, and roles. All critical requirements for DeFi development are identified.

Creating the Product Architecture

An architect of DeFi development company ICODA identifies the main structural elements at the lower level and gradually upscales them, combining them into a single system. The interfaces, behavior, and interaction of elements of the future DeFi system are described in developer terms.

Programming DApps and Smart Contracts

Programmers create the system’s core by writing its code. This is also the stage for smart contract development.

Design

Interface design is developed alongside the programming section. UX and UI designers create an intuitively understandable, logical, and attractive interface for your product. If necessary, we develop a brand book and work on creating a unique style for your brand.

Testing

We use all the modern software testing technologies to identify any errors as soon as they appear. This reduces the debugging and implementation period.

Project Deployment

This is the final technical stage of DeFi development. You get a fully operational product that has all the necessary features.

Marketing

Without promotion activities, the community cannot find out about new DeFi applications. This is why we develop a marketing strategy, create and launch a website, prepare content and launch advertising campaigns.

As a result, the customers of our DeFi development company receive a turnkey solution with everything perfectly thought-through, from design to each business process. We have vast experience in implementing DeFi projects:

- blockchains;

- DeFi token development services;

- DeFi DApp development;

- DeFi wallet development;

- DeFi lottery system development;

- DeFi staking platform development;

- yield farming platform, etc.

Why Is Decentralized Finance Important?

In today’s context, the existing economic system is unstable and obsolete. The Internet erases boundaries, while the representatives of the traditional financial system try to keep the walls up. Many people all over the world do not have access to banking products and do not have bank accounts. They may never even get a bank card.

At the same time, many people own mobile phones. And you only need a simple device with an Internet connection to become a fully valid member of the decentralized finance market. For such people, the choice is obvious.

Another important advantage is the lack of numerous intermediaries in financial transactions. This allows people to save money on fees. The system is based on clear algorithms which reduce the risks associated with the human factor. Even if a smart contract is not perfect and has some errors, these can be fixed, and everything will work smoothly. People, on the other hand, tend to make mistakes over and over again.

This is why DeFi solutions represent independence and equality in the world of finance.

Why Is Decentralized Finance the Future?

The level of DeFi and smart contract development cuts through the red tape of traditional finance.

The world of decentralized finance is inexpensive, accessible, convenient, and simple. Due to the variety of DeFi services, new users can start with several U.S. dollars.

Recent pandemic-related restrictions have shown that humanity is ready for the next stage — the era of globalization. The time of the centralized financial systems with their strict restrictions and high fees will soon be over. Users need equitable decentralized financial services.

Moreover, people value privacy. Government authorities exercise complete control over the financial sphere, and their requirements are getting more and more stringent. Governments believe that they have the right to impose constraints on the economy of ordinary people. Decentralized finance works with addresses and not people, which is why it ensures the independence of users.

Moreover, DeFi is a scalable and universal solution. This technology has almost no limits for development and can be implemented in almost any area.