share

This abbreviation stands for non-fungible token stored on a distributed ledger. However, this definition does not explain all the numerous possibilities of this technology. Let us analyze the concept of NFT from various perspectives.

The Technical Aspect of the Digital Asset

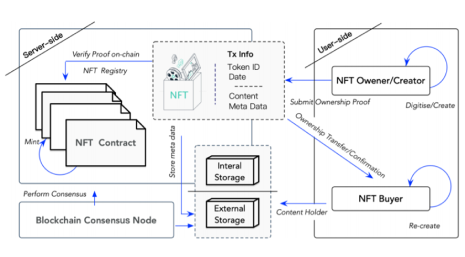

Non-fungible tokens (NFTs) are units of data stored on a blockchain. NFTs are generated by triggering an algorithm of smart contracts to validate a transaction. As soon as it is done, a new record in the form of a digital signature is created. This is an NFT.

The underlying asset is usually stored in the form of a digital file on a third-party platform or a blockchain.

NFTs are created in the environment of the Ethereum network. This is related to the support of smart contracts. NFTs are also created on other blockchains. For example, True NFT is based on the Free TON blockchain.

However, the most widely recognized protocol is ERC 721, which was used to mint the first official non-fungible token in 2017. Later, the ERC 1155 standard was developed that allows users to issue a set of identical NFTs.

Let us explain how NFTs work by comparing them to concert tickets. Some concert tickets are unique. Each of them corresponds to a specific row and seat number. General admission tickets, on the other hand, provide access to any available standing area. NFTs represent these types of tickets. The tickets for specific seats would be issued using the ERC 721 protocol that only creates one NFT for each transaction. GA tickets would be issued based on the ERC 1155 standard that allows users to issue a set of identical fungible tokens. This also works for non-fungible tokens. Moreover, this protocol can be used to send many NFTs in one transaction, even if they are sent to various recipients. Therefore, this protocol is way more flexible. However, it was also designed based on the ERC 721, which is an open standard that can be used by app developers to ensure seamless transfer of NFTs between their platforms and a digital wallet.

Copyright and Digital Art

This is currently the most popular aspect of NFTs. The NFTs have become the technology that solved the problem of copyright in the digital art world. By publishing their digital content to the web, the creators make it publicly available. It belongs to the public domain, and the creators can only profit from it as a means of self-promotion. Anyone can borrow digital artwork without actually owning it. In this case, proving the authorship could turn out to be quite difficult. It is necessary to provide a notarized screenshot or other documents proving that a specific person was the first to upload this NFT artwork.

The NFT technology allows users to provide proof of ownership on the blockchain. It is hardly possible to prove ownership in the offline world, but major markets and popular NFT marketplaces take this proof into consideration and withdraw lots offered by scammers. In 40 years since the invention of the internet, we have seen that it is difficult to implement legal procedures in this environment, but NFTs have made it possible. All databases are publicly available and accessible by any user.

The reason why NFTs have become successful in this sphere is very simple. A creator can convert anything into an NFT, including an image, a video clip, a music piece, and even a physical asset, sell NFTs and make a profit off of their digital art. There are no intermediaries, no need to enter into contracts with galleries, auction houses, recording studios, or publishing houses. A token is minted and sold online — everything is perfectly simple. Creators can also set a “creator share” and receive a percentage from each further use or resale of their content. All of this information is embedded in a programming code, and the expenses are limited to fees from NFT transactions. In the offline world, when an object is resold, a large share of the profits goes to various intermediaries. In the sphere of NFTs, there are no intermediaries except for NFT marketplaces. However, their fees are significantly lower than those in the traditional art industry.

Rights of Ownership to a Digital Artwork

Buyers also faced the same issue. Is it possible to prove that a digital asset belongs to a particular user? Is it possible to define the limits of their rights? In the offline world, the terms and conditions are usually specified on packaging or in a contract. On the internet, the same songs and digital images might be uploaded by hundreds of users, and it might be very difficult to determine who has violated ownership rights.

This problem has also been solved by NFTs. Smart contracts have made it possible to record all the necessary information about a transaction, including the creator, the owner, the data, and the conditions of such a transfer. In case of any violation in relation to NFT ownership, NFTs contain information about the offender. The community reacts to such violations immediately. While the market is still in the early stages of its development, most participants are crypto enthusiasts who are determining the unspoken moral principles of participating in its ecosystem.

The Gaming Industry and NFTs

Gaming has long expanded beyond Tetris and Doom. Nowadays, it is a giant monetized industry where players spend their personal finance. NFTs have become a natural element of this market. In most cases, users buy NFTs, which represent game items such as unique character traits, weapons, ammunition, and even virtual real estate. The items are linked to the owner instead of the account, thus undoubtedly securing the proof of ownership.

Some gaming resources refuse to introduce NFTs or prohibit their use. For example, Valve has prohibited selling in-game items from Steam. This can be explained by the fact that game owners can no longer control objects with this function assigned to users. Obviously, this is unprofitable, which is why the NFT technology is only picking up the pace in the gaming industry.

The first NFT game CryptoKitties provided a great example of the possibilities of the non-fungible token technology. The genome sequence of kitties is programmed as a code, and by breeding kitties, users can get new unique genes. Biologists and medical professionals might look into NFTs to consider data storage capabilities.

Collectors and NFT

Collectors appreciate the new technology because their thought paradigm is different from that of most people. Many people are shocked by the fact that some fans are ready to pay millions of dollars for baseball cards or a painting. A collector, on the other hand, experiences great satisfaction from owning a particular object.

In the offline world, objects are protected by physical security methods. For example, they can be stored in a vault or protected by security personnel. The rights to such physical assets are confirmed by documents. When a digital object is sold online, proof of ownership is necessary, and this is where the NFT concept comes into play.

Skeptics would say that acquiring a physical artwork of a famous artist is a worthwhile investment. What about digital art? The world has changed. Do many of us print photos and stick them into photo albums? Not really. At the same time, many people are willing to buy instruments to create beautiful illustrations with their photos. They create digital collections of family photos and store them on storage devices, hard disks, cloud services, or even social media accounts.

Is there much difference between a printed photo and a digital photo for such people? Not really. Then why should digital art be less valuable than physical art?

The main argument of skeptics is that users can simply download a picture or make a screenshot to get an exact copy of the exact collectible object. However, there has always been the important concept of the value of ownership. A painting and a reproduction are two different things.

It seems that collectors are among the first to have welcomed the digital world and understood its benefits. A good example of this is NBA Top Shot, an NFT marketplace that is an official NBA representative. In this store, users can buy NFTs — short summaries of basketball game highlights. A three-second-long video shows a successful shot or maneuver similar to moving portraits from Harry Potter. NFTs have made magic real.

NBA Top Shot operates both with direct sales and auctions. Auctions are popular among speculators who, with enough patience, can make good profits. However, collectors know the rules of the market, which helps to maintain a natural balance. If a speculator chooses the wrong price or the wrong moment to sell the item, they may lose money.

The Real Estate Market and NFT

It is not yet widely spread, but there have been some reports of users buying virtual real estate. Readers are usually shocked by the high prices thinking that this is about virtual property, but in fact, the situation is slightly different. This is not about digital houses (although they also exist in the gaming industry) but about actual real estate objects associated with non-fungible tokens. They often come at lower prices, and buyers pay in crypto.

So far, this is quite rare due to legal difficulties, and real estate transactions are still conducted with intermediaries. However, precedents have been established. This indicates that real estate agents are making their first steps in the NFT world.

Non-fungible Tokens in the Cinema Industry

This industry has not been captivated by the NFT craze yet, but the most forward-thinking motion picture companies and networks which have suffered during the pandemic are tapping into the world of endless possibilities of NFT. Selling personal event tickets, giving away rights to play in movies, and releasing posters for new movies are just some of the examples of this goldmine. Quentin Tarantino has already understood the rules of the game and offered previously unreleased Pulp Fiction scenes as NFT items.

Even entire movies are released as NFTs. These are the first attempts of directors to connect with the audience without any intermediaries.

The Consumer Market and NFTs

Among the latest businesses to understand the opportunities of NFTs are the consumer market giants. At first thought, it might seem that digital representations of sneakers do not have any value. However, it soon becomes obvious that people do not only value objects. They like to belong to some group and to own something unique.

Nike became one of the pioneers in this sphere and a system of blockchain-compatible sneakers. Later, companies started offering unique virtual objects that are not affordable to many customers in the form of physical assets. On the contrary, many people can afford to have digital representations of Gucci sneakers which cost 9 U.S. dollars. Reebok, Puma, and Snapchat are also exploring this sphere. The main goal is to create a balanced digital scarcity. The number of items should not completely satisfy the market demand and should trigger competition for owning specific objects.

It is obvious why manufacturers of physical objects are interested in this sphere. NFT became a powerful marketing instrument, especially during the pandemic when most people had to stay at home.

NFTs of Network Attributes

Zoomers spend way more time online than apart from their devices. Their values are also deeply connected to their digital life, where users are constantly dealing with user pics, usernames, logins, domain addresses, and other things. Owning NFTs becomes quite important. This world has its own borders and its own rules that can hardly be regulated by national laws, and a non-fungible token becomes a powerful argument for defending one’s rights.

In the Ethereum network, users can purchase an NFT for a domain name or address. This will be a unique sequence of symbols related to the owner both on a semantic level and on the level of blockchain technology.

The Place of NFT in Decentralized Finance

In decentralized finance, non-fungible token assets can be used as collateral for getting a loan. The large NFT marketplace Rarible is moving towards this system, and it has already been implemented by NFTfi. Users can obtain crypto and leave an NFT with a certain value as collateral.

The main problem is that it is still difficult to estimate the actual value of NFTs in crypto or physical money.

Why Would Anyone Buy an NFT?

The reasons why people spend personal finance on NFTs differ.

- Collectors seek out unique digital assets to create or replenish their NFT collections.

- Crypto proponents explore the new concept of a non-fungible token and enjoy having their own NFTs.

- Fans support digital artists by purchasing their works.

- Gamers explore a new way of getting artifacts.

- Traders look for high-potential digital objects to use as collateral.

Anyway, the number of NFT market participants is increasing steadily, which contributes to its development.

What Is an NFT Marketplace?

Platforms for minting and selling NFTs are sort of an automatic intermediary between NFT creators and buyers. They charge fees for certain actions, for example, for generating tokens, sometimes for selling them, and in certain cases, royalty fees for reselling items. Many marketplaces try not to charge fees at all, for example, Nifty Gateway, which allows users to purchase NFTs directly from an Ethereum cryptocurrency wallet. Large companies create their own projects for minting NFTs and distributing tokens in order to pay only for the blockchain fees.

Let us take a look at the three largest NFT marketplaces.

Binance NFT

It has only recently started to support NFTs. Binance mints NFTs by using its own protocols BEP 721 and 1155, which are based on the ERC standard. Users need to complete a registration procedure in accordance with the Know Your Customer (KYC) rules.

The platform charges the following fees:

- minting — 0.000001 BNB;

- NFT trading — 1% of the value;

- deposit and withdrawal — depending on the blockchain where the NFTs are transferred to or from.

OpenSea

This is the first NFT platform. It was launched in 2017. It is often referred to as “the eBay of the digital economy”.

The platform charges fees when an owner starts to sell digital artwork on the Ethereum blockchain. Minting is free of charge; other transactions are subject to a 2.5% commission.

After connecting to Polygon, the marketplace announced that it had become a gas-free service. There are no fees at all if you work on the Polygon blockchain.

Rarible

This is a Russian platform that continues developing in the DeFi area. It has already introduced a governance token. The minting fees are included in the NFT price and paid by the buyer. The gas commission depends on the selected blockchain, and the sale fee is equal to 2.5%.

Why Do Some Experts Predict a Quick Downfall for NFT?

NFT is often called a bubble, and skeptics expect it to burst soon. However, the market exceeded all expectations last year. The record-breaking sale was certainly impressive: digital artist Beeple sold a collage for millions of dollars ($91.8, to be precise).

Of course, the market of non-fungible tokens will not always remain in its current condition. Certain problems need to be solved.

Storing an NFT-Related Object

One of the main drawbacks is the storage of tokenized objects. So far, NFT creators and marketplaces are responsible for its reliability. But if a blockchain network is closed, the asset disappears, and the NFT becomes useless. If a tokenized digital asset can be kept in a new storage environment, the issue will be solved.

The Environmental Issues

Most NFTs are generated on the Ethereum blockchain that operates on the energy-consuming PoW algorithm. The developers have promised to switch to the eco-friendlier PoS algorithm, but it has not happened yet. Some artists refuse to mint non-fungible tokens due to their environmental beliefs. With the appearance of “green” mining, this problem will also be solved.

Fraud

Many artists believe that NFT marketplaces do not ensure the protection of their rights on the NFT market. Anyone can download digital assets online and use them to sell NFTs. However, this problem is not limited to NFTs as a technology. In fact, creators and NFT platforms should join their forces to look for a solution.

Theft

It is difficult to steal NFTs, but tokens can be stolen if they are stored on marketplaces. Platforms strive to protect the assets of their users, but there have been security incidents.

It should be noted that non-fungible tokens appeared in 2017 and became increasingly popular and widespread in 2020. This is why the NFT concept should not be regarded as having its final shape.

Among the pioneers of this sphere, there are many speculators who would like to profit off the hype. However, the situation is going to change gradually. As the NFT market matures, it will occupy an important position in the DeFi jurisdiction.

Also, NFT might be used for real-world items to prove the right of ownership of physical assets and the reliability of counterparties. NFT might substitute documents confirming the right of ownership, registration, and transaction documents by storing necessary proof in several lines of code.

How Can You Use NFTS in Your Business Right Now?

The most profitable way of generating and distributing many NFTs is to create your own app. All the expenses will pay off due to the absence of sale fees. To find your place in this new market, you need to come up with a good idea. You can leave the rest to ICODA. We have substantial experience in developing DeFi and NFT applications. Moreover, we will not leave you one-on-one with the market, but instead, we will create and implement a comprehensive marketing strategy. Your offer will be demonstrated to the largest audience possible, and its presentation will convince most of them of the numerous advantages they can benefit from by supporting your ideas.