share

The world of crypto mainly operates on CEXs (centralized exchanges), which manage the accounts and funds of their users, functioning as intermediary institutions. Many people aren’t willing to share their personal information and rely on exchanges’ security systems. That’s when a decentralized exchange (DEX) joins the game. Let’s dig a little deeper to understand what it is and how it works.

What is a Decentralized Exchange?

By definition, a decentralized exchange or DEX is an online platform that connects crypto sellers and buyers and enables peer-to-peer (P2P) crypto trading. Unlike centralized exchanges, DEXs are non-custodial. In other words, they do not control a user’s private keys.

As such, decentralized exchanges aren’t owned or controlled by any single company but are governed through the majority consensus of the network’s members.

DEX is an important step toward the realization of blockchain-based decentralization. While CEXs connect matching orders, decentralized crypto exchanges connect the traders who issue these orders. DEX users are autonomous in terms of the storage and operation of their crypto assets.

The transactions in DEXs are facilitated through the use of self-executing agreements written in smart contracts. Compared to traditional financial transactions, which are opaque and run through intermediaries who offer very limited insight into their actions.

On the other hand, decentralized exchanges offer complete transparency into the movement of funds and the mechanisms facilitating exchange. Similarly, since there is no involvement of a third party, DEXs reduce counterparty risk and can reduce systematic centralization risk in the cryptocurrency ecosystem.

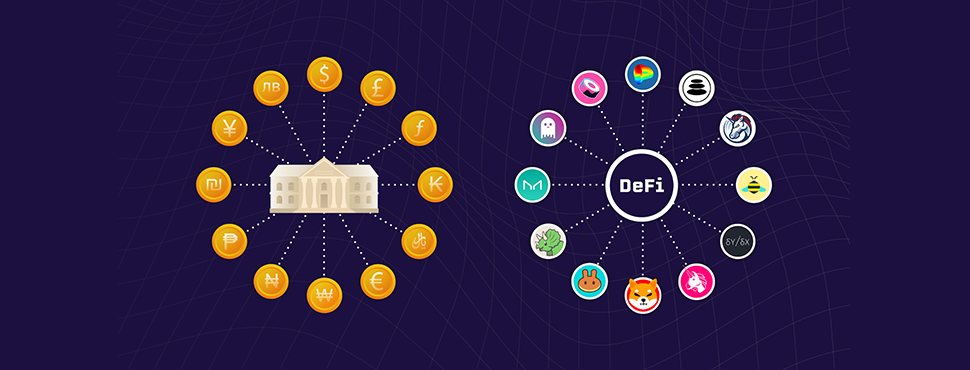

DeFi: The Foundation of Decentralized Exchanges

Before understanding how a decentralized exchange works, it’s important to understand the idea behind decentralized finance.

DeFi is a type of financial technology that enables transactions via smart contracts, thus cutting the need for a middleman or centralized institution like a traditional bank or payment services platform.

This way, users can access cheaper, quicker, and more efficient financial tools.

Decentralized finance promises to disrupt the traditional finance system under the argument that centralized systems hold an unfair monopoly over users, letting them have little control over their financial assets.

DEXs were initially conceptualized to eliminate the need for any authority to supervise and approve trades made within a particular exchange. Through the help of smart contracts, DEXs operate automated order books (or automated market maker) and trades. This makes them “truly peer-to-peer.”

How Does a Decentralized ExchangeWork?

Just like its name suggests, decentralized exchanges are crypto exchanges without a central authority. There is no central server that can be shut down or hacked and no single entity that can control the exchange. This decentralization has many benefits, but one of the most important is security.

The most defining characteristic of decentralized crypto exchanges is having no third parties involved in transactions initiated on such platforms. Instead, trades are made directly between users through an automated process.

This method of exchange is called peer-to-peer, or P2P. Most DEXs are essentially dApps (decentralized applications) or DAOs (decentralized autonomous organizations) that run on Ethereum or any other cryptocurrency network with smart contracts functionality.

So, DEX works on this logic:

- A token owner raises an order: to exchange his/her assets/funds with another available on the DEX. The user also specifies the number of units they want to sell, the cost of each token, and also specifies time duration during which bidding for their assets is allowed.

- Once the selling order, as mentioned above, is set, other users can submit bids through a buy order.

- Once the time assigned by the seller expires, all the bids are reviewed and calculated for the best interest of both the buyer & seller parties.

Types of Decentralized Exchanges

More and more investors are finding decentralized exchanges more reliable than their centralized counterparts. Their uptime is extremely high, as nodes are ready to provide their services at any moment. As a result, they can guarantee that trade settlement and order matching will continue. Users can run their own nodes and transfer their assets to wallets. DEXs exist in three main types: automated market makers, off-chain order books, and on-chain order books. All these types enable members to trade with each other directly using smart contracts.

- Automated market makers (AMM): Automated market makers are decentralized exchanges that do not use an order book to record transactions. Instead, they rely on autonomous smart contracts and liquidity pools to provide users with a decentralized trading experience. They also use oracles like Chainlink to provide information on current crypto prices.

- An off-chain order book: Although an off-chain order book uses a similar verification method to an on-chain order book, it relies on external centralized servers to record trades. The benefit of this model is that off-chain order books typically offer lower fees than on-chain order book DEXs. However, an off-chain order book does not have the same decentralization as competing DEXs.

- An on-chain order book: An on-chain order book uses crypto miners and a system of nodes to validate transactions and store the information on the blockchain. An on-chain order book is the same as in centralized crypto exchanges, except it does not rely on a company to confirm transactions. Since such an order book is publicly viewable on the blockchain, it is considered more transparent than an off-chain order book.

Key Differences Between DEXs & CEXs

Unlike centralized exchanges like Binance or Coinbase, where ownership of coins is 100% of the exchange, DEXs do not own any of the coins. DEXs only act as links between two different entities that want to trade their cryptocurrencies without holding any of the cryptocurrencies that will be exchanged. CEXs are usually at risk of hacking and crypto theft because they are known to hold large sums of cryptocurrency.

At the same time, since centralized exchanges offer the service of being a third party in a cryptocurrency transaction, they usually charge a small transaction fee, aside from the gas fees, for every trade you make on their platform. DEXs, on the other hand, just have the gas fees per transaction.

Anonymity is also a key differentiation between DEXs and centralized exchanges. On a decentralized exchange, users can remain anonymous and have access to more cryptocurrencies while enjoying more security than traditional exchanges.

Centralized exchanges require their users to fill up KYC (know-your-customer) application forms before they start trading on their platforms, whereas DEXs only need you to have a wallet to begin trading – no identity verification is needed.

KYC is needed by centralized exchanges due to regulatory concerns depending on which country they are operating in. Certain people aren’t able to trade or have limited trading services (such as leverage limitations, for example) in centralized exchanges.

How to Use Decentralized Exchanges

Once you select which type of DEX is best for you, your next step is to understand how to use them. DEXs are still in their early stages, with many only supporting basic trading functionality.

As they mature, you can expect to see more features and improvements. Nevertheless, there are a few key things to know about using DEXs.

It’s important to remember that decentralized exchanges are still a relatively new technology. As a result, they may not be as user-friendly or have the same level of customer support as their centralized counterparts.

Here’s a quick guide on how to use decentralized exchanges:

- Choose your decentralized exchange. Some popular options include Uniswap, Curve, PancakeSwap, and Binance DEX.

- Connect your wallet. You’ll need to connect a cryptocurrency wallet to trade on a decentralized exchange. Some popular wallets include MetaMask, Trust Wallet, and Coinbase Wallet.

- You can then add the native token compatible with the DEX, like BEP-20 for Binance DEX, and select different options from trading or yield farming.

Legal Status of DEXs

The rapid growth of decentralized exchanges has turned out to be a challenge for market regulators and has raised new legal issues. The status of DEXs is ambiguous because some of their features, like anonymity, contradict some requirements of the applicable legislation.

Different countries try to solve this problem in different ways. The US makes efforts to apply the existing legal basis, while the authorities of Singapore strive to create a new regulatory system for such exchanges. Nonetheless, there is no unequivocal position on DEXs in these countries, while still others do not regulate such platforms at all.

One of the main difficulties connected with the regulation of decentralized exchanges is that, in most cases, they aren’t controlled by a definite legal entity or person. This leads to problems with the definition of a responsible person if violations are found. There can be considerable difficulties with regard to the regulation of trading activities. That is why it’s impossible to apply measures and rules to them that are applicable to a centralized exchange.

What’s Next for Decentralized Exchanges?

Satoshi Nakamoto conceived of Bitcoin in part to free people globally from traditional financial constraints. For Nakamoto, decentralization was a key component of the ethos of crypto.

While decentralized exchanges offer many significant benefits over a centralized exchange, widespread adoption of DEXs is not likely to occur until DEXs become better understood and easier to use.

Relatively low trading volumes on DEXs also make the markets that they support less liquid than centralized markets for the same tokens.

Technology advances over time are likely to substantially increase the use of DEXs. It is likely only a matter of time before using a decentralized exchange is a more common way to buy or sell cryptocurrency.