share

Throughout 2021, the decentralized finance market demonstrated impressive growth. Initially viewed by crypto enthusiasts as a small section of the crypto space, it has transformed into an entire universe. Today, we witness the evolution of decentralized exchanges, the development of the DeFi infrastructure, and the search for new tools.

What Is Decentralized Finance?

The majority of users still do not fully understand the concept of the decentralization of financial institutions. As we can see, many of them believe that such popular crypto trading platforms as Binance or Coinbase also belong to this sphere. However, these platforms have a centralized governance model.

The main sign of decentralization in finance is the system for storing digital assets. Decentralized exchanges do not require users to create an exchange account and a crypto wallet on their platform. Users have their own private keys, store their cryptocurrency and dispose of it at their own discretion. To start trading, you only need to connect your wallet.

What Risks Are Associated With Centralized Exchanges?

Centralized exchanges, just like the decentralized ones, are subject to the jurisdiction of their country and are governed by its legislation. However, centralization means that the assets are stored within the platform, which is significant from the perspective of security. If regulatory or law enforcement authorities believe that a user is untrustworthy or has suspicious crypto assets (even if such shady coins were bought unknowingly), the central authority can block their crypto deposit.

Nowadays, this process is also subject to political influence. In fact, when you register on centralized exchanges, your rights related to your assets become limited.

Another significant risk is represented by the interest of DEX owners in trading and their ability to influence this process. Price manipulation is quite typical of a centralized exchange.

CeX has the obvious advantages of being protected against hacks and converting assets into fiat currencies.

What Are the Advantages and Disadvantages of Decentralized Exchanges?

The main benefit of decentralized exchanges is that they are not controlled by a central authority that could get involved in trading and get access to the wallets of users. As a rule, such platforms are more secure due to the use of a decentralized hosting service. No one can steal your money from a DEX because it is not stored there. Hackers organize heists to steal liquidity, but most popular decentralized exchanges have solved this problem from a technical point of view.

One of the disadvantages of decentralized exchanges is the problem of providing liquidity. Many exchanges get closed after not being able to collect enough assets for liquidity pools. Moreover, crypto exchanges based on the Ethereum network charge high gas fees. During peak load periods, these can reach hundreds of U.S. dollars.

Due to the market volatility of coins, there is also the risk of impermanent loss. When the price of one asset in the staked pair changes, the balance is disrupted, and the investor risks losing some of the revenue.

Another important risk is that smart contracts are not always perfect. A mistake made by a programmer can result in negative consequences. This is why users tend to prefer platforms with a good track record.

What Is the Operation Principle of a Decentralized Exchange?

Users connect to a service using their crypto wallet and can remain completely anonymous. The funds are provided to the service only for trading and only to the extent determined by the owner.

Further actions depend on what the exchange offers. Most of them have the following features:

- Yield farming allows participants to provide liquidity by locking their digital assets into a liquidity pool. Interest is accrued on the locked assets. This strategy is characterized by high risks of impermanent loss.

- Staking is locking cryptocurrency to earn interest and ensure the security of a network. Crypto exchanges perform the technical aspect, but the interest is significantly lower compared to yield farming.

- Participants can also trade crypto, being able to swap tokens directly with the system.

The Technical Foundation of a DeFi Exchange Platform

From the technical point of view, decentralized exchanges are open-source software in a peer-to-peer network based on blockchain technology, where buyers and sellers trade DeFi tokens with each other. There are three types of trading platforms.

- Earlier, each order used to be registered on the blockchain. This was the principle behind the first decentralized exchanges. It is safe but a very slow and expensive method.

- Orders are stored outside the blockchain and hosted by a relayer. Users maintain control over their assets.

- Smart contracts. This is the new generation technology with the highest potential because it allows users to swap tokens with external reserves, while the formula and the rules are written on a smart contract as algorithms.

It was the introduction of smart contracts that drove the rapid development of DeX and helped decentralized exchanges to compete with centralized counterparts. They implemented almost all traditional trading instruments, including margin trading, derivatives, etc. The foundation of DeX is liquidity mining.

Top DeFi Exchanges in Terms of Reliability

As of early 2022, there are three top decentralized exchanges that offer the best opportunities for earning interest and do not pose risks of fraud.

All data is valid at the time of publication.

Uniswap

This is a peer-to-peer decentralized exchange founded in 2018. For the crypto world, this is quite a long time. This platform tested the concept of an automated market maker (AMM) and allowed Uniswap users to trade cryptocurrency in a system that does not depend on any controlling authority. Many features that are now taken for granted were first introduced at UNISWAP:

- trade based on smart contracts;

- liquidity pools with pairs of tokens;

- the formation of prices based on the liquidity pool volume;

- no authorization;

- quick wallet connection;

- the ability of LP tokens owners to participate in managing the development strategies of crypto exchanges.

Despite the increasing competition, decentralized exchange UNISWAP is still one of the leading platforms for crypto trading.

The automation of market maker functions allowed the platform to get rid of intermediaries. Moreover, the trading fees were decreased.

The trading volume is getting close to one and a half billion U.S. dollars. Users can trade any of the 48 available tokens, including all popular coins and stablecoins, such as USDT and USDC, and can also choose WBTC – wrapped Bitcoin.

Currently, the UNI token has a market cap of $6,375,589,748 and a value of around 9 U.S. dollars.

Policy proposals can be submitted via a special website, and all UNI token holders have voting rights.

The third version of the liquidity protocol introduced limit orders for trade based on the AMM principles. Implementing such orders allows users to wait for the optimal price of the two tokens in the pool and gain maximum profit.

This crypto exchange offers instruments for developing compatible decentralized applications. Over 200 services have been developed based on the Uniswap protocol, including wallets, aggregators, analytic services, portfolio management tools, and, of course, trading instruments. For example, the popular NFT marketplace OpenSea is also based on the Uniswap protocol. Authors of ideas with the highest potential can apply for a development grant.

AAVE

This crypto exchange has operated since 2017. The platform moved to the Ethereum blockchain in 2020 and has since been consistently developing. The platform creators believe that their main advantages are fast transactions and low fees.

Currently, over 30 tokens are available on the platform. Over 100,000 users own the native token (AAVE) and can vote on service management issues. This token is also traded on all leading crypto exchanges, including centralized ones. It has a market cap of $2,010,896,150.

The operating principle of this decentralized exchange is basically the same as that of the others. Liquidity providers earn money by depositing their assets into a liquidity pool. Crypto traders can borrow assets at interest. No authorization is required. Users only need to connect to a crypto wallet.

The AAVE liquidity pool is protected against insolvency risks by a special safety module. Over half a million governance tokens are locked within the system. Participants can not only trade their assets but also make use of staking and term loans that do not require collateral since they are provided for one transaction only.

The platform offers two income opportunities:

- the lending fee, with interest charges allocated proportionally among all liquidity providers;

- the flash loan rate is 0.09% from the loan amount.

Compound

This is a decentralized autonomous organization (DAO) that was founded in 2019 based on the Ethereum blockchain. The Compound Finance lending protocol is designed for borrowing and lending crypto. Smart contracts contain algorithms that adjust interest rates on the go depending on the market balance. This platform was the first one to imitate the features of traditional banking and add decentralization. On this platform, users can borrow money for trading.

The LP token COMP has a capitalization of $739,394,044. APY (the interest you earn) varies within 5% depending on the cryptocurrency.

1Inch

This protocol was launched in 2019 and is also based on the Ethereum blockchain. Flexibility is achieved by aggregating various trading platforms into a single network, which allows exchanging tokens via the best available routes. The fees are paid in gas which is why they might be higher during peak load.

The eponymous governance token with the capitalization of $636,808,006 is trading on all major crypto exchanges.

The network has liquidity of over 55 billion U.S. dollars, and the total value locked is around 166 billion U.S. dollars. Millions of transactions are conducted on this crypto exchange. The trading platform also offers transactions on other chains, such as Polygon, Binance Smart Chain, Optimism, etc.

DeFi Crypto Exchanges With Additional Capabilities

The first decentralized exchanges have the competitive advantage of their popularity and proven reputation. Younger platforms that are looking for their niche on the DEX market have to come up with innovative ways to attract new users.

PANCAKESWAP

The ultimate leader in this area is PANCAKESWAP which is based on the Binance Smart Chain protocol. This trading platform attracts users from first sight — the stylish gaming design and the intuitive user interface of this yield farm will impress even the most sophisticated users.

This cryptocurrency exchange was founded in 2020 and had various features, including yield farming. Users can also lock the native governance token Cake into a Syrup Pool to earn interest. Other features include lotteries and predictions.

PANCAKE is a convenient crypto ecosystem for earning passive income and actively participating in trading. The number of trading pairs is over 4,000.

Cake has a capitalization of $1,781,756,893 and is actively trading, which indicates the project’s success.

The TVL is almost 10 billion U.S. dollars.

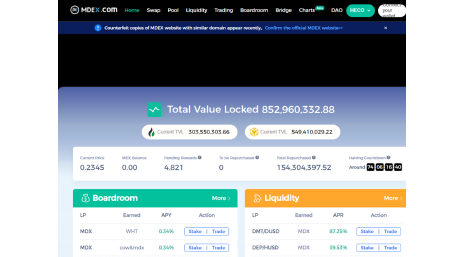

MDEX

This is another young and promising platform that operates on two blockchains at the same time: Ethereum and Huobi-Eco Chain. The former is great at providing liquidity, while the latter offers very low fees. Although this trading platform was based on the centralized entity Huobi, it has all the necessary features of decentralization. MDEX positions itself as the biggest trading platform on the DeFi market and considers UNISWAP to be its main competitor.

The crypto exchange has a great data interface, and its homepage at once immerses the user into the world of trading with its business atmosphere.

The liquidity pool offers users very high-interest rates in a range between 30 and 80 percent. The platform also offers swaps, pools, and trading opportunities.

The governance token has an impressive market capitalization, but its price has not reached the 10 dollar mark yet. Over the last year, its price has also decreased significantly.

BALANCER

The Balancer protocol is based on the Uniswap protocol. One of the main features of an automated market maker is the ability to adjust the ratio of two assets in a pair. Other platforms offer only the 50/50 ratio, while Balancer has come up with an innovative approach.

The developers also added tools for investment portfolio management. Balancer’s liquidity pools are divided into controlled (private) and shared pools.

The project positions itself more as a tool for creating AMM services with low protocol fees. The idea is to create n-dimensional liquidity pools that can include more than two tokens, unlike on any other platform.

The capitalization of the native token (BAL) is $79,243,716.

The amount of various tokens trading on the platform is quite impressive.

SUSHISWAP

Another food-inspired project was created in 2020 as a fork of UNISWAP. Even users who have contributed fewer digital assets can earn rewards on this platform.

From the very first page, the project evokes culinary associations by claiming to be Michelin-star-worthy. This is a multichain AMM with such features as margin trading, staking, and lending. The platform offers a wide choice of tokens. Other features include yield farming and additional sources of passive income, including automatized strategies.

The SUSHI token has a capitalization of $402,083,491.

Best DeFi Applications With Low Trading Fees

Decreasing the transaction fees is one of the main goals of developers. However high the potential profit, if most of it is charged as fees, users won’t stay on such a platform.

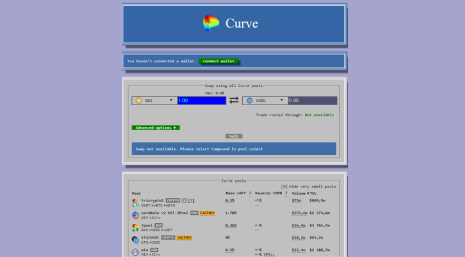

CURVE

The pragmatic design imitating the style of early Windows computers strikes the eye at once. The platform is considered to be too complicated for beginners and is aimed at experienced traders. However, it receives a lot of attention due to the fact that it offers participants to trade in stablecoins. It helps to reduce the impermanent loss risk. Otherwise, the platform is similar to all traditional decentralized exchanges.

In the beginning, the platform experienced some smart contract issues but managed to fix them soon.

The native governance token CRV with the capitalization of $992,866,203 can be used to vote on proposals.

BINANCE DEX

Binance is rightfully considered to be the most actively developing project in the cryptocurrency world. This centralized exchange has expanded the horizon and entered the DeFi industry by creating a parallel network Binance Smart Chain.

The interface is designed for professional traders and can seem intimidating for beginners, but the low transaction fees and good track record attract lots of users.

The centralized version offers exchange, traditional, margin, and extended trading, strategies, yield farming, derivatives, lending, and direct exchange on a peer-to-peer network. Thanks to the decentralized version features, participants can create trading pairs, monitor the market, and send limit orders. You can connect both a Binance chain wallet and many other wallets.

The main objective was to provide the developers with a convenient and intuitive environment for deploying their own projects.

Anyone can try on the role of a trader and use the test platform. When connecting a digital wallet, you need to deposit 1 native token (BNB).

Low fees are implemented thanks to the Proof of Staked Authority (PoSA) consensus algorithm.

INJECTIVE

This is a second-level decentralized exchange based on Cosmos SDK. The platform allows users to buy and sell not only spot but also synthetic assets. Its implementation features helped to reduce the transaction fees and increase the speed.

The staking calculator can be used to calculate the yearly return. The native token is Inj, with a capitalization of $260,336,808.

The Best DeFi Exchange 2021

Each of these crypto exchanges offers users its own features and profit-making opportunities, which is why it might be difficult to choose the best one. However, there is one platform that could be considered the most prominent project of 2021.

In the fall of 2020, Open Ocean was founded. It became the first aggregator between several decentralized exchanges and centralized exchanges in DEX. This platform is part of the new CeDeFi market.

Basically, this is a bridge between crypto exchanges that is accessible to traders of any level. Here, you can always find the best price, and the transaction fees are as low as they get. The project is promoted by BSC as a great entry point into the DeFi ecosystem Binance.

The number of tokens traded on this DEX is very large, and a new user is offered the best price for the selected pair at once.

There is also a referral program that offers 10% of the referral recipient’s trading volume. They also profit from this program and receive a 5% rebate on their trading fees.

Users only pay network fees for their transactions.

The development prospects are also quite impressive: in addition to swaps, the platform intends to launch derivatives, lending, insurance, and yield-generation products. The developers of Open Ocean also plan to introduce margin trading and trading advice.

If all the potential features of this project are implemented, it could become one of the leading players in the DeFi market.

DEX in Numbers

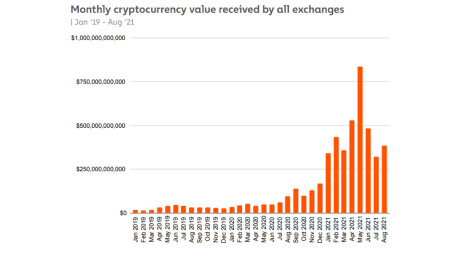

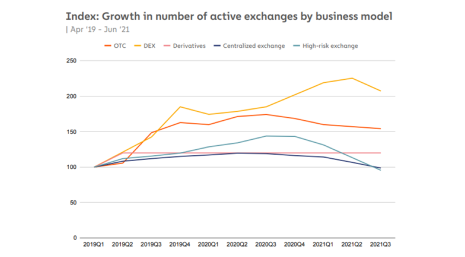

The condition of the DeFi market can be best illustrated by the charts of the ChainAnalisys research conducted in 2021. Even the skeptics might change their minds after analyzing its results.

In the summer of 2021, the market was growing. The decline that followed indicates the increased competition and the consolidation of the DeFi market.

The increase in the number of centralized exchanges slowed down while the number of decentralized projects kept growing. Not all of them survive on the decentralized finance market, but they still prevail over CeX.

The chart above also shows that the number of derivative trading platforms increases, which can be explained by cryptocurrency volatility.

As we can see, the number of advocates of decentralized finance and cryptocurrency keeps growing, and this phenomenon is unlikely to disappear anytime soon.

How to Choose DeFi Exchanges

Choosing a decentralized exchange is a rather difficult task. Below are the main factors you should consider.

Reputation

The reputation and the experience on the DeFi market are important. Major platforms use special algorithms to protect their liquidity pools, which is why even a decrease in the number of liquidity providers will not have critical results. Moreover, some new projects arouse suspicions due to possible scams.

TVL

The total value locked is an indirect indicator of the number of users who entrust the platform with their crypto assets.

Trading in the Platform’s Native Token

Check whether the governance token is presented on other crypto exchanges. If the LP token is traded on other platforms, the DEX is recognized by the community.

Gas Fees

The level of transaction fees is important because high fees may outweigh the staking rewards.

Interest Rates

APY and APR are the interest rates on the assets locked into a pool. Pay attention to them to calculate the potential returns.

A DeFi Exchange List

The more tokens and pairs are traded on the platform, the more choices and opportunities you get.

For beginning crypto traders, the most important factors are an easy entrance to the crypto market and comprehensive documentation.

Another important indicator is the platform’s marketing strategy. If it is promoted constantly and consistently, its creators are interested in its development.

A comprehensive list of the crypto exchanges on the market is available at coinmarketcap.com/rankings/exchanges/dex/.

Here, you can also analyze such important indicators as the trading volume, market share, crypto exchange type, etc.

Conclusion

With the invention of smart contracts, financial products have experienced great changes. Seemingly a simple idea led to the creation of a new trading module with no intermediaries and additional expenses.

Decentralization is associated with obvious benefits, freeing the crypto market of those who might like to manipulate its processes and the assets of users. What we have seen so far is only the beginning, and anyone can join this market as a trader or a service provider.

If you choose to launch your exchange, ICODA can always support and help you. We will develop your project from scratch, launch it and conduct a successful marketing campaign. Who knows, maybe it’s your future trading platform that will soon top the list of the best-decentralized exchanges. Our crypto portfolio includes large projects that have successfully entered the market and have been generating profit for their owners.