share

The DeFi ecosystem has been in high demand in recent years because it enables users not only to trade crypto assets but also to easily make passive income by lending out their coins. In this article, we’ll talk about crypto lending, where and how to find the best interest rate, and how to start lending.

Enter DeFi Lending

In the world of traditional finance, people trade with each other through orders. One trader puts up an order, and, for the deal to happen, another trader must accept it. People keep their money in their savings accounts, which the bank or another financial institution takes the money from to use for its purposes.

The funds people are trading this way are held in custody by a bank or brokerage firm, known in this case as the Market Maker: the company enables trading by providing funds (also known as liquidity) for people to trade with. In traditional banking, just like in CeFi (Centralized Finance), having a bank account is more often than not accompanied by disclosing your identity (KYC).

Decentralized finance is based entirely upon smart contracts – automated algorithms that execute a defined set of operations (e.g. transfer a set amount of the set coin to the set wallet address) after certain predefined conditions have been met. Smart contracts don’t need ‘people’ — they need resources, conditions, and triggers. In DeFi, you alone can decide what happens to your assets while remaining completely anonymous.

How DeFi Is Different

Unlike traditional banks and CeFi, funds in DeFi are stored directly in liquidity pools, which is also where the trading happens. Smart contracts do not need permission from a bank or a broker to access the funds – they already have the funds at their disposal; that’s why DeFi trading is also called permissionless.

In DeFi, if you want to trade with another person, you need a third person to lend the funds to the smart contract beforehand so you two can trade. Those people are called liquidity providers, or LP. DeFi allows them to earn interest by providing liquidity to DeFi protocols and charging fees from the trades made with your money. And the best bit is that anyone can become a liquidity provider: all it takes is a roughly equal amount of cryptocurrency in a certain training pair.

So What Exactly Is Crypto Lending?

Crypto lending is a practice of loaning out your coins to a DeFi protocol, such as a swap, a DEX, or other services. On the user side, it’s much like depositing money in traditional banks – except it’s a lot more flexible and brings many times the profits.

Why Consider DeFi Lending?

There are two main reasons why someone might want to consider crypto lending as the source of their passive income: interest rates and convenience.

In DeFi, interest rates offered on most crypto lending platforms are many times what you could make with fiat currencies using a traditional savings account. For example, while fiat banks offer ~0,5% APY (Annual Percentage Yield), annual DeFi interest rates can reach 5-8% on a rainy day, and sometimes even up to 90% and more. There are even some protocols that offer 300-400% of annual interest, but those are best approached with caution, if at all.

The convenience offered by crypto lending platforms is beyond doubt. You no longer need to create a bank account and put up with all the red tape, inconvenience, and overall lack of privacy linked to it. All you need is a cryptocurrency wallet, some coins on it, and you’re got to go: lend your coins to DeFi platforms and earn yield starting now.

One practice that’s been employed to ensure that token holders will get back their assets is called over-collateralization. The idea is that before borrowing any assets, a user will have to deposit an amount that is larger than the amount they’d like to borrow; this is done to mitigate volatility or other unfavourable circumstances and ensure that the funds will be returned to the initial lender.

Crypto Lending in Cefi vs DeFi: Which Is Better?

While decentralized finance is based on smart contracts, there are some crypto exchanges that have a ‘hybrid’ structure: they offer the same trading and lending functionality as any other DEX, but they also comply with regulations, hold your funds in custody, and need you to do KYC. This field is called CeFi, Centralized Finance. There is no definitive answer as to which one is ‘better’ – CeFi or DeFi lending —but there are some key differences.

Custody

First, it’s the custody system. As said before, DeFi is a space where funds are kept entirely in liquidity pools, and users trust computer algorithms to carry out their transactions.

CeFi, on the other hand, though still part of the cryptocurrency world, is the realm of brokerages – companies you trust with keeping and using your digital assets on your behalf. While the DeFi world remains the place for die-hard crypto believers, CeFi platforms also have interesting stuff to offer: namely, multiple blockchain support and a range of options for fiat currency.

Lending Rates

In terms of the lending rates, DeFi protocols often show lower risk and reward ratios; besides, the interest rates may vary depending on the borrowing demand. Usually, it’s the stablecoins that offer the best yields in DeFi, because that’s what people normally seek as the source of liquidity. Meanwhile, major cryptocurrencies like Bitcoin offer pretty low rewards on DeFi.

CeFi lending platforms (e.g. Nexo and Celsius) are known to offer higher interest rates: they can range from 10% up to 50-60% depending on the coin. Unlike in DeFi, centralized lending protocols offer from 25% up to Bitcoin and other major coins. Their returns are also more consistent and come with a higher level of safety. However, CeFi lending is subject to rate limits, and such platforms are regulated and centralized.

Which one is better is up to you: you need to decide if you’re ready to confirm your identity and trust your digital assets to a platform (while keeping the platform accountable for any misuse of the funds not incurred by you) or if you want to keep full control of your tokens while also taking on full responsibility for the risks you might incur, which is the case with the DeFi ecosystem.

Risks of DeFi Lending

The risks of DeFi lending involve three main aspects:

Impermanent Losses

After you loan out your coins for a set term, the market may go up or down, impacting their value. At the end of the term, the number of cryptos you will redeem may be larger than what you had initially deposited, but its value could’ve gone down. To mitigate this risk, you need to research the market of the coins you wish to loan out and have confidence in the direction of the coin’s growth.

Smart Contract Vulnerabilities

Everything online can (and will) be hacked – smart contracts are no exception. In case a bug or an exploit is exposed, your access to the funds may be severely compromised or even lost. To prevent that, make sure you trust the platform you’re using.

Fraud

Like any other financial tool, lending platforms can be used for fraudulent purposes. Make sure you know how to spot a scam and that the platform you’re considering using isn’t one.

The Best CeFi Lending Protocols

These days, there’s a multitude of decentralized as well as centralized lending platforms offering competitive interest rates alongside a number of additional features. Let’s have a look at a few.

The Best CeFi Lending Platforms

Celsius

Celsius is a popular centralized lending platform. Its main focus is fiat currency loans collateralized against crypto holdings (although users can borrow USD and stablecoins only).

Nexo

Nexo is a widely trusted CeFi platform allowing users to earn interest by lending a number of cryptocurrencies cross-chain. It also offers borrowing USD and stablecoins among its services.

BlockFi

Based in the US, BlockFi allows you to earn interest on crypto savings accounts. It also offers fiat currency loans backed by cryptocurrency collateral.

Mind that only USD or stablecoins are available for borrowing.

Gemini Earn

Gemini Earn is a crypto lending platform by Gemini, one of the world’s key centralized crypto exchanges.

One way Gemini Earn is different from other platforms is that it only offers borrowing funds to accredited institutions. Regular users cannot borrow against their crypto holdings using Gemini. Another notable difference is that Gemini Earn operates in the state of New York, which is more than can be said about most other crypto lending platforms.

The Best DeFi Lending Protocols

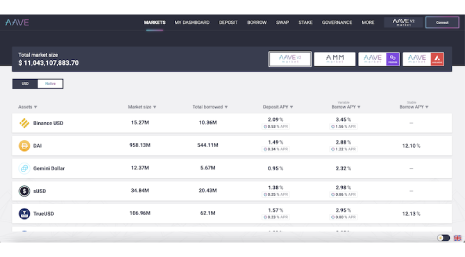

Aave

When it comes to DeFi crypto lending, Aave is often thought of as THE place to go. It is the largest lending protocol to date, offering multi-asset lending and borrowing of Ethereum-based assets. It also ensures its users’ crypto holdings with AAVE, its native coin.

Formerly known as ETHLend, Aave leverages a native token – AAVE – which is used for governance and staked as insurance against shortfall events in exchange for rewards. It also offers AMM market and flash loans, among its additional features.

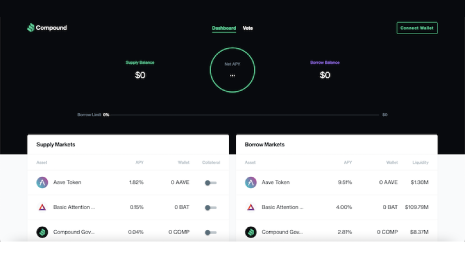

Compound

Compound Finance pioneered DeFi lending as we know it, and it’s still one of the key platforms out there. It’s also known as the first lending protocol with its own governance token, COMP. Here, you can earn interest on a multitude of Ethereum-based assets, as well as borrow crypto through over-collateralization.

Compound algorithms are continuously adjusting interest rates based on borrowing demand for each asset.

Maker

Maker Foundation is home to DAI, the most popular decentralized USD-pegged stablecoin. The platform also features a permissionless lending platform built around the token. Using the in-house Ethereum-based liquidity pool called Oasis, users can mint and borrow DAI straight on the protocol. Borrowing will require you to over-collateralize position with one of ~20 select cryptocurrencies on the Ethereum blockchain.

The Maker protocol also has an interest-bearing component that pays out a rate to DAI depositors – this is called the DAI savings rate, or “DSR”.