share

According to cryptocurrency monitoring service CoinMarketCap, there are over 140 DAO protocols at the time of writing. Virtually every area of blockchain, from DEXes to NFTs to the metaverse, is increasingly oriented towards open governance.

In this article, we’ll analyze the largest DAO platforms that use blockchain technology and their tokens that give their holders voting rights.

What Is a DAO?

We have written extensively about what DAOs are and the role they play in the Web3 ecosystem in the related articles. Read them if you want to know more about how DAOs work. Here we’ll briefly describe the essentials of the technical model.

A Decentralized Autonomous Organisation or DAO is a blockchain platform that is managed decentrally by a community.

Basically, only DAO platforms can be truly decentralized. Why can’t other protocols be? The problem is that blockchain platforms like the Ethereum network or BNB Chain allow you to create decentralized DApps and your own smart contracts based on them. A smart contract is a transparent computer program that executes predefined instructions. One can create autonomous decentralized apps (DApps) that operate on their own, like protocols for lending cryptocurrencies, betting platforms, NFT marketplaces and more.

When Ethereum developers make changes to the smart contract, miners must accept them. But with custom smart contracts, everything is different: developers can change the source code at their own discretion and without the users’ knowledge, and this makes DApps effectively centralized, even though they are based on a decentralized blockchain.

Together with the hierarchical structure inherent in traditional organizations, DAO projects offer a peer-to-peer model where all participants have equal voting rights and can influence community decisions equally.

What Is a DAO Token?

A Decentralized Autonomous Organisation’s cryptocurrency is called a governance token or DAO token. These cryptos’ main function is that they are used for decentralized governance of the blockchain protocol and give their holders the right to vote. The DAO concept assumes that participants in the ecosystem invest in the native tokens of a given platform to vote for a proposal put forward by the community. The decision on the future of the platform is made by all members of the community rather than by a narrow circle of individuals who can only act in their own interests.

Top DAO Tokens

There are several DAO projects in the cryptocurrency market, but few of them have been able to adequately compete with the leading platforms in the decentralized financial ecosystem (DeFi).

To ensure a fair mechanism for managing decentralized networks, developers issue DAO crypto tokens whose owners can participate in voting and thus in the development of the platform, acting in the interest of the community. This is a logical approach: after all, the development of the project directly affects the cost of the DAO coins, so the scenario of holders acting to their own disadvantage is virtually eliminated. Here are the top 10 DAO tokens.

Uniswap (UNI)

Uniswap is the leading AMM protocol and DEX on the Ethereum network launched in 2018. Users of the decentralized exchange enable atomic swaps within a specific blockchain. Uniswap became the first and largest DEX protocol on Ethereum to operate on the principle of an automated market maker DAO.

Initially, Uniswap only offered a swap and liquidity mining function but did not have native tokens. Only two years after its launch, Uniswap became a decentralized autonomous organization, and developers issued UNI tokens that they gave away as a subsequent airdrop to Ethereum users who had swapped at least once on Uniswap DEX. This took the protocol to a new level of development and offered DeFi governance to the crypto community.

Uniswap has long been the leading AMM protocol among all exchanges in decentralized finance (DeFi) but has given way to another platform, Curve. UNI itself, however, is the market capitalization leader among DAO tokens.

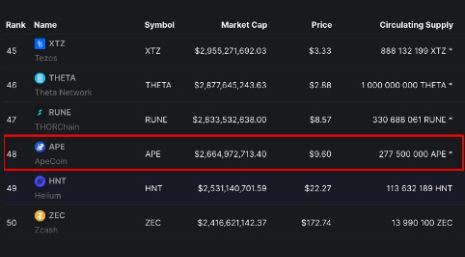

ApeCoin (APE)

APE is a native token issued by Yoga Labs, the creator of one of the most famous and expensive NFT collections called Bored Ape Yacht Club (BAYC) and also Mutant Apes. The token was given for free to the holders of NFTs from these collections. APE Token holders manage the ecosystem and determine how the funds from the ApeCoin DAO fund (created specifically for the development of the project) are used.

Despite the fact that the APE token was released only recently, with the official release in April 2022, it immediately entered the position of a top 50 token by capitalization and became one of the largest DAO tokens. Now Apecoin is the second-largest DAO token in terms of capitalization.

62% of the issuance of APE tokens will be allocated to the ApeCoin DAO fund to support community initiatives and contribute to the development of the project. A total of 1,000,000,000 ApeCoins have been issued. Almost immediately after the airdrop, the token was traded on major exchanges such as Binance, Coinbase, FTX and Kraken.

Maker DAO (MKR)

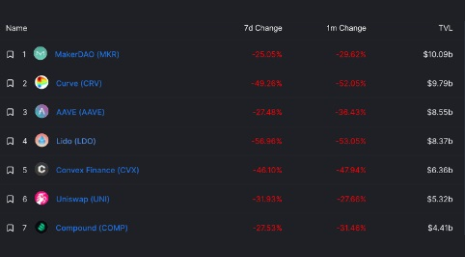

MKR is a governance token issued by the creators of MakerDAO and Maker Protocol on the Ethereum blockchain. MakerDAO is a lending protocol where users borrow and lend cryptocurrencies backed by digital assets. The platform leads in the number of locked assets (TVL) among all DeFi protocols, according to DeFi Llama, and the figure itself exceeds $10 billion.

The largest decentralized stablecoin DAI is issued on the MakerDAO platform. The DAI token is decentralized as it is backed by the cryptocurrency Ethereum.

Users lock their ETH coins in a ratio of about 1.5:1 to generate DAI. No one has central access to the collateral coins. All operations are carried out via a smart contract, and participants in the ecosystem interact directly with each other. Originally, ETH was used to issue DAI, but then the developers added other digital assets that can be deposited as collateral so that a user can get stablecoins.

Furthermore, DAI is an algorithmic stablecoin. The protocol runs entirely on a smart contract, so no company intervenes in the process of providing tokens, as is the case with Tether (USD) and USD Coin (USDC), which are issued by the centralized issuer of Tether and Circle, respectively.

Another key difference is that the community can directly participate in the management of MakerDAO. The issuers of Tether and Circle are forced to strictly adhere to the prescribed rules of the regulators and follow their instructions.

Aave (AAVE)

Aave is the second lending protocol in the DeFi ecosystem in terms of market cap and also the third in TVL after MakerDAO and Curve Finance.

The platform is based on the Ethereum blockchain and offers a decentralized governance system wherein Aave is managed by DAO members. The protocol was launched in 2017 and was originally known as ETHLend, but in 2018 the team rebranded and renamed the platform.

Aave allows users to add assets to liquidity pools or loan pools. Lenders receive interest for lending their digital assets, and borrowers can borrow using the protocol’s smart contract by providing cryptocurrency as collateral. Coins and tokens in loan pools are protected by a liquidation mechanism. In the event of a decline in the collateralized asset, it is released to pay the debt and accrued interest for the current period.

Curve (CRV)

Curve Finance is the leading decentralized exchange in terms of assets locked in the protocol (~$9.7 billion), acting as an automated market maker (AMM) and was founded in 2020. The platform focuses primarily on stablecoins. Curve offers stablecoin swaps and liquidity mining to users on various blockchain networks.

After launching in August of the same year, Curve began to operate as a DAO platform and accordingly, the Curve DAO token was released under the name CRV. The special feature of Curve is that the platform can connect multiple smart contracts based on the Aragon solution, which was also launched on the basis of Ethereum.

In addition to trading and liquidity pools, Curve also offers a DAO ecosystem as part of which holders of CRV tokens with native governance can vote on proposals from the platform community and directly influence their development.

Curve DAO is one of the market leaders in terms of the number of blockchain networks supported: the platform runs on Ethereum, Polygon, Avalanche, Fantom, Arbitrum, Gnosis, Optimism, Harmony, and Moonbeam.

Dash (DASH)

Although this DAO project is not a project in the classical sense and does not even have its own smart contract, it was one of the first to introduce a decentralized governance model.

Dash was launched in January 2014 as a fork of Litecoin, which ironically is a hard fork of Bitcoin. Originally, the project was known as XCoin. In fact, the organizers changed the name of the project twice: first, XCoin was renamed Darkcoin, and then Dash. The last renaming took place in 2015.

Dash is unique in that the platform offers a two-tier network with a hybrid consensus mechanism: Proof-of-Work at one level and Proof-of-Stake (PoS) at the other. The protocol itself is based on the original PoW algorithm known as X11. Dash also introduces masternodes, which are privileged supernodes, for the first time. Thanks to the masternodes, users have access to advanced features such as:

- InstantSend: send instant payments

- PrivateSend: send anonymous payments.

Dash uses a mixing mechanism by grouping transactions and then distributing them between addresses so that the wallets of senders and recipients cannot be traced.

The Dash project pioneered a decentralized project management model similar to decentralized autonomous organizations: 10% of mined coins are allocated to fund future proposals that the community puts forward.

Compound (COMP)

Compound is another lending protocol that allows you to receive and provide loans backed by cryptocurrencies on the Ethereum blockchain. At the same time, lenders on the Compound platform receive additional rewards in the form of DAO tokens called COMP in addition to accrued interest.

Token holders can vote on proposed propositions and thus participate in the development of the ecosystem. Moreover, the platform’s native tokens can be obtained not only by those who lend but also by users who borrow.

The Compound Protocol was founded in 2017 and launched in 2018. Despite launching at an inopportune time for the crypto market, the company managed to attract a major venture capital fund, successfully launch the project and make it one of the leading protocols in the DeFi ecosystem. Compound is currently one of the 10 largest DAO projects, ranking 7th with a TVL of over $4.4 billion.

Decred (DCR)

Decred is a blockchain protocol designed to enable open governance. A notable feature of this DAO project is that the community itself approves all transactions and changes to the protocol and that the mechanism is based on the original architecture of the Bitcoin network. The goal of Decred is to eliminate the monopoly in blockchain governance.

The protocol provides a hybrid network negotiation mechanism, including the provision of voting rights: PoW and PoS with smart contracts. Token holders participate in the voting and governance of the platform, regardless of which consensus algorithm is used.

0x (ZRX)

Ox is an infrastructure protocol founded in 2016. The platform offers a range of smart contracts for trading ERC-20 tokens. It is one of the first decentralized exchanges to operate successfully to date.

DAO tokens called ZRX are used to participate in the management of the platform. Any token holder can submit and vote for proposals from other participants in the ecosystem to change the way the 0x protocol works. In 2019, the platform team decided to change the ZRX tokenomics and propose a new initiative: once adopted, token holders could delegate their stake to market makers but retain voting rights.

Synthetix (SNX)

Synthetix is the leading DeFi protocol releasing tokenized versions of traditional assets. This platform was also the first to introduce the term “synthetic assets”.

Currently, tokenized US dollars and Euros are traded on the platform, but the list of assets is likely to expand in the future. Moreover, this protocol is the first automated market maker to issue and trade cryptocurrency derivatives on the blockchain. These are decentralized perpetual futures. Synthetix has an aggregated liquidity pool provided by major platforms such as Uniswap and Curve.

Synthetix was launched in 2017 and, like some of the other projects on our list, originally had a different name – Havven (HAV). The native token SNX is used as collateral for issuing Synthetix assets, for staking and also as a DAO crypto token to participate in project management via smart contracts.

Although Synthetix is one of the top 10 DAO tokens, its platform is significantly inferior to other projects in terms of TVL, which is just over $500. This is probably due to the small number of assets: a total of 10 digital assets are traded on the platform. Moreover, the exchange charges quite high commissions for token swaps, even compared to DEXs – 0.55%.

Conclusion

In this article, we have discussed the best DAO crypto projects that have rightly become the leading platforms in the crypto space and favourites of the crypto community. The DAO community has every opportunity to demonstrate the advantage of decentralized autonomous organizations over a centralized management model, too. But remember that new projects are regularly emerging that may form formidable competition for these projects in the future.

In other words, the presence of crypto assets in the vaults of companies that we listed and their position in the list of top DAO tokens producers is not a guarantee of success. The market is constantly changing, and decentralized autonomous organizations will have to prove themselves over time and face stiff competition before taking place alongside mastodons like Bitcoin and Ethereum.

Most likely, only certain projects that will have real-world applications will survive. During crypto trends, many projects and their clones raise funds, but in times of correction, “dummy” projects that have no real value are eliminated.

The conclusion is simple: the fact that any given company is one of the leading DeFi projects and has a high market capitalization is no guarantee that this will continue to be the case in the future, so you should always do your own research before investing in crypto assets.

Which DAO crypto tokens do you invest in? Write to us!