share

Welcome to the future of finance, where skyscrapers, bonds, and even luxury yachts are shedding their physical shackles to join the blockchain revolution! At ICODA, your go-to crypto marketing agency, we’re diving deep into the hottest trend of 2025: the Tokenization Takeover. Real-world assets (RWAs) are going digital, and it’s not just a buzzword—it’s a game-changer for investors, businesses, and the crypto ecosystem. Buckle up as we explore how this seismic shift is unfolding, why it matters, and how ICODA can help you ride the wave.

The Big Picture: What’s Tokenization Anyway?

Imagine owning a piece of a Manhattan penthouse or a government bond without needing a fat wallet or a fancy broker. That’s tokenization in a nutshell. It’s the process of turning tangible assets—like real estate, bonds, or even fine art—into digital tokens on a blockchain. These tokens can be traded, split, and owned by anyone with an internet connection, making high-value investments as easy as buying a coffee.

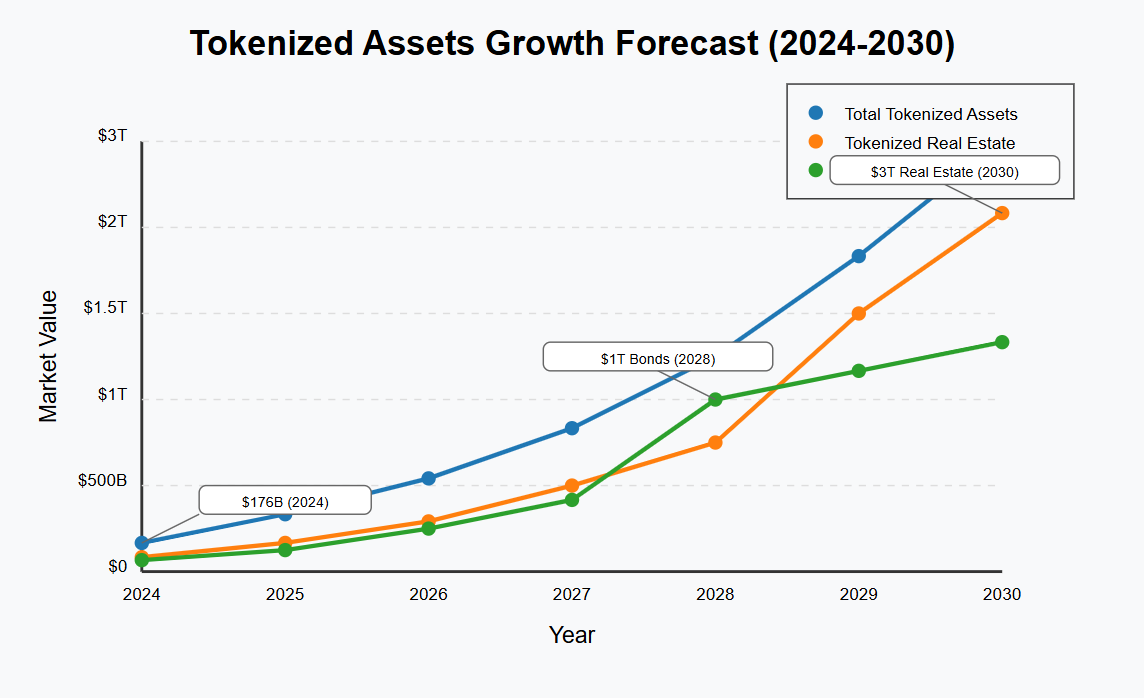

In 2025, this isn’t a sci-fi fantasy—it’s reality. The total value locked in tokenized assets hit over $176 billion in 2024, with non-stablecoin assets surging by 53% (shoutout to the Tokenized Asset Coalition). And the projections? Mind-blowing. Real estate tokenization alone could balloon to $3 trillion by 2030, while tokenized bonds might hit $1 trillion by 2028. At ICODA, we see this as a golden opportunity for our clients to tap into a market that’s redefining wealth.

The Heavy Hitters: Real Estate and Bonds Lead the Charge

Let’s zoom in on the stars of the show: real estate and bonds. Real estate tokenization is popping off, with platforms like Propy turning properties into digital goldmines. Goldman Sachs predicts a $1 trillion industry by the end of 2025—yes, this year! Imagine fractional ownership of a beachfront villa or a downtown office tower, all secured on the blockchain. It’s not just for millionaires anymore; tokenization lets everyday investors grab a slice of the pie.

Bonds are also getting a blockchain makeover. Take OCBC in Singapore, slashing minimum investments from $183,000 to a mere $730. That’s the power of tokenized bonds—liquidity and accessibility on steroids. And who’s leading the pack? None other than BlackRock, with its BUIDL fund raking in $245 million in its first week and expanding across blockchains like Ethereum, Aptos, and Polygon. These aren’t small fry moves; they’re signals that the big dogs are all in.

Why Tokenization Is a Crypto Marketer’s Dream

So, why should you care? Because tokenization is a marketer’s playground—and at ICODA, we’re here to help you dominate it. Here’s the juicy stuff:

- Liquidity Unleashed: Illiquid assets like real estate used to sit dormant. Now, they’re tradeable 24/7, creating new markets and opportunities for your brand to shine.

- Fractional Fun: Smaller investors can join the party, expanding your audience. More players, more buzz, more conversions.

- Efficiency Boost: Blockchain cuts out middlemen, speeds up deals, and screams transparency—perfect for building trust with your crypto-savvy crowd.

- Global Reach: Tokens don’t care about borders. Your project can go from local to global overnight, and ICODA’s marketing magic can amplify that reach.

But it’s not all smooth sailing. Regulatory hurdles and security concerns are real—think of them as the final bosses in this game. The OECD’s 2025 Policy Paper warns that legal clarity is still lagging, and cyber risks loom large. That’s where ICODA steps in, crafting strategies that navigate these choppy waters while keeping your project in the spotlight.

Spotlight: Success Stories Lighting the Way

Need proof this isn’t just hype? Check out BlackRock’s BUIDL fund. Launched in 2024, this tokenized money market fund offers instant settlement and U.S. dollar yields, now live on multiple blockchains. It’s a masterclass in institutional adoption—and a signal to crypto marketers that the mainstream is waking up. Then there’s real estate, with pioneers like the St. Regis Aspen Resort showing how tokenization can democratize luxury property ownership. And don’t sleep on bonds—China’s Zhuhai Huafa Group issued a $190 million digital bond on HSBC’s Orion platform, proving this trend’s got global legs.

The future’s digital, and it’s now. Analysts say tokenized assets could hit 10% of global GDP by 2030—real estate, bonds, and beyond. Want in? Let ICODA be your co-pilot.

Conclusion

The Tokenization Takeover isn’t coming—it’s here. In 2025, real-world assets are going digital at lightning speed, and the crypto world is buzzing with opportunity. Whether you’re a startup dreaming big or an established player scaling up, ICODA’s got the tools, the team, and the vision to make you a tokenization titan. Let’s turn assets into tokens, ideas into action, and clicks into crypto gold. Ready to revolutionize finance? Hit us up—your blockchain breakthrough starts today.