share

Blockchain transactions using cryptocurrencies seem to have become the way of the future.

As an emerging technology, companies performing transactions over cryptocurrency exchanges need to ensure they are not being used to launder illegal funds or fund terrorist organizations. These private entities are mandated by law to impose the necessary KYC (Know Your Customer) standards while protecting customer data at the same time.

In this article, we will explain everything that’s important for an organization to know about crypto exchanges (centralized and decentralized), KYC compliance, and crypto firms.

Let’s dive right in.

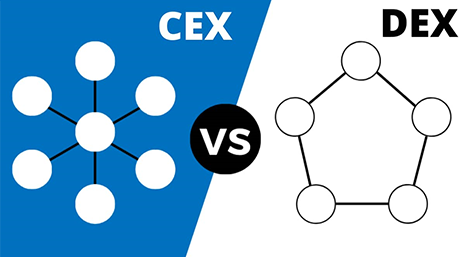

Cryptocurrency Transactions: Decentralized and Centralized Exchanges

Centralized cryptocurrency exchanges (CEX) are currently the predominant form of exchange in the cryptocurrency space. The reason is simple; they are easy to use, have easy-to-use interfaces, and provide trustworthy security (insurance).

However, the part perturbing most organizations’ customers is – most centralized exchanges require their users to give up custody of their private keys (i.e., they don’t store user tokens on their behalf), which essentially means that users cannot directly control or manage those tokens without help from the exchange itself. Additionally, they have strict KYC procedures that users (and businesses) seeking to transact through them must adhere to.

By contrast, DEXes are websites for trading crypto tokens that do not rely on a third party for transaction or asset management services.

Let’s take a closer look at why businesses might choose one type of exchange over the other.

The Benefits and Drawbacks of Decentralized and Centralized Exchanges

A centralized crypto exchange relies on a single server or a group of servers controlled by a company for asset and transaction management. Transactions tend to be slower and cost more.

This is where decentralized exchanges shine, being built on a peer-to-peer network architecture with no single point of failure. Users retain control over their tokens and private keys. All transactions happen directly between peers without the need for a third party. This means lower costs and greater efficiency for companies.

While centralized exchanges are easy for fledgling companies to use, allow traders to buy crypto tokens with fiat money, and help them reach a wider audience due to their simplicity and availability, the same cannot be said with DEX’s, as they tend to be a bit more technical and require a specialist be brought in with technical experience in the field. They are not straightforward (yet), do not comply with local laws, and are not as widely available as centralized exchanges.

A general misconception used to be that CEX was more vulnerable to cyber attacks than DEX. On the contrary, attacks on popular DEXs over the past few years have proven that there are indeed vulnerabilities to exploit, leaving users to rather stick with the devil they know – CEX.

Centralized Exchanges: the Popular Choice for Businesses

Businesses usually select centralized exchanges as they are more transparent, and a professional in the field is not required to launch transactions with cryptocurrencies.

A centralized exchange remains their best crypto firm, especially when they don’t want to read a bunch of complicated articles about cryptocurrency wallets and security practices. Once their customers complete KYC checks, they proceed to purchase any coin on a centralized exchange. And depending on how trustworthy the CEX in question is, their customers can be confident that their assets will be safe even if a hack occurs. Oftentimes, they’re entitled to compensation from the exchange in that case.

Beyond centralized exchanges’ being easy to use, secure, and reliable, KYC measures exist to ensure firms and their customers never permanently lose their tokens. The biggest banks thus far have found digital currency too lucrative an adaptation to pass up. Few firms wish for the fate of James Howells, who forgot about the Bitcoin on a hard drive when he threw it out in 2013 during a clean-out, losing out on an estimated 180 million USD as of August 2022. If he had it on a centralized exchange, all James had to do was prove that he’s the owner, provided he onboarded and did KYC. On the flipside, banks such as Deutsche Bank AG and Skandinaviska Enskilda Banken have been fined 588 million dollars and 107.3 million dollars, respectively, for failing to comply with KYC anti-money laundering measures. Read our separate article for more on the relationship between digital assets and banking.

So now, we’ve mentioned KYC more than three times.

What exactly is it?

Understanding KYC: The Inner Workings of the Crypto KYC Process

Beyond the general description discussed above, there are a few specifics that crypto exchanges mandate in their robust KYC policies, and knowing why and how they do them is a must.

The KYC process includes collecting basic information for customer identity verification like names, addresses, phone numbers, customer identity type, and other details. The customer identity type is categorized into two types. The first is “real-life identities” (RLI), which includes information like social security numbers, driver’s license(s), passport(s), and other documents.

The second type is “self-created identities” (SCI), like email addresses, usernames, and other unique identifiers that are not issued by governments. Another important factor is purpose and authority: the KYC standards can vary according to the purpose of the transaction, the jurisdiction, and the authority conducting the verification. This gives crypto exchanges flexibility to comply with local AML regulations and easily identify and flag customers should something fishy take place.

Centralized Exchanges and KYC Requirements

If organizations intend to permit payment using cryptocurrencies in addition to fiat money, they must undergo a KYC procedure. In crypto, Know Your Customer means that a centralized exchange will require you to provide certain personal information (like your head office address, license information, tax ID, etc.) and proof that you are who you say you are indeed executives duly authorized to represent the company (e.g., a scan of the business license, power of attorney, or proof of ownership).

Centralized exchanges implement the KYC processes because they are regulated financial institutions that are subject to government oversight. They are responsible for preventing money laundering and other illicit activities, and they have to monitor customers to make sure that they are not involved in any illegal activities.

KYC and Company Liability

Since crypto exchanges are a target for a wide range of cybercriminals, KYC compliance is crucial when it comes to financial institutions verifying customers, identifying risks, and mitigating them. It is also important to comply with KYC and AML regulations.

Without these standards, an exchange, like any traditional business, can lose its license to operate, be charged with penalties, and face lawsuits. Jurisdictions are working towards developing AML standards and regulations for crypto exchanges. For this reason, crypto firms (and crypto exchanges) need to consider implementing basic KYC processes before the regulations are in place.

Understanding KYC in Financial Transactions on the Web

There is a misconception that all financial institutions need to request KYC data from their clients to keep them safe. The opposite is true—banks and similar organizations are under pressure from regulatory agencies to do a better job of combating money laundering & fraud. Thus, they are encouraging clients to provide the information and settle any disputes quickly. The reason for this is that it takes a long time for fraud and money laundering investigations to conclude. While the authorities investigate suspicious activities, banks end up liable for the funds. So, as a business, they’re looking out for their interests. Hence why they are keen on getting info from clients to speed up the process.

With that said.

Cybersecurity is more important than ever in the crypto world, as a massive number of users—both regular people and cryptocurrency speculators—have gained access to these platforms.

Drawbacks of KYC Processes for Exchanges

While the KYC process and AML endeavors to prevent schemes are vital to the safety and security of exchange platforms, it is not without limitations. Several issues can affect this and compromise the AML standards. Some of these issues include the following:

- Coverage: not all new customers will be willing to provide their PII. The exchange should have a clear policy of what information is required and what information is optional. The exchange should also ensure that the information is mandatory.

- Accuracy: The data collected during the KYC process must be accurate. Otherwise, the risk assessment could be inaccurate, and customers could end up being irritated by undue scrutiny.

- Completeness: The KYC process should be completed for all customers the standards apply to. While there are exceptions for certain segments, all of an organization’s customers should be provided with a clear explanation of the reason for the exception.

- Privacy and Security: Customers will not use an exchange if they do not feel safe providing information about themselves. This can lead to poor retention rates, reputational damage, and financial loss.

Social Engineering & KYC for Crypto

Among the biggest threats to KYC in exchanges, web 3.0 is social engineering.

According to data, there social engineering was engaged in 47% of financial fraud attempts discovered in Europe between Q2 2021 and Q2 2020, an increase of 37%.

Social engineering is how criminals use investment returns as incentives to coerce victims into depositing cryptocurrencies into their wallets or handing over their login information.

A pyramid scheme, also known as a so-called high-yield investment program, or HYIP, is the most typical social engineering approach. These con artists demand that their victims put their cryptocurrencies into a “fund” that pays a certain percentage each month. When there is not enough money flowing in from new customers to pay off previous users, the fraud continues to operate as claimed.

Free handouts from cryptocurrency exchanges are a typical form of social engineering attack. Attackers pose as businesses or famous people and offer an alluring giveaway, but a little contribution is needed to make the transaction possible.

Nowadays, one Know Your Customer (KYC) procedure includes verifying a customer’s PII snapshot during the program’s onboarding phase.

A completely new, continuous strategy is required in light of recent social engineering techniques. Once the passenger has boarded and been approved, they need a constant, “movie-like” method of consumer verification. This ongoing KYC strategy is known as “Identity Monitoring”.

Customer Experience and KYC

Because KYC adds complexity to the onboarding process as consumers undergo requisite identity verification stages, emerging technologies for online identity verification are essential. Banks incur costs as a result of lengthy wait periods, and consumers who anticipate quick responses find this annoying. In fact, recent studies found that customers gave up trying to sign up for new financial services. The main reason? It simply took too long and was too difficult.

Every organization must therefore figure out how to strike a compromise between KYC requirements and the need for quick, effective onboarding procedures that provide a satisfying customer experience.

Is Customer KYC Authentication Secure?

KYC is based on a company’s biometric data and biometric verification processes, so there is no room for deception. Company data is not transferred between servers. The data is encrypted, and the business is given its own storage space. Genuine KYC infrastructure does not infringe on customers’ privacy.

The Main Intent of Crypto KYC Regulations

Reducing the risk of identity theft, money laundering, financial fraud, and funding criminal groups are the main goals of KYC. Implementing robust KYC policies aids in risk management and further helps understand client behavior. Due to the significance of the KYC process, exchanges are required to gather and verify certain information about companies’ customers, including their names and authorized signatures, the legal status of the company, the identification of account owners, and other details based on the risk strategy. Companies demonstrating KYC mandatory in the near future add a level of necessary security and protect themselves from legal issues.

Conclusion

The KYC regulations should be standard practice for any company that wants to comply with existing regulations and protect their customers from fraud and money laundering on a crypto exchange. While the process has its limitations, it is an essential component of conducting a business that permits transactions via a crypto exchange that substantially facilitates commerce. Major exchanges are regulated differently by region in terms of the crypto verification process, your cryptocurrency wallet, and cryptocurrency transactions. For that reason, we’ve broken down a list by region here.

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)