share

EstateX is revolutionizing the real world assets (RWA) tokenization landscape with its groundbreaking multi-stage token launch strategy. By seamlessly blending strategic tokenomics, rock-solid regulatory compliance, advanced technology, vibrant community engagement, and carefully phased token distribution, EstateX has set a new benchmark in the RWA space. This comprehensive approach not only strengthens the foundation for its native token (ESX) but also creates a blueprint for other real world assets projects to follow, driving sustainable growth and boosting investor confidence for the long haul.

Tokenomics: A Community-Centric Approach

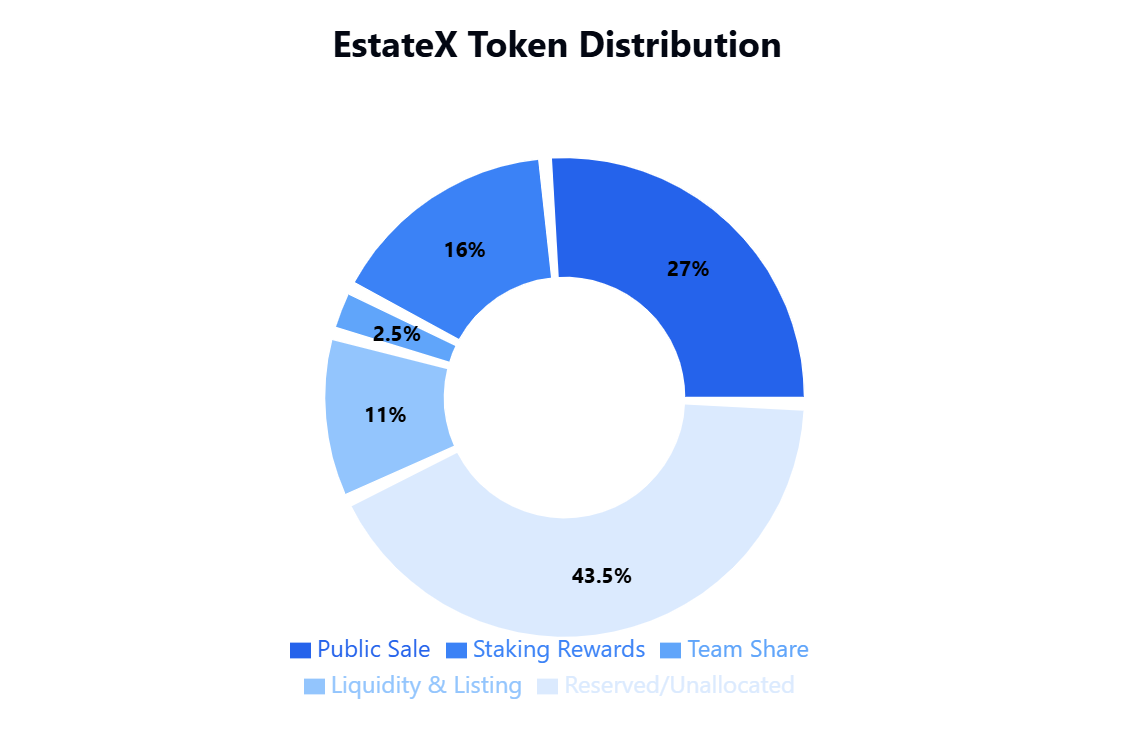

One of the most significant factors behind EstateX’s success was its community-driven tokenomics. Unlike many projects that allocate a large portion of tokens to the team or insiders, EstateX carefully designed its token distribution to avoid centralization and ensure broad participation from the community.

- Public Sale: 27% of the total token supply was allocated to the public sale, ensuring accessibility for the broader community.

- Staking Rewards: 16% was dedicated to incentivizing long-term holders through staking rewards, thus encouraging sustained interest and engagement.

- Team Share: Only 2.5% of tokens were reserved for the team, ensuring that the project’s growth was not dominated by a few key players.

- Liquidity & Listing: 11% was allocated to liquidity and listing, ensuring smooth trading and stability for the token on exchanges.

This thoughtful allocation helped avoid a concentration of power in the hands of a few, reducing the risks associated with price manipulation and sudden sell-offs. EstateX’s strategic approach to tokenomics fostered a loyal community that supported the project through thick and thin.

Legal Compliance: Building Trust for RWAs

EstateX’s commitment to legal compliance played a crucial role in its success. By registering in the Netherlands, EstateX adhered to EU and US regulations, including MiCA and SEC rules. This legal transparency reassured institutional investors, which in turn increased credibility and trust in the project.

Key compliance measures included:

- KYC/AML: A strict Know Your Customer (KYC) and Anti-Money Laundering (AML) process ensured that only verified users participated in the token sale, mitigating the risks of fraud and malicious activities.

- Licensing: EstateX’s full regulatory compliance in the EU and the US meant that investors could feel confident about the legal standing of their investments.

This approach helped establish EstateX as a trustworthy and credible player in the RWA tokenization space, making it a safe choice for both retail and institutional investors.

Technological Foundation: Robust and Secure Infrastructure

The technological backbone of EstateX’s platform was another vital element of its success. EstateX chose Binance Smart Chain (BSC) as its primary blockchain, with bridges to Ethereum and Solana, ensuring broad user access and cross-chain compatibility. The use of BSC allowed for fast and low-cost transactions, which was crucial for the project’s scalability.

Key technological elements included:

- Smart Contracts: Smart contracts were used to manage the issuance of the ESX utility token and the PROPX tokens, which represent fractional ownership in real estate assets. These contracts were thoroughly audited to ensure security and protect investors from vulnerabilities.

- Security Measures: EstateX adopted best practices in cybersecurity, including SSL protection, Cloudflare, and multi-factor wallet protection to safeguard user funds and ensure the integrity of its platform.

By focusing on security and scalability, EstateX created an ecosystem where both users and investors could trust that their investments were safe and that the platform would continue to perform efficiently.

How to Achieve Community Growth for Real-World Assets

Community engagement is crucial to the success of any blockchain project, and EstateX made this a top priority. EstateX leveraged major social platforms like Twitter, Telegram, and Discord, as well as traditional educational tools, to build a loyal, well-informed user base.

Key community-building strategies included:

- Educational Programs: EstateX launched initiatives like EstateX University to educate users about the benefits of real estate tokenization and the project’s ecosystem. This not only empowered users but also created a community of advocates who understood the project’s value.

- AMA Sessions and Transparency: Regular AMAs (Ask Me Anything) and updates kept the community informed and engaged. Transparent communication about project milestones, token sales, and technical developments created a strong sense of community ownership.

- Partnerships: Strategic partnerships with well-known real estate brands like RE/MAX added credibility and visibility to the project, attracting both crypto enthusiasts and traditional investors.

These efforts helped foster a loyal and supportive community, ensuring steady interest and long-term growth rather than short-term speculation or volatile “pump-and-dump” behavior.

Staged Token Launch: Gradual Distribution for Long-Term Stability

One of the standout features of EstateX’s approach was its multi-stage token launch. Rather than releasing the entire token supply in one go, EstateX employed a phased approach that allowed for gradual distribution, minimizing volatility and building sustained investor interest.

The stages included:

- Private Rounds: The project began by raising funds through private rounds with strategic investors, which provided initial capital and expertise.

- Public IDOs: Following the private rounds, EstateX conducted a series of public Initial DEX Offerings (IDOs) on multiple launchpads, including Seedify, TrustSwap, and others. This ensured that the project had a broad and diverse group of token holders.

- Vesting Schedules: EstateX implemented strict vesting schedules for its token sales, with only a small portion of tokens unlocked at the time of the token generation event (TGE). The rest was gradually unlocked over a period of several months, preventing large-scale sell-offs and ensuring a stable token price.

This gradual distribution helped maintain a steady demand for tokens and ensured that the price of ESX remained relatively stable post-launch, with support from a well-informed and engaged community.

RWA Marketing Strategy: Leveraging PR and Partnerships

EstateX’s marketing strategy combined traditional PR, influencer partnerships, and crypto-specific media to build its brand recognition. By leveraging media appearances and collaborating with renowned real estate brands like RE/MAX, EstateX was able to attract attention from both the crypto and traditional finance sectors.

Key marketing strategies included:

- Press Coverage: EstateX received coverage in prominent publications and news outlets, which helped to generate buzz around the project and attract new investors.

- Influencer Marketing: The project also partnered with well-known influencers in the crypto space to spread the word about its token launch and ongoing developments.

- Social Media Engagement: Social media platforms like Twitter and Telegram were used to keep the community informed about progress, milestones, and upcoming events. Regular updates, countdowns to TGE, and transparency in token sale conditions helped build excitement and anticipation.

EstateX’s ability to combine these marketing channels effectively helped to position it as a credible and exciting project in the RWA space.

Market Volume in Tokenized Real World Assets (RWAs)

Tokenized Real World Assets, especially within the blockchain and crypto ecosystem, is an emerging market. However, the total market volume is difficult to pin down precisely due to its nascent stage and lack of standardized reporting. Still, there are some estimates and growth forecasts available from industry analysts.

| Asset Class | 2023 Volume | 2024 Projected Volume | 2025 Projected Volume |

|---|---|---|---|

| Tokenized Real Estate | $200M – $300M | $600M – $900M | $1.5B – $2B |

| Tokenized Commodities | $100M – $150M | $300M – $500M | $1B |

| Tokenized Infrastructure | $50M – $100M | $150M – $300M | $500M – $1B |

| Total Tokenized RWAs | $300M – $500M | $1B – $2B | $4B – $6B |

Conclusion

For RWA projects eager to make a lasting impact, EstateX’s playbook offers more than lessons—it offers a proven formula for dominance. To truly maximize success in the competitive real world assets market, partnering with industry experts like ICODA can be a game-changer. By combining EstateX’s winning approach with ICODA’s marketing expertise, RWA projects can unlock unmatched growth, credibility, and long-term success in the blockchain space.