The perpetual DEX sector commanded $1.064 trillion in monthly turnover by late 2025, capturing a decisive 26% of all crypto derivatives volume. But this explosive growth masks a brutal reality: the October 2025 flash crash, which triggered $19.35 billion in liquidations, separated battle-tested platforms from pretenders. For traders navigating this fragmented market, platform selection is no longer about chasing the highest leverage or lowest fees—it’s about identifying which protocols survived the stress test with their infrastructure, user capital, and reputation intact.

1. Hyperliquid: The Speed King With a Credibility Problem

Key Metrics: $9.1B Open Interest (18.1% market share), 190+ markets, 0.1-0.2s finality

Best For: High-frequency traders and professional market makers prioritizing execution speed

Unique Features: Custom L1 blockchain, zero gas fees, 31% Genesis airdrop with no VC allocation

Hyperliquid remains the undisputed technology leader in the perpetual dex ecosystem, processing 20,000 orders per second on its purpose-built Layer 1 with sub-second finality. The platform’s $9.1 billion in Open Interest proves that professional traders value raw performance above all else—this metric represents sticky, high-conviction capital that costs users funding fees to maintain. The platform’s tokenomics masterclass, directing 97-99% of trading fees to HYPE buybacks while maintaining zero gas fees, created a powerful flywheel that generated $1.24 billion in annualized revenue with just 11 employees.

However, the October 10 crash exposed severe vulnerabilities. Hyperliquid recorded $10.31 billion in liquidations—more than Binance and Bybit combined—wiping out 1,000+ wallets completely. The December 2024 North Korea security incident, where DPRK-linked wallets traded on the platform and triggered $502.7 million in net outflows, revealed concerning centralization risks with only 16-20 validators securing the $2.3 billion bridge. The platform’s core code remains unaudited and closed-source despite DeFi claims, and the team dismissed external security researchers’ assistance. For traders, this means superior execution speed comes packaged with elevated security risk and potential insider trading concerns during black swan events.

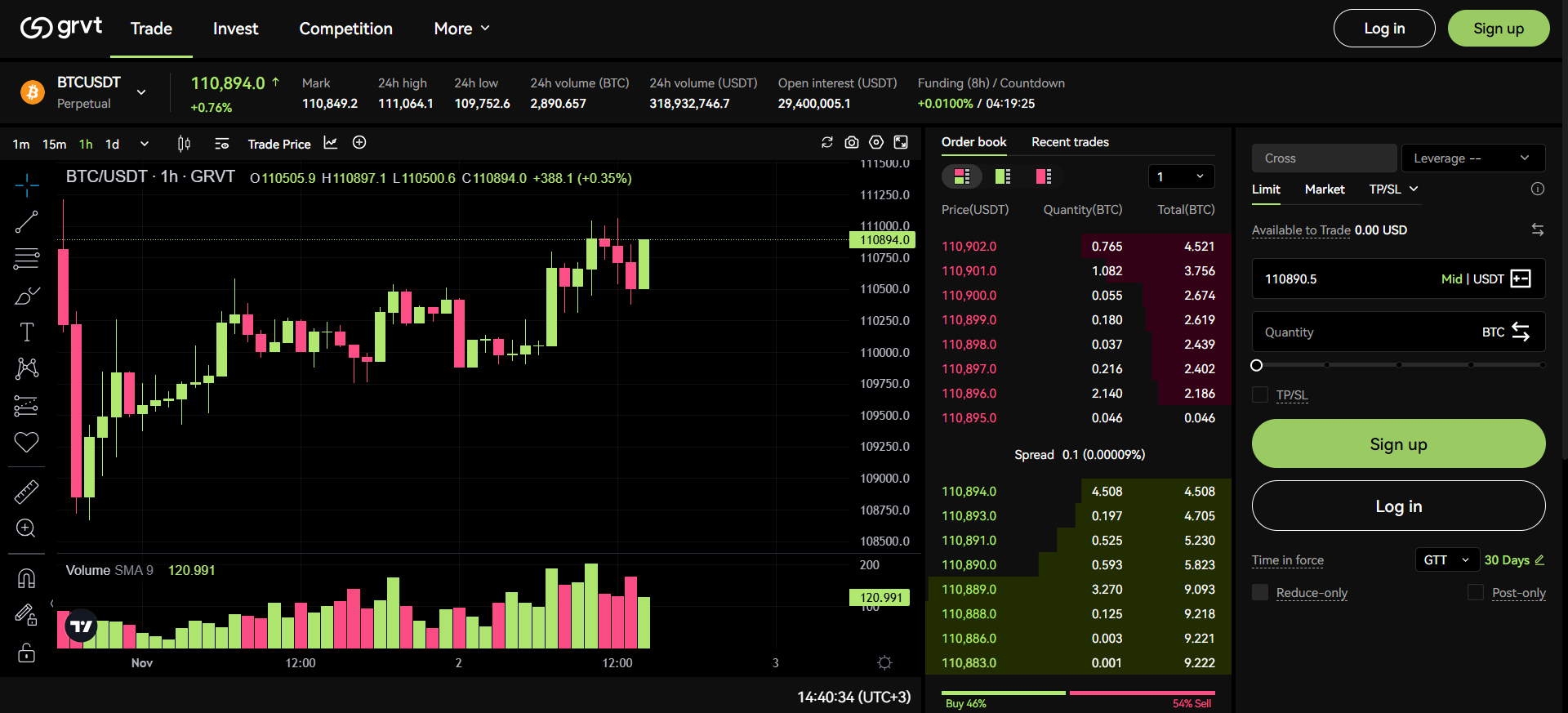

2. GRVT: The Institutional Safe Haven

Key Metrics: $43.9M Open Interest, 67+ markets, 100% uptime during Oct 10 crash

Best For: Risk-averse institutions and professional traders prioritizing security and regulatory compliance

Unique Features: Bermuda Class M license, privacy-by-default architecture, hybrid orderbook + RFQ model

GRVT emerged as the dark horse of 2025, delivering what may be the perpetual dex sector’s most impressive performance during the October 10 stress test: zero downtime, zero socialized losses, and full stability throughout $19.35 billion in market-wide liquidations. For institutional traders burned by Hyperliquid’s catastrophic crash performance, GRVT’s flawless execution—achieved just months after launch—represents a paradigm shift toward reliability over raw speed.

The platform’s strategic moat is threefold. First, its Bermuda Class M DABA license (with Dubai and EU MiCA applications pending) creates genuine regulatory separation from unlicensed competitors, addressing institutional compliance requirements that 1001x leverage platforms deliberately ignore. Second, its zkSync Validium architecture provides privacy-by-default—position sizes, entry prices, and liquidation levels remain hidden, preventing front-running and liquidation sniping that plague transparent platforms. Third, the hybrid orderbook + RFQ model combines retail accessibility with institutional-grade guaranteed liquidity via 16 pre-committed market makers ($3.3 billion in commitments). While current trading volume remains modest compared to leaders, GRVT’s $33.3 million in funding and 52-person team (50% engineers) suggest long-term infrastructure investment over short-term volume farming.

3. Lighter: The Zero-Knowledge Verifier

Key Metrics: $1.67B Open Interest (18.2% market share), 100+ markets, zero fees for retail

Best For: Traders prioritizing cryptographic fairness guarantees and capital-efficient execution

Unique Features: Application-specific zkSync Validium, verifiable order matching, zero retail fees

Lighter Protocol achieved top-3 market share through a controversial bet: that cryptographic verifiability matters more than brand recognition. Built as an application-specific zk-Rollup on Arbitrum, Lighter provides mathematical proof of fair execution—every trade match is cryptographically transparent, eliminating the “black box” manipulation risks inherent to centralized matching engines. This technical innovation, combined with true 0/0 fees for retail traders, drove daily volumes past $9.1 billion despite invite-only access and minimal marketing presence.

However, Lighter’s trajectory reveals the perpetual dex sector’s sustainability crisis. The platform experienced significant stability issues during the October 10 crash, including sequencer outages that prevented traders from closing positions, resulting in an estimated $50 million in user losses ($25M from the crash itself, $7M from post-crash outage). While the platform offered 250,000 points compensation (~$20M at pre-crash prices), this represented a 40% shortfall. More fundamentally, the zero-fee model creates a revenue problem: without fees from the 18.2% market share, monetization depends entirely on future premium API access for institutions and the success of a yet-to-launch token. The platform’s 0.19-0.27 volume/OI ratio—far below the healthy ≤5 range—indicates extensive airdrop farming rather than organic demand, suggesting 50-70% volume collapse post-TGE is likely.

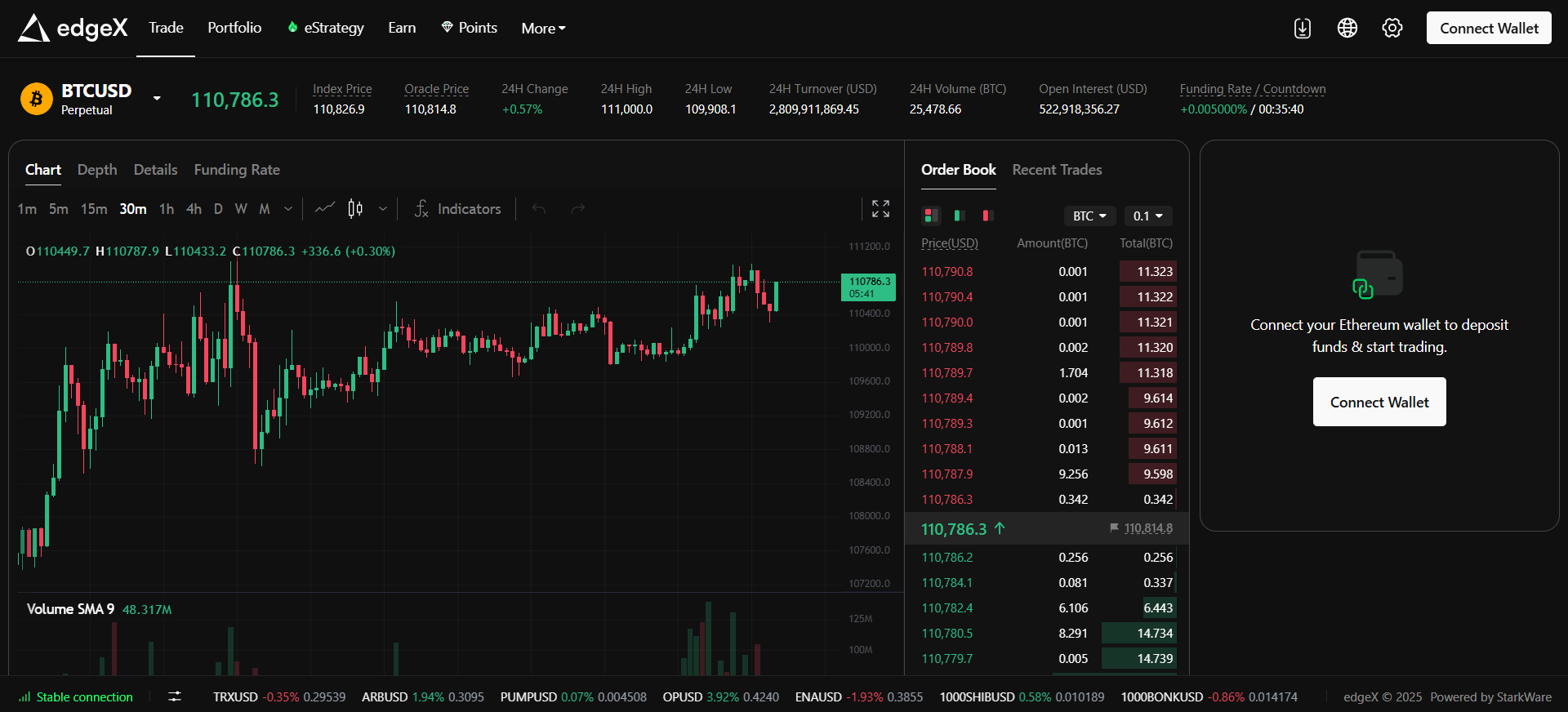

4. EdgeX: The TradFi Transplant

Key Metrics: $863M Open Interest (12.8% market share), 170+ markets, 200K orders/sec with <10ms latency

Best For: Former institutional traders seeking familiar infrastructure with self-custody benefits

Unique Features: Amber Group incubation ($5B AUM), team from Morgan Stanley/Barclays/Goldman Sachs

EdgeX represents the “TradFi playbook” for perpetual dex competition: leverage elite team pedigree, institutional backing, and professional-grade infrastructure to capture traders who prioritize reliability over experimental features. Incubated by Amber Group, which provides deep market-making support across 30+ banks and 2,000+ institutional clients, EdgeX delivered CEX-grade performance (200,000 orders per second, sub-10ms latency) on battle-tested StarkEx infrastructure that has processed $1.28 trillion since 2020.

The platform’s October 10 performance validated this conservative approach: EdgeX maintained normal operations with no system failures or liquidation cascade, while mobile app functionality continued seamlessly—a competitive advantage over desktop-only competitors. The four-layer architecture (Settlement on Ethereum, Match Engine at 200K TPS, Hybrid Liquidity across 70+ chains, UI Layer) combined with Stork Oracle’s 50ms updates provides the redundancy that prevented single points of failure during extreme volatility. However, EdgeX’s 12.8% market share and $863 million Open Interest remain insufficient to challenge Hyperliquid’s dominance, suggesting the institutional segment—while stable—may lack the viral growth potential of retail-focused platforms. The platform’s Asian market focus, particularly Korea, positions it well for regional expansion but limits global penetration.

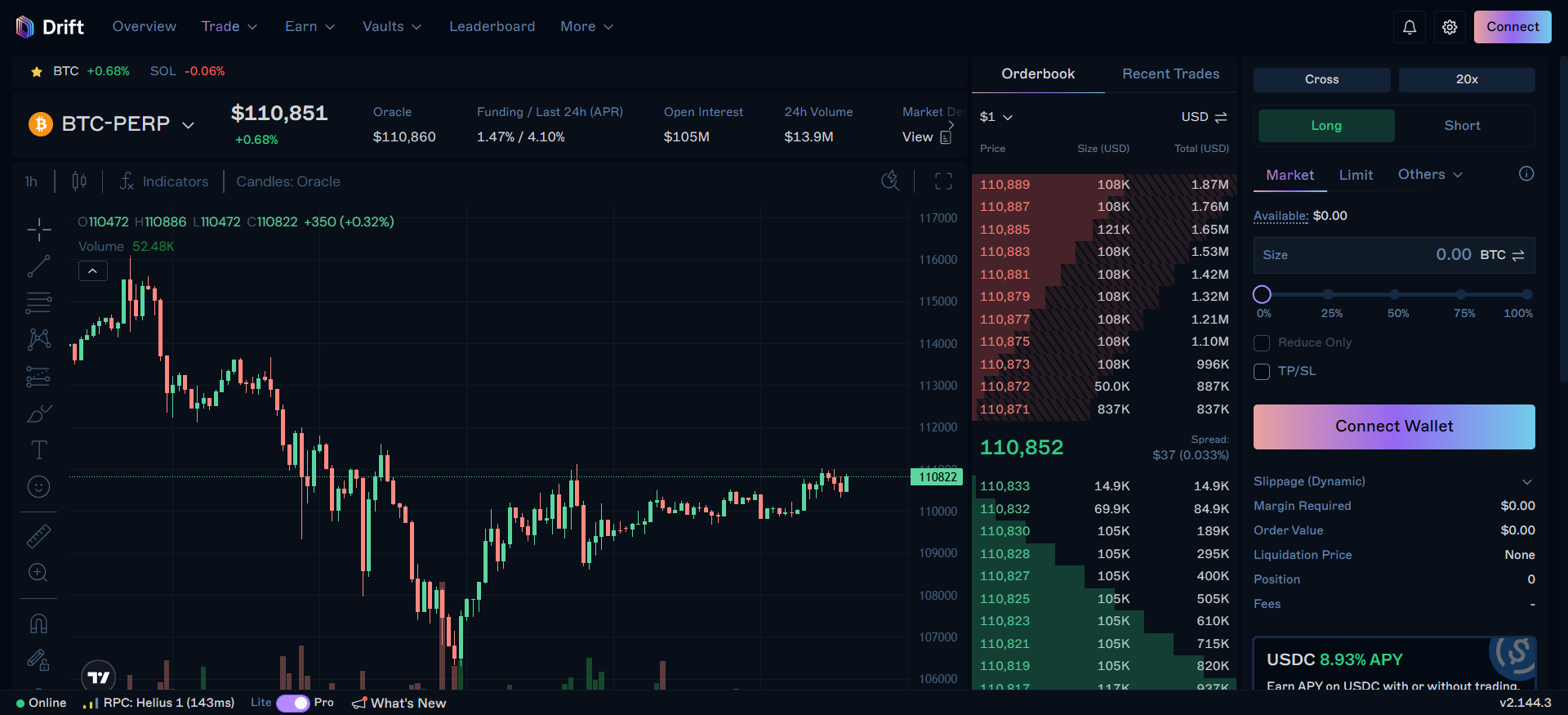

5. Drift Protocol: The Solana Survivor

Key Metrics: $580M Open Interest, 70+ markets, $29M annualized revenue

Best For: Solana ecosystem traders seeking capital-efficient, multi-product DeFi hub

Unique Features: Survived Terra Luna and FTX collapses, Super Protocol (perps + spot + lending + vaults)

Drift Protocol‘s most valuable asset isn’t technology—it’s trust earned through three years of crisis survival. As the definitive Solana-native derivatives champion, Drift weathered the Terra Luna collapse (May 2022) that exposed V1 vulnerabilities, responded with seven months of transparent rebuilding, then survived the FTX/Alameda Research collapse despite direct backing from Alameda. This “battle-tested” narrative, combined with $52.5 million in funding from Multicoin, Jump Capital, and Polychain, positions Drift as the anti-fragile alternative in the perpetual dex wars.

The platform’s evolution from pure perps to “DeFi SuperApp” demonstrates strategic product diversification. The hybrid vAMM + DLOB + JIT model solved static liquidity issues plaguing competitors, while deep integration of Solana-native assets (SOL, mSOL, jitoSOL, BONK) as collateral maximizes capital efficiency for ecosystem traders. Recent expansion includes Drift Vaults ($170M TVL in two months—strong product-market fit signal), BET prediction markets ($20M 24h volume week one), and Drift Earn auto-yield (66% APY peak). However, Drift’s fate remains inextricably linked to Solana’s infrastructure: any future major outage or network-level exploit directly impacts the platform’s viability. With TVL growing from $15M to $1B+ (66x) and cumulative volume exceeding $55 billion, Drift proves that longevity and retention trump short-term volume farming—but only within the Solana ecosystem’s walls.

6. dYdX Chain: The Declining Empire

Key Metrics: $114M Open Interest (0.60% market share collapsed from 80% peak), 240+ markets

Best For: Traders prioritizing market variety and established brand governance

Unique Features: Sovereign Cosmos appchain, 100% fee revenue to validators/stakers, permissionless listings

dYdX‘s migration from StarkEx Layer 2 to its own Cosmos SDK blockchain represented a bold bet on vertical integration and sovereignty—capturing 100% of protocol revenue rather than paying Layer 1 fees. The strategic thesis was compelling: a purpose-built appchain with off-chain orderbook managed by validators, custom MEV protection, and sub-second finality would cement dYdX as the “endgame” for decentralized derivatives. Instead, market share collapsed from 80% dominance (2021-2023) to 0.60% by late 2025, with Q2 2025 earnings dropping 84% due to Hyperliquid competition.

The October 10 crash crystallized dYdX’s vulnerabilities. An 8-hour outage during the largest liquidation event in history—caused by misordered code deployment and validator coordination delays—resulted in stale oracle prices and incorrect liquidations affecting 27 users. While governance approved $462,097 in compensation (76.99% turnout, 89% approval), the timing damaged trust irreparably. The platform’s 240+ perpetuals strategy (industry-leading variety via permissionless listings with USDC bond) prioritizes breadth over depth, risking liquidity fragmentation across hundreds of thin markets. For traders, dYdX remains relevant for accessing obscure assets unavailable elsewhere and participating in mature on-chain governance, but the “own chain” architecture introduces user friction (bridging to non-EVM Cosmos) that faster competitors avoid. The $20M DYDX trading rewards program and planned US market re-entry via spot trading represent attempts to recapture relevance, but network effects require critical mass per market—not just total market count.

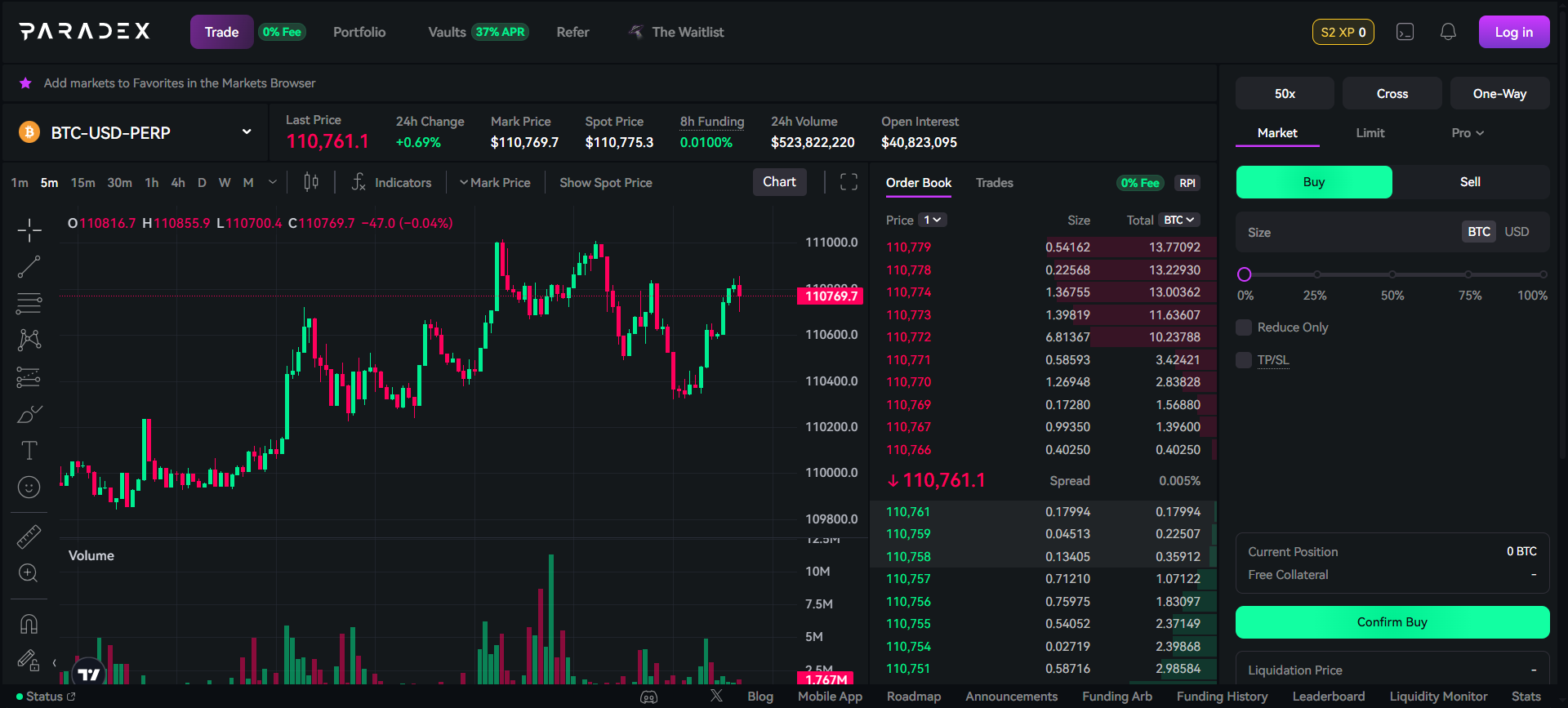

7. Paradex: The Long-Tail Contrarian

Key Metrics: $208M Open Interest, 591 perpetuals (3X nearest competitor), zero fees on 100+ markets

Best For: Degen traders seeking exposure to emerging altcoins and memecoin perps

Unique Features: Paradigm-incubated, fastest perpetual listings in the sector, unified margin across 591 markets

Paradex is executing the perpetual dex sector’s boldest contrarian thesis: rather than competing with Hyperliquid and dYdX on BTC/ETH liquidity depth, create an entirely new “blue ocean” market by offering derivatives on assets no one else lists. The platform’s 591 perpetuals represent a deliberate strategic choice—targeting degen traders who want to long memecoins, short new L1s, or trade “friend-tech” points with leverage. If Hyperliquid is Coinbase, Paradex is deliberately positioning as Kucoin.

Incubated by Paradigm (one of crypto’s most technically respected VCs) and built on a Starknet appchain, Paradex leverages internal spot oracles to enable instant listings and pre-market trading before CEXs. The September 2025 implementation of zero fees (0% maker, 0% taker on 100+ perp markets, excluding BTC/ETH) follows the Hyperliquid playbook of subsidizing growth for market share. The unified margin system allows traders to manage all 591 markets from a single account with cross-collateralization, preventing capital lock-up that would otherwise make such breadth impractical. During the October 10 crash, Paradex maintained zero downtime and remained solvent, with its mark price system preventing unfair liquidations from corrupted oracle data. However, liquidity remains very thin on most of the 591 pairs—the top 10-20 pairs offer strong execution, but the remaining 400+ show wide spreads. The platform’s extended Season 2 airdrop (20% supply allocation) postponed TGE due to “unfavorable market conditions,” suggesting post-airdrop retention concerns may delay monetization plans.

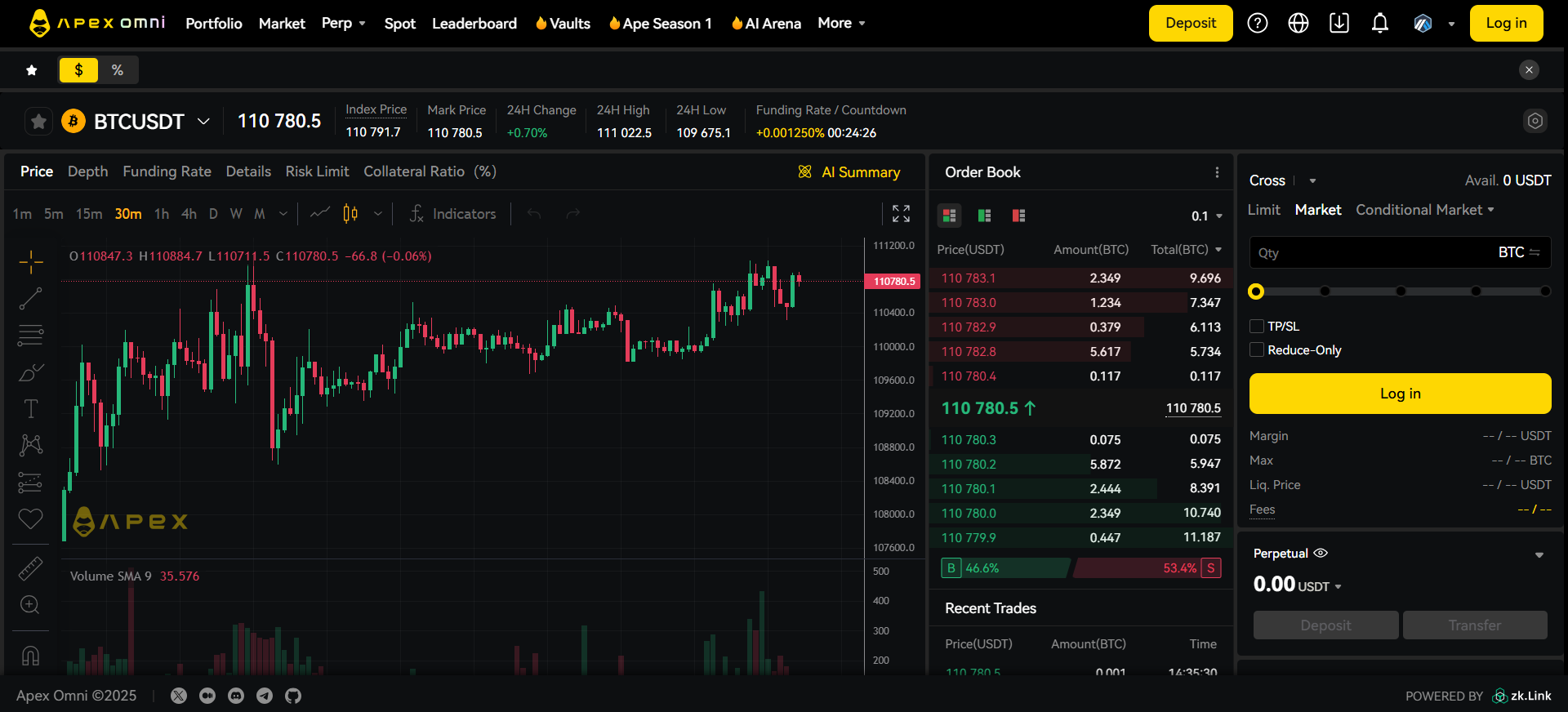

8. ApeX Omni: The Multi-Chain Aggregator

Key Metrics: $54M Open Interest (4.60% market share), 120+ markets across 5+ chains

Best For: Traders seeking seamless multi-chain access without manual bridging

Unique Features: Omni-chain deposits (Ethereum, Arbitrum, BSC, Solana, Base, Mantle), Grid Bots with negative fees

ApeX Omni achieved 14.5x user growth in six months (10,000 to 145,000 users) by solving the perpetual dex sector’s fragmentation problem: instead of forcing traders to choose a single chain, operate across all major EVM chains with unified UX and no manual bridging. Built on StarkEx with deposits accepted from Ethereum, Arbitrum, BSC, and Solana, ApeX provides capital efficiency through cross-collateralization of eight tokens while future-proofing the protocol by enabling easy addition of new chains as ecosystems emerge.

The platform’s rapid scaling from 45 to 120+ markets in 18 months demonstrates modular architecture advantages—StarkEx enables quick deployments while the Bybit partnership provides resources and liquidity access. ApeX differentiates through gamification: daily check-ins offer Mystery Boxes with prizes (iPhone, Apple Vision Pro, Lamborghini), ApeSoul SBT tracks reputation, and Grid Bots provide automated strategies with negative fee rebates (-0.002%). The Trade-to-Earn model distributes APEX tokens (supply reduced from 1B to 500M via quarterly burns) with weekly buybacks of 30,000-50,000 APEX from 50-90% of fees. However, ApeX faces the same sustainability concerns as Aster: T2E models inherently incentivize wash trading and inflate volume metrics, potentially degrading market quality. With 16 market makers committing $3.3 billion monthly and StarkEx’s battle-tested infrastructure, the platform likely maintained stability during October 10, but specific crash performance data remains undisclosed. For multi-chain traders prioritizing convenience over maximum liquidity depth, ApeX offers genuine utility—but whether this translates to long-term retention post-airdrop remains unproven.

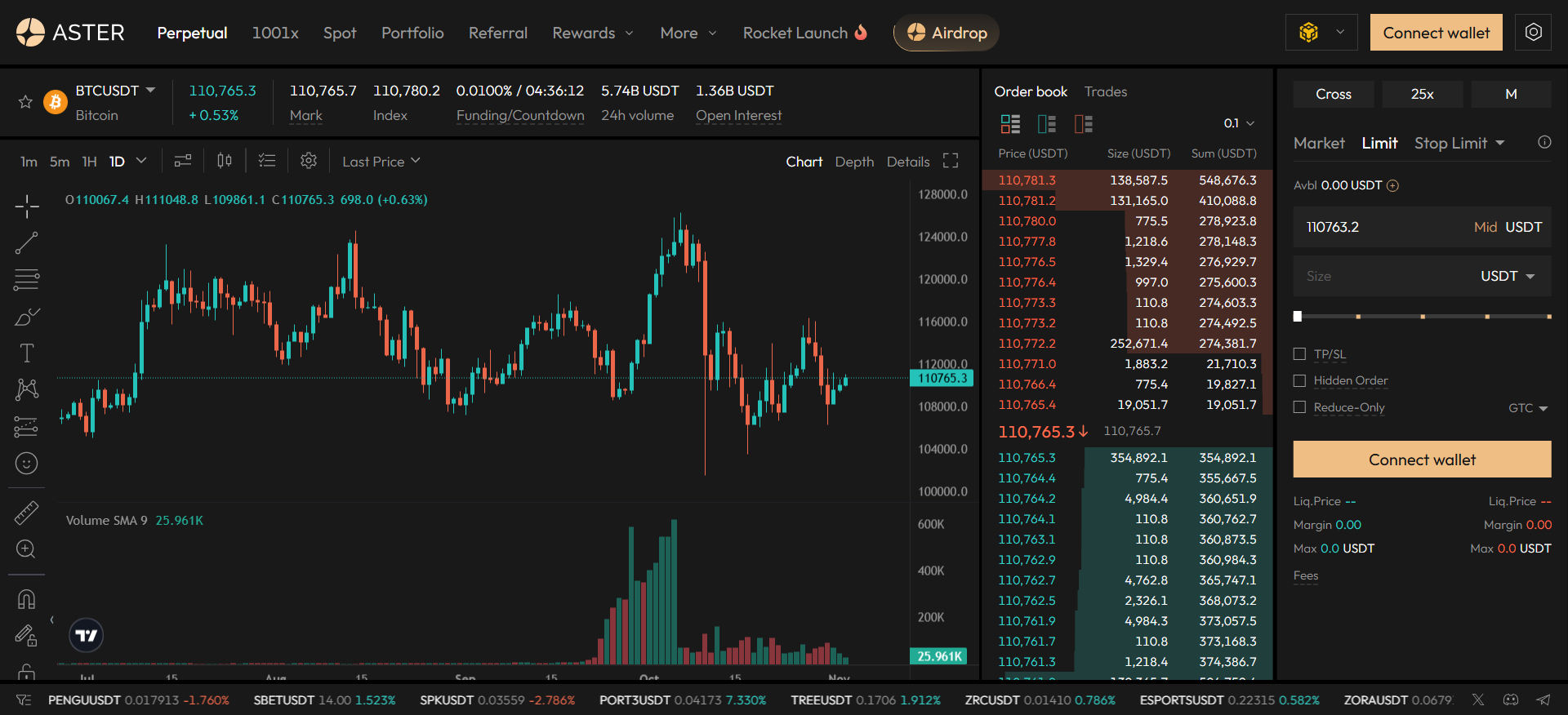

9. Aster: The Compromised Volume Leader

Key Metrics: $2.98B Open Interest (21.47% volume share—disputed), 140+ markets, 1001x leverage

Best For: High-risk traders seeking maximum leverage and yield-bearing collateral features

Unique Features: CZ endorsement, hidden orders (dark pool-style), yield collateral (5-7% on asBNB/USDF)

Aster‘s meteoric rise to 21.5% volume share stems from Changpeng “CZ” Zhao’s endorsement and YZi Labs backing (formerly Binance Labs), triggering a 400% token surge and mainstream attention via MrBeast’s $114,000 purchase. The platform’s aggressive retail features—1001x “Degen Mode” leverage, hidden orders to prevent front-running (CZ-endorsed), yield-bearing collateral enabling passive income while trading, and 24/7 stock perpetuals—created a perfect storm of viral growth. Operating on BNB Chain with a hybrid AMM + orderbook model, Aster achieved 2M+ users and briefly topped DeFiLlama fee rankings at $25M+ daily.

However, credibility concerns overshadow performance metrics. On October 5, 2025, DeFiLlama founder 0xngmi delisted Aster after discovering volumes mirrored Binance perpetuals almost exactly (1:1 correlation), suggesting extensive wash trading. The platform cannot provide granular data (taker/maker addresses, transaction IDs) and volumes appeared “non-organic,” possibly exchange-generated. While relisted October 19 at Aster’s request, 0xngmi stated the platform remains a “black box” with unverifiable numbers and historical data showing “big gaps.” Token concentration exceeds 90% in fewer than 10 wallets, anonymous leadership (CEO “Leonard” pseudonymous with no verifiable track record), and 85-90% volume collapse from September peaks ($40-60B to $328M) compound concerns. Paradoxically, Aster maintained operational stability during the October 10 crash with no reported system failures—superior to some CEXs—but lower Open Interest ($1.15-2.5B versus Hyperliquid’s $9.1B) meant less genuine stress testing. For traders, Aster offers innovative features at ultra-competitive fees (0.01% maker/0.035% taker) but carries elevated wash trading and regulatory risks that may outweigh convenience.

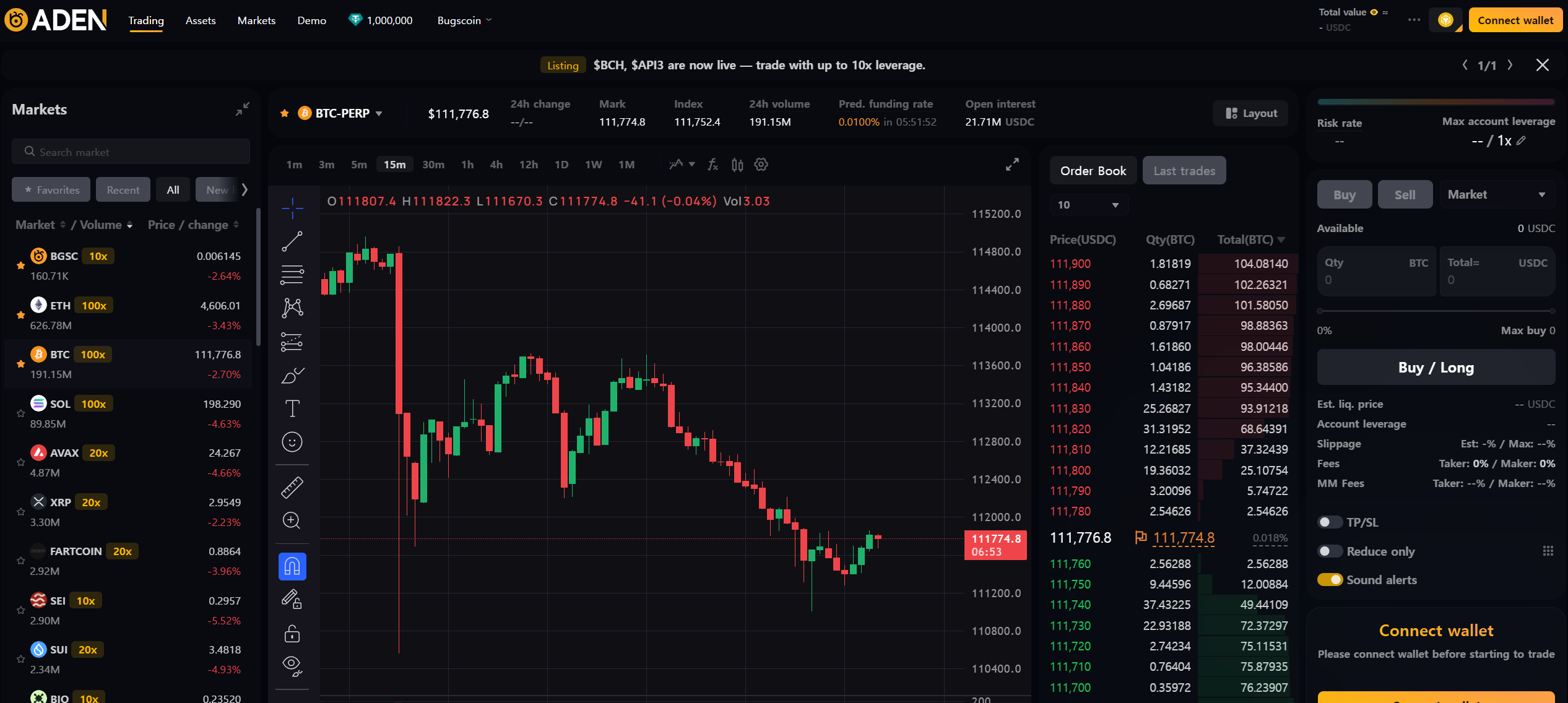

10. ADEN: The Educational On-Ramp

Key Metrics: $22M Open Interest (0.85% market share), 225+ markets, 700K YouTube subscribers

Best For: Korean market traders and those transitioning from simulated to real trading

Unique Features: Bugscoin/AntTalk Global integration (largest simulated trading in Korea), Gate.io acquisition

ADEN represents a unique perpetual dex positioning: the “EduFi-to-DeFi bridge.” Launched July 2025 by INBUM (creator of Bugscoin and AntTalk Global), the platform extends Korea’s largest simulated trading ecosystem into real-market conditions. This educational pipeline converts learners to traders, providing warm leads rather than cold acquisition—a 700,000 YouTube subscriber base offers built-in distribution that competitors cannot replicate. The October 2025 acquisition by Gate Ventures, with official integration November 3, 2025, validates the M&A strategy in perpetual dex consolidation: CEXs acquiring decentralized infrastructure rather than building from scratch.

Built initially on Orderly Network white-label infrastructure (enabling shared liquidity and faster time-to-market), ADEN is migrating to Gate Layer (OP Stack, EVM compatible, secured by GateChain) for enhanced scalability. The platform launched with 225 markets—extremely ambitious for a new entrant—suggesting capital-efficient architecture or aggressive listing strategy learned from Paradex. Ultra-low fees (0% maker, 0.009% taker) and 100M BGSC giveaway for launch celebration drove 45,000 wallet connections on day one, representing 66.8% of Orderly Network’s total DAUs. However, ADEN remains largely unproven: launched just months before the October 10 crash with no documented performance data, BGSC token down 60% from highs, and white-label model offering less technical differentiation than custom-built competitors. The Gate acquisition creates uncertainty around independence and long-term strategic direction. For traders, ADEN’s value proposition is regional (Korean market penetration) and educational (simulated trading conversion), but whether this translates to sustainable liquidity and professional-grade execution remains an open question with only months of operational history.

Strategic Selection Guide: Finding Your Perfect Platform Match

Choosing the right perpetual dex in 2025 requires matching platform strengths to your specific trading profile and risk tolerance:

For Speed-Obsessed Professional Traders:

Hyperliquid remains the performance leader with 0.1-0.2s finality and $9.1B Open Interest proving institutional confidence—but accept elevated security risk (unaudited code, small validator set) and potential insider trading concerns during black swan events. Alternative: EdgeX offers 200K orders/sec with <10ms latency on audited StarkEx infrastructure backed by Amber Group’s institutional liquidity.

For Risk-Averse Institutions:

GRVT’s perfect October 10 crash performance (zero downtime, zero socialized losses), Bermuda regulatory license, and privacy-by-default architecture provide institutional-grade reliability. Trade-off: lower liquidity and nascent ecosystem compared to established platforms.

For Capital Efficiency Maximalists:

Lighter’s zero retail fees and cryptographic verifiability via ZK-proofs eliminate both cost and trust friction—but sustainability concerns (zero-fee revenue model, 50-70% expected post-TGE volume collapse) and October 10 sequencer outages create retention risk. Alternative: Aster’s yield-bearing collateral (5-7% on asBNB) enables passive income while trading, though wash trading concerns compromise credibility.

For Solana Ecosystem Natives:

Drift Protocol’s three-year survival through Terra Luna and FTX collapses, combined with deep LST collateral integration (SOL, mSOL, jitoSOL, BONK) and Super Protocol diversification (perps + spot + lending + vaults), make it the anti-fragile Solana choice—but platform risk remains inextricably linked to Layer 1 performance.

For Long-Tail Asset Speculators:

Paradex’s 591 perpetuals (3X nearest competitor) and fastest-listing mechanism capture memecoin and emerging L1 derivatives unavailable elsewhere, with unified margin preventing capital fragmentation—but expect thin liquidity outside top 20 pairs and prepare for 50%+ volume drop post-20% airdrop TGE.

For Multi-Chain Flexibility:

ApeX Omni’s seamless omni-chain deposits across Ethereum, Arbitrum, BSC, Solana, Base, and Mantle eliminate bridging friction while maintaining unified margin—but Trade-to-Earn model risks wash trading inflation and post-airdrop churn.

Red Flags to Avoid:

Unverifiable volume metrics (Aster’s DeFiLlama delisting), unaudited core code (Hyperliquid), anonymous teams with no track record (Aster’s “Leonard”), platforms with <3 months operational history during the October 10 crash (ADEN, GRVT pre-stress-test), and any protocol offering >100x leverage without robust risk management documentation.

Quick Comparison: Leading Platforms at a Glance

| Platform | Open Interest | Markets | Key Advantage | Primary Risk |

|---|---|---|---|---|

| Hyperliquid | $9.1B (18.1%) | 190+ | Fastest execution (0.1-0.2s), strongest tokenomics | Unaudited code, Oct 10 $10.3B liquidations |

| GRVT | $43.9M (1.72%) | 67+ | Perfect crash record, regulatory license, privacy | Limited liquidity, nascent ecosystem |

| Lighter | $1.67B (18.2%) | 100+ | ZK-verifiable matching, zero retail fees | Sustainability crisis, Oct 10 outages |

| EdgeX | $863M (12.8%) | 170+ | Institutional backing, stable crash performance | Lower liquidity vs. leaders, regional focus |

| Drift | $580M (0.70%) | 70+ | Battle-tested (3+ years), Solana ecosystem depth | Platform risk tied to Solana L1 |

| dYdX | $114M (0.60%) | 240+ | Most markets, sovereign appchain, mature governance | Declining from 80% peak, Oct 10 8-hour outage |

| Paradex | $208M (1.35%) | 591 | Long-tail assets (3X competitors), fastest listings | Thin liquidity on most pairs, airdrop dependency |

| ApeX Omni | $54M (4.60%) | 120+ | Omni-chain (5+ networks), gamification | T2E wash trading risk, unproven retention |

| Aster | $2.98B (21.47%)* | 140+ | Highest leverage (1001x), yield collateral | Wash trading scandal, 85-90% volume collapse |

| ADEN | $22M (0.85%) | 225+ | Educational pipeline (700K subs), Gate.io backing | Too new (July 2025), white-label dependency |

*Volume share disputed due to wash trading concerns

Final Thoughts: The Post-Crash Recalibration

The October 2025 flash crash fundamentally reset the perpetual dex competitive landscape. The $19.35 billion liquidation event—with Hyperliquid alone accounting for $10.31 billion—proved that migrating CEX-level speed to decentralized infrastructure without robust, multi-layered risk controls creates structural fragility rather than genuine innovation. The market’s $1.064 trillion monthly turnover and 26% capture of crypto derivatives volume demonstrate systemic relevance, but the path forward diverges sharply from the 2024 playbook of maximizing volume at any cost.

Strategic winners in 2026 will be platforms that solve the speed-fragility trade-off through multi-source, liquidity-weighted oracles and cryptographic execution guarantees (Lighter’s ZK-proofs, GRVT’s privacy-by-default Validium). The regulatory arbitrage driving current growth—1001x leverage, zero KYC, borderless access—faces inevitable compliance pressure as the sector matures. Platforms prioritizing sustainable infrastructure (EdgeX’s institutional backing, Drift’s three-year survival record) over short-term airdrop farming (Aster’s 85% volume collapse post-scandal) will capture long-term capital seeking reliability over speculation.

For traders, the 2025 meta demands segmentation-based selection: speed demons prioritize Hyperliquid despite security concerns, institutions choose GRVT’s regulatory moat and perfect crash record, Solana natives default to Drift’s battle-tested ecosystem integration, and degen speculators chase Paradex’s 591 long-tail markets. The era of one-size-fits-all perpetual dex dominance has ended—replaced by specialized platforms optimizing for distinct user segments in a winner-take-most market where execution quality, not vanity metrics, determines survival.

Frequently Asked Questions (FAQ)

A perpetual DEX is a decentralized exchange for trading crypto futures with leverage, no expiry dates, and self-custody. Popular platforms include Hyperliquid and dYdX.

Yes. Perpetual futures trading involves high leverage, liquidation risk, and volatility. The October 2025 crash saw $19B in liquidations across perpetual DEX platforms.

Perpetual DEXs generate revenue from trading fees, liquidation fees, and funding rates. Leading platforms like Hyperliquid earn over $1B annually from trading volume.

Perpetuals offer leverage and short selling but carry liquidation risk. Spot trading is safer with full asset ownership. Choose based on your risk tolerance and strategy.

Close your perpetual position by executing an opposite order on the DEX platform. You can exit anytime since perpetual futures have no expiration date, unlike traditional contracts.

US regulations restrict leveraged derivatives for retail investors. Most perpetual DEX platforms operate offshore and block US users, though some offer compliant spot trading.

Rate the article