share

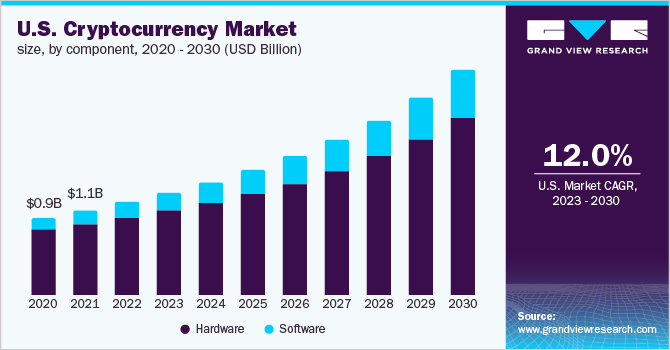

Blockchain technology isn’t just a word being thrown around anymore, it’s priming the gears of industries and gearing up to rule the digital world. Cryptocurrency transactions are getting faster and more efficient than anything banks could ever dream of, and the influx of funding in this nascent sphere just won’t seem to stop. So, no wonder everyone’s trying to grab a piece of this techno action.

Whether it’s pushing an old business into the future or launching a sparkling new endeavor, you’re gonna cross paths with a burning question – time to mint a token, perhaps?

In this article, we’ll zip through the cosmos of crypto tokens, uncovering their superpowers for businesses and customers alike. We’ll also arm you with clever tips on how to create a cryptocurrency of your own.

Coin vs. Token 101

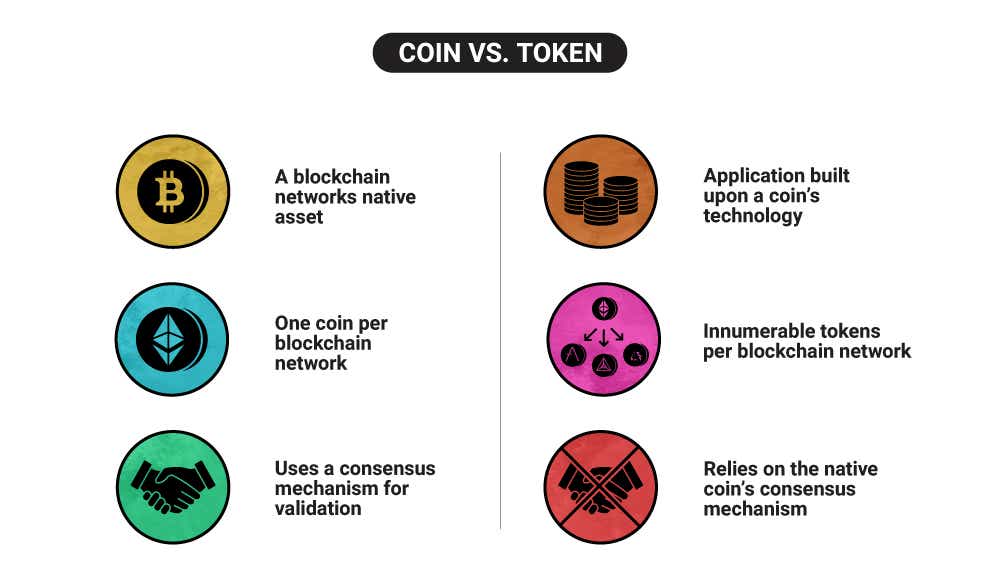

Want to start your own cryptocurrency? You have two main options: make a crypto coin or a crypto token.

When making your own crypto coin, you’re setting up your own blockchain (or forking an existing one). Building your own coin is like building your own digital fortress, complete with bespoke rules to confirm and record all transactions. This approach means building your own consensus mechanism and validation methods.

On the other hand, you can take the token route and leverage an existing blockchain infrastructure. Tokens are sub-assets, if you will, living by the rules of an existing blockchain platform that’s powered by – you guessed it – its native cryptocurrency coin. It’s the digital equivalent of moving into a ready-made fortress – you borrow the walls and guards, and the fortress has its own core treasury that’s out of your reach. Examples? Ethereum, BNB Smart Chain, Solana.

Building your own blockchain architecture is a big task indeed, so in this guide, we’ll assume you decided to take the low-resistance route and create your own token.

Legality Check

Cryptocurrency laws fluctuate radically from one region to another, making it absolutely imperative to gain proficient legal backing. First of all, ask yourself: is cryptocurrency legal in the legislation(s) you’re aiming for? Not all govs are happy with crypto flowing in their domains, and you don’t want to be on the wrong side of the law. Delve into your local legislation, pinpoint the legal standing of your token, and guarantee strict adherence.

Deciding on Token Type and Use Cases

Let’s figure out what kind of token you want to make and how it’s going to be used.

Start by asking yourself some basic questions. What problem will your token fix? How will it make things better for the users or the system? Getting this sorted will point you in the right direction and make everything else easier.

Maybe you’re thinking of a utility token that gamers can earn and trade on your online gaming platform. This could be used for cool in-game stuff, swapped for other cryptocurrencies, or more.

Or maybe you’ve got a tech startup, and you want to offer security tokens. These act like shares in your business. When someone buys these tokens, they’re actually buying a piece of your business and could make money when your business makes money.

The key point here is knowing what your token is for. This shapes how you design it. Remember, the type of token you decide on may also change how much paperwork you need to fill in, especially if you’re going for security tokens.

Protocol Selection and Define Token Properties

Next up, let’s set up the nitty-gritty details for your token.

What’s your token called? What’s its symbol? How many decimal places does it have (we usually see eighteen, but you could choose less or more). And how many tokens will there be in total? Make sure these details match your overall game plan.

Say you’re setting up a social media site. You’d probably want a fun, catchy name for your token. Plus, you might want loads of tokens with lots of decimal places. Why? Lower token value makes it easier for people to play with. But fewer tokens could mean they’re more valuable.

Choose a Blockchain Platform

You’ll also have to choose what blockchain to use.

We’ll give you a run-down on the most popular networks to date.

Ethereum

A popular choice for projects like Uniswap, Chainlink, and Aave. It’s got a big support network and a proven track record. With smart contracts, crafting unique tokens is a breeze. But there are downsides too. Its hefty transaction fees and slower operations when the network is busy, can bite.

Binance Smart Chain (BSC)

Friends of PancakeSwap go here for a broad reason – it’s like Ethereum but cheaper and faster! But watch out, it’s more centralized, and its security isn’t as solid owing to fewer network nodes.

Cardano

Home to the ADA token, it’s boosted by those who fancy speed, eco-friendliness, and safety. Like Ethereum, it’s got smart contracts and uses a cool proof-of-stake method to save energy. However, compared to Ethereum, it’s still in its toddler stages, with fewer developers, apps, and users at the moment.

Solana

Speed demons like Serum love Solana for its lightning-fast transactions and minimal fees, making it ideal for decentralized trading. Its unique timestamp system speeds things up, but just like Cardano, it’s still playing catch-up with Ethereum’s mature ecosystem.

Polygon

If you’re an Ethereum fan mouthing off about its high fees, Polygon is your friend. It’s a cheaper, fast-track version compatible with Ethereum but less decentralized and relies on Ethereum for security.

Polkadot

If you’re after scale, Polkadot is your match. It processes transactions on multiple chains at once, removing bottlenecks. But remember, it’s still rolling out the red carpet for its ecosystem, unlike the older kids on the block.

Tron

Tron is another speedster with low fees and a rap for fast, capable decentralized apps. But it got some flak over claims of copycatting in its whitepaper, and its centralization level has some critics rolling their eyes.

Tezos

Tezos manages to evolve without major splits (no hard forks). It’s got lower transaction fees and uses proof-of-stake, but its community of coders is still smaller.

Cosmos

Cosmos is all about speedy cooperation between different chains, often termed the internet of blockchains. But, like the others, it’s got a less mature ecosystem than Ethereum.

Your perfect pick among these comes down to your project’s demands. Consider speed, fees, community support, security, and degree of control – they all count. Each platform has its strengths and trade-offs, so the trick is to find your project’s perfect fit.

Tokenomics 101: Setting Your Crypto Pumpkin to Grow

Next up, you should lay down your token economics aka tokenomics.

Here’s an elementary guide on what factors to keep in mind:

Total Supply

Determine how many tokens will be created in total. This is critical because it will weigh heavily on the value of each token. A smaller supply may bump individual token’s value but also bottleneck the total number of potential users. A larger supply may make it easier for people to hold tokens, but each one may be worth less.

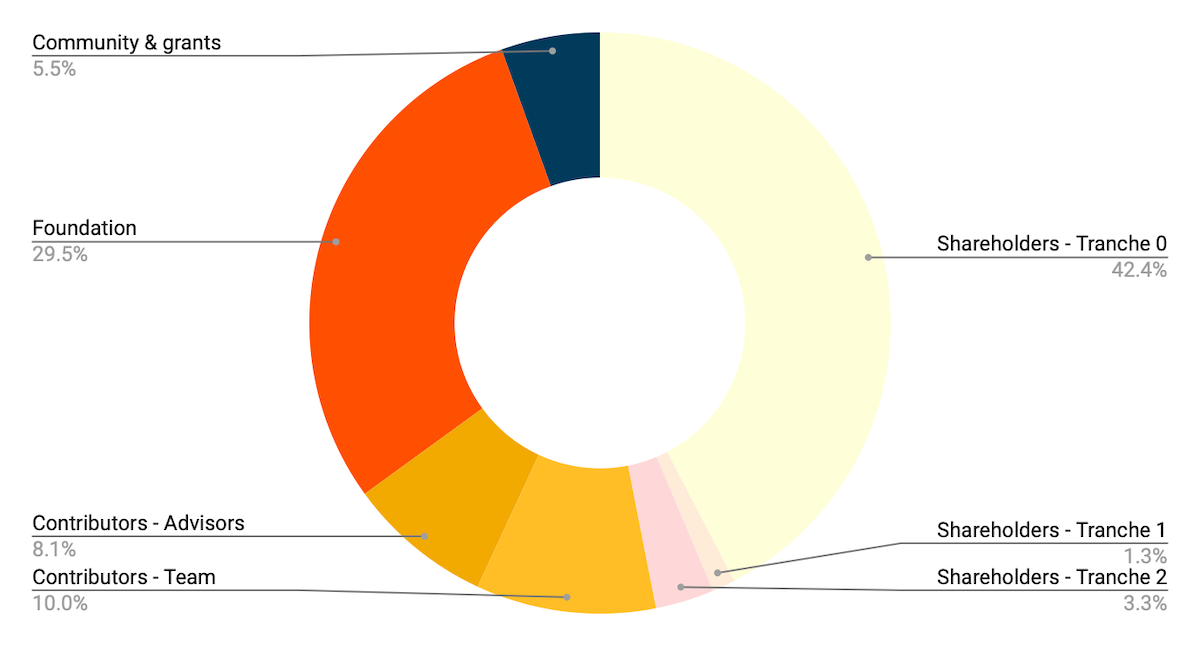

Token Distribution

Decide on how tokens will be distributed. Will some be sold in an initial token offering for raising funds? How many tokens will be given or sold to early users or contributors, often known as ‘early bird’ or ‘whale’ investors? Are any tokens held in reserve by the team or for future uses?

Incentives and Rewards

Will the token holders get any special perks or rewards, like dividends, voting rights, or access to particular services? Tokens with extra perks can lure in more potential buyers.

Token Utility

Consider the purpose of the token. Will it be used just as a currency within an ecosystem (for services and products), or does it have other functions, e.g., governance rights, staking, or other blockchain interactions? This function can profoundly influence demand and, as a result, token value.

Inflation/Deflation Mechanisms

Will the token supply change over time, or is it fixed from the get-go? Some tokens may have an inflation rate, expanding the token supply over time, while others may employ ‘burning’ mechanisms to gradually decrease the supply and potentially increase the value of remaining tokens.

Caveats to Keep in Mind

“Bulletproof Security, Eh?”

Crypto tokens chilling on blockchain networks may seem untouchable, but hey, that’s not all true! Brace yourself for the two common threats:

1. Software interacting with tokens can be low-hanging fruit for hackers.

2. Greenhorn wallet owners make for easy scam targets (watch out!)

When developing tokens, doubling up on hardware and software protection becomes a must. Encryption secures crypto tokens on the blockchain, sure, but the software it talks to – both front and back end – merits security as well.

Considering a quasi-decentralized setup? Beware of admin keys – think of them as the red carpet for security risks. These keys let you tinker with parameters and smart contracts, but at a price – they need safeguarding too. To bulletproof this, use a multi-signature tech requiring several team nods for critical transactions.

Total Anonymity Is a Thing of… Never

Remember, your public crypto wallet is an open transactions book. Keeping users in the loop about this helps big time.

No Fees? Wake Up!

The hype around Ethereum is real, but so are hefty transaction fees. Remember, problems with scaling still make Ethereum a pocket pincher. Sure, Ethereum 2.0 should smooth out these issues, but in any case, zero or minuscule transaction fees are no promise for any crypto token.

Your choice of blockchain, with its validators and transaction traffic, decides the hit on your wallet. Want to ditch fees? Consider building your own blockchain.

Instant Transactions… right?

You wish! Ethereum transactions can go on for hours. It’s faster than international bank transfers, sure, but it’s still not instant. And, sure enough, failed transactions can burn a hole in your pocket.

Ready-Made Tools For Token Deployment

Cryptocurrency development becomes a breeze with these platforms, each designed with the no-coder-wannabe-blockchain-developer in mind. Let’s explore their features:

CoinTool: CoinTool turns token creation into an express affair, supporting ERC-20 and BEP-20 token standards. Define essentials like token name, symbol, supply, and decimals with ease, and even dabble in advanced features like burn, mint, and liquidity addition functions. Yup, zero coding skills necessary.

BakeMyToken: with BakeMyToken, crafting a BEP20 token is as easy as filling out a form. It’s tailor-made to your preference, whether you lean towards deflationary, rebase, or standard tokens. Extra perks include anti-whale mechanisms, transaction taxes, and automatic liquidity addition.

Token Factory: Token Factory offers a simplistic approach to the creation of ERC20, ERC223, and ERC721 (NFT) tokens. With its clear-cut UI, set your token’s elemental characteristics and decide on enticing add-ons like burn or freeze features. From setup to monitoring, enjoy a fuss-free journey with Token Factory.

TokenMint: TokenMint simplifies token creation on Ethereum, fully supporting ERC20 and ERC721 standards. Just key in your token’s properties – such as token name, symbol, total supply, and decimals – and decide whether you’d like minting or burning capabilities.

Mintable: NFT creation is easy-peasy with Mintable. It allows users to create, manage, and even sell their ERC721 or ERC20 tokens hassle-free. Open ‘storefronts’ for your tokens and take your crypto journey to new heights.

Roll: Meet Roll, the platform that enables bloggers and influencers to mint their own ‘social money’ tokens. Use these tokens as rewards or exclusive content and community access.

StellarTerm: A comprehensive offering from StellarTerm provides a web-based wallet with an in-built token issuing facility. Create and distribute your assets within the Stellar network, even setting trust lines, all from your browser.

Minereum Token Service (MNS): Efficiently create smart contract tokens on the Ethereum blockchain using MNS. Customize your token’s defining traits, such as name, symbol, initial supply, and decimals, to tailor your token’s identity.

Waves Exchange: With Waves Exchange, a custom token is three clicks away. It’s applauded for its easy-to-use interface, letting you define the token name, symbol, total supply, and reissuability.

It’s down to you to define fundamental attributes like token burning, minting, management roles, and ownership rights. With minimal coding required, these platforms make token creation accessible for all.

Safety Check

Your slickly-designed smart contract is now deployed and ready for action. But hold on, we’re not done yet! The next step is a rock-solid security audit.

Load up powerhouse tools like Oyente or Securify, or rope in seasoned pros for an extra layer of certainty. The mission is to make your code safer than a locked vault while working smoothly.

Imagine you’re the bad guy – run various scenarios to test if your code can be tricked or exploited. Proper prep helps avoid those uh-oh moments after your token hits the market. Stay vigilant and protect your token like a precious gem!

Keeping Momentum Post Token Launch

When your token hits the market, it’s vital to keep an eye on the ball. Let’s be real, it’ll just gather digital dust if no one knows about it.

Keep in touch with your tribe. Let them in on your secret sauce – future plans, current status, the latest happenings. You need to show off your shiny new token to get folks excited and keen on investing. You need a killer game plan that shines in the digital world – think tweets, emails, and your website – and rolls old school – like press and billboards, for example.

Try a few tricks: top-of-the-game SEO, ads on popular platforms, webinars, and AMAs (plain old Q&As, but way cooler). Partner up with big names in the blockchain world to get the word out. Keep it simple. Make sure folks understand why your token rocks

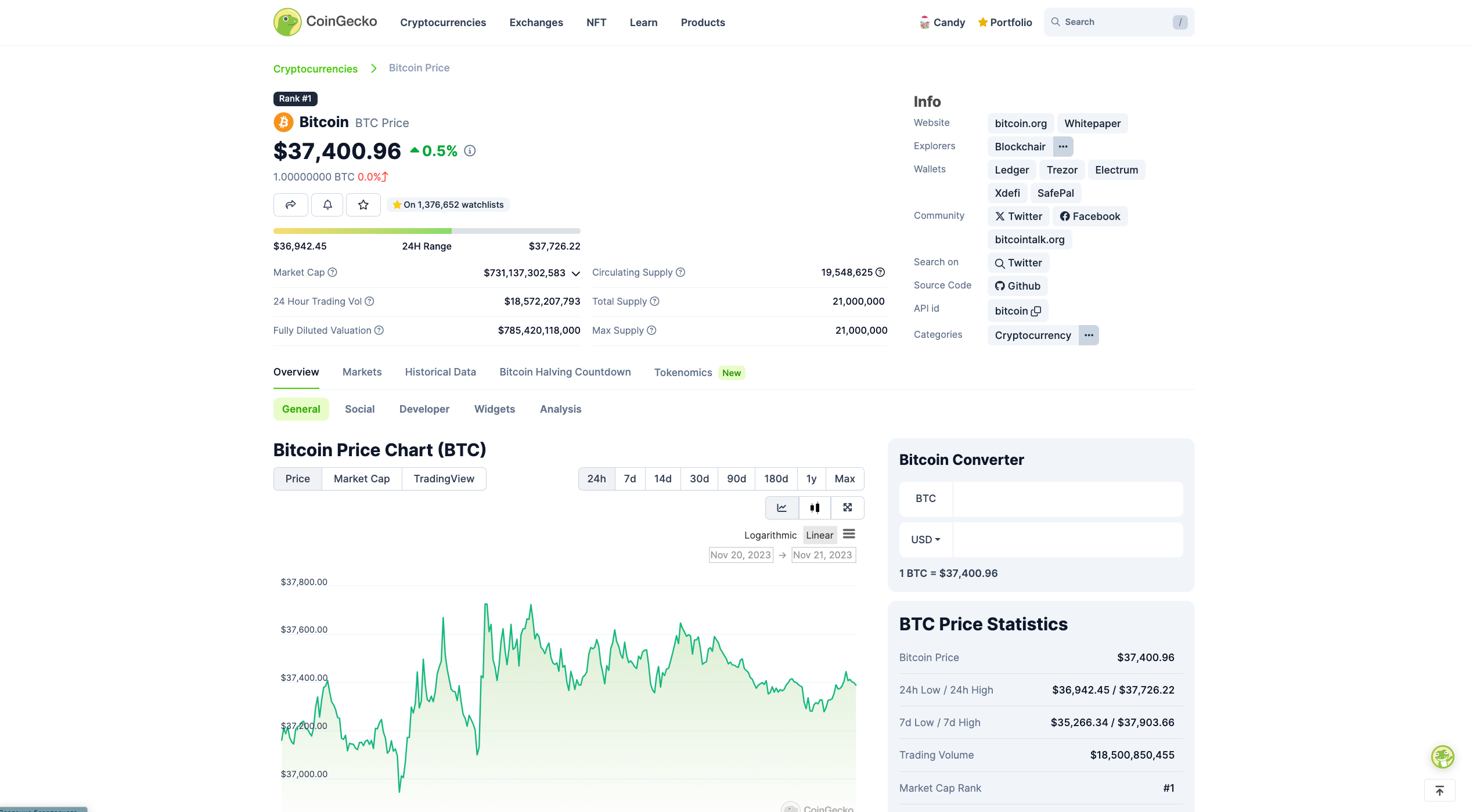

Pay constant attention to must-watch metrics like trading traffic, market cap, token value, and market buzz. Platforms like TheGraph, CoinGecko, and Dune Analytics can give you the 411 on these numbers.

These tools serve up data-based insights, feeding you real-time info about your token’s market position and how investors are taking to it. Patterns or trends in this data might spotlight areas needing a tune-up. Could be your marketing needs an overhaul, or you spot some security snags to fix up. Or it might be the right moment to throw in some fresh tech to keep pace.

Сontinual tweaks based on well-informed insights are your key to staying on top. It’s okay to switch lanes from your initial roadmap as you navigate through your journey as a token issuer. Just act like Goldilocks: not too quick to change but not too slow for necessary upgrades. Confused by code changes? Sites like GitHub can help keep track of it all. It makes collaboration a breeze, plus keeps a record like your own digital time capsule.

Get Plugged in With Exchange Biggies

Now that you’re all shiny and popular, it’s time to list on cryptocurrency exchanges. Like getting your song on Spotify, it ups your chances of being noticed and bought. But landing on an exchange comes with hoops to jump through, like being crystal clear about your business and ensuring your coins can flow freely for trades. Big-shot platforms like Binance and Coinbase are pretty picky, but don’t overlook the lesser-known ones – they’re like stepping stones to success.

Your goal is to shine on cryptocurrency trackers like CoinMarketCap or CoinGecko. They’re like informative stalker fans, following your token, watching its price, trade volume and market cap, making you look all legit to your potential peeps.

Your Secret Tool: ICODA

At this point, you may be wondering: how can I ever lift that weight alone? Is there no one to spot me? The answer is: yes, there is, and it’s ICODA. At ICODA, we’d be happy to be your pathfinders in the crypto jungle. Leveraging our broad expertise and tech acuity, we’re versed in many facets of the crypto landscape, be it in birthing new tokens or propelling existing projects.

Join forces with ICODA, and let’s blaze a trail in your digital voyage across the blockchain vista.