share

Blockchain and market decentralized finance have already proved the viability of traditional economic instruments in their environment: trading, lending, derivatives, and much more are available to users. New phenomena have also emerged, such as farming and NFTs. VC funds took their place in the cryptocurrency space.

When crypto companies first enter the market, few of the founders have an initial capital of millions of dollars and business experience. Most often, ideas in blockchain technology are generated by developers — people who are far from economic realities. They need a lot of help to realize themselves and become full-fledged players in the crypto market. This is when investment companies come to the rescue.

Mainstream Adoption for the Crypto Industry

People buy cryptocurrency – this is already an indisputable fact, proved by many studies. The capitalization of crypto companies in the distributed registry is growing continuously. New players are constantly appearing in the cryptocurrency industry. Big businesses and public management bodies are actively implementing crypto, and not only at the financial level. Data security and unbiased algorithms — are the main benefits of the blockchain network that attract users.

Future belongs to the blockchain technology, which will become a platform for making transactions, storing data, and organizing processes. The business models of many crypto companies are once again refocusing on new technologies. At first, it was the Internet. Now, it is the crypto space.

Why Has Venture Capital Gained Success in the Crypto Space?

There are many alternative methods to get funding. A few years ago, blockchain startups collected initial capital through an initial coin offering (ICO). Ordinary community users and retail investors participated in this activity. However, the high percentage of fraudulent offers has discredited this method. Both parties faced significant risks:

- Startup founders did not always collect the required amount, and even if they did, they simply did not have enough experience to properly distribute the funds,

- Retail investors lost money due to failure or scams, and they did not always understand the real reason.

This fact spoiled the reputation of the developers and destroyed even the most promising ideas due to the lack of experience in the blockchain.

A venture capital fund is acting more prudently. Before accepting an application for investments, a thorough check of the applicants is done. By attracting institutional investors, a startup receives the status of legitimacy, as far as one can talk about it in the crypto community.

Due to the readiness for taking high risks and competent diversification, a VC fund is almost always net positive in terms of profit. Investors are business and technology savvy people with every opportunity to track business development and the ability to intervene if necessary. In fact, now it is an ideal way to finance projects in crypto at any stage of development.

Alternative Methods to Get Investments

Private Equity

Smaller blockchain projects, as well as those which are not ready to go public and declare an ICO, can use private investing. In 2021, the number of such transactions in the world increased by 8%, and their amount approached $600 billion.

The main feature of Private Equity is direct investments. When it is not possible to take out a loan or bring shares to the stock market, and there is no desire to distribute digital tokens in the crypto space, the developer is looking for a PE firm that manages PE funds. Limited partners invest their money into funds but do not have management rights. They earn a percentage of the profit depending on the amount of the investment.

The firm acquires a controlling stake and takes part in the development of the company or organizes its merger with a more successful business. Profit is in receiving interest in the management process, usually at a level of about 2%. Often such investing is used by companies that have problems and need to cover risks. Usually, a Private Equity firm has experts who can manage the process of restructuring and recovery from the crisis.

Hedge Funds

These are the funds with high profitability and diversification, which attract institutional investors. In the offshore zone, the entry point starts from $100,000, and in the US, the private investors need to have five million dollars to enter. The structure of the firm is the same as that of Private Equity and venture firms — it is headed by hedge fund managers who are responsible for choosing targets for investing.

The main difference between venture capital is its openness to partners. You can enter and exit at any time since liquid digital assets are selected for conducting activities — those that can be sold at any time. In fact, investing in startups is quite rare, and hedge funds are mostly used to make a profit at the expense of already well-known companies that need expansion and development.

Traditional Venture Capital Structure

A VC fund is always owned by a venture capital firm. Any company that wants to get super profits through investments in projects, most often technological ones, can become a venture capital firm. The firm implies the presence of members taking several main roles.

Hedge Fund Managers

This is a key position with the following tasks:

- The attraction of investors,

- Selection of projects requiring investment,

- Monitoring the startup development process,

- VC fund management.

There can be several general partners (sometimes called managing directors).

Partners Without Legal Liability

Non-voting partners are ordinary investors who are willing to invest in a specific project. The entry threshold starts at $100,000. These can be rich people or legal entities: private businesses or state-owned companies.

Firm’s Employees

Since the venture capital firm is interested in business development, where to invest money, employees or third-party financial services companies are engaged in the process, and various services are provided to the startup in addition to the funds. At the stage of choosing a project for investing, analysts play an important role, collecting all the data on the company that has submitted the application. Further, the new business player is advised by experts in economics, finance, management, marketing, and advertising.

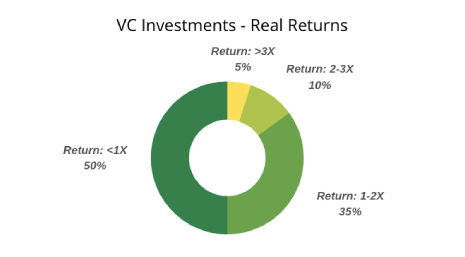

Risks and Profits of the Funds

A venture capital fund is an enterprise with high risks. Therefore, investor funds are distributed among different blockchain projects, but the risks remain high. Usually, no more than 30% of projects are profitable. Another third allows investors to break even. The rest lead to a loss of funding.

Successful venture firms that have been on the market for a long time mainly invest in technology projects and early-stage companies, often related to IT. In the 90s, to get investing was enough to present a website, but now the requirements have become higher. However, so are the potential profits. For example, having invested in a small student network, TheFacebook, general partners from Accel Partners and Founders Fund still take the first places in the lists of the world’s most successful investors, according to Forbes.

Crypto Companies and Venture Investments

The next logical step was to expand investment into technological solutions related to blockchain technology. First, financial instruments develop — DeFi is proof of this. People got an excellent opportunity to earn income without intermediaries, and DeX simply blew up the cryptocurrency space by implementing traditional financial instruments and adding their own.

All startups require initial capital — at the seed funding stage, only a minimal product appears, showing the viability of the idea. And in the future, millions of dollars will be required for business development. To optimize this project, venture capital firms were invented. They are already accustomed to the most unusual ideas and ready to take risks for the sake of super-profits.

The crypto industry is attracting more and more users — over 200 million people already own cryptocurrencies. Leading experts tell you how to build your crypto portfolio and minimize risks. With $1,000 in blockchain, you can get more than 100% yield per year while avoiding bureaucracy and intermediaries. Digital assets are popular, and people turn into analysts, trying to predict the success of a specific enterprise. When a venture capital fund stands behind crypto startups, this is a kind of confirmation of the high probability of future success, and such projects attract much more followers.

Large crypto companies themselves become investors, offering to fund early-stage projects. Sometimes it is enough to formulate an idea, and you can already get the first investments for implementation. Thus, the Electric Capital company became famous for the creation of a venture fund of 1 billion dollars worth of investment, built on new principles for the distribution of managing digital tokens. They are focused on the community, which means they are ready to develop the decentralized finance market, focusing on the needs of customers and not the Great of the World.

How Investing Is Done

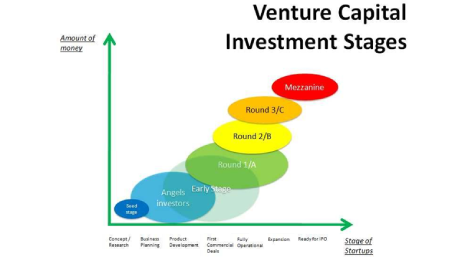

When a project is approved by a venture capital fund manager, the funds are allocated in stages. Typically, it goes through four stages, of which three are managed by a VC fund.

Seed Funding

Normally, investors are relatives and friends of the startup founder. Sometimes own funds are used, and investors are attracted — the so-called angels. These are individual investors with sufficient capital. Venture firms rarely enter a startup at the idea stage. More often, they need a functioning product to make a conclusion about its viability.

Series A. Start-up Capital

Venture firms enter the game. They allocate initial funds from the VC fund for the growth and development of the company. Here the project team is built or expanded, and marketing and branding are done. At this stage, investors expect to get their first income from the investment.

If the idea is successful, then the project captures the market. Preferred shares are distributed. They take about 30% of the total amount of shares. The funding implies an investment of up to $10 million. This stage lasts from six months to 2 years. Large investments are not attracted at this stage, as it is risky, and young businesses do not need them yet. Analysts are actively working on the project, defining its business models and future development.

Series B. Early-Stage Projects

They are defined as an early stage of the business operations — this is the stage where the first profit is collected. They need investment to scale and grow. In early-stage companies, a large portion of investments is spent on attracting new users, marketing, product improvement, and team growth.

Series C. Growth Stage

The expansion stage is implemented only with an established and successfully operating business. This is no longer a startup, and the product has proven itself in the blockchain community. It is entering new markets and expanding its product line. This stage is characterized by the lowest risks — if the company has reached this stage, then we can talk about getting a stable profit for investors.

And although revenues were received already at the early stage, where they begin to grow. The business model is going through a transformation process, new technologies are used, and additional ideas are brought to life.

How to Get Venture Financing

The applications for early-stage projects are submitted to a venture capital fund. It is necessary to have a professional business plan and present your portfolio. This is important since only about 1% of blockchain companies achieve success. But the stakes here are also higher — investments are estimated at millions of dollars.

You need to be prepared for a detailed check not only of the idea but also of its author, as well as the team if one has already been built. This is the standard approach of funds, but it results in forming the reputation of the company into which investments are poured since when considering the application, scammers and swindlers are eliminated.

How to Find an Investor

Simply coming to a venture capital firm with your own business plan will not work. There are a lot of crypto startups, and the competition for funds is very high. Here are some methods to be noticed.

Crypto Companies’ Websites

Many crypto industry players that have developed from crypto startups are ready to help their followers — due to the features of distributed ledger technology and decentralized finance. This has a good effect on the development of the underlying blockchain technology (protocol). Consider the invitation to present your idea on the website — you will need to fill out a form and submit your business plan.

Investors’ Blogs

Many investors keep blogs on the network, where they share their experiences. Contact them using a feedback form, and maybe you will be noticed.

Social Networks

Only truly unique ideas have chances here since few people consider social networks as a platform for doing serious business.

This is one of the few social networks targeted at establishing business contacts. The higher your activity in the network, the more likely you are to establish direct contacts with investors.

Industry Events

Here, those who develop in the field of industry and technology have more chances. Industry workshops are held quite often. You should consider attending them and networking with other people. This will give an additional experience of presenting your ideas.

AngelList

This is a platform for startups members. Here you can place an application to search for a job, investments, or projects. Members from other venture funds and investors are also invited.

Blockchain Companies Offer to Finance Projects in the Crypto Industry

These are the pioneers of the crypto-assets market, which have developed and offer not only trading but also other services, including assistance in building your crypto portfolio. Usually, decentralized finances grow in the blockchain ecosystem. The more projects are implemented there, the higher the income of crypto world members.

HUOBI Capital

This is an investment fund of the blockchain of the same name. It offers to invest exclusively in the crypto industry. Its statement says that applications are accepted by courageous, charismatic leaders who are ready to develop the infrastructure network.

BitForex Capital

This is the investment department of the exchange of the same name with insured assets, where you can get funding for any promising crypto project.

Polygon

The well-known protocol built on Ethereum offers developers a whole range of support measures: crypto investments, marketing, and assistance in finding investors. The main condition is the deployment of crypto startups on Polygon.

Polkadot

Parachain offers crypto investments for development in its ecosystem. The grant is paid as digital assets.

Compound

This is another company that offers crypto investments for development, issued as COMP tokens. If the project receives initial development, it will not be difficult to find investors in the future.

Leaders Among Venture Capital Firms

At the time of writing, there are more than 400 powerful crypto venture funds in the world. Most of them offer users to apply directly on the website, but you will have to wait a long time. The most active market players try to contact the managers directly.

You can view the full selection list of crypto portfolios of these companies at Coinmarketcap.com.

Pantera

Founded in 2013, this is the first crypto-focused venture fund in the world.

a16z Crypto

The largest investment company in Silicon Valley (San Francisco) has also refocused on crypto projects and startups. They invest in OpenSea, Maker, Compound, and others. There are three funds working with crypto with a total capital of more than $3 billion. On the website, you can find video tutorials and instructions for startups.

Union Square Ventures

Since 2003, the firm has been investing in Internet companies, recently paying attention to the crypto markets. In 2013, they implemented the stages of Series A for Coinbase. The website contains the email address and phone numbers.

Polychain Capital

This platform was founded in 2016 by a former Coinbase employee. Only job seekers can contact through the website. There are no application tools here. They manage the capital of about $2 billion.

FBG Capital

This is a new venture capital firm that trades cryptocurrencies on the stock exchange. At the same time, they invest in crypto startups. Communication is possible via email only. They are known for having increased their capital 10 times in one year, up to $200 million.

1confirmation

They invest in Polkadot, Ethereum, OpenSea, and others. To date, the crypto portfolio includes 9 items.

Digital Currency Group

Its mission is to accelerate the growth of blockchain technology. Communication is possible via Twitter, LinkedIn, or AngelList, as well as on the website using a form.

Benchmark Capital

These investors did not care much about the content of their website. There is a single page where the seekers for investments can find all the contacts. All activities are managed through Twitter.

1kx

This is exclusively a crypto venture capital fund. All contacts can be found on Twitter. This venture fund positions itself as an “angel” fund, targeted at startups at the idea level. A total of 29 investments have been made.

Sequoia Capital

Founded in 1972 as a venture capital firm, it is one of the largest players in the market and in San Francisco in particular. They have invested in almost all successful projects since the beginning of IT development — Oracle, Cisco, Yahoo, Google, LinkedIn, etc. Now they are actively investing in blockchain infrastructure and protocols.

![CONF3RENCE 2025: Leading Web3 & AI Event [Promo Code ICODA20]](https://icoda.io/wp-content/uploads/2025/06/6203-23-1024x580.png)