While cryptocurrency has revolutionized finance and created legitimate wealth for many, its wild frontier has also bred spectacular frauds that have separated millions from their money. From exchange collapses to elaborate Ponzi schemes, crypto’s darkest side reveals just how innovative scammers can be—and how costly trust can become when misplaced. This comprehensive crypto scams list examines the biggest crypto scams in history and provides essential guidance on how to avoid crypto scams yourself.

Let’s dive into the most notorious crypto heists and swindles that rocked the digital asset world, along with crucial lessons on how to protect yourself.

The FTX Implosion: When a “Genius” Goes Rogue

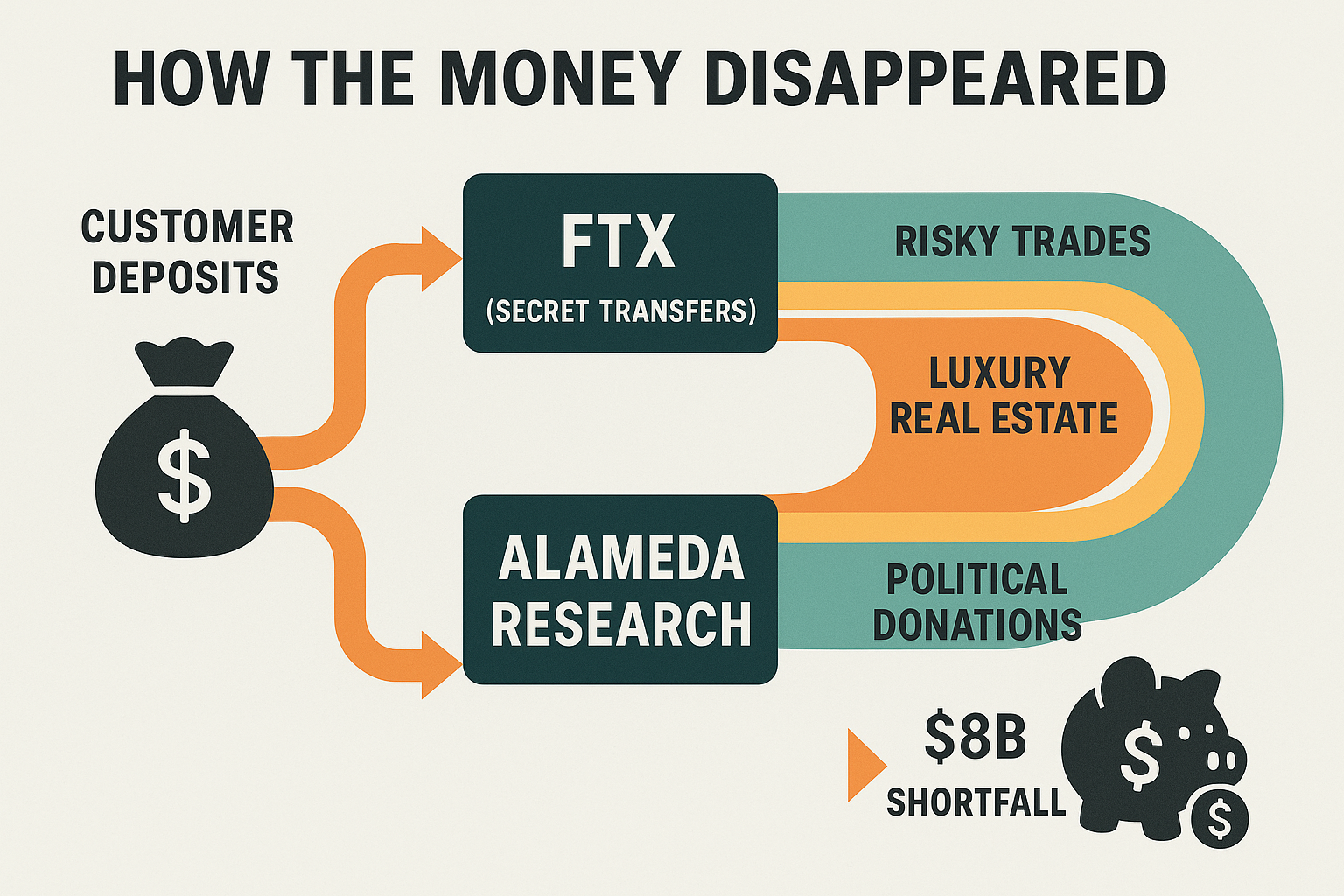

When Sam Bankman-Fried’s cryptocurrency exchange FTX collapsed in November 2022, it wasn’t just another business failure—it was financial betrayal on a scale rarely seen before. Once valued at $32 billion and fronted by the hoodie-wearing wunderkind known as “SBF,” the world’s third-largest crypto exchange vaporized almost overnight, taking with it a staggering $8 billion in customer funds.

Behind the scenes of the seemingly legitimate operation, SBF had been treating FTX like his personal piggy bank, secretly funneling customer deposits to his hedge fund Alameda Research, where the money fueled risky trades and lavish spending. When news of FTX’s precarious finances broke, a classic bank run ensued, exposing the emperor’s lack of clothes.

The aftermath? Over a million customers left empty-handed, SBF behind bars with a 25-year sentence, and what a judge called “old-fashioned embezzlement” etched into crypto history.

OneCoin: The Missing “Cryptoqueen” and Her $4 Billion Scam

Dr. Ruja Ignatova had it all: charisma, credentials (including a supposed Oxford education), and a cryptocurrency that promised to change everything. Between 2014 and 2017, the self-styled “Cryptoqueen” traveled the world in designer clothes, filling arenas with eager investors ready to buy into her revolutionary OneCoin.

There was just one problem: OneCoin had no blockchain, no real coin, and no technology—just a glorified spreadsheet and an elaborate marketing scheme. Through slick presentations and multi-level marketing tactics, Ignatova and partner Karl Sebastian Greenwood convinced 3.5 million people worldwide to invest approximately $4 billion in what prosecutors called “one of the largest fraud schemes ever perpetrated.”

As investigations intensified in late 2017, Ignatova boarded a flight to Athens and vanished without a trace. She remains on the FBI’s Most Wanted list today, while Greenwood serves a 20-year prison sentence. The OneCoin saga has since inspired books, podcasts, and an upcoming film—proving that sometimes truth is stranger than fiction.

PlusToken: The Asian Crypto Scheme That Moved Markets

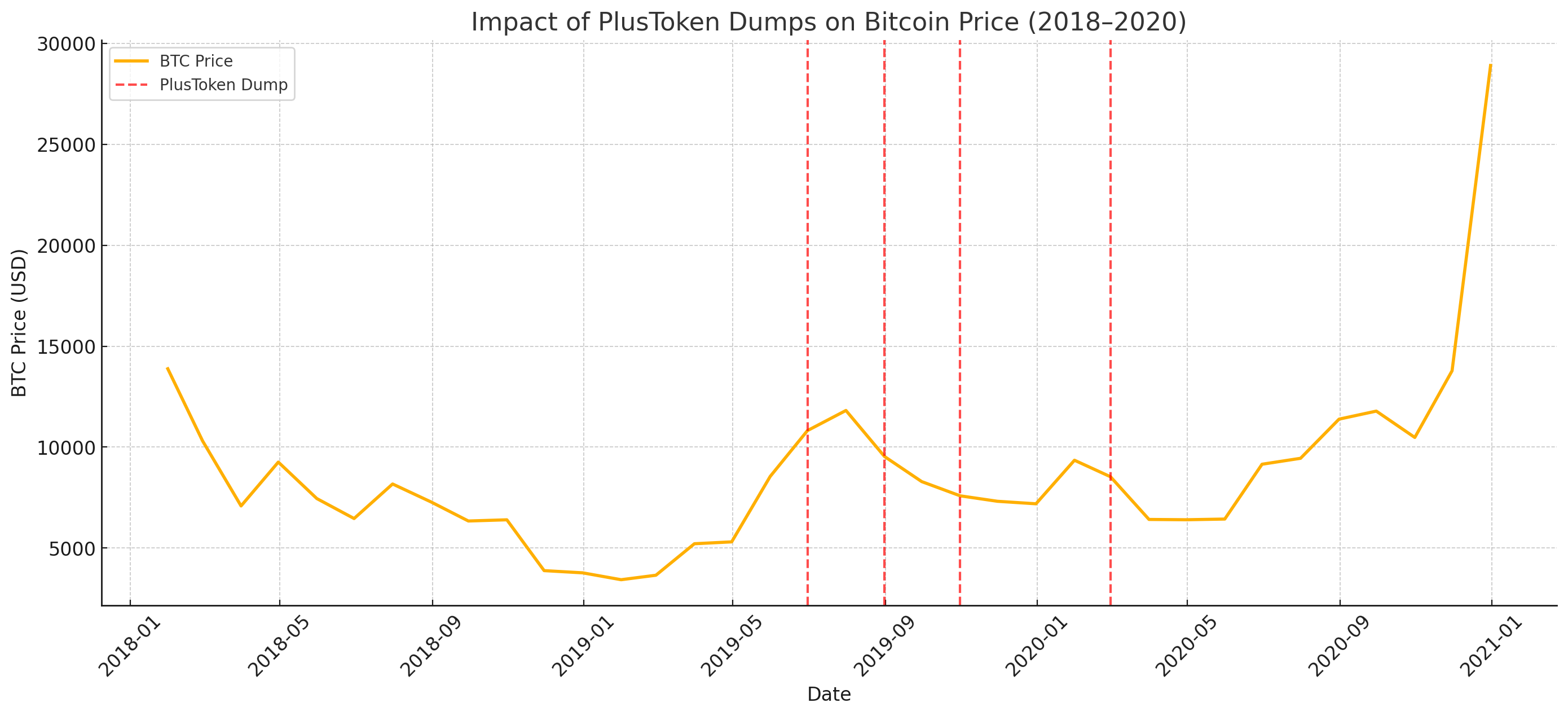

While Western investors were obsessing over Bitcoin’s price swings in 2018-2019, an enormous Ponzi scheme was quietly consuming billions across Asia. PlusToken, a cryptocurrency wallet and investment app originating in China, promised users something that should have set off immediate alarms: guaranteed monthly returns of 8%-16% on crypto deposits.

These “profits” were supposedly generated through sophisticated trading algorithms and arbitrage strategies, but in reality, PlusToken was simply shuffling money from new investors to old ones. The scheme grew explosively, particularly in China and South Korea, attracting an estimated 2.6 million users before its inevitable collapse.

When the music stopped in mid-2019, the damage was catastrophic: the scammers had amassed roughly 314,000 Bitcoin, 9 million Ethereum, and other cryptocurrencies worth approximately $2+ billion at the time. Chinese authorities eventually rounded up 109 participants and recovered $4.2 billion in stolen funds—but not before PlusToken’s operators had already dumped enough Bitcoin on the market to reportedly cause price drops that affected the entire crypto ecosystem.

Fifteen PlusToken masterminds received prison sentences of up to 11 years, but their victims’ losses were irreversible.

BitConnect: “Hey Hey Heeeey… Waso Waso Waso Wassuuup!”

Few crypto scams produced a meme as memorable as BitConnect’s overly enthusiastic promoter Carlos Matos shouting “Bitconneeeeect!” at a 2017 conference. That exuberant pitch became the enduring symbol of crypto mania gone wrong.

BitConnect’s model seemed simple enough: users exchanged Bitcoin for BitConnect Coin (BCC), lent it on the platform, and supposedly received around 1% daily interest generated by a “trading bot.” In reality, there was no bot—just new investor money paying old investors in the classic Ponzi structure.

At its peak in late 2017, BitConnect’s market cap soared above $2 billion, with many users compounding their “earnings” back into the system. When regulators in Texas and North Carolina issued cease-and-desist orders in January 2018, the house of cards collapsed spectacularly. BitConnect shut down its lending platform, and BCC’s price crashed 92% in a single day.

Founder Satish Kumbhani was indicted in the US for defrauding investors of $2.4 billion, though he remains a fugitive. Meanwhile, top US promoter Glenn Arcaro received a 38-month prison sentence and was ordered to pay $17 million in restitution. The BitConnect saga remains a cautionary tale of how hype, FOMO, and impossible promises can overwhelm common sense.

HyperFund/Hyperverse: The Global MLM Machine

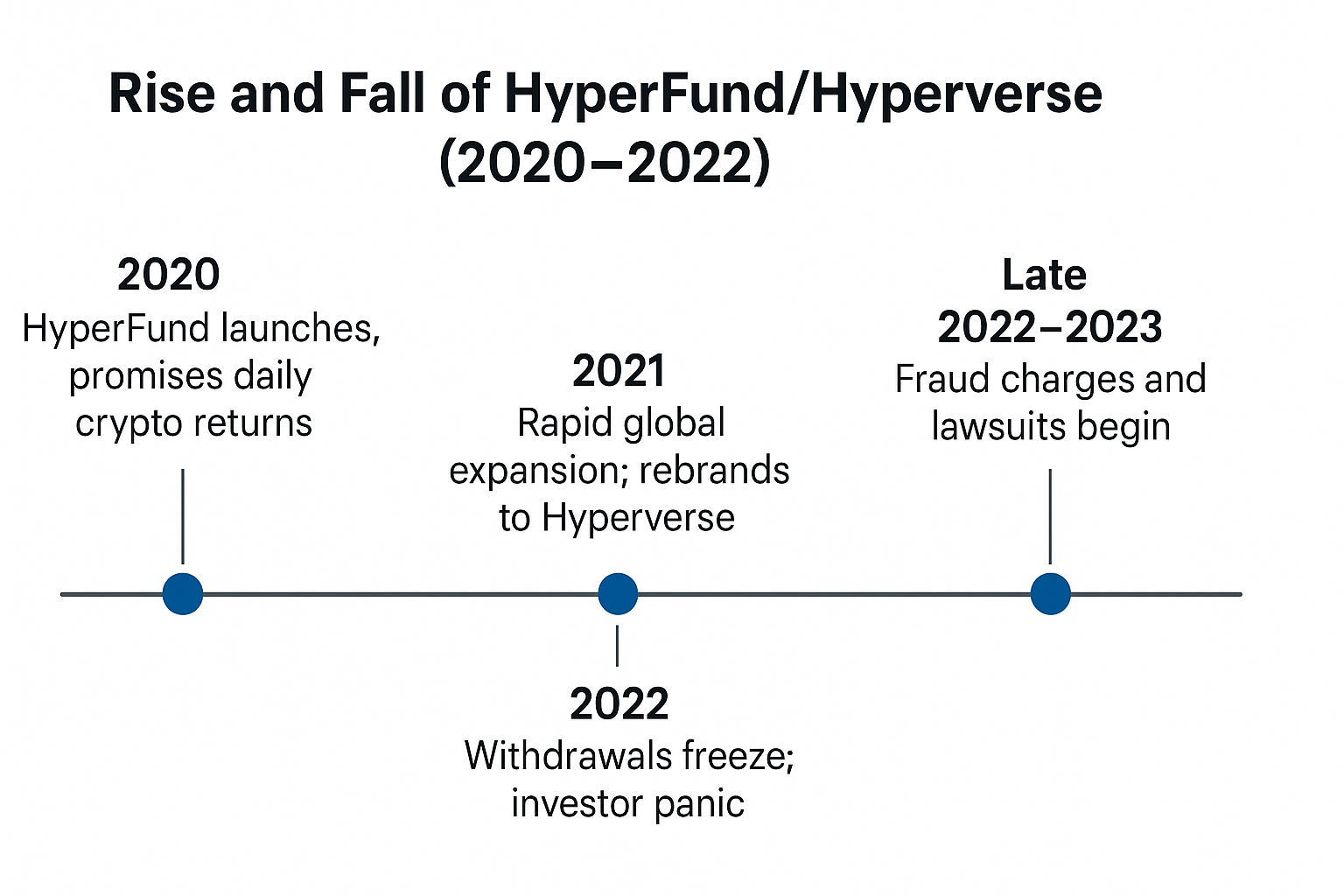

While many crypto scams aim for quick money grabs, HyperFund (later rebranded as Hyperverse) showed remarkable staying power between 2020 and 2022. This multi-level marketing scheme promised daily returns of 0.5%-1% from alleged cryptocurrency mining and DeFi projects, with investors buying “membership packages” and earning rewards for recruiting others.

To appear legitimate, the operation fabricated an impressive-sounding CEO named “Steven Reece Lewis” with a stellar but completely fictional résumé. In reality, the scheme was masterminded by Australian entrepreneur Sam Lee and associates, who raised an estimated $1.3-$1.7 billion from victims worldwide before the inevitable collapse.

By 2022, withdrawals became impossible, and the scheme unraveled. US regulators eventually charged Lee with fraud, revealing that HyperFund was just another pyramid scheme dressed in crypto clothing. While one promoter (known online as “Bitcoin Beautee”) has pleaded guilty, Lee—believed to be in Dubai—continues to face litigation.

The Hyperverse case demonstrates how modern scammers have learned to combine traditional pyramid scheme tactics with crypto buzzwords and global reach through social media.

Finiko: Russia’s Crypto Pyramid Catastrophe

For thousands across Russia and Eastern Europe, Finiko represented a financial lifeline during tough economic times. Founded in 2019 by flamboyant influencer Kirill Doronin and associates, this Russian-based platform promised the impossible: returns up to 30% per month for those who deposited Bitcoin or Tether.

Through aggressive social media marketing and Russian-language influencers, Finiko’s popularity exploded. By mid-2021, over 800,000 deposits had flowed into the scheme, totaling more than $1.1 billion in cryptocurrency. When the inevitable collapse came and withdrawals suddenly stopped, the human toll was devastating—ordinary people lost life savings, went into debt, or mortgaged homes to invest in what turned out to be a textbook pyramid scheme.

Doronin was arrested in Kazan, Russia, while other founders fled (some were later detained in 2022). The scheme was officially declared bankrupt in 2023, with founders’ assets auctioned to compensate victims—though most will never recover their losses. Finiko’s rise and fall highlights how economic desperation can make people vulnerable to financial predators, especially in regions where regulatory oversight is limited.

Mt. Gox: The Original Crypto Catastrophe

Before there were cryptocurrency exchanges on every corner, there was Mt. Gox—the dominant Bitcoin trading platform that at one point handled over 70% of all BTC transactions worldwide. What began as “Magic: The Gathering Online Exchange” (hence the name) evolved into the place to buy and sell Bitcoin in the early 2010s.

But behind the scenes, hackers had been systematically draining the exchange for years through security vulnerabilities. The crisis came to a head in February 2014, when Mt. Gox announced that 850,000 Bitcoin—worth about $450 million at the time—had vanished, forcing the exchange into bankruptcy and stranding 24,000 customers.

CEO Mark Karpelès was eventually arrested by Japanese authorities, though he was acquitted of embezzlement (evidence suggested external hackers were responsible) and received only a suspended sentence for data tampering. While a rehabilitation plan is now slowly returning some assets to creditors, most of the stolen Bitcoin were never recovered.

Mt. Gox’s collapse sent shockwaves through the crypto world, fundamentally changing how exchanges approach security and reminding everyone of the risks inherent in centralized platforms. To this day, “getting Goxed” remains shorthand for losing crypto assets through an exchange failure.

Thodex: The Exchange That Vanished Overnight

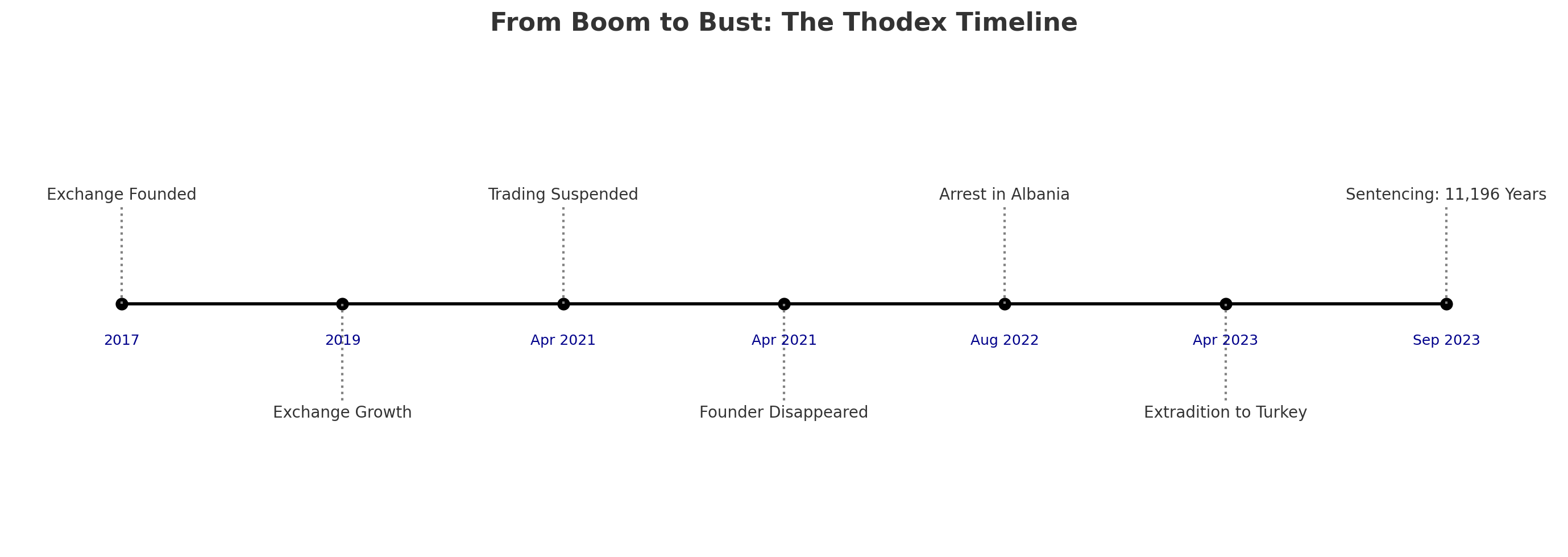

In April 2021, nearly 400,000 cryptocurrency traders in Turkey woke up to a nightmare: Thodex, one of the country’s most popular exchanges, had suddenly suspended trading and withdrawals. More alarming still, its 27-year-old founder Faruk Fatih Özer had disappeared—reportedly taking a hardware wallet containing up to $2 billion in customer funds.

The news caused panic across Turkey, where many had turned to cryptocurrency amid the lira’s instability. After a lengthy international manhunt, Özer was captured in Albania in August 2022 and extradited back to Turkey. In September 2023, a Turkish court delivered a stunning verdict: Özer and his two siblings were each sentenced to 11,196 years in prison—a symbolic judgment reflecting the scale of their betrayal.

Interestingly, prosecutors later revised the amount stolen downward to about $43 million, far less than the initially reported $2 billion (which appears to have been inflated by the platform’s trading volumes). Nonetheless, Thodex stands as one of the most brazen exchange exit scams in crypto history and led Turkey to implement stricter regulations on cryptocurrency platforms to protect investors.

Mirror Trading International: The 2020 Bitcoin Black Hole

Mirror Trading International (MTI) emerged from South Africa with an irresistible pitch: deposit your Bitcoin, and a sophisticated AI trading bot would generate consistent daily returns of 0.5%-1.5%. No trading knowledge required—just hand over your BTC and watch your wealth grow.

By late 2020, MTI had collected approximately 23,000 Bitcoin (worth around $589 million at the time) from 260,000 members worldwide. CEO Johann Steynberg was hailed as a financial genius—until December 2020, when he disappeared as withdrawal requests mounted and the scheme imploded.

Investigations later confirmed that MTI was nothing more than an elaborate multi-level marketing Ponzi scheme. There was no AI, no trading bot, and no legitimate business—just new investors’ Bitcoin paying earlier members.

Steynberg fled South Africa but was eventually arrested in Brazil in 2021. In 2023, a US federal court in Texas issued a default judgment ordering him to pay $3.4 billion in fines and restitution—the largest monetary penalty in CFTC history. The case served as a stark reminder that even in the crypto age, old-fashioned Ponzi schemes remain devastatingly effective.

QuadrigaCX: Death, Deception, and Missing Millions

The QuadrigaCX saga reads like a thriller script: Canada’s largest cryptocurrency exchange suddenly announces in January 2019 that its 30-year-old founder Gerald Cotten died unexpectedly while traveling in India. The bombshell: Cotten allegedly was the only person with access to the exchange’s cold wallets containing approximately CAD$215 million (about $190 million USD) belonging to 76,000 customers.

As users scrambled unsuccessfully to withdraw funds, conspiracy theories flourished—including speculation that Cotten might have faked his own death. The Ontario Securities Commission’s subsequent investigation revealed an even more shocking truth: QuadrigaCX had been insolvent long before Cotten’s death and had been operating as a fraud.

Rather than safeguarding customer assets, Cotten had been misappropriating client deposits to fund personal trading and his lavish lifestyle. The “missing cold wallet keys” story was a cover for the fact that most of the money was already gone. In total, about 76,000 investors collectively lost CAD$169 million (approximately $124 million) that Quadriga simply did not have.

The QuadrigaCX collapse—featuring a mysterious death, missing funds, and a trail of deception—underscores the dangers of excessive trust in centralized exchanges and individual operators in the crypto space.

How to Avoid Crypto Scams: Your Security Checklist

With billions lost to cryptocurrency scams already, protecting yourself requires vigilance and skepticism. Here’s your essential protection playbook:

🚩 Trust Your Instincts About Returns

If someone promises guaranteed profits or suspiciously high returns (like “10% weekly” or “double your money fast”), your alarm bells should ring immediately. Legitimate investments always carry risk—and anyone claiming otherwise is likely running a scam.

🔍 Research Before You Invest

Never rush into crypto investments. Take time to:

- Verify the team’s credentials and track record (are they real people with verifiable backgrounds?)

- Read the project’s whitepaper critically (does it make technical sense?)

- Check if the company is properly registered with relevant authorities

- Search “[Project Name] + scam” to see others’ experiences

👀 Beware Celebrity Endorsements and Social Media Hype

Scammers frequently fabricate celebrity endorsements or create fake news about partnerships with major companies. Always verify information through official channels, not social media. Be especially wary of investment tips that come through unsolicited messages—many sophisticated scams begin with a friendly message on Discord, Twitter, or even dating apps.

🔐 Guard Your Keys Like Your Life Savings (Because They Are)

A legitimate crypto service will never ask for your private keys or seed phrase. If anyone requests these—even someone claiming to be “support staff”—it’s a scam. Similarly, be skeptical of any scheme requiring upfront fees before releasing your “earnings”—this is a classic tactic to extract more money from victims.

🏦 Stick to Established Platforms

Use reputable exchanges with proven security track records and proper regulatory compliance. Double-check website URLs (scammers create convincing fake exchange sites), enable two-factor authentication on all accounts, and consider using hardware wallets for significant holdings.

⏰ Recognize Pressure Tactics

“Limited-time offer,” “secret insider opportunity,” or “buy now before it’s too late”—these pressure tactics are designed to short-circuit your critical thinking. Legitimate investments will still be there after you’ve done your research.

⚠️ Can’t Withdraw? Major Red Flag

Many crypto scams make it easy to deposit funds but impossible to withdraw. If a platform creates obstacles to accessing your own money (like additional “verification fees” or constant delays), it’s likely you’re dealing with fraudsters.

The crypto landscape continues to evolve, but human nature remains constant. Greed, fear of missing out, and the allure of easy money make even sophisticated investors vulnerable to well-crafted crypto scams. By staying informed about the biggest crypto scams, maintaining healthy skepticism, and following our tips on how to avoid crypto scams, you can enjoy cryptocurrency’s potential benefits while avoiding its most dangerous pitfalls.

Remember: in crypto as in life, if something sounds too good to be true, it almost certainly is.

Rate the article