share

The last two years have shown a high growth of interest in crypto markets from crypto holdings and ordinary people. The reason is the opportunity to get additional profit. Yield farming has become especially popular, where you can get high-interest rates for a deposit. While the stock market and banks offer us 0.05%, the crypto market provides income from 3% to 100%. The usual income is about 20%.

Why You Should Start With Stablecoin

Stablecoin yield farming is a low-risk strategy. It is a safer option for a beginner investor who is not versed in tracking crypto prices or predicting trends. However, experienced investors also invest in stablecoins, sacrificing higher earnings for the security of always having a sum available for investing in other coins.

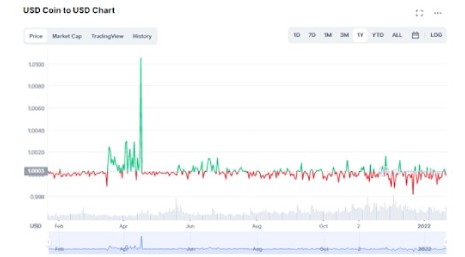

If you take a look at the yearly price history of cryptocurrencies, you will see how volatile they are. The value may fluctuate in the range of several dozen thousand dollars: a good example of this is Bitcoin.

The price of Ethereum is also constantly surging and dipping by hundreds of dollars.

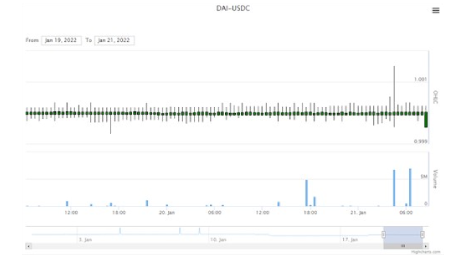

Stablecoins are different. In most cases, their price is linked to fiat money — the U.S. dollar. Their price fluctuations are estimated at thousandths of a cent, which is why stablecoin yield farming is a low-risk option.

How Does It Work?

Yield farming provides a platform for lending your crypto holdings to companies that need crypto for trading or conducting business. Borrowing coins is a long-established practice because the profit margin covers the interest fees.

Loans are provided via a yield farm — a platform where common users can invest their assets and make some money. The more users join a platform, the larger the liquidity pool — the amount of crypto available for borrowing.

Users can invest any amount. The rewards are paid in the platform’s tokens, known as governance tokens. Although the rates are specified in the description of investment options, an investor should also pay attention to the volatility of tokens so that the resulting assets are not worth less than the initial coins at the time of investment.

The assets are locked up by the platform for a certain period to generate returns. The reward consists of the specified interest rate accrued during the borrower’s transactions. This procedure is known as liquidity mining, and it helps to provide sufficient liquidity pools, showing that the decentralized exchange is stable and protected against scams. The users who invest their assets become liquidity providers.

The general stability of a farm can be assessed by TVL (Total Value Locked) — an indicator that is similar to the market cap in traditional finance. It reflects the total amount of crypto that has been deposited into the farm. It is calculated in fiat money, mostly —U.S. dollars. This indicator is equal to the number of coins multiplied by their current value.

There are two basic sources of passive income.

Liquidity Pools

The assets are locked up, creating liquidity pools for the entire platform.

Yield Farming

A user purchases a pair of two coins (a governance token and a stablecoin) in a 50/50 value ratio. Put simply. Users bet on the price movement of tokens.

Various platforms offer certain additional features such as bonuses or an opportunity to invest native tokens at high-interest rates.

What Risks Does Yield Farming Pose to the Investors?

The most critical high risk is the impermanent loss. It is determined by the volatility of the invested crypto assets. If the price of one of the assets in the pair changes, the amount of the second asset will increase or decrease proportionally, with the shares allocated according to the prices. An investor may find out that the amount of the cheaper cryptocurrency has increased, and the selling price is lower than the initial costs.

This risk is significantly lower for stablecoins where the price is pegged to fiat money. The volatility is low, almost completely eliminating the risk of impermanent loss. However, the interest rate is also lower compared to less stable currencies.

The second risk of yield farming is the smart contract risk. Each time crypto is staked in a liquidity pool. It is locked in a smart contract. This contract specifies the allocation of profits between the participants. To attract customers, decentralized platforms keep developing more and more sophisticated algorithms for participation procedures and bonus distribution. This can lead to errors in the smart contract — the computer code describing the terms of the agreement.

Many yield farmers lose money due to the volatility of tokens. These tokens are used by exchanges to provide additional rewards and bonuses. When converting such tokens to a fiat currency, you can find out that the price has decreased sharply. On this chart, you can see the last-year price history of BNB (the token of the Binance smart chain).

As you can see, investors should always look for the right moment to sell it.

What Unpleasant Surprises Does Yield Farming Pose to the Borrowers?

These risks are caused by the need to provide collateral to yield farmers. The crypto market of DeFi yields farming is designed in a way that the lender should never be at a loss. Before proceeding to the deal, the borrower needs to deposit double the amount of the future loan as collateral whether they use the same cryptocurrency or other assets. If the liquidity ratio decreases, the smart contract can automatically liquidate the borrower account.

Sometimes this happens so fast that the borrower does not have the time to repay the loan. Liquidity risk occurs when the price of the collateral drops and the loan amount increases. This is known as the price risk.

The amount of a potential loan is determined by the Loan to Value ratio, LTV. It is calculated individually as the ratio of a loan to the value of an asset.

Defi Exchanges for Stablecoin Yield Farming

When looking for a source of passive income, a prospective crypto farmer is met with countless options. We have conducted our own research and selected decentralized platforms with a very low scam risk, a high Total Value Locked, and low smart contract risks.

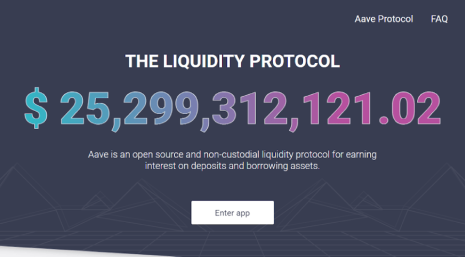

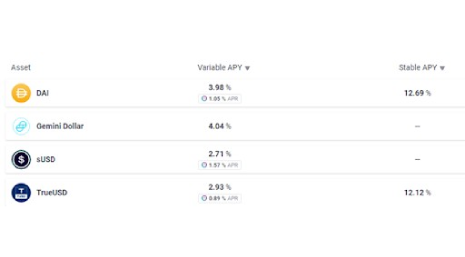

AAVE

At the time this article was written, the Total Value Locked amounted to about $23 bn. This value is constantly changing and can be found on the platform’s website.

The market volume of this exchange is estimated at billions of coins. It supports DAI (Ethereum’s stablecoin), sUSD, USDT, and many other coins.

In general, the returns do not exceed 3%. Compared to traditional yield farming, it seems low. However, thanks to the lower risks, long-term profit may be as high as in the case of more aggressive farming.

Before staking coins, check out the detailed documentation on the platform’s website. It provides information on calculating the interest rates, risks, and other issues.

The platform’s native token is traded actively in the range between $180 and $240.

You can also make money by staking the AAVE token by locking it up in a pool. The returns are 6.69% in 10 days.

It is also worth mentioning that this platform for DeFi yields farming has managed to make yield farming safe and to provide secure smart contracts — this platform has never been hacked.

SUSHI

This is a decentralized platform that was forked using Uniswap. The Total Value Locked is $2.36 bn. In the case of stablecoin yield farming, stablecoins are paired with governance tokens. The interest rates are rather high, reaching about 35%.

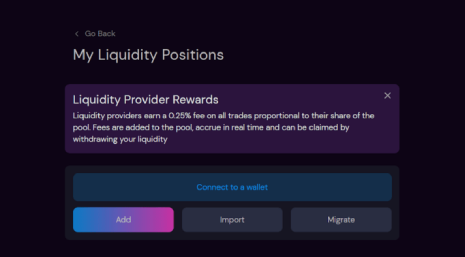

Apart from yield farming, you can also join a liquidity pool. Liquidity providers earn a 0.25% fee allocated based on their share in the pool.

Lending is provided using various stablecoins: DAI, USDC, USDT, etc.

The price of the governance token Sushi varies in the range of up to $10.

Binance Liquid Swap

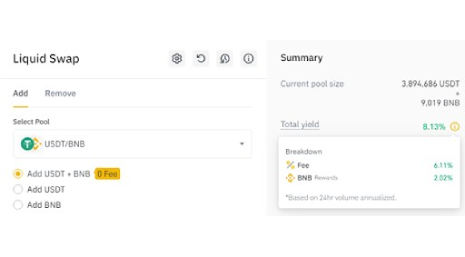

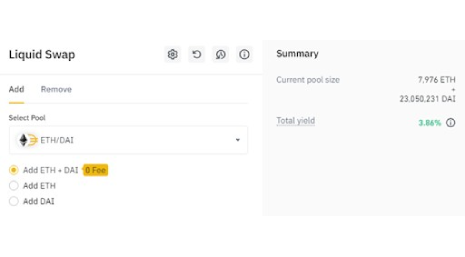

This is a platform for yield farming by Binance. It offers many swap pairs, some of which include stablecoins. The returns are adequate. For example, the returns for the BNB/USDT pair are about 8%, including BNB rewards at 2%.

The percentage varies depending on the pairs, and it should be taken into account.

The platform also allows users to exchange cryptocurrency.

The Total Value Locked is not specified, but it is shown for each cryptocurrency individually.

Venus

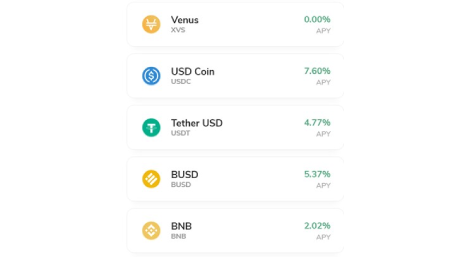

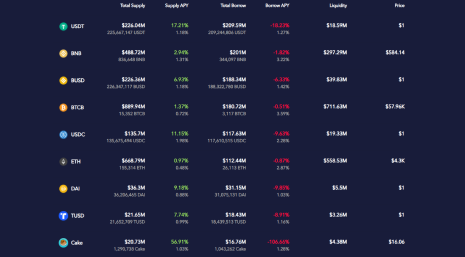

This is a decentralized exchange for lending and borrowing stablecoins.

The Total Value Locked is also not calculated, but you can see the total price of the selected coins.

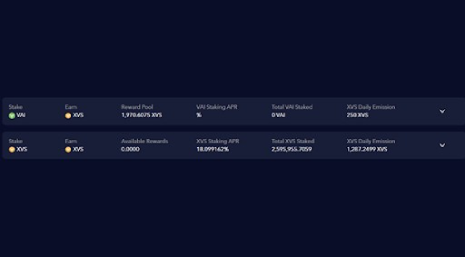

The platform is based on the Binance Smart Chain and supports the BEP-20 protocol. The native synthetic stablecoin VAI does not have a yield curve to determine its interest rate. The coin is pegged to the U.S. dollar. The governance token is XVS.

XVS is distributed based on liquidity mining, with 35% of the daily rewards distributed to borrowers and the token holders, 35% to liquidity providers, and 30% to stablecoin miners.

Investors earn interest on their assets.

Users can stake money or earn interest by voting. Just as in traditional yield farming, the rewards are provided in the platform’s native token — XVS. Staking is available for VAI, with a rather high-interest rate that depends on the pool size.

It operates not only with stablecoins but also various other tokens.

This is more of a crypto bank than a platform for yield farming on its own. Unlike in traditional finance, there are no savings accounts — Venus does not store the invested assets but puts them into circulation by using smart contracts. This protects the investors’ digital assets because these cannot be taken by anybody else.

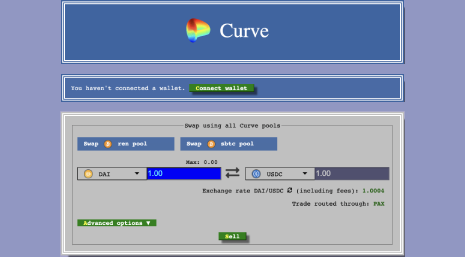

Curve

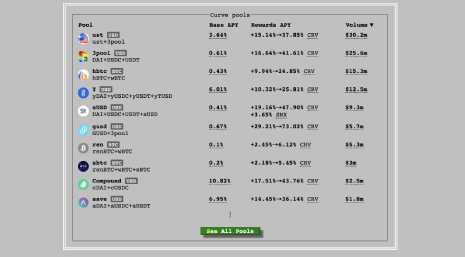

The total value locked is over $9 bn. This is a decentralized exchange for stablecoins. Liquidity providers receive rewards from each transaction in proportion to their share. As the trading fees depend on the volume, the interest rates change very quickly.

Additional interest is accrued to Curve pools.

The trading information is presented in the form of an informative chart.

Interestingly enough, the UI is designed in the style of Windows 3.11, which can confuse new users.

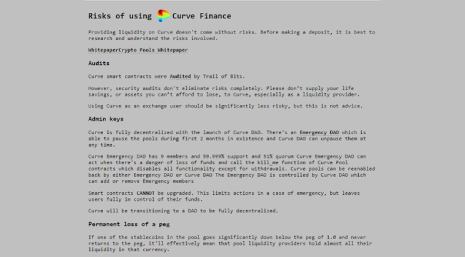

There is a section dedicated to risks.

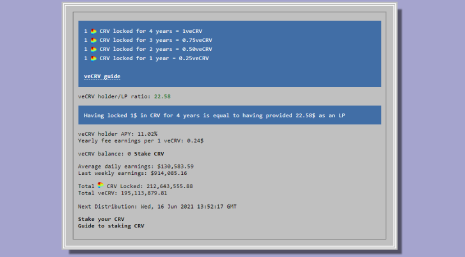

You can also find detailed calculations of potential returns.

The website has a section containing a full description of the platform’s operation principle.

The governance tokens CRV trade at up to $5.

The platform’s smart contracts operate without faults and have been supervised by Trail of Bits, Quantstamp, and MixedBytes.

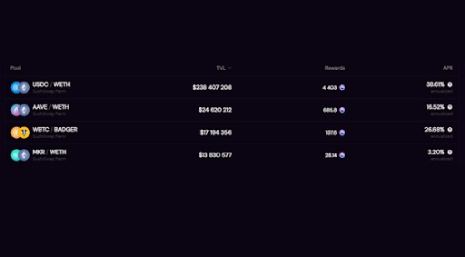

Harvest

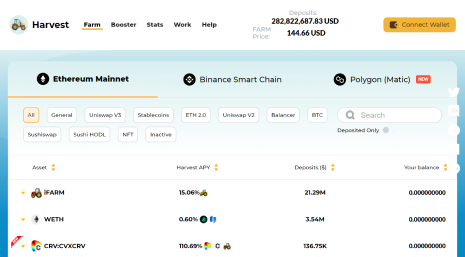

Because this yield farming platform is new, it offers high-interest rates. For example, by investing in the USDC-ETH pair, a farmer can earn 43.51%.

The deposits amount to over 200 mln U.S. dollars. The native cryptocurrency is Harvest Finance (Farm). The platform has a lower total value locked than its competitors; so far, it has not exceeded 300 mln U.S. dollars.

The platform was designed for earning interest by forming a liquidity pool and yield farming.

On October 26, 2020, the exchange was hacked, but its users were compensated for their losses. However, although there is no chance of a scam here, this issue still represents a security risk.

Conclusion

Compared to the yield farming of a volatile cryptocurrency, stablecoin yield farming has two main differences.

- The risk is lower because the coin’s price is linked to the value of fiat money.

- The profit is lower because the interest rate is not as high.

In any case, however, investors should exercise caution and consideration.