What We Analysed

We analyzed organic traffic and SEO strategies of five cryptocurrency exchanges: MEXC, Bitget, WEEX, Toobit, and WhiteBit. Our analysis covered the period from January 2024 to June 2025.

Our methodology included:

- Traffic analysis using Similarweb, Ahrefs, and Google Trends data

- Regional traffic distribution and user behavior patterns

- Comprehensive backlink profile evaluation

- Content performance and keyword ranking analysis

- Link building investment estimates and ROI calculations

This comprehensive approach gives us clear insights into what drives success in crypto exchange SEO and where the biggest opportunities lie.

Key Findings

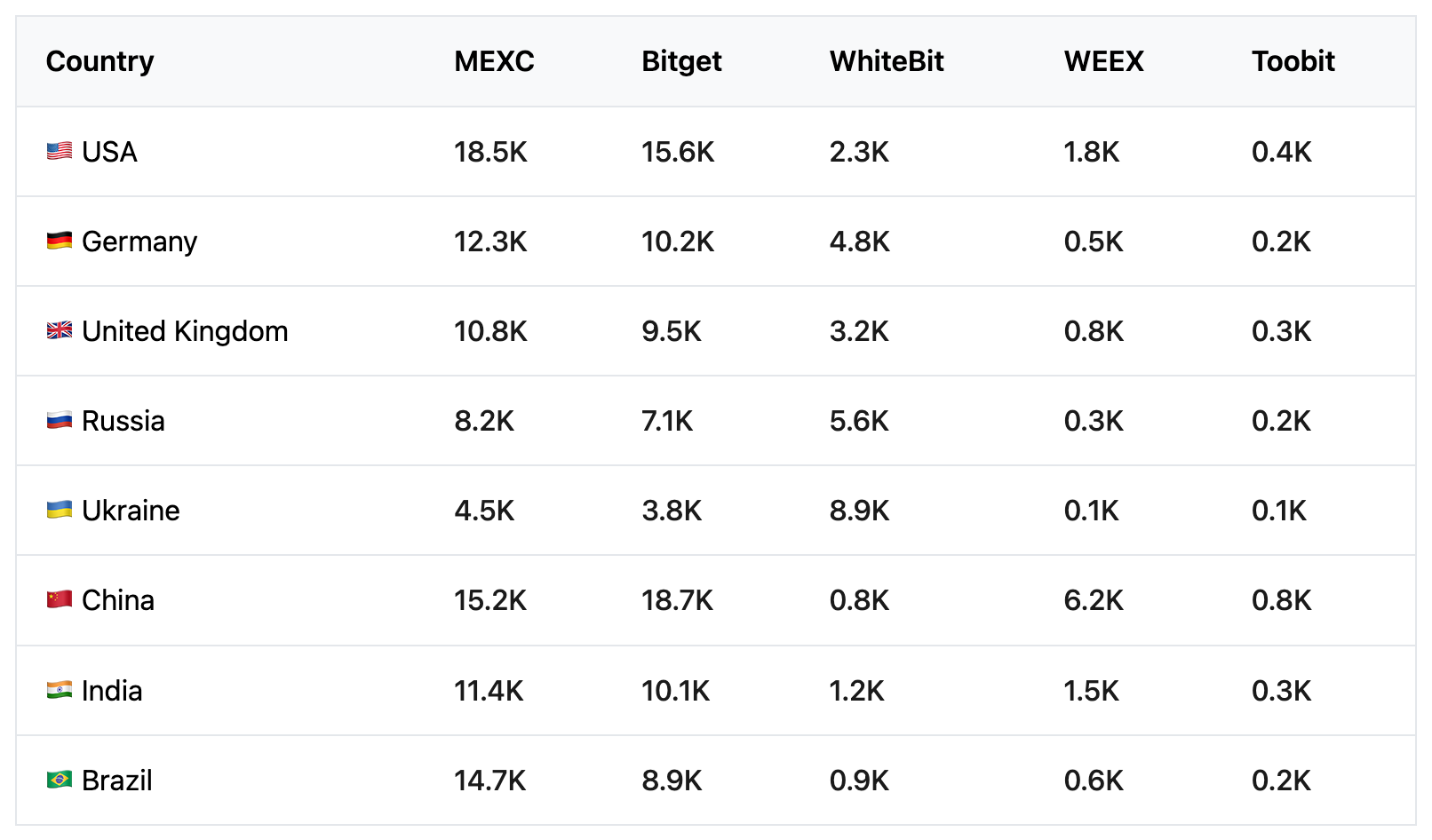

MEXC leads in non-branded traffic — 153 thousand visitors per month. Bitget follows with 120 thousand. WhiteBit attracts 38.6 thousand, WEEX — 12.4 thousand, Toobit — 2.7 thousand.

Non-branded traffic (thousands of visitors per month)

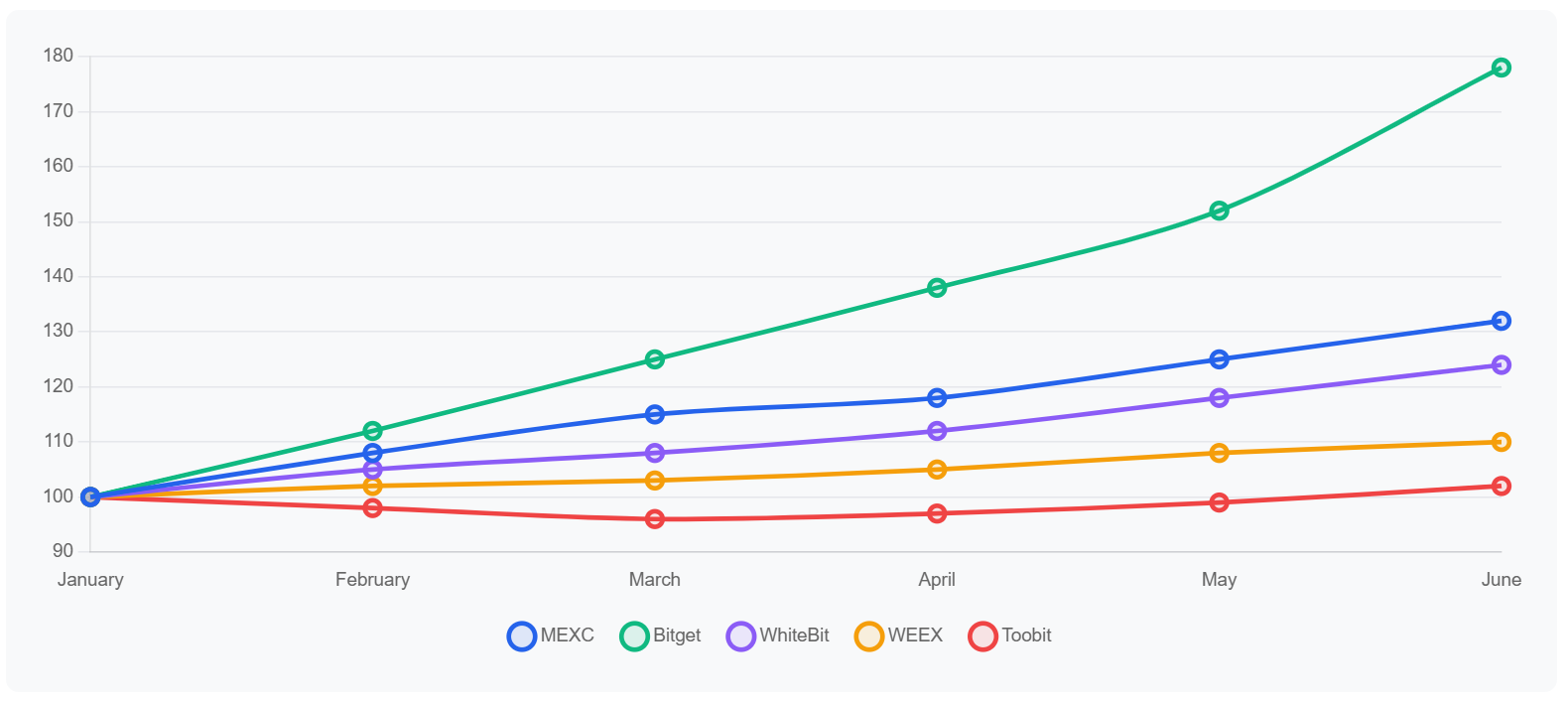

Traffic growth in 2025 (baseline = 100)

Growth Rate Comparison (% increase from January to June 2025)

Bitget grows fastest, plus 78% in the first half of 2025. MEXC added 32%, WhiteBit — 24%, WEEX — 10%, Toobit — 2%.

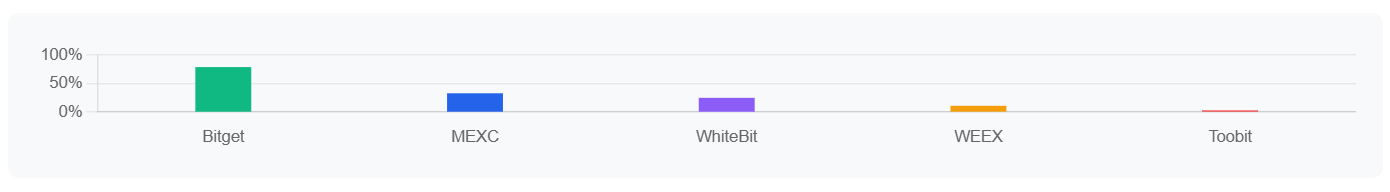

MEXC invests most in links — approximately 2.5 million dollars. Bitget spent 1.8 million, WhiteBit — 450 thousand, WEEX — 150 thousand, Toobit — 80 thousand.

Link building investments (thousands of dollars)

Key insight: There’s a clear correlation between SEO investment and traffic results. The platforms investing more in quality link building are seeing proportionally higher traffic growth.

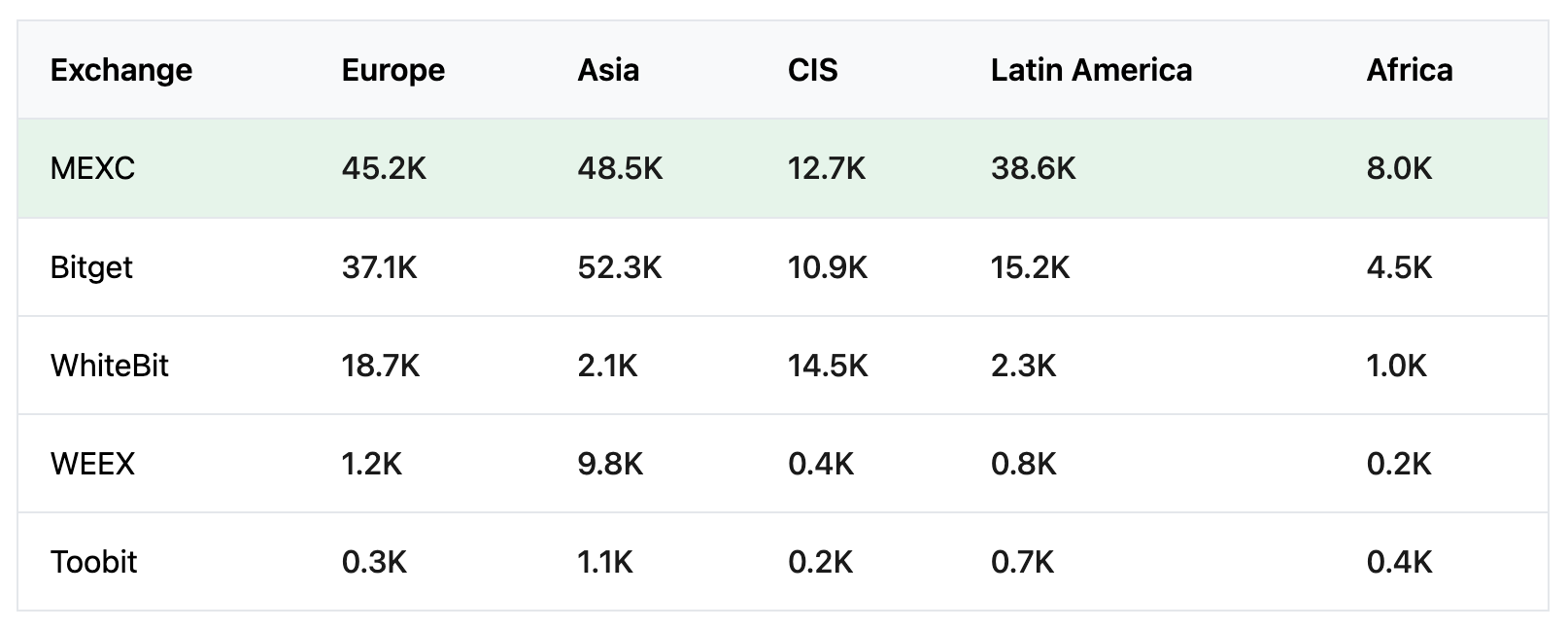

Traffic by regions

MEXC and Bitget operate globally. Present in all key regions: Europe, Asia, CIS, Latin America.

WhiteBit focuses on Europe and CIS. 48% of traffic comes from Ukraine, Russia, Poland and neighbouring countries.

WEEX operates only in Asia. 79% of traffic from China, India and Southeast Asia.

Toobit aims to establish a foothold in emerging markets. Small presence in Africa and Latin America.

What Works in SEO

High-Performing Content Categories

Educational content consistently outperforms promotional content across all analyzed platforms. Users searching for crypto-related information are primarily seeking knowledge before making trading decisions.

At MEXC, the traffic drivers are:

- Bitcoin price prediction for 2025: 38,000 visitors/month

- DeFi tokens list directory: 28,000 visitors/month

- Comprehensive trading guides: 25,000 visitors/month

At Bitget, educational content dominates:

- “What is cryptocurrency trading” comprehensive guide: 47,000 visitors/month

- Crypto trading strategies for beginners: 41,000 visitors/month

- Bitcoin halving explained article: 35,000 visitors/month

At WhiteBit, localized content performs best:

- How to buy Bitcoin in Europe guide: 18,000 visitors/month

- EU crypto regulations page: 12,000 visitors/month

- Staking rewards calculator: 9,000 visitors/month

Untapped Opportunities with Massive Potential

Our keyword analysis revealed several high-volume, low-competition niches that even market leaders haven’t fully exploited:

Immediate Opportunities:

- Crypto tax calculator: 22,000 monthly searches with surprisingly low competition

- DeFi exchange comparison: 18,000 monthly searches, perfect for conversion-focused content

- AI trading bots: 25,000 monthly searches, rapidly growing category

- Cross-border crypto payments: 15,000 monthly searches

- Crypto inheritance planning: 8,000 searches but growing 200% annually

Why These Topics Work:

- High commercial intent (users are closer to making financial decisions)

- Tool-based content naturally earns backlinks and social shares

- Evergreen value (tax and planning content remains relevant long-term)

- Low current competition despite high search volume

Link Profiles

Quality vs. Quantity Analysis

MEXC has accumulated 15,300 referring domains and continues growing with 850 new domains monthly. Importantly, their profile toxicity is only 3%, indicating high-quality link acquisition strategies.

Bitget maintains 12,800 referring domains with a growth rate of 720 new domains per month. Their toxicity rate of 5% is still very manageable and shows they’re scaling link building while maintaining quality.

Other platforms show significant weaknesses in link building:

- WhiteBit: 4,200 referring domains (decent but limited growth potential)

- WEEX: 1,800 referring domains (insufficient for global expansion goals)

- Toobit: 900 referring domains (critical weakness limiting all SEO efforts)

Fast-Growing Markets

Latin America

- 🇧🇷 Brazil: crypto query growth of 125% per year

- 🇦🇷 Argentina: 156% growth due to inflation

- 🇲🇽 Mexico: 98% growth

Southeast Asia

- 🇻🇳 Vietnam: 142% growth

- 🇵🇭 Philippines: 108% growth

- 🇮🇩 Indonesia: 95% growth

CIS

- 🇺🇿 Uzbekistan: 125% growth

- 🇰🇿 Kazakhstan: 78% growth

- 🇬🇪 Georgia: 95% growth

What to Do Right Now: Your Action Plan

In 30 days, you can:

- Fix hreflang tags — will add 15% of international traffic

- Update review pages — add current 2025 data

- Optimise content for Featured Snippets

- Add Schema markup for trading pairs

In 90 days, you can:

- Build a DeFi educational portal

- Localise guides for growing markets

Ambitious projects:

- AI tax calculator for 50+ countries

- Portfolio widget for partner sites

Summary

MEXC and Bitget control the market. They have more traffic, money for promotion, and global presence.

Bitget grows fastest, plus 78% in six months. If it maintains the pace, it will overtake MEXC by year-end.

WhiteBit firmly holds Europe and CIS. WEEX and Toobit lag significantly and risk remaining niche players.

Main growth opportunities:

- Fast-growing markets: Latin America, Southeast Asia, CIS

- Educational content and interactive tools

- Featured Snippets optimization

- High-volume, low-competition keywords

The platforms investing in quality SEO see proportional traffic growth. Success requires consistent execution across technical optimization, content creation, and strategic link building.

Rate the article