Comparison Table: Best Crypto Presales November 2025

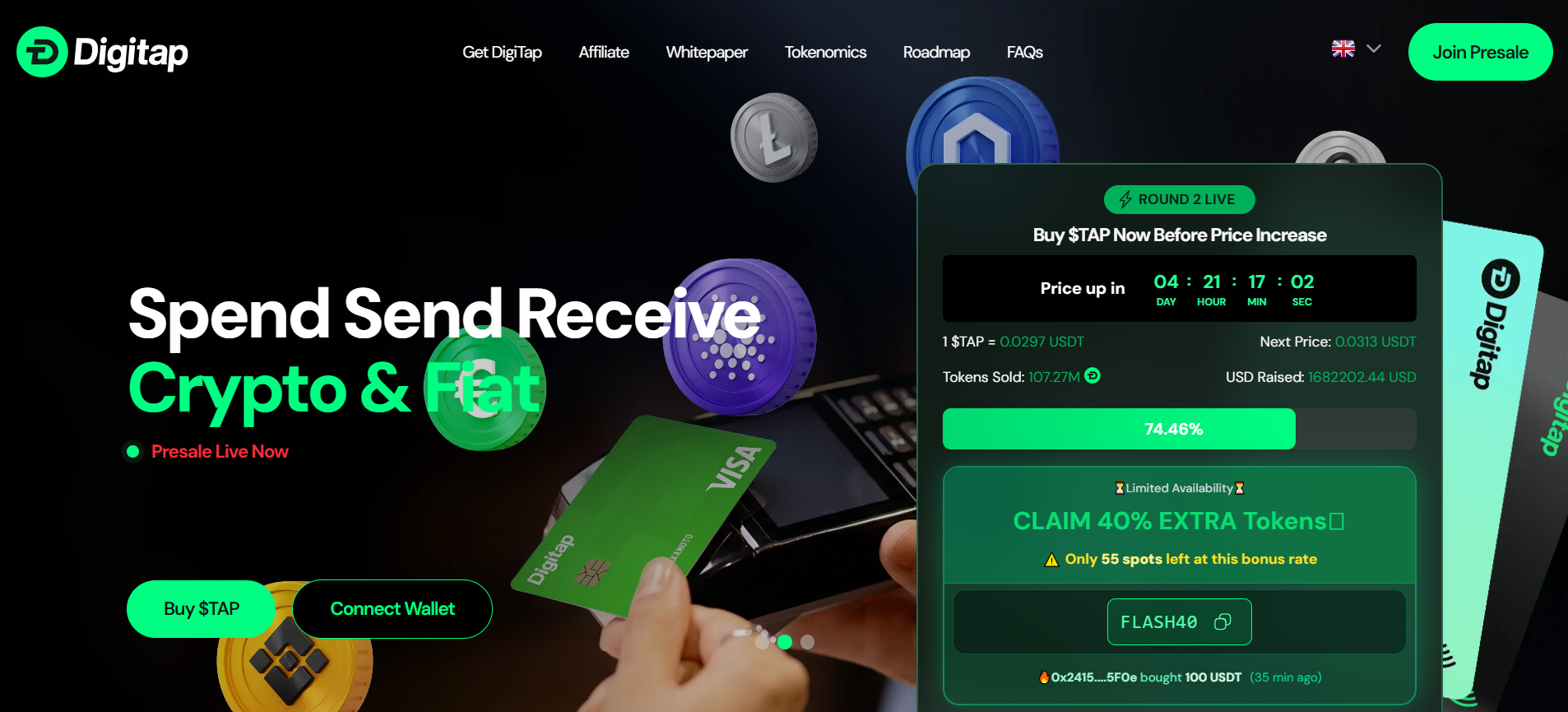

DigiTap ($TAP)

Banking infrastructureCategory

- DeFi

- Banking

Launchpad

Funding Goal

Immunefi ($IMU)

AI security platformCategory

- Security

- AI Infrastructure

Launchpad

Funding Goal

Flying Tulip ($FT)

Cross-margin DeFi protocolCategory

- DEX

- Perpetuals

- Lending

Launchpad

Funding Goal

YouHodler ($YHDL)

CeFi rewards tokenCategory

- Lending

- Exchange

- Wallet

Launchpad

Funding Goal

Tria

Chain abstraction neobankCategory

- Payments

- Cross-Chain

Launchpad

Funding Goal

Talisman ($SEEK)

Multi-chain DeFAI walletCategory

- Wallet

- AI Agents

Launchpad

Funding Goal

Makina ($MAK)

AI yield aggregatorCategory

- Yield

- Trading

- AI

Launchpad

Funding Goal

Kokodi ($KOKO)

Cross-chain P2E shooterCategory

- GameFi

- Shooter

Launchpad

Funding Goal

Battle Derby ($TOG)

Mobile combat P2ECategory

- GameFi

- Mobile

Launchpad

Funding Goal

Khugaverse ($KOIN)

Multi-game metaverseCategory

- GameFi

- NFT

- P2E

Launchpad

Funding Goal

Quranium ($QRN)

Quantum-secure L1Category

- Layer 1

- AI

Launchpad

Funding Goal

ByteDance Mirror ($rTTOK)

Tokenized equity exposureCategory

- RWA

- Securities

Launchpad

Funding Goal

November 2025 presents exceptional opportunities across blockchain infrastructure, DeFi protocols, and security platforms. The best crypto presales November showcase projects backed by tier-1 venture capital firms, established teams with proven track records, and innovative tokenomics designed for long-term sustainability. From Andre Cronje’s $200M-backed Flying Tulip to Immunefi’s AI-powered security platform protecting $180B in assets, this month’s presales span institutional-grade infrastructure, consumer fintech abstraction, and specialized gaming ecosystems. With total raises exceeding $250M and strategic backing from Framework Ventures, Brevan Howard Digital, and Polygon co-founders, these carefully vetted projects represent the evolution from speculative ventures toward foundational Web3 solutions addressing security, capital efficiency, and mass adoption challenges.

Our Analysis Approach: Evaluating the Best Crypto Presales to Invest in November 2025

We evaluated projects based on institutional validation, team transparency, and structural innovation to identify the best crypto presale November 2025 opportunities.

Key evaluation criteria include:

- Regulatory compliance: Projects with multi-jurisdictional registrations and transparent legal structures

- Team verification and track record: Public founders with documented achievements in DeFi, security, or infrastructure development

- Institutional backing quality: Tier-1 VC participation from Framework Ventures, Brevan Howard, Electric Capital, and specialized gaming funds

- Tokenomics structure: Vesting schedules, unlock mechanisms, and investor protection features like redemption rights

- Market positioning: Addressing critical infrastructure gaps in security, capital efficiency, or user experience abstraction

- Product maturity: Established platforms launching tokens versus greenfield projects with future delivery timelines

Project Analysis: Best Crypto Presales November 2025

1. DigiTap ($TAP) – Tokenized Banking Infrastructure

Website: presale.digitap.app

DigiTap positions itself as omni-banking infrastructure enabling traditional financial institutions to modernize through tokenization. The platform targets the gap between legacy banking systems and blockchain technology, offering combined DeFi/TradFi services including crypto-backed Visa cards, instant crypto-fiat conversions, and multi-currency accounts. The value proposition centers on providing banks the technological foundation to serve 1.4 billion unbanked individuals globally while accessing the $290+ trillion cross-border payments market projected by 2030. The presale allocation of 44% (880M tokens) from 2B total supply demonstrates significant early community distribution. The ERC-20 token features staking programs up to 124% APR and deflationary tokenomics through a 50% buyback mechanism. Zero-KYC access differentiates the platform in privacy-conscious markets. The project targets listing at $0.14 from presale price of $0.0268, establishing growth expectations. DigiTap competes in the crowded crypto-fiat bridge space alongside established players like Coinbase and Crypto.com.

Key Token Sale Details:

- Type: Multi-round presale on official website at $0.0268

- Supply: 2B total, 44% presale allocation (880M tokens)

- Features: 124% APR staking, 50% buyback, crypto Visa card integration

- Network: Ethereum ERC-20 with cross-chain compatibility

- Target: 1.4B unbanked individuals, $290T+ payments market

2. Immunefi ($IMU) – AI-Powered Web3 Security Platform

Website: immunefi.com

Immunefi stands as the undisputed leader in blockchain security infrastructure, having protected over $180 billion across 650+ protocols including Ethereum, Aave, and Arbitrum since its 2020 founding. The platform has paid $110-120M in bug bounties to over 60,000 security researchers, preventing an estimated $25B in potential exploits. CEO Mitchell Amador, previously VP Marketing at Steemit and CMO at SingularityNET, leads a 50+ person team operating from Singapore and Lisbon headquarters. The revolutionary Security OS leverages proprietary AI trained on the industry’s largest dataset of exploits and bug fixes to provide predictive threat detection. Immunefi’s transition from service platform to tokenized ecosystem creates a self-reinforcing security flywheel where protocols stake $IMU for premium features, researchers earn $IMU for threat intelligence, and community members back both parties through the Patrons Program. With institutional backing from Framework Ventures, Electric Capital, and Samsung Next totaling $29.5M in equity funding, Immunefi addresses the critical $11.7B problem of crypto security losses.

Key Token Sale Details:

- Price: $0.01337 per token on CoinList (November 12-19, 2025)

- FDV: $133.7M with 10B total supply, 3.74% allocated to public sale

- Vesting: 100% unlock at TGE (February 2026) for public; 36-month lock for team/investors

- Utility: Powers Credits Program (protocol staking), Boost Program (researcher rewards), Patrons Program (community backing)

- Backing: Framework Ventures (lead), Electric Capital, P2 Ventures, SamsungNext, The LAO

3. Flying Tulip ($FT) – Andre Cronje’s Full-Stack DeFi Exchange

Website: flyingtulip.com

Flying Tulip represents Andre Cronje’s most ambitious project since Yearn Finance, building a complete on-chain financial system integrating spot trading (AMM + CLOB), perpetuals, options, lending, native stablecoin (ftUSD), and on-chain insurance with unified cross-margin efficiency. The protocol raised $200M in private funding from institutional powerhouses including Brevan Howard Digital, CoinFund, DWF Labs, Nascent, Hypersphere, and Susquehanna International Group. What distinguishes Flying Tulip is its revolutionary tokenomics: zero team allocation at genesis, with founders compensated exclusively through protocol revenue buybacks. This alignment ensures the team profits only when the protocol generates sustainable fees. The groundbreaking “perpetual put” redemption right allows all primary sale participants to burn tokens and redeem original principal from an on-chain segregated reserve, effectively creating a price floor at ICO valuation. Built on the zero-fee Sonic network, Flying Tulip competes with established giants like dYdX, Aave, and Uniswap by offering capital efficiency through cross-margin integration and oracle-less perpetuals design.

Key Token Sale Details:

- Price: $0.10 estimated for Impossible Finance IDO (active until November 16, 2025)

- FDV: $1B valuation, same terms as $200M private round

- Innovation: Perpetual redemption right (burn tokens to recover principal), 0% team allocation

- Architecture: Unified cross-margin system combining spot, derivatives, lending, insurance

- Backing: Brevan Howard Digital, CoinFund, DWF Labs, Nascent, Republic, Susquehanna ($200M raised)

4. YouHodler ($YHDL) – Established CeFi Platform Token

Website: youhodler.com

YouHodler brings seven years of operational excellence to tokenization, having served 2+ million clients across 60+ countries since its 2017 founding. CEO Ilya Volkov, with 20 years in FinTech and former Managing Director at Forex Club, leads a fully transparent C-suite including Igor Bannikov (CRO) and Julian Grech (General Counsel). The platform offers crypto-backed loans at 90% LTV, interest accounts, MultiHODL trading tools, and BTC cloud mining. $YHDL transforms this established business into a token-enhanced ecosystem where holders receive reduced trading fees, elevated APY rates, card cashback boosts, mining advantages, and referral rewards. With regulatory approvals from Switzerland (FINMA framework), Spain (Bank of Spain VASP registration), Italy (OAM), and Argentina (CNV), YouHodler demonstrates multi-jurisdictional compliance. Strategic partnerships with Ledger, Lightspark, Fireblocks, and Bitget Wallet strengthen infrastructure security. The token distribution prioritized existing users through airdrops to 100K+ qualified recipients based on loyalty levels, creating immediate utility demand from an established customer base.

Key Token Sale Details:

- Price: $0.30 on Gamestarter (November 20-23, 2025), $500K raise

- Supply: 1B total, 250M initial circulating (25%), 1.66M tokens in IDO

- Distribution: 150M airdrop (~$45M value), loyalty rewards, Zealy campaigns, DappRadar PRO

- Utility: APY boosts, trading fee reductions, card cashback, mining acceleration, staking rewards

- Compliance: FINMA (Switzerland), Bank of Spain VASP, OAM (Italy), CNV (Argentina)

5. Tria – Self-Custodial Chain Abstraction Neobank

Website: tria.so

Tria addresses Web3’s most pressing adoption barrier: complexity. The self-custodial neobank abstracts away gas fees, bridging, and chain-switching across 100+ networks while providing traditional banking features like Visa card payments in 150+ countries with 6% cashback and zero fees. The BestPath AVS (Actively Validated Service) powered by AI-driven intent resolution processes 70+ protocols, enabling gasless cross-chain settlements on Arbitrum Orbit and MoveVM architecture. Founder Parth Bhalla, blockchain veteran since 2014 and youngest Microsoft Ambassador, built the team from alumni of Binance, Polygon, and OpenSea. The $12M pre-seed round secured backing from Sandeep Nailwal (Polygon co-founder), P2 Ventures, and Aptos, alongside advisors from Polychain. Tria’s closed beta generated $1.2M revenue and processed $15M volume across 20K users in just 11 weeks, demonstrating product-market fit. The platform supports 1,000+ tokens with up to 15% APY on idle assets, positioning itself as “Revolut for crypto” while maintaining complete self-custody—a unique value proposition in the crowded wallet market.

Key Token Sale Details:

- Platform: Legion/Nozomi launchpad, pre-liquid token round structure

- Timeline: November 2025 (active), merit-based + FCFS allocation

- Traction: $1.2M revenue, $15M volume, 20K users in 11-week beta

- Access: Guaranteed allocation through Tria Card purchase ($20-$225 tiers)

- Backing: Sandeep Nailwal (Polygon), P2 Ventures, Aptos, Polychain advisors

6. Talisman ($SEEK) – Multi-Chain DeFAI Wallet Evolution

Website: talisman.xyz

Talisman evolves from a mature multi-chain wallet supporting 900+ networks into an AI-powered DeFi aggregation platform. Founded in 2021, the wallet has established strong adoption with 6M+ DOTs staked and native support for Ethereum, Solana, Bittensor, Polkadot, and Kusama ecosystems. The $SEEK token launch accompanies the introduction of “Agent Intelligence” infrastructure enabling AI-driven yield automation and gamified Quest systems. Co-founders Jonathan Dunne (Head of Tech) and Brandon Aaskov (CTO) lead a 10-50 person team from New York headquarters. The strategic backing from Hypersphere Ventures—founded by Polkadot co-founder Robert Habermeier—provides exceptional credibility in the substrate ecosystem. Additional investors Zee Prime Capital, D1 Ventures, DFG, and PAKA validate the project’s technical direction. Talisman’s four-year operational track record with real users differentiates it from greenfield projects. The AI agent roadmap positions the wallet to capture the emerging “DeFAI” narrative while maintaining compatibility with established ecosystems.

Key Token Sale Details:

- Price: $0.30 across Eesee ($150K) and ChainGPT ($200K) platforms

- FDV: $60M valuation, $350K total public raise

- Vesting: 25% TGE unlock, 6-month linear vesting schedule

- Networks: 900+ chains including Ethereum, Solana, Bittensor, Polkadot, Kusama

- Backing: Hypersphere Ventures (Polkadot co-founder), Zee Prime, D1 Ventures, DFG, PAKA

7. Makina ($MAK) – Institutional AI Yield Automation

Website: makina.finance

Makina Finance delivers institutional-grade DeFi execution through non-custodial AI-powered strategies targeting sophisticated users including asset managers, protocol treasuries, and advanced traders. The platform’s “Machines” (automated vaults) execute complex operations like delta-neutral hedging, cross-chain leveraged arbitrage, and risk-adjusted yield optimization using “Calibers” for cross-chain liquidity management. Founded by crypto-native builders averaging eight years industry experience and spun out from Dialectic (a respected multi-year DeFi fund), Makina combines proven operational excellence with cutting-edge AI agent integration. The $3M funding at $35M FDV attracted cyber Fund, Interop VC, Steakhouse Financial, Bodhi Ventures, and notable angels including Cozomo de’ Medici and Axie Infinity co-founder Aleksander Larsen. Makina’s launch strategy emphasizes fairness with public token holders and SAFT investors receiving identical valuation terms. Season 1 strategies are live, demonstrating real execution capability. Target yields of 10-18% USD, 10-14% ETH, and 6-8% BTC address institutional demands for reliable, risk-adjusted returns in DeFi’s maturing landscape.

Key Token Sale Details:

- Platform: Legion launchpad, Season 0 “Tickets” for priority access

- Valuation: $35M FDV for seed/ICO rounds

- Status: Season 1 live with active strategies, TGE late 2025

- Yields: Target 10-18% USD, 10-14% ETH, 6-8% BTC strategies

- Backing: cyber Fund, Interop, Steakhouse Financial, Cozomo de’ Medici, Bodhi Ventures, BaseDAO

8. Kokodi ($KOKO) – AAA Cross-Chain Extraction Shooter

Website: kokodi.io

Kokodi brings AAA gaming production values to Web3 with a third-person fantasy extraction shooter built by veterans from EA, Wargaming, and Sony. CEO André Freitas, Founder Tatiana Bolotova, and COO Antonina Binetskaya lead development of a Tarkov-inspired Raids mode and Valorant-style Arena competition. The cross-chain architecture spans Avalanche and Beam, with 5,526 NFTs distributed to 1,729 holders. Pre-alpha Season 1 actively engages players, demonstrating functional gameplay ahead of token launch. Merit Circle, the premier GameFi-focused VC and guild, leads backing alongside Avalanche Foundation, Dutch Crypto Investors, Tenzor Capital, and Kangaroo Capital. Merit Circle’s involvement signals strong marketability potential and guild distribution capability. The extraction shooter genre is experiencing significant growth in 2025, positioning Kokodi to capture audience interest. Seedify’s 2022 incubation provided early infrastructure support. The game targets core gamers seeking high-skill, high-retention experiences rather than casual mobile audiences, differentiating it within the GameFi landscape.

Key Token Sale Details:

- Price: $0.015 listing price, $0.012 private sale, $15M FDV

- Platforms: Spintop IDO (primary), Kanga IEO (April 2024 completed)

- Supply: 1B total, initial market cap $430.5K (low-float structure)

- Team: EA, Wargaming, Sony veterans; Seedify incubated 2022

- Backing: Merit Circle (lead), Avalanche Foundation, Dutch Crypto Investors, Tenzor Capital

9. Battle Derby ($TOG) – Mobile Proof-of-Skill Combat

Website: linktr.ee/battlederby

Battle Derby revolutionizes Play-to-Earn sustainability through its “Proof of Skill” incentive structure rewarding genuine gameplay expertise over financial investment. The free-to-play mobile vehicular combat game runs on Chromia with Immutable X integration, featuring Syndicate Car NFTs and scholarship systems promoting accessibility. CEO Isidro Quintana brings 17 years experience including Disney, Marvel, and Warner Brothers credentials, while CTO Ricardo Varela contributed to Tom Clancy’s Division, Assassin’s Creed, and Castlevania at Ubisoft, Konami, and Sony. Chief Investment Officer Steven Dobesh’s background as Pentagon Technology Chief and first DoD blockchain architect provides exceptional credibility. The game is soft-launched on iOS and Android with multiple combat modes operational. Chromia and GYB lead investment, with Merit Circle strategic partnership and Polygon ecosystem support. The mobile-first approach addresses the largest gaming market segment while the Proof of Skill mechanism ensures token rewards correlate with player value contribution rather than inflationary time-spent models that plagued earlier P2E attempts.

Key Token Sale Details:

- Price: $0.075 on Gamestarter, $30M FDV, $475K public raise

- Vesting: 20% TGE unlock, 12-month linear release, 50% burn mechanism

- Funding: $3.46M total ($1.35M 2021, $1.64M 2022, $475K 2024)

- Team: Pentagon CIO (Steven Dobesh), Ubisoft/Konami veterans (Ricardo Varela), Oxford educator (Isidro Quintana)

- Partnerships: Chromia (lead), Merit Circle, Immutable X, Polygon ecosystem

10. Khugaverse ($KOIN) – Multi-Game Cat-Themed Ecosystem

Website: khuga.io

Khugaverse builds a multi-game entertainment ecosystem centered on “fierce, battle-ready cats” IP spanning Khuga Rumble Arena (multiplayer brawler) and Khuga Bash! (action combat). The Abstract Chain deployment provides technical infrastructure for the 5,555 NFT collection already distributed to community members. Khuga Labs operates the ecosystem from Indonesia, targeting the accessible GameFi and digital entertainment market. The multi-game strategy aims to build durable IP value rather than relying on single-title success, similar to established gaming franchises. Token allocation designates 30% for presale/public sales and 10% for existing NFT holders, creating utility for early supporters. The $200K Huostarter IDO at $0.035 per token establishes a $35M FDV with 1B total supply. The cat-themed IP differentiates within the crowded GameFi space, potentially attracting both crypto-native audiences and mainstream gaming demographics. Abstract Chain’s infrastructure provides scalability for the multi-game vision while maintaining EVM compatibility for developer accessibility.

Key Token Sale Details:

- Price: $0.035 on Huostarter, $200K raise, $35M FDV

- Supply: 1B total, 30% presale/public, 10% NFT holder allocation

- Network: Abstract Chain (EVM-compatible)

- Games: Khuga Rumble Arena (brawler), Khuga Bash! (action), 5,555 NFT collection

- Listing: MEXC, BingX, CoinW, Uniswap planned exchanges

11. Quranium ($QRN) – Quantum-Secure AI Layer 1

Website: quranium.org

Quranium addresses the future existential threat quantum computing poses to blockchain security by implementing NIST-approved post-quantum cryptography (SLH-DSA) as a foundational Layer 1 protocol. CEO Kapil Dhiman, former PwC India Web3 leader, and CTO Yaduvendra Yadav lead a 120+ expert team operating from Switzerland, UAE, and Singapore offices. The convergence layer combines quantum security with native AI logic and EVM compatibility, enabling seamless Solidity contract deployment. Ecosystem tools include QSafe quantum-secure multi-chain wallet and Q-REMIX AI for agent-based smart contract generation. Animoca Brands’ strategic investment validates the platform’s potential for metaverse, AI, and gaming applications despite its security-focused foundation. This partnership hedges timing risk—if quantum threats materialize slowly, Quranium maintains relevance through immediate AI and GameFi narratives. Advisory support from David Chaum (digital cash inventor) and Sebastien Borget (The Sandbox) strengthens credibility. The $200K Huostarter IDO targets early community building at $0.0667 price with 2.1B total supply and $140M FDV.

Key Token Sale Details:

- Price: $0.0667 on Huostarter, $200K raise, $140M FDV

- Supply: 2.1B total, vesting 10% TGE, 10-month monthly release

- Technology: NIST-approved SLH-DSA post-quantum cryptography, EVM-compatible

- Tools: QSafe wallet, Q-REMIX AI contract generator

- Backing: Animoca Brands (strategic), David Chaum (advisor), PwC partnership

12. ByteDance Mirror Token (rTTOK) – Tokenized Private Equity Exposure

Website: bytedance.com/

The ByteDance Mirror Token represents sophisticated RWA tokenization, offering exposure to TikTok’s parent company through a Contingent Payout Note issued by RepublicX LLC. This debt security references ByteDance common stock at a $250 per share reference price, implying ~$400B valuation. Investors receive payouts upon Qualified Liquidity Events (IPO, acquisition) or the November 2035 maturity date, calculated as (FMV ÷ Reference Price) × Principal. The structure allows retail participation in typically accredited-only private equity opportunities. CoinList users receive a 5% bonus allocation. The offering spans CoinList and Republic platforms with up to $25M total raise at $1 per token and $250 minimum investment. This represents Republic’s Mirror Token program encompassing 24 similar offerings for unicorn companies. The 10-year maturity provides long-duration exposure aligned with ByteDance’s eventual liquidity event. Investors hold senior unsecured claims against RepublicX LLC rather than direct ByteDance equity. The tokenized structure enables fractional ownership and potential secondary market trading post 1-year lockup, democratizing access to elite private company exposure.

Key Token Sale Details:

- Price: $1.00 per token, $250 minimum investment, up to $25M offering

- Reference: ByteDance $250/share (~$400B valuation), 10-year maturity (2035)

- Structure: Contingent Payout Note issued by RepublicX LLC, senior unsecured claim

- Platforms: CoinList (5% bonus) and Republic (October 30 – November 13, 2025)

- Payout: Formula-based on liquidity events (IPO, acquisition) or maturity date valuation

Understanding Presale Investment Strategies for Maximum Returns

Strategic presale participation requires distinguishing between institutional-grade infrastructure projects and early-stage ventures based on capital structure and market positioning. The best crypto presales November 2025 demonstrate clear patterns: projects like Flying Tulip and Immunefi backed by $200M+ institutional rounds offer structural stability through proven teams and tier-1 VC validation, while earlier-stage GameFi projects present higher volatility with Merit Circle or Avalanche Foundation ecosystem support. Investors should assess vesting schedules carefully—100% TGE unlocks create immediate liquidity but risk selling pressure, while extended team locks (36+ months) signal long-term commitment. Redemption rights, as pioneered by Flying Tulip, fundamentally alter risk profiles by providing principal protection. Geographic diversification matters: YouHodler’s multi-jurisdictional compliance (Switzerland, Spain, Italy) demonstrates regulatory sophistication versus single-jurisdiction operations. Token utility drives sustainable demand—Immunefi’s security flywheel, Makina’s yield automation, and Tria’s neobank features create organic usage versus purely speculative assets. The November 2025 cohort notably emphasizes AI integration (Immunefi, Makina, Quranium, Talisman), quantum security (Quranium), and chain abstraction (Tria), representing forward-looking infrastructure bets.

Evaluating Tokenomics and Vesting Structures in November Presales

Critical Tokenomics Assessment Framework:

| Evaluation Factor | High-Quality Signal | Risk Indicator |

|---|---|---|

| Team Allocation | <20% with 3+ year vesting | >30% or short vesting |

| Public Sale % | 3-10% of total supply | <1% (extreme low-float) |

| Investor Locks | 24-48 month schedules | <12 months or unclear |

| Unlock Schedule | Linear/gradual releases | Large cliff unlocks |

| Utility Integration | Multi-feature platform use | Single-use or unclear |

Flying Tulip’s 0% team allocation with revenue-based compensation represents gold-standard alignment, while Immunefi’s 100% public unlock paired with 36-month insider locks demonstrates confidence in immediate utility demand. Low-float models (Kokodi’s $430K IMC vs $15M FDV) create short-term price dynamics but require awareness of future dilution. Inflationary schedules like Quranium’s 10% monthly unlocks over 10 months demand careful position sizing. The best crypto presales to invest in November 2025 balance initial accessibility with long-term sustainability—YouHodler’s 25% circulating supply at TGE from an established user base differs fundamentally from greenfield launches. Redemption mechanisms, buyback programs, and deflationary features (DigiTap’s 50% buyback, Battle Derby’s 50% burn) can offset inflationary pressure. Staking utility (Immunefi’s three-program system, YouHodler’s APY boosts) removes tokens from circulating supply while rewarding long-term holders.

Conclusion: Positioning for November 2025’s Most Promising Presales

The best crypto presales November 2025 landscape reflects Web3’s maturation from speculative ventures toward institutional infrastructure and regulatory-compliant consumer solutions. Flying Tulip’s $200M raise and revolutionary redemption rights, Immunefi’s $180B in protected assets and AI-powered security, and YouHodler’s seven-year operational track record with multi-jurisdictional compliance represent the quality tier. Tria’s $12M backing from Polygon’s co-founder and Talisman’s support from Polkadot ecosystem founders demonstrate strategic infrastructure positioning. GameFi projects Battle Derby, Kokodi, and Khugaverse bring AAA development talent and Merit Circle validation to blockchain gaming’s evolution. Makina’s institutional yield focus and Quranium’s quantum-security thesis address specialized but critical market needs. The November cohort emphasizes AI integration, chain abstraction, and real-world utility over purely speculative plays. Investors should prioritize verified teams, tier-1 backing, transparent tokenomics, and genuine product-market fit. As November progresses, these twelve presales offer diversified exposure across security infrastructure, DeFi innovation, consumer fintech, gaming entertainment, and tokenized securities—positioning participants for Web3’s next growth phase with carefully evaluated opportunities spanning risk profiles and sector focuses.

Frequently Asked Questions (FAQ)

The best crypto presales November 2025 include Immunefi (IMU) with $180B in protected assets, Flying Tulip (

FT) backed by 200Mfromtier−1VCs,andYouHodler(200M from tier-1 VCs, and YouHodler (

200Mfromtier−1VCs,andYouHodler(YHDL) from an established CeFi platform. These projects demonstrate institutional validation, transparent teams, and innovative tokenomics that differentiate them from speculative ventures.

To participate in crypto presales, you typically need to register on launchpad platforms like CoinList, Impossible Finance, or Legion, complete KYC verification, and hold specific tokens for allocation tiers. Most November 2025 presales require connecting a Web3 wallet (MetaMask, Coinbase Wallet) and having USDT, USDC, or ETH ready for purchase during the designated sale window.

ICOs (Initial Coin Offerings) are public token sales often on centralized platforms like CoinList, while IDOs (Initial DEX Offerings) launch directly on decentralized exchanges like Uniswap or PancakeSwap. Presales occur before public launches, offering early access at discounted prices to private investors, community members, or launchpad participants—the best crypto presales November typically combine multiple sale stages.

Crypto presales carry elevated risk due to early-stage project development, lower liquidity, and potential for scams or failed execution. However, the best crypto presales to invest in November 2025 mitigate risk through verified teams, tier-1 VC backing (Framework Ventures, Brevan Howard), audited smart contracts, and transparent tokenomics with long vesting periods for insiders.

Professional crypto marketing agencies like ICODA (icoda.io) provide comprehensive launch support including presale strategy, community building, influencer partnerships, and SEO-optimized content that drives qualified investor attention. Successful November 2025 presales leverage expert marketing to build trust, demonstrate legitimacy, and create sustainable demand beyond initial token generation events.

Strong tokenomics for best crypto presales November 2025 include team allocations under 20% with 3+ year vesting, public sale portions of 3-10% supply, clear utility mechanisms, and gradual unlock schedules. Red flags include 100% TGE unlocks, anonymous teams with large allocations, and projects where private investors paid 10x+ less than public participants.

Key November 2025 presale deadlines include Immunefi on CoinList (November 12-19), Flying Tulip on Impossible Finance (ending November 16), and YouHodler on Gamestarter (November 20-23). Several projects like Tria and Makina on Legion have rolling allocations without fixed end dates, allowing flexible participation for qualified investors throughout the month.

Rate the article