Project Comparison Overview

DigiTap ($TAP)

Live Omni-Banking PlatformCategory

- DeFi

- Banking

Launchpad

- Own website

Funding goal

- TBA

RZTO ($RZTO)

Decentralized Telecom (DePIN)Category

- DePIN

Launchpad

- Own website

Funding goal

- TBA

Almanak ($ALMANAK)

AI-Powered DeFiCategory

- AI Agents

- DeFAI

Launchpad

- Legion

Funding goal

- TBA

EO ($EO)

Oracle NetworkCategory

- Oracle

- Restaking

- Node

Launchpad

- Legion

Funding goal

- TBA

Tilted ($TLT)

Gaming MarketplaceCategory

- Marketplace

- Launchpad

Launchpad

- Siduspad

Funding goal

- $100,000

Mawari ($MAWA)

Decentralized InfrastructureCategory

- DePIN

- AI

- Node

- L3

- Modular

Launchpad

- Republic

Funding goal

- $500,000

Disclaimer: This is not financial advice. Crypto investments are risky. Always consult a professional before investing

The cryptocurrency landscape continues to evolve rapidly, with Initial Coin Offerings (ICOs) remaining a cornerstone of blockchain innovation and investment opportunities. As we navigate through 2025, identifying the best crypto ICO projects requires careful analysis of technology, team credentials, market potential, and tokenomics. Our research team at ICODA has meticulously evaluated hundreds of projects to bring you this curated list of nine standout opportunities that represent the future of decentralized finance, artificial intelligence, and blockchain infrastructure.

In this comprehensive analysis, we dive deep into each project’s unique value proposition, examining everything from their innovative solutions to their backing by prestigious venture capital firms. Whether you’re a seasoned crypto investor or exploring ICO opportunities for the first time, this guide provides the insights you need to make informed investment decisions in today’s dynamic market.

Our Ranking Approach: Rigorous Selection Criteria

Our evaluation methodology combines quantitative metrics with qualitative assessment to identify the most promising ICO opportunities. Each project underwent comprehensive scrutiny across multiple dimensions to ensure we’re presenting only the highest-quality investment prospects.

Key Selection Criteria:

- Technology Innovation: Breakthrough solutions addressing real-world problems

- Team Expertise: Proven track record of founders and core development team

- Market Opportunity: Size and growth potential of target market segments

- Investor Backing: Quality and reputation of venture capital supporters

- Tokenomics Structure: Sustainable economic model and utility design

- Community Engagement: Social media presence and follower quality metrics

- Regulatory Compliance: Adherence to legal frameworks and transparency standards

Detailed Project Analysis

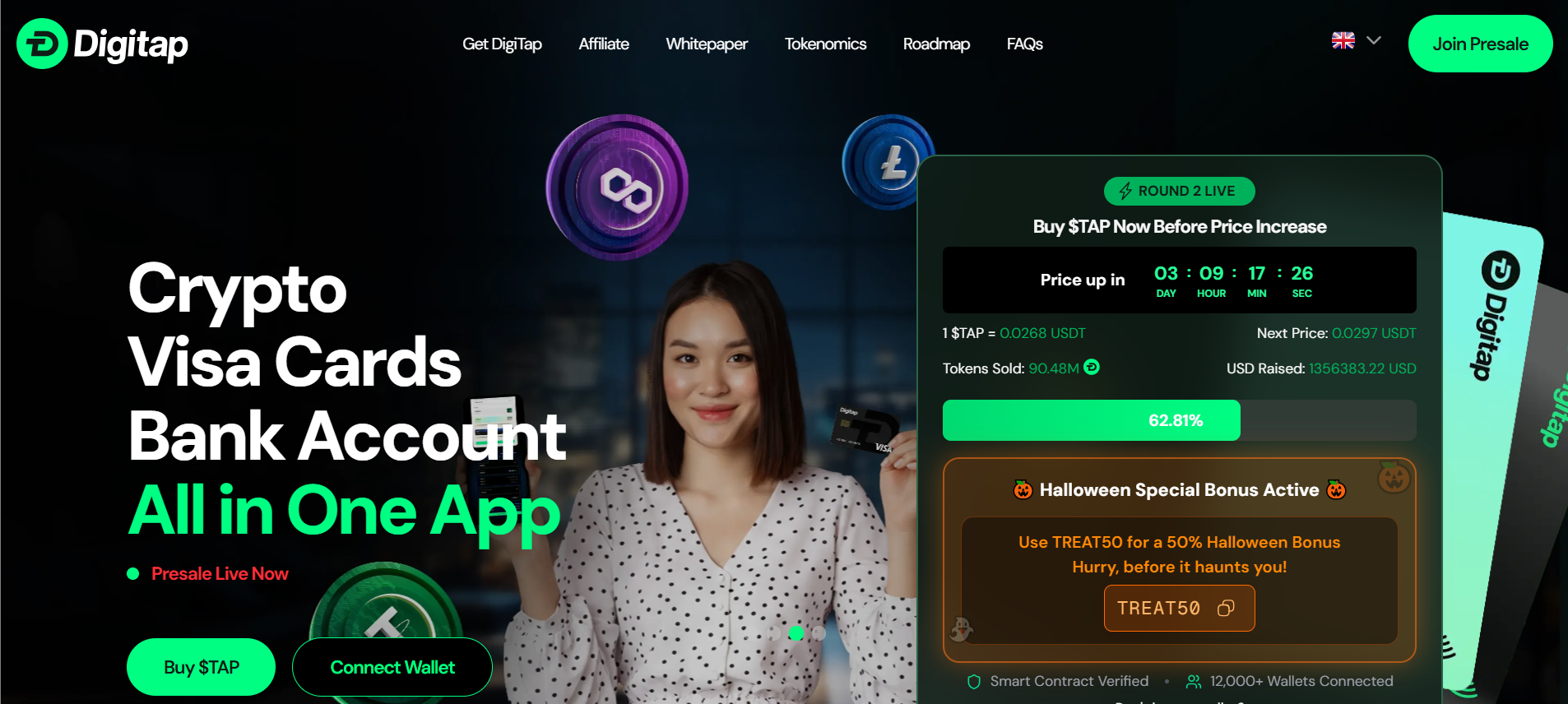

DigiTap ($TAP)

DigiTap emerges as a groundbreaking force in the crypto-fiat convergence sector, delivering what most blockchain projects only promise: a fully operational product available now. Built as a comprehensive omni-banking platform on multiple blockchains including Ethereum and Bitcoin, this project represents the evolution of financial services where traditional banking meets cryptocurrency innovation through seamless integration. The team behind DigiTap understands that the future of crypto adoption lies in eliminating friction between fiat and digital assets through enterprise-grade infrastructure.

The project’s approach to unifying crypto and fiat ecosystems creates a unique value proposition in an increasingly fragmented market. Their live product status across iOS, Android, and web platforms demonstrates execution capability that most presale projects cannot match. What sets DigiTap apart is their commitment to creating sustainable utility through offshore banking accounts, physical payment cards, AI-powered exchange routing, and PCI-DSS Level 1 security compliance, ensuring the platform’s viability beyond speculative investment cycles.

Key Token Sale Details:

- Blockchain: Ethereum, Bitcoin, multi-chain support

- Sale Period: Currently active presale

- Funding Target: To be announced

- Platform: Own website presale at presale.digitap.app

- Token Type: Utility token with staking, governance, and fee reduction

- Security: PCI-DSS Level 1, AES-256 encryption, multi-signature custody

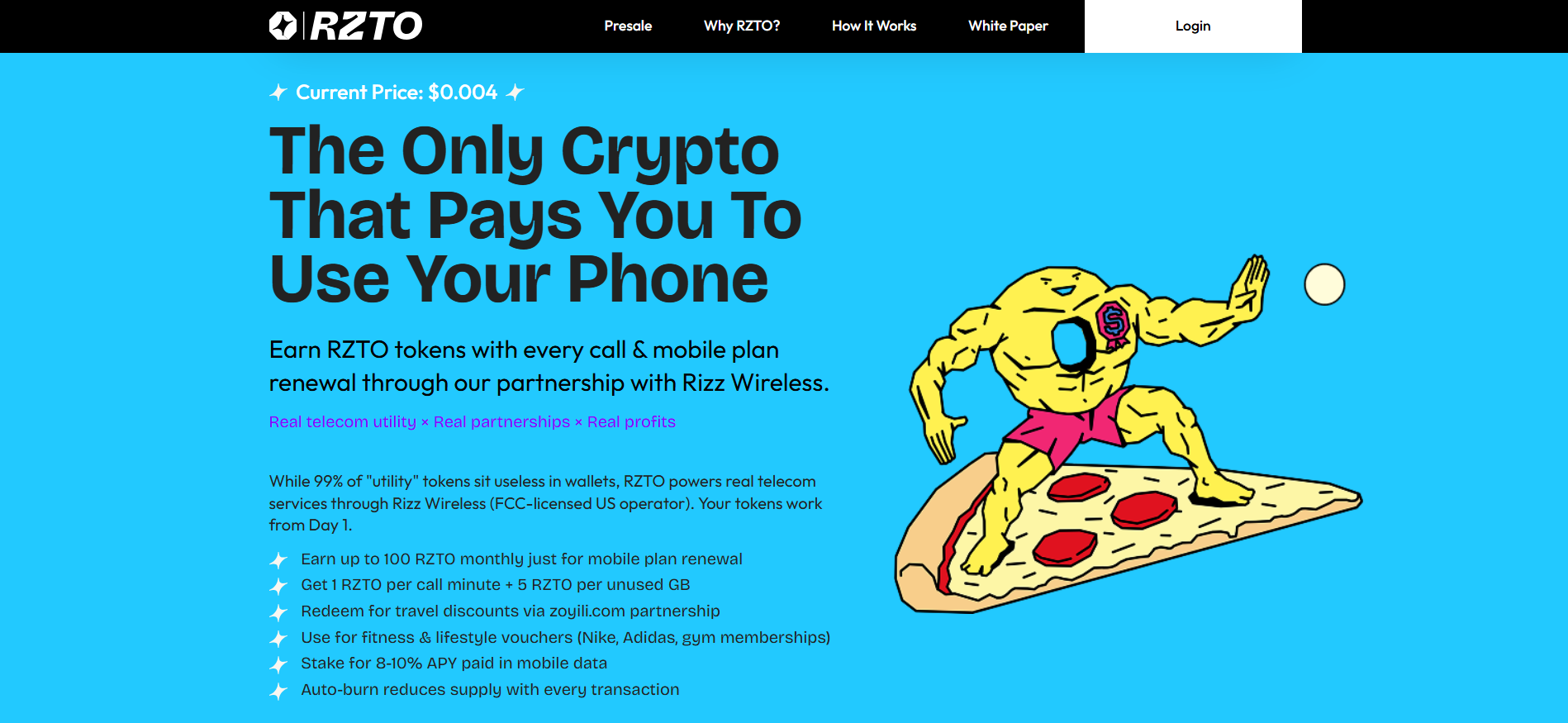

RZTO ($RZTO)

RZTO stands at the forefront of decentralized telecommunications, addressing one of the most critical challenges facing the mobile industry today. Built on Solana’s high-performance infrastructure, RZTO provides users and mobile operators with innovative Call-to-Earn mechanisms that don’t compromise on connectivity quality or cost-effectiveness. The project has attracted significant attention through its partnership with Rizz Wireless, an FCC-licensed MVNO, signaling strong operational credibility.

The DePIN telecom sector represents a massive opportunity as traditional carriers struggle with centralized models and users demand greater value from their mobile services. RZTO’s technology enables tokenized mobile rewards, data trading capabilities, and travel benefits integration, opening possibilities for user-owned telecom networks, loyalty tokenization, and seamless global connectivity. Their strategic partnership with operational telecom infrastructure positions them perfectly to capture value as utility-driven tokens become essential rather than speculative assets.

Key Token Sale Details:

- Blockchain: Solana

- Launch Date: To be announced

- Funding Target: To be announced

- Platform: Own website presale

- Operational Partner: Rizz Wireless (FCC-licensed MVNO)

- Token Symbol: $RZTO

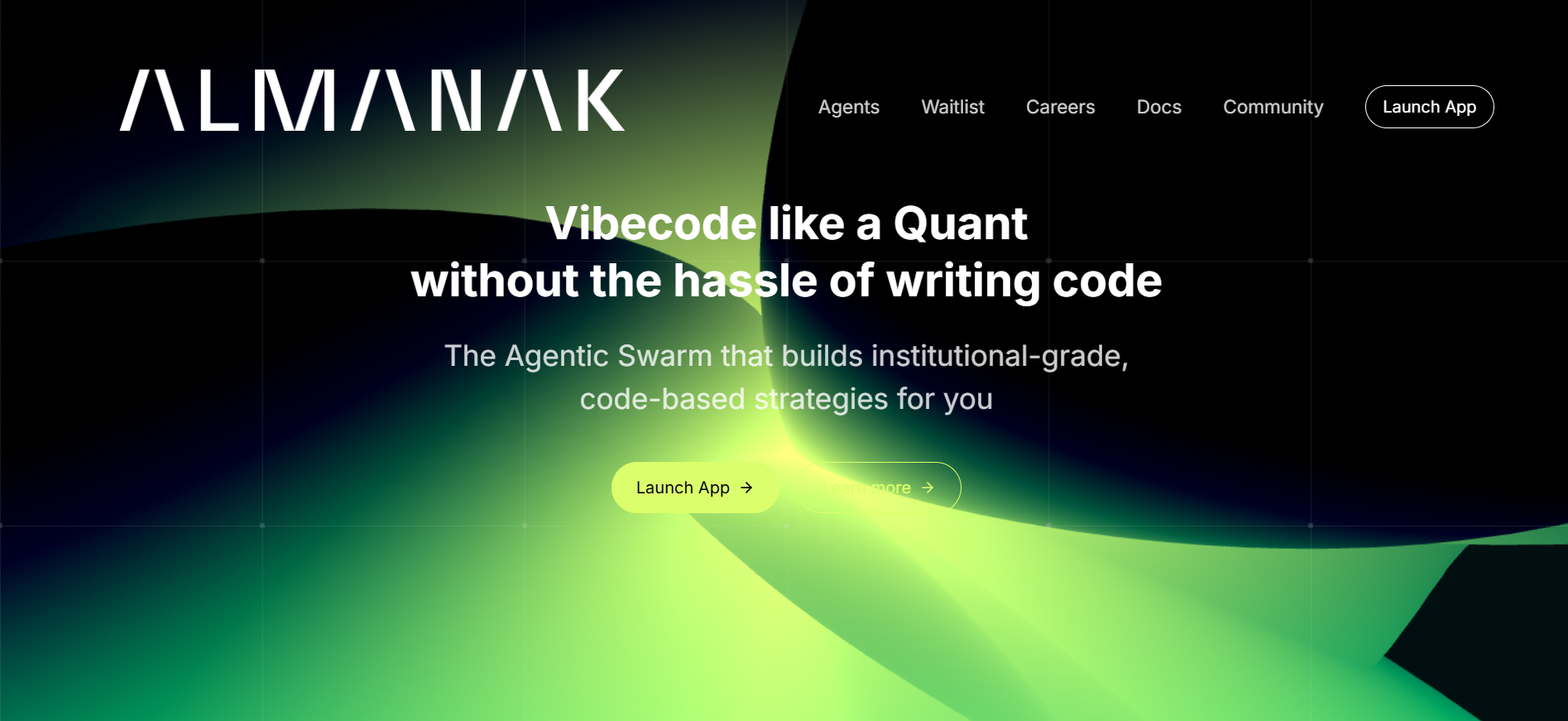

Almanak ($ALMANAK)

Almanak represents the convergence of artificial intelligence and decentralized finance, creating what they term “DeFAI” – a new category that promises to revolutionize how we interact with financial protocols. Built on Arbitrum for optimal scalability and cost-efficiency, Almanak deploys AI agents that can autonomously execute complex trading strategies, manage liquidity positions, and optimize yield farming operations across multiple protocols simultaneously.

The project’s backing by Delphi Labs and Near Foundation provides both technical expertise and strategic guidance crucial for navigating the complex intersection of AI and DeFi. Almanak’s AI agents are designed to learn from market conditions, adapt to changing environments, and execute strategies that would be impossible for human traders to implement manually. This positions the project at the cutting edge of algorithmic trading and automated portfolio management.

Key Token Sale Details:

- Blockchain: Arbitrum

- Launch Date: To be announced

- Funding Target: To be announced

- Platform: Legion launchpad

- Focus Areas: AI agents, DeFAI protocols

- Strategic Partners: Delphi Labs, Near Foundation

Inference Labs

Inference Labs addresses the critical infrastructure gap in AI-powered blockchain applications, providing the computational backbone necessary for running complex machine learning models on decentralized networks. Operating on Ethereum Mainnet, the project has assembled an exceptional team of investors including Delphi Ventures, Mechanism Capital, and industry veterans who understand the massive potential of decentralized AI infrastructure.

The project’s timing couldn’t be better, as demand for AI computational resources continues to skyrocket while centralized solutions face increasing concerns about censorship, data privacy, and single points of failure. Inference Labs creates a marketplace where computational resources can be bought and sold in a decentralized manner, ensuring AI development remains open, accessible, and resistant to corporate control. Their infrastructure enables everything from real-time AI inference to large-scale model training across distributed networks.

Key Token Sale Details:

- Blockchain: Ethereum Mainnet

- Launch Date: To be announced

- Funding Target: To be announced

- Platform: Legion launchpad

- Investor Count: 25+ major VCs and strategic angels

- Focus: Decentralized AI computation infrastructure

EO ($EO)

EO (formerly eOracle) tackles the critical oracle problem that has plagued blockchain networks since their inception, providing secure, reliable, and decentralized data feeds essential for DeFi protocols, insurance platforms, and prediction markets. Built on Ethereum with innovative restaking mechanisms, EO creates economic incentives that ensure data accuracy while punishing malicious actors through slashing conditions.

The project’s impressive investor lineup including HashKey Capital, Bankless Ventures, and Anthony Sassano reflects the critical importance of oracle infrastructure in the blockchain ecosystem. EO’s approach combines traditional oracle functionality with advanced restaking protocols that allow validators to secure multiple networks simultaneously, creating additional revenue streams while improving overall network security. This positions EO as essential infrastructure for the next generation of blockchain applications.

Key Token Sale Details:

- Blockchain: Ethereum Mainnet

- Launch Date: To be announced

- Funding Target: To be announced

- Platform: Legion launchpad

- Technology: Oracle network with restaking

- Notable Investors: HashKey Capital, Bankless Ventures

Tilted ($TLT)

Tilted revolutionizes the GameFi landscape by creating a comprehensive marketplace and launchpad specifically designed for gaming projects. Operating on BNB Chain for optimal transaction costs and speed, Tilted addresses the fragmentation in the gaming crypto space by providing a unified platform where developers can launch tokens, players can discover new games, and investors can access early-stage gaming opportunities.

The project’s modest $100,000 funding goal through Siduspad demonstrates their lean approach to capital efficiency, focusing on product development rather than excessive marketing spend. With gaming representing one of the fastest-growing sectors in cryptocurrency adoption, Tilted’s marketplace approach positions them to capture value from the entire ecosystem rather than betting on individual game successes. Their launchpad component adds additional revenue streams while supporting the next generation of blockchain gaming innovations.

Key Token Sale Details:

- Blockchain: BNB Chain

- Token Price: $0.05 USD

- Total Supply: 1,000,000,000 TLT

- Initial Market Cap: $3,058,900

- Funding Goal: $100,000

- Platform: Siduspad

- Payment Method: USDT accepted

Reveel ($REVA)

Reveel transforms the payments landscape by providing seamless cryptocurrency payment solutions that bridge the gap between traditional commerce and digital assets. While not following the traditional IDO model, Reveel’s approach through Poolz demonstrates their focus on building sustainable partnerships rather than quick fundraising. The project has attracted significant attention from YZi Labs (previously Binance Labs), Jets Capital, and other strategic investors who recognize the massive opportunity in crypto payments.

The payments sector represents one of cryptocurrency’s most practical applications, with billions in transaction volume waiting to be captured by projects that can solve usability and integration challenges. Reveel’s focus on merchant adoption and user experience positions them to benefit from the ongoing shift toward digital payments. Their technology stack emphasizes speed, security, and simplicity – three critical factors for mainstream adoption.

Key Token Sale Details:

- Blockchain: BNB Chain (claim and IDO)

- Launch Date: To be announced

- Access: Council Members only (20k $POOLX lock required)

- Platform: Poolz

- Strategic Focus: Payment processing solutions

- Lead Investor: YZi Labs (Binance Labs)

Zoth ($ZOTH)

Zoth pioneers the Real World Asset (RWA) tokenization space, creating bridges between traditional finance and decentralized protocols through innovative lending and asset management solutions. Operating on Ethereum with a $300,000 funding target across Poolz and Decubate launchpads, Zoth addresses the trillion-dollar opportunity in tokenizing real-world assets for DeFi protocols.

The project’s investor base includes Blockchain Founders Fund, Borderless Capital, and Outlier Ventures – firms known for identifying transformative infrastructure plays. Zoth’s approach to RWA tokenization focuses on compliance, liquidity, and risk management, creating sustainable bridges between traditional assets and DeFi yields. This positions them at the center of one of the most significant trends in cryptocurrency: the tokenization of everything from real estate to commodities.

Key Token Sale Details:

- Blockchain: Ethereum

- Launch Date: To be announced

- Funding Target: $300,000

- Platforms: Poolz, Decubate

- Payment Method: USDT accepted

- Focus: RWA tokenization and lending

- Investor Count: 10+ strategic VCs

Mawari ($MAWA)

Mawari represents the cutting edge of Decentralized Physical Infrastructure Networks (DePIN), combining artificial intelligence, node operations, and Layer 3 scalability solutions to create next-generation blockchain infrastructure. With a $500,000 funding goal and backing from Samsung Next, 1kx, and Animoca Brands, Mawari addresses the growing demand for decentralized compute and storage solutions.

The project’s innovative node purchase agreement model, priced at $333 per node with a maximum investment of $1,000,000, demonstrates their commitment to decentralization while creating clear value propositions for early adopters. Mawari’s DePIN approach enables individuals and organizations to contribute physical resources to the network while earning rewards, creating a sustainable economic model that scales with adoption. Their modular Layer 3 architecture positions them to support the next generation of bandwidth-intensive applications.

Key Token Sale Details:

- Node Price: $333.00 per node

- Total Nodes: 125,000 available

- Minimum Investment: $333

- Maximum Investment: $1,000,000

- Funding Goal: $500,000

- Deadline: September 1, 2025

- Platform: Republic

- Security Type: Node Purchase Agreement

What is an ICO?

An Initial Coin Offering (ICO) represents a fundraising mechanism where blockchain projects sell newly created cryptocurrency tokens to early investors, typically before the project launches its full platform or service. ICOs emerged as the crypto industry’s answer to traditional venture capital funding, democratizing investment opportunities by allowing retail investors to participate in early-stage blockchain projects that previously would have been accessible only to accredited investors and venture capital firms.

The ICO process typically involves publishing a whitepaper that outlines the project’s vision, technology, tokenomics, and roadmap, followed by a public sale period where investors can purchase tokens using established cryptocurrencies like Bitcoin or Ethereum. Unlike traditional equity investments, ICO tokens often provide utility within the project’s ecosystem rather than ownership stakes, though some projects incorporate governance rights that allow token holders to participate in protocol decisions.

| Funding Method | Token Type | Investor Access | Listing Process | Regulatory Status |

| ICO | Utility/Governance | Public participation | Direct exchange listing | Evolving regulations |

| IDO | Utility tokens | Launchpad users | DEX launch | DeFi-focused |

| IEO | Exchange tokens | Exchange users only | Guaranteed listing | Exchange-regulated |

| STO | Security tokens | Accredited investors | Regulated exchanges | Full compliance required |

How to Safely Invest in an ICO

Research the project team’s background, verify their LinkedIn profiles, and assess their technical expertise. Look for teams with proven track records in blockchain development or relevant industry experience.

Analyze the project’s whitepaper for technical feasibility and assess whether their solution addresses a real market need. The best crypto ICO opportunities typically solve significant problems with innovative technology.

Examine how tokens will be distributed, what percentage goes to the team versus public sale, and whether there are reasonable vesting schedules that prevent immediate dumps.

Ensure the project operates within appropriate legal jurisdictions, has obtained necessary regulatory approvals, and provides clear terms of service.

Never invest more than you can afford to lose completely, as ICO investments carry high risks including total loss of capital. Diversify across multiple projects and sectors to reduce concentration risk.

How Does a Platform for Launching ICO Work?

ICO launchpad platforms serve as intermediaries that connect promising blockchain projects with potential investors while providing essential infrastructure, vetting services, and community access. These platforms typically conduct rigorous due diligence on projects before accepting them, evaluating factors such as team credibility, technology viability, market opportunity, and regulatory compliance to protect their reputation and investor community.

The launchpad process usually begins with project applications that undergo multi-stage review processes, including technical audits, team interviews, and tokenomics analysis. Approved projects gain access to the platform’s investor network, marketing support, and fundraising infrastructure, while investors benefit from pre-vetted opportunities and streamlined participation processes. Many launchpads also provide post-launch support including exchange listing assistance, community management, and ongoing advisory services that increase project success rates.

Why Do Projects Use ICO Launchpads?

Projects choose ICO launchpads primarily for access to established investor communities and the credibility that comes from platform endorsement. Reputable launchpads have cultivated networks of active cryptocurrency investors who trust the platform’s vetting process, significantly reducing the marketing burden and customer acquisition costs for new projects. This pre-qualified investor base often leads to faster fundraising completion and higher success rates compared to independent ICO launches.

Additionally, launchpads provide essential infrastructure and expertise that many early-stage projects lack internally, including smart contract development, security auditing, legal compliance guidance, and post-launch exchange listing support. The platform’s reputation and relationship with exchanges, market makers, and other ecosystem participants can be crucial for ensuring liquidity and long-term success. For many projects, partnering with established launchpads like Legion, Poolz, or Republic represents the difference between successful launches and failed fundraising attempts in an increasingly competitive market.

Frequently Asked Questions (FAQ)

Ethereum remains the most successful ICO in history, raising $18 million in 2014 and growing to become the second-largest cryptocurrency by market capitalization, with its platform hosting thousands of decentralized applications and protocols.

An ICO hot list refers to curated selections of trending and high-potential Initial Coin Offerings that crypto analysts and investment platforms recommend based on factors like team strength, technology innovation, and market opportunity.

Switzerland, Estonia, and Singapore are considered among the best jurisdictions for ICOs due to their clear regulatory frameworks, favorable tax policies, and supportive government attitudes toward blockchain innovation and cryptocurrency businesses.

ICO investments can offer significant returns but carry substantial risks including total loss of capital, regulatory changes, and project failure, making them suitable primarily for experienced investors with high risk tolerance.

ICOs offer greater accessibility and global participation compared to IPOs but lack the regulatory protections and established frameworks that traditional public offerings provide to investors.

El Salvador leads in crypto adoption by making Bitcoin legal tender, while countries like Switzerland, Singapore, and the UAE provide comprehensive regulatory frameworks that support cryptocurrency innovation and adoption.

Investors can earn from ICOs through token appreciation after public listing, staking rewards, participation in protocol governance, and utilizing tokens within project ecosystems, though success requires careful project selection and risk management.

Rate the article