October 2025 Presale Comparison

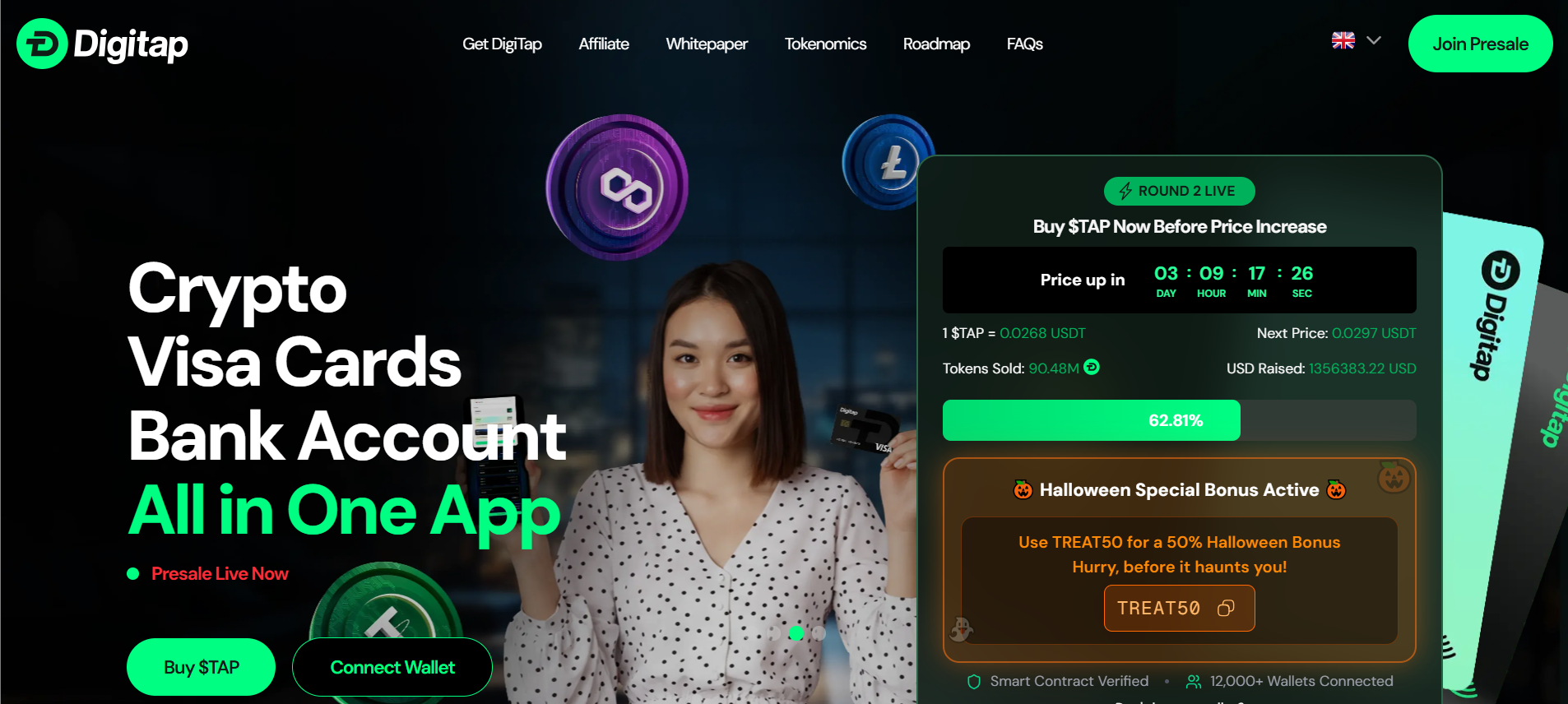

DigiTap ($TAP)

Live omni-banking platform merging crypto and fiatCategory

- Banking Platform

- DeFi

Launchpad

Funding Goal

Tea ($TEA)

Open-source software reward networkCategory

- Data Service

Launchpad

Funding Goal

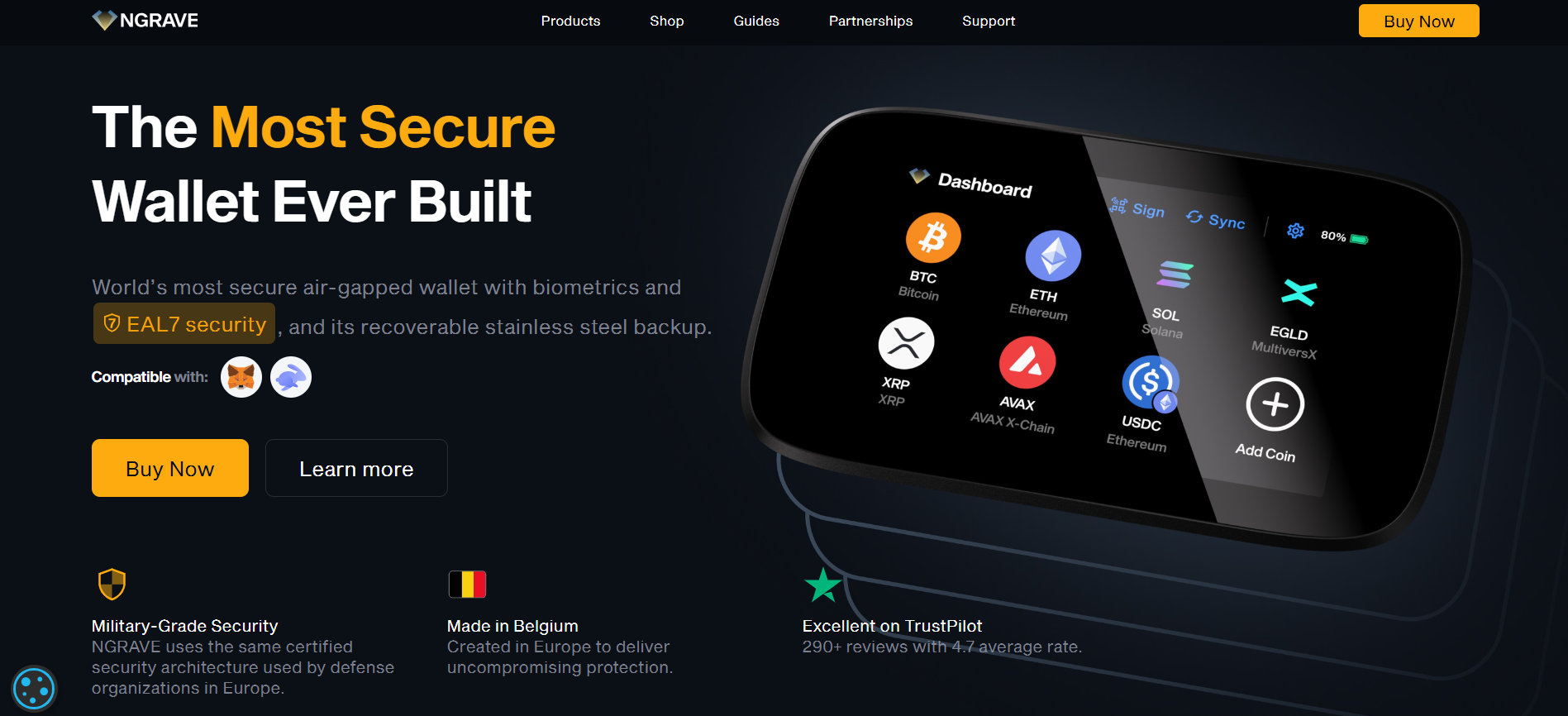

NGRAVE

EAL7-certified hardware walletCategory

- Wallet

Launchpad

Funding Goal

iLayer ($ILR)

Cross-chain execution layerCategory

- DeFi

- AI

Launchpad

Funding Goal

Aimagine ($AIMG)

AI agent data aggregationCategory

- AI Platform

Launchpad

Funding Goal

Datai Network ($DATAI)

Blockchain data intelligenceCategory

- Data Service

- AI

Launchpad

Funding Goal

October 2025 presents compelling opportunities for investors seeking early access to innovative blockchain projects. The current presale landscape features six distinctive ventures spanning prediction markets, open-source infrastructure, hardware security, cross-chain solutions, and AI-powered platforms. These offerings provide diverse entry points into sectors experiencing significant growth momentum. With funding goals ranging from $100,000 to $2 million and valuations between $6.5 million and $75 million, investors can strategically position themselves across multiple blockchain narratives. This comprehensive analysis examines tokenomics, vesting schedules, and technological foundations to help identify the best crypto presales to invest in October 2025.

Our Research Approach

Our analysis methodology combines multi-layered verification processes to evaluate project viability and investment potential. We examined official whitepapers, scrutinized team backgrounds through LinkedIn and public records, analyzed backing from established venture capital firms, and assessed community engagement metrics across Twitter and Discord platforms. Technical documentation review included smart contract architecture evaluation, tokenomics sustainability modeling, and competitive positioning analysis against similar market offerings.

We prioritized projects demonstrating transparent allocation structures, realistic roadmap milestones, and clear utility propositions. Each presale underwent rigorous assessment of launchpad credibility, with particular attention to Coinlist’s track record in launching projects like Filecoin and Solana, Capital Launchpad’s integration with Kaito’s reputation systems, and ChainGPT Pad’s specialized focus on AI infrastructure ventures. This systematic approach filters speculative offerings from substantive opportunities worthy of investor consideration.

Best Crypto Presales in October Detailed Review

1. DigiTap: The First Live Crypto-Fiat Omni-Banking Platform

DigiTap represents a paradigm shift in crypto presales—unlike projects launching with concepts and promises, DigiTap delivers a fully functional omni-banking ecosystem available for download today on Apple App Store, Google Play Store, and web platforms. The platform has achieved what most blockchain projects only aspire to: bridging the $3 trillion traditional banking sector with the $2.5 trillion cryptocurrency market through a single, unified application. This live product status eliminates the primary risk factor plaguing crypto presales—vaporware—by enabling investors to test, verify, and experience the platform’s capabilities before committing capital.

The architectural foundation combines on-chain settlement across multiple blockchain networks including Ethereum and Bitcoin with off-chain clearing through interconnected fiat payment rails such as SWIFT, SEPA, Faster Payments, and ACH. This multi-rail infrastructure enables seamless cryptocurrency-to-fiat conversions while maintaining regulatory compliance across jurisdictions. The Smart Exchange Engine leverages artificial intelligence to execute real-time conversions via automated triggers, dynamically routing transactions through on-chain DEXs, OTC desks, or banking FX channels based on optimal cost, liquidity, and speed parameters.

Security architecture implements AES-256 encryption for data at rest, TLS 1.3 with Perfect Forward Secrecy for data in transit, and PCI-DSS Level 1 compliance for payment card operations—standards typically reserved for major financial institutions. The platform’s hybrid cold/hot wallet custody model protects digital assets through multi-signature access controls for long-term reserves while maintaining hot wallet liquidity protected by continuous risk scoring and automated withdrawal limits. This enterprise-grade security framework positions DigiTap as the bridge between traditional finance’s regulatory rigor and cryptocurrency’s innovation velocity.

The platform’s functionality extends beyond basic wallet services to comprehensive financial management. Users access both personal and business offshore banking accounts, deploy physical and virtual payment cards for everyday transactions, and manage multi-currency portfolios without switching between applications. The Account Abstraction Layer unifies fiat and crypto holdings into a single control panel, eliminating the fragmentation that has historically prevented mainstream adoption. With tokenized settlement records providing on-chain auditability without exposing private transaction details, DigiTap addresses institutional compliance requirements while maintaining user privacy.

DigiTap ($TAP) Token Presale

- Sale Dates: Live on Official Website

- Platform: presale.digitap.app

- Total Supply: Detailed in Tokenomics

- Utility: Transaction fee reduction, staking rewards, governance participation, VIP membership perks, enhanced cashback rates

- Available Platforms: App Store, Google Play, Web (my.digitap.app)

- Notable Features: Already functional with active user base, enterprise security certification, multi-blockchain support, AI-powered routing

2. Tea Protocol: Monetizing Open-Source Contributions

Tea Protocol addresses a fundamental market failure in software development—the Nebraska problem where critical open-source packages supporting billions in downstream value receive zero compensation. The project introduces Proof of Contribution, an algorithmic ranking system similar to Google’s PageRank that measures each software package’s importance based on dependency graphs across the global open-source ecosystem. Projects receive a teaRank score from 0 to 100, with higher rankings translating to larger token reward allocations.

Built as an Optimism-based Layer 2 network currently in testnet, Tea Network features CHAI protocol for autonomous maintainer rewards distributed directly to developers’ GPG keys—eliminating traditional wallet setup friction. The platform’s revolutionary approach enables developers to claim earnings using existing cryptographic signatures from Git commits, bridging decades-old open-source infrastructure with blockchain economics. This GPG integration represents the first blockchain to natively support such signatures through custom Ethereum precompiles.

The token sale on Coinlist from September 25 to October 2 offers 4 billion TEA tokens at $0.0005 each, representing 4% of the 100 billion total supply. With backing from YZi Labs (formerly Binance Labs), Lattice, and Woodstock Fund, Tea positions itself as infrastructure for the age of AI where training data and model dependencies increasingly rely on open-source foundations. The project’s governance-controlled inflation mechanism caps annual issuance at 2%, with token burns offsetting emissions to maintain long-term supply equilibrium.

Tea Protocol (TEA) Token Sale

- Sale Dates: September 25 – October 2, 2025 (17:00 UTC)

- Price: $0.0005 per TEA

- Total Raise: $2,000,000 target

- Vesting: 100% unlock at TGE

- Platform: Coinlist

- Notable Backers: YZi Labs (formerly Binance Labs), Lattice, Woodstock Fund

3. NGRAVE: Institutional-Grade Self-Custody Hardware

NGRAVE Zero distinguishes itself as the world’s only hardware wallet achieving EAL7 certification—the highest security standard typically reserved for military and intelligence applications. The Belgian company addresses the migration of institutional capital from centralized custody to self-custody solutions by offering features consumer-grade wallets cannot match. Unlike Ledger or Trezor devices that connect via USB or Bluetooth, NGRAVE operates completely air-gapped, transmitting signed transactions exclusively through one-way QR codes scanned by the companion Liquid mobile application.

The device secures over $1.6 billion across 30,000 wallets with an average wallet size of $130,000, demonstrating market validation among high-net-worth users. Hardware margins of 44% combine with monthly recurring revenue between $150,000 and $250,000 from device sales. The company is scaling manufacturing toward 1,000 units monthly while preparing high-margin staking and swap modules alongside proof-of-concept integration with a top-five global cryptocurrency exchange.

The equity raise through PAID Network offers accredited investors access at a $30 million valuation—representing a 15% discount to the next institutional round. Minimum investment starts at $500, with PAID handling investor relations, quarterly reporting, and eventual exit distributions. Backing from Mechanism Capital, Woodstock Fund, Morningstar Ventures, DFG, and Europe’s IMEC deep-tech incubator validates the technical foundation. With hardware wallet sales surpassing 8 million units in 2024, NGRAVE targets the institutional segment through features like the GRAPHENE metal backup system and 4-inch touchscreen interface combining security with premium user experience.

NGRAVE Equity Sale

- Type: Equity (SAFE Note)

- Minimum Investment: $500

- Raise Target: $100,000

- Valuation: $30,000,000

- Platform: PAID Network

- Notable Backers: YZi Labs, Mechanism Capital, Morningstar Ventures, DFG

4. iLayer: Programmable Intent-Based Execution

iLayer positions itself as a programmable execution layer designed for modular blockchain environments, focusing on cross-chain operations powered by artificial intelligence agents. The project aims to simplify complex multi-chain interactions by enabling intent-based execution where users specify desired outcomes rather than transaction sequences. This abstraction layer reduces friction in decentralized finance activities spanning bridging, swapping, and yield optimization across fragmented liquidity pools.

The presale through Coin Terminal runs from September 23 to October 14 at $0.012 per ILR token against a $12 million project valuation. With $150,000 targeted for the raise and 1 billion total supply, the initial market capitalization calculates to approximately $521,465 based on the circulating supply of 43.4 million tokens. The Base blockchain deployment aligns with growing infrastructure focusing on Ethereum Layer 2 scaling solutions.

Technical documentation emphasizes autonomous agent capabilities for executing sophisticated DeFi strategies without requiring deep protocol knowledge. The roadmap includes integration with major cross-chain messaging protocols and deployment of specialized AI agents for portfolio management, arbitrage detection, and liquidity provision optimization. However, limited public information about the core team and absence of disclosed venture backing require additional diligence for prospective investors evaluating this opportunity within the competitive cross-chain infrastructure landscape.

iLayer (ILR) Token Presale

- Sale Dates: September 23 – October 14, 2025

- Price: $0.012 USDT per ILR

- Total Raise: $150,000

- Valuation: $12,000,000

- Platform: Coin Terminal

- Blockchain: Base

5. Aimagine: Data Aggregation for AI Agent Economies

Aimagine constructs critical infrastructure for the emerging AI agent economy by providing a Data Layer aggregating information from news sources, social media platforms, and custom providers. The platform addresses a fundamental bottleneck—AI agents require high-quality, structured datasets for training machine learning models and making autonomous decisions, yet most existing blockchain platforms fail to provide suitable data access mechanisms.

The ecosystem features three core components: the Data Layer for real-time information aggregation, an AI Agent Launchpad enabling one-click deployment with bonding curve token mechanics, and an IP Marketplace where developers monetize creations through licensing arrangements. Revenue models include data access fees paid in AIMG tokens, licensing revenue from the marketplace, and transaction fees from ecosystem activity. This circular economy design ensures sustainable demand for tokens through buyback and burn mechanisms.

The ChainGPT Pad presale offers 76.9 million AIMG tokens at $0.0065 targeting $500,000 in total raise. With a $6.5 million fully diluted valuation and vesting schedule of 25% unlocked at token generation followed by four-month linear distribution, the structure incentivizes early participation while maintaining price stability. Secured grants from the Arbitrum Foundation demonstrate institutional validation, while partnerships with ChainGPT, Binance Wallet, and Game GPT provide ecosystem integration. The network of over 200 AI creators reaching 1.4 million followers offers built-in distribution for platform adoption.

Aimagine (AIMG) Token Presale

- Price: $0.0065 USDT per AIMG

- Total Raise: $500,001

- FDV: $6,500,000

- Vesting: 25% TGE unlock, 4 months linear vesting

- Platform: ChainGPT Pad (Arbitrum)

- Notable Backers: Elevate Ventures, Xtream Capital, Hourglass

6. Datai Network: Blockchain Intelligence Infrastructure

Datai Network evolved from Merlin, a centralized blockchain data provider, into a decentralized data intelligence layer serving the Web3 ecosystem. The platform aggregates, indexes, and analyzes blockchain history across more than 50 chains, transforming raw on-chain data into actionable insights for developers, businesses, and researchers. Machine learning models process indexed data to deliver cross-chain analytics critical for understanding user behavior, tracking money flows, and maintaining regulatory compliance.

The modular architecture features three distinct layers: Data Sourcing handles blockchain indexing and extraction, Data Refining applies AI and ML models for pattern recognition and anomaly detection, and the Application Layer provides APIs for consumer-facing products. Current clients include Ledger, Zerion, and Etherspot—established Web3 companies relying on Datai’s infrastructure for portfolio tracking, transaction analysis, and wallet functionality.

The ChainGPT Pad offering allocates 24 million DATAI tokens at $0.025 each for a $600,000 raise against a $25 million fully diluted valuation. Vesting structure includes 15% unlock at token generation, one-month cliff period, then six-month linear distribution. Strategic backing from Shima Capital, FBG Capital, ChainGPT Labs, Big Brain Holdings, Blizzard Fund, and Metavallon provides both capital and network access. The roadmap for Q1 2025 includes user behavior API launch, Web3 AI training datasets, and the token generation event, while Q2 focuses on the labeling arena MVP for data classification systems.

Datai Network (DATAI) Token Presale

- Price: $0.0250 per DATAI

- Total Raise: $600,000

- FDV: $25,000,000

- Vesting: 15% TGE, 1 month cliff, 6 months linear

- Platform: ChainGPT Pad

- Notable Backers: Shima Capital, FBG Capital, ChainGPT Labs

How to Evaluate the Best Crypto Presales October 2025

Identifying the best crypto presale October 2025 requires systematic analysis beyond marketing materials. The following framework helps investors separate legitimate opportunities from speculative ventures.

Team Verification and Track Record: Research founding team backgrounds through LinkedIn, GitHub contributions, and previous project involvement. Strong teams feature relevant experience at established technology companies or recognized open-source contributions. Red flags include anonymous teams, fabricated credentials, or histories of abandoned projects.

Venture Capital Validation: Backing from reputable firms like Coinbase Ventures or Dragonfly provides due diligence validation. However, VC participation alone doesn’t guarantee success—evaluate the relevance of backers to the specific sector.

Tokenomics Structure Assessment: Examine total supply allocation—team tokens with multi-year vesting demonstrate commitment, while public sale percentages around 10-20% prevent dumps. Calculate fully diluted valuation against comparable projects to assess pricing reasonableness.

Technical Innovation Evaluation: Review whitepapers for novel approaches to genuine problems. Strong projects demonstrate clear technical differentiation, experienced development teams, and realistic roadmap milestones. GitHub activity and testnet performance signal execution capability.

Community and Market Demand: Examine engagement quality on Discord, Telegram, and Twitter. Partnerships with established projects and real-world use case pilots demonstrate market validation beyond speculation.

Understanding Presale Risk Factors in October 2025 Market

Crypto presales carry substantial risks requiring clear assessment before capital deployment. Sophisticated investors implement risk management frameworks to protect capital while maintaining upside exposure.

Regulatory Landscape Evolution: Securities law compliance remains the primary legal risk. Projects conducting compliant raises implement KYC/AML procedures and restrict US person participation. Verify legal frameworks governing token sales and understand implications for future trading liquidity.

Smart Contract and Technical Risks: Evaluate audit thoroughness by reviewing full reports rather than badges. Consider whether contracts are upgradeable or immutable. Testnet performance and bug bounty programs signal commitment to security.

Market Liquidity and Lock-up Periods: Vesting schedules prevent immediate token sales after TGE but create liquidity constraints. Understand cliff periods and linear release schedules. Projects with 100% unlock typically experience higher initial volatility.

Project Execution Risk: Evaluate team execution capability through past delivery and development progress transparency. Red flags include constantly shifting roadmaps, lack of developer activity, or absence of testnet deployments.

Diversification Strategy: Presale investments should represent 10-20% of crypto holdings due to elevated risk. Diversify across different sectors, development stages, and blockchain ecosystems to minimize correlated failures.

Step-by-Step Participation Guide for October 2025 Presales

Successfully participating in the best crypto presales October 2025 requires preparation across wallet setup, KYC completion, and strategic timing.

Step 1: Research and Preparation (1-2 weeks before sale) Review project documentation including whitepaper, tokenomics, and team backgrounds. Join official channels to monitor announcements. Bookmark official websites and set up two-factor authentication. Prepare identification documents for KYC verification.

Step 2: Platform Registration and Tier Qualification Create accounts on relevant launchpads well in advance. Many platforms implement tiered access based on platform token holdings or participation history. Calculate required holdings for desired tier access.

Step 3: Complete KYC Verification Prepare government-issued ID, proof of address, and clear facial recognition photos. Upload high-resolution images to avoid rejection. Budget time for potential resubmission requests.

Step 4: Wallet Configuration and Funding Set up compatible wallets for target blockchain networks. Fund wallets with required stablecoins plus native gas tokens for transaction fees. Account for gas price volatility by maintaining a 20-30% buffer.

Step 5: Presale Participation Execution Mark presale start times with timezone conversions. Log in early to address potential technical issues. Monitor transaction confirmation on blockchain explorers and save transaction hashes.

Step 6: Post-Sale Follow-up and Token Claims Track announcement channels for TGE dates and token claim instructions. Add token contract addresses through official channels. Mark unlock dates for vested distributions and maintain transaction records for tax purposes.

Final Thoughts

The best crypto presales October 2025 present diverse opportunities across prediction markets, open-source infrastructure, hardware security, and AI-powered platforms. From DigiTap’s live omni-banking platform merging crypto and fiat with enterprise-grade security to Tea Protocol’s revolutionary developer rewards on Coinlist, each project addresses distinct market needs with varying risk profiles. NGRAVE offers institutional-grade security through equity investment, while iLayer, Aimagine, and Datai Network position themselves at the intersection of artificial intelligence and blockchain infrastructure. Successful presale participation requires thorough due diligence examining team credentials, tokenomics sustainability, and technical differentiation. These best crypto presales to invest in October 2025 demand careful evaluation of vesting schedules, regulatory compliance, and market timing. Diversification across multiple presales and sectors remains essential for managing the inherent volatility and execution risks associated with early-stage blockchain investments.

Frequently Asked Questions (FAQ)

The top presales this month include DigiTap for prediction markets with backing from Coinbase Ventures and Maelstrom, Tea Protocol raising on Coinlist with YZi Labs support, NGRAVE’s institutional hardware wallet equity offering, and AI platforms Aimagine and Datai Network on ChainGPT Pad. Each addresses distinct market segments with varying risk-reward profiles.

Safe participation requires using only official websites verified through project Twitter accounts, completing KYC on reputable launchpads, never sharing private keys, and using hardware wallets for large investments. Allocate only capital you can afford to lose, and research team backgrounds and tokenomics thoroughly before committing funds.

Presales occur before public launches, offering discounted pricing to early investors in exchange for development capital. Public sales happen after exchange listings at market prices. Presales provide lower entry prices and early access but include liquidity restrictions during vesting periods and higher failure rates.

Regulatory treatment varies by jurisdiction and token classification. Most presales exclude US persons to avoid SEC jurisdiction. Projects conducting compliant raises implement KYC/AML procedures and restrict participation from prohibited jurisdictions. Investors should understand their local regulations before participating.

Vesting structures range from immediate unlock to multi-stage releases over 6-12 months. Longer vesting protects token prices from sell pressure but reduces investor liquidity. Evaluate vesting against personal liquidity needs and project milestone timelines when selecting presales.

Strong tokenomics balance stakeholder incentives through reasonable allocations: public sales typically 10-20%, team 15-20% with multi-year vesting, and ecosystem development 20-30%. Avoid excessive team allocations exceeding 30%. Examine inflation schedules and calculate fully diluted valuation compared to similar projects.

Presale returns vary dramatically from complete losses to significant gains. The majority underperform with many failing to sustain initial valuations. Risk-adjusted returns require portfolio diversification across multiple presales since individual outcomes remain highly uncertain.

This analysis represents research and educational content only and should not be considered financial advice. Cryptocurrency investments carry significant risks including potential total loss of capital. Always conduct independent research and consult qualified financial professionals before making investment decisions.

Rate the article