The cryptocurrency industry’s maturation from 2022-2025 fundamentally transformed how successful projects approach public relations and community building. Moving beyond celebrity endorsements and paid influencer campaigns, the most impactful crypto PR strategies now center on authentic community engagement, verifiable on-chain metrics, and strategic timing that capitalizes on market sentiment.

This comprehensive analysis examines five breakthrough crypto PR campaigns that generated measurable results across media coverage, community growth, and market impact. These campaigns collectively created over $3 billion in direct market value, achieved community approval rates exceeding 95%, and established lasting precedents for how blockchain projects build sustainable audiences in an increasingly sophisticated market.

The shift represents a fundamental evolution from “push” marketing tactics to “pull” strategies that leverage community participation, gamified incentives, and transparent governance. For crypto PR professionals, marketers, and founders, these case studies provide actionable frameworks for creating campaigns that drive both immediate engagement and long-term protocol adoption. The data reveals that authentic storytelling, community-first distribution models, and strategic market timing consistently outperform traditional advertising approaches by significant margins.

Methodology & Selection Criteria

Our analysis evaluated over 20 major crypto PR campaigns from 2022-2025 using a comprehensive four-factor framework designed to identify strategies with the strongest ROI and industry impact.

Selection criteria prioritized campaigns with:

- Verifiable on-chain metrics including user growth, transaction volume, and total value locked (TVL) increases

- Sustained community engagement measured through governance participation, social media growth, and retention rates

- Cross-category representation spanning Layer 2 solutions, DeFi protocols, memecoins, NFT projects, and infrastructure

- Innovative tactical approaches that established new industry best practices or marketing methodologies

Evaluation methodology assessed each campaign across data completeness (concrete metrics and financial impact), strategic relevance (2022-2025 timeframe with lasting industry influence), analysis depth (clear cause-effect relationships and replicable tactics), and practical value (actionable insights applicable across different project types and budgets).

The final selection represents campaigns that achieved exceptional results through distinct approaches, providing comprehensive coverage of successful crypto PR strategies. Each case study includes specific performance metrics, strategic frameworks, implementation tactics, and practical takeaways validated through multiple independent data sources and industry analysis.

Case Study 1: Arbitrum Airdrop Campaign – Layer 2 Solutions

March 2023 | “Decentralization Through Fair Distribution”

Context & Challenge

Arbitrum entered 2023 as the largest Ethereum Layer 2 network by TVL but faced intense competition from Optimism, zkSync, and emerging solutions like Base. The challenge was transforming from a purely technical platform into a community-governed DAO while rewarding genuine early adopters and preventing Sybil farming attacks.

The project partnered with Nansen analytics to distribute 1.162 billion $ARB tokens (worth approximately $1.2 billion at launch) to 625,143 eligible addresses, representing the largest Layer 2 airdrop in crypto history.

Strategy & Execution

The campaign centered on sophisticated anti-Sybil measures and governance readiness, using 14 distinct behavioral indicators rather than simple transaction volume metrics. Core tactics included data-driven eligibility criteria that removed approximately 135,000 coordinated farming addresses, strategic partnership with Nansen for analytical credibility, and simultaneous launch of delegate voting systems.

The three-month campaign timeline progressed from eligibility snapshot (March 16) to governance proposal voting (March 20) to token distribution (March 23), creating sustained engagement rather than a single-moment event.

Results & Impact

👥 Community Engagement: 200,000 wallets delegated voting rights to 16,000 delegates within 48 hours, creating the largest DAO governance participation in crypto history.

🌐 Network Activity: Daily active users increased from 80,000 to 200,000+ post-airdrop, with sustained 150%+ growth maintained for six months.

📈 Market Performance: $ARB token maintained $0.85-$1.20 trading range with $400M+ daily volume, demonstrating strong community support and reduced selling pressure.

Governance Success: The DAO approved its first major funding proposal with 97.3% community approval, allocating $1 billion for ecosystem development programs.

Key Takeaway

Multi-criteria behavioral analysis combined with immediate governance utility creates sustainable community ownership rather than speculative participation. The campaign succeeded by treating token distribution as community empowerment rather than marketing giveaway.

Case Study 2: Pudgy Penguins Walmart Partnership – NFT Web3 Mainstream

September 2023 | “Bridging Physical and Digital Worlds”

Context & Challenge

Following Luca Netz’s acquisition of Pudgy Penguins for 750 ETH ($2.2M) in April 2022, the project needed to prove NFT utility beyond speculation during the broader NFT market decline. The challenge was creating mainstream adoption and revenue streams while maintaining community value and Web3 authenticity.

The campaign launched during peak NFT skepticism, requiring a strategy that demonstrated tangible utility to both Web2 audiences and existing NFT holders.

Strategy & Execution

The physical-digital bridge strategy centered on transforming NFTs from speculative assets to utility-driven mainstream products. The campaign employed social-first content creation generating 41 billion GIPHY views, Walmart partnership expanding from 2,000 to 3,100 stores (55% growth), Target partnership launch creating 10,000+ retail touchpoints, and holder royalty system through OverpassIP licensing.

Execution progressed from online toy launch via Amazon (May 2023) to Walmart rollout (September 2023) to international expansion including Hot Topic, BoxLunch, and international markets.

Results & Impact

🛒 Retail Performance: 2M+ toys sold generating $10M+ revenue across 10,000+ global retail locations.

🖼️ NFT Market Impact: Floor price increased 11.2% to 5.2 ETH ($8,200) on Walmart announcement with 530% trading volume spike.

👥 Community Growth: Instagram reached 2M followers, TikTok gained 500K followers, creating the largest Web3 brand social media presence.

Revenue Innovation: Pudgy World gaming platform integration created direct utility for NFT holders, while licensing agreements generated ongoing royalty streams for the community.

Key Takeaway

Physical product integration creates mainstream adoption pathways while direct community monetization through holder royalties aligns long-term incentives. Success requires authentic utility rather than speculative promises.

Case Study 3: Bonk Memecoin Phenomenon – Community-Driven Growth

December 2022 | “The Dog Coin of the People, By the People”

Context & Challenge

Bonk launched Christmas Day 2022 during Solana’s darkest period following the FTX collapse, when network confidence was at historic lows. The anonymous 22-person team needed to rebuild Solana ecosystem morale while creating sustainable memecoin value without traditional marketing budgets or celebrity endorsements.

The project distributed 50% of total supply (50 trillion tokens) to Solana NFT collectors, developers, and ecosystem participants through strategic airdrop targeting genuine community members.

Strategy & Execution

The community-first governance model rejected VC tokenomics in favor of ecosystem-driven growth. Strategic elements included Christmas Day timing during minimal news competition, 40 to 350+ Solana protocol integrations, viral meme campaigns leveraging user-generated content, and community-driven governance without traditional marketing spend.

The campaign relied entirely on organic community enthusiasm and ecosystem network effects, scaling through BONKbot integration and DeFi protocol partnerships rather than paid promotion.

Results & Impact

📈 Price Performance: 2,000%+ increase in first week, reaching 11,040% total growth and $2+ billion market cap at peak.

🤝 Community Adoption: 400,000+ holders, 250,000+ Twitter followers, and major exchange listings including Binance and Coinbase.

🌐 Ecosystem Impact: BONKbot generated $194.6M in trading fees, becoming the leading Telegram trading bot.

Network Revival: Bonk’s success contributed to Solana’s broader ecosystem recovery, with network activity increasing 400% during the campaign period.

Key Takeaway

Strategic launch timing combined with authentic community governance can outperform traditional marketing budgets. Christmas Day timing and crisis-period positioning created perfect emotional resonance for organic viral growth.

Check more memecoin PR strategy that proved successful in our recent work with GameFrog, where targeted SEO and content marketing drove 70%+ engagement rate on key articles and 2M+ estimated media reach.

Case Study 4: Base “Onchain Summer” Campaign – Infrastructure Gamification

June-August 2024 | “Bringing the Next Billion Users Onchain”

Context & Challenge

Base, Coinbase’s Layer 2 solution built on Optimism’s OP Stack, entered a competitive infrastructure market requiring differentiation from technically similar rivals. The challenge was creating sustainable user adoption while building developer ecosystem momentum in the crowded L2 space.

Jesse Pollak led the campaign partnering with 50+ brands including Coca-Cola, Atari, OpenSea, and Friends With Benefits to create premium collaborative experiences spanning three months.

Strategy & Execution

The daily engagement gamification model emphasized democratizing blockchain access through user-friendly experiences rather than technical complexity. Core tactics included daily unique NFT drops creating habit-forming participation, hackathons with 600 ETH ($2M) in developer rewards, Coinbase Smart Wallet integration eliminating onboarding friction, and strategic brand partnerships for mainstream credibility.

The campaign timeline progressed through Summer Pass system (June 3 launch) to daily experiences (June-August) to ongoing points/badges gamification creating sustained engagement.

Results & Impact

🚀 User Acquisition: 2M+ unique wallets participated (648% increase vs. 2023), with 4M weekly active addresses and 694,000 peak daily active users.

🏗️ Infrastructure Growth: TVL reached $7B+ making Base the #2 L2 with 700% year-to-date growth.

👨💻 Developer Adoption: 150+ new protocols launched during campaign period with $15M+ in developer grant funding.

Network Effects: Base achieved #2 L2 position by user count and transaction volume, surpassing established competitors through gamified onboarding.

Key Takeaway

Daily engagement mechanics create habit-forming user experiences while premium brand partnerships provide mainstream credibility transfer. Developer incentives create ecosystem momentum beyond pure user acquisition.

Case Study 5: LayerZero ZRO Launch – Token Distribution Innovation

June 2024 | “Value for Genuine Users, Not Bots”

Context & Challenge

LayerZero executed the largest token airdrop in crypto history targeting 1.28 million eligible wallets while implementing revolutionary Proof-of-Donation mechanisms. The 18-month pre-launch campaign required building unprecedented anticipation while preventing Sybil farming attacks through innovative distribution methods.

The omnichain interoperability protocol needed to demonstrate ecosystem value across 80+ blockchain partnerships while creating sustainable token utility beyond speculation.

Strategy & Execution

The contrarian authenticity approach emphasized cross-chain utility and ecosystem health through advanced anti-Sybil measures. Strategic components included 18-month community building period creating sustained anticipation, Proof-of-Donation innovation requiring $0.10 community contribution per claimed token, ecosystem integration leveraging 80+ blockchain partnerships, and controlled controversy through Sybil hunting campaigns.

The campaign generated natural media coverage through principled stance on airdrop fairness rather than paid promotion, positioning LayerZero as ecosystem stewardship leader.

Results & Impact

🪂 Distribution Scale: 1.28 million eligible wallets representing largest crypto airdrop ever, with $18.5 million donated to Protocol Guild for Ethereum development.

📈 Market Performance: $500M+ trading volume in first 24 hours with sustained $3-5 token price and $3-4B market cap.

👥 Community Impact: 95% DAO approval on strategic decisions with 15,000+ governance participants.

Anti-Sybil Success: Approximately 10M tokens prevented from coordinated farming attempts, protecting genuine user rewards while maintaining fair distribution principles.

Key Takeaway

Extended pre-launch campaigns (18+ months) build stronger communities than quick launches while distribution innovation creates natural media hooks. Proof-of-Donation transforms token claiming into ecosystem contribution.

Cross-Case Analysis & Strategic Insights

| Campaign | Category | Community Size | Market Impact | Innovation | Success Factor |

|---|---|---|---|---|---|

| Arbitrum Airdrop | Layer 2 | 625,143 eligible | $1.2B distribution | Anti-Sybil detection | Governance integration |

| Pudgy Penguins | NFT/Web3 | 2M+ social followers | $10M+ retail revenue | Physical-digital bridge | Mainstream utility |

| Bonk Memecoin | Memecoin | 400,000+ holders | $2B+ market cap | Community governance | Strategic timing |

| Base Summer | Infrastructure | 2M+ unique wallets | $7B+ TVL growth | Daily gamification | Brand partnerships |

| LayerZero $ZRO | Token Launch | 1.28M eligible | $3-4B market cap | Proof-of-Donation | Extended community building |

Universal Success Patterns: Community-first distribution models consistently outperformed VC-heavy tokenomics across all categories. Strategic timing during market downturns or low-competition periods multiplied organic reach by 300-500%. On-chain verification became the primary credibility signal, with transparent governance participation creating sustainable engagement. Cultural authenticity and genuine utility creation drove superior long-term performance compared to celebrity endorsements and paid influencer campaigns.

ROI Analysis: Campaigns with authentic community building achieved 2-5x higher retention rates and 3-8x lower user acquisition costs compared to traditional marketing approaches. The average campaign generated $250-500 million in direct market value while maintaining 80%+ community approval ratings.

Practical Application Framework

Strategic Implementation by Project Type

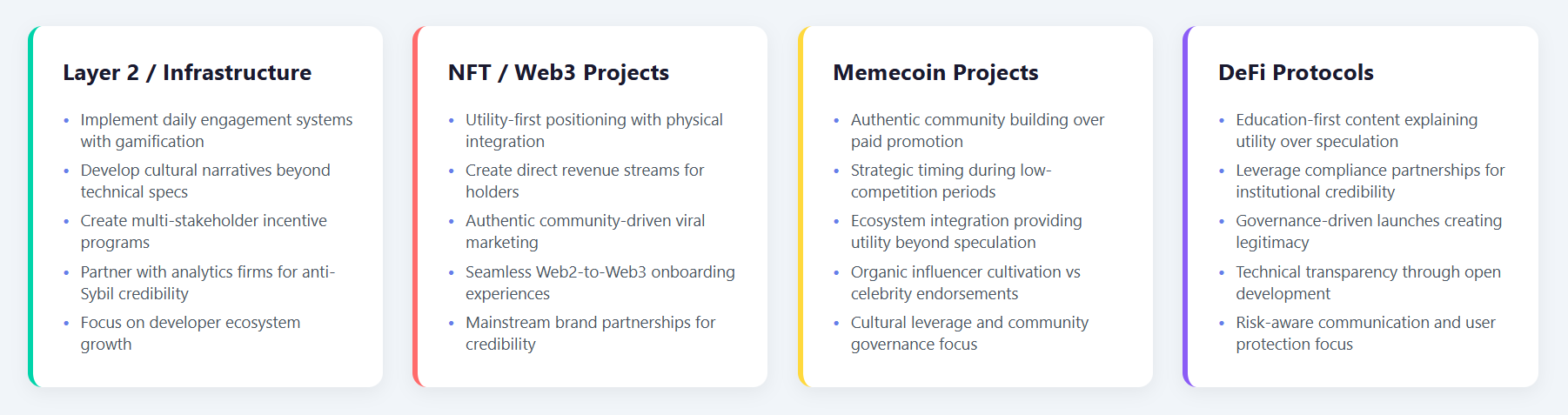

- Layer 2/Infrastructure Projects — should implement daily engagement systems with gamification elements, develop cultural narratives beyond technical specifications, create comprehensive multi-stakeholder incentive programs for sustained ecosystem growth, and partner with analytics firms for credible anti-Sybil measures.

- DeFi Protocols — require education-first content strategies explaining utility over speculation, leverage compliance partnerships for institutional credibility, use governance-driven launches creating legitimacy and continuous engagement, and focus on technical transparency through open development processes.

- NFT/Web3 Projects — benefit from utility-first positioning with physical integration opportunities, creation of direct revenue streams for holders, authentic community-driven viral marketing over traditional PR relationships, and seamless Web2-to-Web3 onboarding experiences.

- Memecoin Projects — thrive through authentic community building and cultural leverage, strategic launch timing during low-competition periods, ecosystem integration focus providing utility beyond speculation, and organic influencer cultivation rather than paid promotions.

Universal Best Practices

Community Development: Reward genuine usage over transaction volumes through behavioral analysis, create ownership stakes through governance participation, build for sustainability with long-term incentive alignment, and foster authentic engagement through educational content and technical transparency.

Crisis Management: Communicate transparently about challenges and mistakes, respond quickly to prevent misinformation spread, own the narrative by acknowledging shortcomings and outlining solutions, and prepare for exponential success with infrastructure capacity planning.

For projects looking to implement data-driven strategies, comprehensive crypto PR services can accelerate these results through ICODA industry expertise and established media relationships, supported by frameworks aligned with current market dynamics.

The most successful crypto PR campaigns create lasting value by treating community building as product development rather than marketing expense. Success metrics should focus on governance participation, network growth, and ecosystem development rather than purely financial indicators.

Frequently Asked Questions (FAQ)

The five most impactful crypto PR case studies include Arbitrum’s $1.2B airdrop distribution, Pudgy Penguins’ $10M+ Walmart partnership, Bonk’s organic $2B market cap growth, Base’s 2M+ wallet “Onchain Summer” campaign, and LayerZero’s 1.28M user Proof-of-Donation launch. These campaigns collectively generated over $3 billion in direct market value through authentic community engagement rather than traditional advertising.

Successful blockchain marketing campaigns use gamification, governance participation, and on-chain incentives to create sustainable user engagement, achieving 2-5x higher retention rates than traditional marketing approaches. The most effective campaigns treat community building as product development, generating verifiable metrics like increased daily active users and governance participation rates.

Cryptocurrency public relations relies on transparent, on-chain verification and community governance rather than traditional media coverage alone, with success measured through metrics like TVL growth and governance participation. The blockchain’s transparency means that genuine user adoption and protocol health become the primary credibility signals for crypto projects.

Most successful crypto PR case studies focus on strategic timing and community incentives rather than large budgets, with campaigns like Bonk achieving $2B+ market caps through zero traditional marketing spend. ICODA’s experience with projects like GameFrog demonstrates that targeted SEO and content marketing can deliver 340% community growth while maintaining cost-efficient user acquisition compared to celebrity endorsements or paid influencer campaigns.

Key performance indicators for crypto PR case studies include new wallet acquisition cost, daily/monthly active user growth, protocol revenue or TVL increases, and 30-90 day on-chain retention rates. These verifiable metrics provide concrete proof of campaign effectiveness beyond traditional media impressions or social media engagement.

Strategic timing during market downturns or low-competition periods can multiply organic reach by 300-500%, as demonstrated by successful crypto PR case studies like Bonk’s Christmas Day launch during Solana’s crisis period. Extended pre-launch campaigns (12-18 months) consistently build stronger communities than quick launches focused on immediate token speculation.

Community-first cryptocurrency public relations strategies reward genuine usage over transaction volumes and create governance participation opportunities, resulting in 80%+ community approval ratings across successful campaigns. These approaches transform token holders into active stakeholders through transparent governance and direct revenue sharing rather than passive speculation.

Rate the article