The $85 Billion Question Every DEX Founder Must Answer

You’ve assembled the team. You’ve secured seed funding. Your whiteboard is covered in technical diagrams for the next-generation perpetual DEX that will finally dethrone centralized exchanges.

But before you write a single line of code, you face a strategic fork in the road that will determine everything: Do you spend the next two years building a fortress of proprietary technology, or do you launch in six months with maximum marketing firepower and massive token incentives?

Choose wrong, and you’ll either burn through your treasury chasing unsustainable growth or spend years building a technically perfect product that nobody uses.

The thesis: Success isn’t about picking the “right” strategy. It’s about flawlessly executing the path that matches your team’s DNA, resources, and market timing—then knowing when to evolve.

The New Battlefield: Why the Perpetual DEX War Matters Now

The spot trading wars are over. AMMs won, liquidity fragmented across 200+ protocols, and the entire model commoditized into irrelevance for anyone launching today.

The real battle has shifted to derivatives.

The numbers tell the story: DEX-to-CEX spot volume ratio climbed from 0.13 to 0.23 in Q2 2025 alone. More importantly, perpetual DEX volume surpassed $898 billion in the same quarter while CEX derivatives actually contracted by 3.6%. The market share of perpetual DEXs relative to centralized venues doubled from 4.5% to over 10% in just 12 months.

This isn’t incremental growth. This is a fundamental market restructuring.

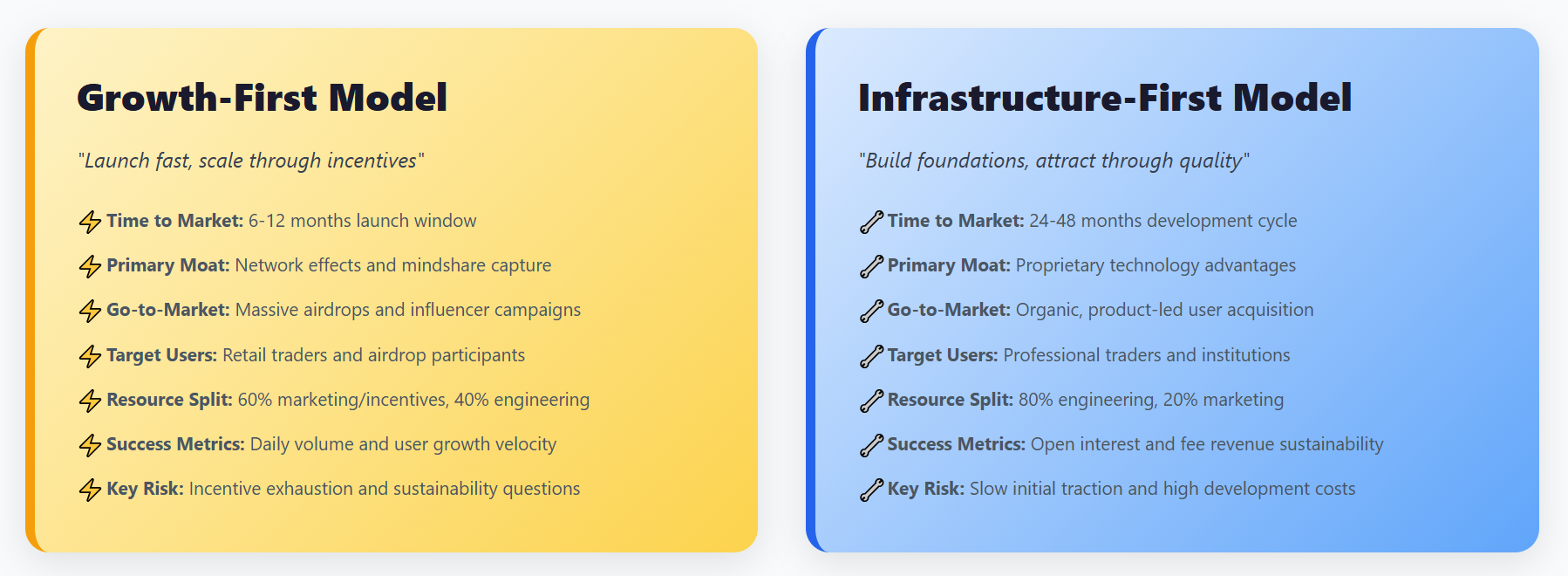

Defining the Dichotomy: Two Philosophies, Two Playbooks

The Growth-First Model prioritizes rapid user acquisition and market share capture through massive token incentives, influencer marketing, and viral product features. Launch fast on established chains, leverage existing liquidity, and measure success in volume velocity and social mentions.

The Infrastructure-First Model prioritizes building proprietary, defensible technology first—custom blockchains, novel consensus mechanisms, performance that competitors cannot match. Target sophisticated traders through product excellence and measure success in uptime, latency, and sustainable fee revenue.

The Strategic Dichotomy at a Glance

| Dimension | Growth-First (Aster) | Infrastructure-First (Hyperliquid) |

|---|---|---|

| Time to Market | 6-12 months | 24-48 months |

| Primary Moat | Network effects, mindshare | Proprietary technology |

| Go-to-Market | Massive airdrops, influencer campaigns | Organic, product-led |

| Target Users | Retail speculators, airdrop farmers | Professional traders, institutions |

| Resource Allocation | 60% marketing/incentives, 40% engineering | 80% engineering, 20% marketing |

| Success Metric | Daily volume, user growth velocity | Open interest, fee revenue sustainability |

| Primary Risk | Incentive exhaustion, wash trading | Slow initial traction, high development cost |

Growth-First Deep Dive: The Aster Blitzkrieg

Aster didn’t gradually build market share. It detonated onto the scene in September 2025 with a coordinated assault that made every other DEX launch look timid by comparison.

The Playbook: Engineering Virality at Scale

The foundation was strategic timing and ecosystem leverage. Aster emerged from a merger of APX Finance and Astherus, combining functional trading infrastructure with liquidity aggregation. Rather than building from scratch, the team rebranded and turbocharged existing components with an unprecedented incentive layer.

The results? Within the first week post-launch, the ASTER token surged over 2,000%, market cap hit $3.8 billion, and the platform registered 330,000 new wallet addresses in 24 hours. At peak, daily trading volume exceeded $85 billion—briefly eclipsing the entire established DEX sector.

This wasn’t luck. This was deliberate architectural decisions designed for maximum velocity:

Multi-Chain Aggregation: Rather than building a custom chain, Aster deployed across BNB Chain, Arbitrum, Ethereum, and Solana simultaneously. This eliminated bridging friction and allowed immediate access to billions in existing liquidity. Time to market: six months versus Hyperliquid’s three years.

Product Hooks Designed for Headlines: The platform offered 1001x leverage in “Simple Mode”—a number deliberately chosen to generate buzz and media coverage. Competitors offered 20x, 50x, maybe 100x. Aster made the leverage itself a marketing weapon.

Yield-Bearing Collateral: Users could deposit staked BNB (asBNB) as margin, earning 5-7% base yield while trading. This “trade and earn” model created a compelling value proposition that differentiated Aster in a crowded market.

The Weapon: The CZ Effect

Every tactical advantage pales compared to Aster’s strategic masterstroke: the explicit backing of Changpeng “CZ” Zhao, Binance’s founder.

CZ’s public endorsements on X transformed Aster from “another DEX” into a cultural phenomenon. His statement—”competes with Binance, but helps BNB”—provided instant credibility and legitimacy impossible for any new protocol to achieve organically.

The market response was visceral. Within days of CZ’s initial posts, ASTER surged 7,000% from launch price. The platform’s CMC Launch campaign generated 400 million homepage impressions and over 3 million tweet impressions. When CZ speaks, retail listens—and buys.

This influencer-driven momentum was weaponized through tokenomics. Aster allocated 53.5% of total supply to community rewards, with 704 million tokens (8.8% of supply) distributed immediately at launch. This created a reflexive loop: massive airdrop drives volume → volume validates token value → higher token value attracts more farmers → more volume.

The Trade-Offs: Speed Versus Sustainability

Aster’s explosive growth came with structural vulnerabilities inherent to the Growth-First model.

Volume Quality Questions: On-chain analysts flagged substantial wash trading, with reports suggesting $2.5 billion of a $42 billion volume period was non-organic. When users farm points through delta-neutral hedging—buying spot ASTER while shorting it 1x on perpetuals—they generate enormous volume with zero genuine trading intent.

Extreme Centralization: Analysis revealed that three to six wallets controlled over 90% of the token supply. This concentration fundamentally contradicts decentralization principles and creates severe manipulation risk.

Future Supply Pressure: The October 2025 unlock released 183 million ASTER tokens worth $325 million—11% of market cap—into circulation in a single event. Large recurring unlocks create sustained selling pressure that growth must continually absorb.

Infrastructure Fragility: Unlike Hyperliquid’s complete on-chain history, Aster’s trade data was accessible only through limited APIs. Critics labeled it a “CEX without KYC where you login with your wallet.” When a bug involving the XPL token caused improper liquidations, the platform manually reimbursed users—revealing centralized intervention capabilities.

Yet dismissing Aster as pure hype ignores genuine innovation. The platform’s MEV-free “hidden orders” function like a dark pool, concealing order direction and size until execution. This protects traders from front-running and sandwich attacks—a tangible improvement praised even by CZ himself.

Infrastructure-First Deep Dive: The Hyperliquid Fortress

If Aster represents blitzscaling, Hyperliquid represents patient capital deployed toward building technological dominance.

The Thesis: Performance Is the Product

Hyperliquid’s founding philosophy: in derivatives trading, sophisticated capital flows to superior execution. Period.

Professional traders and market makers don’t care about airdrops. They care about latency, slippage, reliability, and capital efficiency. Build the best trading engine, and the most valuable users will find you organically.

This belief drove the team to a radical decision: rather than deploy as an app on Ethereum or an L2, they would build an entire Layer-1 blockchain from scratch, purpose-built for one application—high-frequency derivatives trading.

The Engine: A Custom L1 and On-Chain Order Book

The Hyperliquid L1 runs on HyperBFT, a proprietary consensus mechanism achieving 20,000 orders per second with sub-second finality. Compare this to general-purpose chains where DEXs compete for limited blockspace and inherit the host chain’s performance ceiling.

Built atop this foundation sits a fully on-chain Central Limit Order Book (CLOB). Unlike AMMs that use probabilistic pricing curves, a CLOB directly matches buy and sell orders—the same model professional traders use on every major centralized exchange. This enables tighter spreads, greater capital efficiency, and advanced order types.

The killer feature: zero gas fees for traders. Users pay only maker/taker fees, creating a cost structure identical to Binance or Coinbase while maintaining self-custodial security.

This architecture required a multi-year development cycle and elite engineering talent. It’s the opposite of Aster’s “launch fast and iterate” approach. But it created something competitors cannot easily replicate: a structural performance advantage requiring hundreds of millions and years to match.

Proof of Concept: The Bitwise ETF Filing

In September 2025, Bitwise Asset Management filed an S-1 with the SEC for a spot Hyperliquid ETF—a physically-backed fund holding HYPE tokens with Coinbase as custodian.

This represents extraordinary validation. A major regulated asset manager deemed Hyperliquid’s infrastructure sufficiently robust, secure, and mature to serve as the foundation for a public investment vehicle bridging DeFi and traditional finance.

You don’t get ETF filings for platforms running on incentive-driven volume. You get them for protocols demonstrating institutional-grade reliability.

Performance, Economics, and the Moat

Prior to Aster’s emergence, Hyperliquid captured approximately 80% of perpetual DEX market share and processed $478 billion in 2024 trading volume. Even after Aster’s explosive launch, Hyperliquid maintained 62% market share in open interest—the metric that matters most because it reflects committed, long-term capital rather than transient farming activity.

The platform generates consistent daily fee revenue around $3 million, peaking at $106 million monthly in August 2025. This organic cash flow validates the high lifetime value of its user base.

The HYPE tokenomics model aligns with long-term sustainability: 93-99% of trading fees fund automatic token buybacks, creating deflationary pressure that rewards holders through supply reduction rather than inflationary emissions. By mid-2025, the Assistance Fund had acquired over 28.5 million HYPE tokens.

The Infrastructure-First Trade-Offs

Superior technology doesn’t eliminate risk—it shifts it.

Slower Initial Growth: Years spent on R&D meant Hyperliquid was vulnerable to a well-funded competitor executing a vampire attack via incentives. Aster briefly captured more daily volume, proving marketing can overcome technical superiority in the short term.

Centralization Concerns: Achieving CEX-level performance required architectural choices that drew criticism. The protocol relies on 16 permissioned validators versus Ethereum’s 800,000+. The team initially didn’t open-source core code, raising transparency concerns.

Token Unlock Pressure: Hyperliquid faces a major test starting November 2025: a linear unlock of 237.8 million HYPE over 24 months. At $50 per token, this represents roughly $500 million in monthly selling pressure. The platform’s ability to generate organic demand through HyperEVM adoption and trading revenue will determine whether this supply shock is absorbed or becomes a death spiral.

Architecture and Performance Benchmarks

| Metric | Aster (Growth-First) | Hyperliquid (Infrastructure-First) |

|---|---|---|

| Foundation | Multi-chain app (BNB, ETH, SOL, ARB) | Custom L1 (HyperCore + HyperEVM) |

| Orders/Second | Dependent on host chain | 20,000 |

| Finality | Host chain dependent (~1-15 seconds) | Sub-second |

| Gas Fees | Host chain gas + trading fees | Zero gas; maker/taker fees only |

| Development Time | 6 months (merger + rebrand) | 36+ months |

| Core Innovation | Hidden orders (app-layer MEV protection) | On-chain CLOB + custom consensus |

| Replication Cost | Low (forkable architecture) | Extremely high (custom L1) |

The Decision Framework: Five Pillars for Choosing Your Path

The Aster-Hyperliquid Framework distills these case studies into an actionable decision model built on five strategic pillars.

Pillar 1: Foundational Architecture 📐

Infrastructure-First: Build a proprietary L1 or L2 optimized for your specific use case. Accept high R&D costs and extended timelines in exchange for a defensible moat and full control over performance and value capture.

Growth-First: Deploy on established L1s/L2s or operate as a multi-chain aggregator. Sacrifice performance ceiling and value capture in exchange for speed to market and immediate access to existing user bases.

Decision Driver: Do you have elite engineering talent and patient capital to build custom infrastructure? Or do you need to launch within 6-12 months to capture a market window?

Pillar 2: Go-to-Market Strategy ♟️

Infrastructure-First: Organic, product-led growth targeting sophisticated traders through superior execution. Marketing emphasizes technical specifications and reliability.

Growth-First: Incentive-driven growth via massive airdrops, influencer campaigns, and viral features. Marketing emphasizes potential rewards and community narrative.

Decision Driver: Is your team world-class at narrative warfare and community building? Or do you have the technical chops to let the product speak for itself?

Pillar 3: Product Philosophy 📜

Infrastructure-First: Methodical feature development prioritizing stability, performance, and capital efficiency. User experience tailored for professionals.

Growth-First: Rapid feature velocity introducing novel hooks (extreme leverage, gamified modes, unique collateral) designed to generate buzz and differentiate.

Decision Driver: Are you building for traders who measure success in basis points and milliseconds? Or for users who value entertainment and potential 100x returns?

Pillar 4: Economic Model 🔄

Infrastructure-First: Sustainable tokenomics with deflationary mechanisms. Token utility tied to network security and governance. Value accrual through fee buybacks.

Growth-First: Inflationary tokenomics with large allocations to incentives. Token value predicated on growth narrative and future potential.

Decision Driver: Can your protocol generate enough organic fee revenue to support a buyback model? Or do you need to bootstrap a network effect through temporary subsidies?

Pillar 5: Target User Persona 👤

Infrastructure-First: Professional traders, HFT firms, institutions. Users sensitive to execution quality, latency, and fees.

Growth-First: Retail speculators, airdrop farmers, users in emerging markets. Users sensitive to incentives, leverage availability, and narrative.

Decision Driver: Who are you actually building for—and do you have the resources to acquire and retain them?

The Five Pillars Decision Matrix

| Pillar | Choose Growth-First If… | Choose Infrastructure-First If… |

|---|---|---|

| Architecture | You need to launch in <12 months | You can commit to 2-4 year build cycle |

| Go-to-Market | You have marketing/BD expertise | You have elite engineering talent |

| Product | You excel at rapid iteration | You prioritize technical perfection |

| Economics | You have capital for subsidies | You can bootstrap via product excellence |

| Users | You’re targeting retail/emerging markets | You’re targeting institutions/professionals |

Why Hybrid Approaches Usually Fail

The obvious answer: “Why not do both?” Here’s why it’s harder than it looks. Hybrid strategies create organizational confusion, diluted resource allocation, and narrative incoherence. Growth-First requires marketing DNA; Infrastructure-First requires engineering DNA. These cultures clash. Your team will excel at one or the other—rarely both simultaneously. The successful hybrids (like dYdX’s evolution from dApp → L2 → L1) are sequential: master one phase, then evolve into the other. Not simultaneous execution.

Measuring Success: Different Metrics for Different Models

Using Growth-First KPIs to evaluate an Infrastructure-First protocol is like judging a Formula 1 car by how many people fit inside. The metrics must align with strategy.

Key Performance Indicators by Strategy

| KPI Category | Growth-First | Infrastructure-First |

|---|---|---|

| User Acquisition | New wallet growth rate, airdrop claim rate, social mention velocity | Developer adoption rate, institutional onboarding, referrals from power users |

| Activity | Daily active users, 24h volume, TVL growth rate | Open interest, average trade size, user retention at 90 days |

| Financial | Token price performance, market cap rank | Protocol fee revenue, P/F ratio, buyback volume |

| Quality | Virality coefficient (k-factor) | Slippage rates, transaction finality, uptime percentage |

| Health | User retention (30/60/90 day), incentives paid vs. revenue | Market share vs. competitors, time-to-market vs. roadmap |

The Retention Cliff

Over 96% of users on Solana-based DEXs are “one-time users” who never return. The Growth-First model amplifies this problem: users arrive for incentives, not utility. When airdrops end, 90%+ churn. Infrastructure-First protocols like Hyperliquid address this by making execution quality so superior that users stay for the product. The sticky factor isn’t tokens—it’s performance.

Practical Takeaways: Your Action Plan

Based on ICODA’s analysis of DEX protocols, here’s how to apply this framework:

For Founders: The Self-Assessment Checklist

Choose Infrastructure-First if you have:

- Elite engineering team with L1/L2 development experience

- Patient capital ($10M+ runway for 2+ years)

- Technical innovation truly difficult to replicate

- Target market: institutions and professional traders

- Tolerance for slow initial growth

Choose Growth-First if you have:

- World-class marketing and community management

- Access to influential backers or ecosystem partners

- Capital for aggressive incentive programs ($5M+ for airdrops)

- Target market: retail and emerging markets

- Need for rapid market validation

Red Flags for Both Paths:

- Growth-First: Token distribution where <20 addresses control >50% supply, no plan for post-incentive retention, reliance on wash trading for volume

- Infrastructure-First: Development roadmap >3 years, no clear path to decentralization, inability to articulate technical advantages in simple terms

For Investors: The Due Diligence Framework

Evaluating a Growth-First Protocol:

- Analyze tokenomics: What percentage allocated to community vs. team/insiders?

- Check wallet distribution: Are airdrop recipients concentrated or diverse?

- Assess volume quality: Compare reported volume to independent analytics (Dune, DeFiLlama)

- Test retention: What’s the 90-day return rate for new users?

- Verify revenue: Is the protocol generating fees that exceed incentive costs?

Evaluating an Infrastructure-First Protocol:

- Review technical benchmarks: Independently verify latency, TPS, and uptime claims

- Assess developer adoption: How many external teams are building on the platform?

- Check institutional signals: Any partnerships with regulated entities, custodians, or traditional finance?

- Examine tokenomics: Is value accrual tied to genuine protocol usage or speculative narrative?

- Measure open interest: Does the platform command significant long-term committed capital?

Risk Assessment Matrix

| Risk Category | Growth-First (Aster) | Infrastructure-First (Hyperliquid) | Mitigation Strategy |

|---|---|---|---|

| Sustainability | HIGH: Incentive exhaustion | LOW: Organic fee generation | Phase out subsidies gradually while improving product |

| Centralization | HIGH: Token concentration | MODERATE: Small validator set | Implement progressive decentralization roadmap |

| Regulatory | HIGH: Extreme leverage, no-KYC | MODERATE: Custom L1 oversight | Build compliance infrastructure early |

| Technical | LOW: Battle-tested infrastructure | HIGH: Novel, unproven architecture | Extensive audits, bug bounties, gradual rollout |

| Competition | HIGH: Easily forkable features | LOW: Difficult to replicate moat | Continuous technical innovation and user lock-in |

Looking Forward: The Convergent Future

Long-term winners will blend both models. Aster must evolve toward infrastructure investment—the CEO has hinted at plans for a dedicated high-performance chain. Without technical defensibility, sustained dominance becomes impossible once incentives expire.

Hyperliquid must accelerate user acquisition through strategic growth initiatives. The November 2023 launch of a points program represents this evolution: incentivize genuine usage without compromising execution quality. The protocol’s token unlock pressure starting November 2025 makes this pivot urgent—generating organic demand through HyperEVM adoption becomes critical.

The future belongs to protocols that master the sequential evolution: start with one path, execute flawlessly, then layer on elements of the opposing strategy before your initial advantage expires.

The bottom line: The perpetual DEX market will support multiple winners, but each must choose their strategic DNA at inception. Growth-First captures attention; Infrastructure-First captures value. Your job isn’t to pick the “right” path—it’s to execute your chosen path with absolute conviction, then evolve before market dynamics force your hand.

Frequently Asked Questions (FAQ)

Decentralized exchanges (DEXs) allow users to trade cryptocurrencies directly from their wallets without transferring custody to a third party, while centralized exchanges (CEXs) like Binance or Coinbase hold user funds and act as intermediaries. DEXs use smart contracts for peer-to-peer trading, whereas CEXs operate order books on centralized servers with faster execution but require trust in the platform.

The first decentralized exchanges emerged around 2016-2017, but DEXs gained significant traction during “DeFi Summer” in 2020 when Uniswap popularized the automated market maker (AMM) model. The perpetual DEX sector evolved later, with protocols like dYdX launching derivatives trading in 2021 and infrastructure-focused platforms like Hyperliquid emerging in 2023.

Decentralized exchanges offer self-custody (users control their private keys), censorship resistance, permissionless access without KYC requirements, and transparency through on-chain settlement. Advanced DEX protocols now provide zero gas fees, CEX-level execution speeds up to 20,000 orders per second, and innovative features like yield-bearing collateral unavailable on centralized platforms.

Decentralized exchanges typically have lower liquidity than major CEXs, slower transaction speeds on general-purpose blockchains, higher technical complexity for new users, and limited customer support when issues arise. Some DEXs also face challenges with wash trading, token concentration among whales, and sustainability questions around incentive-driven volume versus organic trading activity.

Decentralized exchanges operate in a regulatory gray area that varies by jurisdiction, with platforms offering features like extreme leverage (1001x) or no-KYC policies facing higher scrutiny from regulators like the SEC. Infrastructure-focused DEX protocols building compliant frameworks and working with regulated custodians (like Hyperliquid’s Bitwise ETF filing) demonstrate paths toward legal operation, though global regulatory frameworks for DeFi remain in development.

The future of decentralized exchanges points toward convergence between Growth-First and Infrastructure-First models, with successful protocols blending proprietary technology moats and sustainable user acquisition strategies. Perpetual DEX market share is projected to continue growing from 10% toward 20-30% of total derivatives volume as custom Layer-1 blockchains achieve CEX-parity performance while maintaining decentralization and attracting institutional capital through regulatory compliance.

Rate the article