share

What do you associate cryptocurrencies with? Digitalization? Decentralization? Blockchain? For many, cryptocurrencies have become a symbol of affordable income, easy access to the trading market and profits through trading. Unlike the stock market, crypto trading is accessible to almost everyone: no need to find a broker or a trusted person, get the appropriate classification of a qualified investor or find workarounds to trade due to sanctions costs. That is why the number of traders on the crypto market is increasing every crypto day, and each of them is trying to find their own crypto strategies.

In general, a trading strategy is a set plan of actions and tools used to buy/sell an asset for the purpose of making a profit.

Regardless of which trading method you choose, a trader will always have to determine for himself which tools to use, the point of entry and closing of a deal, the amount of the deal, and the framework of risk management.

Now together with you, we will look at the crypto plans according to the time and tools to use, beginners or professionals, with high and minimum risk for the financial market. Let’s begin!

Daytime Operations in the Crypto Segment

It is the process of trading within crypto markets, committed during the crypto day (trading day) and taking into account changes in the rates during this period. Uses variations in the volatility of traded assets in the market in short timeframes (from minute charts to hourly charts). The very name of day trading says that all operations will be performed in one day without stretching the risks for several days or weeks.

Features

Day trading is done on 5M-1H charts of crypto rates. Analysis of intraday price movements allows for 1 to 12 transactions per trading period, and profits when using the day trading crypto market can range from 0.5% to 10% of the portfolio, depending on the situation.

The advantage for the trader is that all positions in trades are closed on the same day, which avoids high price spikes during night trading sessions.

Factors

Factors that should be considered when building crypto day trading strategies. They include:

- Accounting for the liquidity of a traded asset.

Liquidity, or the ability to sell or buy an asset quickly in order to cash out, is an important factor for day trading strategies, as a trader is limited in the timing of transactions and problems with the collateral of the asset can affect the timing of the transaction.

- The marginal collateralization of the transaction is below average.

As the probability of asset price ruptures, most often carried out during impulse movements at night, is reduced, the riskiness is also reduced.

- Asset crypto volatility.

In such a short time frame as a day, it is most beneficial to use highly volatile assets, as trading this type of cryptocurrency provides more trade opportunities if you use the right trading strategy.

Within the framework of the daily strategy can be distinguished and separate subspecies. Let’s take a closer look at them.

Scalping

This is a style of trading on short-term bets used by traders. The 1Tick and 5M charts are used to place trades—the shortest periods on the charts. Profits from such operations are not large, from a hundredth of a percent to a few units of the transaction amount.

But the number of transactions is greater than in classical trading: from a dozen to hundreds, depending on the trend.

Scalping is one of the most accessible ways to trade cryptocurrencies because it does not require serious training, is used by advanced traders and beginners alike, is available both during the rise of the asset and during the fall, and is applicable to minor changes in price.

Automatic Scalping or High-Frequency Crypto Trading

This strategy of day trading cryptocurrencies on the same low trading periods (timeframe) as the classic scalping, but with the use of trading bots.

A trading bot is a special software that connects to a user’s account through a cryptoexchange API and makes trades on his behalf, according to a predetermined scenario. Automatic scalping with the help of trading bots allows for increased intraday trading due to a more sensitive reaction on shorter timeframes. In addition, many exchanges offer their own bots (e.g., Binance, Huobi), which further simplifies the trading process.

Non-directional Range Trading

Cryptocurrency trading within a set price range (range trading) also belongs to the daily crypto trading strategies. It is ideal for use in a pronounced sideways trend.

The trader determines the intraday trading range by analyzing the rate chart and trading volume and identifying support and resistance levels. Buying on support and selling on the approach to resistance can easily earn money in intraday trading.

It is important to follow risk management in case of breakdown and out of the range to keep the price within the chosen path.

Technical Analysis Indicators

The strategy of trading on technical indicators implies mathematical forecasting of asset price movement according to predetermined trends. There are a lot of market indicators nowadays, with the help of which traders look for optimum ways of entering or exiting a deal.

Examples of Technical Market Indicators

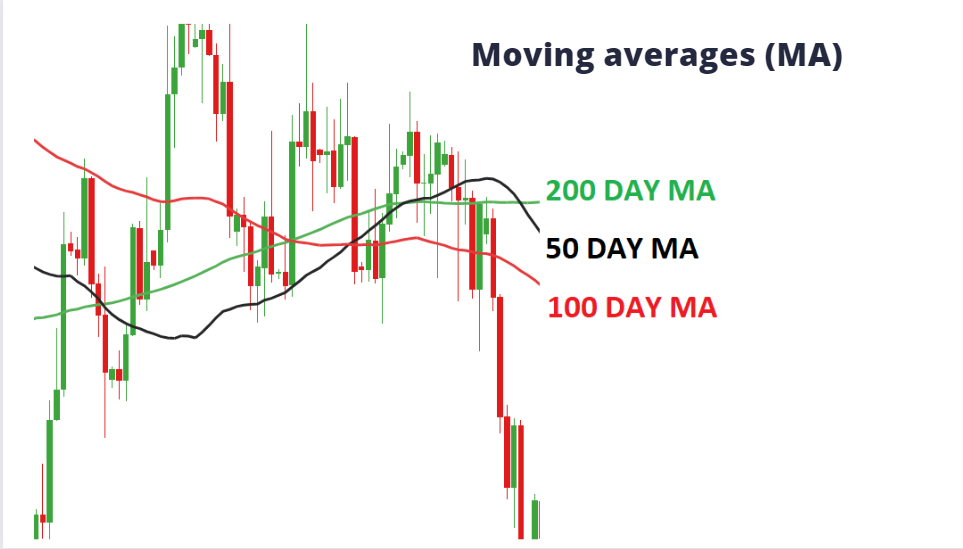

Moving Averages (MA)

Moving averages (MA) are a popular market indicator. It is a graph of the average price movement of an asset in a chosen time period (a day, a week, a month, 200 days, 100 days etc.). This indicator is also often used as a basis for other strategies, as the Moving Average (MA) chart smoothly and affordably reflects price changes. The daily moving average is evaluated as part of day trading.

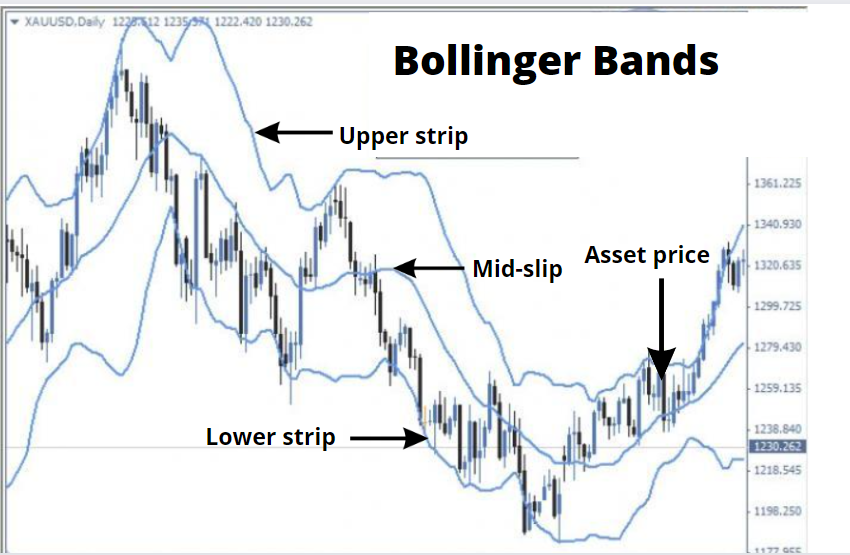

Bollinger Bands

The technical indicator of volatility in the market reflects the strength of the deviation of the asset rate from the average price value for the period.

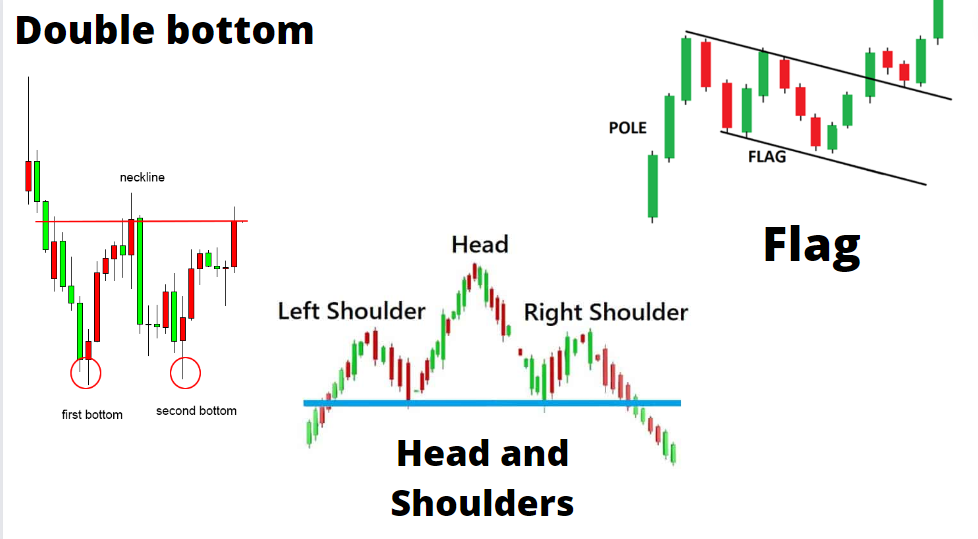

Relative Strength Index (RSI)

Relative strength index (RSI)—a technical indicator of trend strength and probability of trend reversal. It is used to analyze market patterns: “Head and Shoulders”, “Double top”, “Double bottom”, “Wedge”, “Flag”, and others.

Pivot and Retracement Trading Strategy in the Crypto Market

Pivot and Retracement trading are also universal strategies, which are suitable for intraday trading as well as for longer periods. They are all based on a strong movement in the value of the cryptocurrency from a set level of support or resistance.

Trading by Market News

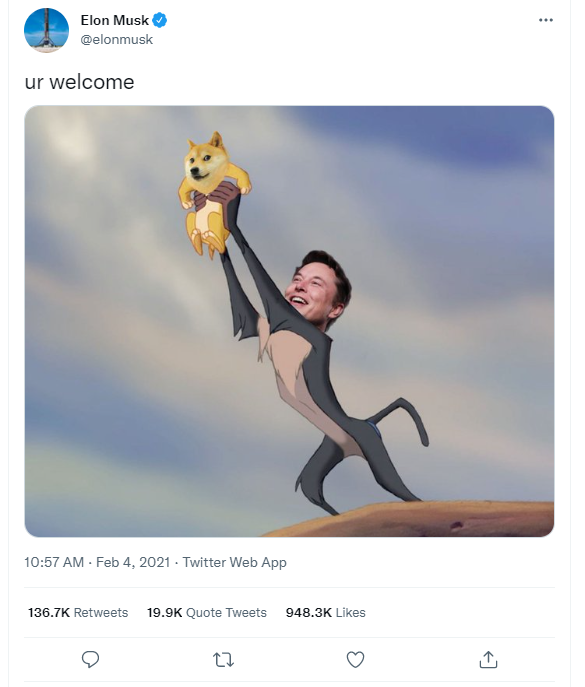

The “Market News Trade” strategy involves the use of a news background during the analysis of changes in the price of a digital asset. Thus, it is widely known that news affects the price of an asset, especially a volatile.

A quick response to the news allows you to earn above average or well if the insight was received in time.

A vivid example of using such news insider trading is the rise in the value of Dogecoin after tweets by Elon Musk on his account. In 2021, any mention of this asset on the social network allowed for an instant 7-15% rise in a few hours.

Trading is not limited to day trading. There are strategies designed for a longer time period. Let’s remember the main examples.

HODL

HODL (buy and hold) is a long-term strategy for investing in cryptocurrencies. It assumes that the investor will not benefit from the transaction gradually, and the main profit from the operation will receive from the long-term (more than 3 years) growth of the asset rate.

This strategy is also called “diamond hands”.

Swing Trading Strategy

Swing trading is trading on the reversal when the trader catches the change in the market (more often on the decline). It is more of a medium-term type of trading, in which a cryptocurrency investor evaluates both daily and weekly charts, making predictions for changes over several hours (swing in a daily trading strategy) to several weeks.

Futures and Stock Indexes in Trade Crypto

These risky ways to trade cryptocurrencies, both in the case of trading crypto futures (contracts for a specific asset price) and in the case of trading stock indices (indicators of changes in the value of a basket of assets in a fund), the investor does not have the cryptocurrency at his disposal, but only trades the possibility of changes in its value.

Arbitrage Crypto Trading

Arbitrage is also suitable for intraday trading as well as trading over a longer period. The point of this strategy is to profit from price differences of the same asset on different trading floors (crypto exchanges, mobile trading apps, banking services).

In this case, the trader buys on one cryptocurrency exchange at a lower price and then resells it on other marketplaces or applications where the price is slightly higher. The difference from the sale is the profit of the investor.

Conclusion

As we can see, there are a lot of opportunities for trading and choosing your own trading strategy. There is no universal advice for trading here, as every investor in a crypto asset chooses financial instruments that reflect their complex market concepts. Every investor should evaluate possible market risk based on the analysis of the whole crypto market, not on his own emotions and desire to make a profit.

Successful trader remembers that the market is unpredictable, which means it is necessary to prepare not only trading strategies but also risky strategy—because operations are all in digital currencies, but funds which an investor loses in case of unsuccessful trading are real.