The New Crypto Marketing Landscape

The liquidity wars have begun. Your competitors are fighting for users, trading volume, and community attention. Winners will dominate their sectors. Losers will fade into irrelevance.

Four sectors are capturing the most attention and capital in 2025: perpetual decentralized exchanges, Internet Capital Markets (ICM), Layer 2 ecosystems (particularly Base), and prediction markets. Each sector offers unique opportunities—and requires different marketing approaches.

This guide shows you where to allocate marketing resources, which channels drive results, and how to compete against established players.

Perpetual DEX Marketing: Winning the Trading Volume Battle

Perp DEXs are stealing market share from centralized exchanges through transparency and user control.

Perpetual decentralized exchanges let traders open leveraged positions on perpetual futures entirely through smart contracts. No custody, no intermediaries, no platform risk. When centralized exchanges collapse or freeze withdrawals, Perp DEXs keep operating.

Why Traders Choose Perp DEXs

The value proposition is clear:

- Transparency: Every trade executes on-chain. No fake volume, no hidden orders, no manipulation. Traders verify everything.

- Control: Users never surrender custody. Funds stay in their wallets until positions open.

- Lower fees: No centralized overhead means reduced trading costs. Some platforms burn fees, creating token deflationary pressure.

- Reliability: Smart contracts can’t go bankrupt or steal funds. Code executes as written.

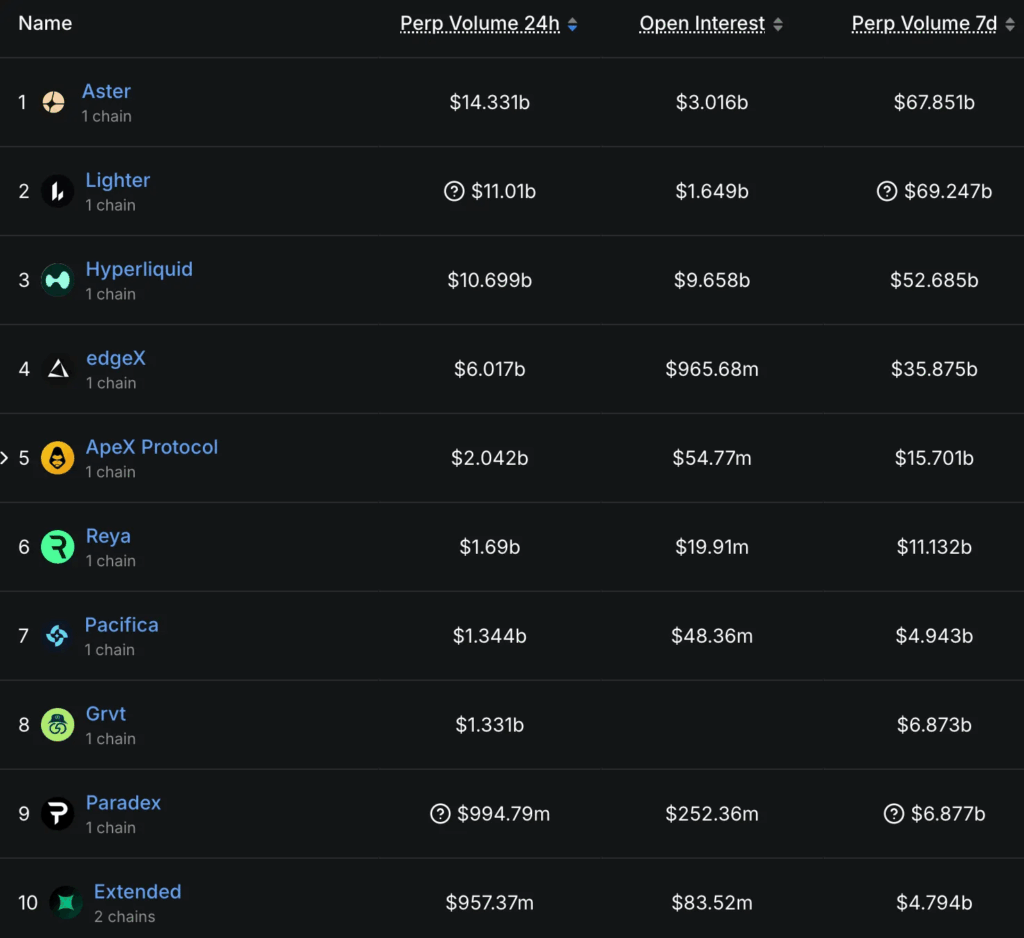

The Competitive Landscape

Competition in perpetual DEX is intense. The sector includes:

| Platform Type | Characteristics | Marketing Focus |

|---|---|---|

| Established leaders | High volume, mature communities | Retention, advanced features |

| Asian-backed platforms | Institutional support, deep liquidity | Regional expansion, partnerships |

| Wallet-integrated DEXs | Built-in user base | Cross-promotion, ease of use |

| New entrants | Aggressive airdrops, low fees | User acquisition, differentiation |

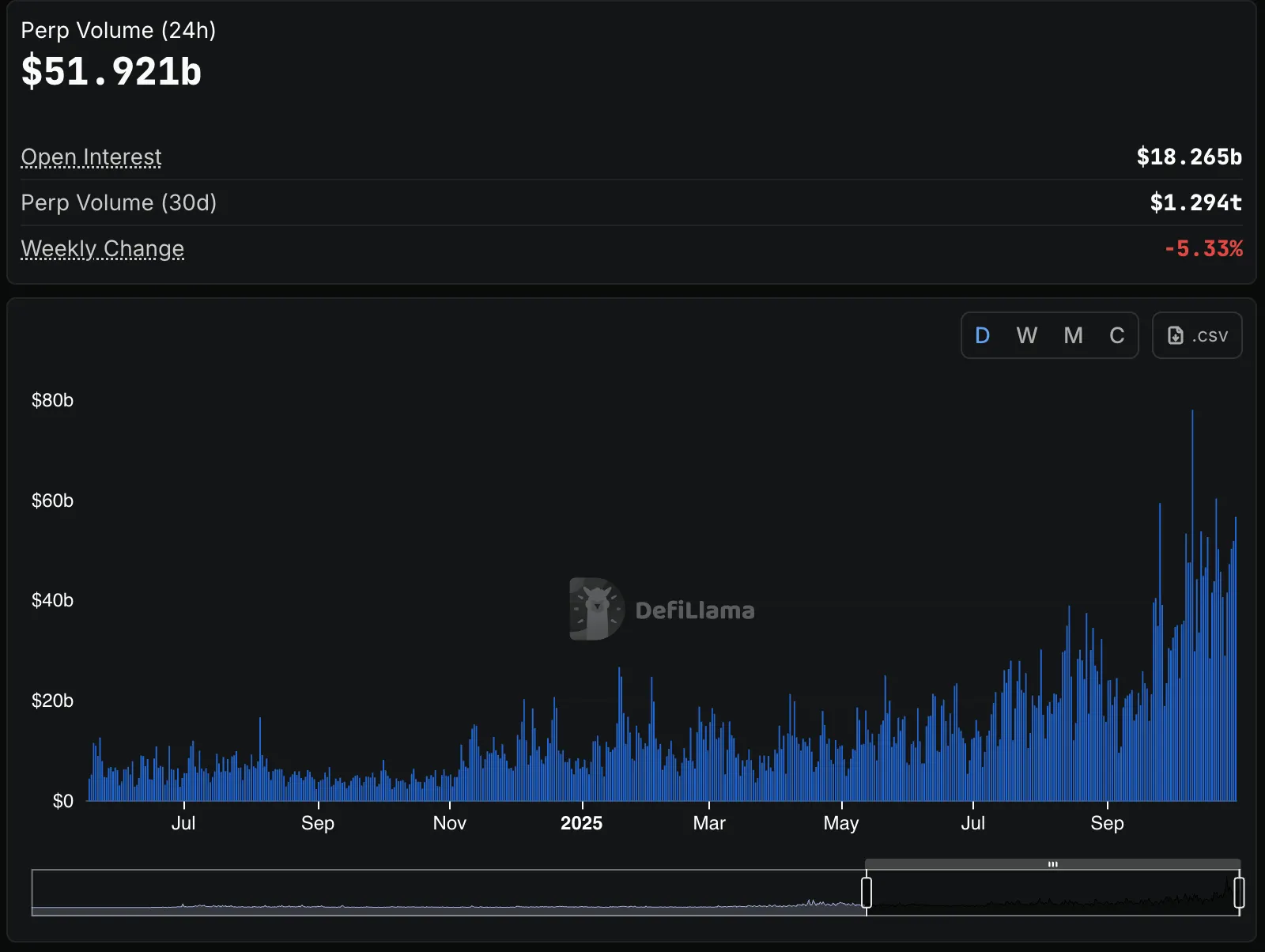

Daily trading volumes exceed $50 billion across the sector. The platform with the most liquidity attracts more traders, creating a network effect. Early marketing wins compound.

Marketing Channels That Drive Trading Volume

Focus on these channels in priority order:

- Crypto Twitter (X): Traders live here. Share real-time PnL screenshots, market analysis threads, and platform updates. Partner with trading influencers who demonstrate profitable strategies on your platform. Post during high-volatility periods when traders are most active. Create controversy—debate CEX vs DEX advantages, challenge competitor claims, share liquidation data. Engagement drives visibility.

- Trading Discord communities: Active traders coordinate in Discord. Sponsor existing channels rather than building from scratch. Host weekly AMAs where you answer technical questions. Provide exclusive alpha—early feature access, trading competitions, or market insights. Build relationships with community leaders who can advocate for your platform. Offer them affiliate deals or ambassador roles.

- Crypto media and podcasts: Secure coverage in DeFi publications like The Defiant, Decrypt, and CoinDesk. Pitch stories about volume milestones, technical innovations, or competitive advantages. Explain your edge over competitors with specific data. Prepare quotable soundbites for journalists. Sponsor relevant podcasts where your target audience already listens.

- Airdrop campaigns: Reward early users with points systems. Successful Perp DEXs allocate 20-40% of tokens to community incentives. Design programs that reward trading volume, not just deposits. Consider tiered rewards—higher multipliers for larger positions or longer holding periods. Publish leaderboards to gamify participation. Make eligibility criteria transparent to build trust.

- Referral programs: Traders bring other traders. Offer fee discounts for both referrer and referee—typically 10-20% reduction for both parties. Top platforms generate 30-50% of new users through referrals. Create special tiers for power referrers who bring high-volume traders. Track which influencers drive the most valuable users and increase their incentives.

Budget Allocation for Perp DEX Projects

For a 6-month launch campaign with $200K-500K budget:

- 40% – Airdrop/incentive programs

- 25% – Influencer partnerships and KOLs

- 15% – Content creation and SEO

- 10% – Paid advertising (CT, DeFi publications)

- 10% – Community management and moderation

ICM Platforms: Marketing Token Launches at Scale

ICM launchpads democratize early-stage investing, but success depends on attracting quality projects and engaged communities.

Internet Capital Markets (ICM) platforms enable anyone to create tokens and raise capital on-chain. No KYC, no accredited investor requirements, no geographical restrictions. Projects launch through bonding curves that automatically provide liquidity.

The ICM Lifecycle Challenge

Most ICM platforms follow a predictable pattern:

- Hype phase: Influencer launches platform, initial projects succeed

- Gold rush: Projects flood the platform, quality declines

- Correction: Users lose money on failed launches, trust erodes

- Evolution: Platform pivots to curated launches or dies

Your marketing must address this lifecycle. Don’t just attract users—attract the right users with realistic expectations.

Marketing ICM Platforms

Platforms need two distinct audiences: project creators and investors.

For project creators:

- Emphasize ease of launch and fair pricing mechanisms

- Showcase successful project case studies

- Provide launch guides and best practices

- Build reputation for hosting quality projects

For investors:

- Set realistic expectations about risks

- Highlight transparency advantages over private fundraising

- Share due diligence frameworks

- Celebrate successful early backer stories

Marketing Individual ICM Launches

Projects launching on ICM platforms have 2-4 weeks to capture attention before momentum dies.

Essential elements:

- Pre-launch community: Build 1,000+ engaged members before token creation. Discord or Telegram with active discussions, not just lurkers. Host voice chats, run contests, and create opportunities for members to contribute. Track message rates and active users—100+ daily active members indicates real engagement. Use bots to prevent spam but don’t over-moderate. Some chaos is better than sterile silence.

- Narrative strength: What makes your project different? Why does it deserve to exist? One-sentence answer or you don’t have clarity. Test your pitch on skeptics—if they don’t immediately understand the value proposition, refine it. Avoid crypto jargon when explaining to newcomers. Use analogies to familiar products or services.

- Founder visibility: Personal brands drive ICM success. If you’re anonymous, find a credible advocate with audience. Share your background, motivations, and vision publicly. Do AMAs weekly in the lead-up to launch. Answer every question, even hostile ones. Transparency builds trust. Document your journey through blog posts, video updates, or Twitter threads.

- Post-launch momentum: Most projects die after initial pump. Plan content calendar, feature releases, and partnership announcements for the month following launch. Schedule at least one significant update per week. Maintain Discord activity even when price declines. Active founders who engage during downturns earn long-term community loyalty. Consider these milestones: first 100 holders, first partnership, first product feature, first community event.

- Visual identity: Strong branding helps projects stand out. Invest in professional logo and graphics before launch. Create consistent visual language across all platforms. Meme-able assets help organic spread—the best crypto marketing is shareable content that communities create without prompting.

Budget 60-70% of marketing spend on pre-launch community building. The first 1,000 believers matter more than the next 10,000 speculators. These early supporters become your evangelists, content creators, and long-term holders.

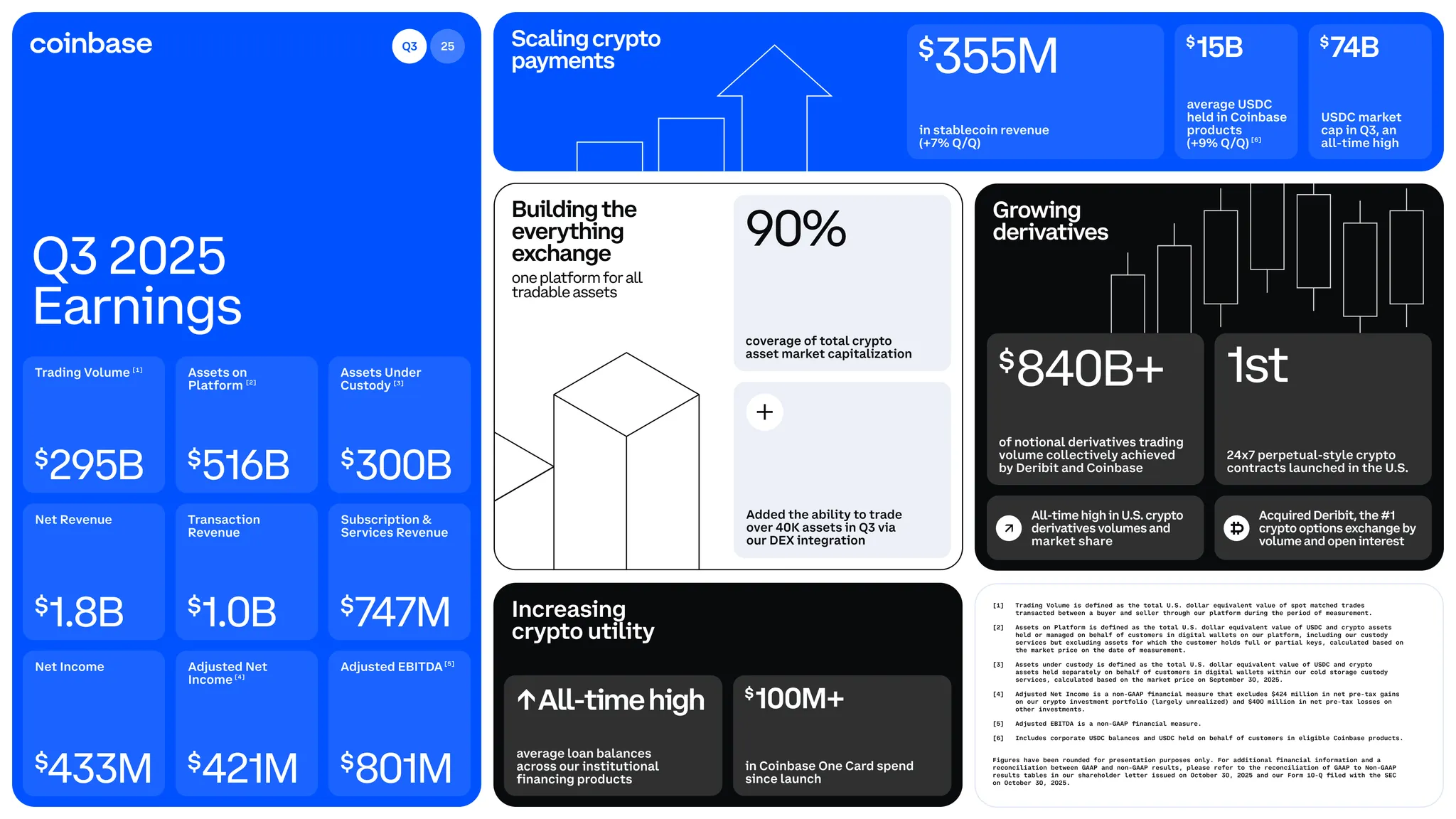

Base Ecosystem: Layer 2 Protocol Marketing Strategy

Base dominates Layer 2 growth through mainstream integration and low transaction costs.

Base is an EVM-compatible Layer 2 built on Optimism, backed by a major centralized exchange. It combines Ethereum security with dramatically reduced fees and faster transactions.

Why Projects Choose Base

Base offers compelling advantages:

- EVM compatibility enables easy deployment from other chains

- Integration with mainstream financial services simplifies onboarding

- Transaction costs 100x lower than Ethereum mainnet

- Daily active addresses exceed 1 million

- Strategic backing provides credibility and resources

Blockchain Selection for Your Project

Your chain choice determines your addressable market, transaction costs, and ecosystem support.

| Chain | Best For | Marketing Challenge | User Base |

|---|---|---|---|

| Ethereum | Serious DeFi protocols | High fees hurt adoption | Largest, most sophisticated |

| Solana | High-frequency applications | Reliability concerns remain | Large, NFT/meme focused |

| Base | Mainstream crypto adoption | Standing out in crowded ecosystem | Growing rapidly, mixed experience |

| Specialized L1s | Niche use cases (trading, gaming) | Limited ecosystem reach | Small but engaged |

Marketing on Base

Base projects must differentiate in an increasingly crowded ecosystem.

Effective strategies:

- Ecosystem partnerships: Collaborate with other Base projects. Cross-promotion works when audiences overlap. DeFi protocols partner with wallets, NFT projects partner with marketplaces.

- Bridge mainstream users: Base’s strength is non-crypto-native users. Create onboarding that doesn’t assume blockchain knowledge. Explain benefits in normal language.

- Leverage Base brand: The backing from a major exchange provides trust. Highlight this in messaging to mainstream audiences nervous about crypto.

- Build for Base-first: Don’t just deploy existing contracts. Optimize for Base’s specific advantages—low fees enable new interaction models.

- Community grants: Apply for Base ecosystem grants. Funding provides resources plus credibility signal.

Focus marketing on use cases that only work with low fees: frequent micro-transactions, gaming interactions, social applications, tipping, etc.

Prediction Market Marketing: Capturing the Betting Audience

Prediction markets are capturing users frustrated with traditional bookmakers through transparency and crypto payments.

Decentralized prediction markets enable betting on real-world events through smart contracts. Sports, elections, technology releases, corporate announcements—anything with verifiable outcomes.

Why Users Switch from Traditional Betting

Traditional bookmakers face trust problems:

- Arbitrary account limitations or bans

- Withdrawal restrictions and delays

- Opaque odds and unclear commissions

- Geographic restrictions and regulations

Prediction markets solve these through transparency and decentralization. Every bet executes through smart contracts. Payouts are automatic. No accounts to freeze, no withdrawals to block.

Marketing Prediction Market Platforms

Target frustrated bettors from traditional platforms while educating crypto newcomers.

Key channels:

- Sports Twitter: Engage during major events—playoffs, championships, tournaments. Share interesting bets and real-time odds. Create threads analyzing betting patterns. Quote-tweet major sporting moments with “People predicted this” style commentary. Partner with sports analysts who already have engaged audiences.

- Political Twitter: Elections drive massive volume. Establish presence 6-12 months before major races. Share daily odds updates. Create markets for debates, primary results, and cabinet appointments. Avoid partisan stances—appeal to bettors from all political backgrounds who want fair odds.

- Sports Discord/Reddit: Communities like r/sportsbook discuss betting strategies. Provide value through educational content about blockchain betting advantages. Don’t just drop links—answer questions, explain how smart contracts work, and share unique market insights. Build reputation as helpful resource before promoting your platform.

- Crypto media: Explain advantages over centralized platforms through case studies. Share volume milestones and unusual market outcomes. Pitch stories about your largest bets, most controversial markets, or unexpected results. Journalists love human-interest angles—find your platform’s best stories.

- SEO: Rank for “[event] betting odds” and “how to bet on [event]”. Prediction markets have SEO advantage—you can create market pages for any future event. Optimize for long-tail searches like “Super Bowl betting crypto” or “presidential election prediction market.” Update content frequently as events approach to maintain rankings.

Content strategy: Publish weekly “market movers” articles highlighting interesting bets, unusual odds shifts, or contrarian positions. Create educational guides comparing traditional betting to prediction markets. Feature user success stories (with permission) showing significant wins.

Airdrop Strategy for Prediction Markets

Most successful platforms allocate tokens based on:

- Trading volume (70-80% of points)

- Win rate (5-10% of points)

- Referrals (10-15% of points)

- Early adoption (5-10% of points)

Weight volume heavily. You want active bettors, not just deposits. Reward consistency over single large bets.

Essential Marketing Metrics by Sector

Track different metrics depending on your sector:

Perp DEX:

- 24h trading volume (primary metric)

- Daily active traders

- Average position size

- Liquidation rates (lower is better)

- User retention (30-day)

ICM Platform:

- Projects launched per week

- Average raise per project

- Project success rate (30-day token performance)

- Platform daily active users

- Repeat launchers/investors

Layer 2 Ecosystem:

- Daily active addresses

- Transaction count

- Total value locked (TVL)

- Number of active contracts

- Cross-chain bridge volume

Prediction Market:

- Bet volume (24h, 7d, 30d)

- Number of active markets

- Average bet size

- User retention

- Win rate distribution

Common Marketing Mistakes to Avoid

Mistake 1: Copying CEX Marketing Playbooks

Decentralized platforms require different marketing. CEX marketing emphasizes trust and security. DEX marketing emphasizes transparency and control. Your messaging must reflect these differences.

Mistake 2: Ignoring Airdrop Farmers

Airdrop hunters will come. Design programs that reward genuine usage, not just deposits. Require minimum trading volume, time-based vesting, or proof of engagement.

Mistake 3: Over-Promising Launch Timelines

Crypto projects consistently miss deadlines. Under-promise and over-deliver. Better to surprise users with early launches than lose credibility through delays.

Mistake 4: Neglecting Community Management

Your Telegram and Discord need active moderation. Scammers impersonate team members, spread FUD, and steal from users. Budget for full-time community managers from day one.

Mistake 5: Focusing Only on Price

Token price obsession kills projects. Focus on product usage metrics, user growth, and protocol revenue. Price follows utility, not marketing hype.

Budget Guidelines by Project Stage

| Project Stage | Pre-Launch (3-6 months) | Launch Phase (1-3 months) | Growth Phase (6-12 months) |

| Goal | Build core community of 1,000-5,000 engaged users | Achieve product-market fit, validate core use case | Scale to sustainable revenue, reduce user acquisition costs |

| Budget Guidelines | 40% – Community building (Discord/TG management, events) 30% – Content creation (educational material, documentation) 20% – Influencer seeding (early advocates, not paid promotions) 10% – Brand development (design, messaging, positioning) | 35% – Airdrop/incentive programs 25% – PR and media coverage 20% – Paid acquisition (targeted ads, sponsorships) 15% – Influencer partnerships 5% – Events and conferences | 30% – Performance marketing (data-driven user acquisition) 25% – Strategic partnerships and integrations 20% – Content marketing and SEO 15% – Community expansion (regional communities, ambassadors) 10% – Brand campaigns |

| Total budget | $50K-150K | $200K-500K | $500K-1M+ |

The Marketing Meta: What’s Working Now

Successful crypto marketing in Q4 2025 requires authentic community building, not paid advertising.

The most effective strategies:

- Founder visibility: Personal brands drive project success. Founders who engage directly with communities build stronger loyalty than anonymous teams.

- Transparent communication: Share metrics, challenges, and roadmap adjustments. Communities forgive mistakes but not dishonesty.

- User-generated content: Your best advocates are successful users. Amplify their stories, feature their strategies, reward their contributions.

- Ecosystem integration: Solo projects struggle. Partner with complementary protocols. Share audiences, bundle services, create flywheel effects.

- Long-term thinking: Mercenary capital and airdrop farmers will leave. Design for users who stay. Reward loyalty over speculation.

Taking Action: Your Next Steps

Focus determines success. You can’t execute all strategies simultaneously.

Choose your primary battleground:

📈 If you’re building a Perp DEX: Prioritize trading influencers and airdrop design. You need volume fast.

💰 If you’re launching on an ICM platform: Build pre-launch community first. Everything else is secondary.

🔵 If you’re deploying on Base: Integrate with ecosystem projects immediately. Collaboration beats competition.

🔮 If you’re creating a prediction market: Focus on one vertical (sports, politics, crypto events). Depth beats breadth initially.

Allocate 70% of resources to your primary channel. Use remaining 30% to test secondary channels. Master one thing before expanding.

The crypto marketing meta changes every quarter. The fundamentals don’t: build genuinely useful products, communicate transparently, and reward your community. Everything else is tactics.

Frequently Asked Questions (FAQ)

Perpetual DEX marketing focuses on trading volume growth through influencer partnerships, airdrops, and community building on Twitter and Discord.

Every campaign is custom-tailored to your goals. Use ф calculator to estimate costs for your specific project needs.

DeFi protocol marketing requires community building first, then influencer partnerships, transparent metrics sharing, and ecosystem integration.

Crypto Twitter, Discord communities, and strategic airdrops drive most results. Referral programs and KOL partnerships amplify organic growth.

Plan 3-6 months pre-launch for community building, 1-3 months for launch phase. Rushing launch without community leads to failed projects.

Layer 2 marketing emphasizes low transaction costs, EVM compatibility, and ecosystem partnerships. Base projects focus on mainstream adoption.

Prediction markets attract bettors through transparent smart contracts, crypto payments, and better odds than centralized bookmakers.

Market conditions and competitive dynamics evolve rapidly. What works today may not work tomorrow. Stay adaptable, measure everything, and be willing to pivot quickly.

Rate the article