share

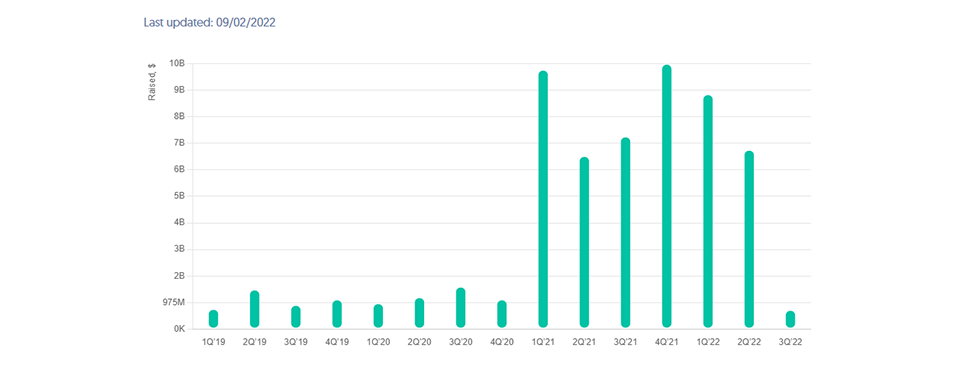

The nature of the cryptocurrency and blockchain industry productively influences the development and opportunities for new technological discoveries. This is leading to more and more examples of crypto startups and more funding for innovative solutions to the crypto market.

Booming use of tokens in digitalization of business, NFT, growth of decentralized finance sector, expansion of CEX and DEX exchanges offerings: the more ways to use blockchain networks, the more intensive new, dynamic projects appear.

There are several priority areas for the development of new services for crypto startups:

- Web3 — a decentralized World Wide Web based on blockchain technology and decentralized autonomous services and online communities.

- Metaverse — digital reality, which aims to transfer all spheres of life to the online segment.

- Decentralized Finance (DeFi)—an alternative to traditional finance way of managing and earning your own digital assets without the involvement of third-party centralized services.

- Management of human resources for a digital portfolio, qualified specialists of the crypto and blockchain industry, exchange of experience and interaction.

- Blockchain-based social networks—a type of providing, sharing, and monetizing content on the Internet through tokenization.

- Financial infrastructure 2Earn and NFT models.

- Development of cryptocurrency and digital finance exchanges for digital currency trading that are more accessible.

- Bitcoin ATMs help to expand access to cryptocurrencies and fiat money and exchanges.

- Services for storing crypto assets.

- Software development processes.

Benefits of Blockchain Startups. The Top 5 Pros of Crypto Startups

Flexibility and Novelty of the Industry

Cryptocurrency startups are a set of the most relevant, in-demand, unique innovations that are discovered along with the use of blockchain and crypto development. Every discovery and move here is unique, as the industry itself is only 14 years old and only 10 years in an active stage of development. Therefore, the conditions for crypto startups are as flexible as possible, the best development minds are concentrated here, and there is a constant process of modernization and development of the industry.

High Earning Power

The crypto industry has gained a share of notoriety due to its high-profit generation in a fairly short period of time. The digital economy is only gaining speed, and every startup here is like a new source of invaluable ideas and practical applications. Therefore, earnings in the cryptocurrency industry are often higher than in traditional assets.

The Technological Assault

The entire service, design, and technology base of cryptocurrencies is built from scratch. There are no early examples or precedents to build on. This is a great field for activity, finding out-of-the-box solutions, and brainstorming.

Industry Performance

The cryptocurrency industry is one of the most intensive, so the startups that were able to demonstrate high adaptability to the market survive here. The overall speed of change forces the pace of each team to increase, which means, among other things, the overall productivity of this segment of the digital economy.

Exclusivity

The unique services of crypto startups do not go unnoticed by those around them, as despite the external volume of the crypto market, an exclusive and sought-after offering is immediately noticeable.

The unique services of crypto startups do not go unnoticed by others because, despite the external volume of the crypto market, the exclusive and sought-after offer is immediately noticeable.

Top Crypto Companies That Began as Startups

Chainalysis

Founded in 2014

Location: New York, NY

Funds raised: $536.6 million.

It is a company that has developed a data analytics suite for the blockchain industry. Data from the information provider Chainalysis is used all over the world, in more than 60 countries, as well as by regulatory agencies and statistical and law enforcement agencies.

As a crypto startup, Chainalysis has occupied an important niche as a provider of statistical information and analytics that are so necessary for the development of cryptocurrency financial turnover.

Data from Chainalysis reports has already been involved in solving cybercrime and the use of cryptocurrencies in such areas as the Darknet, extortion and blackmail, illegal money laundering, theft, phishing, fraud, and financing of terrorist and extremist groups.

Blockdaemon

Founded in 2017

Place of incorporation: Los Angeles, California

Funds raised: $398.2 million (with venture capital from Hashkey, CoinShares, Blockchain.com, and Fenbushi Capital).

Blockdaemon is a tool for institutional investors and infrastructure solution developers to manage full nodes in 30+ popular blockchain protocols.

Blockdaemon helps address one of the key growth drivers of the crypto market at the moment—institutional adoption of digital assets and increased use of blockchain technology by functioning businesses.

Yuga Labs

Founded in 2021

Location: Miami, FL, New York

Funds raised: $450 million in various funding rounds.

For Yuga Labs, it all started with a simple mission of releasing an NFT Bored Ape Yacht Club collection, but the success that came to the developers of the Bored Ape exclusive community concept helped scale the idea into a complex project.

Now Yuga Labs is doing more than just promoting the Bored Ape brand. They are icons of NFT development, have rallied a community of their token holders, and have announced the stages of implementing their own digital reality Metaverse. The company is supported by many Hollywood stars, and the performance style of Bored Ape has become the most copied in the digital collections of NFT artists.

Phantom

Founded in 2021

Location: San Francisco, California

Funds raised: $118 million in various funding rounds.

Phantom is a new technological blockchain wallet. It provides security for storage, transactions, exchanges, and betting of the Solana blockchain ecosystem, one of the most popular projects of recent years.

The growing demand for services on the smart contracts Solana network, including numerous NFT token collections and DeFi projects, required the creation of a universal storage location for multiple SPL standard digital objects.

Prominent venture capitalists and funds, including Andreessen Horowitz, Paradigm, A16z, and others, have invested in the wallet’s development.

Animoca Brands

Founded in 2014

Location: Hong Kong Island, Hong Kong

Funds raised: $773.3 million in various funding rounds.

Animoca Brands is a renowned digital property rights management company, including little-regulated properties such as GameFi, NFT, Metaverse, and others. A leader in blockchain-based digital entertainment, one of the developers of such famous names in crypto as The Sandbox and token SAND, Crazy Defense Heroes. Indirect investor or participant in funding rounds of major projects like Harmony, OpenSea, Axie Infinity, and others.

Performs an important function for the crypto market about legitimate use, accounting for the circulation of digital objects and the relationship of all actors.

CoinList

Founded in 2017

Location: San Francisco, California

Funds raised: $59.7 million in various funding rounds.

CoinList is a platform for raising private funding for cryptocurrency startups under development. Based in San Francisco (California), it became one of the flagships of ICO/IDO promotion in 2018-2022. At different stages, CoinList has hosted such well-known cryptocurrencies as NEAR, Flow, Filecoin, Ocean, Solana, and others.

Platform CoinList offers to compile its digital portfolio from the newest projects that are implemented within the framework of the Offer to Sell, which allows initial investors to earn maximum profits by purchasing assets at a minimum cost.

Investors in the CoinList startup have raised several tens of millions of dollars in venture funding. The most prominent investor in the project is Twitter founder and former CEO Jack Dorsey. Dorsey backed the platform with $10 million in 2019.

Top Blockchain and Crypto Startups in 2022

Spectral

Founded in 2020

Place of incorporation: N/A

Funds raised: $30 million (including Samsung, Circle Ventures, Franklin Templeton).

Spectral is a decentralized credit risk management solution for the Web3 segment. The developers are positioning themselves as an alternative to traditional FICO risk assessment in the classical finance market. The Multi-Asset Credit Risk Oracle (MACRO) service from Spectral allows the user to check creditworthiness and risk levels in a DeFi environment, something that was not available on the market before.

Spectral’s developers have now created a risk assessment chain on a single blockchain; the development process will further expand the crypto startup’s capabilities to multiple networks.

According to the company, Spectral wants to restore confidence in DeFi, especially after the recent failures of Celsius and BlockFi.

Nestcoin and Metaverse Magna (MVM)

Founded in 2021

Place of incorporation: Africa

Funds raised: $3,1 million (including Samsung, Circle Ventures, Franklin Templeton).

Web3 apps are one of the most popular types of crypto startups, and Nestcoin is amplifying that development in continental Africa with a comprehensive approach to developing the Breach Club and Metaverse Magma crypto content platform.

Metaverse should help adapt games to the Web3 standard and tap into Africa’s burgeoning market for gaming spaces. According to the company developer’s assessment, Africa is the largest continent in the world in terms of the number of young people, with high unemployment among them. All games and applications that allow earning from the P2Earn model and Metaverse monetization will be in demand.

Rambooor

Founded in 2022

Place of incorporation: Philippines

Another representative of the Web3 generation is Rambooor. Its proposal is to increase accessibility, security, and profitability for DeFi in conjunction with digital wallet storage.

Rambooor also promises to provide affordable conditions for the passive use of capital and making money from it, including providing liquidity and stacking.

CleverChain

Founded in 2022

Location: London, UK

CleverChain offers its own vision of capital management developments in FinTech, cryptocurrencies, token turnover, and banks. It is a RegTech startup with a SaaS platform for anti-money laundering monitoring and verification in automatic mode.

Popstox

Founded in 2021

Location: Massachusetts, USA

Another platform based on SaaS technology and artificial intelligence capabilities. Popstox offers information failure and analytics about mentions of financial products in social networks. This will include discussions of the stock market and securities trading, cryptocurrency, and digital trading objects.

The target audience, according to Popstox’s statement, is web companies and mid-sized funds for a more accurate buy offer to potential investors.

To Sum It up About Crypto and Blockchain Startups

As you see, the investment potential of cryptocurrencies is not yet exhausted. Now is the time when education, tools, development, events, trading, and integrations with banks – any business has a chance to be heard by the target audience and gain popularity. The industry is filling up with vital players, becoming alive and well.