Introduction: The $2 Trillion Problem

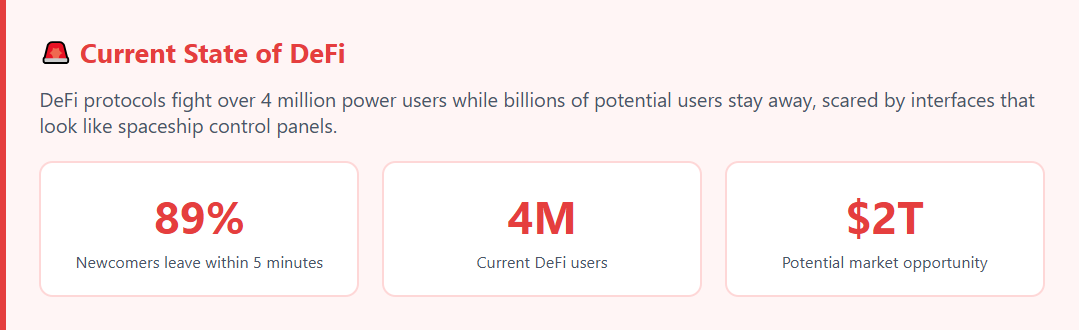

DeFi has a dirty secret: it’s stuck in a user acquisition loop. Protocols fight over the same 4 million power users while billions of potential users stay away, scared by interfaces that look like spaceship control panels.

We analyzed why 89% of newcomers flee DeFi protocols within 5 minutes and what an ideal lending protocol could look like to break this cycle. This research shows how solving real user problems can unlock massive DeFi growth and create authentic DeFi marketing opportunities.

Note: Not all solutions may be immediately feasible, but they point toward the industry’s potential with proper product thinking.

Watch: CEO Insights on DeFi’s User Experience Crisis

Our CEO breaks down the key findings from this research and shares the vision for the next generation of DeFi protocols.

💡 Pro tip: Watch the video first for a high-level overview, then dive into the detailed research below.

Research Methodology

Data Sources:

- Analysis of negative user reviews from Aave, Compound, and other protocols

- Interviews with current and potential DeFi users

- Study of behavioral patterns in existing protocols

- Analysis of successful practices from traditional fintech

Approach: We applied classic product discovery methods to the DeFi vertical, focusing on users’ jobs-to-be-done rather than technical capabilities.

Research: Main User Barriers

Analysis of Current Protocol Problems

We identified 10 critical problems that prevent user base growth and hamper DeFi marketing effectiveness:

1. Interface Complexity

Frequency: 89% of newcomers leave protocols within the first 5 minutes

User feedback examples:

“This UI is cancer for the technology… So many people hold crypto on exchanges, scared to dive into DeFi”

“What is gas fee, slippage? These words are too technical for non-techies”

Root cause: Interfaces created by developers for developers, without considering user experience.

2. Unpredictable Liquidations

Frequency: 78% of users consider this the main risk

Typical complaint: Users wake up to find their collateral sold at unfavorable prices without clear advance warnings.

3. High and Hidden Fees

Frequency: 67% cancel transactions due to unexpected fees

User feedback examples:

“Gas fee has become a burden for many users, especially those with small amounts”

“I’ll never withdraw – commission is more expensive than the coins themselves”

Problem: Users don’t see the full cost of operations in advance.

4. Inefficient Collateral Capital

Impact: Loss of 3-8% annual yield on “dead” collateral

User complaint: Collateral just sits idle when it could generate income through staking or yield farming.

5. Lack of Guidance for Newcomers

User feedback examples:

“I don’t know where to start, what coin to choose, what tools to use – too much unfamiliar stuff”

Problem: Protocols assume users already know what to do.

6. Security Fears

Frequency: 84% cite security as the main concern

Typical user questions:

“If the platform crashes, can I somehow get my locked funds back?”

Community response: “Most likely not. Hacker will take the money, leaving no easy way to return them to owners”

7. Mobile Experience

Statistics: 68% of interactions happen on mobile devices, but protocols aren’t optimized for them.

8. Over-collateralization Confusion

Impact: 43% of potential users don’t understand the system’s economics

Common question: “Why borrow $100 if I have $150?”

9. Governance Alienation

Statistics: 76% don’t participate in protocol governance

Reason: Regular users don’t influence decisions; power is concentrated among large token holders.

10. Tax Reporting

Impact: 95% don’t know how to properly report DeFi operationsolesale, wrap each listing in a mini-season, and gently move spot traders into futures.

Ideal Lending Protocol Concept

Based on identified problems, we developed a protocol concept that could attract mass audiences and retain existing users while enabling more effective DeFi marketing strategies.

Main Differences from Existing Solutions

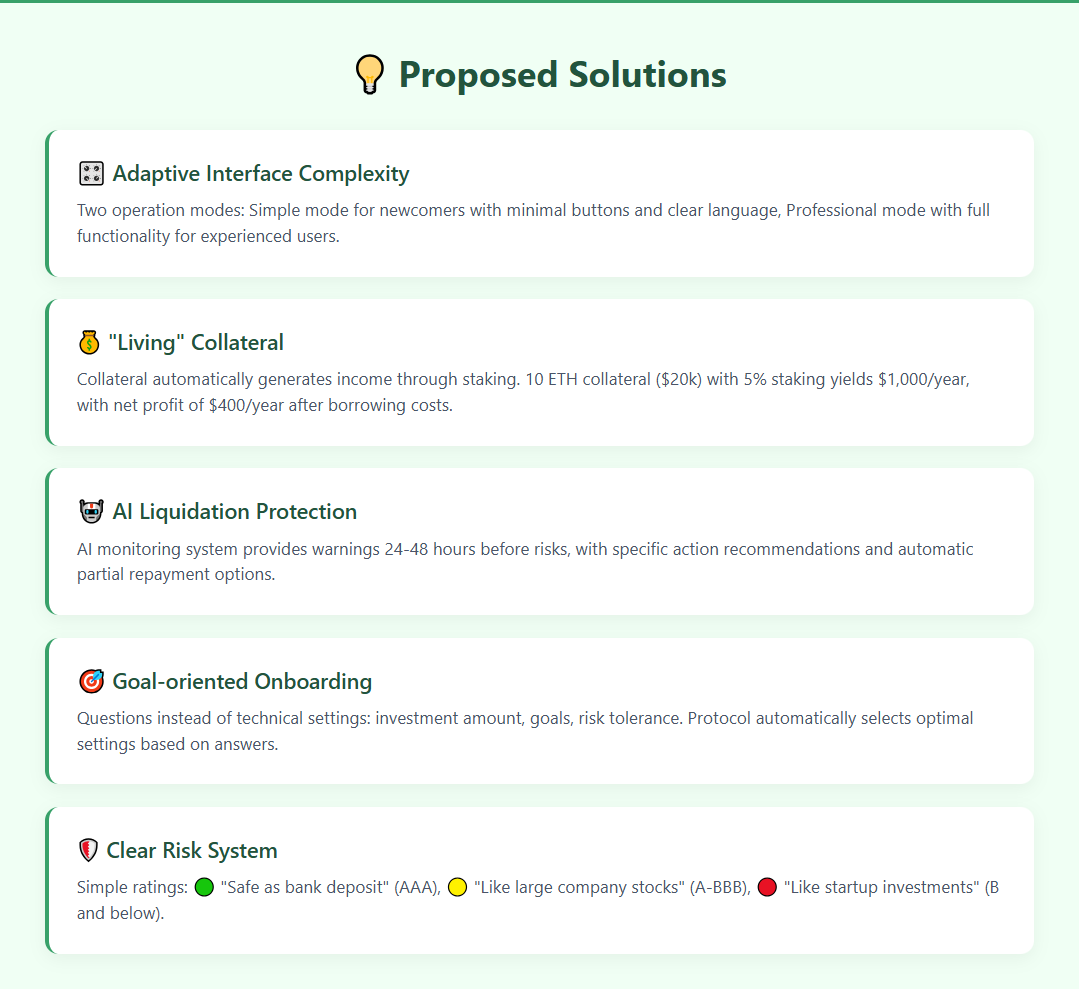

1. Adaptive Interface Complexity

Problem: One interface for all user types

Our Solution: Two operation modes

- Simple mode for newcomers: minimal buttons and clear language

- Professional mode: full functionality for experienced users

Simple mode example:

💰 My Money: $1,000

📈 Earned This Month: +$50

✅ All Good

[Deposit Money] [Withdraw Money]

Professional mode example:

Portfolio Value: $1,000 (+5.2% MTD)

APY: 12.3% (variable) | Health Factor: 2.4

Collateral Ratio: 150% | Liquidation Price: $1,847

2. “Living” Collateral

Problem: Inefficient use of collateral capital

Our Solution: Collateral automatically generates income

- ETH or BTC in collateral participates in staking

- Generated income goes toward debt repayment or position increase

- User chooses strategy with one click

Economics: 10 ETH collateral ($20,000) with 5% staking yields $1,000/year. With 3% borrowing cost ($600/year), net profit is $400/year.

3. Predictive Liquidation Protection

Problem: Sudden liquidations without warning

Our Solution: AI monitoring system

- Warnings 24-48 hours before potential risks

- Specific action recommendations

- Automatic partial repayment with user permission

4. Clear Risk System

Problem: Technical metrics instead of understandable assessments

Our Solution: Simple risk ratings

- 🟢 “Safe as bank deposit” (AAA-rated assets)

- 🟡 “Moderate risk, like large company stocks” (A-BBB)

- 🔴 “High risk, like startup investments” (B and below)

5. Goal-oriented Onboarding

Problem: Lack of guidance for new users

Our Solution: Questions instead of technical settings

- “How much are you ready to invest?”

- “What’s your main goal?”

- “How do you feel about risk?”

Based on answers, the protocol automatically selects optimal settings.

Detailed Solutions by Category

UX and Interface

Human-readable Transactions

Instead of technical details, users see clear descriptions:

“You’re depositing 1000 USDC into the protocol. Expected yield: 4.5% annually. Risk: very low. You can withdraw money anytime. Main risks: [link to details]”

Fee Forecasting

Before any transaction, we show predictions: “This operation will cost approximately $12. Usually after 2 hours fees decrease by 40%”

Personal AI Assistant

Built-in chatbot answers questions in simple language and helps with protocol navigation.

Security and Trust

Multi-level Protection

- Soft liquidation: partial repayment instead of total collateral loss

- Emergency mode: one button to close all positions

- Sleep protection: automatic actions when user is offline

Transparent Insurance Fund

Part of protocol revenue goes to a public insurance fund to compensate user losses during force majeure events.

Social Proof Elements

- “847 users are using this strategy”

- “Zero liquidations in the last 30 days”

- “Community average yield: +18.5%”

Economic Efficiency

User sees unified interface while protocol automatically chooses optimal network for each operation.

Protocol automatically selects least congested times for non-urgent operations.

AI system scans all available opportunities and suggests the best capital allocation options considering user’s risk profile.

DeFi Marketing Opportunities

How Product Solutions Create Marketing Messages

Effective DeFi marketing starts with solving real user problems. Each product feature becomes a natural marketing message that drives organic DeFi growth.

“Living” Collateral

Message: “Your money works even while you sleep”

Content ideas for DeFi marketing:

- Videos with real-time dashboard showing collateral growth

- Efficiency calculators vs static collateral

- User testimonials: “My debt paid itself off in 6 months”

AI Liquidation Protection

Message: “Personal financial guardian in DeFi”

DeFi marketing content ideas:

- Case studies of prevented losses

- Comparisons with “silent” protocols

- Interactive AI demos in action

Adaptive Interface

Message: “From beginner to pro in one app”

Content strategies for DeFi growth:

- Split-screen videos (Simple vs Pro mode)

- Success stories from users of different levels

- Before/after comparisons with existing UI

Built-in Viral Mechanics for DeFi Growth

“Melting Debt” Effect

Users naturally share screenshots of automatically repaying debt on social media, creating organic DeFi marketing content.

Achievement System

Achievements create natural sharing moments that support DeFi growth: “Got Risk Master status! 3 months without liquidations 💎”

Referral Program

Long-term incentives: referrer gets percentage of friend’s yield for a year, motivating quality user invitations and sustainable DeFi growth.

Conclusions and Recommendations

The bottom line: DeFi’s next trillion dollars won’t come from better smart contracts—it’ll come from better user experiences.

For founders building the future:

- Test your interface with someone’s mom, not just crypto Twitter

- Make your product’s best feature so obvious it sells itself

- Remember: users choose with their hearts, then justify with their heads

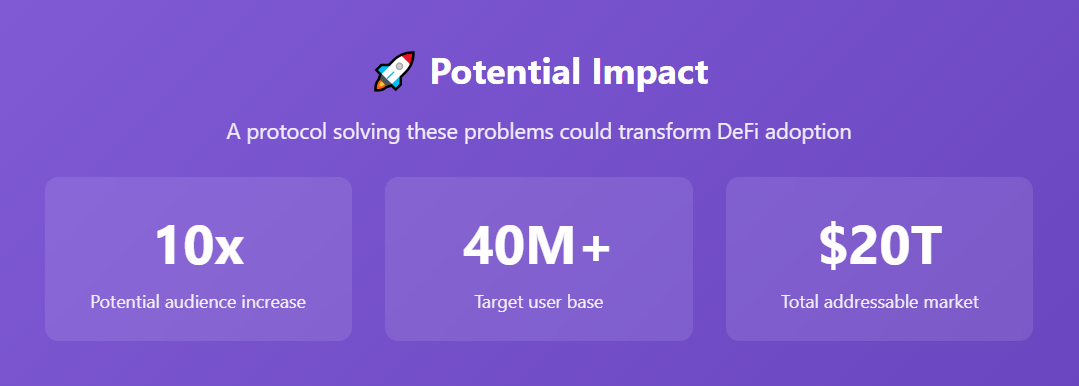

A protocol that solves these user problems could increase DeFi’s total audience by 10x. The question isn’t whether this will happen—it’s who will do it first.

The future belongs to protocols that understand: in the race for DeFi growth, user love beats technical complexity every time.

Frequently Asked Questions (FAQ)

The top barriers include interface complexity (affecting 89% of newcomers), unpredictable liquidations (78% concern), and hidden fees (67% transaction cancellations). These DeFi user adoption barriers prevent billions of potential users from entering the ecosystem.

DeFi lending protocols can implement adaptive interfaces with simple and professional modes, goal-oriented onboarding, and clear risk ratings using familiar terms. Companies like ICODA are pioneering user-centric DeFi UX solutions that prioritize accessibility over technical complexity.

Living collateral automatically generates income through staking while securing loans, turning “dead” assets productive. This DeFi UX solution can yield $400+ annually on $20,000 ETH collateral after borrowing costs.

Users flee because DeFi lending protocols use developer-designed interfaces with technical jargon, complex navigation, and unclear fee structures. These DeFi user adoption barriers create immediate friction that overwhelms newcomers.

Key DeFi UX solutions include AI liquidation protection, predictive fee optimization, human-readable transactions, and simplified risk assessment systems. Implementing these solutions could expand the DeFi lending protocol user base from 4 million to 40+ million users.

Rate the article