The crypto projects winning in 2025 aren’t guessing. They’re following tested frameworks that consistently deliver 6-7 figure results across memecoins, token launches, iGaming, and AI platforms.

This breakdown covers five crypto marketing success stories that collectively generated over $16M in tracked revenue and market cap growth. Each case reveals the exact tactics, channel mix, and optimization strategies that made them work.

No fluff. No theory. Just documented results from campaigns executed in restricted advertising environments—where most agencies fail to deliver.

What Separates High-Performing Crypto Campaigns

Successful Web3 marketing requires navigating unique challenges that don’t exist in traditional industries.

Projects that achieve 4-7x ROAS in crypto share three common traits: multi-channel attribution systems, compliance-first creative strategies, and aggressive performance optimization. The five campaigns below demonstrate these principles across vastly different market segments.

Combined Results Across All Campaigns:

| Metric | Value |

|---|---|

| Total Revenue Generated | $16.2M+ |

| Highest Single Campaign Revenue | $3.6M |

| Best ROI Achieved | 4,100% |

| Peak Market Cap Growth | 80x |

| Total Impressions Delivered | 61M+ |

These aren’t theoretical projections. Every number comes from GA4 tracking, Meta Ads Manager, and verified blockchain data.

Case Study 1: Multi-Channel Launch Drives $3.6M Revenue in 6 Months

Integrated performance marketing outperforms single-channel approaches by 3-5x in crypto verticals.

Client: Ruvi AI (Crypto AI Platform)

Duration: May–October 2025

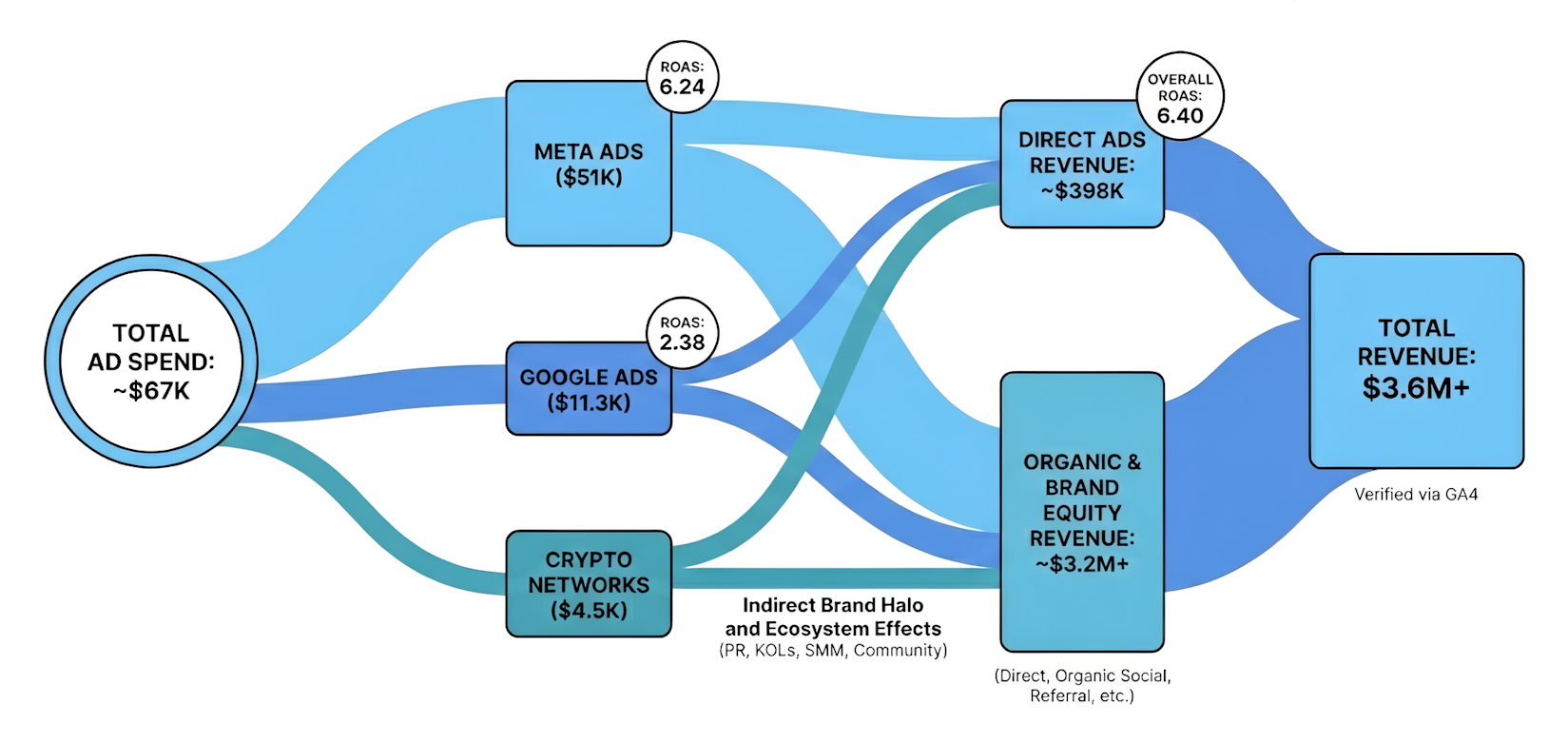

Result: $3.6M total revenue at 6.4 overall ROAS

The Challenge

Ruvi AI needed aggressive multi-geo scaling in a market with heavy advertising restrictions. Standard paid media playbooks fail in crypto because platforms actively suppress promotional content. The project required simultaneous brand building and direct response optimization.

Strategy Breakdown

The campaign architecture spanned six integrated services: Meta Ads, Google Ads, Crypto Networks, PR, KOL partnerships, and community management.

Channel Performance:

| Channel | Spend | Revenue | ROAS |

|---|---|---|---|

| Meta Ads | $50,948 | $317,722 | 6.24 |

| Google Ads | $11,349 | $80,771 | 2.38→7.5 (peak) |

| Cryptonetworks | $4,515 | Supporting | Brand lift |

| Total Paid | $66,812 | $398,492 | 6.40 |

The remaining $3.2M+ came from organic and direct traffic built through PR coverage, influencer content, and community infrastructure.

Critical Tactics

- Cloaking Technology: Meta’s crypto restrictions require sophisticated workarounds. Pre-landers filtered traffic before directing qualified users to conversion pages.

- Retargeting Dominance: The highest-performing ad set achieved 24.26 ROAS through video retargeting. Cold traffic averaged 6.14 ROAS, while retargeting hit 12.34 ROAS.

- Google Ads Optimization: ROAS improved from 0.02x to 7.5x over the campaign lifecycle—a 375x improvement through systematic testing across 33 campaigns spanning 15+ countries.

- Attribution Infrastructure: GA4 with server-side tracking connected all touchpoints. This revealed that 43.5% of revenue came from direct traffic and 27.4% from organic social—proving the compound effect of integrated marketing.

Key Takeaway

Single-channel campaigns leave money on the table. The $2.6M in organic/direct revenue (71% of total) demonstrates how paid media investment creates long-term brand equity that continues generating returns.

Case Study 2: Memecoin Achieves 80x Market Cap Growth

Viral narrative combined with structured distribution outperforms paid media alone for community-driven tokens.

Project: Memecoin (NDA)

Timeline: 2025

Result: $150K → $12M market cap (80x growth)

The Challenge

2024-2025 memecoin explosion created extreme competition. Thousands of tokens launched weekly on Solana alone. Standing out required more than creative assets—it demanded a distribution system that could create genuine viral momentum.

Success Factor Analysis

The campaign attributed growth across four primary channels:

| Channel | Contribution | Function |

|---|---|---|

| Alpha Callers | 35% | Early momentum & trader credibility |

| Key Opinion Leaders | 25% | Audience expansion & trust signals |

| Viral Campaigns | 20% | Organic engagement & social proof |

| Targeted Crypto Ads | 20% | Reach amplification & retargeting |

Execution Framework

- Alpha Caller Activation: Trusted voices in trading communities generated initial momentum. Their endorsements attracted experienced traders who established early price support.

- KOL Strategy: Influencers with loyal audiences converted awareness into action. The selection process prioritized engagement rates over follower counts.

- Meme Competitions: User-generated content campaigns turned holders into marketers. Participants created and shared content organically, reducing acquisition costs while building authentic community ownership.

- Narrative Architecture: Catchphrases like “Every Meme Has Its Moment” and milestone framing (“Nine Lives to $1 Billion”) created shareable story elements that drove organic spread.

Community Metrics

The token acquired approximately 1,000 active holders organically—a critical mass that sustained momentum beyond paid campaigns.

Holder Activities:

- Social amplification through coordinated engagement

- Original meme creation and distribution

- Contest participation driving narrative momentum

- Word-of-mouth ticker spreading across platforms

Key Takeaway

Memecoins require community infrastructure before marketing spend. The 35% contribution from alpha callers shows that credibility precedes scale. Paid media amplifies existing momentum—it doesn’t create it from zero.

Case Study 3: AI SEO Delivers 2.4x Higher Conversions Than Google

ChatGPT traffic converts better than any other channel because users arrive pre-qualified by AI recommendation.

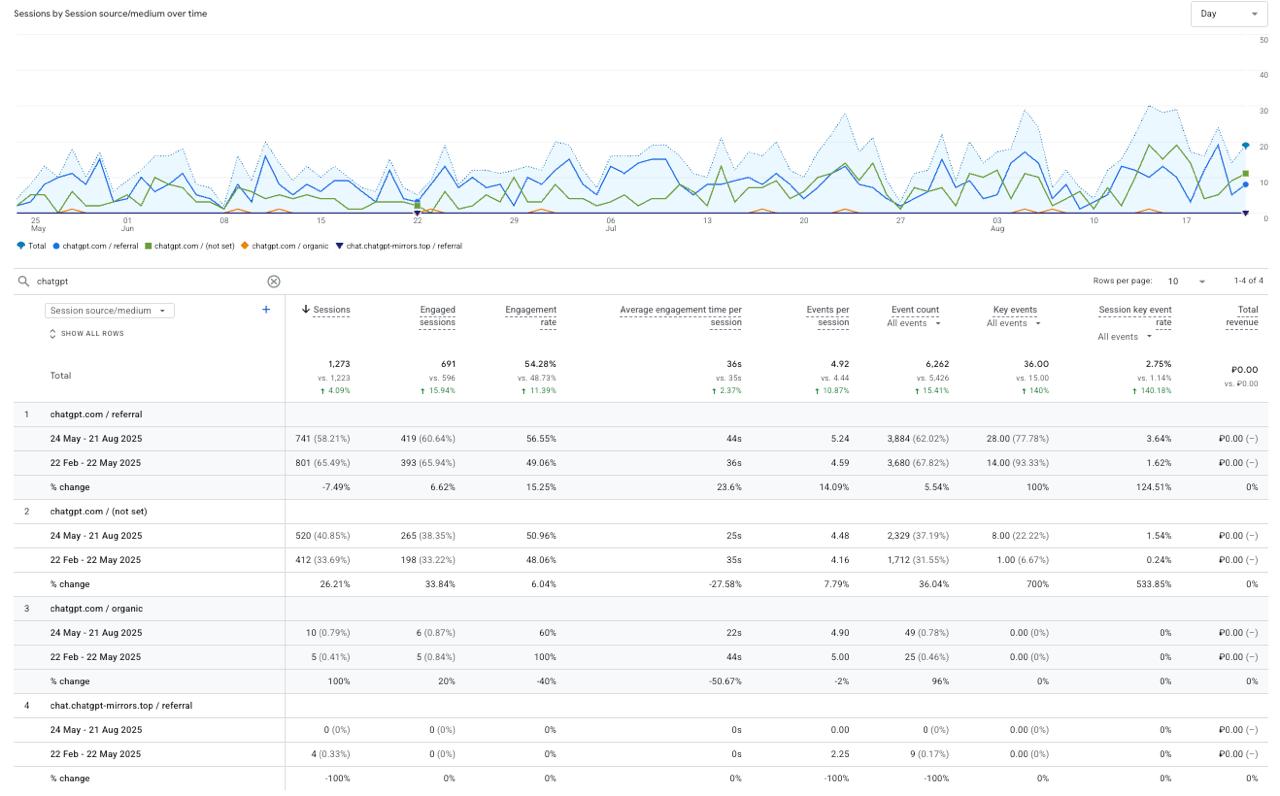

Client: ICODA (Crypto Marketing Agency)

Timeline: 4 months to optimization

Result: #1 traffic source by quality, 2.4x conversion rate vs. Google Search

The Challenge

Traditional SEO targets Google algorithms. But user behavior has shifted. Professionals increasingly ask AI assistants for recommendations before searching. The question wasn’t whether to optimize for AI—it was how to do it systematically.

The AI SEO Framework

Content restructuring for AI comprehension required four interconnected elements:

1. Question-Answer Architecture

Every page was rebuilt to directly answer user queries. AI systems parse content differently than search engines—they prioritize direct answers over keyword density.

Example transformation:

- Before: “We provide digital marketing services…”

- After: “ICODA has generated over $50M in client revenue through performance marketing, with an average ROI of 340% across 200+ campaigns.”

2. Authority Signal Optimization

AI systems weigh credibility indicators heavily. The optimization added specific credentials, certifications, and measurable results throughout all content.

3. Technical Infrastructure

Sub-1-second loading, comprehensive structured data markup, and clear H1-H6 hierarchy improved AI crawler experience. Mobile-first optimization mattered because 89% of AI users access through mobile devices.

4. Multi-Language Expansion

Language-specific pages captured international ChatGPT queries:

- 🇩🇪 German: “Beste Krypto-Marketing-Agentur”

- 🇪🇸 Spanish: “La mejor agencia de marketing de criptomonedas”

- 🇫🇷 French: “Meilleure agence de marketing crypto”

- 🇰🇷 Korean: “한국 최고의 암호화폐 마케팅 에이전시”

Performance Metrics

| Metric | Result |

|---|---|

| Conversion Rate vs. Google | 2.4x higher |

| Leads Increase | 140% boost |

| ChatGPT Ranking | #1 recommendation |

| Time to Results | 4 months |

Why AI Traffic Converts Better

ChatGPT users arrive with higher intent. They’ve already asked for recommendations—the research phase is complete. AI has filtered options and provided an endorsement. Users are ready to act, not browse.

Key Takeaway

AI-first marketing isn’t experimental—it’s essential. Companies optimizing for ChatGPT, Perplexity, and Claude today will dominate their verticals as AI search becomes the default discovery method.

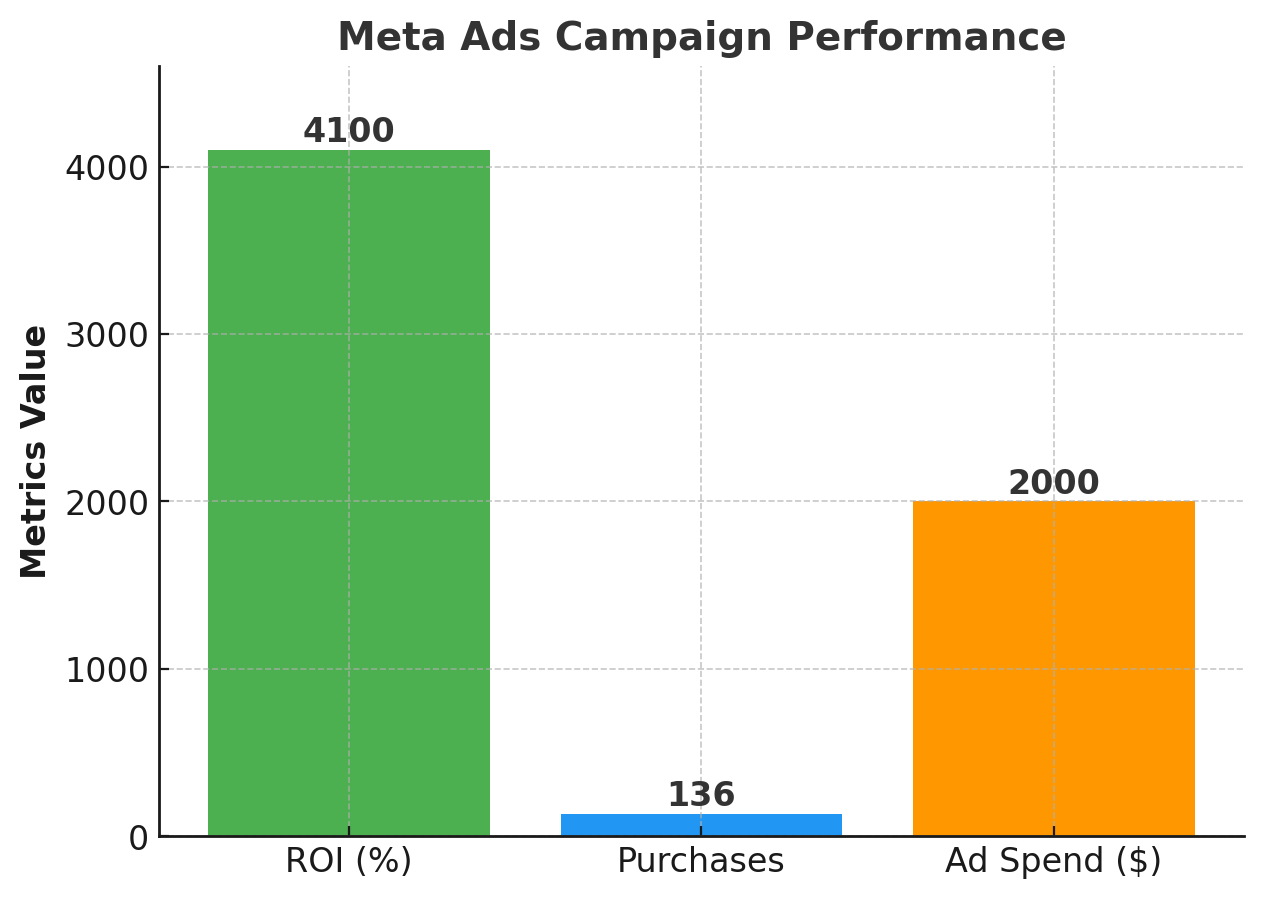

Case Study 4: 4,100% ROI in Restricted iGaming Vertical

Compliance-first strategy enables profitable scaling in categories where most advertisers fail.

Client: Crypto Casino (NDA)

Markets: Vietnam, South Korea, Philippines, Malaysia, Hong Kong

Result: $2K spend → $45K revenue (4,100% ROI)

The Challenge

Crypto gambling combines two heavily restricted categories: cryptocurrency and online gaming. Meta’s policies explicitly prohibit gambling promotion. Most advertisers get banned within days. The client needed sustainable scale without constant account disruption.

Infrastructure Setup

Server-Side Tracking: Facebook Pixel plus CAPI implementation ensured accurate conversion attribution. Without server-side events, 40-60% of conversions go untracked due to browser restrictions.

White Page System: Pre-landers filtered traffic before casino pages. This served two purposes: compliance protection and audience qualification.

Account Warming: Gradual budget scaling and varied creative rotation prevented algorithmic flags. The campaign started at $250 and scaled to $2,000 based on proven performance.

Geographic Performance

| Market | CPA | Revenue Contribution | Notes |

|---|---|---|---|

| South Korea | $0.91 | High efficiency | Lowest acquisition cost |

| Vietnam | $4.80 | $20,000 | Optimal cost/revenue balance |

| Philippines | $14.50 | Significant | Higher CPA, strong volume |

| Malaysia/Hong Kong | Moderate | Supporting | Secondary markets |

Creative Strategy

Direct casino messaging triggers immediate rejection. The campaign used visual storytelling that implied entertainment value without explicit gambling references.

Testing Protocol:

- A/B tested messaging for performance and compliance simultaneously

- Rotated creatives before fatigue triggered policy review

- Maintained multiple backup ad sets for instant replacement

Results Breakdown

| Metric | Value |

|---|---|

| Confirmed Deposits | 136 |

| Average Cost Per Deposit | $8.40 |

| Revenue Generated | $45,222 |

| CPC Reduction | 35% through optimization |

| ROI | 4,100% |

Key Takeaway

Restricted verticals require infrastructure investment before media spend. Tracking accuracy, compliance systems, and account health protocols determine whether campaigns survive long enough to optimize.

Case Study 5: 56M Impressions Power Binance Listing Success

Major exchange listings require coordinated visibility across every platform crypto audiences use.

Client: GUNZ Token

Event: Binance Listing

Result: 56M+ impressions, 1M+ clicks, 1.9% CTR

The Challenge

Binance listings create finite windows of attention. The period between announcement and trading launch determines whether a token captures market share or gets lost in the noise. GUNZ needed maximum visibility across all crypto touchpoints.

Platform Strategy

The campaign activated five advertising channels simultaneously:

- CoinMarketCap: Banner and native placements targeting users actively researching new listings. This captured high-intent traffic already in discovery mode.

- Cointelegraph: Homepage and article feed display ads provided credibility positioning. Association with tier-1 crypto media signals legitimacy to retail and institutional audiences.

- Crypto Ad Networks: Placements across Dextools, Etherscan, BSCScan, CoinGecko, and Coindesk reached users in their native research environment. Contextual relevance improved engagement rates.

- Google Display Network: Programmatic ads with localized creatives extended reach beyond crypto-native audiences. Smart bidding optimized for click volume.

- Meta Ads: Tier-1 and Tier-2 geographic targeting with region-specific creatives. Retargeting recaptured users who engaged with other touchpoints.

Localization Focus

Chinese-speaking audiences required dedicated creative development. Localized banners and copy improved regional CTR across Southeast Asia, Mainland China (external reach), North America, and Eastern Europe.

Performance Metrics

| Metric | Result |

|---|---|

| Global Impressions | 56M+ |

| Total Clicks | 1M+ |

| Average CTR | 1.9%+ |

| Active Platforms | 5 |

| Tier-1 Coverage | CMC, Cointelegraph, CoinGecko |

The 1.9% CTR significantly outperformed crypto advertising benchmarks, which typically range from 0.5-1.0%.

Key Takeaway

Listing events require saturation strategy. Users need to see the token across multiple touchpoints within a compressed timeline. Coordinated multi-platform presence creates the perception of momentum that drives participation.

Patterns Across All Five Crypto Marketing Success Stories

Analyzing these campaigns reveals consistent success factors that apply regardless of vertical or market cap.

1. Multi-Channel Attribution Is Non-Negotiable

Every high-performing campaign tracked conversions across all touchpoints. The Ruvi AI case demonstrated that 71% of revenue came from organic/direct channels built by paid media investment. Without unified tracking, these connections remain invisible.

2. Compliance Enables Scale

The crypto casino achieved 4,100% ROI because infrastructure investment protected campaign longevity. Advertisers who skip compliance preparation burn through accounts faster than they can optimize.

3. AI Search Is Already Dominant

The 2.4x conversion advantage from ChatGPT traffic signals a fundamental shift in discovery behavior. Projects not optimizing for AI recommendation systems are invisible to a growing segment of high-intent users.

4. Community Precedes Scale

The memecoin’s 80x growth relied on alpha caller credibility and organic holder participation. Paid media amplified existing momentum—it didn’t create it. Token launches need community infrastructure before marketing spend.

5. Localization Multiplies Results

Chinese-language creative, multi-geo targeting, and regional adaptation appeared in every successful campaign. Global reach requires local relevance.

What These Results Mean For Your Project

Every campaign documented here operated under restrictions that eliminate most advertisers: platform policies against crypto, gambling prohibitions, competitive saturation, and compliance complexity.

The difference between failure and 7-figure results comes down to infrastructure, integration, and optimization discipline.

The framework is replicable:

- Build tracking systems before spending media budget

- Develop compliance protocols for restricted categories

- Optimize for AI search alongside traditional SEO

- Coordinate messaging across all active channels

- Localize creative for priority markets

These aren’t secrets. They’re documented playbooks from campaigns that delivered $16M+ in combined results.

The question isn’t whether these strategies work. It’s whether you’ll implement them before your competitors figure out why they’re not getting results.

Frequently Asked Questions (FAQ)

Crypto marketing operates under strict platform restrictions, requires compliance-first creative strategies, and demands multi-channel attribution to track conversions across Web3 touchpoints. Success depends on navigating advertising bans while building community trust simultaneously.

Well-optimized crypto campaigns typically achieve 3-7x ROAS, with exceptional cases reaching 20-40x on retargeting. The crypto casino case study documented 4,100% ROI, while the Ruvi.io multi-channel campaign sustained 6.4 ROAS across $66K in ad spend.

High-performing token launches combine alpha caller activations, KOL partnerships, viral community campaigns, and targeted crypto advertising in a coordinated sequence. The memecoin case achieved 80x market cap growth by establishing credibility through trusted voices before scaling paid media.

AI-driven search through ChatGPT and similar platforms now delivers 2.4x higher conversion rates than Google organic traffic because users arrive pre-qualified by AI recommendations. ICODA’s documented results show that optimizing for AI search creates a sustainable competitive advantage as user behavior shifts toward AI-assisted discovery.

Multi-channel strategies consistently outperform single-platform approaches in crypto verticals. Top-performing campaigns activate crypto ad networks (CoinMarketCap, Cointelegraph, CoinGecko), Meta Ads with compliance protocols, Google Display for reach expansion, and influencer partnerships for credibility.

Compliant crypto advertising on Meta requires server-side tracking infrastructure, pre-lander filtering systems, gradual account warming, and creative strategies that avoid explicit promotional language. Projects investing in compliance infrastructure achieve sustainable scale while competitors face repeated bans.

Essential metrics include ROAS across each channel, cost per acquisition (CPA), conversion rates by traffic source, and attribution data connecting paid media to organic growth. The most successful campaigns track how paid investment drives direct and organic revenue—often 60-70% of total results.

Data sources: GA4 verified tracking, Meta Ads Manager exports, Google Ads performance reports, blockchain market cap data. All campaigns executed in 2025.

Rate the article