Best Crypto Presales September 2025 Comparison Overview

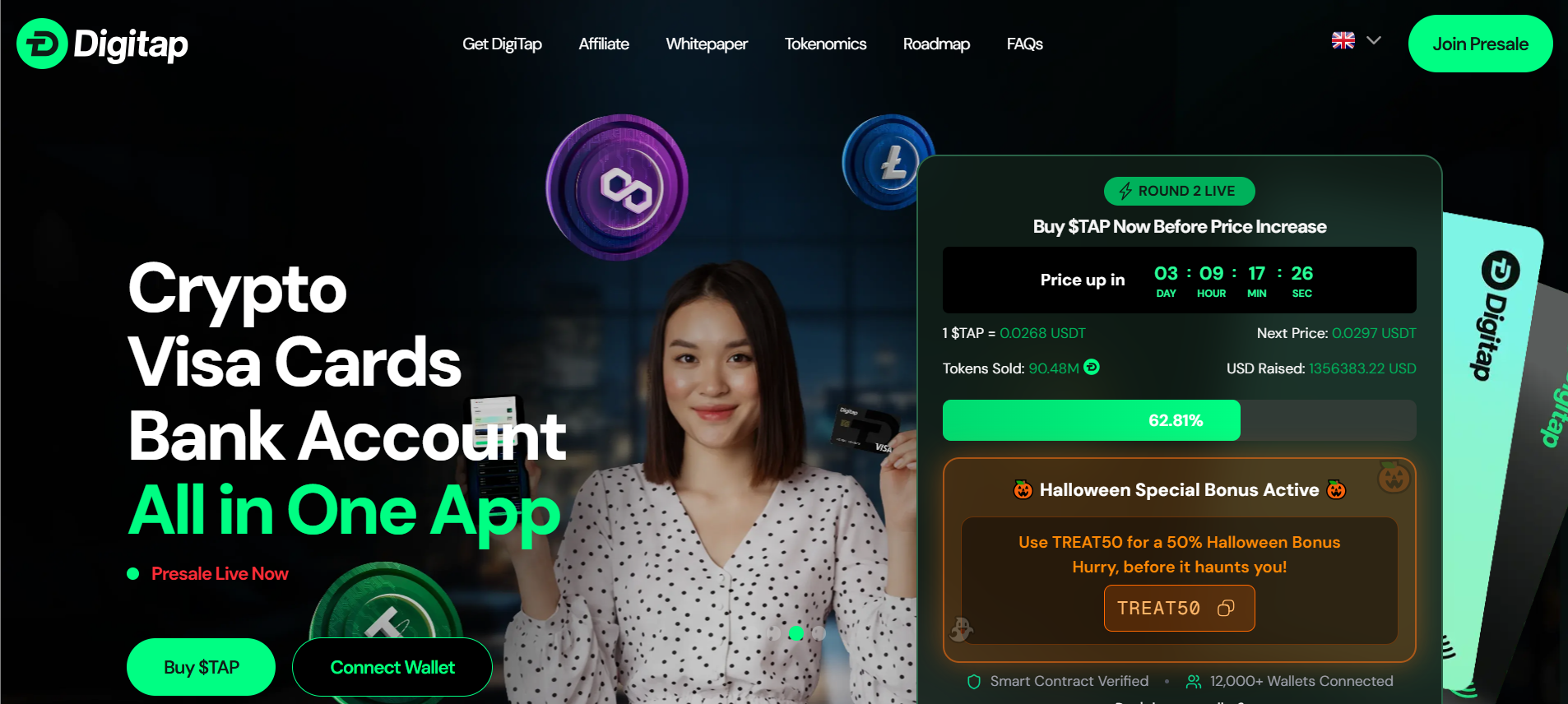

DigiTap ($TAP)

Live omni-banking platformCategory

- Banking

- DeFi

Launchpad

Funding Goal

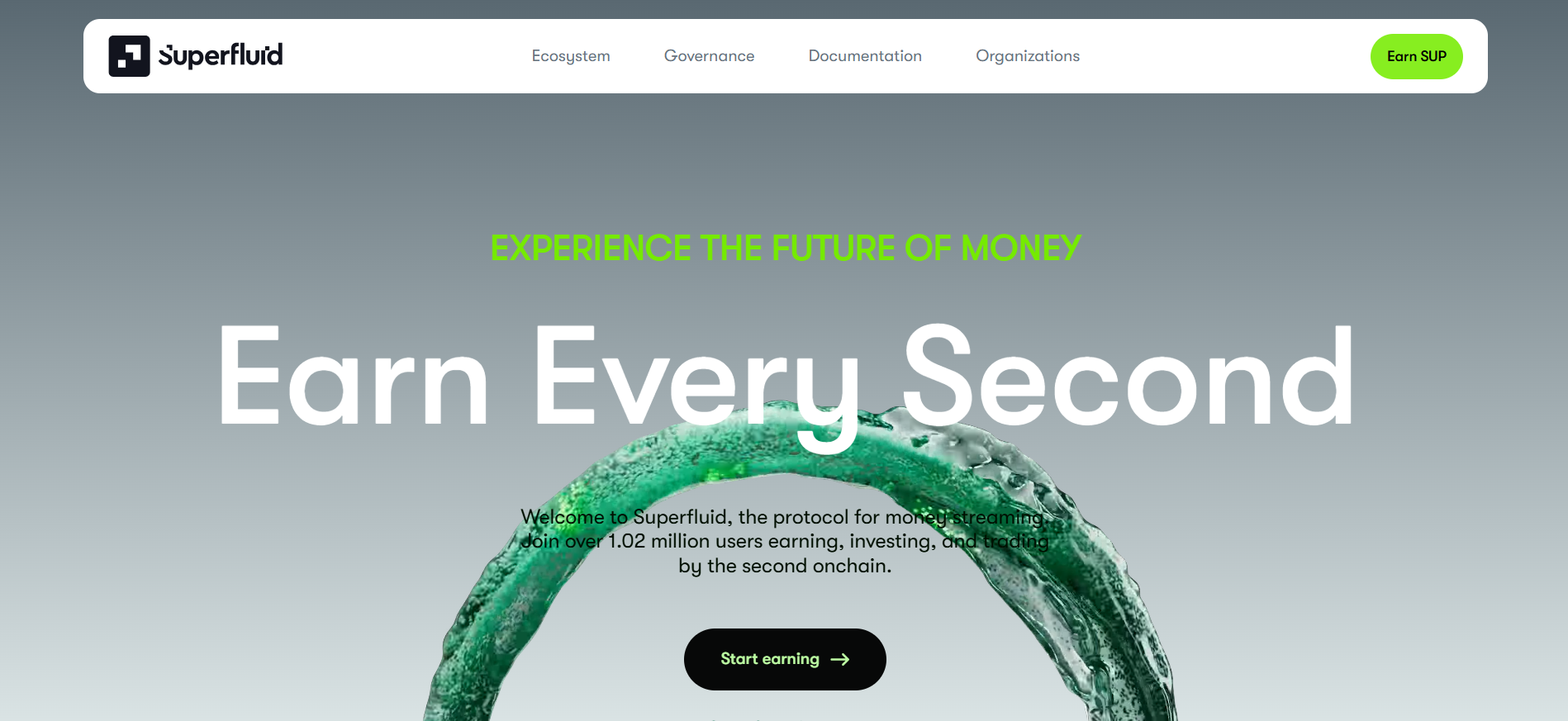

Superfluid ($SUP)

Next-gen payment streamingCategory

- DeFi

- Payments

Launchpad

Funding Goal

Arcium ($ARX)

Privacy infrastructure protocolCategory

- Privacy

- Service

Launchpad

Funding Goal

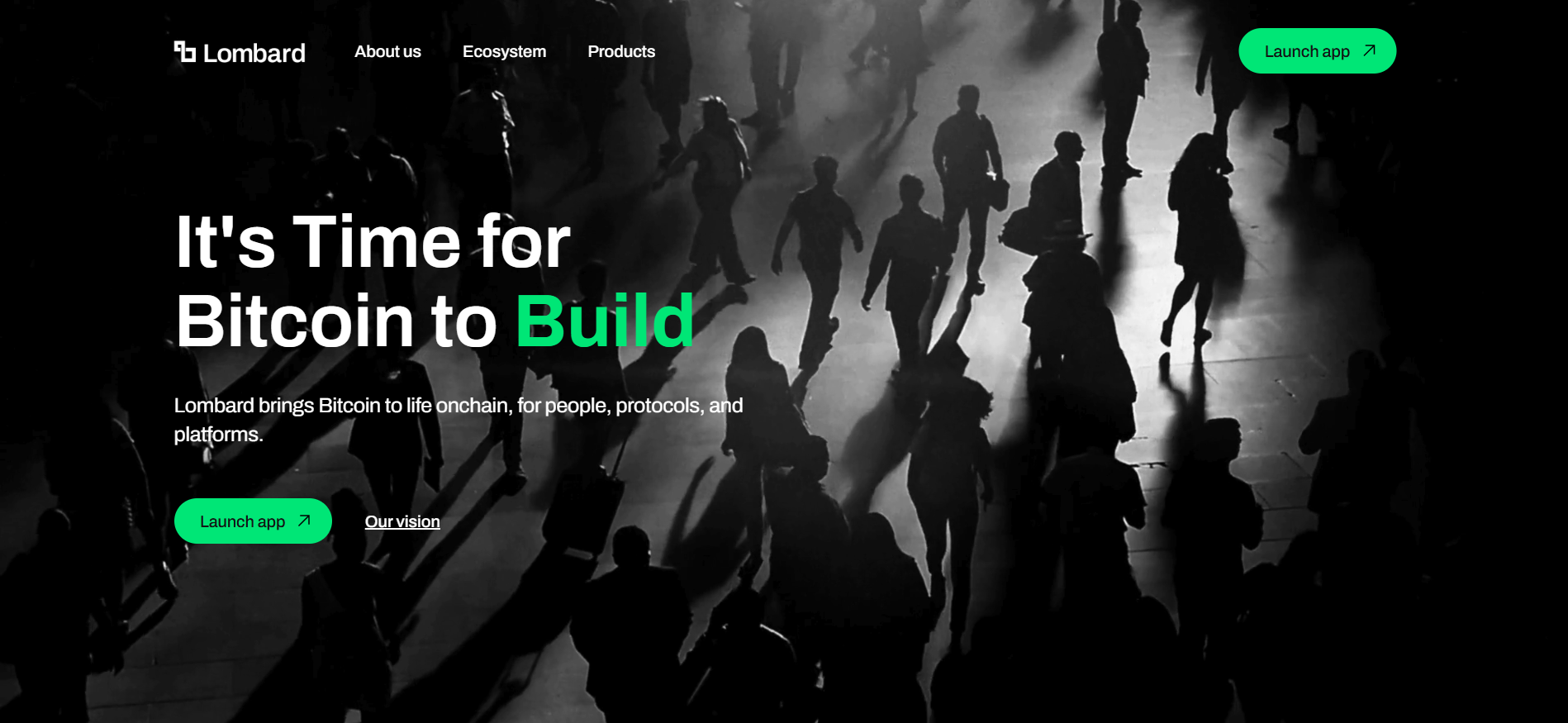

Lombard ($BARD)

Bitcoin liquid restakingCategory

- DeFi

- Restaking

Launchpad

Funding Goal

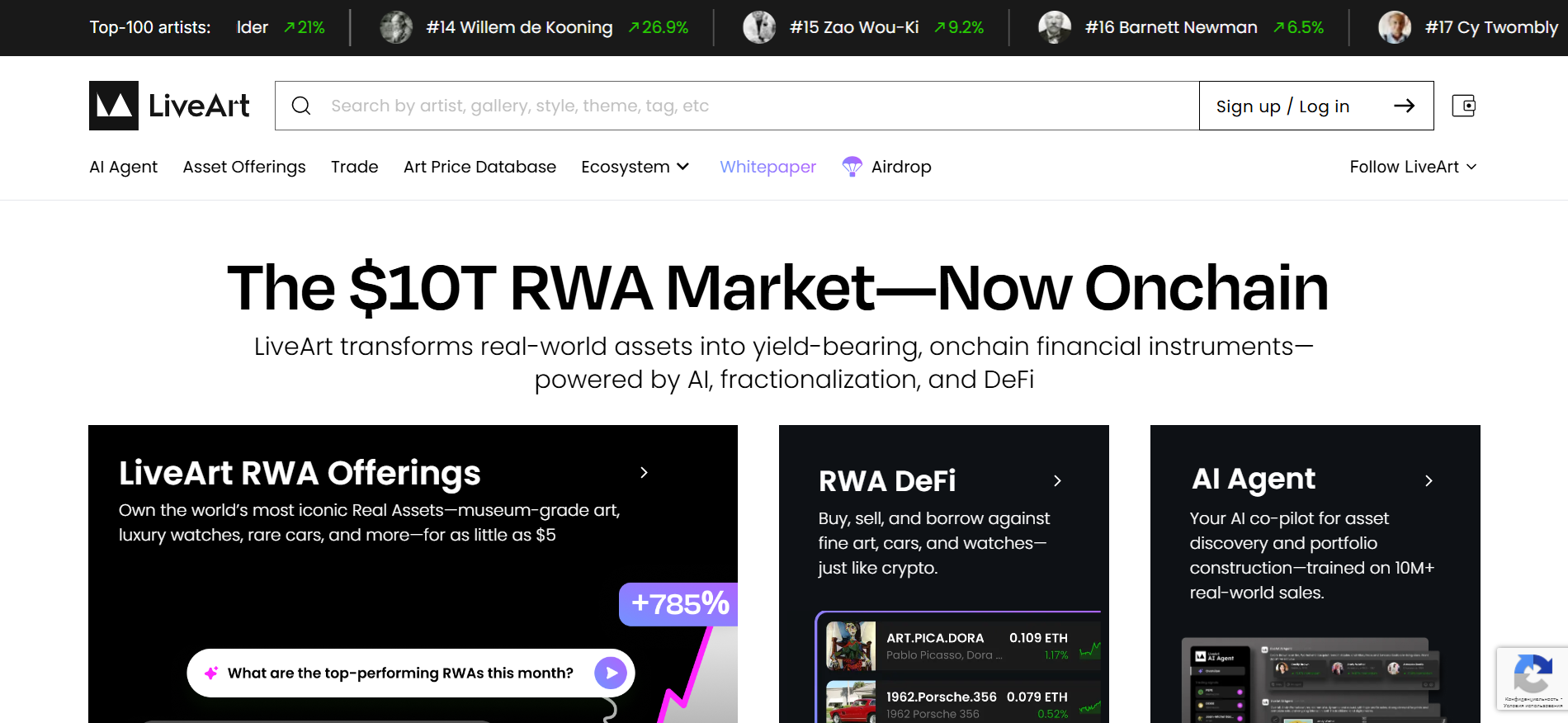

LiveArt ($ART)

NFT creation platformCategory

- NFT

- Marketplace

Launchpad

Funding Goal

Intuition ($TRUST)

Decentralized knowledge graphCategory

- Infrastructure

- Data

Launchpad

Funding Goal

Inference Labs

AI computation networkCategory

- Infrastructure

- AI

Launchpad

Funding Goal

Eoracle ($EO)

Restaking oracle networkCategory

- Infrastructure

- Oracle

Launchpad

Funding Goal

NGRAVE

Hardware wallet ecosystemCategory

- Service

- Wallet

Launchpad

Funding Goal

The cryptocurrency presale landscape is heating up as we move through 2025, with September presenting some of the most promising opportunities for early investors. As the crypto market continues to mature and institutional adoption accelerates, identifying the best crypto presales September 2025 has become crucial for maximizing investment returns.

Our comprehensive analysis reveals eight standout projects across diverse sectors including DeFi, AI infrastructure, privacy solutions, and NFT platforms. These carefully selected presales represent the cutting edge of blockchain innovation, each addressing unique market gaps with strong backing from top-tier venture capital firms and industry leaders.

The current market environment presents an ideal backdrop for presale investments. With regulatory clarity improving in major markets and technological infrastructure becoming more robust, these early-stage opportunities offer the potential for significant returns while contributing to the next wave of blockchain adoption. Whether you’re seeking exposure to Bitcoin restaking protocols, AI-powered blockchain services, or next-generation privacy solutions, this curated selection of the best crypto presale September 2025 opportunities provides diverse options for sophisticated investors.

Ranking Criteria

Our selection methodology focuses on fundamental strength and market potential rather than speculative hype. Each project underwent rigorous evaluation based on proven frameworks that have historically identified successful blockchain ventures.

Key Selection Criteria:

- Team and Advisory Strength – Proven track records in blockchain development and business scaling

- Investor Quality – Backing from reputable VCs including Coinbase Ventures, Polychain Capital, and Multicoin Capital

- Market Opportunity Size – Addressing large, addressable markets with clear growth potential

- Technical Innovation – Unique technological approaches or significant improvements to existing solutions

- Tokenomics Structure – Sustainable economic models with clear utility and value accrual mechanisms

- Regulatory Compliance – Adherence to evolving regulatory frameworks across major jurisdictions

Detailed Crypto Presale Project Analysis (September 2025)

1. DigiTap ($TAP) – Live Omni-Banking Platform

DigiTap leads our September 2025 presale rankings by delivering what most blockchain projects only promise: a fully functional product available now on Apple App Store, Google Play Store, and web browsers. The platform bridges the $3 trillion traditional banking sector with cryptocurrency markets through unified infrastructure supporting offshore banking accounts, physical and virtual payment cards, and instant cross-border transactions—all within a single application backed by PCI-DSS Level 1 security compliance.

Unlike conceptual presales requiring years of development, DigiTap’s operational status eliminates the primary risk of vaporware. The technological architecture combines multi-blockchain settlement across Ethereum and Bitcoin with traditional payment rails including SWIFT, SEPA, and ACH. The AI-powered Smart Exchange Engine executes real-time crypto-fiat conversions by dynamically routing transactions through optimal channels based on cost efficiency and liquidity depth, while hybrid cold/hot wallet custody implements enterprise-grade security through multi-signature access controls.

The $TAP token drives ecosystem economics through transaction fee reduction, staking rewards, governance participation, and VIP membership perks including enhanced cashback rates. Currently securing substantial assets across its active user base, DigiTap demonstrates operational resilience and regulatory compliance across multiple jurisdictions while addressing the convergence of traditional finance and blockchain technology with proven functionality rather than theoretical roadmaps.

$TAP Token Sale Details

- Sale Period: Currently active presale

- Presale Access: presale.digitap.app

- Product Availability: Live on iOS, Android, and web platforms

- Key Features: Omni-banking app, offshore accounts, virtual/physical cards, AI-powered exchange routing, multi-currency management

- Security Standards: AES-256 encryption, TLS 1.3, PCI-DSS Level 1, multi-signature custody

- Blockchain Support: Ethereum, Bitcoin, multiple networks with cross-chain compatibility

- Token Utility: Fee reduction, staking rewards, governance, VIP perks, enhanced cashback

- Eligibility: International markets with jurisdiction-specific compliance

2. Superfluid ($SUP) – Revolutionizing Payment Flows

Superfluid represents a paradigm shift in how payments flow through decentralized finance. Rather than traditional batch transactions, Superfluid enables continuous, real-time payment streams that unlock new use cases for subscription services, payroll, and automated financial products. The protocol’s innovative approach to programmable cashflows has attracted backing from industry leaders including Multicoin Capital, Delphi Ventures, and Circle.

The project’s $90 million valuation reflects strong market confidence in payment streaming technology. With over 40 notable investors including prominent figures like Balaji Srinivasan and Stani Kulechov, Superfluid has assembled one of the most impressive backing profiles among current presales. The platform addresses a critical infrastructure need as DeFi evolves toward more sophisticated financial products requiring continuous payment flows.

Technical innovation centers on Super Tokens, which upgrade standard ERC-20 tokens with streaming capabilities. This allows developers to build applications where money flows continuously rather than in discrete chunks, enabling everything from per-second salary payments to real-time subscription services. Early partnerships with major protocols demonstrate real-world utility beyond theoretical applications.

$SUP Token Sale Details

- Sale Period: Pledging ongoing, current round ends in 9 days

- Funding Goal: $2,000,000

- Valuation: $90,000,000

- Vesting: 100% unlock at Token Transferability Event

- Platform: Kaito

- Eligibility: EU, eligible US participants, other permitted jurisdictions

3. Arcium ($ARX) – Privacy-First Blockchain Infrastructure

Arcium tackles one of blockchain’s most persistent challenges: maintaining privacy while preserving transparency and verifiability. Built on Solana, the protocol provides confidential computing infrastructure that enables private smart contract execution without sacrificing the performance benefits of modern blockchain architecture.

The project’s approach to privacy differs significantly from existing solutions. Rather than relying solely on cryptographic techniques that can create performance bottlenecks, Arcium combines multiple privacy preservation methods to create a more practical and scalable solution. This balanced approach has attracted backing from Coinbase Ventures, Jump Crypto, and other infrastructure-focused investors.

Market timing appears optimal as regulatory frameworks increasingly emphasize privacy rights while maintaining compliance requirements. Arcium’s architecture allows organizations to leverage blockchain benefits while protecting sensitive data, addressing a key barrier to enterprise blockchain adoption. The Solana foundation provides high-throughput capabilities essential for practical privacy applications.

$ARX Token Sale Details

- Sale Period: TBA

- Funding Goal: TBA

- Platform: Legion

- Network: Solana

- Structure: ICO format

4. Lombard ($BARD) – Bitcoin Restaking Revolution

Lombard Finance introduces liquid restaking to Bitcoin, allowing holders to earn yield while maintaining liquidity. This innovative approach addresses Bitcoin’s limited DeFi utility by creating wrapped Bitcoin tokens that participate in securing other networks while remaining tradeable and composable within DeFi protocols.

The $450 million fully diluted valuation reflects enormous market opportunity as Bitcoin holders seek yield-generating strategies beyond simple holding. With Polychain Capital leading the investment round alongside Binance Labs and OKX Ventures, Lombard has secured backing from the industry’s most sophisticated institutional players.

Technical implementation leverages Babylon’s Bitcoin staking infrastructure to enable participation in proof-of-stake consensus mechanisms. This creates a new asset class of yield-bearing Bitcoin that maintains exposure to Bitcoin’s price appreciation while generating additional returns through network security services. The approach opens significant liquidity for Bitcoin holders without requiring them to exit their core position.

The August 26 to September 2 sale window on Buidlpad represents one of the most anticipated launches among current presale opportunities. Multiple subscription assets including USDC, BNB, and LBTC provide flexible participation options for investors across different ecosystems.

$BARD Token Sale Details

- Sale Period: August 26 – September 2, 2025

- Funding Goal: $6,750,000

- Token: BARD on Ethereum

- Valuation: $450,000,000 FDV

- Subscription Assets: USDC, BNB, LBTC

- Platform: Buidlpad

5. LiveArt ($ART) – Creator Economy Platform

LiveArt reimagines NFT creation and distribution through an integrated platform combining creation tools, marketplace functionality, and creator monetization features. Rather than focusing solely on trading existing NFTs, LiveArt emphasizes empowering creators with professional-grade tools and direct monetization channels.

The project addresses key pain points in the current NFT ecosystem including creator discovery, fair monetization, and user experience barriers. With backing from Animoca Brands, Binance Labs, and HashKey Capital, LiveArt has assembled strong support from both gaming-focused and infrastructure investors, indicating broad market appeal.

Platform features include AI-assisted creation tools, customizable storefronts, and integrated payment processing that simplifies the creator-to-consumer journey. The focus on creator empowerment rather than speculative trading aligns with the NFT market’s evolution toward utility and practical applications.

$ART Token Sale Details

- Sale Period: TBA

- Funding Goal: $200,000

- Platform: Agentlauncher

- Focus: NFT marketplace and creation tools

6. Intuition ($TRUST)

Intuition builds composable knowledge graphs that enable decentralized applications to share and build upon structured data. The protocol creates a foundational layer for AI and data-driven applications by providing standardized ways to store, verify, and monetize knowledge contributions.

The September 3-10 sale window on CoinList offers two investment options with different vesting schedules, providing flexibility for various investor preferences. ConsenSys and Superscrypt leading the investment rounds demonstrates strong technical validation from established blockchain infrastructure providers.

Market opportunity extends beyond cryptocurrency into broader data economy applications. As AI systems require increasing amounts of high-quality, verified data, Intuition’s approach to incentivizing knowledge contribution creates sustainable economic models for data generation and curation.

Technical architecture enables trustless data verification and attribution, addressing key challenges in current data markets around quality, provenance, and fair compensation. The protocol’s composable design allows multiple applications to benefit from shared knowledge resources while maintaining appropriate access controls and attribution.

$TRUST Token Sale Details

- Sale Period: September 3-10, 2025

- Platform: CoinList

- Option 1: $0.075 per token, 50% TGE unlock + 12-month linear

- Option 2: $0.085 per token, 100% TGE unlock

- Purchase Options: USDC, USDT, USDe

- Limits: $100 minimum, $250,000 maximum

7. Inference Labs – AI Computation Network

Inference Labs creates decentralized infrastructure for AI model inference, addressing growing demand for accessible, cost-effective AI computation. The protocol distributes AI workloads across a network of distributed nodes, reducing costs while improving availability compared to centralized cloud providers.

Backing from Delphi Ventures, Mechanism Capital, and other infrastructure specialists indicates strong technical validation of the approach. The project targets the rapidly expanding AI inference market, which represents billions of dollars in annual spending currently concentrated among few providers.

Network design incentivizes node operators to provide computation while ensuring quality service delivery through reputation and stake-based mechanisms. This creates sustainable economics where both AI users and infrastructure providers benefit from network participation.

The timing aligns with increasing concerns about AI centralization and access equality. By democratizing AI computation access, Inference Labs addresses both economic and philosophical challenges in the current AI landscape.

Inference Labs Token Sale Details

- Sale Period: TBA

- Platform: Legion

- Network: Ethereum Mainnet

- Structure: ICO format

- Focus: AI computation infrastructure

8. eOracle ($EO) – Restaking Oracle Network

Eoracle combines oracle services with Ethereum restaking to create more secure and economically aligned data feeds. By leveraging restaked ETH as collateral, the protocol aligns oracle operators’ incentives with data accuracy while providing additional yield opportunities for ETH stakers.

The approach addresses persistent oracle security challenges through economic rather than purely technical mechanisms. Oracle operators stake significant value, creating strong disincentives for providing inaccurate data while enabling rapid response to malicious behavior through slashing mechanisms.

HashKey Capital and other infrastructure investors backing the project indicates market confidence in the restaking oracle model. The approach builds on proven economic security models while extending them to critical infrastructure services.

Integration with existing restaking infrastructure provides network effects as the protocol can leverage established validator communities and staking infrastructure rather than building entirely separate networks.

$EO Token Sale Details

- Sale Period: TBA

- Platform: Legion

- Network: Ethereum Mainnet

- Structure: ICO format

- Focus: Oracle and restaking services

9. NGRAVE – Hardware Wallet Evolution

NGRAVE develops next-generation hardware wallet solutions emphasizing maximum security through innovative design approaches. The company’s focus on “coldest” storage methods reflects growing institutional demand for enhanced security solutions as crypto adoption scales.

The equity-based fundraising approach on PAID platform differs from typical token sales, offering direct company ownership rather than utility tokens. This structure appeals to investors seeking exposure to the growing hardware security market through traditional equity mechanisms.

Product innovation centers on eliminating attack vectors present in current hardware wallet solutions through design choices that maximize offline security while maintaining usability. The approach targets both retail users seeking enhanced security and institutional customers requiring custody-grade solutions.

NGRAVE Token Sale Details

- Sale Period: TBA

- Funding Goal: $100,000

- Structure: Equity investment (SAFE Note)

- Valuation Cap: $30M with 15% discount on next round

- Minimum Investment: $500

- Platform: PAID

Is it good to buy presale tokens?

Historical successes like Ethereum, Solana, and Polygon show 10x to 100x returns are possible when projects achieve technical milestones and market adoption.

Presales provide early exposure to breakthrough technologies before mainstream recognition, allowing investors to benefit from genuine innovation rather than following trends.

Quality presales often have low correlation with broader crypto markets during early phases, providing portfolio diversification for Bitcoin and Ethereum holders.

Substantial risks include total capital loss, regulatory changes, and extended development timelines. Many projects fail to deliver promised functionality or achieve sustainable adoption.

Success demands extensive research and technical understanding to evaluate project feasibility, team competency, and competitive positioning in evolving markets.

Extended lock-up periods and limited initial trading liquidity require investors to hold positions for months or years before achieving meaningful liquidity.

How to buy coins before launch

Participating in cryptocurrency presales requires careful preparation and strategic timing.

Step 1: Research and Due Diligence

Research project whitepapers, team backgrounds, and tokenomics. Verify investor credentials and check community discussions. Cross-reference information to identify potential red flags.

Step 2: Platform Registration and KYC

Register on launchpad platforms (Kaito, Legion, Buidlpad, CoinList) well in advance. Complete KYC verification early as approval can take several days. Check eligibility restrictions for your jurisdiction.

Step 3: Wallet Setup and Funding

Set up compatible wallets and ensure sufficient funds plus gas fees. For multi-chain investments, configure network connections and bridge assets. Test small transactions first.

Step 4: Timing and Execution

Monitor sale times carefully (UTC zones). Prepare transactions but wait for official start. Have backup plans for network congestion during high-demand sales.

Step 5: Post-Purchase Management

Verify transaction success and save confirmations. Add token contracts to wallet and set reminders for vesting schedules. Consider hardware wallet storage for security.

Final Thoughts

The September 2025 presale landscape presents compelling opportunities across diverse blockchain sectors, from Bitcoin restaking and privacy infrastructure to AI computation networks. Our comprehensive evaluation of the best crypto presales September 2025 reveals projects with strong fundamentals, institutional backing, and clear market positioning that distinguish them from speculative offerings. Projects like Lombard’s Bitcoin liquid restaking, Superfluid’s payment streaming protocol, and Arcium’s privacy infrastructure represent genuine technological advancement rather than iterative improvements.

Success in presale investing requires balancing opportunity recognition with prudent risk management. While identifying the single best crypto presale September 2025 depends on individual investment criteria, the projects analyzed demonstrate varying risk-reward profiles, from established protocols seeking liquidity expansion to early-stage infrastructure plays targeting emerging market needs. Investors should prioritize projects with proven teams, sustainable tokenomics, and addressable market opportunities while maintaining appropriate portfolio allocation limits. As the cryptocurrency ecosystem continues maturing, these carefully selected presales offer exposure to the next wave of blockchain innovation for those willing to conduct thorough due diligence and accept inherent early-stage investment risks.

Frequently Asked Questions (FAQ)

The optimal presale depends on individual risk tolerance, investment timeline, and sector preferences. Among current opportunities, the best crypto presale September 2025 candidates focus on projects with strong technical fundamentals, experienced teams, and clear market demand rather than following speculative hype.

Early-stage opportunities exist across multiple sectors including AI infrastructure, privacy protocols, and DeFi innovation. Prioritize projects addressing real market needs with sustainable economic models over purely speculative investments.

Extreme returns require breakthrough technology adoption combined with perfect market timing. Historical precedents exist but are rare exceptions rather than typical outcomes. Focus on solid fundamentals rather than chasing unrealistic return expectations.

EOS raised over $4 billion in their year-long ICO, while Ethereum’s initial sale raised approximately $18 million but achieved much higher returns. These examples demonstrate that fundraising size doesn’t necessarily correlate with investment success.

AI-focused blockchain projects must demonstrate clear advantages over traditional cloud computing solutions. Evaluate technical feasibility, competitive positioning, and real-world adoption potential rather than following AI market hype alone.

Market trends change rapidly in cryptocurrency markets. Focus on long-term value creation through technology adoption rather than short-term trading momentum when evaluating investment opportunities.

Rate the article