About ICODA

ICODA is a Web3 growth partner that has been driving adoption since 2017.

We help DeFi protocols attract stakers, grow TVL & liquidity, and scale globally — from launch to PMF and beyond.

📊 300+ projects successfully executed

🌍 Clients in 40+ countries

Selected DeFi partners: de.fi, 1inch, SwissBorg, Godex, AgentLauncher, Over Protocol, Filecoin, Blockchain.com, BingX, Phemex.

Goals & KPIs

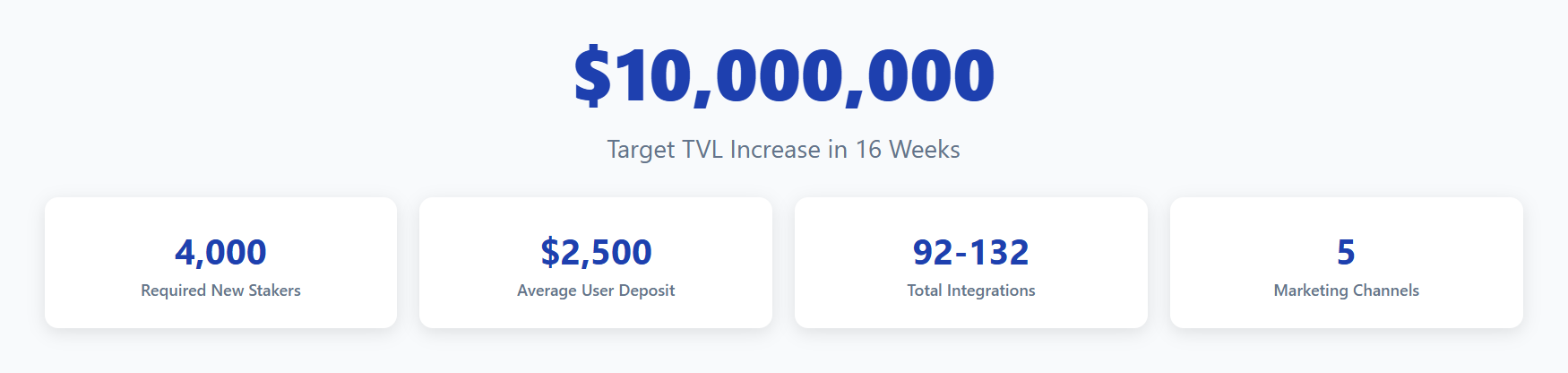

+$10,000,000

cost per acquired staker

cost per $1 of TVL

weekly (Spend → CTR → LP CR → Signup/KYC → Stake → CPA / CP‑TVL)

Plan Description

- Influencers connect to the protocol themselves and walk through staking (step‑by‑step).

- Every integration is tracked with UTM / promo codes / on‑chain metrics.

- PR listicles target search intents (e.g., “best staking platforms”) + link‑building for ranking.

- Partner aggregators to secure boosted users/TVL.

- Weekly control of CPA Staker and CP‑TVL; we scale the best‑performing mixes.

Channels We Would Use

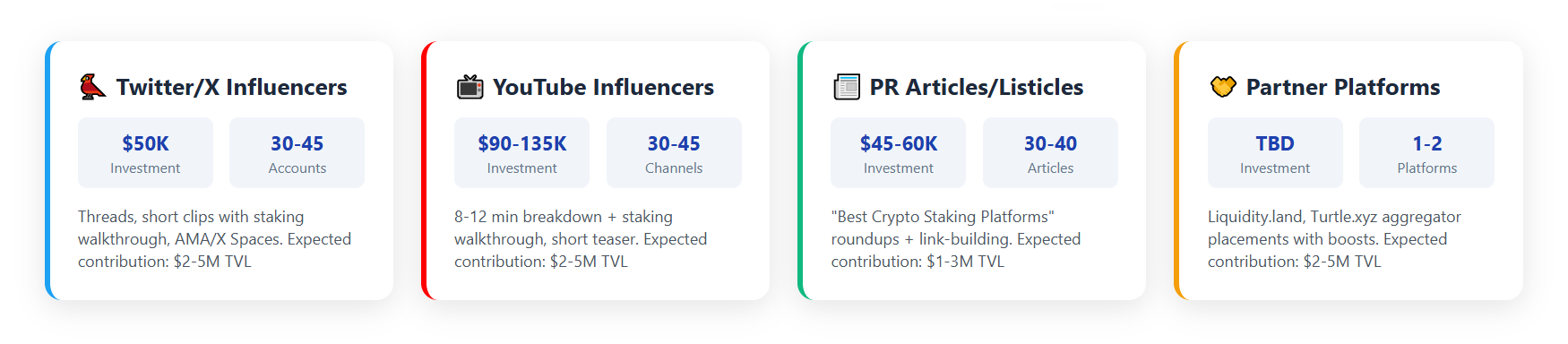

1. Twitter Influencers

Idea: threads/short clips with a JBank staking walkthrough, AMA/X Spaces, pinned links.

Wave package: 30–45 X accounts.

Cost guide: $50,000

Samples of KOLs we work with:

| Influencer (X) | Followers (≈) | Link |

|---|---|---|

| Stacy Muur (@stacy_muur) | ≈70k | https://x.com/stacy_muur |

| andrew.moh (@0xAndrewMoh) | ≈61k | https://x.com/0xAndrewMoh |

| riddler (@RiddlerDeFi) | ≈56k | https://x.com/RiddlerDeFi |

| Tindorr (@0xTindorr) | ≈45k | https://x.com/0xTindorr |

| DeFi Warhol (@DeFi_Warhol) | ≈41k | https://x.com/DeFi_Warhol |

2. YouTube Influencers

Idea: 8–12 min breakdown + staking walkthrough, short teaser, links in description & pinned comment.

Wave package: 30–45 channels.

Cost guide: $90,000–135,000

Samples of KOLs we work with:

| Channel / Author | Subscribers (≈) | Topic / Specialty | Link |

|---|---|---|---|

| Stephen TCG / DeFi Dojo | ≈63.9k | Yield‑farming, calculators, research | https://www.youtube.com/@TheCalculatorGuy |

| Taiki Maeda | ≈105k | In‑depth DeFi/NFT reviews & honest takes | https://youtube.com/@TaikiMaeda |

| Dynamo DeFi | ≈58.1k | Crypto & economics education; DeFi risks/strategies | https://youtube.com/@DynamoDeFi |

| CryptoLabs Research | ≈33.1k | Passive income via DeFi | https://youtube.com/@CryptoLabsResearch |

| The DeFi Whale | ≈54.5k | Reviews of small & large projects | https://youtube.com/@TheDeFiWhale |

3. PR Articles / Listicles (SEO)

Idea: placements in “Best Crypto Staking Platforms” roundups + link‑building to hold top positions.

Wave package: 30–40 materials.

Cost guide: $45,000–60,000 + $5 000 for backlinks

Samples of Media and Articles:

| Title | Media | Topic / Link |

|---|---|---|

| 12 Best Crypto Staking Platforms for 2025: Earn High Staking APY | 99Bitcoins | https://99bitcoins.com/cryptocurrency/best-crypto-staking-platforms/ |

| 12 Highest APY Crypto Staking Platforms in August 2025 | CryptoNews.com | https://cryptonews.com/cryptocurrency/best-crypto-staking-platforms/ |

| 8 Best Crypto Staking Platforms for 2025 | coinlaunch.space | https://coinlaunch.space/blog/best-crypto-staking-platforms/ |

| 15 Best Crypto Staking Platforms in 2025 | Geekflare.com | https://geekflare.com/crypto/best-crypto-staking-platforms/ |

4. Partner Platforms

- Liquidity.land — showcase of DeFi campaigns with additional boosts/cashbacks.

- Turtle.xyz — aggregator of boosted programs (e.g., extra % for entering via Turtle).

Expected contribution: $1–5M TVL (realistic range with 1–2 partner placements; exact terms after approval by platforms).

5. CustDev (Optional)

Interviews with 10 active yield‑farmers (from target geos) to lift LP → Stake conversion.

Topics: what triggers moving a portfolio slice to JBank, when users share referrals, info sources, barriers/triggers.

Example of questions:

- What would need to happen for you to move part of your assets specifically to our product? Which portion of your portfolio would you allocate first?

- Under what circumstances would you share your referral link with friends?

- Where do you learn about new and interesting yield-farming models?

Number of Stakers

| Average user deposit (USD) | Required number of users |

|---|---|

| 2,500 | ~4,000 |

Since $10,000,000 ÷ $2,500 = 4,000, we target ~4k new stakers.

Budget & Volumes (per wave)

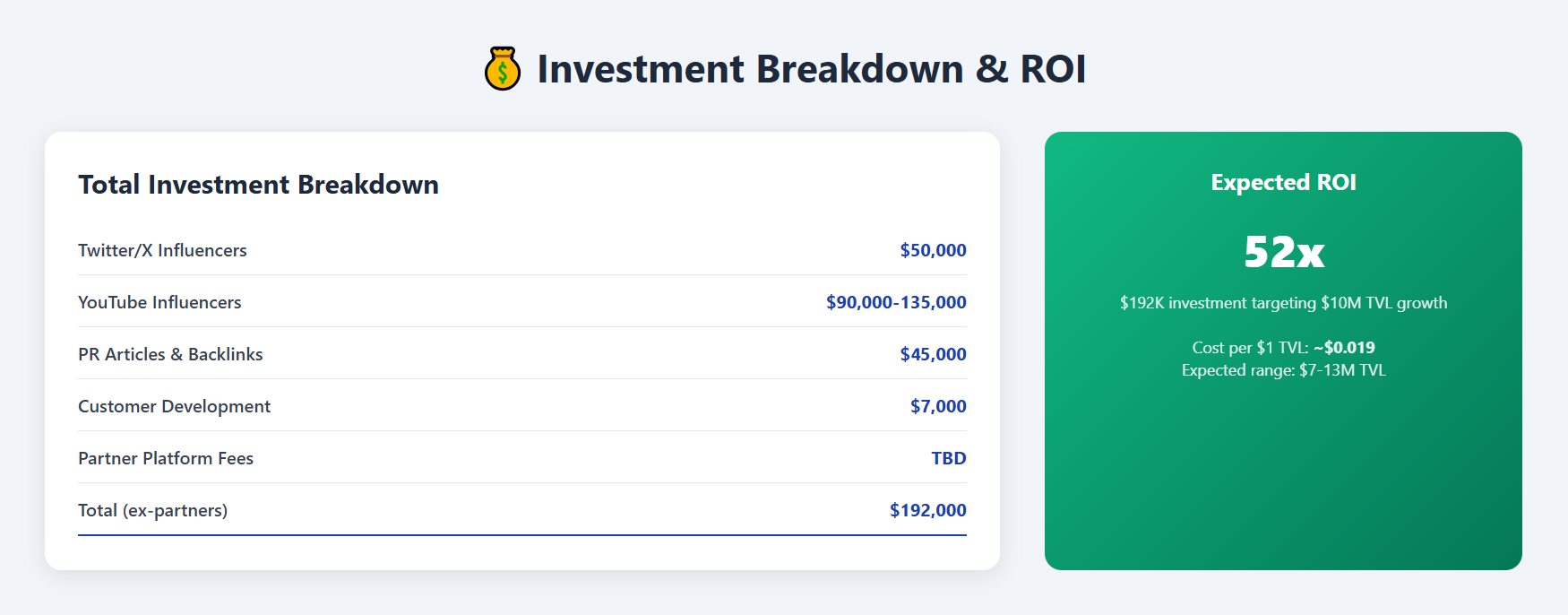

| Channel | Expected TVL contribution ($M) | Avg. contribution ($M) | Required users (≈) | Est. # of integrations | Cost ($) |

|---|---|---|---|---|---|

| Twitter (X) Influencers | 2–5 | 3.5 | ~1,400 | 30–45 accounts | 50,000 |

| YouTube Influencers | 2–5 | 3.5 | ~1,400 | 30–45 channels | 90,000 |

| PR Listicles | 1–3 | 2.0 | ~800 | 30–40 articles | 45,000 |

| Partner platforms | 2–5 | 3.5 | ~1,400 | 1–2 platforms | TBD (per terms) |

| CustDev | 7,000 | ||||

| Total (ex‑partners) | 7–13 | 9.0 | ~3,600 | 92–132 integrations | 192,000 |

Totals exclude partner‑platform incentives. Actual impact depends on site/compliance fixes and creative quality.

Timeline (16 Weeks)

Strategic 3-wave deployment for maximum impact:

- Wk 0–2 — Foundation: audit/FAQ “How yield is generated”, public audit link, launch Discord and real moderation (no chatters), pixels/UTM, creative briefs.

- Wk 3–5 — Wave 1: 10 X + 10 YT + 10 PR; first partner placements; measure CPA/CP‑TVL; fast LP/messaging fixes.

- Wk 6–10 — Wave 2: +20 X, +20 YT, +15 PR; EN/ES/PT/DE localizations; AMA/X Spaces.

- Wk 11–16 — Wave 3: +15 X, +15 YT, +5 PR; referral activations; goal — cumulative + $10M TVL.

Latest Industry Researches & Case Studies

- The Ideal DeFi Lending Protocol: Research on User Problems and Solution Concept

- DeFi Growth Strategy: How to 10x Your DeFi TVL in 18 Months

- How to Grow Your DeFi TVL to $340K/Month with Web2 Users

Post Examples That We Made for DeFi

ICODA Team

Frequently Asked Questions (FAQ)

Effective DeFi TVL growth requires a multi-channel approach combining influencer partnerships, PR placements, and strategic partnerships with aggregator platforms. The most successful strategies typically involve 90-130 integrated marketing touchpoints over 16 weeks to achieve significant TVL milestones.

The most effective marketing strategies for DeFi staking platforms include Twitter/YouTube influencer campaigns with step-by-step staking walkthroughs, SEO-optimized PR listicles targeting “best staking platforms” searches, and partnerships with liquidity aggregators. These channels typically generate 2-5M in TVL contribution per wave when executed properly.

Professional DeFi protocol marketing campaigns typically cost $192,000 for comprehensive multi-channel execution, targeting $10M in TVL growth. ICODA’s proven approach delivers measurable results through 90+ integrated marketing touchpoints across influencer networks, PR placements, and strategic partnerships.

еThe average CPA for DeFi stakers varies by channel and strategy, but successful campaigns typically target cost-per-TVL metrics alongside traditional CPA measurements. Weekly optimization of these metrics ensures efficient scaling of the best-performing marketing channel combinations.

Influencer campaigns drive DeFi TVL growth by providing authentic, step-by-step staking demonstrations through trusted voices in the community. Combining 30-45 Twitter accounts with 30-45 YouTube channels creates comprehensive coverage that can contribute 2-5M in TVL per marketing wave.

Essential DeFi protocol marketing metrics include CPA Staker, CP-TVL, and weekly conversion tracking from initial spend through final staking action. These KPIs enable real-time optimization and ensure maximum ROI throughout the crypto staking TVL acceleration campaign.

Rate the article