The crypto community management landscape has reached an inflection point. With over 13,000 active DAOs managing $23 billion in treasuries and traditional agencies serving 750+ crypto clients, project founders face a critical decision: Should you hire a crypto community manager through a traditional agency, or embrace DAO consulting to build a self-governing ecosystem?

The data reveals a surprising truth: Projects implementing progressive decentralization achieve 40-60% cost savings within 18-24 months while maintaining 65-80% long-term community retention—nearly double that of traditionally managed communities. Yet 70% of founders remain uncertain about when and how to transition from professional management to community governance.

This analysis, based on 2024-2025 market data and recent case studies, provides the strategic framework you need to navigate this decision at your project’s scaling stage.

How DAOs Work and How They Differ from Classic Communities

The Fundamental Architecture Difference

Traditional community management operates like a broadcasting tower: Your agency or in-house team creates content, moderates discussions, and drives engagement from a central point of control. Decisions flow from the top down—your team decides, the agency executes, and the community responds. This model has powered crypto’s growth, with specialized agencies achieving 15-25% monthly community growth rates and managing crisis response within 1-4 hours.

DAO consulting, by contrast, architects a fundamentally different structure. Instead of managing your community, consultants build the governance infrastructure—smart contracts, voting mechanisms, and treasury systems—that enable your community to manage itself. Token holders become decision-makers, proposing and voting on everything from treasury allocations to protocol changes. The community isn’t just engaged; it’s empowered.

The Operational Reality

In practice, these differences manifest in every aspect of operations:

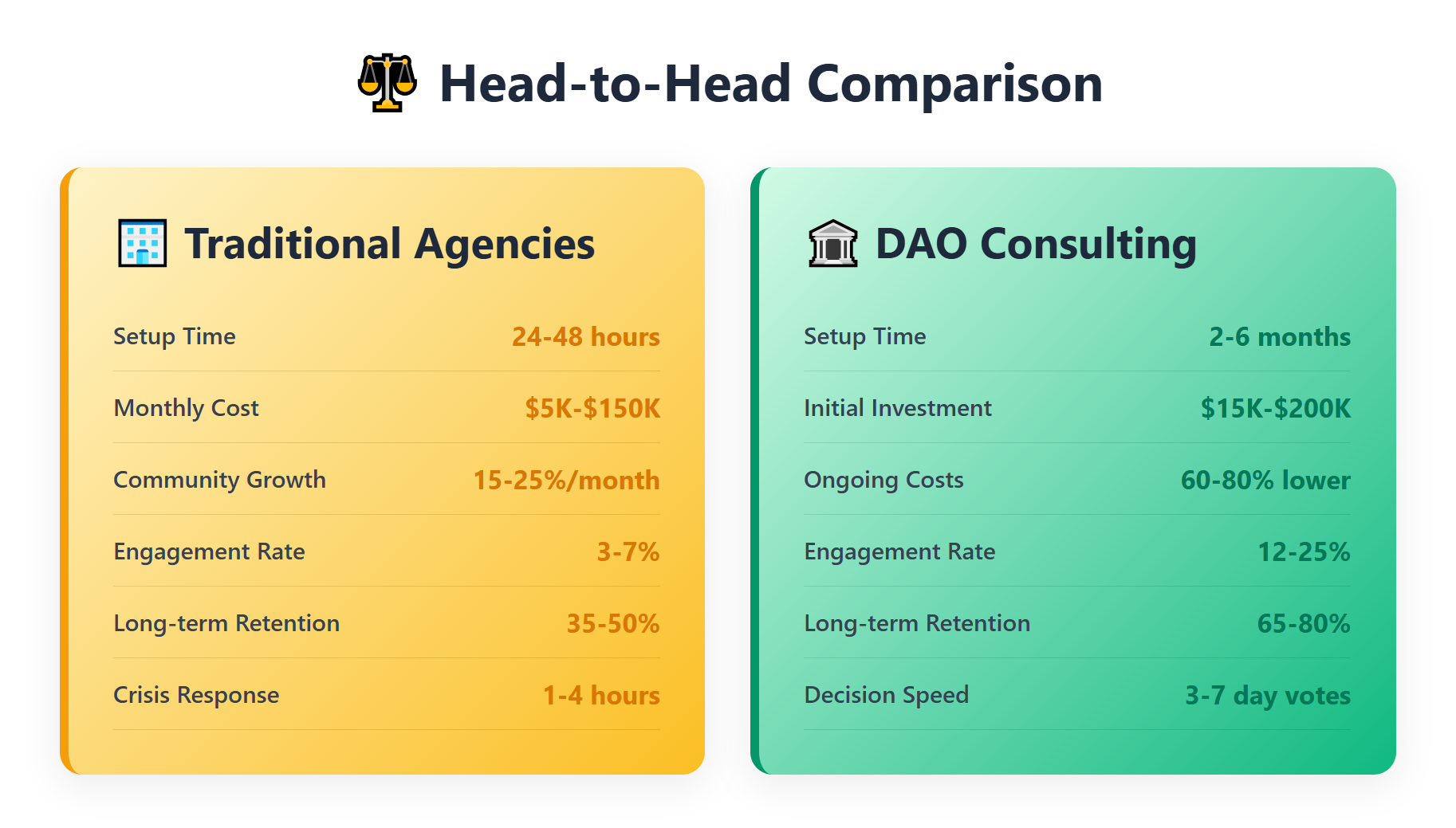

Decision Speed: Traditional agencies execute within 24-48 hours for routine decisions. DAOs require 3-7 day voting cycles, but once consensus is reached, smart contracts execute automatically.

Cost Structure: Agencies charge predictable monthly retainers ($5,000-$150,000), while DAO consulting requires upfront investment ($15,000-$200,000) with lower ongoing costs that decrease as the community scales.

Engagement Metrics: Here’s where the data becomes compelling. Traditional management achieves 3-7% active engagement rates. DAO communities show 12-25% participation in governance—a 3-4x improvement. More critically, DAOs retain 65-80% of members long-term versus 35-50% for traditionally managed communities.

Control Distribution: This represents the philosophical divide. Agencies maintain your control while professionalizing execution. DAO consulting systematically transfers control to token holders, creating shared ownership but reducing founder authority.

Strengths of DAO Consulting

Economic Efficiency at Scale

The financial argument for DAO consulting becomes overwhelming as communities grow. While initial setup costs are substantial—smart contract development, security audits, and legal structuring can total $50,000-$200,000—the long-term economics are transformative.

Consider Uniswap DAO’s model: After initial setup, the protocol manages a $3 billion treasury through community governance, with operational costs primarily limited to gas fees and delegate compensation ($6,000 monthly for top contributors). A traditional agency managing comparable assets and activity would cost $100,000+ monthly.

The break-even analysis is clear: Projects with over 1,000 active members typically recoup DAO infrastructure investments within 8-12 months, then operate at 60-80% lower costs than agency models.

Trust Through Transparency

In crypto’s trust-minimized environment, DAO consulting delivers a unique value proposition: radical transparency. Every vote, every treasury transaction, and every governance decision lives immutably on-chain. This isn’t just philosophical—it’s financially material.

Research comparing 365 DAOs revealed that projects using transparent, on-chain voting maintain treasuries averaging 5x larger than those using opaque, off-chain systems. Investors and community members literally put their money where transparency exists.

MakerDAO exemplifies this trust premium. Their fully transparent governance model, managing over $7 billion in protocol reserves, achieved 5x token returns following their “Endgame” governance restructuring. The market rewards verifiable, decentralized decision-making.

Network Effects and Exponential Scaling

Traditional agencies scale linearly—double the community requires roughly double the management resources. DAO community building leverages network effects for exponential scaling. As token holders become co-owners, they transform from passive consumers into active evangelists and contributors.

Optimism DAO demonstrates this perfectly. Their bicameral governance system maintains 67% active participation among top delegates while managing 152,254 total delegates. The community self-organizes, creates value, and scales without proportional cost increases.

Innovation Through Collective Intelligence

DAO consulting unlocks your community’s collective intelligence. Instead of relying on a small team’s insights, governance tokens align thousands of stakeholders to contribute ideas, identify opportunities, and solve problems.

Gitcoin DAO transformed public goods funding through community-driven innovation. Their quadratic funding mechanism, refined through countless governance proposals, has distributed millions to open-source projects—innovation that emerged from community collaboration, not top-down planning.

When to Work with an Agency vs. When to Embrace DAO Consulting

Choose Traditional Agencies When:

You’re Pre-Launch to Early Growth (0-6 months) — Your priority is establishing market presence, not governance infrastructure. Agencies deliver immediate results: professional Discord setup, 24/7 moderation, influencer campaigns, and crisis management. TokenMinds’ work with Gensokishi—achieving a $200,000 token sellout in 20 seconds—exemplifies agency-driven launch success.

Speed is Critical — When FUD strikes or opportunities emerge, agencies respond within hours. Their centralized structure enables rapid pivots, immediate damage control, and coordinated multi-platform campaigns. You can’t wait for a governance vote when your protocol is under attack.

You Need Predictable Costs — With $50,000 monthly budget, you know exactly what you’re getting: defined deliverables, guaranteed coverage, and measurable KPIs. This predictability is valuable when fundraising or managing burn rates.

Regulatory Compliance is Paramount — For projects tokenizing real-world assets or operating in regulated jurisdictions, professional agencies provide the controlled communication and compliance expertise that DAOs can’t guarantee.

Choose DAO Consulting When:

You’ve Achieved Product-Market Fit (6+ months) With a working product and engaged community exceeding 500 members, DAO infrastructure becomes economically viable. The initial investment pays dividends as your community scales.

Decentralization is Core to Your Value Proposition DeFi protocols, governance tokens, and infrastructure projects require credible neutrality. Users won’t trust a “decentralized” protocol with centralized decision-making. DAO consulting aligns your operations with your ethos.

You’re Managing Significant Treasury Assets Once your treasury exceeds $1 million, community governance becomes both practical and necessary. The transparency and shared decision-making protect against founder key-person risk while building community trust.

Long-term Sustainability Matters More Than Short-term Growth If you’re building infrastructure meant to outlive its founders—like Ethereum or Bitcoin—DAO consulting creates the self-sustaining governance necessary for multi-generational projects.

The Hybrid Sweet Spot

Most successful projects don’t choose one model—they sequence both strategically:

- Phase 1 (Months 1-6): Hire crypto community managers through agencies for professional launch

- Phase 2 (Months 6-12): Introduce governance elements while maintaining agency support

- Phase 3 (Months 12+): Transition to DAO-led governance with retained advisory services

This progressive decentralization captures immediate growth while building toward sustainable community ownership.

Examples Where the DAO Approach Delivered Results

MakerDAO: The $7 Billion Governance Evolution

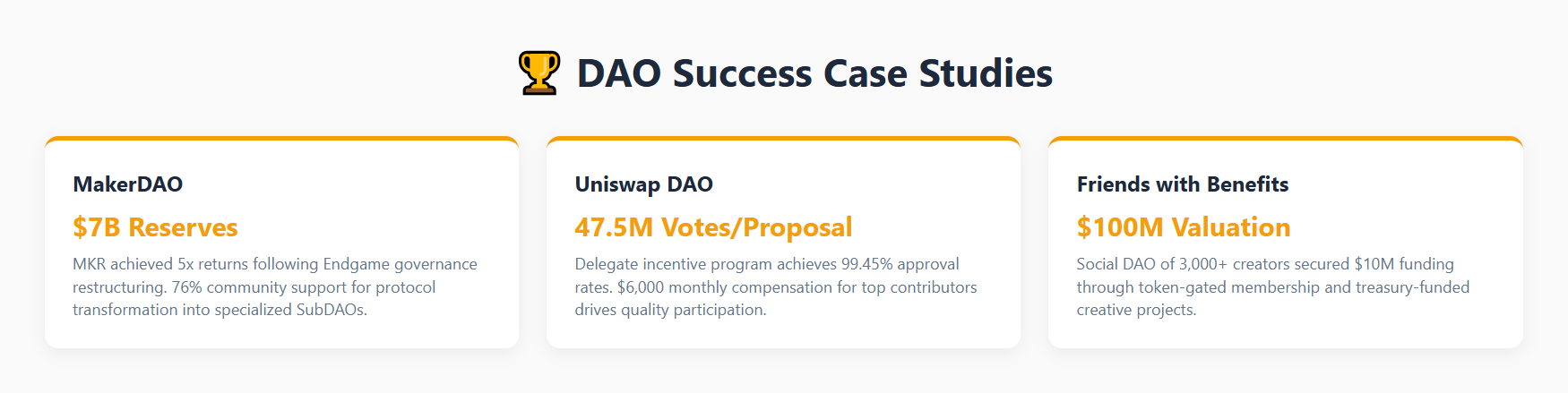

MakerDAO’s transformation from foundation-led to community-governed demonstrates DAO consulting’s potential. Their “Endgame Plan,” approved with 76% community support, restructured the entire protocol into specialized SubDAOs.

Results: MKR token achieved 5x returns within one year, the protocol manages $7 billion in reserves through transparent governance, and innovation accelerated with AI-assisted governance tools and new token launches (SKY/USDS).

The lesson: Complex protocols benefit from sophisticated DAO structures that distribute expertise across specialized groups while maintaining unified governance.

Uniswap: Incentivizing Quality Governance

Uniswap’s delegate incentive program shows how DAO consulting solves participation challenges. By compensating active delegates up to $6,000 monthly and implementing gas rebates, they maintain 47.51 million votes per proposal with 99.45% approval rates.

Key innovation: Reducing proposal thresholds from 2.5M to 0.25% of supply democratized participation while maintaining quality through reputation systems.

Friends with Benefits: The Cultural DAO

FWB proves DAOs aren’t limited to DeFi. This social DAO of 3,000+ creators secured $10 million funding at a $100 million valuation by combining token-gated membership with treasury-funded creative projects.

Success factors: Clear value proposition (exclusive access), balanced governance (application review + token requirement), and tangible outputs (brand partnerships with Hennessy and Taika).

Making Your Strategic Decision

The choice between DAO consulting and traditional agencies isn’t binary—it’s evolutionary. Your project’s stage, philosophy, and resources determine the optimal path.

Start by honestly assessing where you are:

- Pre-launch? Focus on professional community building

- Post-product-market fit? Begin exploring governance options

- Managing significant treasury? DAO infrastructure becomes essential

- Facing regulatory scrutiny? Maintain professional management

Remember: The most successful projects plan their decentralization journey from day one, even if they don’t implement it immediately. Building with progressive decentralization in mind ensures smooth transitions when the time comes.

The data is clear: Projects implementing thoughtful, strategic approaches to community governance achieve superior long-term outcomes—higher engagement, better retention, and lower costs. Whether through traditional agencies, DAO consulting, or hybrid approach, the key is aligning your community management strategy with your project’s fundamental mission and growth trajectory.

The future belongs to projects that master both professional excellence and community empowerment. The question isn’t whether to decentralize, but when and how to do it strategically. With the right partner and approach, you can capture the benefits of both models while mitigating their respective risks.

Frequently Asked Questions (FAQ)

DAO consulting builds self-governing infrastructure where token holders make decisions through on-chain voting, while traditional agencies provide centralized, professional management with 24/7 moderation and rapid crisis response. The key difference is ownership: agencies manage your community for you, while DAO consultants enable your community to manage itself.

DAO consulting requires $15,000-$200,000 upfront investment but reduces ongoing costs by 60-80% after 18-24 months, while hiring crypto community managers through agencies costs $5,000-$150,000 monthly with predictable recurring fees. Projects typically break even on DAO infrastructure within 8-12 months when managing communities over 1,000 active members.

The optimal transition point for DAO community building is 6-12 months post-launch when you have 500+ engaged members, proven product-market fit, and a treasury exceeding $1 million.

Early-stage projects face significant challenges with DAO consulting including high upfront costs, 3-7 day voting delays that can harm crisis response, and potential legal liability for token holders as shown in the Lido DAO case. Pre-product-market-fit projects typically achieve better results hiring crypto community managers for rapid, professional growth.

Full DAO community building implementation typically takes 3-6 months for governance framework design and smart contract development, followed by 2-3 months of community onboarding and education. Most projects see meaningful governance participation within 6-8 months and achieve optimal community-led operations by month 12-18.

Rate the article