The Traditional KOL Model Is Dying—Here’s What’s Replacing It in Web3 Marketing

If you’re still paying influencers thousands of dollars per month for content that disappears from feeds within 24 hours, you’re already behind. While you’re burning through your marketing budget on one-off posts, savvy web3 projects are locking in 3-6 months of sustained promotion for a fraction of the real cost—and the results speak for themselves.

Welcome to the world of OTC token deals: the crypto influencer marketing strategy that’s quietly revolutionizing how web3 projects work with influencers. This isn’t just another trend—it’s a fundamental shift in how smart projects approach influencer partnerships, align incentives, and build lasting community advocacy.

The Problem Everyone Knows But Nobody Talks About

Let’s be honest: the traditional KOL model is broken.

Projects come to agencies asking for “just one post” from a major influencer. They want results. They want engagement. They want their token to moon. But they don’t want to commit to month-long campaigns with five-figure price tags in stablecoins.

Sound familiar?

Meanwhile, influencers are tired of the same model too. They see projects pump and dump, they get paid in dollars while watching tokens they promoted 100x, and they’re constantly hunting for the next gig instead of building long-term partnerships.

There has to be a better way. And there is.

Enter OTC Token Deals: The Game-Changer

Here’s how the smartest projects in crypto are playing a completely different game:

Instead of paying influencers in cash, they’re allocating substantial token reserves and offering them to influencers at significant discounts—we’re talking 40-50% below market price. These tokens vest over several months, creating a powerful alignment of incentives that traditional crypto influencer marketing simply cannot match.

Why This Changes Everything

For Projects:

- Extended marketing pressure spanning 3-6 months instead of fleeting one-off posts

- No upfront cash burn on your marketing budget

- Built-in accountability: If influencers don’t deliver content, you can delay their vesting

- Authentic promotion: When influencers have skin in the game, their content quality skyrockets

- Scalable reach: Work with dozens or even hundreds of influencers simultaneously

For Influencers:

- Massive upside potential through discounted token acquisition

- Hedging opportunities to lock in profits immediately

- Long-term partnerships instead of transactional relationships

- Multiple revenue streams from the same deal

Why OTC Deals Are the Future of Web3 Marketing

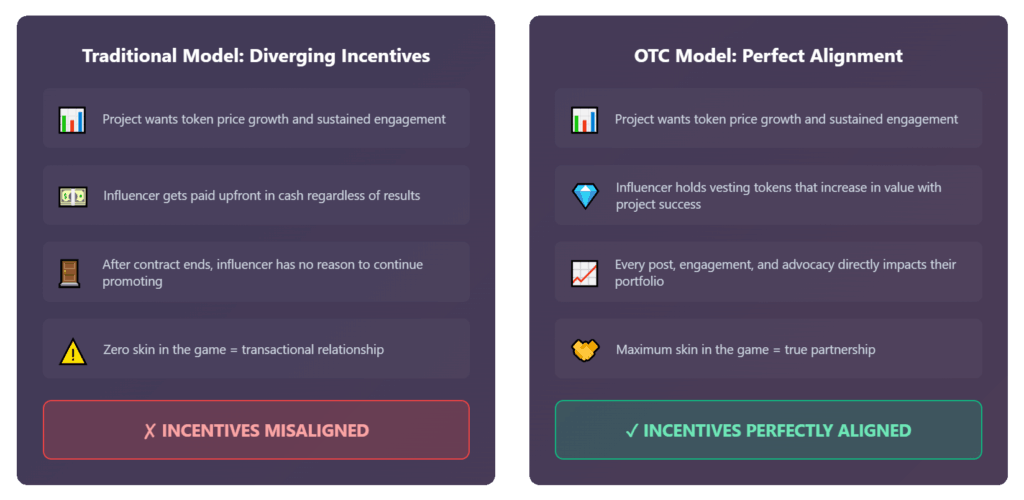

The shift to OTC token deals represents more than just a new payment structure—it’s a fundamental reimagining of web3 marketing itself. Unlike web2 influencer marketing where transactions are purely financial, web3 marketing thrives on aligned incentives, community ownership, and long-term stakeholder relationships.

Traditional crypto influencer marketing operates on a legacy advertising model: pay for posts, hope for results, repeat. But web3 marketing demands something different—a model where influencers become genuine stakeholders in a project’s success, not just paid spokespeople.

OTC token deals achieve what no amount of cash payments can: true alignment between project success and influencer compensation. When an influencer holds vesting tokens, every post they create, every community they engage with, and every piece of content they produce directly impacts their own portfolio value. This isn’t marketing—it’s partnership.

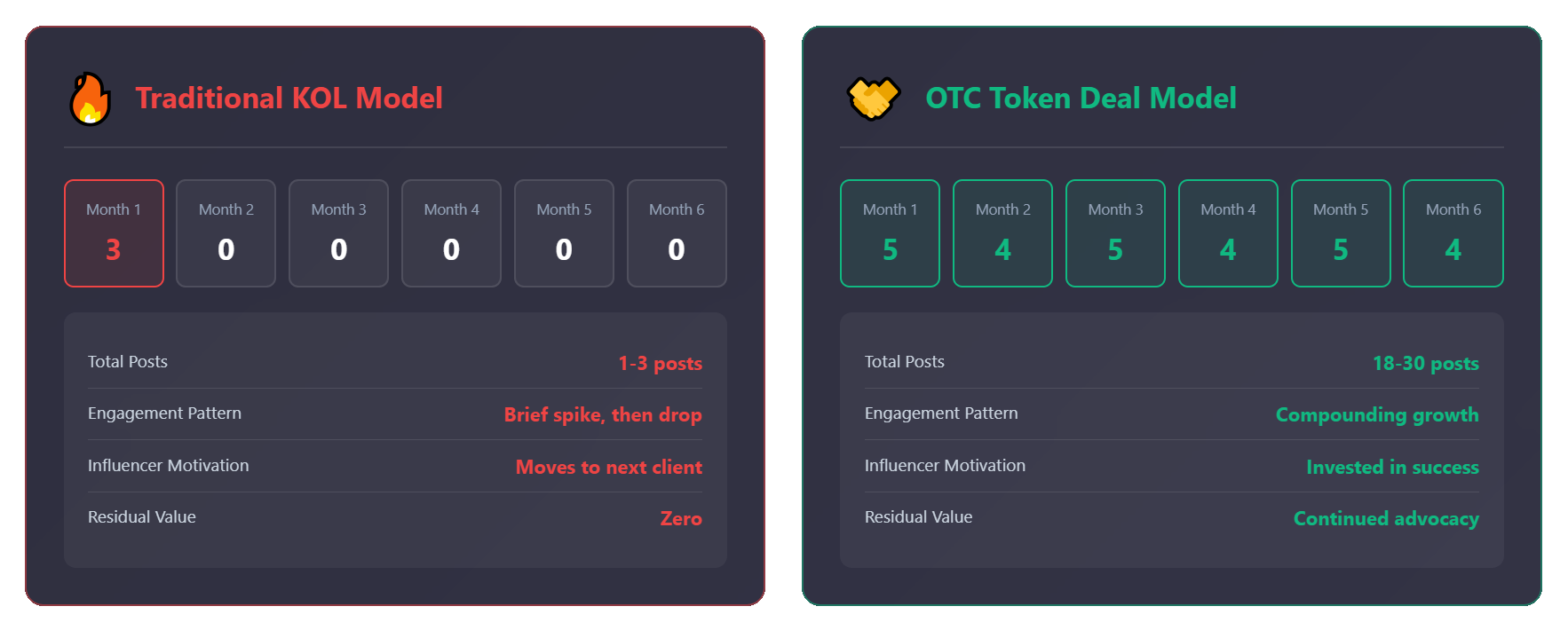

The numbers prove it. Projects using OTC token deals report:

- 3-5x more content per influencer compared to paid campaigns

- Higher quality messaging as influencers research and understand the project deeply

- Organic advocacy that extends beyond contractual obligations

- Community building rather than just audience reach

This is why forward-thinking web3 projects are abandoning traditional KOL contracts in favor of token-based partnership models. It’s not just more cost-effective—it’s more effective, period.

The Numbers That Will Make Your CMO Rethink Everything

Let’s talk ROI. Traditional KOL campaigns might get you scattered posts across a few weeks. With OTC deals, projects are seeing:

- 150+ influencers promoting simultaneously

- 3-5 posts per month from each participant

- Sustained narrative building over the entire vesting period

- Community growth that compounds month over month

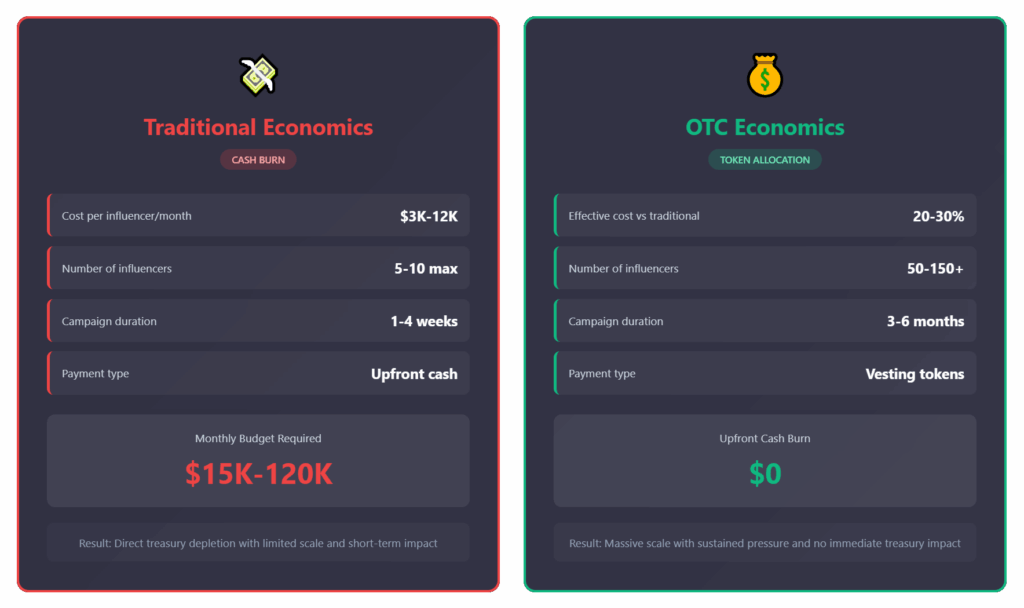

And here’s the kicker: the effective cost can be a small fraction of what you’d pay for equivalent coverage through traditional means, especially when you factor in token allocation versus market spend.

Traditional KOL Marketing vs OTC Token Deals: The Complete Comparison

| Factor | Traditional KOL Marketing | OTC Token Deals |

|---|---|---|

| Payment Structure | Cash (stablecoins/fiat) upfront | Discounted tokens with vesting (40-50% discount) |

| Campaign Duration | Typically 1-4 weeks | 3-6 months sustained promotion |

| Budget Impact | Direct cash burn from treasury | Token allocation (no immediate cash expenditure) |

| Influencer Incentive | Fixed fee regardless of results | Direct stake in project success |

| Content Volume | 1-3 posts per contract | 3-5 posts per month over entire vesting period |

| Content Quality | Transactional, often generic | Deep understanding, authentic advocacy |

| Scalability | Limited by cash budget | Can onboard 50-150+ influencers simultaneously |

| Risk for Project | Cash spent regardless of performance | Vesting can be delayed for non-performance |

| Risk for Influencer | None (paid upfront) | Token price volatility (mitigated by hedging) |

| Accountability | Minimal (payment already made) | Built-in (tokens only vest with performance) |

| Relationship Type | One-time transaction | Long-term partnership |

| Post-Campaign | Influencer moves to next client | Influencer remains invested in success |

| Community Building | Temporary awareness spike | Sustained growth over months |

| Cost Efficiency | High ($3K-12K+ per month per influencer) | Low (effective cost 20-30% of traditional after discount) |

| Narrative Control | Limited to contract terms | Organic evolution as project develops |

| Suitable For | Quick launches, short-term buzz | Long-term growth, sustainable marketing |

Key Takeaway

The fundamental difference isn’t just in payment method—it’s in incentive alignment. Traditional marketing creates vendors. OTC deals create partners.

But Wait—Isn’t This Risky?

Smart question. And yes, there are considerations:

Token price volatility?

— Solved through hedging mechanisms that allow influencers to lock in their discount immediately.

Liquidity concerns?

— This model only works for projects with strong liquidity on reputable exchanges—which is exactly where you want to be anyway.

Influencers not delivering?

— Vesting schedules include performance clauses. No posts? No tokens. Simple.

The reality is that OTC deals have been standard practice in the venture capital world for years. Now they’re becoming the norm in crypto influencer marketing too—and the projects that adopt this model early are seeing outsized returns.

Who Should Be Using This Strategy?

This isn’t for everyone, and that’s by design. OTC token deals work best for:

- Projects listed on tier-1 exchanges with solid liquidity

- Tokens with established market presence and trading infrastructure

- Teams serious about sustained marketing pressure, not pump-and-dump schemes

- Projects that understand the value of aligned incentives

If you’re a pre-launch project or struggling with liquidity, this isn’t your play yet. But if you meet the criteria? You’re leaving money on the table by sticking with traditional models.

The Market Is Moving Without You

Here’s what you need to understand: this shift is already happening.

While you’re debating whether to try this approach, your competitors are already closing OTC rounds worth six and seven figures. They’re building armies of genuinely invested advocates who have real reasons to see your competitors succeed.

Major projects across the ecosystem have been quietly leveraging this model. The influencers with real reach and influence? They’re increasingly prioritizing OTC opportunities over standard paid promotions.

The window of opportunity is now. As more projects adopt this model, the influencers with the best reach and engagement will be fully allocated. The cost of entry will only increase as the model proves itself further.

What This Means for Modern Crypto Marketing

OTC token deals represent a fundamental shift in how we think about crypto influencer marketing and web3 marketing more broadly:

- From transactional to partnership-based

- From cash burn to token allocation

- From one-off posts to sustained campaigns

- From misaligned incentives to shared success

The traditional model of paying influencers fixed rates for temporary content isn’t just expensive—it’s obsolete. It belongs to a previous era of crypto marketing, before projects understood the power of true stakeholder alignment.

The Infrastructure Is Ready

The best part? The infrastructure to execute these deals already exists. Specialized operators who understand both the influencer landscape and the technical requirements of vesting schedules, hedging strategies, and compliance frameworks are actively facilitating these rounds.

They’re handling:

- Due diligence on token liquidity and market depth

- Vesting contract setup and management

- Influencer recruitment and onboarding at scale

- Performance tracking and enforcement

- Risk mitigation through proper hedging channels

This isn’t some theoretical future state—it’s operational today.

The Bottom Line

If you’re running a crypto project with genuine traction and you’re still approaching influencer marketing the old way, you’re paying too much for too little.

The projects that will dominate the next bull cycle aren’t the ones with the biggest traditional marketing budgets. They’re the ones that learned to align incentives, scale intelligently, and turn their community into stakeholders.

OTC token deals aren’t just another crypto influencer marketing tactic. They’re a fundamental reimagining of how projects, influencers, and communities can work together toward mutual success. They represent the evolution of web3 marketing from borrowed web2 playbooks to models that are native to tokenized ecosystems.

The question isn’t whether this model will become the standard. It already is.

The question is: how much market share will you lose before you adapt?

Frequently Asked Questions (FAQ)

OTC token deals let projects pay crypto influencers with discounted tokens (40-50% off) that vest over 3-6 months, creating aligned incentives for sustained promotion.

OTC deals align incentives—influencers profit when the project succeeds. You get 3-6 months of content vs. one-off posts, at lower effective cost than traditional KOL campaigns.This model only works for projects with strong liquidity on reputable exchanges—which is exactly where you want to be anyway.

Web3 marketing emphasizes community ownership and stakeholder alignment vs. transactional ads. It uses token economics to create genuine partnerships, not just paid promotions.Solved through hedging mechanisms that allow influencers to lock in their discount immediately.

Traditional KOL campaigns cost $3,000-$12,000+ monthly per influencer in cash. OTC token deals use token allocation instead, reducing upfront cash burn significantly.

Agencies like ICODA specialize in web3 marketing and OTC token deal structuring, helping established projects transition from traditional KOL contracts to performance-based models.

Rate the article