The New Landscape of Crypto Marketing

The cryptocurrency market of 2025 is radically different from what we saw five years ago. If previously it was enough to launch an exchange and wait for traders, today there are over 600 centralised exchanges on the market, fighting for the attention of the same users.

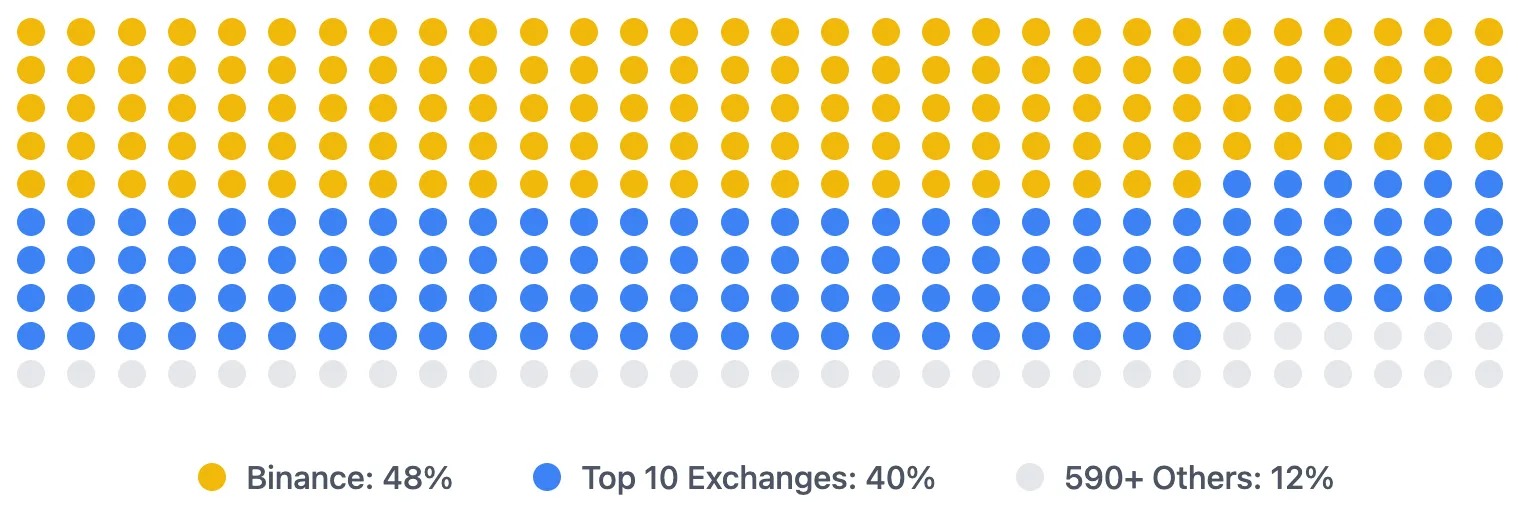

Two factors define the modern landscape. The first is fierce competition. Binance controls 48% of the spot market, while the next ten exchanges collectively share another 40%. New players are left with crumbs. The second factor is regulatory pressure. MiCA in Europe, tightening SEC requirements in the USA, local restrictions in Asia — all this forces exchanges to spend millions on compliance and licensing.

Under these conditions, scattered marketing activities are ineffective. A systematic strategy is needed where each element reinforces the other. An exchange without a strategy burns budgets, attracting users who leave after a week. An exchange with a strategy builds an ecosystem where traders stay for years.

Strategy Foundation: Positioning and Analytics

Defining Target Audience

A common mistake of new exchanges is trying to attract everyone at once. Instead, specific segments need to be identified. Crypto newcomers (35% of the market) value interface simplicity and educational content, fear losing money due to their own mistakes. Active traders (25%) use 3-5 exchanges simultaneously, for them low fees and API for bots are critical. Long-term investors (40%) prioritize security and passive income opportunities through staking. Understanding the needs of each segment determines the choice of marketing channels and messages.

Unique Value Proposition

The UVP must clearly answer the question: why will a trader choose your exchange over Binance? Generic phrases about “security and convenience” don’t work — these are basic requirements, not advantages.

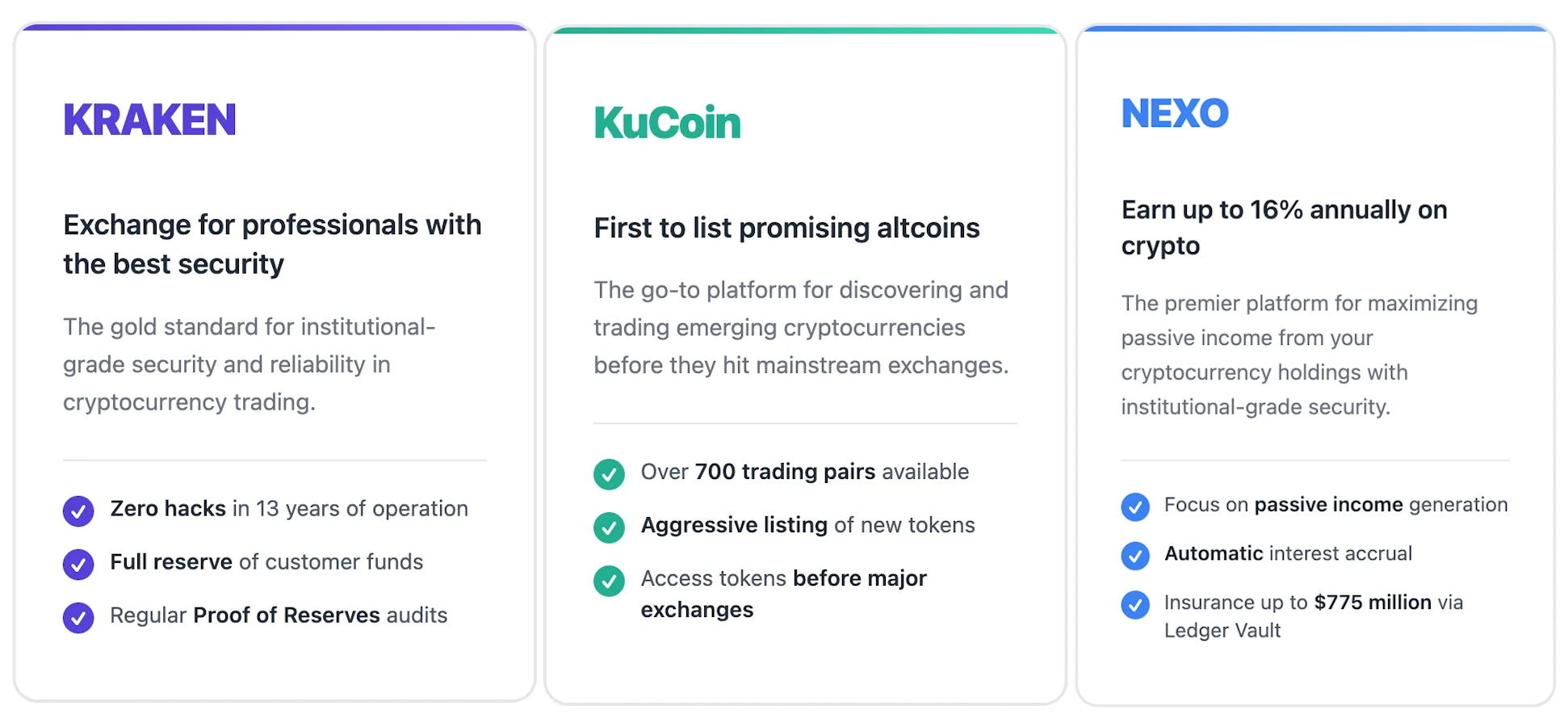

Examples of strong UVPs:

Setting Key Performance Indicators

Many exchanges focus on vanity metrics — such as the number of registrations or social media followers. However, 100,000 registered accounts, of which only 500 are active traders, don’t generate a profit. Critical KPIs: CAC (cost of acquiring a paying trader, norm $50-200), LTV (commissions over lifetime, target LTV/CAC > 3), average trading volume per user ($5,000-15,000 per month at top exchanges), Retention Rate at 30/60/90 days (good indicator: 40%/25%/15%). Without proper metrics, an exchange will burn budgets on a non-target audience.

Key Acquisition Channels

Content Marketing and SEO: Foundation of Trust

Content addresses the primary issue of the crypto industry — a lack of understanding. According to Coinbase data, 76% of people don’t buy cryptocurrency because they “don’t understand how it works”.

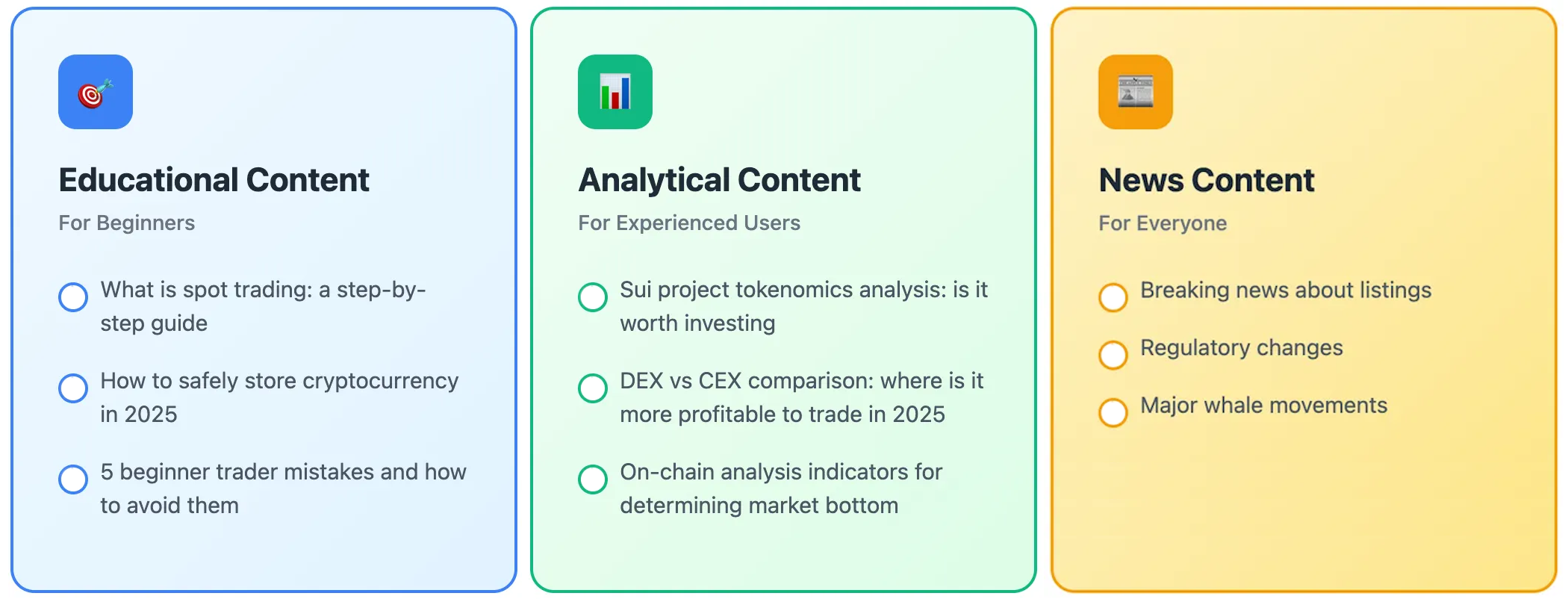

An effective content strategy includes three levels:

SEO optimisation is critical. Binance Academy receives 5 million organic visitors per month — this is a free acquisition channel worth $2-3 million when buying the same traffic through advertising.

Performance Marketing

Google Ads and Meta remain the main paid acquisition channels, despite restrictions for crypto projects. The key to success is proper segmentation and creatives.

What works:

- Remarketing to site visitors (ROI 300-500%)

- Look-alike audiences based on active traders

- Geo-targeting to countries with high crypto adoption (UAE, Singapore, Nigeria)

Alternative crypto advertising networks, such as Coinzilla or Bitmedia, show low effectiveness. CPM is 3-4 times higher than Google, traffic quality is worse, and targeting capabilities are limited. It makes sense to use them only for highly specialised campaigns.

Influencer Marketing

The difference between “shilling” and quality influencer marketing is in long-term value. When a blogger simply posts “Register on exchange X using my link”, this brings registrations but not active traders.

The right approach is a partnership with fixed payment plus KPIs on trading volume. The influencer receives, for example, $5,000 for integration, plus 10% of trading commissions from attracted users over a 6-month period. This motivates them not only to mention the exchange but also to create high-quality educational content.

Successful example: Bybit’s partnership with trader Crypto Banter. Instead of simple advertising, they conduct joint educational streams on technical analysis, where they naturally demonstrate the exchange’s functionality. Result — 50,000+ active traders per year.

Online Reputation Management: The Invisible Foundation of Growth

Reputation in the crypto industry is an asset that’s easy to lose and hard to restore. One hack, one scam listing, one story about blocked funds — and years of work are nullified.

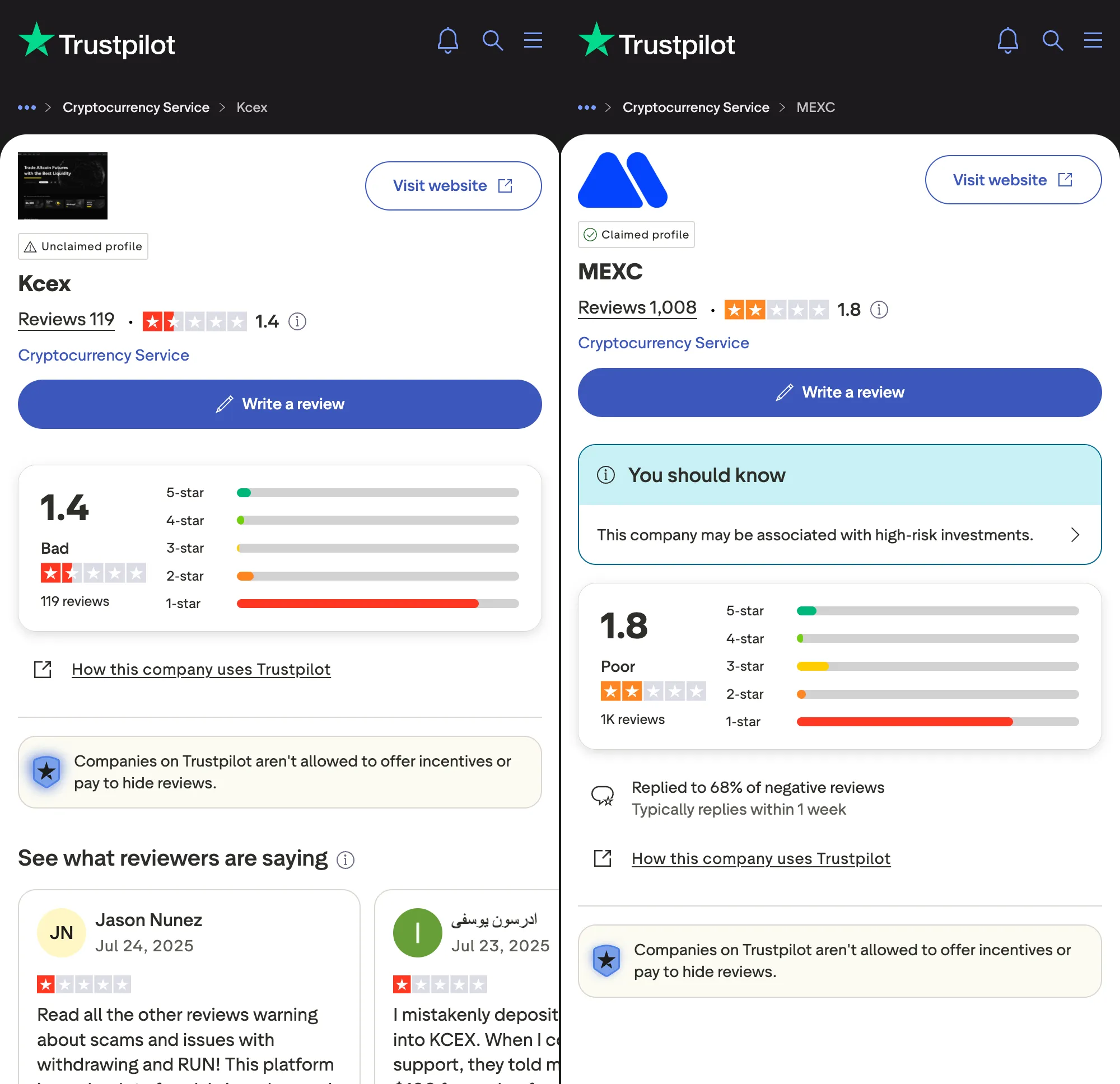

Look at exchange ratings on Trustpilot:

Reputation management strategy includes:

Proactive work:

- Mention monitoring through Brand24 or Mention

- Quick responses to negativity (within 2 hours)

- Public resolution of user problems

- Loyalty program for active community members

Reactive work:

- Crisis communications during technical failures

- Transparency in any incidents

- Compensation for affected users

In the crypto industry, negative reviews spread 10 times faster than positive ones. Investments in reputation are investments in long-term survival.

Conclusion: Integrated Approach — Key to Success

A successful cryptocurrency exchange marketing strategy is an integrated system where each element supports and reinforces the others. Content marketing creates organic traffic and builds trust. Performance marketing scales acquisition. Influencer marketing adds social proof. Reputation management protects against crises. Retention programs turn traders into brand advocates.

At the foundation of any successful exchange lies trust. Technology can be copied, interface can be redesigned, but trust is built over years and lost in minutes. The crypto industry will continue to consolidate. In 5 years, 50-100 significant exchanges will remain, down from the current 600. Those who now invest in building a sustainable brand with a loyal audience will survive.

Frequently Asked Questions (FAQ)

The most effective cryptocurrency exchange marketing strategies combine content marketing, performance advertising, and influencer partnerships with strong reputation management. Success requires targeting specific user segments rather than attempting to attract all crypto traders simultaneously.

A balanced crypto exchange strategy typically allocates 40% to content marketing and SEO, 35% to performance marketing, 15% to influencer partnerships, and 10% to reputation management. The exact distribution should align with your target audience and competitive positioning.

A successful digital asset trading platform differentiates through unique value propositions like specialized security features, exclusive token listings, or superior passive income opportunities. Companies like ICODA have shown that focusing on specific niches rather than competing directly with major exchanges often yields better results.

Cryptocurrency exchange marketing faces significant restrictions on major platforms like Google Ads and Meta, requiring creative approaches through crypto-specific networks and content marketing. Compliance costs can consume substantial marketing budgets, making organic traffic generation increasingly important.

Effective crypto exchange strategy content marketing uses a three-tier approach: educational content for beginners, analytical content for experienced traders, and timely news content for all users. This approach builds trust while addressing the industry’s core challenge of user education and understanding.

Rate the article