Six-Month Objectives

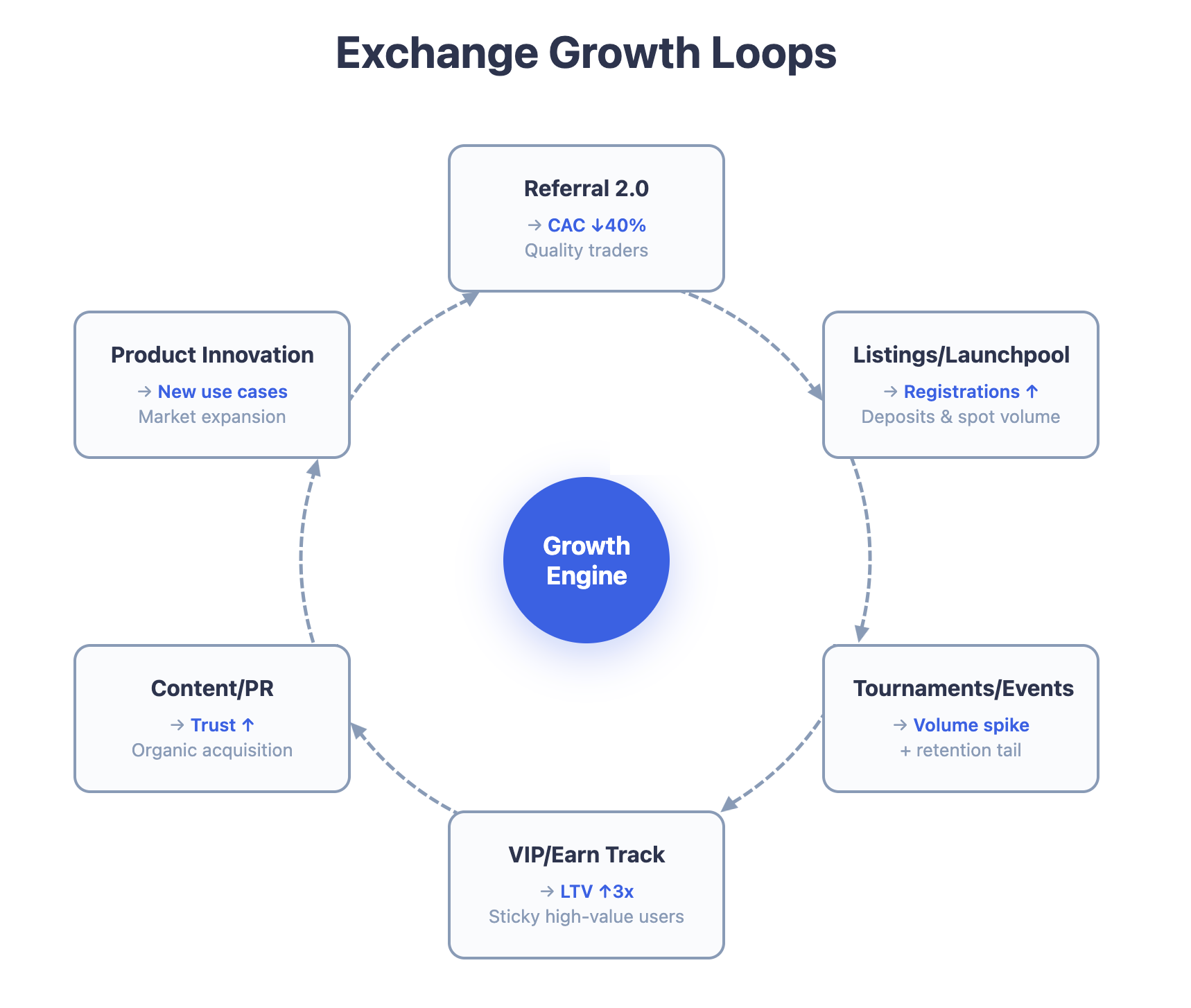

The primary objective is sustained trading-volume growth via three levers: acquiring quality traders, reactivating the existing base, and raising volume per user. In parallel, we optimize CAC and target LTV/CAC ≥ 3, expand the share of VIP clients, and stabilize retention (D30/D90). These goals reinforce each other: move one loop, and the others follow .

Quick Wins (First 30 Days)

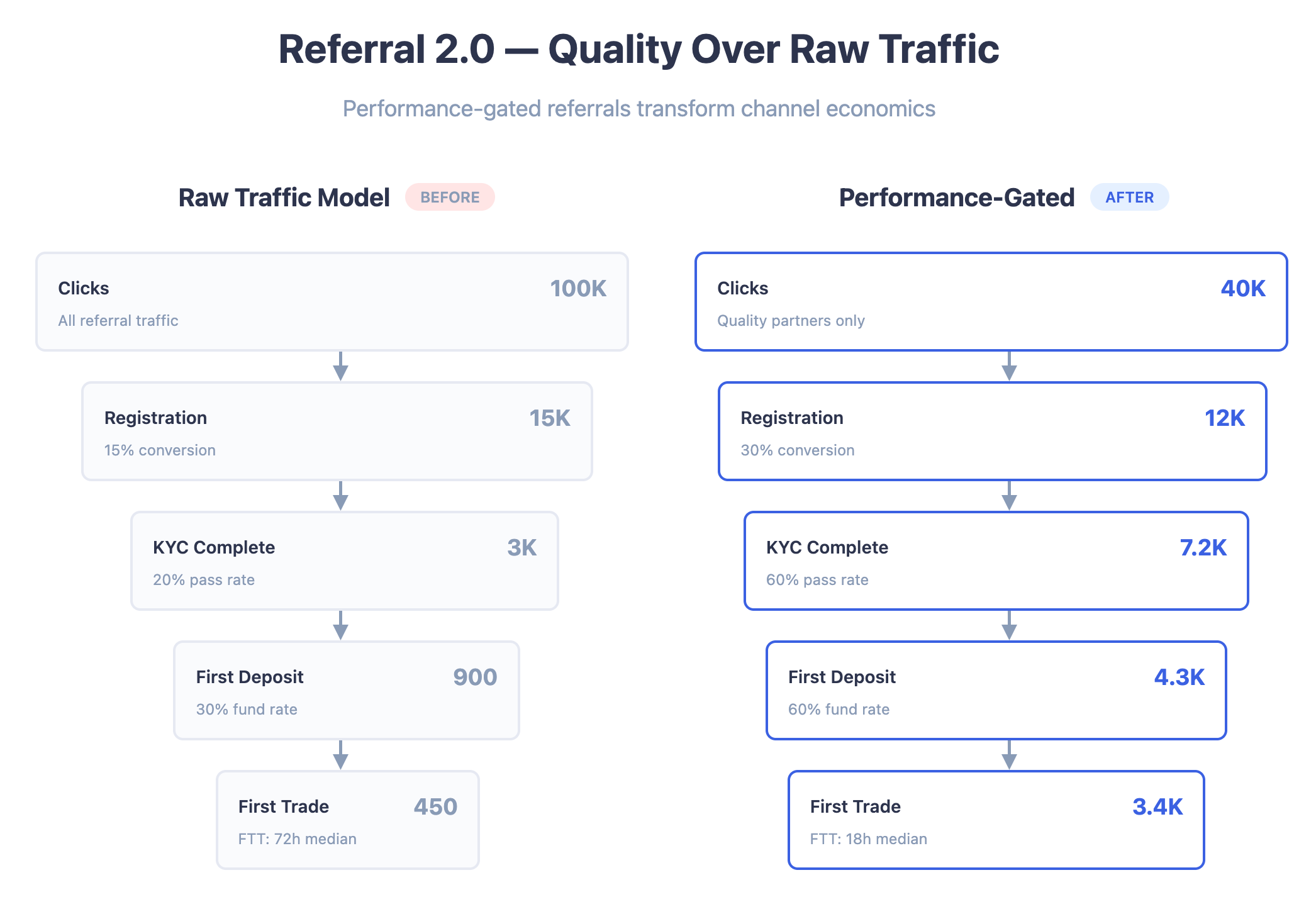

Start with precise mechanics. Strengthen your referral program for the active base for 60–90 days and add “quests”: reward delivered volume, not raw sign-ups. This aligns with Binance’s 2025 direction—referral/affiliate rewards up to 50% for top partners with performance gating—turning referrals into a controllable, ROI-positive channel rather than a lottery of spammy leads.

Run a win-back for dormant segments: KYC completed but no trades; funds deposited but no activity; inactive for 30/60/90 days. Combine emails/pushes/in-app banners with a hard deadline and a clear, short-window benefit: commission cashback, a bundle of zero-fee trades on 2–3 top pairs, priority allow-list access for the next listing. Measure FTT (First Trade Time) and remove friction in onboarding (deep link to a pair, order presets).

If you need liquidity fast, apply zero-fee pricing surgically, not platform-wide: pick 3–5 target pairs, gate perks by KYC and minimum turnover, and prepare a “bridge” into paid markets (personal recs, grace periods, fee bundles).

Systemic Growth (Days 30–90)

A VIP ladder should feel like an “escalator of privileges,” not just a fee table: lower fees for higher volume/balance, extra value for the native token (discounts + early access to listings/Launchpool/IEO), higher API limits, and mediated OTC. In 3–6 months, target ≥20% of total volume from VIPs.

Gamification and trading tournaments create repeatable volume spikes and a long “tail” of activity. In October 2024, Bybit’s WSOT ran for a month with tens of thousands of participants and multi-million USDT prizes. Even with a smaller purse, transparent PnL rules and public leaderboards consistently bring users back and deepen liquidity where you need it.

A conveyor of listings/Launchpool must run on rhythm. In 2024 Binance sequenced launches (PIXEL in Feb, ENA/Ethena in Apr, NOT/Notcoin in May, etc.). The cadence produces repeatable peaks in registrations, deposits, and spot volume, which then spill into derivatives and Earn. Retention comes not from a single “blast,” but from repeatability and clear benefits to holders of your “glue” token (discounts, priority, pool participation).

Scaling (Days 90–180)

Treat localization as a full experience, not just translation: local funding/withdrawal rails, support in-language, local KOLs, and listings of locally relevant tokens. In mature markets, pair a cultural message with high-quality production—like Coinbase’s 2025 UK campaign “Everything Is Fine”—and immediately catch the spike with performance funnels and short KYC flows (localized landing pages, fast deposit options).

Use product as marketing. On April 24, 2025, Coinbase and PayPal zeroed fees for PYUSD and added direct USD redemption in-app—activating payment use-cases, attracting new cohorts (merchants/payers), and generating stablecoin volume.

Create seasonal community frames. In 2024–2025, Coinbase/Base ran Onchain Summer—a series of hackathons and daily on-chain activities with a sizable prize pool—stretching attention across months, lowering CAC, and boosting retention.

Detailed 2024–2025 Cases

Binance: Performance-Gated Referrals + Launchpool Cadence

In summer 2025, Binance announced an upgraded referral/affiliate model: up to 50% commission for top partners, automated performance evaluation, and removal of caps—all tied to traffic quality and actual traded volume, not raw sign-ups. In 2024, Binance kept a steady Launchpool tempo (PIXEL in Feb, ENA in Apr, NOT in May, etc.) and promoted Megadrop as a new “airdrop with utility” format combining Simple Earn and its Web3 wallet.

What to adapt: roll out “Referral 2.0” with volume/quality-based tiers (KYC, FTT, volume per active), keep a predictable release cadence (pools/listings), and explain benefits to holders of your native “glue” token.

Bybit: Flagship Seasons + Frequent Niche Activations

WSOT 2024 ran all October; final comms cited tens of thousands of entrants and record-level prize pools. Effect: a surge in registrations and volume during the event, plus a “tail” if you immediately segue participants into mini-challenges and convert them into VIP/derivs/Earn. In 2025 Bybit added frequent niche events—e.g., an ETH competition for Ethereum’s 10th anniversary (100k USDT purse) and an xStocks promo (tokenized stocks/ETFs) with 150k USDT. Small, sharp stories target liquidity gaps, holding attention between WSOT/Grand Prix seasons.

Coinbase: Big Brand Hit + Product Incentives + Seasonal Frame

In the UK (summer 2025), Coinbase launched the musical-satirical “Everything Is Fine” (Mother London; director Steve Rogers)—its first major brand push in that market (video, OOH, social). Such “cultural capital” must be caught by performance nets and fast onboarding to convert awareness into installs, deposits, and trades. On April 24, 2025, Coinbase and PayPal zero-fee’d PYUSD with direct USD redemption—changing the economics of the stablecoin entry route. Meanwhile, Onchain Summer (2024–2025) cemented organic growth with daily activities, grants, prizes, and a public on-chain showcase.

Content, PR, and Trust

Content should serve conversion and retention, not “fill the blog”: short explainers of real user flows (“how to deposit/withdraw,” “API trading in 10 minutes,” “futures risk management”), honest fee/spread comparisons, and regular security reports (including Proof of Reserves and incident post-mortems). Plan PR in waves tied to product events (tournaments, listings, partnerships) and localize by market (media, KOLs, language). This lowers CAC and raises trust where users decide where to trade.

Control Metrics

Keep a single control panel: CAC (by channel/region), KYC conversion, FTT, Retention D30/D90, VIP-share of volume, MAU/DAU, and volume per active trader. Prioritize mechanics that move multiple metrics at once (tournaments → volume + retention; Launchpool → registrations + deposits + spot; VIP ladder → LTV and high-margin volume share).

Conclusion: What to Watch, What You Gain

Focus on repeatable growth loops, not one-off blasts: performance-gated referrals, seasonal tournaments plus mini-events, a conveyor of Launchpool/listings, and the VIP/Earn track. These loops reinforce each other—the same user passes through several arcs and raises both volume and LTV at each step.

Put transparency at the center: Proof of Reserves, plain-English post-mortems, and clear terms reduce churn and increase conversion from interest to deposit. In mature markets, add a localized cultural message (as Coinbase did in the UK) and back it with ready-to-run onboarding and payment rails.

Executed consistently, this plan yields: sustained growth in total trading volume and volume per user; better acquisition economics (lower CAC, higher LTV via VIP and repeatable events); stronger retention (D30/D90) through events and product incentives; a higher VIP share of volume and more predictable revenue; and increased brand trust through transparency and steady communication.

Frequently Asked Questions (FAQ)

Crypto marketing refers to the strategies and tactics used to attract, retain, and engage users of blockchain-based products like crypto exchanges, wallets, or tokens—focusing on metrics like trading volume, user retention, and acquisition cost.

Referral optimization is the process of improving a referral or affiliate program by focusing on high-quality leads, traded volume, and performance-based rewards instead of just sign-ups.

Manage your referral program by implementing quality-based tiers (e.g., based on KYC, volume, FTT), tracking ROI, and regularly refreshing incentives to keep participants engaged.

A well-structured referral program can deliver high ROI if it aligns rewards with actual user behavior like volume traded or first trade time, reducing CAC while increasing LTV.

Promote your referral program through in-app banners, email campaigns, influencer partnerships, and “quests” that reward meaningful actions like completed trades or verified KYC.

Rate the article