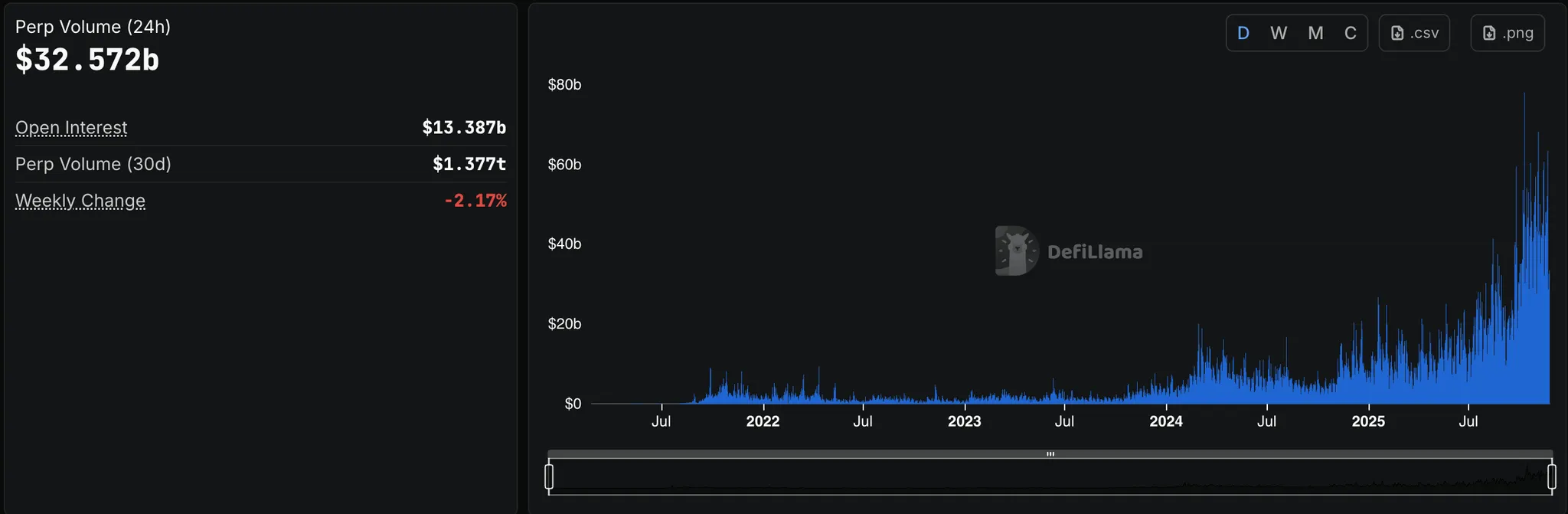

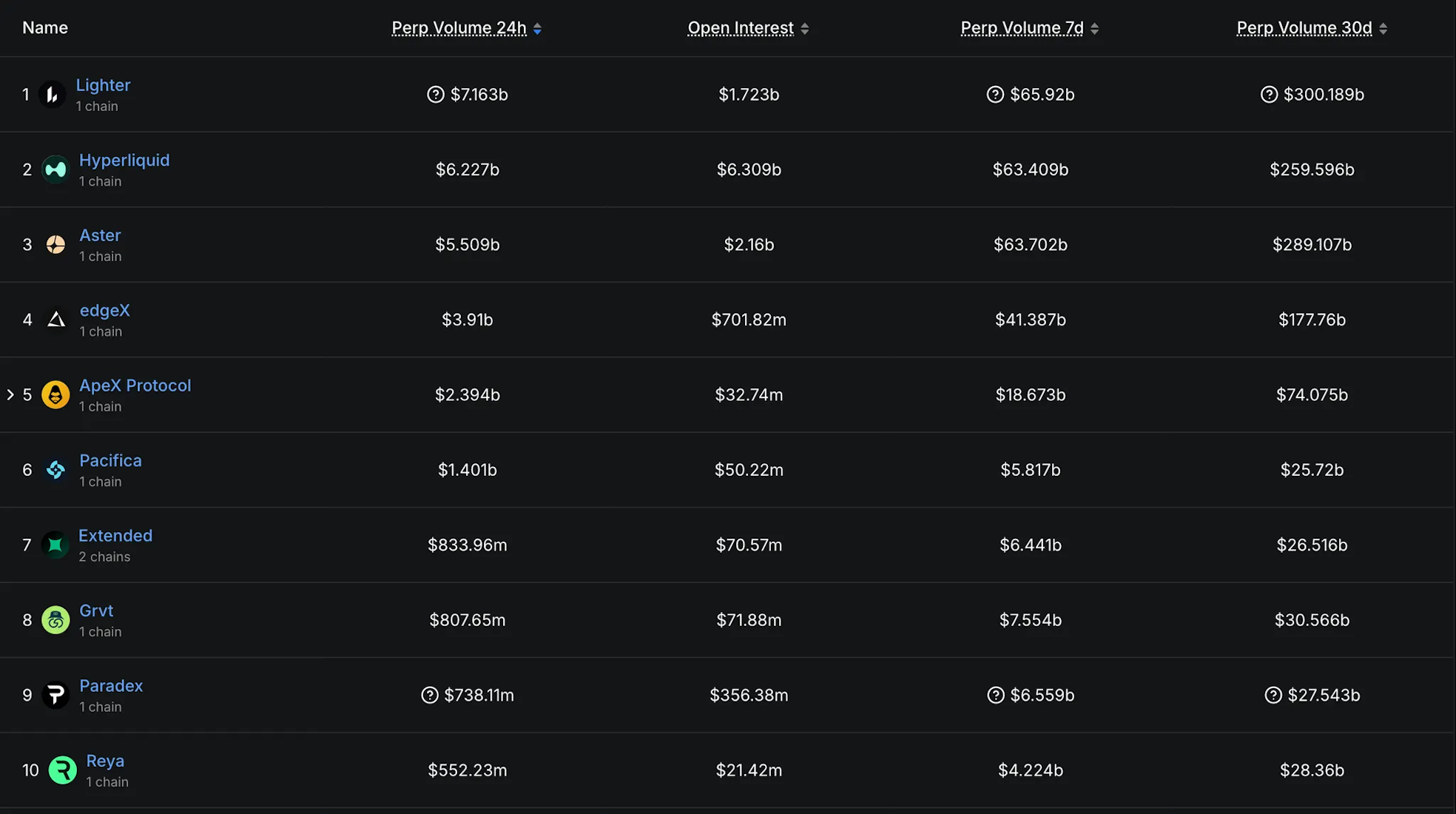

The perpetual DEX market is projected to exceed $X billion in 2026, with platforms competing for trader attention in an increasingly crowded space. This guide reveals the marketing tactics that separate successful Perp DEXs from failed launches, based on data from Hyperliquid, Lighter, and other leading platforms.

Brief Overview of Perp DEX and How It Differs From Classic DEX

Perp DEX (Perpetual Decentralized Exchange) is a decentralized exchange where traders can trade perpetual futures with leverage on cryptocurrencies directly through smart contracts:

- All operations occur in a decentralized manner: traders manage their positions and deposits through their own wallets, with no intermediaries or controlling entities.

- Leverage trading is available (e.g., 10x, 20x), amplifying both profit potential and risks.

- Liquidity is provided by participant pools (LPs) or AMM algorithms. The protocol automatically finds counterparties to execute trades quickly and transparently.

- When a trader exceeds risk limits (a position goes negative beyond available collateral), the protocol automatically liquidates the trade, covering losses from margin or the liquidation fund.

- Positions can be held for a year or longer, as long as margin requirements are met. This distinguishes perpetual contracts from traditional futures.

- The market is highly volatile. Holding Bitcoin for 6 months might be boring, but trading altcoins with 50x leverage is exciting (though essentially gambling).

Perp DEX vs Traditional Exchanges

Perp DEX vs CEX

| Metric | Perp DEX | CEX |

|---|---|---|

| Control | Users control funds through their wallet | Exchange holds your deposits |

| Transparency | All data is available on-chain, operations are visible to everyone | Actions and volumes are often opaque |

| Control | No intermediaries, trades executed via smart contracts | Exchange can restrict or freeze funds |

| Reliability | Won’t go bankrupt or run away with user funds | Bankruptcy risks, scam potential |

| Corruption/Risk | Protocol risks and exploits, code vulnerabilities | Human factor risks, loss of funds, fraud |

| Fees | Usually lower, minimal gas fees or none | Standard/hidden fees, sometimes high |

| 11.10.2025 | No red flags (Moderate ADL) | Red flags (Binance was down) |

Most Popular Perp DEXs

Check a detailed comparison of the top 10 platforms: https://icoda.io/blog/perpetual-dex-platforms/

Why Perp DEXs Are Growing and Will Continue to Dominate:

- Advanced Trading Tools: Traders demand leverage, hedging, and complex strategies—all executable on-chain without intermediaries.

- True Ownership: Non-custodial architecture means users control their assets with no KYC friction or geographic restrictions.

- Aggressive Incentives: Airdrops, point farming, and gamified rewards drive rapid user acquisition and liquidity growth.

- Performance Breakthrough: Layer 2s and appchains now deliver CEX-level speed and cost, making on-chain derivatives genuinely competitive.

- Asset Diversity: Perp DEXs list long-tail tokens and synthetic assets faster than centralized exchanges, expanding market opportunities.

- Regulatory Edge: As compliance pressures mount on CEXs, traders migrate to permissionless platforms for privacy and flexibility.

- Community Ownership: Governance participation and token incentives create loyal users who actively promote the protocol.

- Degen Culture: High-risk traders fuel viral growth through social engagement, competitions, and yield chasing.

Airdrops and Point Farming: The Engine Behind Perp DEX Growth

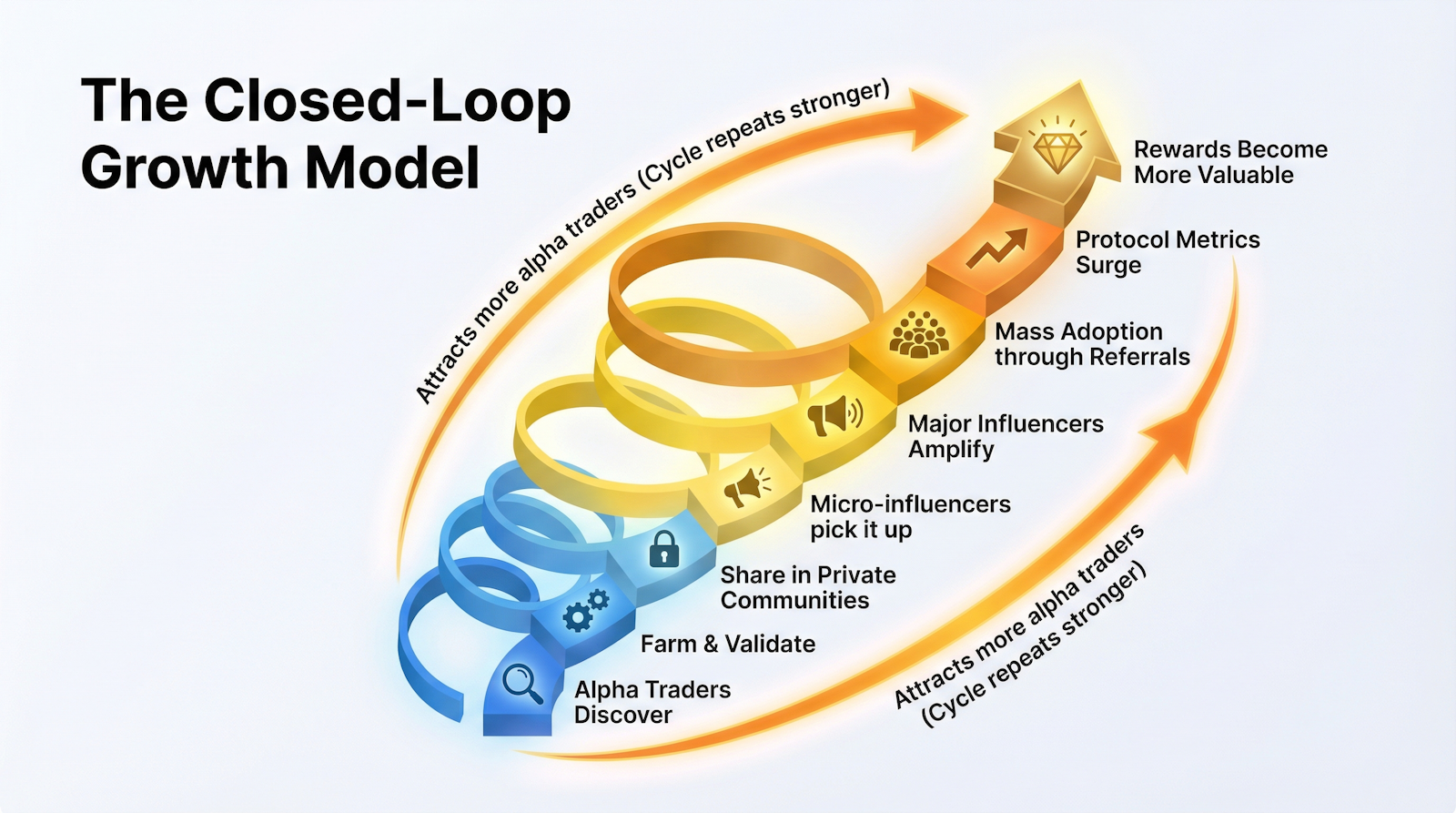

Airdrops and point-farming systems have become the backbone of perpetual DEX growth but these aren’t your standard token giveaways. The best Perp DEXs have transformed airdrops into sophisticated growth engines that work on a closed-loop principle: smart users discover the opportunity, validate it, share it within their circles, and create a self-reinforcing cycle that attracts increasingly larger waves of participants.

The Closed-Loop Growth Model

What makes Perp DEX airdrops different is their closed-loop structure. Unlike typical token launches that spam ads hoping to catch retail investors, successful perpetual platforms build tight ecosystems where each group of participants naturally leads to the next:

Alpha traders discover opportunity → Farm and validate → Share in private communities → Micro-influencers pick it up → Major influencers amplify → Mass adoption through referrals → Protocol metrics surge → Rewards become more valuable → Attracts more alpha traders → Cycle repeats stronger

This closed-loop approach ensures growth starts with informed, high-quality users rather than random speculators. The system naturally filters people: only those willing to put in real capital, time, and strategic thinking can farm effectively. You end up with engaged traders, not just passive token holders hoping for pumps.

How It Actually Works

The core idea is simple: experienced traders spot a promising new protocol like Hyperliquid/Lighter/Aster by analyzing the tech, team, and early buzz. Their bet: if I trade actively, provide liquidity, and engage with governance now, I’ll get rewarded massively when the token drops.

But the execution has become far more competitive and layered. Here’s how it unfolds:

Alpha Circles Discover First

Everything starts with the “smart money”—people who track on-chain data, read between the lines of developer tweets, and spot opportunities before they go mainstream. These traders hang out in exclusive Telegram groups and private Discord servers where they share analysis and farming strategies.

When a credible project like Hyperliquid emerges, alpha traders move quickly. Often months before any token announcement, they quietly farm points and test the platform. Their goal: figure out the optimal strategy before the masses arrive.

Word Spreads Within Informed Communities

As alpha farmers rack up volume and provide liquidity, they start talking. On-chain analysts, small influencers, and community leaders validate the protocol through their own research, then share it in targeted spaces—crypto newsletters, technical Twitter threads, educational content.

This creates controlled awareness among people who actually understand derivatives, can evaluate smart contract risks, and have capital to participate meaningfully. Not normies, but informed degens.

Influencers Amplify to Broader Audiences

Mid-tier and major crypto influencers spot the trend through hard data: TVL climbing, wallet activity spiking, Discord getting active. They create accessible content—YouTube explainers, Twitter threads, comparison guides—and push it to their larger followings.

This is when projects like Lighter or Aster see massive user influx, as thousands rush in to start farming, hoping to qualify for the eventual airdrop.

Referral Programs Create Viral Loops

Once there’s momentum, protocols launch referral campaigns. Users get bonus points for bringing friends. Influencers blast their referral codes and create entire content series on “how to maximize your airdrop.”

This triggers exponential growth: more users → more social proof → more FOMO → even higher trading volume and liquidity → stronger network effects.

Hardcore Optimization Phase

As the program matures, serious players and even bot operators join the game. They use advanced tactics: multiple wallets, coordinated trading teams, custom scripts analyzing hidden eligibility requirements discovered through on-chain detective work.

The most dedicated farmers aren’t chasing scraps—they’re competing for leaderboard spots, multiplier tiers, and VIP allocations that could be worth hundreds of thousands or even millions.

The Protocol Benefits Massively

Every new user, tweet, and referral boosts the protocol’s core metrics: liquidity depth, trading volume, fees generated. The cycle feeds itself:

More buzz → More users → Higher TVL → More credibility → Higher expected token value → Even more buzz

Real Examples: What Actually Worked

🟢 Hyperliquid nailed the long game. They ran point-farming seasons for months without promising anything concrete about tokens. Early adopters (“OGs”) farmed consistently, shared strategies in closed groups, and built real conviction in the platform. When the airdrop finally hit, 31% of total supply—it went to actual traders, not airdrop mercenaries. Result: a loyal, high-value community that kept trading after launch.

⚫ Lighter went aggressive with gamification: daily quests, volume multipliers, competitive leaderboards. This sparked massive organic activity and created a whole “meta” around farming optimization—guides, analysis threads, team strategies.

🟡 Aster (backed by Binance CEO CZ) connected testnet participation, governance voting, and trading milestones to future airdrop eligibility, while keeping the exact formula vague. This fueled constant speculation, community detective work, and sustained engagement, people stayed active because they never knew exactly what would count.

Why This Actually Works

These airdrops succeed because they filter for quality users:

- Real capital needed: You can’t fake leveraged trading or LP provision

- Time commitment: Months of consistent activity, not one-off tricks

- Actual skill: Understanding perps, managing risk, optimizing strategy

- Community involvement: Active in Discord, voting on governance, giving feedback

This attracts degens and smart traders—people who understand DeFi, can judge protocol quality, and stick around because they’re actually there to trade, not just flip tokens.

What This Means for Perp DEXs Marketing

For teams building Perp DEXs, airdrops can’t be a standalone gimmick. They need to be part of a real, deep growth strategy:

- Build alpha communities early: Create exclusive channels, drop strategic hints, engage directly with power users

- Make the product genuinely good during farming: Competitive fees, unique trading pairs, smooth UX

- Design anti-bot systems: Reward real traders over sock puppets and farming scripts

- Add smart gamification: Leaderboards, achievements, social recognition

- Plan for after the token drops: Staking, governance, ongoing rewards that keep people engaged

The Self-Reinforcing Engine

Here’s the full loop in action:

Smart traders find it → Validate and share in private groups → Small influencers amplify → Big influencers broadcast → Mass market joins via referrals → Protocol metrics explode → Rewards get more valuable → Attracts even more smart traders → Cycle intensifies

Users go from passive participants to serious players in an ongoing game—constantly optimizing, sharing insights, and keeping the protocol at the center of crypto conversation.

ICODA’s Marketing Solutions for Perp DEXs

SMM & Community Building

A strong, authentic social media presence is the backbone of any successful web3 project. Our team specializes in:

- Launching and nurturing vibrant communities on Discord, Telegram, Twitter/X, and emerging platforms favored by power users (“smart and degens”).

- Building engagement loops: regular AMA sessions, trading competitions, meme contests, and collaborative threads that encourage conversations beyond just price action.

- Designing visually appealing, informative feeds and channels that inspire trust—one of the first things advanced users look for is if the team is transparent, safe, and open to feedback.

- Managing rapid responses to questions, FUD, and technical issues—keeping the community feeling heard and empowered.

- Helping set up governance frameworks, moderating votes, and pushing user-driven decisions to the front, so your Perp DEX becomes known for genuine participation and user agency.

KOLs & Influencer Integrations

Viral traction in web3 starts with the right voices. ICODA can orchestrate:

- Targeted campaigns with top-tier KOLs (“Key Opinion Leaders”): crypto Twitter personalities, Telegram alpha sources, YouTube traders, and niche Discord admins who drive real DeFi adoption.

- Coordinated waves of shoutouts, reviews, and “first-look” integrations so your DEX gets relevant, trusted exposure—this isn’t shallow shilling, but thoughtful breakdowns, strategy guides, challenge events, and feature spotlights.

- Ambassador programs to attract long-term creators and educators, not just paid promoters.

- Multi-language coverage, reaching key Asian, European, and US trading communities.

- Viral “chain reactions”—KOLs amplify early wins (leaderboards, point farming, new partnerships), sparking organic excitement and network effect that brings in elite users.

PR & Brand Awareness

Thousands of users want to try Perp DEXs but don’t know which platform fits their needs—or which is legit. ICODA delivers:

- Strategic PR in top crypto media outlets, explaining your protocol’s unique strengths, security audits, and points of differentiation (fees, supported assets, innovation).

- Comparative reviews and explainer articles that cut through the noise—helping traders and liquidity providers make informed decisions, not just follow hype.

- Coordinated launches of educational campaigns, “how-to” guides, and event recaps, ensuring your Perp DEX is always present in the conversations that matter.

- Creation of branded infographics, protocol “battle cards,” and visual comparisons against legacy competitors, making your strengths both clear and memorable.

- Crisis management and reputation optimization: in fast-moving DeFi, trust can be fragile. We help navigate issues, respond proactively, and maintain a positive image with advanced users.

Frequently Asked Questions (FAQ)

Marketing budgets vary significantly based on launch scope, target audience, and competition. Costs include KOL partnerships, community management, airdrop incentives, PR campaigns, and ongoing engagement. For accurate pricing tailored to your project’s specific needs, use ICODA’s campaign cost calculator to estimate your launch investment.

Yes, but execution has evolved dramatically. Generic airdrops fail; sophisticated point-farming systems with anti-bot mechanisms, volume multipliers, and long-term engagement requirements succeed. Hyperliquid’s 31% token allocation to active traders proves that well-designed airdrops remain the most effective user acquisition strategy when combined with genuine product quality.

Expect 3-6 months for a comprehensive launch. This includes 4-8 weeks pre-launch for community building, alpha testing, and KOL seeding, followed by 2-3 months of airdrop farming seasons, then ongoing post-launch optimization. Rushing launches without proper community foundation consistently leads to poor adoption and retention rates.

Launching without an engaged community first. Many protocols prioritize technical development but neglect early user cultivation. Starting airdrop campaigns too late, choosing low-quality KOLs for quick reach, or copying competitor strategies without differentiation consistently leads to failed launches. Community trust precedes trading volume.

Focus on differentiation: unique trading pairs, lower fees, better UX, or specific geographic/community niches. Offer superior airdrop terms, faster customer support, and exclusive features competitors lack. Partner with mid-tier influencers for authentic endorsements rather than competing for top-tier KOLs. Build genuine relationships, not just transaction counts.

Track Total Value Locked (TVL) growth, daily active wallets, trading volume trajectory, community engagement rates (Discord/Telegram activity), organic social mentions, and user retention beyond airdrop periods. Successful campaigns show 40%+ month-over-month growth in active traders and 60%+ retention rates post-airdrop.

Agencies provide immediate crypto-native expertise, established KOL networks, and proven frameworks—critical for time-sensitive launches. In-house teams offer deeper product knowledge but require 3-6 months to build connections. Hybrid approach works best: agency for launch intensity, internal team for long-term community management and strategic direction.

Rate the article