Code Is Law, DeFi Audit Is Constitutional Review

In the world of decentralized finance, code becomes indisputable law, and transactions are irreversible. The most brilliant protocol can collapse overnight due to a single vulnerability. The first half of 2025 has been catastrophic for the crypto industry: $2.17 billion was stolen from blockchain platforms, already exceeding the total losses for all of 2024.

A DeFi security audit is not a technical formality. It’s a fundamental risk management process that validates the legitimacy of your digital law and protects the scarcest resource in Web3 — user and investor trust. Every successful DeFi project today recognizes that a comprehensive DeFi audit serves as both a security measure and a competitive advantage.

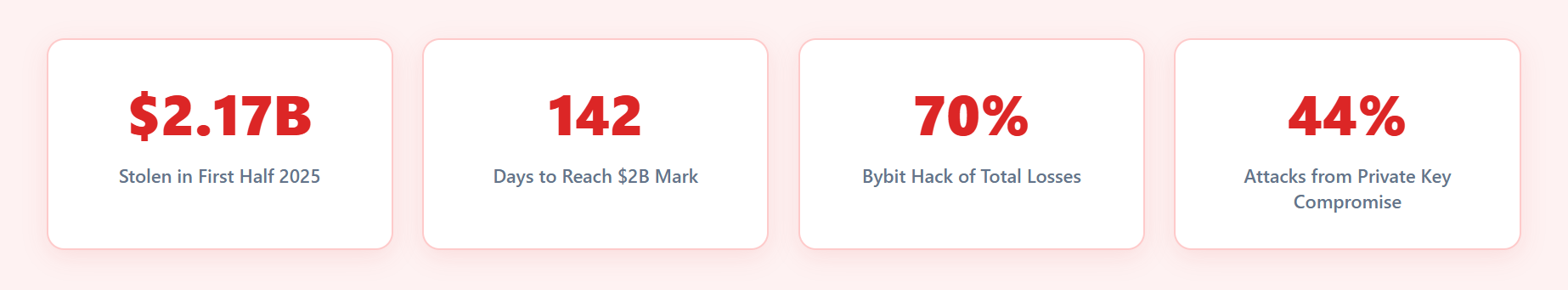

The Scale of the Problem in 2025 Numbers

The statistics paint an alarming picture for why DeFi security audit services have become essential:

- $2.17 billion stolen in the first half of 2025

- 142 days needed to reach the $2 billion mark (compared to 214 days in 2022)

- Bybit hack for $1.5 billion comprised 70% of all losses

- Private key compromise — the cause of 44% of all thefts

For founders, this means a fundamental shift in risk assessment. Risk has become ecosystem-wide — a vulnerability in one protocol can trigger a cascading effect across all of DeFi. This reality makes professional DeFi audit services more critical than ever.

Trust Economics: Why DeFi Audit Is a Business Necessity

Anatomy of Business Damage from Exploits

Direct losses are just the tip of the iceberg. Indirect costs are often more devastating, which is precisely why smart contract DeFi security audit has become a standard business practice:

Immediate consequences:

- Instant loss of user funds

- Panic selling of native token (50-95% drops)

- Mass liquidity exodus from the protocol

Long-term damage:

- Reputational losses (users don’t return)

- Loss of institutional investor confidence

- Legal risks and regulatory scrutiny

- Inability to raise new capital

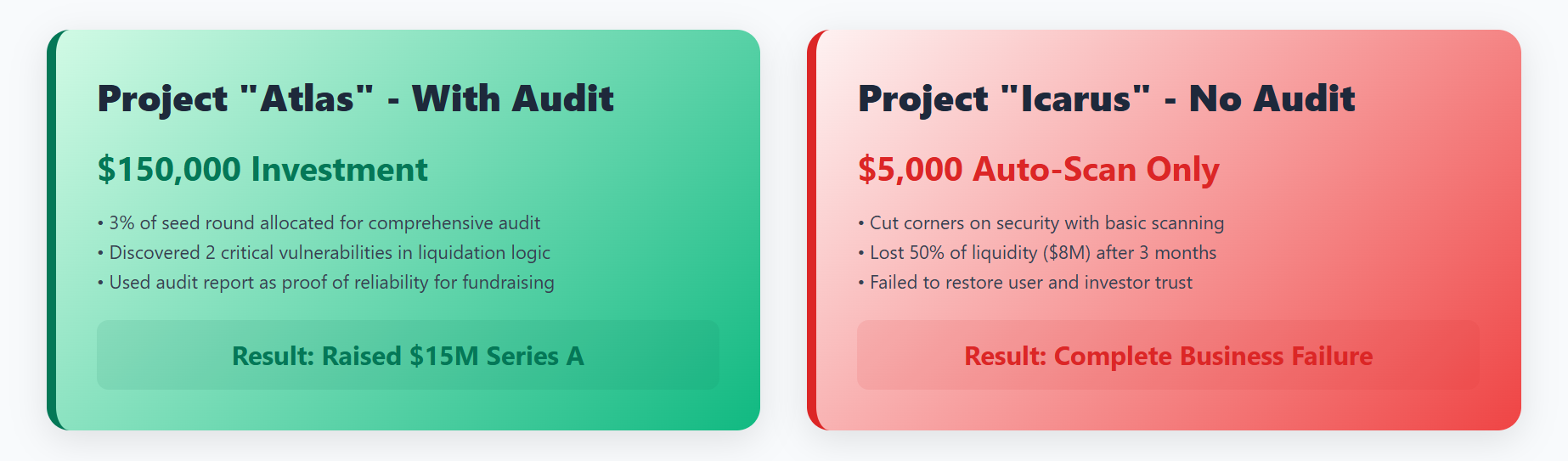

Case Study: “Atlas” vs. “Icarus” Projects

Project “Atlas” – The Power of Professional DeFi Security Audit:

- Allocated $150,000 (3% of seed round) for comprehensive DeFi audit

- Discovered 2 critical vulnerabilities in liquidation logic

- Raised $15M in Series A, using DeFi security audit report as proof of reliability

Project “Icarus” – The Cost of Skipping DeFi Audit:

- Cut corners on security, limited to auto-scanning for $5,000

- Lost 50% of liquidity ($8M) after 3 months due to exploit

- Failed to restore trust and ceased operations

Conclusion: Saving $145,000 on DeFi audit cost the project $8M in direct losses and complete business failure.

Anatomy of Professional Smart Contract DeFi Security Audit

Understanding the DeFi audit process is critical for effective collaboration with audit firms and evaluating service quality.

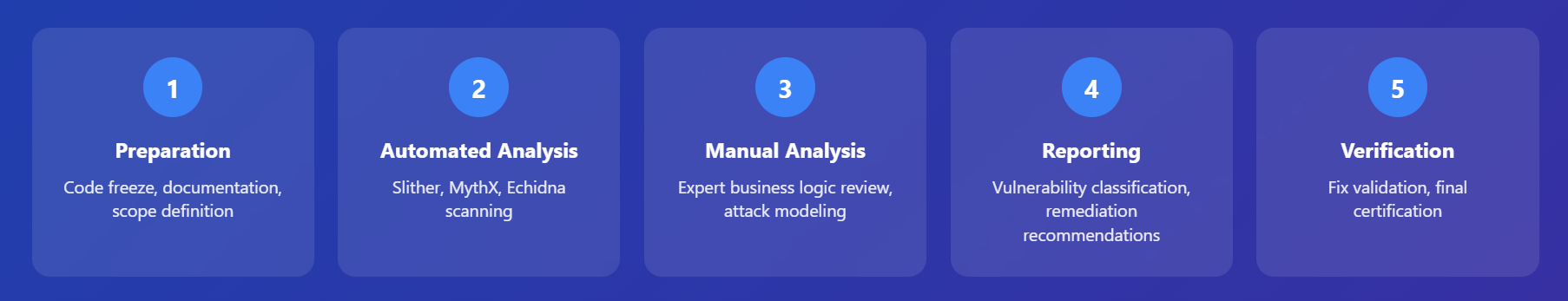

Stage 1: DeFi Audit Preparation and Code Freeze

Analogy: Submitting final building blueprints for government inspection.

Key actions for successful DeFi security audit:

- Providing final version of smart contracts

- Code freeze — no changes during DeFi audit

- Submitting technical documentation and specifications

- Defining scope and timelines

Stage 2: Automated Analysis in DeFi Audit Process

Analogy: Checking a building with thermal imaging for heat leaks.

- Tools used in modern DeFi security audit: Slither, MythX, Echidna

- Purpose: Quick identification of common vulnerabilities

- Limitations: Cannot find logic errors and complex attack vectors

Stage 3: Manual Expert Analysis – Core of DeFi Audit

Analogy: Experienced structural engineer checking foundation and load-bearing structures.

DeFi security audit analysis focus:

- Protocol business logic analysis

- Attack scenario modeling

- Economic incentive verification

- Extreme condition behavior testing

- External protocol interaction analysis

Stage 4: DeFi Audit Reporting

Professional DeFi security audit report structure:

- Executive Summary for management

- Vulnerability classification (Critical/High/Medium/Low)

- Detailed attack vector descriptions

- Specific remediation recommendations

- General production readiness conclusions

Stage 5: DeFi Audit Remediation and Verification

Process:

- Developer team fixes vulnerabilities

- Re-verification of critical changes

- Confirmation of proper fixes

- Final DeFi security audit certificate issuance

Top DeFi Vulnerabilities in Business Terms – Why DeFi Audit Matters

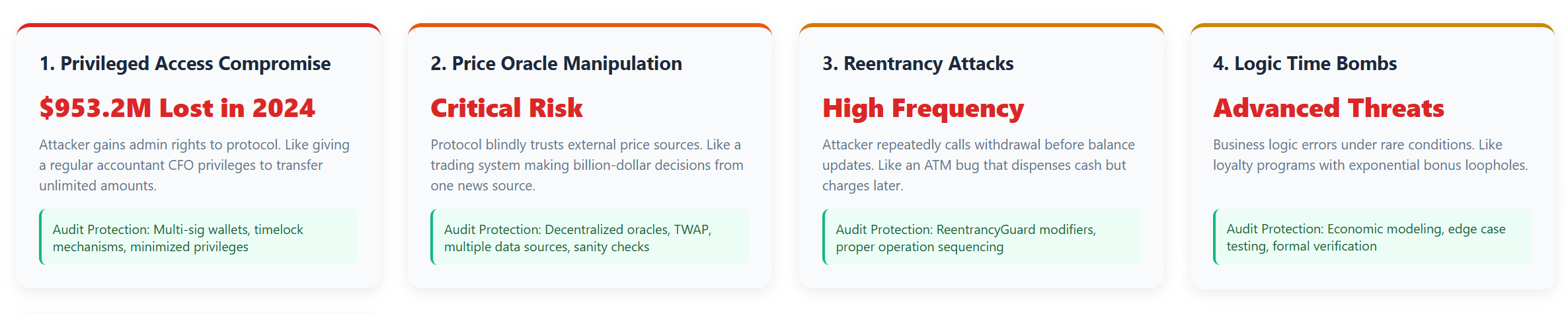

1. Privileged Access Compromise — $953.2M Lost in 2024

Risk essence: Attacker gains admin rights in your protocol.

Business analogy: Regular accountant suddenly gets CFO privileges and can transfer any amounts.

Why DeFi security audit catches this: Professional DeFi audit teams systematically review access controls and privilege escalation paths.

Consequences without proper DeFi audit:

- Instant loss of all protocol funds

- Ability to change critical parameters

- Complete operation shutdown

Protection identified in DeFi security audit:

- Multi-signature wallets

- Timelock mechanisms for critical actions

- Minimized administrative privileges

2. Price Oracle Manipulation – Critical DeFi Audit Focus

Risk essence: Protocol “blindly trusts” external price sources.

Business analogy: Trading system makes billion-dollar decisions based on one news agency’s data.

How DeFi audit prevents this: Experienced DeFi security audit teams test oracle integration under various market conditions.

Attack mechanism:

- Flash loan to distort DEX price

- Protocol receives false data

- Attacker extracts arbitrage profit

DeFi audit recommended protection:

- Decentralized oracles (Chainlink)

- Time-weighted average price (TWAP)

- Multiple data sources

- Sanity checks for anomalous deviations

3. Reentrancy Attacks — “Double Withdrawal”

Risk essence: Attacker repeatedly calls withdrawal function before balance update.

Business analogy: ATM with bug that dispenses cash but charges account later.

Why DeFi security audit is essential: Professional DeFi audit includes systematic reentrancy testing across all contract functions.

Consequences:

- Cyclical contract draining

- Loss of all liquidity in one transaction

DeFi audit protection measures:

- ReentrancyGuard modifiers

- Checks-Effects-Interactions pattern

- Proper operation sequencing

4. Logic Time Bombs – Advanced DeFi Audit Detection

Risk essence: Business logic errors manifesting under rare conditions.

Business analogy: Loyalty program with loophole giving exponential bonuses under specific combinations.

How comprehensive DeFi security audit helps: Advanced DeFi audit includes economic modeling and edge case testing.

Examples:

- Interest calculation formula errors

- Incorrect rebalancing mechanisms

- Tokenomics vulnerabilities

DeFi audit protection methods:

- Thorough protocol economics modeling

- Stress testing under extreme conditions

- Formal verification of critical logic

How to Choose a DeFi Audit Partner

DeFi Security Audit Provider Evaluation Matrix

| Criteria | What to Look For in DeFi Audit | Key Questions | Importance |

|---|---|---|---|

| DeFi Audit Experience | Public reports for similar projects | “Tell us about the most complex vulnerability found in our protocol type” | High |

| Analysis Depth | >70% manual analysis in DeFi security audit proposal | “How many person-hours allocated for manual business logic analysis?” | High |

| DeFi Audit Report Quality | Anonymous example with clear classification | “Can you provide a DeFi audit report sample for structure evaluation?” | High |

| Methodology | Detailed DeFi security audit process description | “How is communication structured with the dev team?” | Medium |

| Support | DeFi audit remediation verification included | “Is fix verification included in the cost?” | Medium |

Red Flags When Choosing DeFi Audit Companies

Avoid DeFi security audit companies that:

- Promise DeFi audit results “by tomorrow”

- Guarantee 100% security after DeFi audit

- Work only with automated scanners for DeFi security audit

- Won’t provide DeFi audit report examples

- Demand 100% upfront payment for DeFi audit

- Refuse technical meetings with team

DeFi Security Audit Market Pricing Guidelines

$10,000-$20,000

$30,000-$75,000

$75,000-$150,000+

$100,000+

Remember: Cheap DeFi audit is the most expensive lesson in DeFi.

Conclusion: DeFi Audit as Demonstration of Strength

In an ecosystem where trust is the most valuable resource, DeFi security audit becomes a market statement about the seriousness of your intentions. Projects with professional DeFi audit attract 300-500% more TVL and gain institutional investor confidence.

Key Principles for Leaders:

- Plan DeFi audit early — include DeFi security audit in project roadmap and budget

- Choose DeFi audit partner, not contractor — reputation matters more than price

- Use DeFi security audit as competitive advantage — audit builds trust and facilitates capital raising

DeFi audit costs pay for themselves by preventing one incident, but the real value lies in building trust — the foundation of successful DeFi business.

DeFi security audit is not about finding weaknesses. It’s demonstrating strength of your code, team, and vision for reliable financial future. In 2025, no serious DeFi project launches without a comprehensive DeFi audit — make sure yours doesn’t either.

Frequently Asked Questions (FAQ)

DeFi audit costs range from $10,000-$20,000 for simple tokens to $75,000-$150,000+ for complex protocols, with tier-1 smart contract audit companies charging $100,000+. Professional DeFi security audit pricing reflects the expertise required to protect millions in user funds.

A comprehensive DeFi security audit typically takes 2-4 weeks depending on protocol complexity and code size. The DeFi audit process includes automated analysis, manual review, reporting, and remediation verification phases.

The most common smart contract vulnerabilities include privileged access compromise ($953M lost in 2024), price oracle manipulation, reentrancy attacks, and business logic errors. Professional DeFi security audits systematically test for these critical attack vectors.

While not legally required, DeFi security audits have become essential for attracting users and institutional investors in 2025. Projects without smart contract audits face significantly higher risk of exploits and struggle to gain market trust.

Select DeFi audit companies based on relevant experience, manual analysis depth (>70%), detailed methodology, and quality report samples. Companies like ICODA and other established firms provide comprehensive smart contract security audit services with proven track records.

After receiving your DeFi audit report, developers fix identified vulnerabilities and submit changes for re-verification. The audit firm confirms proper remediation before issuing the final smart contract audit certificate.

Automated scanning tools catch only 20-30% of smart contract vulnerabilities and miss complex business logic errors. Professional DeFi security audits combine automated tools with expert manual analysis for comprehensive protection.

Rate the article