share

It is hard to imagine Web3 without DAOs, same as without DeFi and Metaverses. Many modern DApps in decentralized finance are built using DAO rules and have no central authority. In this article, we will look at what Decentralized Autonomous Organizations (DAO) mean for the world of cryptocurrencies and what role they play in the Web3 ecosystem.

What’s a DAO, and What Function Do DAOs Perform in the Blockchain?

DAO stands for Decentralized Autonomous Organization. We’ve looked at what a DAO is in more detail in another article called “What’s a DAO in crypto”, so we won’t dwell on that topic for long but just briefly outline the essence of the concept:

A DAO is a fully decentralized governance model on the blockchain that has no central government. Smart contracts act as autonomous foundations of the structure.

Here are the most important things you need to know about decentralized autonomous organizations:

- DAOs operate on blockchain technology, which ensures transparency of the system and all transactions, including vote process.

- The decision is made by all participants of the ecosystem by voting on the proposals submitted by the community memebers. Unlike traditional organizations, the platform has no central leader. The decision to change the functioning of the blockchain protocol is made only if the majority of votes are “in favor” and rejected if the participants vote “against”.

- The work of DAOs is automated by smart contracts that execute the instructions embedded in the algorithm. These instructions are predetermined and can change in the vote. Thanks to smart contracts, platforms with decentralized control become fully autonomous.

- Not all DAOs are truly decentralized. Some DAOs, especially the early ones, use a model based on voting rights, where large token holders gain an advantage and can band together to influence decision-making.

Why Are DAOs Needed, and What Happens When (if) They Disappear?

Before you understand the role of Decentralized Autonomous Organizations in Web3, you need to find out what the goal of the proponents of DAO is and why these systems were originally created. But first, let’s find out what Web3 is and why it’s relevant.

Web3, also called Web 3.0, is the third generation of the World Wide Web, after Web 2.0 or the Internet as we know it today. In other words, the idea of Web3 is based on the concept of a fully decentralized Internet built on the blockchain.

Besides the decentralization of the economy or tokenomics, the main strength of Web 3.0 is transparency, resistance to censorship and the elimination of the central link that controls the system and enforces its rules alone (namely governments, large corporations and influential people).

While the focus of Web 2.0 was on user-generated content, the cultivation of minimalism, social media, and usability, Web 3.0 focuses primarily on the absence of barriers on the Internet in a global sense: from freedom of speech to a free economy where anyone can use whatever digital assets they want, but also freely make their own, and the community members decide which ones have the right to exist and flourish.

DAO Brings Greater Transparency to the Social Impact Space

DAO creates new opportunities for greater transparency in the area of social impact. Transparency is at the core of Web3, bringing philanthropic activities such as fundraising and disbursement of funds onto the chain so sponsors can control how much money comes in, how it is spent, and how much goes to charities. You will be able to know if it will be donated directly.

Beyond finance, DAO enables more transparent decision-making on important organizational issues. When it comes to DAO, there are no on-camera voting sessions or secret management decisions. Records of all major decisions voted on by DAO members may be made publicly available on-chain to ensure a high level of accountability and transparency.

How Did DAOs Come Into Existence, and What Did They Do?

Although the platform based on the concept of DAO and known as “The DAO” appeared only in 2016 through the efforts of the developers of Ethereum, a similar approach was already implemented in the first Bitcoin blockchain network. Before accepting changes in the operation of the protocol, most miners should support the decision.

However, this approach has a number of drawbacks. This is because the strength of the miners is determined by the amount of computing power, so the main influence is concentrated in a few large mining pools, while individual miners are practically left out. Thus, the pools can easily reject any change to the Bitcoin protocol that’s inconvenient or detrimental to them. In addition, the Bitcoin network doesn’t have Turing completeness, meaning that there are no smart contracts that can independently execute transactions between two parties.

A DAO-like mechanism to control and allocate funds was also implemented before The DAO was launched in 2016. This feature was built into the Dash protocol, which was one of the first blockchains to use a hybrid consensus model: the platform supports Proof-of-Work (PoW) with mining and Proof-of-Stake (PoS). Trivia: Dash originated as a fork of the original Bitcoin network.

Launched in 2016, DAO functioned as a venture capital fund, but due to a hack that same year, the platform ceased operations. Later in 2017, the U.S. Securities and Exchange Commission (SEC) admitted that the DAO securities were illegal. Because the platform’s digital assets were recognized as securities, The DAO violated securities laws in the United States.

Many DAOs use a voting mechanism in which governance token holders delegate their assets by casting a vote to accept or reject a particular community proposal. A proposal is accepted only if a majority of the members vote in favor of it. Therefore, only the community members decide how the DAO platform will develop.

Who’s in Control of A DAO?

Thanks to DAOs, every member of a cryptocurrency community – those who hold tokens – has the opportunity to propose changes or shape the token’s future. When a proposal is made, the community votes on it to determine whether or not it goes ahead, and approved changes are implemented automatically. No single entity (or individual) can approve or deny a proposal by itself, and any activity is clear for all to see.

It should be noted, however, that in most cases, those who hold a significant number of tokens have greater voting rights and, therefore, more power over those who only own a small number in comparison. Though that may seem unfair – and is one of the biggest criticisms of the DAO model – it’s worth considering that those who hold more tokens have more to lose if a bad decision is approved.

What Does DAO Mean for the Web3 Industry?

The DAO model plays one of the key roles in decentralized finance (DeFi) and fits perfectly into the Web3 concept of a digital economy based on cryptocurrencies. Web3 can be seen as a fully transparent and decentralized version of the Internet. Unlike traditional companies, in DAOs, all members participate in decision-making. Each member of the community has the same voting rights as the others. Basically, DAO means crypto that actually does what it has always been supposed to do.

Almost all blockchain-based projects work with open source code. Today, many DApps, from decentralized exchanges to NFT marketplaces and metaverses, use a decentralized approach to managing DAOs. These include DEXes like Uniswap and SushiSwap.

Before the advent of DAOs, Web3 sites were decentralized in use but not in management. This meant that developers could make changes to the way the protocol worked, including the rules encoded in smart contracts, at any time without the approval of the crypto enthusiast community. For example, developers can add the feature of centralized management of the liquidity pool to the source code and have full control over the funds held in it. DAOs are changing this paradigm.

How Are DAOs Beneficial in the WEB3 Space?

No Central Authority at DAO

The biggest appeal of Web3 DAO is the lack of a central authority. A DAO enables the creation of communities with clear goals. As such, it allows truly democratized control over what happens within a particular community.

The basic design principle of DAOs focuses on achieving the maximum extent of decentralization. The members of a DAO can express their voice for the organization’s future because of their voting power, which is significantly more distributed than in traditional organizations.

DAO and its Transparency

Everything in a DAO, from foundational rules to transactions, is recorded on a fully verifiable public ledger. DAOs also eliminate human error and fund manipulation. So, this makes DAOs particularly beneficial for fundraising projects.

Automation

Smart contracts help move things along quickly since there is no need to wait for a vote or for the leader to decide. The smart contract effortlessly self-executes every time it needs to.

Community-driven

A DAO is truly community-driven to run through the people who are a part of the community. So the members vote on all proposals submitted by the DAOs community and make autonomous decisions. Decentralized autonomous organizations give participants a sense of ownership which drives them to innovate and set new precedents. Every member of a DAO holds the unique privilege of shaping the organization’s future. Multiple inputs from DAO members power innovative developments.

DAO’s Cons

The DAO industry today faces a number of problems that developers and the crypto community need to solve. Failure to address these and other industry issues could significantly impact the future of DAO.

DAOs and Legal Uncertainty

The legal status of DAOs hasn’t yet been clarified, so regulators haven’t yet developed rules for the operation of decentralized platforms in the financial sector. The same is true for the DeFi industry itself. So far, no company can legally interact with DAOs and use these platforms in business transactions, although this isn’t prohibited. But anyone entering the DeFi industry will face legal challenges. Few jurisdictions have legalized DAOs. Wyoming, for example, was the first U.S. state to recognize DAOs as legal entities.

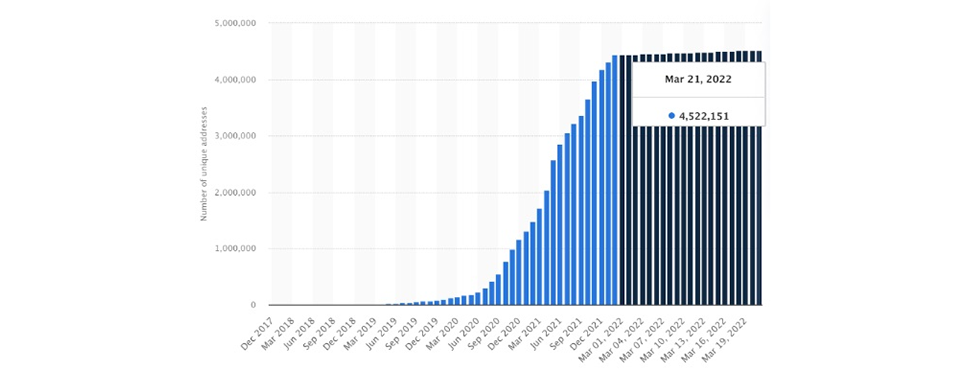

Despite all this, there are currently hundreds of financial applications on the blockchain. According to Statista, the number of DeFi users surpassed 300,000 in early 2022.

The Social Aspect of DAOs

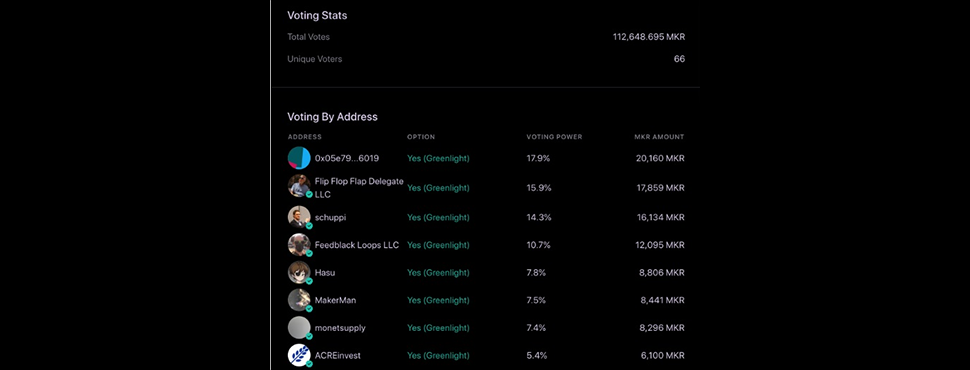

The number of voters is usually not controlled or limited in any way. Formally, this means that both 10,000 participants and only five can participate in the voting. For example, in the last survey on the well-known MakerDAO platform on the Ethereum blockchain, which issues the decentralized algorithmic stablecoin DAI, fewer than 50 people participated, most of whom voted for the proposed proposition.

Non-participating community members damage the functionality of a Decentralized Autonomous Organization. It turns out that only a small percentage of MakerDAO users participate in the voting.

Vote Distribution at DAOs

Another problem is that some DAOs use a voting system where the weight of a vote is determined by the number of tokens delegated to the protocol. This means that any DAO member with a large number of coins can prevail over other members of the communities, even if they’re in the majority.

Let’s return to the example with MakerDAO that we discussed in the previous paragraph. According to the vote and its results in a survey, 4 out of 46 participants had a weight of 58.8%. This means that the decision would be in their favor even if the rest of the participants voted against it.

The approach used in MakerDAO actually leads to centralized control, which is contrary to the nature of decentralized autonomous organizations. The irony is that even changing the voting mechanism won’t work if the largest token holders at DAOs vote against it.

Security Aspects

Another aspect concerns the decentralized nature of DAOs. Many DAOs operate on fully decentralized blockchains such as the Ethereum network, Cosmos, Solana, and Cardano. In the event of a successful breach of the protocols, it’s impossible to stop the attackers and prevent the movement of assets. This means that they can freely withdraw funds from the pool of a compromised decentralized protocol. These risks are outlined in legal agreements, so always read the platform’s terms of use before working with it.

A prime example would be a famous incident with the first platform DAO, known as The DAO, in 2016, which led to the fork of the Ethereum network and the emergence of a hard fork of Ethereum Classic, which later became the main network, while the original network remained in its original form.

The DAO managed to raise $150 million in ETH coins during its Initial Coin Offering (ICO), making it one of the most successful ICO projects in the history of cryptocurrencies. However, after the hack, the platform ceased operations, and the tokens were delisted from major exchanges. Now the token belongs to the MakerDAO platform under the ticker DAO – it’s an issuer of DAI stablecoins backed by ETH coins and a launchpad that conducts Strong Holder Offerings (SHO) for DAO token holders.

How to Create a DAO?

Any user or organization can create his/her own DAO platforms. That’s much easier and cheaper than starting and growing a normal business. However, it’s important to design the DAO properly to avoid many problems after the launch and think of tokenomics. Here are the 4 main steps to starting a DAO platform:

Develop a Smart Contract

This is one of the most important steps because the security of the platform depends on it: If the smart contract contains vulnerabilities in the source code or backdoors, hackers can hack the DAO and steal users’ assets, which can cause severe or even irreparable damage to the company and its users.

The smart contract sets the rules for users’ interaction with the DAO system and executes instructions. Moreover, the principle of DAO is that the community members can propose changes to the rules of the platform. Therefore, when developing DAOs, you must keep in mind that you’re transferring the right to manage the communities, and little depends on the organization.

You can create a DAO on an existing blockchain like Ethereum, BNB Chain, Solana, Cardano, Cosmos Network, Polkadot or Near Protocol or based on your own custom network.

Tokenomics

To manage DAOs, it’s necessary to issue governance assets. However, digital assets should be used for other purposes as well. For example, the governance token CAKE of the decentralized exchange PancakeSwap on the BNB Chain is used to reward people for staking and farming, buy NFTs on the marketplace, and let people participate in the Initial Farm Offering (IFO). IFO is an alternative to the Initial DEX Offering, where investors block LP tokens or liquidity tokens (usually CAKE-BNB on PancakeSwap) instead of exchanging tokens to participate in the token sale.

Therefore, when developing DAO tokenomics, it’s necessary to consider what functions the platform and its governance and other asset will have. The more functions a project has that governance tokens can be used for, the better in the long run. However, for the launch of the platform, basic functions such as voting on proposals and deploying tokens will suffice.

But there’s another aspect of DAOs that needs to be considered: How will your platform’s tokenomics differ from those of your competitors?

Test and Launch of DAOs

This is where you put DAOs in the hands of the community. To prevent the situation from getting out of control, you need to test all the features of the DAOs and make sure that no unforeseen situations occur. After that, you can create a full-fledged DAO release. From that point on, the platform is no longer under your control, and its development depends on the decisions of the organization members, who are all community members who own governance tokens.

It’s important to control the development process at every stage, from designing the DAOs to testing and publicly launching the platform. ICODA offers smart contract development and PR services. You can see the full list of DAOs solutions and services like creating governance asset on the website and book a free consultation to find out the costs.