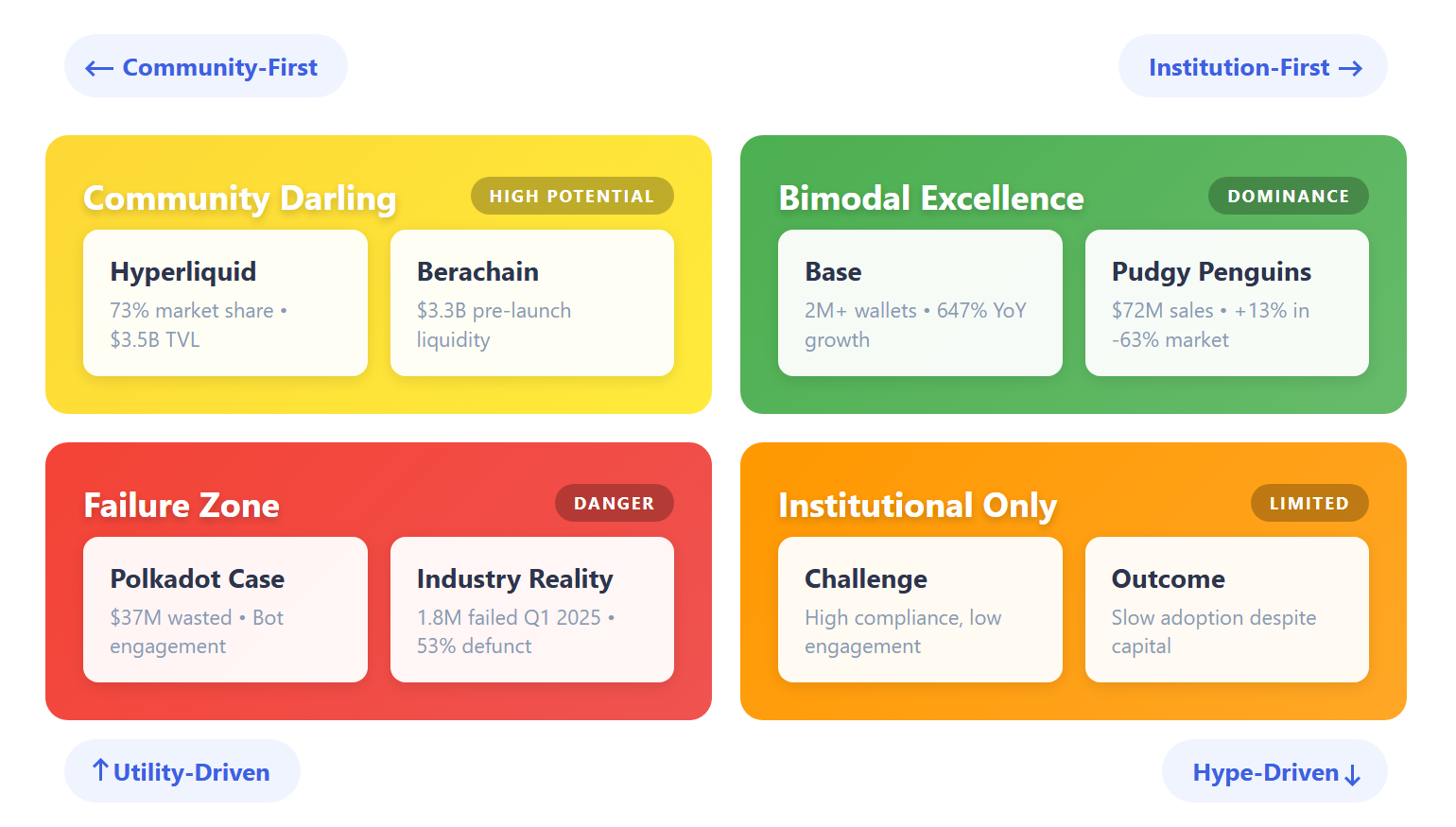

The cryptocurrency industry has reached a critical inflection point where traditional hype-driven tactics no longer deliver results. With 53% of all crypto projects launched since 2021 now defunct and 1.8 million failures in Q1 2025 alone, the survivors share a common trait: they’ve replaced speculation-focused messaging with data-centric PR strategy built on authentic utility and community engagement.

The numbers tell a stark story. Web3 ad spending exceeded $12 billion in 2025, yet the failure rate suggests that throwing money at marketing without strategic foundation is a path to irrelevance. Meanwhile, projects that mastered AI-driven targeting achieved 12-20x ROI versus traditional approaches, and those prioritizing community-first engagement delivered 3x better retention rates with 45% lower acquisition costs than paid advertising.

The regulatory environment has transformed from obstacle to opportunity. The EU’s MiCA regulation, full U.S. federal frameworks like the GENIUS Act, and the UK’s FCA authorization requirements have created a landscape where compliance messaging increases conversion by up to 36%. Institutional capital now flows to projects that can demonstrate regulatory readiness, technical utility, and sustainable unit economics.

This guide dissects the winning crypto PR strategy frameworks of 2025 and extracts actionable blueprints for 2026 dominance. We’ll analyze campaigns that generated 647% year-over-year growth, moved $10+ million in physical product sales, and onboarded 13 million users through “invisible blockchain” approaches. More importantly, we’ll identify the anti-patterns that destroyed $37 million in marketing spend and generated negative returns for investors.

For founders and marketing teams, the imperative is clear: 2026 belongs to projects that can prove value through verifiable on-chain metrics, speak the language of institutional compliance, and build communities that function as stakeholders rather than speculators.

The Evolving Landscape of Crypto PR Strategy

Crypto PR has fundamentally shifted from broadcasting price targets to demonstrating sustainable utility and institutional readiness.

The market has bifurcated into two distinct audiences demanding entirely different communication approaches. On one side, institutional players—BlackRock, Fidelity, JPMorgan—now hold over $175 billion in Bitcoin and Ethereum ETFs. This cohort requires PR strategy that emphasizes compliance frameworks, risk-adjusted returns, and infrastructure robustness. On the other side, crypto-native communities have retreated into encrypted, high-fidelity platforms like Discord, Telegram, and Farcaster, where they demand fair launches, community ownership, and transparent governance.

The data reveals both impressive growth and concerning stagnation. Global crypto adoption surpassed 560 million people in early 2025 (6.8% of global population), yet Daily Unique Active Wallets reached only 24.6 million—a 3% decline from the previous quarter. This disconnect between market cap growth and active engagement signals that awareness campaigns succeed at attracting capital but fail at converting interest into sticky application users.

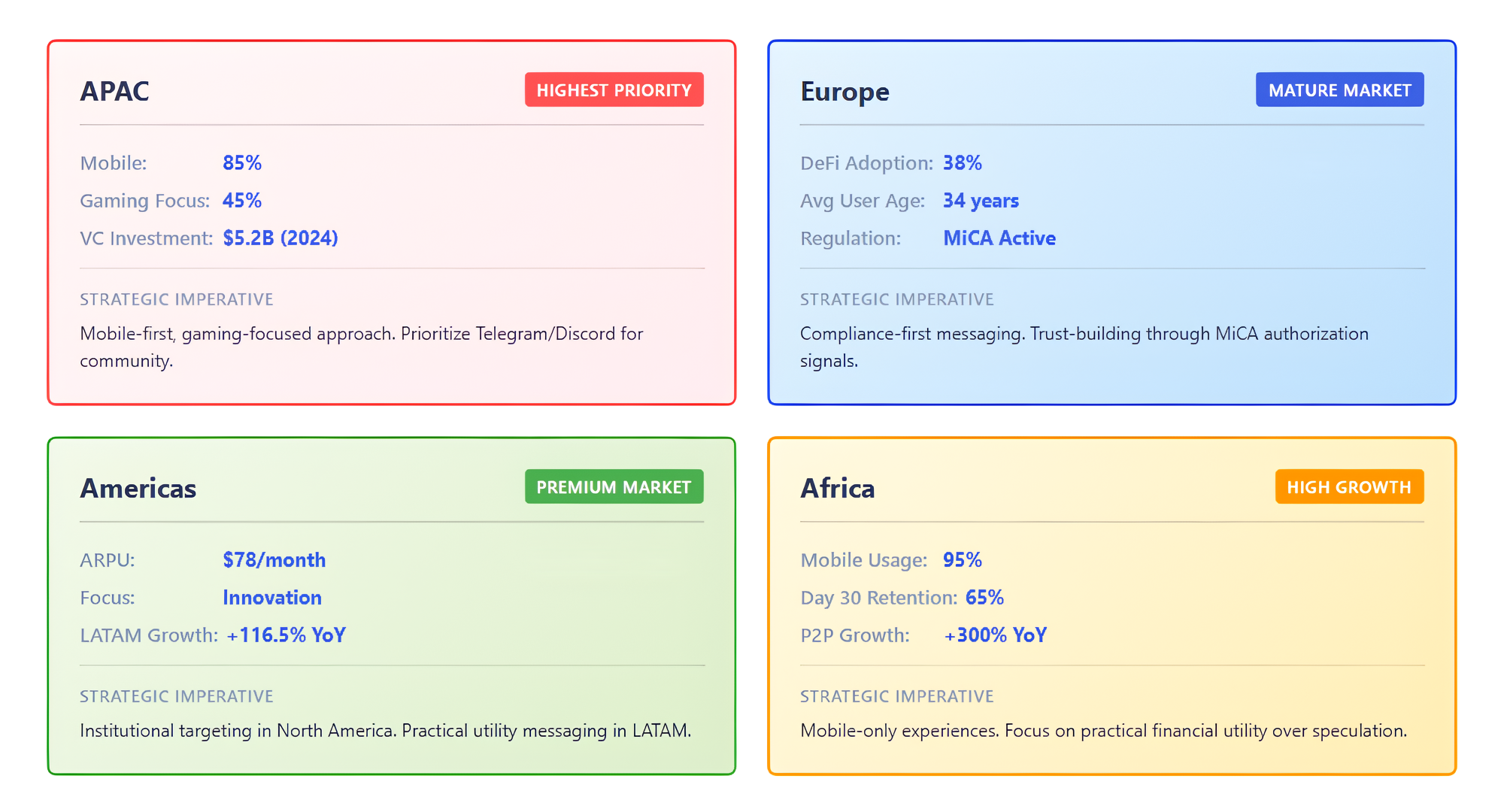

Regional dynamics demand localized crypto PR strategy:

| Region | Key Characteristics | Strategic Imperative |

|---|---|---|

| APAC | 85% mobile adoption, 45% gaming preference | Mobile-first, gaming-focused approach |

| Europe | 38% DeFi adoption, avg age 34 | Regulatory compliance messaging, trust-building |

| Americas | $78 monthly ARPU (highest globally) | Innovation adoption, institutional targeting |

| Africa | 95% mobile usage, 65% Day 30 retention | Mobile-only experiences, practical financial utility |

The competitive landscape has intensified with 20-30 heavyweight players now competing for crypto users as Web2 companies launch blockchain integrations while crypto-native projects move into real-world financial services. Customer acquisition costs run 3-7x higher in Web3 than Web2, with Web3 companies spending 29-95% of enterprise value on customer acquisition compared to just 7-15% for traditional software.

Modern crypto PR agencies have evolved beyond simple press distribution to become strategic partners offering media intelligence analytics, crisis navigation capabilities, and multi-channel execution. The top 30 crypto media outlets commanded 72.7 million users globally in December 2024, with heavyweights like Cointelegraph, CoinDesk, and Decrypt capturing 75% of all crypto media visits. However, AI referrals now account for 18% of media traffic on average, with some Asian outlets seeing up to 68% from AI aggregators—fundamentally changing how content must be structured for discovery.

The technology stack has transformed radically. Machine learning tools measure sentiment across platforms in real-time, enabling predictive analytics that identify trending topics and optimize publication timing. NFT-based ad campaigns generate 28% more engagement than traditional digital ads, while blockchain attribution reduces cost per acquisition by 34% through superior tracking.

Trust has become the scarcest resource. 70% of consumers value ad transparency in Web3, and 61% of advertisers trust blockchain-based auditing over traditional methods. Projects showcasing security audits, team transparency, and proof of reserves gain decisive advantages in a market where $9.9 billion in global scam losses occurred in 2024.

Competitive markets increasingly reward strategic organic positioning over paid acquisition. A crypto casino achieved Top 3 placement in Google AI Overview and Top Stories carousel across India and Malaysia markets using zero paid traffic—demonstrating that AI-era visibility flows from authoritative content distribution rather than advertising budgets.

Core Strategies for Crypto PR Dominance

1. Gamification Plus Mainstream Partnerships

Base’s “Onchain Summer” campaign proves that combining gamified engagement with recognizable brand partnerships creates exponential growth trajectories.

Coinbase’s Layer-2 network orchestrated a multi-week campaign featuring daily NFT drops from partners including Coca-Cola, Atari, Parallel, and FWB. The strategic innovation wasn’t just the celebrity brands—it was removing crypto’s notorious friction through Coinbase Smart Wallet’s 60-second, 1-click onboarding. Users received a “Summer Pass” with point-based rewards and over $2 million in prizes and gas credits.

The results validated the PR strategy:

- 2023: 268,000+ unique wallets, 700,000+ NFTs minted, $242 million bridged in two weeks

- 2024: 2+ million unique wallets (647% YoY increase), $5+ million in creator revenue, 4 million active addresses

- Peak activity: 145,000 active users and 1.4 million daily transactions

The campaign succeeded because it addressed crypto’s core barriers simultaneously. Gamification created airdrop speculation that sustained engagement beyond campaign periods. Mainstream brand partnerships provided legitimacy that pure crypto-native campaigns couldn’t achieve. Simplified wallet creation onboarded crypto novices at scale without requiring seed phrase education.

For 2026 crypto pr, the lesson is clear: partnerships with non-crypto brands instantly legitimize projects to broader audiences. But the partnership must serve a functional purpose—removing friction, providing distribution, or creating genuine utility—rather than existing purely for press release fodder.

2. Physical-Digital Bridge Strategy

Pudgy Penguins demonstrates how physical retail insulates digital assets from crypto volatility while maintaining NFT holder value.

The project launched physical toys in 3,100 Walmart stores, with each toy including QR codes linking to digital NFTs that unlock traits in Pudgy World (a zkSync blockchain game). They expanded partnerships to Target, Amazon, and Five Below, while running a creator compensation program paying $50-$100 for unboxing videos.

Performance metrics exceeded expectations:

- $10+ million in toy sales and 750,000+ toys sold within 12 months

- Floor price surged from 6 ETH to 21 ETH ($61,000)—a 250% increase

- Became 3rd highest NFT collection by market cap

- Q1 2025 sales: $72 million with 13% YoY growth despite a 63% NFT market decline

This crypto PR strategy worked because physical distribution provided mainstream accessibility while automatic royalty payments to NFT holders maintained community value. QR codes onboarded non-crypto consumers to Web3 without technical barriers, proving IP can compete with traditional toy brands when paired with strong distribution.

The broader implication: projects must build bridges to physical commerce and Web2 distribution channels. McDonald’s partnership with Doodles generated 41.6% revenue growth during market contraction. The winning approach positions blockchain as invisible infrastructure supporting traditional commerce rather than a replacement requiring consumer re-education.

3. Community-First Anti-VC Positioning

Hyperliquid’s “anti-VC” narrative carved out massive market share by positioning as the “people’s exchange” in a market fatigued by predatory token economics.

The decentralized exchange explicitly rejected venture capital funding, relying instead on a sophisticated “Points” program that rewarded skill and liquidity provision rather than just volume. This filtered out low-quality sybil attackers and attracted professional market makers and high-conviction traders.

The community-first crypto PR strategy delivered exceptional results:

- TVL growth: $564 million to $3.5 billion (269% increase)

- Market share: 73% of all decentralized perpetual trading volume

- Revenue: $800+ million annualized, proving fair launch economic viability

- Technical capability: 20,000 TPS, matching centralized exchange UX

The campaign succeeded because it aligned messaging with actual product economics. The underlying HyperEVM blockchain delivered institutional-grade performance while the governance structure ensured community ownership. This authenticity resonated in a market where 88% of airdropped tokens lose value within 3 months due to predatory vesting schedules.

For PR strategy execution, the “Fair Launch” narrative provides powerful differentiation—but only when paired with genuine performance. Projects must demonstrate that community-first approaches deliver superior economics, not just ideological positioning.

4. AI-Powered Precision Targeting

Blockchain-Ads’ Binance APAC campaign demonstrates how on-chain behavioral data achieves returns impossible through traditional demographics.

The campaign deployed hyper-targeted cost-per-acquisition using proprietary WalletTargeting™ technology, focusing on specific crypto profiles across Middle East, Southeast Asia, and Eastern Asia. Instead of demographic attributes (age, income), targeting used wallet activity, portfolio composition, and on-chain trading patterns.

Performance metrics validated the crypto PR approach:

- Investment: $25,000 total

- Results: 4,600 new traders, $1.1+ million in transactions

- ROI: 19.8x return (1,980%)

- Activity: 33,303+ transactions in 30 days

Similarly, Defiway achieved 12.5x ROI by targeting Web3 natives and DeFi traders with specific portfolio values, leading with transparent value propositions emphasizing “Only 0.2% Commission” and “Bridge Faster” messaging.

The strategic insight: blockchain data enables precision impossible in Web2. Projects can target users who hold specific token combinations, participate in particular DAOs, or demonstrate measurable on-chain sophistication. This transforms customer acquisition from spray-and-pray to surgical strikes on high-value, high-intent audiences.

Advanced Web3 analytics platforms deliver quantifiable advantages:

- 40-60% CAC reduction versus traditional approaches

- 25-35% LTV increase for DeFi campaigns

- Superior data layer through wallet clustering, DeFi interactions, NFT trading patterns

For 2026, AI-driven PR strategy becomes table stakes. Machine learning tools now measure sentiment across X, Discord, and Telegram in real-time, enabling predictive analytics that identify trending topics and suggest optimal publication timing. Projects not leveraging these tools will be systematically outcompeted by those achieving 12-20x efficiency gains.

SEO-driven content distribution achieves similar precision through strategic placement. A new crypto wallet with zero brand history secured Google Top 10 rankings and AI Overview visibility within weeks through 23 optimized listicles across tier-1 crypto media, generating 4,032 sessions with 44.52% engagement rates—demonstrating that strategic content positioning rivals paid targeting efficiency.

5. Invisible Crypto for Mass Adoption

Off The Grid succeeded where countless GameFi projects failed by making blockchain elements optional rather than gatekeeping mechanisms.

The AAA battle royale shooter marketed itself as a game first, with blockchain elements (trading skins, items) integrated into the backend. Players could enjoy the complete experience without knowing they interacted with an Avalanche subnet. The crypto aspect became an optional layer for those wanting to monetize assets.

Results validated the invisible crypto PR strategy:

- 13+ million unique users, 450,000 daily active players

- Topped Epic Games Store’s “Most Popular Free-to-Play” list

- 150,000 concurrent Twitch viewers

- Partnerships with major streamers (Ninja, Scump) legitimized to traditional gaming audiences

This approach overcame the “anti-crypto” stigma endemic in gaming communities. By hiding complexity and exposing blockchain functionality only when users explicitly sought monetization, the project achieved mainstream penetration impossible through crypto-native marketing.

Helium Mobile applied similar principles to DePIN (Decentralized Physical Infrastructure). The $20/month phone plan provided clear, fiat-denominated value requiring no crypto knowledge. The Solana Seeker smartphone promotion bundled hardware with service, while “lazy claiming” architecture allowed reward earning without gas fees. Results: $18.3 million annualized revenue with 541,000+ subscribers.

6. Regulatory Compliance as Competitive Advantage

MiCA compliance messaging transformed from defensive necessity to offensive marketing weapon in 2025.

Projects that proactively communicated regulatory readiness saw up to 36% conversion increases. The EU’s Markets in Crypto-Assets regulation established strict transparency and disclosure requirements, forcing issuers to maintain full reserves and perform regular audits. Successful crypto PR strategy pivoted to publishing audit reports as marketing collateral rather than hiding compliance as overhead.

Compliance-first positioning delivers multiple advantages:

| Compliance Element | Marketing Value | Strategic Benefit |

|---|---|---|

| Security audits | Trust signals for retail | Reduces perceived risk |

| Reserve proofs | Institutional confidence | Unlocks capital access |

| MiCA authorization | Competitive differentiation | Market access advantage |

| Team transparency | Community credibility | Reduces exit scam perception |

The U.S. GENIUS Act (July 2025) mandated 100% reserve backing for the $260 billion stablecoin market with federal licensing pathways. The CLARITY Act defined SEC versus CFTC boundaries, making CFTC the primary spot market overseer. Projects that positioned these frameworks as enabling infrastructure rather than restrictive burdens gained decisive competitive positioning.

UK FCA promotion rules requiring risk warnings, cooling-off periods, and clear sponsored content indication forced a shift from “shill” models to educational content partnerships. Projects that embraced this shift built sustainable influencer relationships rather than transactional promotional blasts.

What Doesn’t Work: Anti-Patterns in Crypto PR

Vanity Metrics Over Substance

Polkadot’s catastrophic $37 million marketing spend demonstrates how artificial engagement destroys trust and capital faster than competitors.

The project allocated nearly double its development budget to marketing, spending $300,000 per month-long influencer campaign, $450,000 for event expenses, $480,000 for two-year Coinmarketcap logo display, and $180,000 for private jet branding. Investigation revealed bot-driven accounts, YouTube channels materializing overnight with implausible subscribers, and Twitter profiles showing coordinated automation.

The results: millions of views but stagnant token prices, slowing ecosystem development, and treasury projected to last only 2 more years. Community outrage over prioritizing marketing over development killed trust irreparably.

This anti-pattern afflicts the industry broadly. Platforms like Pump.fun made token creation too easy, flooding markets with projects lacking utility, proper tokenomics, liquidity, and genuine community engagement. Projects treating communities as numbers games—100K followers meaning nothing if disengaged—fail systematically when sophisticated crypto audiences detect bots using increasingly powerful on-chain analytics.

Influencer Fraud and Undisclosed Promotions

SEC enforcement demonstrates the legal and financial risks of influencer-dependent crypto PR strategy without transparency.

Academic research confirms the performance disaster: following crypto-influencer advice generated significant negative returns with initial gains fading within 2-5 days (mean return -1.02%), 10-day returns of -2.24%, 30-day returns of -6.53%, and 90-day returns of -18.90%. The more “expert” the advisor claimed to be, the steeper the loss.

Major enforcement actions include:

- 8 influencers charged with $100 million securities fraud in Atlas case

- Kim Kardashian fined for undisclosed promotion

- Jake Paul and celebrities charged for promoting TRX/BTT without disclosure

With $9.9 billion in global crypto scam losses in 2024, regulators tightened enforcement. Undisclosed paid promotions constitute Section 17(b) violations punishable by heavy fines and criminal charges. Up to 50% of influencer budgets are wasted on fake engagement, requiring vetting tools to audit audiences.

The winning approach: shift from transactional promotional blasts to long-term educational partnerships. Engagement rates over follower counts become the primary metric, with crypto influencers averaging 5.2% engagement versus traditional categories. Multi-touchpoint campaigns bundling content across platforms outperform isolated posts by 2-3x.

Hype Without Utility Creates Mercenaries

Projects relying on FOMO tactics (“limited time,” “only a few spots left”) while jamming buzzwords (RWA, AI, AI Agents) into messaging generate short-term attention that vanishes during downturns.

Users who never understand why a project matters create communities of speculators who leave immediately when markets dip or competitors enter. The 2025 reality: crypto communities are “jaded because of many scams,” making users increasingly sophisticated at spotting hollow hype.

Educational content alternatives that build believers:

- AMAs and direct founder access on Discord/Telegram

- Technical white papers and case studies showcasing real utility

- Webinars and tutorial series breaking down concepts (the “5-year-old test”—if you can’t explain to a child in 1 minute, not ready for launch)

- Transparent tokenomics explanations and security audit showcases

Community-driven campaigns deliver 3x better retention rates and 45% lower acquisition costs than paid ads. Value exchange for data—offering personalized recommendations, exclusive benefits, token rewards, and NFT-based loyalty programs—replaces extractive practices.

Poor Timing and Market Ignorance

Launching during extreme market fear, major exploits, or regulatory crackdowns proves fatal regardless of fundamentals.

The 2025 context demonstrates this brutally: even during “pro-crypto” political environments, 1.8 million failures occurred in Q1 coinciding with market volatility after Trump inauguration. Retail sentiment drives engagement—launching when markets are flat or distracted dooms projects.

Successful crypto PR strategy tracks macro sentiment using Fear & Greed Index, on-chain liquidity flows, and Twitter sentiment while delaying launches if timing proves unfavorable. Projects waiting for market recovery periods systematically outperform those launching into adverse conditions.

Bear market silence signals abandonment. Projects going quiet during downturns—canceling PR initiatives, stopping community engagement—betray responsibility to followers, investors, and teams. Low-cost alternatives including blog posts from lead developers, local meetups, Twitter AMAs, Discord engagement, and educational content maintain community connection and competitive positioning through cycles.

Metrics and Benchmarks for PR Strategy Success

Effective crypto PR requires quantifiable performance measurement through on-chain metrics and financial efficiency ratios.

Key Performance Indicators for 2026:

| Metric | Benchmark | Strategic Implication |

|---|---|---|

| LTV:CAC Ratio | 3:1 to 4:1 minimum, target 5:1+ | Projects below 3:1 burn capital unsustainably |

| Daily Unique Active Wallets | 24.6M industry average | Measures genuine engagement vs. speculation |

| Transaction Volume | Ethereum L2s: +18% QoQ growth | Proves network utility and adoption |

| Retention (Day 30) | 42% global average, 65% Africa | Indicates product-market fit quality |

| CAC Reduction via Analytics | 40-60% achievable | Validates data-driven targeting ROI |

Sector-specific customer acquisition costs reveal strategic priorities:

- 🔗 DeFi platforms: $85 CAC with 32% first transaction rate, prioritize crypto news sites and partnerships (30% of acquisition)

- 🎮 Web3 gaming: $42 CAC with 45% Day 1 retention, prioritize Discord communities (35% of acquisition)

- 🎰 Crypto casinos: $125 CAC with $890 player LTV, prioritize affiliate marketing (40% of acquisition)

Presale projects demonstrate exceptional efficiency through ICODA’s strategic crypto PR approach combining SEO-optimized listicles with premium media distribution. A recent presale campaign achieved 6+ Google Top 10 rankings across 30+ tier-1 crypto media outlets, generating 70%+ engagement rates and thousands of organic conversions with zero ad spend—validating that content-first approaches deliver superior CAC performance.

Channel-specific performance guides budget allocation. Email/Push achieves 6.1% conversion producing ~$35 CAC as top retention lever. SEO/Content achieves 2.5% conversion producing ~$55 CAC with compounding ROI over time. Influencer/KOL varies with ~2.2% conversion producing ~$90 CAC, strong for DeFi-native reach.

Critical conversion funnel benchmarks:

- DeFi: Landing Page → Wallet Connection (15%), Wallet Connection → First Transaction (45%), First Transaction → Regular User (60%)

- Gaming: Landing Page → Registration (25%), Tutorial Completion (65%), First Game (80%)

- Casino: Landing Page → Registration (30%), Registration → KYC (70%), KYC → First Deposit (85%)

Drop-off points reveal optimization opportunities. KYC/Onboarding loses >40% of retail users, while wallet connection converts only 15% in DeFi. Top exchanges benchmark onboarding flows under 3 minutes from homepage to funded wallet. Mobile optimization delivers +40% higher conversion rates and +55% better retention versus desktop-only experiences.

Cross-platform integration delivers +45% better retention rates and 2.5x higher LTV versus single-platform approaches. Community-led growth achieves 2.8x higher referral/advocacy rates with community-driven strategies versus top-down campaigns.

Conclusion: The 2026 PR Strategy Blueprint

Success in 2026 demands integration of compliance messaging, AI-powered analytics, and community-first engagement within a unified crypto PR strategy framework.

The data proves that dominance no longer flows from who spends most but who optimizes fastest. Projects achieving 12-20x ROI through AI-driven targeting, building communities that deliver 3x better retention at 45% lower costs, and positioning regulatory compliance as competitive advantage will systematically outperform competitors burning capital on vanity metrics and transactional influencer relationships.

The winning framework requires “bimodal” execution: presenting sanitized, compliant messaging to institutional audiences while fostering culturally rich, fiercely loyal communities through meme-aware, authentic communication. Base demonstrated this by bridging mainstream brands with crypto-native culture. Hyperliquid proved community-first models achieve superior economics. Pudgy Penguins showed physical-digital bridges insulate from volatility while maintaining holder value.

Actionable priorities for immediate implementation:

Restructure documentation so AI agents and LLMs can parse protocol data, whitepapers, and audit reports via API

Migrate core community to platforms you control (Discord, Telegram, Farcaster) to secure social graph independent of platform risk

Launch campaigns on Layer3, Galxe, or Zealy to build verified, non-sybil user bases through on-chain action requirements

Publish MiCA preparedness, audit reports, and regulatory strategy as primary trust anchors unlocking institutional capital

Abstract blockchain complexity through Account Abstraction, social recovery, and flexible gas payment so users experience seamless Web2-quality interfaces

The era of whitepaper promises has ended. The era of on-chain proof has begun. Projects that can cryptographically demonstrate value to institutions, culturally resonate with natives, and seamlessly integrate into daily lives through invisible blockchain infrastructure will dominate the 2026 landscape. Those clinging to hype-driven tactics will join the 53% of failed projects, casualties of a market that has fundamentally matured beyond speculation toward sustainable utility.

Frequently Asked Questions (FAQ)

Crypto PR builds project credibility through media coverage, community engagement, and thought leadership to drive adoption and investor trust in blockchain ecosystems.

Press release distribution places project announcements across crypto media outlets like CoinDesk and Cointelegraph to boost SEO, visibility, and authority signals.

Choose agencies with proven case studies, crypto-native expertise, and measurable results. ICODA’s work achieving Top 10 rankings and AI visibility demonstrates this standard.

Leading outlets include CoinDesk, Cointelegraph, Decrypt, CoinTelegraph, The Block, and Bitcoin.com—commanding 75% of crypto media traffic with 72.7M monthly users.

Crypto PR agencies manage media relations, create SEO-optimized content, execute influencer campaigns, handle crisis response, and build community engagement strategies.

Blockchain marketing leverages on-chain data for precision targeting, emphasizes community ownership over ads, and requires transparency—with CAC running 3-7x higher than Web2.

Rate the article