Crypto marketing in 2026 will look nothing like 2024. The industry has crossed a critical threshold where speculation-driven tactics no longer work, regulatory frameworks demand professionalism, and AI systems mediate most user discovery. The crypto marketing trends 2026 landscape rewards projects that understand three fundamental shifts: AI has replaced Google as the primary search interface, compliance has become a competitive advantage, and blockchain complexity must become invisible to users.

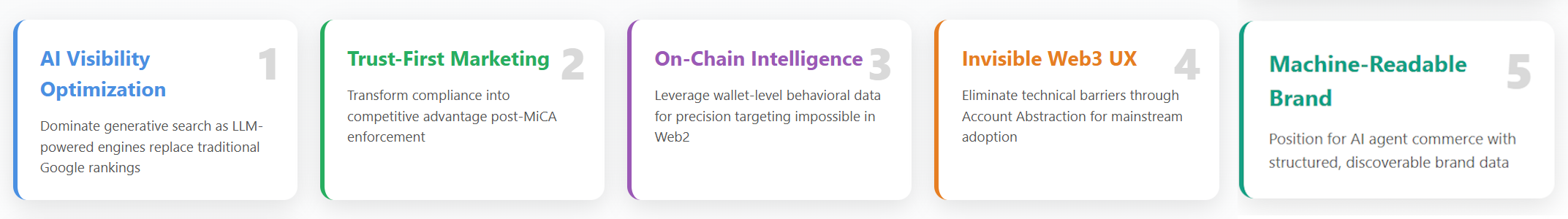

The numbers tell the story: over 70% of searches now end without clicks as AI engines provide direct answers, the crypto market is projected to hit $5 billion by 2030, and 40.5 million Smart Account deployments in 2024 represent 5x year-over-year growth. This analysis identifies five trends that separate winners from losers: AI Visibility Optimization captures users searching through ChatGPT and Perplexity, Trust-First Marketing unlocks institutional markets through compliance, On-Chain Intelligence enables precision targeting impossible in Web2, Invisible Web3 Experience onboards mainstream users seamlessly, and Machine-Readable Brand positioning ensures discoverability as AI agents mediate commerce. Together, these trends represent crypto marketing’s evolution from hype to infrastructure.

How We Identified These Trends

Analysis scope:

- Timeframe: Q1 2024 through Q1 2025

- Sources: Industry reports, platform case studies, compliance statistics, technology adoption metrics

- Data from: 200+ crypto marketing platform clients, European post-MiCA compliance data, blockchain infrastructure providers

Selection criteria (trends must demonstrate all three):

- Proven ROI: Quantifiable results from production implementations

- Accelerating adoption: 5x-10x year-over-year growth trajectories

- Infrastructure readiness: Available tools and platforms enabling immediate implementation

What we excluded: Speculative concepts without production validation, theoretical trends lacking measurable Web3 business outcomes

This methodology ensures recommendations reflect actual market dynamics rather than theoretical possibilities.

The 2026 Landscape: 5 Trends Reshaping Crypto Marketing

All five crypto marketing trends converge on a single principle: removing friction from crypto adoption by making discovery easier, trust higher, targeting more precise, experiences simpler, and future positioning secure.

| Trend | Core Innovation | 2026 Impact |

|---|---|---|

| AI Visibility Optimization | LLM-optimized content for generative search | Dominates discovery as AI answers replace link rankings |

| Trust-First Marketing | Compliance embedded in growth strategy | Regulation becomes competitive advantage post-MiCA |

| On-Chain Intelligence Marketing | Blockchain behavioral data for segmentation | Wallet-level attribution enables Web3-native targeting |

| Invisible Web3 Experience | Account Abstraction eliminates technical barriers | Mainstream onboarding without crypto knowledge |

| Machine-Readable Brand | Marketing directly to autonomous AI agents | Ensures discoverability in agent-mediated commerce |

The pattern is clear: crypto marketing’s maturation from speculation to professionalism. Projects implementing AI SEO see 1,200-1,400% traffic growth and 60% CAC reduction, while compliant European exchanges gained 22% more retail investors post-MiCA. These aren’t vanity metrics—they represent fundamental shifts in how users discover, trust, and adopt Web3 technology. Projects ignoring these crypto marketing trends 2026 will become invisible as competitors leverage AI citations, regulatory clarity, behavioral intelligence, seamless UX, and machine-readable positioning.

Deep Dive: The 5 Transformative Crypto Marketing Trends 2026

1. AI Visibility Optimization: Winning the Generative Search Game

AI SEO adapts content for LLM-powered search engines, critical as searches shift from Google to ChatGPT and Perplexity.

The paradigm has fundamentally changed. Traditional SEO optimized for ranking in link lists; AI Visibility Optimization (encompassing AI SEO, AEO, and GEO) ensures your project gets cited within AI-generated answers. Over 70% of searches now end without clicks because AI engines provide direct answers, making traditional link rankings increasingly irrelevant. Among all crypto marketing trends 2026, this requires three interconnected approaches: AI SEO uses machine learning for semantic search optimization, AEO (Answer Engine Optimization) positions content for zero-click responses, and GEO (Generative Engine Optimization) ensures brands appear in ChatGPT, Perplexity, and Gemini recommendations.

Only 20% of marketers have implemented AEO, creating a significant first-mover advantage window similar to early Google SEO. The opportunity is massive: projects using ChatGPT SEO achieve 1,200-1,400% traffic growth, 9x higher conversions with 15.9% conversion rates, and 60% CAC reduction.

Traditional SEO focuses on keywords and backlinks; AI SEO prioritizes factually consistent narratives, semantically clear messaging, and structured data AI can parse. Traditional SEO targets human readers scanning results; AI SEO targets LLMs synthesizing information from multiple sources. Traditional SEO succeeds with keyword density; AI SEO succeeds with verifiable claims, authoritative citations, and machine-readable formats like Schema.org markup.

Implementation strategy

Start with structured data (JSON-LD markup for tokens, exchanges, NFTs), create question-based content answering actual user queries, and structure on-chain proof points as machine-readable data. Tools like QuickCreator provide AI content platforms with built-in crypto compliance, while Writesonic AI Visibility Tool tracks brand presence across AI platforms. Agencies like ICODA, specializing in AI SEO for crypto projects, report that early adopters dominate AI answer spaces before competition intensifies—the same dynamic that made early Google SEO adopters market leaders. Monitor AI citation rates across ChatGPT, Perplexity, and Gemini as your primary KPI, replacing traditional ranking metrics.

2. Trust-First Marketing: Compliance as Competitive Advantage

Trust-First Marketing embeds regulatory compliance directly into growth strategies from inception, transforming legal requirements into market differentiators.

This approach treats compliance not as an afterthought but as a trust accelerator. MiCA enforcement became fully effective in December 2024, requiring all marketing be fair, clear, and not misleading with penalties up to €5M or 10% annual turnover. Rather than viewing regulation as constraint, leading projects leverage compliance to build credibility in a market historically plagued by scams and uncertainty.

The market has matured dramatically. Bitcoin crossed $100K and the crypto market is projected to hit $5 billion by 2030, with 39% of US investors viewing crypto as inflation hedge—speculation is transitioning to utility-driven adoption requiring professional marketing standards. MiCA implementation correlated with 32% fraud reduction, 27% fewer consumer complaints, and 41% decrease in fraudulent ICOs.

Current adoption shows clear results: 78% of major European exchanges achieved full MiCA compliance by early 2025, and these compliant platforms experienced 22% increase in new retail investors. The message is clear—compliance attracts capital rather than repelling it.

Implementation framework

Build compliance into content strategy from day one with transparent risk disclosures, education-first messaging, and verification workflows. Deploy platforms like Chainalysis (monitoring ~$400 billion monthly with 750+ clients) for transaction monitoring, Scorechain for real-time wallet risk scoring across 30+ blockchains, or Notabene for Travel Rule compliance with 2,000+ institutions. Success metrics include compliance audit pass rates, institutional partnership velocity, and regulatory inquiry resolution time.

3. On-Chain Intelligence Marketing: Behavioral Data Revolution

On-Chain Intelligence uses blockchain transaction data and wallet behaviors to enable Web3-native marketing with precision impossible in Web2.

Traditional CRM relies on emails and phone numbers; Web3 CRM uses pseudonymous wallet addresses as primary identifiers, unifying on-chain and off-chain data for persistent cross-platform tracking without cookies or PII. Blockchain transparency provides unprecedented marketing intelligence while maintaining user pseudonymity, solving the privacy versus personalization paradox that plagues Web2.

The business case is compelling. DeFi projects cut acquisition costs 60% and NFT campaigns increased conversions 40% using on-chain insights. Major Web2 brands entering Web3—LVMH, Accor, Bulgari, Rimowa—leverage these platforms for customer intelligence unavailable through traditional analytics.

Adoption is accelerating across project types. Cookie3 serves 200+ business clients tracking wallet journeys across multiple chains, while enterprise platforms access hundreds of millions of wallet profiles. DeFi protocols optimize acquisition costs, NFT projects target collectors based on holdings, and Layer 1/2 blockchains track ecosystem growth through actual wallet activity rather than vanity metrics.

Tactical deployment

Implement platforms like Formo for multi-chain analytics across 15+ EVM chains plus Solana with AI-driven reporting and real-time attribution, or Absolute Labs accessing 369 million active crypto-consumers among 1.1 billion+ wallet profiles. Track wallet lifetime value, on-chain engagement scores, and cross-protocol activity as core metrics. The immutable, transparent nature of blockchain data provides verifiable ROI metrics Web2 tools cannot match.

4. Invisible Web3 Experience: Account Abstraction’s UX Revolution

Account Abstraction transforms crypto wallets into programmable smart contracts, eliminating technical barriers that prevent mainstream adoption.

Based on ERC-4337 standard, AA enables gasless transactions (dApps sponsor fees or users pay in any token), eliminates seed phrases through social recovery, allows session keys for pre-approved actions, supports biometric authentication, and enables batched transactions. “I need ETH to use this?” represents the biggest adoption blocker; AA removes gas fee barriers and seed phrase burden intimidating non-crypto users.

Growth metrics reveal explosive adoption: 40.5 million Smart Account deployments in 2024 represented 5x year-over-year growth, while Safe processed 151 million transactions representing 8.5x versus 2023. The trajectory continues: 200 million+ smart account deployments are projected for 2025, representing another 5x increase.

Production implementations prove the concept. Overtime onchain sportsbook uses full Account Abstraction with Particle Network social login and Biconomy SDK, while Flippy Flop gaming implementation uses passkeys, session keys, and Paymaster for complete fee abstraction. DeFi super apps like Infinex, Picnic, and Zeal compete with centralized exchange UX while maintaining self-custody.

Implementation path

Deploy AA SDKs like Biconomy’s Smart Account SDK with Paymaster services and session keys, Etherspot’s complete modular SDK with Arka Paymaster for gas sponsorship, or Particle Network’s social login infrastructure creating smart accounts via Web2-style onboarding. Measure wallet creation friction, transaction completion rates, and user retention among non-crypto natives as success indicators.

Overtime achieved $200 million+ betting volume with 50,000 active users requiring zero blockchain education, while Flippy Flop sustained 127 TPS with under 2 seconds average confirmation and 100% invisible blockchain.

5. Machine-Readable Brand: Positioning for AI Agent Commerce

Machine-Readable Brand structures information so AI systems can discover, understand, and accurately recommend brands without human curation.

This differs fundamentally from traditional marketing. Rather than visual storytelling and emotional resonance optimized for human perception, machine-readable positioning prioritizes factually consistent narratives, semantically clear messaging, and verifiable claims in structured formats AI can parse. The AI agent crypto market reached $10 billion market cap in early 2025 from virtually zero late 2024, while 74% of US C-level executives expect AI agents in business operations during 2025.

The infrastructure is production-ready. Coinbase developed tools enabling AI agents like Claude and Gemini to access crypto wallets, while Google’s Agent Payments Protocol (AP2) enables AI agents to securely transact with 60+ partners including Coinbase, Ethereum Foundation, MetaMask, Mastercard, and PayPal. Crypto is uniquely positioned as machine-native payment infrastructure—agents can autonomously access wallets and transact without bank accounts.

Early movers show dramatic results. Virtuals Protocol launched 21,000+ agent tokens in November 2024 reaching market cap of $1.6-1.8 billion, while ai16z AI-managed investment DAO passed $2.5 billion market cap with autonomous trade execution.

Strategic implementation

Structure brand assets using Schema.org vocabulary with JSON-LD markup for exchanges, tokens, and NFTs. Deploy AEO platforms tracking AI Search Monitoring across ChatGPT, Perplexity, Gemini, and Claude, integrate crypto payment protocols enabling agent transactions, and maintain factually consistent narratives across all channels. Track AI citation frequency, agent interaction rates, and autonomous transaction volume as key metrics.

How These Crypto Marketing Trends Work Together

Implementing crypto marketing trends 2026 synergistically creates multiplicative value rather than additive gains when trends work in isolation.

- AI Visibility + On-Chain Intelligence = Precision Content Targeting. Web3 CRM platforms track which wallet segments convert from specific AI-generated content, enabling you to optimize content not just for AI citation but for the exact wallet behaviors driving revenue. This feedback loop is impossible in Web2 where attribution breaks between search and conversion.

- Trust-First + Machine-Readable Brand = Algorithmic Credibility. Compliance-by-design creates factually consistent narratives AI systems reward, because verifiable claims and transparent documentation improve both regulatory standing and AI citation rates. AI preferentially cites authoritative sources; compliance infrastructure provides that authority.

- Invisible Web3 + On-Chain Intelligence = Behavioral Enrichment. Account Abstraction-powered wallets generate richer behavioral data for segmentation because they eliminate gas friction causing incomplete sessions in traditional wallets. More complete sessions mean better attribution and more accurate lifetime value calculations.

Recommended implementation sequence: Start with AI Visibility (quick wins, immediate traffic impact) while building compliance infrastructure (longer timeline, foundational requirement). Layer in On-Chain Intelligence to optimize the traffic AI Visibility generates. Deploy Invisible Web3 to reduce conversion friction identified by behavioral data. Finally, structure for Machine-Readable Brand to future-proof as agent commerce scales. Attempting all simultaneously dilutes focus; sequential implementation with clear dependencies maximizes ROI.

Your 2026 Action Plan: Where to Start

Strategic implementation of crypto marketing trends 2026 requires staged deployment based on resource availability and current infrastructure maturity.

Immediate priorities (Q1 2026)

Launch AI Visibility Optimization and Trust-First Marketing simultaneously. AI Visibility delivers fastest ROI with projects seeing 1,200-1,400% traffic growth within months, while compliance infrastructure requires time to build but protects against regulatory risk. Implement Schema.org structured data, create question-based content, and monitor AI citations across ChatGPT and Perplexity. Simultaneously, audit marketing materials for MiCA compliance and deploy transaction monitoring platforms covering your operational jurisdictions.

Growth phase (Q2-Q3 2026)

Activate On-Chain Intelligence Marketing and begin Invisible Web3 implementation. Deploy Web3 CRM to track wallet-level attribution for the traffic AI Visibility generates, enabling precise optimization. Start Account Abstraction integration for flagship products, beginning with gasless onboarding flows that eliminate the “I need ETH to use this?” friction preventing mainstream adoption. These initiatives build on Q1 infrastructure and compound earlier investments.

Innovation edge (Q4 2026+)

Position for Machine-Readable Brand as AI agent commerce scales. Structure all brand assets using Schema.org vocabulary and integrate crypto payment protocols enabling autonomous agent transactions. Track AI citation frequency and agent interaction rates as leading indicators of commerce mediation shift. This positions you as an early mover in agent-driven discovery while competitors still optimize for human search.

The strategic principle is clear: quick wins fund longer-term infrastructure, and each phase creates the foundation for subsequent capabilities. Projects attempting to implement all five trends simultaneously typically achieve none well; staged deployment with disciplined sequencing maximizes both learning velocity and ROI.

From Trends to Transformation

The crypto marketing trends 2026 landscape represents a fundamental reset—speculation gives way to professionalism, regulatory compliance becomes competitive advantage, technical complexity becomes invisible, and AI systems mediate most discovery and commerce.

Core principles emerging from these trends:

- Optimize for machines first, humans second: AI citations matter more than link rankings; structured data matters more than visual design

- Compliance accelerates rather than constrains: Regulation enables institutional capital and retail trust

- Behavioral data beats demographic targeting: Wallet activity reveals intent more accurately than age and geography

- Invisible wins: Best crypto UX makes blockchain complexity disappear entirely

- Machine-readable is discoverable: If AI can’t parse your brand, you don’t exist in agent commerce

This evolution mirrors every technology’s maturation from novelty to infrastructure. Early internet marketing emphasized flash animations and splash pages; mature web marketing optimizes for accessibility and load speed. Early mobile marketing created separate m-dot sites; mature mobile marketing uses responsive design. Early crypto marketing emphasized hype and speculation; mature Web3 marketing emphasizes accessibility, trust, and measurable outcomes.

The projects dominating 2026 will be those that recognize crypto marketing has permanently shifted from selling possibility to delivering value. They’ll be cited by AI systems because they provide authoritative, structured information. They’ll attract institutional capital because compliance infrastructure demonstrates professionalism. They’ll achieve precision targeting using on-chain behavioral data traditional marketers can’t access. They’ll onboard mainstream users who don’t realize they’re using blockchain. And they’ll remain discoverable as AI agents mediate increasing transaction volume.

The question for crypto marketers isn’t whether these trends matter—the data proves they do. The question is whether you’ll be among the early adopters capturing outsized returns, or the late majority implementing commodity practices. Start with one trend, measure rigorously, and build systematically toward complete transformation.

Frequently Asked Questions (FAQ)

AI is fundamentally transforming crypto marketing through generative search engines like ChatGPT and Perplexity, which now handle over 70% of searches that end without clicks, making AI Visibility Optimization (AI SEO, AEO, GEO) essential for Web3 projects to get cited in AI-generated answers rather than just ranking in traditional search results. Projects implementing AI SEO strategies report 1,200-1,400% traffic growth and 60% CAC reduction by optimizing content for LLM-powered discovery.

Account Abstraction (AA) transforms crypto wallets into programmable smart contracts that eliminate technical barriers like gas fees and seed phrases, enabling gasless transactions and social recovery that make blockchain experiences invisible to mainstream users. For crypto marketing, AA is critical because it enables onboarding non-crypto natives without technical education—projects like Overtime achieved 50,000 active users and $200M+ betting volume by making Web3 completely invisible through Account Abstraction UX.

Traditional SEO optimizes for keyword rankings in link lists, while AI SEO for crypto focuses on getting cited within AI-generated answers through structured data, factually consistent narratives, and machine-readable content formats like Schema.org markup for tokens and NFTs. Agencies like ICODA specializing in AI SEO for crypto report that early adopters dominate AI answer spaces before competition intensifies, similar to the first-mover advantage seen in early Google SEO.

Yes, compliance-first marketing (Trust-First Marketing) has become a competitive advantage rather than constraint, with 78% of major European exchanges achieving full MiCA compliance by early 2025 and experiencing 22% increases in new retail investors. Regulatory adherence correlates with 32% fraud reduction and enables institutional capital access, while non-compliant projects face penalties up to €5M or 10% annual turnover under MiCA regulations.

Crypto projects optimize for generative AI engines through Generative Engine Optimization (GEO) by implementing structured data markup, creating question-based content answering user queries, maintaining factually consistent narratives across all channels, and using tools like Writesonic or QuickCreator to monitor AI citations across ChatGPT, Perplexity, and Gemini. The key difference from traditional blockchain SEO is prioritizing semantic clarity and verifiable claims AI systems can parse over keyword density and backlink quantity.

The five defining crypto marketing trends for 2025-2026 are AI Visibility Optimization for generative search discovery, Trust-First Marketing embedding compliance as growth strategy, On-Chain Intelligence Marketing using wallet behavioral data, Invisible Web3 Experience through Account Abstraction, and Machine-Readable Brand positioning for AI agent commerce. These Web3 marketing trends represent the industry’s evolution from speculation-driven tactics to data-driven, professional strategies prioritizing accessibility, trust, and measurable outcomes.

The crypto market is projected to reach $5 billion by 2030 with 2026 representing a critical maturation phase where regulatory clarity (post-MiCA), institutional adoption, and AI-mediated discovery converge to shift the industry from speculation to utility-driven growth. Market predictions emphasize that projects succeeding in 2026 will be those implementing professional marketing infrastructure including compliance-by-design, AI visibility optimization, and invisible UX rather than relying on hype-driven token marketing tactics.

While specific price predictions vary, 2025 market indicators show strong fundamentals: Bitcoin crossed $100K, 39% of US investors view crypto as inflation hedge, institutional players like BlackRock and JPMorgan are actively deploying blockchain infrastructure, and regulatory frameworks like MiCA provide clarity driving mainstream adoption. The bull market thesis for 2025-2026 centers on utility and infrastructure maturation rather than pure speculation, with growth driven by Account Abstraction adoption (40.5M Smart Accounts in 2024, 5x YoY growth) and enterprise blockchain implementations.

Rate the article