Executive Summary: The Game Has Changed

The crypto landscape just experienced a seismic shift that most exchanges haven’t even noticed yet.

AI assistants have quietly become the primary information source for users choosing cryptocurrency exchanges, creating an entirely new battlefield where traditional marketing rules no longer apply. Our groundbreaking study of 25 major exchanges across 8 AI platforms reveals shocking disparities that are already reshaping market dynamics.

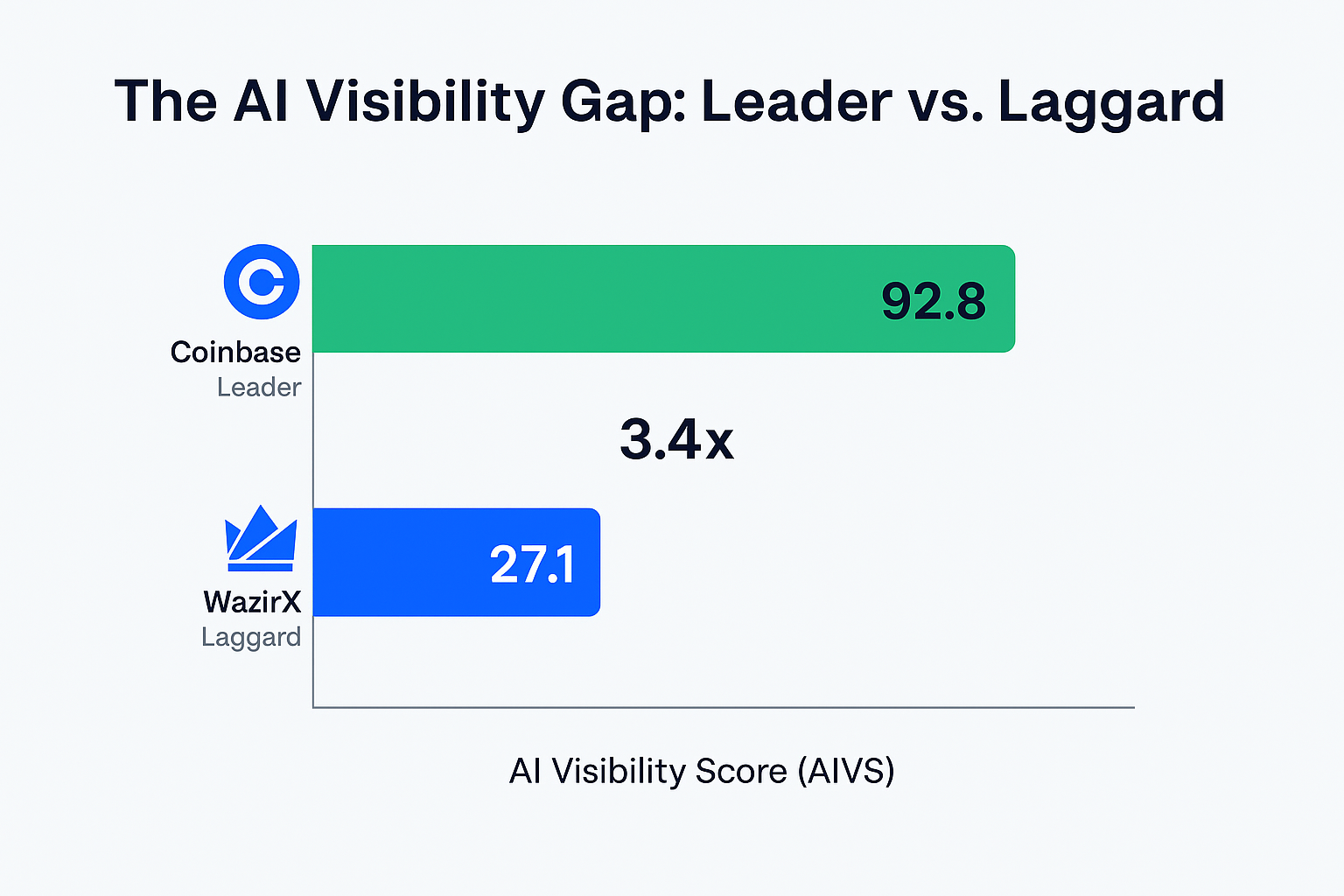

The brutal reality: Leading exchanges receive 3-4x more AI recommendations than those at the bottom of our rankings. This isn’t just a marketing metric—it’s becoming the difference between explosive growth and slow death.

Research Methodology

Study Scope

- 25 major exchanges (representing majority of global trading volume)

- 8 leading AI systems (ChatGPT, Claude, Gemini, Perplexity, Copilot, Meta AI, Grok, Google SGE)

- 6 key regions (US, UK, Germany, Japan, Korea, Singapore)

- 1,000+ queries across all AI systems

AIVS Scoring Framework

We evaluated exchanges across 12 factors:

- Core factors (40%): Trading volumes, security, product offerings

- Marketing (25%): Media presence, digital marketing, brand recognition

- Regional factors (20%): Regulatory compliance, localization, partnerships

- AI factors (15%): Educational content, search optimization

Maximum score: 100 AIVS

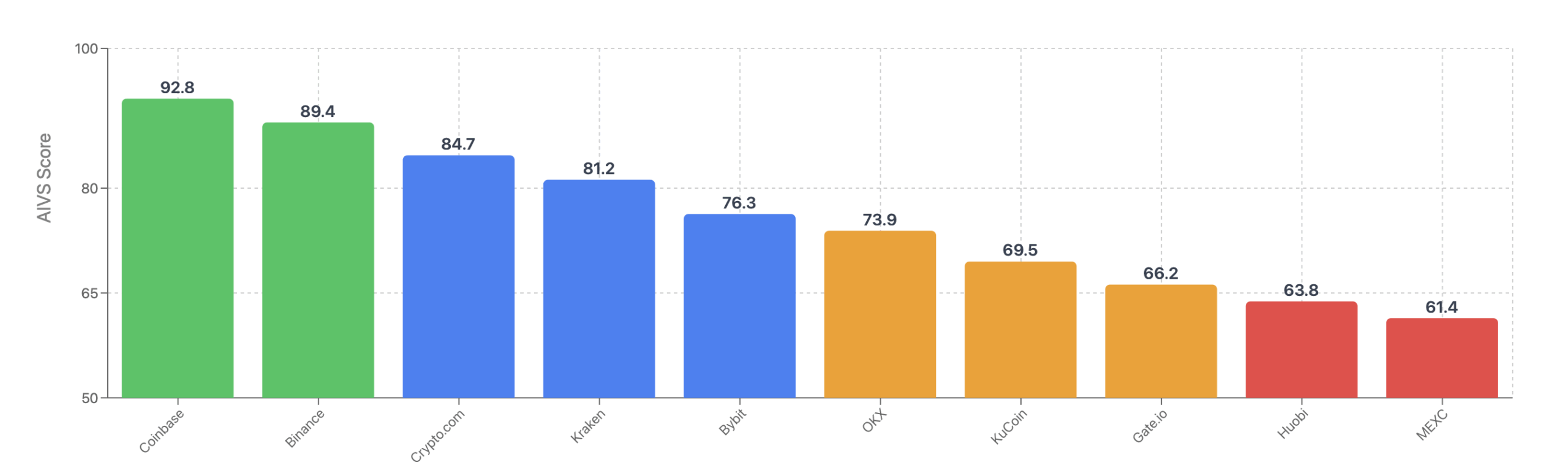

The Complete AI Visibility Rankings

Top 10: Market Leaders

We’ve developed the AI Visibility Score (AIVS)—a revolutionary 0-100 metric measuring how frequently AI systems recommend specific exchanges across various user scenarios. Think of it as the “Google PageRank” for the AI era.

Translation: If you’re not in the top tier, you’re bleeding potential users to AI recommendations every single day.

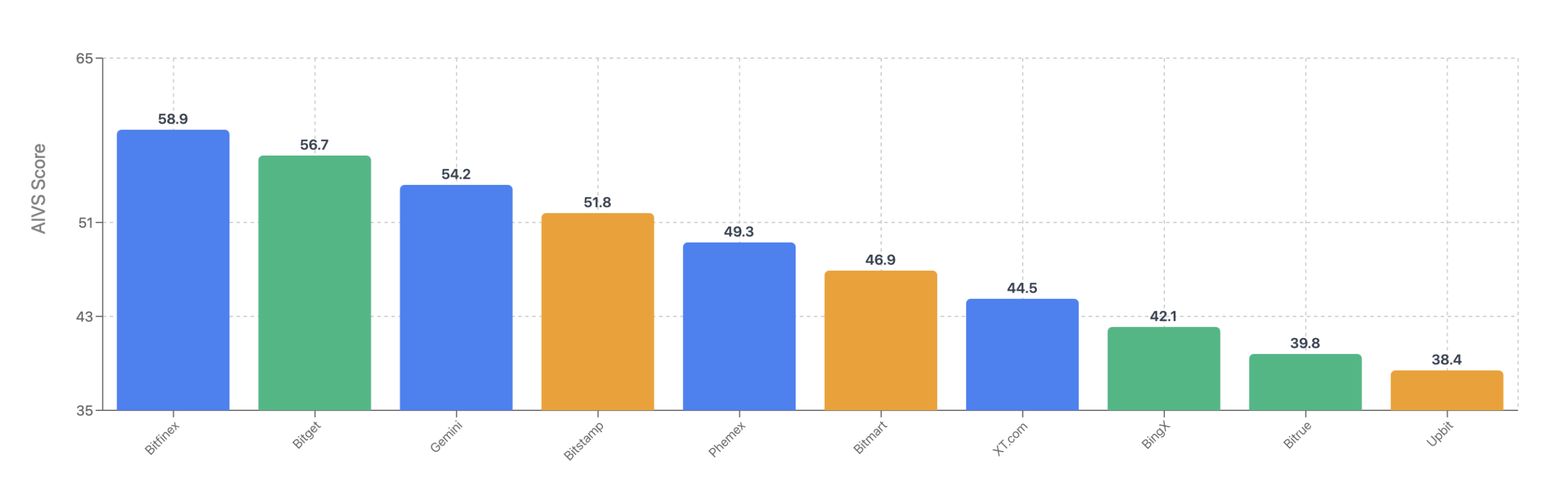

The Opportunity Zone (Ranks 11-20)

⚡ Opportunity Alert: These exchanges show the highest potential for rapid AIVS growth. With focused strategies, a 15-20 point improvement is achievable within 6-12 months, potentially breaking into the top 10.

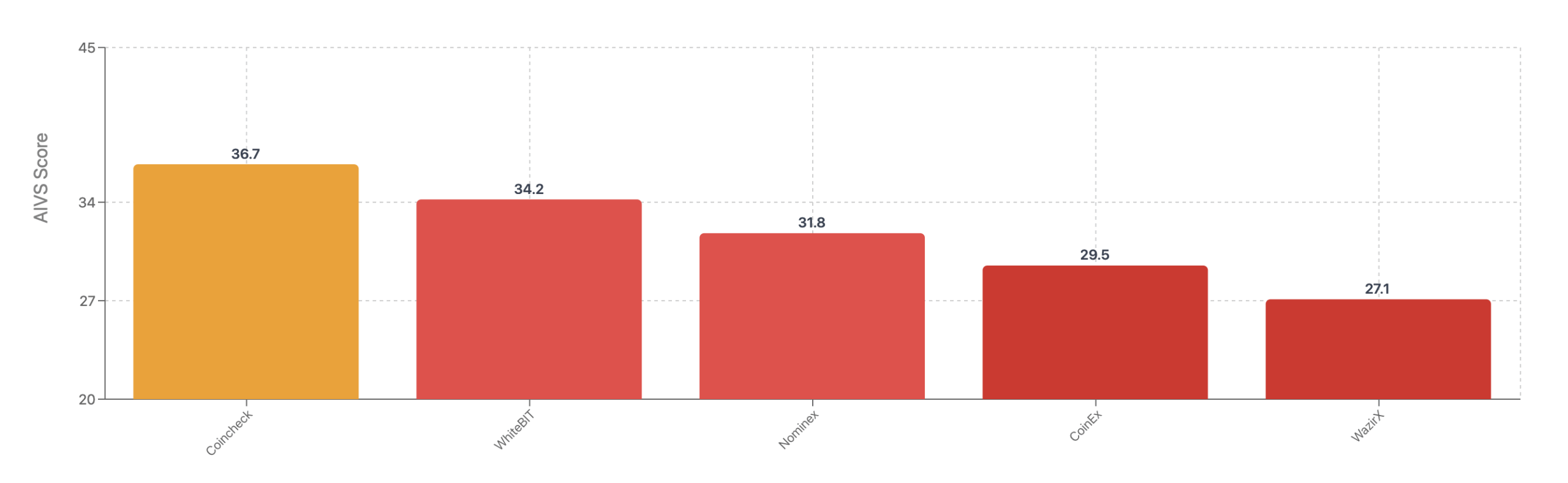

Growth Potential (Ranks 21-25)

🚨 CRITICAL ALERT: These exchanges risk becoming invisible to AI-assisted users. Despite strong regional positions, they’re losing 65-70% of potential AI recommendations to competitors. Immediate foundation-building required to prevent market share erosion.

Key Insight: The gap between the leader (92.8) and bottom performer (27.1) is 3.4x—meaning Coinbase receives recommendations 3-4 times more frequently than exchanges at the bottom of our rankings.

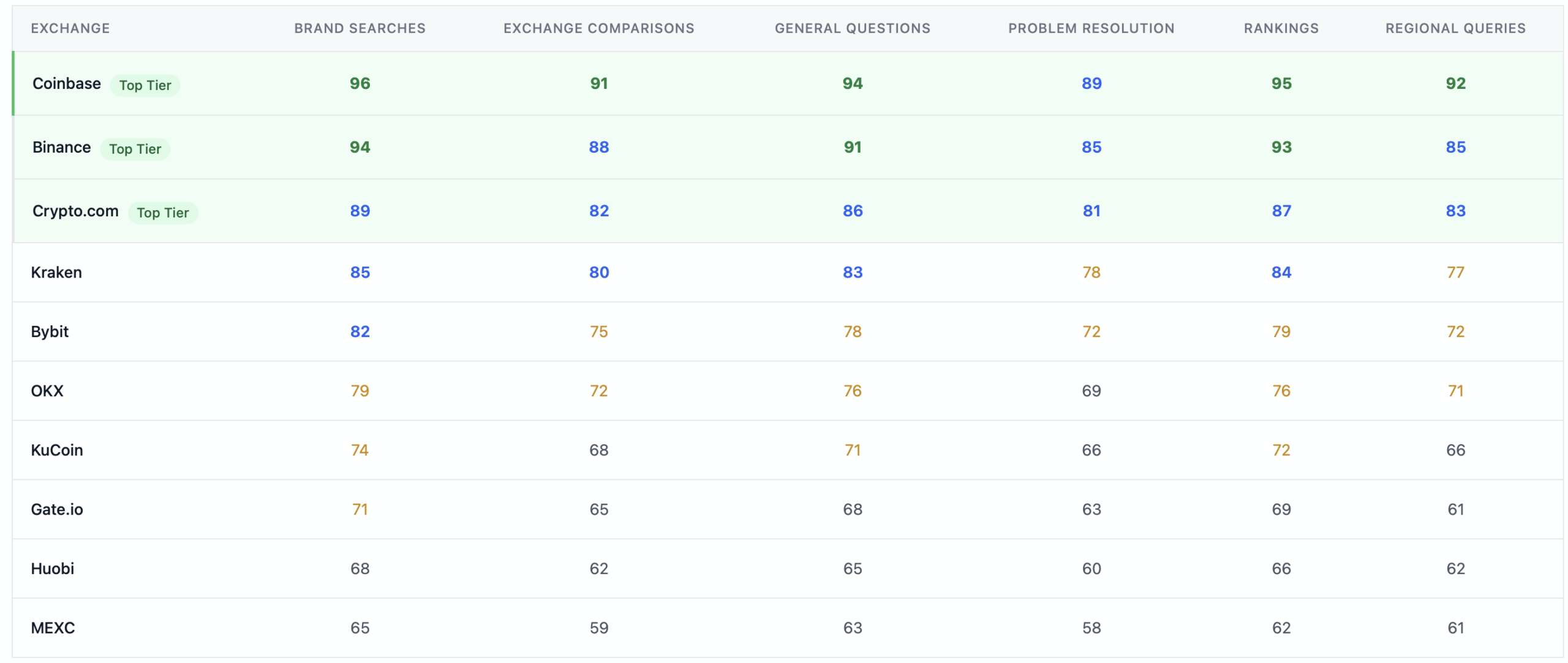

How Exchanges Perform Across Different User Scenarios

Not all AI recommendations are created equal. Our analysis across various user query types reveals distinct patterns:

Business Implications:

- Brand queries: Coinbase and Binance dominate through name recognition

- Comparisons: Coinbase leads, especially in head-to-head scenarios

- Problem resolution: Coinbase and Kraken benefit from safety reputation

- Regional queries: Maximum variation—local exchanges often outperform global ones

How Different AI Systems Evaluate Exchanges

Each AI platform has distinct biases and preferences that marketers must understand:

ChatGPT: Safety and Compliance First

- Loves: Coinbase (95), Kraken (83)—licensed, regulated exchanges

- Cautious about: Exchanges under regulatory pressure

- Focus: User protection, beginner education

- Marketing implication: Emphasize compliance and security credentials

Google SGE: Following Search Popularity

- Loves: Coinbase (97)—the most searched exchange

- Influenced by: Fresh news coverage significantly impacts rankings

- Focus: Technical metrics over regulatory status

- Marketing implication: Invest in SEO and media coverage

Claude: Educational Balance

- Loves: Quality educational content and transparency

- Approach: Recommendations tailored to different user types

- Focus: Honest risk assessment and opportunities

- Marketing implication: Create comprehensive educational resources

Gemini: Google Integration

- Loves: Verified business information and broad market presence

- Influenced by: Google services integration boosts rankings

- Focus: Regional search pattern optimization

- Marketing implication: Optimize Google Business Profile and local presence

2025 Market Movers: Who’s Rising and Falling

Rising Stars

Crypto.com – Explosive growth driven by:

- Aggressive sports marketing (UFC, Formula 1)

- Compliance investments

- Superior mobile app experience

- Banking card program success

MEXC – Asian specialist growing through:

- Massive altcoin selection

- Competitive fee structure

- Strong trader community presence

- Effective community marketing

Declining Stars

Huobi – Losing ground due to:

- Regulatory issues in key markets

- Reduced marketing presence

- Competition from newer platforms

- Brand confusion from rebranding attempts

Bitfinex – Stagnating because of:

- Limited appeal to retail users

- Legacy regulatory issues

- Professional-only focus

- Limited geographic expansion

Key Insight: Marketing investments and regulatory clarity drive rapid AI visibility growth. Regulatory problems and passive marketing lead to decline.

Regional Market Dynamics

AI recommendations vary significantly by geography, reflecting local regulatory and cultural preferences:

🇺🇸 United States: Compliance Is King

- Leaders: Coinbase (96.4), Kraken (88.7), Gemini (82.3)

- Critical factor: SEC licenses and banking relationships are essential for AI recommendations

🇬🇧 United Kingdom: Post-Brexit Adaptation

- Leaders: Coinbase (94.2), Kraken (89.8), Binance (85.6)

- Critical factor: FCA authorization became mandatory post-Brexit

🇯🇵 Japan: Local Dominance

- Leaders: Coincheck (91.3), Bybit (87.9), Binance (82.4)

- Critical factor: FSA licensing and JPY trading pairs are mandatory

🇰🇷 South Korea: Strict Regulation

- Leaders: Upbit (94.7), Bithumb (89.2), Coinone (84.6)

- Critical factor: Local exchanges completely dominate due to strict regulations

🇸🇬 Singapore: Crypto Hub

- Leaders: Crypto.com (92.8), Binance (87.3), Coinbase (83.9)

- Critical factor: MAS licensing and regional hub status matter most

Universal Pattern: Local regulatory compliance is critical. Domestic exchanges typically outperform global ones in their home markets.

The Three Pillars of AI Visibility Success

Our research identified three critical factors that consistently drive high AI visibility across all platforms and regions:

1. Regulatory Compliance: The Foundation

Clear regulatory positioning provides stable, high AI visibility across all regions and systems. AI models heavily weight compliance when making recommendations, especially for financial services.

2. Educational Content: The Secret Weapon

Exchanges with quality educational materials consistently outperform competitors. AI systems value and reward helpful, informative content when training their recommendation engines.

3. Technical Optimization: The New Necessity

Search optimization directly impacts AI visibility. Structured data and machine-readable content improve how AI systems understand and categorize exchanges.

Strategic Recommendations by Tier

For Market Leaders (Top 5)

- Defend positions through continued compliance and educational content investment

- Expand internationally while maintaining regulatory standards

- Innovate in AI-friendly formats (structured data, comprehensive guides)

For Mid-Tier Exchanges (Ranks 6-15)

- Focus on regional specialization and niche product excellence

- Invest heavily in educational content to compete with larger brands

- Target specific AI platforms based on user demographics

For Emerging Exchanges (Ranks 16-25)

- Define clear positioning and unique value proposition

- Prioritize compliance in target markets

- Build educational content foundation before scaling marketing

The Opportunity Window for Mid-Tier Exchanges

Exchanges ranked 11-20 show enormous growth potential. The 15-20 point AIVS gap can be closed within 6-12 months with the right strategy. This represents the biggest opportunity in today’s market.

Success factors for rapid growth:

- Identify 2-3 AI platforms where you’re underperforming

- Create platform-specific content strategies

- Address compliance gaps in target markets

- Invest in technical optimization

- Monitor and iterate monthly

Immediate Action Plan for All Exchanges

1. Audit Your AI Visibility

- Test your exchange across all major AI platforms

- Identify where you’re over/under-performing versus competitors

- Map performance to specific query types

2. Prioritize Educational Content

Create comprehensive, helpful content that AI systems can reference:

- Beginner guides and tutorials

- Security best practices

- Market analysis and insights

- FAQ sections addressing common concerns

3. Clarify Regulatory Status

- Prominently display all licenses and regulatory approvals

- Create dedicated compliance pages

- Regularly update regulatory status

- Address any compliance gaps immediately

4. Optimize for AI Discovery

- Implement structured data markup

- Create machine-readable content formats

- Optimize page loading speeds

- Ensure mobile-first design

5. Regional Adaptation

- Customize content for local markets

- Obtain relevant local licenses

- Partner with regional payment providers

- Localize customer support

6. Continuous Monitoring

- Track AI visibility monthly

- Monitor competitor movements

- Adjust strategy based on performance data

- Stay updated on AI platform changes

The Urgency Factor

AI systems are rapidly becoming the primary method for information discovery. Exchanges that don’t optimize their AI visibility now will face serious competitive disadvantages within months, not years.

The reality: AI visibility gap = user acquisition gap

As AI adoption accelerates, traditional marketing channels become less effective. Users increasingly trust AI recommendations over traditional advertising, making AI visibility the new frontier of digital marketing.

Conclusion: The New Rules of Crypto Marketing

The cryptocurrency industry is entering a new era where AI visibility has become a decisive competitive factor. Our research shows clear market stratification: leaders are strengthening their positions through regulatory clarity and educational content, while laggards risk losing even more users.

The bottom line: AI hasn’t just changed the rules of the game—it has already changed them. Exchanges that adapt to this new reality will gain competitive advantages. Those that ignore AI optimization risk being left without new users.

The window of opportunity is open, but it’s closing fast. The time to act is now.

This research represents a comprehensive analysis of crypto exchange AI visibility as of June 2025. AI algorithms and market conditions evolve rapidly. We recommend regular strategy updates to maintain competitive positions.

Rate the article